When most people think about enterprise billing software, they probably think about clunky monolithic systems.

But that's not necessarily the case.

There are plenty of modern enterprise-ready billing solutions that won't come with the less than desirable user experience (nor the price tag) that a lot of us are all too familiar with.

Dare we say, enterprise billing is getting really exciting? With players like Metronome being acquired by Stripe, new challengers like Alguna stepping up to the plate, and legacy enterprise billing software like Zuora acquiring Togai to keep up with modern SaaS monetization needs.

There's a lot happening in the space, and there's more software to choose from than ever.

That's why in this guide, we're digging into some real pain points (and what happens when your billing software isn't truly enterprise grade) along with the top seven enterprise billing platforms that will make processing tens and thousands of invoices feel like a walk in the park.

What is enterprise billing software?

Unlike basic billing tools that generate simple monthly invoices, enterprise billing software supports advanced SaaS monetization and AI pricing models, strict financial controls, and global compliance at scale.

An enterprising billing solution can be a standalone system that integrates with the rest of your finance stack, or be part of an end-to-end quote-to-cash platform.

What exactly makes billing “enterprise-grade?"

Enterprise billing software is built for scenarios where billing is no longer simple, predictable, or linear.

That usually means it can handle:

1. Complex pricing models

- Subscriptions + usage-based pricing

- Hybrid contracts (base fee + overages)

- Tiered, volume, ramped, and contract-specific pricing

- Credits, minimum commits, and true-ups

2. High transaction volumes

- Millions of usage events or line items per month

- Real-time or near-real-time usage aggregation

- Accurate invoicing even as usage spikes unpredictably

3. Multi-entity and global operations

- Parent–child account structures

- Multiple legal entities and subsidiaries

- Multi-currency billing and FX handling

- Region-specific tax rules (VAT, GST, sales tax)

4. Finance-grade accuracy and controls

- Revenue recognition support (e.g. ASC 606 / IFRS 15)

- Audit trails and versioned contracts

- Proration, mid-cycle changes, and amendments

- Clean handoff to ERP and accounting systems

5. Cross-team workflows

- Sales, RevOps, Finance, and Product working from the same source of truth

- Quotes turning directly into live billing schedules

- Fewer manual reconciliations (and fewer surprises)

Real pain points from an enterprise billing team

We recently had a conversation with an enterprise client who had the following situation:

- Generates thousands of invoices daily and processes the corresponding payments.

- Operates internationally with billing in four different currencies and handling taxes in a couple of them.

- Manages a customer base that includes:

- Small businesses (SMBs)

- Mid-market clients with several locations

- Large enterprises with hundreds or thousands of locations

- The current tech stack included CPQ software, a middleware for integrations, Stripe for credit card processing, among other systems.

Because their enterprise billing system couldn't handle the setup, the finance team was left in a reactive state having to spend a significant portion of their day, estimated at 25% to 50%, on manual workarounds and managing complications.

This is why modern enterprises need billing systems that can handle complex hierarchies, frequent plan changes and hybrid pricing without draining the finance team.

So which enterprise billing systems are up for the task? Let's take a look.

Enterprise billing systems: Comparison overview

| Vendor | Hierarchical / Multi‑Entity | Mid‑Cycle Proration | Automation | Customization | Reporting |

|---|---|---|---|---|---|

| Alguna | Unified billing, usage & revenue; multi-entity support | Auto-proration; consolidated invoices | No-code workflows, real-time metering | Flexible catalog; no engineering needed | Built-in dashboards & rev rec reports |

| Chargebee | Parent–child hierarchy; consolidated billing | Auto-proration & scheduled changes | Invoicing, dunning, rev rec (modular) | UI config; advanced features gated by tier | Dashboards + GAAP/IFRS (add-on) |

| Maxio | Multi-subscription; CRM/ERP integration | Built-in proration support | Full rev rec + SaaS analytics | Setup requires onboarding help | ARR, cohort & rev waterfall analytics |

| Zuora | Full account hierarchy; parent billing | Custom cycles, multi-charge proration | High-volume billing + rev rec | Powerful config; requires trained admins | Audit-ready reports + Zuora Revenue |

| Sage Intacct | ERP-native multi-entity setup | Proration & co-terminations | Automated GL postings & billing | Finance-driven config; low no-code | MRR, deferred rev, consolidated views |

| Salesforce Revenue Cloud | Multi-entity via profiles; CPQ-driven | Usage, renewals, hybrid plans | Recurring & milestone billing + rev rec | Custom flows via CPQ/Flow (admin-heavy) | CRM-connected dashboards |

