• AI CPQ promises faster quotes, smarter pricing, and fewer approval bottlenecks.

• This guide breaks down leading platforms like Alguna, along with what's changing and why.

Configure-Price-Quote (CPQ) software has become a cornerstone of modern sales and monetization workflows. By centralizing product catalogs, pricing rules, and contract templates, CPQ tools help reps generate accurate quotes in minutes.

But there isn’t a lot of AI functionality in CPQ (yet).

That said—the CPQ market is changing.

Currently, it’s on a steep upward curve, growing from $7.4 billion in 2022 to an expected $11.2 billion by 2026, according to MGI Research.

This surge is driven by the rise of AI-powered automation and the shift toward usage-based pricing models. With 56% of SaaS companies now using consumption-based pricing, traditional quoting tools are struggling to keep up.

It’s a fact: clunky CPQ tools slow down sales.

Now imagine this: faster deal configuration, predictive pricing, automated approvals, and infallible quote accuracy.

That’s the impact of the next generation of AI CPQ software.

In this blog post, we look at the difference between traditional CPQ and AI CPQ, emerging features, and how it’ll change revenue workflows—for good.

What is CPQ?

CPQ stands for Configure-Price-Quote, and is a system that organizes your product catalog and pricing in one central place. This provides a representation of the monetization rules that govern product packaging, support pricing and margin discipline, and manage timely and comprehensive quote creation, review, approval, submission, and tracking.

CPQ platforms integrate with CRMs in the front end and ERP in the backend to make the sales process streamlined, faster, and organized—making sure everyone’s working based on the same data.

Traditional CPQ vs. AI CPQ

Historically, CPQ solutions were big, monolithic platforms (think Salesforce CPQ and Oracle CPQ) tailored to standard license sales. They were powerful but often slow to deploy, costly to customize, and rigid about pricing models. Plus, any change usually required an IT ticket.

By contrast, a new wave of AI CPQ platforms is emerging for SaaS and usage-driven businesses. These are built cloud-first, with simple interfaces, and seamless billing integration from day one.