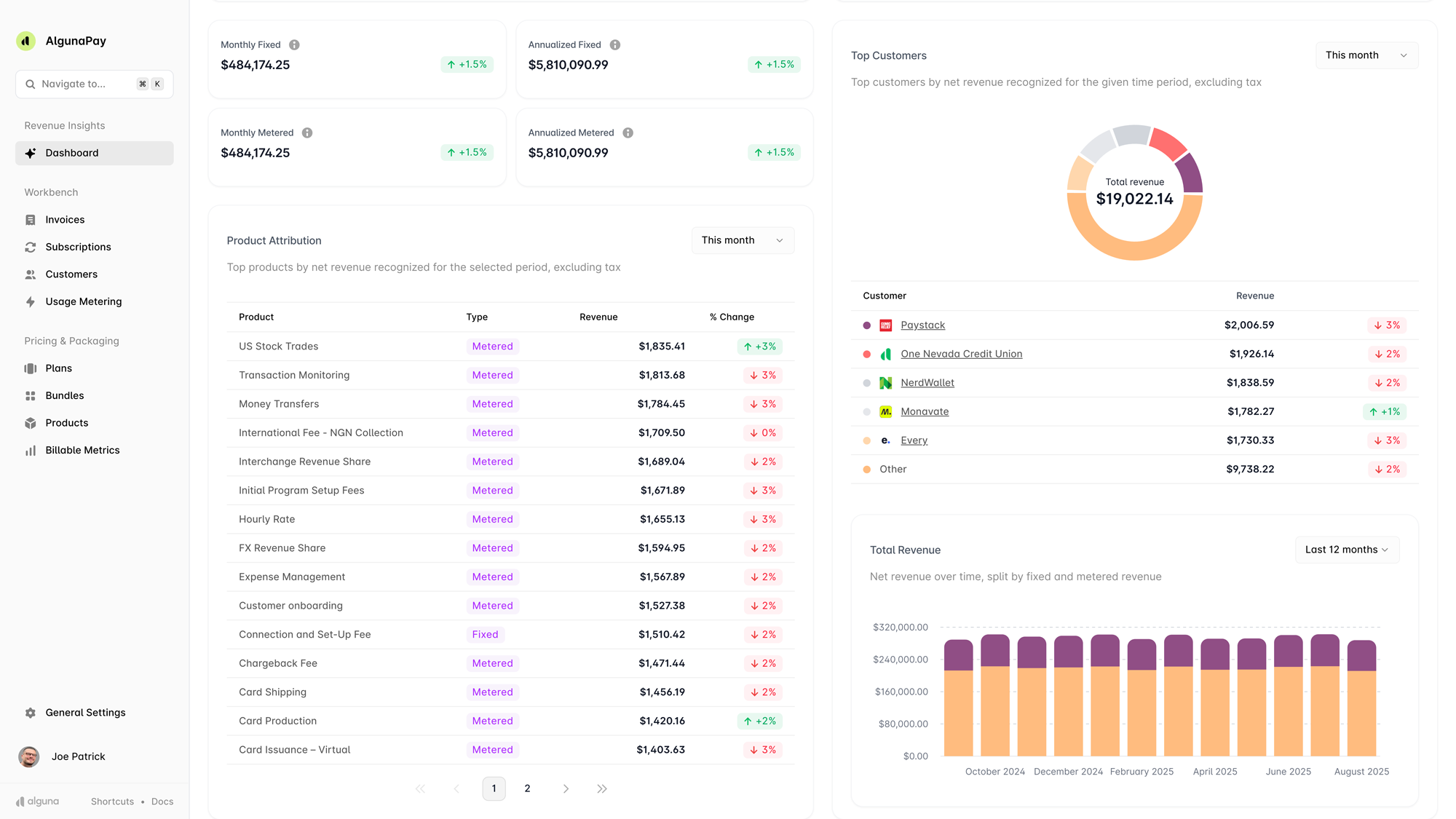

1. Alguna: AI-native quote-to-revenue platform for enterprise SaaS billing

Y Combinator backed Alguna is a modern, enterprise-grade billing engine and revenue automation platform purpose-built for scale, complexity, and flexibility.

It unifies quoting, usage metering, invoicing, and revenue recognition in a single system, eliminating the integration gaps that plague legacy stacks.

With support for multi-entity hierarchies, no-code workflows, and real-time reporting, Alguna empowers finance and RevOps teams to adapt pricing, manage custom contracts, and reduce manual intervention without waiting on engineering.

Alguna is regarded as one of the best enterprise billing software for complex contracts due to it's incredibly flexible CPQ.

- Adam Liska, CEO and Co-founder at Glyphic AI

Read case study

Enterprise billing features:

- Complex pricing and usage: Alguna’s catalog supports subscriptions, usage‑based charges, prepaid credits and hybrid models. The platform meters API calls or token usage in real time and feeds the data directly into billing, enabling granular, parent‑level invoicing.

- Bulk AI‑powered contract ingestion: Upload existing contracts in bulk and Alguna's Contracts AI feature will extract billing terms automatically, eliminating manual data entry.

- Integrated CPQ and order management: Sales can configure deals, generate quotes and manage signatures within Alguna. The CPQ layer is tied directly to billing so what sales sells is exactly what finance bills. This prevents misalignment and manual re‑entry.

- Automated invoicing and proration: Invoices are generated automatically with support for credit card, ACH, and bank transfers, and even cheques. Alguna handles proration, consolidated invoices and payment retries out of the box, ensuring mid‑cycle upgrades or cancellations are billed accurately.

- Revenue recognition and compliance: ASC 606/IFRS 15 revenue schedules and multi‑currency support are automated, so finance teams don’t need separate rev‑rec tools.

- No‑code automation and integrations: A no‑code workflow engine and pre‑built integrations (Salesforce, NetSuite, etc.) allow RevOps and finance teams to automate approvals, dunning or sync data without developer effort.

Strengths: Built for complex usage and hybrid pricing; unified quote‑to‑revenue platform reduces manual reconciliation and provides a single source of truth. Customers highlight clear revenue visibility and fewer errors.

Considerations: Alguna is a newer entrant (YC S23). Pricing starts at $699/month, with higher tiers for advanced features.

Book your personalized demo today

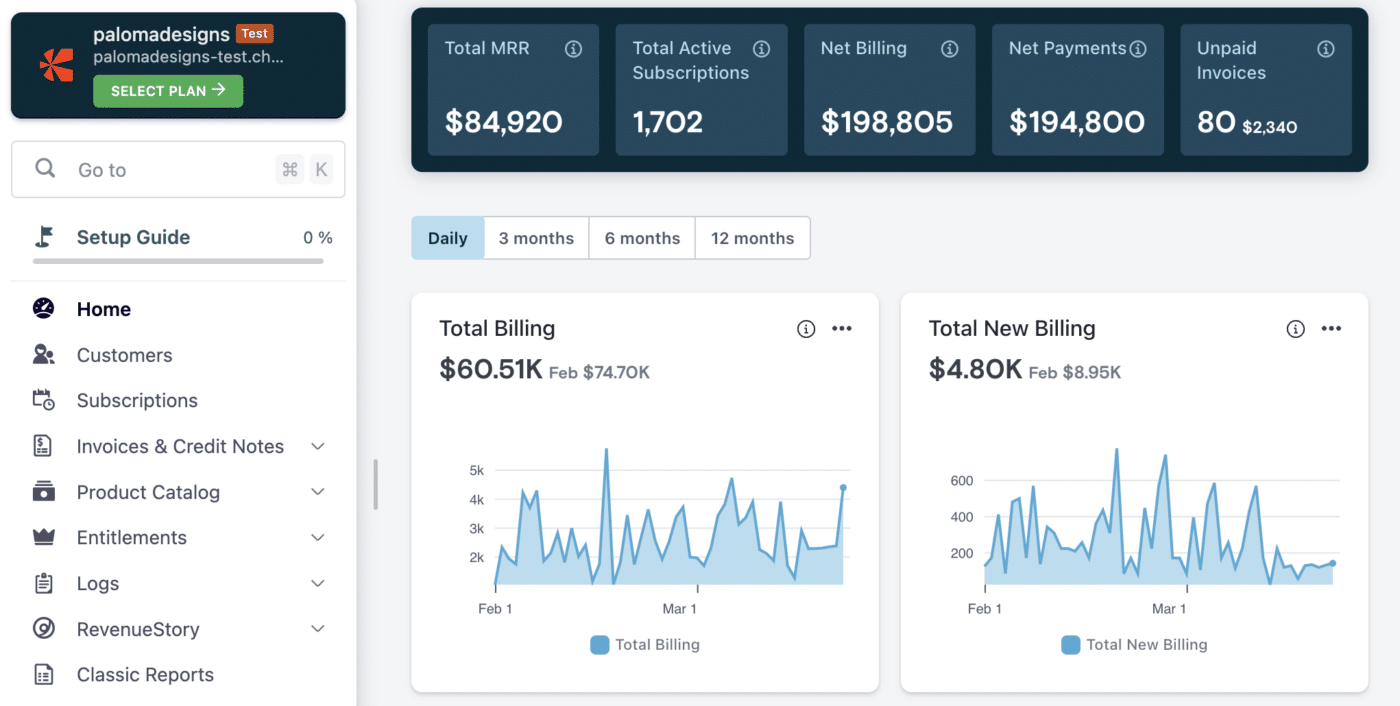

2. Chargebee: Best enterprise subscription billing software

Chargebee is a mature subscription management platform with a dedicated enterprise tier offering features like Account Hierarchy, consolidated invoicing, and advanced automation.

While the platform is highly configurable via UI, some enterprise capabilities (like GAAP compliance and deeper reporting) require add-ons or higher-tier plans.

Enterprise billing features:

- Advanced subscription management: Chargebee allows tiered, volume and usage‑inclusive pricing; multiple active subscriptions per customer; trials and add‑ons. These options let teams match complex enterprise contracts without coding.

- Proration and mid‑cycle changes: The platform automatically prorates upgrades and downgrades, schedules plan changes and includes configurable dunning workflows. This handles mid‑cycle activations and cancellations without manual calculation.

- Account hierarchy and consolidated invoices: Chargebee’s Account Hierarchy lets businesses model complex organisations as parent–child relationships and define who pays for which subscriptions. Combined with consolidated invoicing and calendar billing, teams can roll up charges for subsidiaries and issue a single invoice on a chosen date.