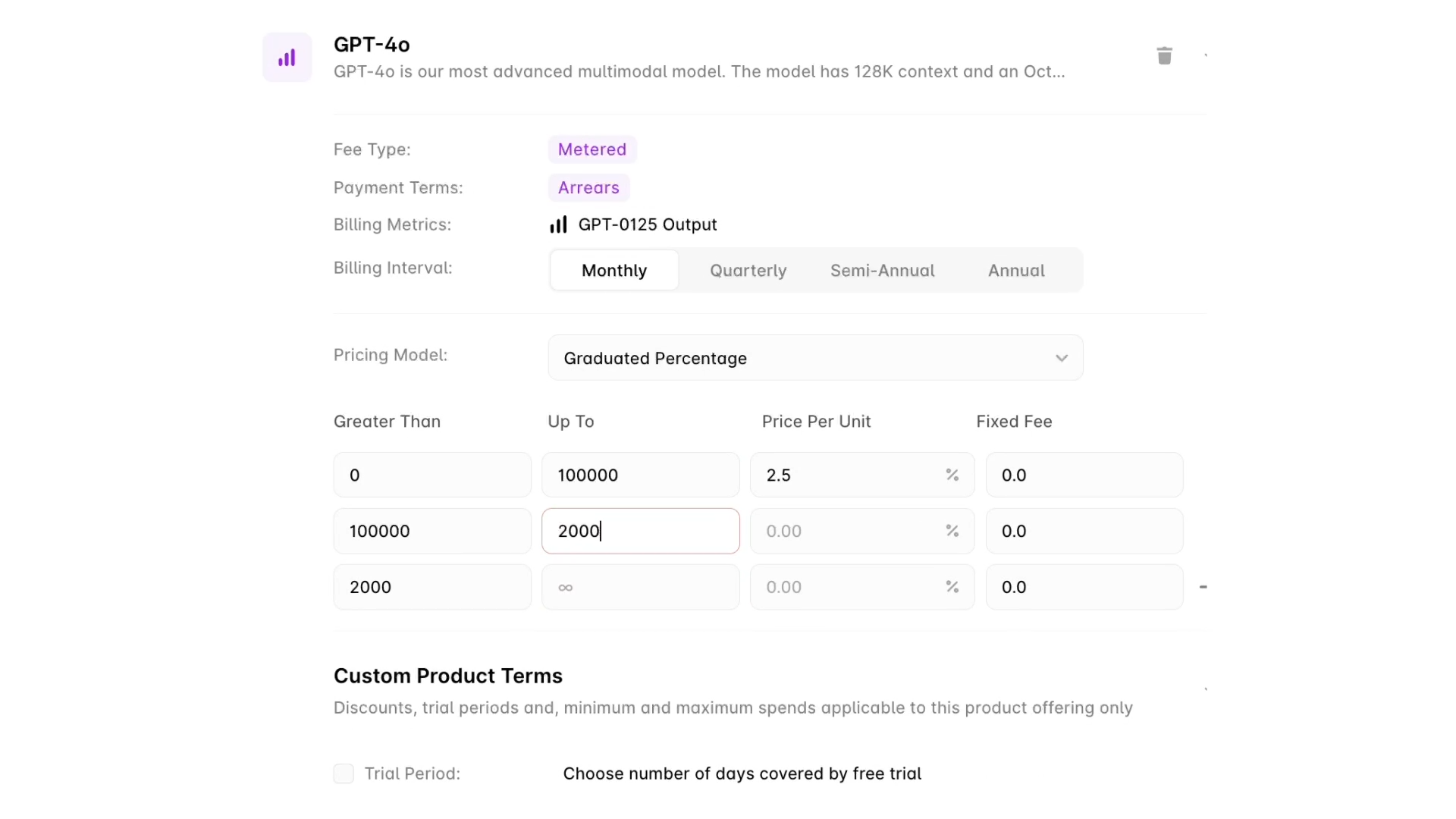

In practice that means you get real-time usage metering, no-code pricing changes, and instant deployment. Companies like Alguna (and others such as Subskribe or Nue) are already betting that combining CPQ and billing into one AI-ready system is the future.

In short, whereas legacy CPQs focus on rigid rules, AI CPQ will be designed to learn and adapt based on your sales workflow.

The promise of AI in CPQ: 4 emerging features to look for

While true AI-driven CPQ remains a work in progress, a handful of real, tangible capabilities are starting to surface as platforms like Alguna and Zenskar are offering features like AI-enabled contract uploads..

These are just early signs of how AI is beginning to shape the quoting process.

From smarter automation to adaptive pricing models, here are some of the most promising features gaining traction—and why RevOps and finance teams should be paying close attention.

- Dynamic pricing and bundling: Some platforms are experimenting with AI-driven pricing recommendations. Given a deal’s attributes, the system might propose which products or bundles to include, or what discount to apply, based on similar past deals. Over time these suggestions will get smarter as the AI trains on win/loss history.

- Automated approvals and deal scoring: Rather than blanket manual sign-offs, AI CPQs will be increasingly equipped to flag only risky deals. For instance, they might highlight deals with unusually deep discounts or terms, routing only those for extra review. In theory, a future AI CPQ could even score each quote for win probability or margin impact.

- Guided selling: Interactive proposal generators (“guided selling”) are also maturing. Some CPQ platforms already include AI chat assistants that help reps configure quotes. While these are not full AI chatbots (yet), these features make the quoting process more intuitive.

- Predictive features: AI could also drive new predictive features. Imagine the system scoring each deal and predicting its win probability or ideal price similar to lead scoring in CRM. Or picture AI analyzing customer usage patterns to suggest churn-preventing upsells.

These are budding use cases in the pipeline. Some startups hint at real-time AI deal scoring, or chat-assistant interfaces for quoting, even if most CPQs don’t do that just yet.

10 ways AI CPQ will change revenue workflows

- Faster deal turnaround

AI streamlines quote creation by recommending optimal configurations and pricing instantly. What used to take hours (or days) now takes minutes. - Smarter discounting and pricing

AI learns from past deals to suggest ideal price points and discount strategies based on what actually closes, reducing guesswork and improving margins. - Approval bottlenecks, eliminated

Instead of routing every quote for manual review, AI flags only outliers, saving time and accelerating deal velocity without compromising control. - Live usage-based quoting

AI-powered CPQ can ingest real-time product usage (API calls, compute hours, transactions) and reflect that instantly in quotes and billing which is critical for modern SaaS, AI, and fintech companies. - Predictive deal intelligence

AI can score deals, forecast likelihood to close, and suggest adjustments, giving RevOps real visibility into pipeline quality and risk. - Error reduction through automation