- Business‑friendly UI and integrations: Finance, support and RevOps teams can manage subscriptions, credits, invoices and customer changes directly through the interface, reducing dependence on engineering. Integrations with accounting and CRM systems make data sync straightforward.

Strengths: Comprehensive subscription features and proration rules reduce workarounds. Hierarchical billing and parent–child payment responsibilities support multi‑brand enterprises.

Considerations: Chargebee’s multi‑entity/account hierarchy feature is only available on the Enterprise plan. Total cost rises quickly due to percentage overage fees and implementation can require careful planning and migration.

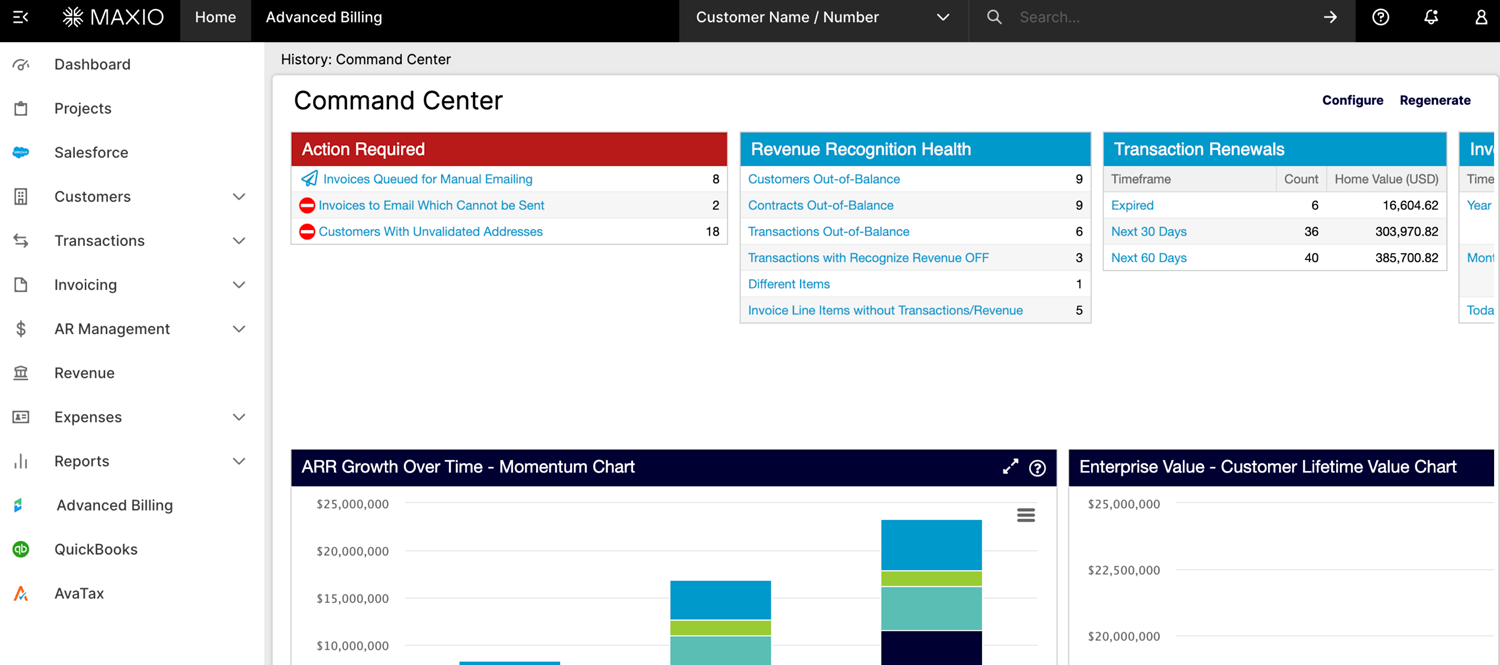

3. Maxio: Finance-led enterprise billing

Maxio (formerly SaaSOptics + Chargify + RevOps.io) is engineered for finance teams at growing SaaS companies that need serious analytics and revenue recognition at scale.

It supports complex subscription structures, integrates tightly with ERPs and CRMs, and delivers granular ARR metrics, cohort trends, and revenue waterfalls. While setup can require expert onboarding, Maxio’s strength lies in its combination of billing automation and powerful, finance-ready reporting.

Enterprise billing features:

- Flexible billing and proration: Maxio supports multiple pricing models, proration, add‑ons, coupons and multiple subscription schedules per customer. It can handle complex billing events while automatically adjusting invoices.

- Automated invoicing and net‑terms support: The system generates invoices automatically, supports net payment terms and works with major gateways like Stripe and Authorize.net.

- Built‑in revenue recognition: GAAP/IFRS‑compliant revenue schedules, partial‑period recognition and multi‑element arrangements are automated, reducing the need for spreadsheets.

- CRM & accounting integrations: Tight integration with Salesforce, QuickBooks, Xero and Intacct ensures deal terms flow into billing and invoices without manual re‑entry. Finance teams also get deep SaaS analytics such as ARR movements and cohort analyses.

Strengths: Combines billing, revenue recognition and SaaS analytics in one platform; strong alignment between sales and finance thanks to CRM integrations.

Considerations: Maxio has a steeper learning curve and more complex UI; full configuration can take time. Pricing starts around $599/month and rises with volume.

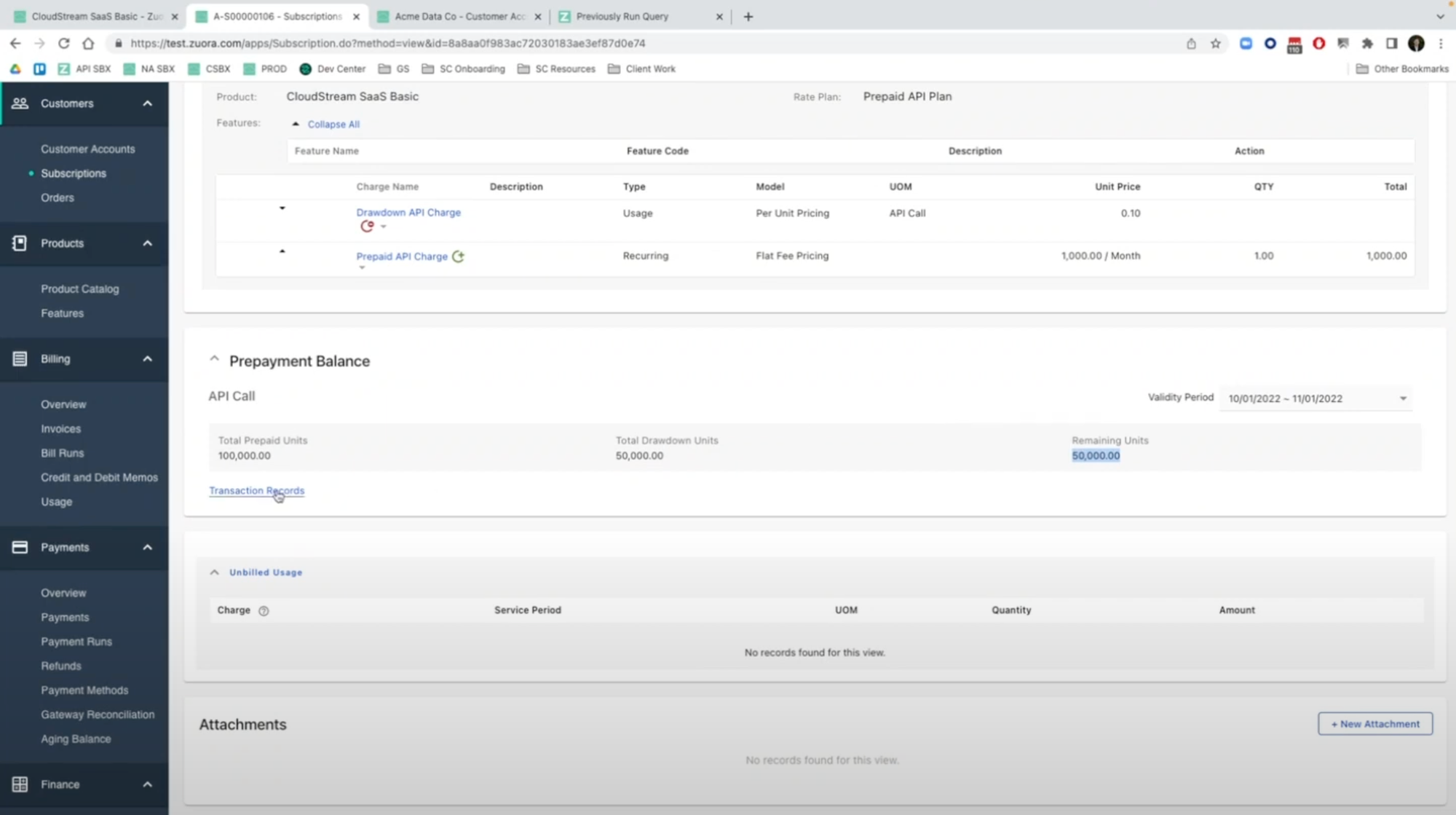

Zuora

Zuora is one of the most established players in enterprise billing, powering complex monetization strategies across global enterprises.

It offers robust support for hierarchical accounts, multiple charge models, customized billing cycles, and advanced revenue analytics via Zuora Revenue. While the platform is extremely flexible and scalable, it often requires dedicated admins or certified consultants to implement and manage.

Enterprise billing features:

- Configurable pricing engine: Zuora’s product catalog supports advanced usage models, tiered or volume‑based rates, bundled offerings and hybrid plans, giving enterprises the flexibility to model almost any contract.

- Lifecycle‑based subscription management: Every subscription event—upgrades, downgrades, renewals or cancellations—is treated as a time‑stamped order. This architecture ensures that all changes are captured and reflected in billing and revenue schedules.