By automating rule validation, AI CPQs catch inconsistencies before a quote goes out, preventing downstream billing mismatches and revenue leakage. - Finance-ready from day one

Modern AI CPQs integrate with billing and rev rec systems, ensuring quote terms align with how revenue is recognized with no manual reconciliation needed. - No-code agility

RevOps and finance teams can update pricing logic, launch promotions, or test new billing models without engineering as AI helps validate and simulate changes before launch. - Better customer experience

Quotes become more accurate, transparent, and tailored which builds trust, reduces back-and-forth, and shortens the sales cycle. - Scales with complexity

As your business grows and you add more products, currencies, entities, and pricing models, AI CPQ systems will learn and adapt, reducing the admin burden and risk of human error.

3 platforms leading the next wave of AI-powered CPQ

AI-powered CPQ is no longer theoretical. A small group of platforms is already redefining how pricing, quoting, and revenue workflows operate, especially for SaaS, AI, and usage-based businesses.

Below are three platforms leading this shift, each taking a distinct approach to bringing intelligence, automation, and flexibility into CPQ.

1. Alguna: Unified quote-to-revenue platform (AI CPQ + Billing + RevRec)

Y Combinator backed Alguna was purpose-built for modern monetization and the AI era pricing requirements of modern SaaS and fintech companies.

Rather than treating CPQ as a standalone sales tool, it embeds quoting directly into a broader AI-native quote-to-revenue platform designed specifically for usage-based, hybrid, and outcome-based pricing models.

- Primary focus: End-to-end monetization platform with native CPQ, usage-based billing, and revenue recognition in one system.

- Strengths: No-code CPQ built for SaaS and AI pricing models with real-time usage metering and deep CRM and ERP integrations. Unified quote-to-cash workflow reduces manual handoffs.

- Best for: Scaling SaaS, AI, and fintech companies that need flexible pricing (subscriptions + usage + hybrid) and seamless revenue automation without engineering bottlenecks.

- Edge: Ships features faster than competitors (especially legacy players), combining configuration intelligence with real-time revenue data.

Simplify quoting with Alguna’s no-code CPQ

Build, price, and quote in minutes—no engineering, no manual work.

Zenskar: Order-to-cash automation

Zenskar approaches CPQ from a finance-first perspective. Its core strength lies in automating order-to-cash workflows using AI, with quoting capabilities emerging as part of a broader contract, billing, and revenue automation engine rather than as a standalone CPQ product.

- Primary focus: AI-driven order-to-cash platform that automates billing, revenue recognition, collections, and SaaS metrics. CPQ support is emerging but not core yet.

- Strengths: Strong AI automation for contracts and finance workflows; flexible handling of subscriptions, usage, and custom contracts; 200+ integrations; real-time analytics and automated O2C processes.

- Best for: Finance-led teams looking to eliminate manual billing and revenue ops while handling complex pricing and contract terms; CPQ capabilities are not the central focus.

3. DealHub: AI-enabled guided selling for revenue teams

DealHub is a sales-centric CPQ platform focused on helping reps build, present, and close deals faster. Its strength lies in guided selling, proposal workflows, and buyer collaboration—using light AI and analytics to improve deal execution rather than deeply re-architect pricing models.

- Primary focus: Modern CPQ with guided selling and sales-centric quote-to-revenue workflows, often bundled with DealRoom and lightweight subscription/billing features.

- Strengths: Strong guided selling, digital sales room, proposal generation, and CLM; fits mid-market B2B sales teams; relatively fast implementation.

- Best for: Mid-market companies prioritizing collaboration, sales engagement, and traditional CPQ functionality, with some light AI analytics—but less depth on usage-based billing and predictive pricing compared to AI-native monetization platforms.

Now’s the time to move to AI CPQ innovators

The CPQ process matters because quoting is critical to revenue velocity and AI could make it a lot smarter. Most tools are busy building and we’ll likely see some of the features mentioned sooner rather than later.

RevOps and finance leaders should take stock of their pain points (error-prone quotes? slow approval bottlenecks? complex usage billing?) and watch AI CPQ developments closely as AI monetization platforms (like Alguna) are sprinting toward the vision of intelligent, self-optimizing quoting.

Ultimately, even if your current CPQ feels adequate, it will soon fall short and you could lose deals based on quote turnaround time alone.