- Scalable billing and proration: Zuora produces detailed invoices at high volume with automated proration, custom billing cycles and multiple charge schedules per subscription. Support for account hierarchies allows subscriptions to be owned by one account and billed to another, rolling up usage from child accounts and consolidating reporting.

- Integrated revenue automation: Zuora Revenue automates ASC 606/IFRS 15 compliance, handling allocation across performance obligations, deferred revenue tracking and release schedules.

Strengths: Trusted enterprise‑grade reliability with strict audit trails and governance; a rich ecosystem of consultants and integration partners. Native Salesforce integrations and order‑based architecture align sales and finance.

Considerations: Zuora has a high total cost of ownership (implementations start around $50k/year and climb into six figures). Implementation and ongoing configuration require dedicated expertise, which can slow pricing iteration.

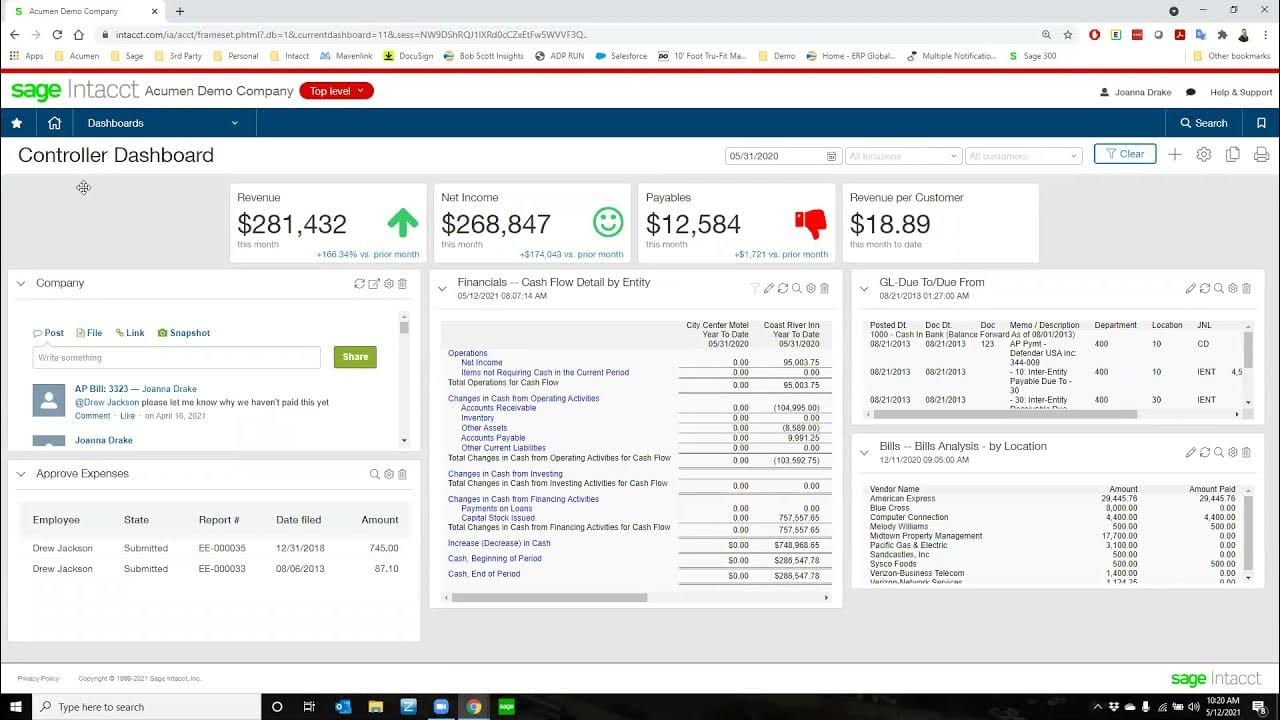

Sage Intacct

Sage Intacct is a cloud-native ERP that includes sophisticated billing and revenue modules tailored for finance teams. It handles multi-entity consolidations, mid-cycle proration, and ASC 606-compliant revenue recognition directly within the accounting system.

Intacct excels in auditability and financial visibility but is best suited for finance-led teams comfortable working within ERP-style workflows, with less emphasis on product-led customization.

Enterprise billing features:

- Contract & subscription automation: Intacct creates contract records with terms, pricing, renewals and amendments and automatically generates billing schedules with proration and co‑terming. This handles mid‑cycle plan changes and ensures invoices stay aligned with contract terms.

- Native revenue recognition: The system builds deferred revenue schedules, allocates contract value across performance obligations and posts rev‑rec entries directly to the general ledger, reducing reliance on spreadsheets.

- Salesforce integration & multi‑entity reporting: Closed‑won deals sync from Salesforce into Intacct contracts. Real‑time dashboards consolidate multi‑entity financials and unify billing, AR and cash management.

Strengths: Unified billing, accounting and revenue recognition give finance teams a single source of truth; strong compliance controls for ASC 606 make audits easier.

Considerations: Intacct is less flexible for complex pricing experiments and has a finance‑centric UI. Implementations require paid partners and can be expensive for smaller teams.

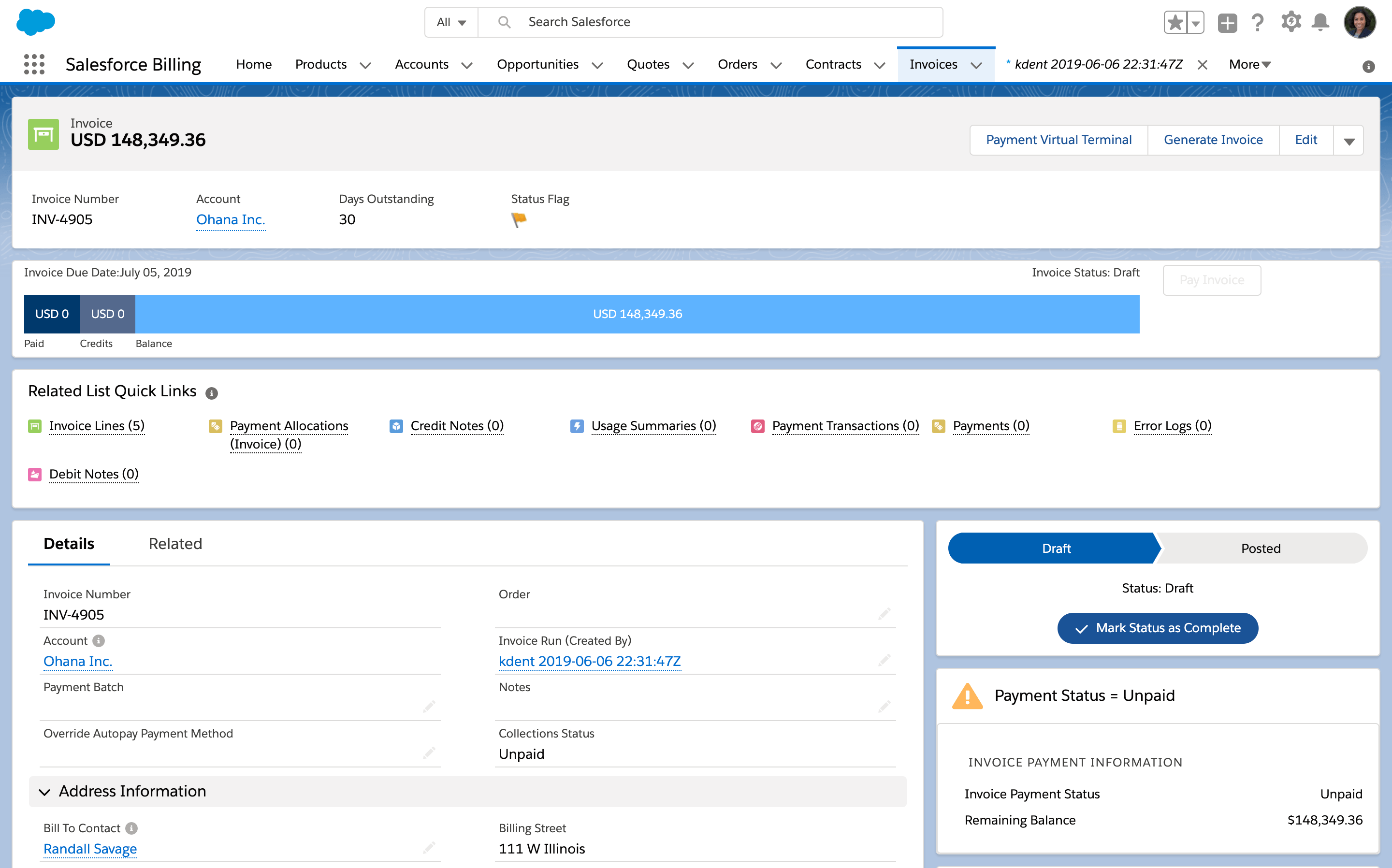

Agentforce Revenue Management (formerly Salesforce Billing/Revenue Cloud)

Agentforce Revenue Management, formerly Salesforce Revenue Cloud, brings together CPQ, billing, and revenue automation under the Salesforce ecosystem, making it ideal for orgs already embedded in Salesforce workflows. It supports multi-entity setups, usage-based billing, and custom flows through CPQ and Salesforce Flow.

While it offers deep cross-functional insights and unified CRM-billing data, configuring and managing Agentforce RM typically requires admin expertise or partner involvement.

Enterprise billing features:

- End‑to‑end quote‑to‑cash: Agentforce RM unifies catalog, CPQ, contracts, orders, assets, billing and revenue recognition on one platform, so sales, RevOps and finance teams work from the same data model.

- Subscription and usage support: The platform handles subscriptions, renewals and usage‑based billing with usage records and summaries for consumption models.

- Automated billing and invoicing: Recurring, milestone and hybrid invoices are generated automatically; tax calculation and payment collection are built in. Revenue recognition is order‑based and aligns with ASC 606/IFRS 15.

Strengths: Native Salesforce integration makes it attractive for companies already using Salesforce CRM; strong support for complex quoting, contract amendments and approval workflows.

Considerations: Implementations are admin‑heavy and often require specialist partners; more advanced usage scenarios or multi‑entity invoicing may need additional add‑ons. For simple SaaS businesses, Agentforce RM can be "too much system."

Choosing the right enterprise billing software

Selecting an enterprise billing vendor is a strategic decision.

Start by documenting your specific requirements based on the billing challenges you're facing: pricing models, transaction volumes, compliance needs, integration points, and any vertical specifics (telecom, SaaS, fintech, etc.).

Then involve all stakeholders from finance, IT, sales, and operations in the decision process.

When evaluating products, compare feature sets (support for usage billing, renewals, currency, dunning, etc.) and non-functional aspects (security, SLAs, support). Ask vendors for demos focused on your use cases.

Key considerations include:

- Does the architecture fit your IT strategy (cloud vs on-prem, microservices vs monolith)?

- Can it integrate with your existing systems and data flows?

- Does it support your required pricing/compliance models out of the box?

- What’s the vendor’s roadmap for AI, analytics, and future pricing trends?

- What implementation services and support will be provided?

Also compare pricing and value. Enterprise billing systems vary from flat subscriptions to percentage-based fees. Consider total ROI: faster billing cycles and fewer errors often pay back the investment quickly.

Look for customer success stories or analyst reports (e.g. Gartner Magic Quadrant) to gauge vendor credibility.

In many cases, trial runs or proof-of-concepts are invaluable. They let your team test key scenarios and see the UI in action.

Ultimately, the best solution will feel like a partner that automates your revenue processes and provides insights, so that billing becomes a strategic advantage, not just paperwork

Frequently asked questions about enterprise billing

Q: What differentiates enterprise billing from regular billing software?

A: Enterprise billing is designed for scale and complexity. It goes beyond basic invoicing to include features like multi-currency support, automated revenue recognition, usage metering, advanced analytics, and integrations with CRM/ERP systems. Regular billing tools may handle simple subscriptions or one-off invoices, but they often buckle when customer count or contract complexity grows.

Q: Who typically needs enterprise billing?

A: Any large business or fast-growing tech company with complex monetization needs. Examples include SaaS firms with usage-based products, telecom/media companies with metered services, and multinational organizations needing multi-currency/tax support. If your finance team struggles with spreadsheets, if billing errors are causing churn, or if you’re expanding globally, it’s a sign you need an enterprise-grade solution.

Q: Is enterprise billing only for subscription models?

A: Not at all. While many subscribers use it, modern enterprise billing also handles one-off charges, license fees, ad-hoc services, and any combination thereof. It’s flexible enough to support subscriptions, perpetual licenses, usage fees, commissions, or hybrid models on the same platform.

Q: How does enterprise billing improve finance operations?

A: By automating manual tasks, enforcing accounting rules, and providing real-time revenue visibility. Automatic reconciliation, aging reports, and compliance checks mean the finance team can close books faster and audit with confidence. As analysts report, automated billing typically reduces Days Sales Outstanding (DSO) by 10–20% and prevents revenue leakage.

Q: What should a CFO look for in these platforms?

A: Key things include robust revenue recognition for GAAP compliance, complete audit trails, and the ability to drill into revenue and churn metrics. Also important are security certifications (PCI DSS, SOC 2) and the vendor’s reliability track record. A CFO will also value features that accelerate forecasting and decision-making, such as AI-driven anomaly detection or churn prediction (a 2025 survey noted that AI analytics can improve revenue forecasting accuracy by ~20–30%).

Q: Can I start small with enterprise billing?

A: Yes. Many modern billing platforms are modular. You can implement core subscription billing first and add usage or CPQ modules later. The important thing is to choose a system that can scale. Starting with a lightweight enterprise billing solution (rather than purely legacy on-prem) can save a painful migration later as your needs grow.

Q: How does enterprise billing support growth as a strategic advantage?

A: By turning billing from a bottleneck into an innovation engine. For instance, quick price experimentation and automated renewals allow faster time-to-market for new offers. Improved accuracy and transparency build customer trust. Predictive analytics can forecast customer value and cash flow. In sum, firms with modern billing often see faster closes, reduced churn, and an ability to explore new business models – all of which can strengthen competitive positioning.

Enterprise billing capabilities as a strategic, long-term advantage

Enterprise billing ensures that every deal is billed correctly, every revenue dollar is captured, and finance has the data to make strategic decisions. As industry observers emphasize, modern billing tools provide the transparency and agility that senior leaders need to innovate on pricing and expand globally.

For CFOs and RevOps leaders, the imperative is clear: upgrading to an enterprise-grade billing system unlocks better forecasts, faster cash flow, and new revenue levers.

For orward-looking enterprises the choice is no longer if to modernize billing, but how fast they can make it a competitive advantage.

Book a personalized demo with Alguna and see how you can eliminate manual work, automate revenue workflows, and support complex billing structures without writing code.