You can design the smartest pricing tiers in the world, but without a billing system that reliably tracks usage, applies pricing rules correctly, and adapts as customers change plans, your revenue workflows (and teams' sanity) will break down fast.

Soon, it will show up in the form of revenue leakage, customer disputes, or churn. Not to mention potential workarounds and time spent manually reconciling invoices.

So what type of billing capabilities does a modern, tiered pricing structure require?

Below, we list the non-negotiables that you'll need to support as you scale.

Choosing the right billing platform

The first decision is whether to build billing in-house or rely on a dedicated platform.

For most AI companies, purpose-built AI monetization platforms dramatically reduce time to market and technical risk.

Modern billing platforms handle complex scenarios out of the box, including:

- Mid-cycle proration for upgrades and downgrades

- Automated dunning for failed payments

- Tax calculation across jurisdictions

- Compliance with standards like PCI-DSS and SCA

Building and maintaining these capabilities internally often costs hundreds of thousands of dollars, but more importantly, it pulls valauble engineering time away from core AI development.

That said, custom billing can make sense in (extreme) edge cases. Extremely high-frequency micro transactions, unconventional usage metrics, or deep integrations with specialized payment rails may justify a bespoke solution.

The key is to evaluate whether your requirements are truly differentiating or simply expensive reinventions of solved problems.

Why quote-to-cash is the best option for tiered AI pricing

Tiered pricing rarely fails at the billing layer alone. It fails in the gaps between quoting, usage, invoicing, and revenue recognition.

That’s why quote-to-cash (Q2C) platforms are increasingly the best foundation for AI companies. Instead of stitching together CPQ, usage metering, billing, invoicing, and accounting as separate systems, a quote-to-cash approach treats pricing as a continuous lifecycle.

In a Q2C model:

- What sales quotes is exactly what gets billed

- Usage terms agreed in contracts automatically become enforceable meters

- Mid-cycle changes flow cleanly from contract → invoice → revenue

- Finance sees one consistent source of truth, not multiple reconciliation points

This matters even more for tiered and usage-based AI pricing strategies, where:

- Contracts often include custom tiers, ramps, or commitments

- Pricing changes mid-term as customers scale

- Usage must be reconciled precisely against commercial terms

When quoting, billing, and revenue live in separate tools, every handoff becomes a potential failure point. We're talking misapplied tiers, incorrect proration, invoice disputes, and revenue leakage. Quote-to-cash platforms remove these translation layers entirely.

The result is faster deal velocity, cleaner billing, fewer disputes, and dramatically less manual reconciliation for Finance and RevOps teams. Instead of constantly validating whether invoices match contracts and usage, teams can focus on optimizing pricing and expansion.

For most AI companies, especially those monetizing through tiered or hybrid models, quote-to-cash ss the only approach that scales without breaking trust as usage, complexity, and deal sizes grow.

Real-time usage metering

Usage tracking in Alguna.

Accurate usage tracking is the foundation of tiered and usage-based pricing. Your system must capture every billable event reliably, even during traffic spikes or partial outages.

Best practices include:

- Storing raw usage events in a durable data warehouse for audits and dispute resolution

- Aggregating usage in hourly, daily, or monthly windows for billing and quota enforcement

- Using distributed counters or time-series databases to handle high write volumes

Many teams also separate metering paths:

- Synchronous for real-time quota checks and enforcement

- Asynchronous for billing calculations and analytics, where eventual consistency is acceptable

This balance preserves performance without sacrificing accuracy.

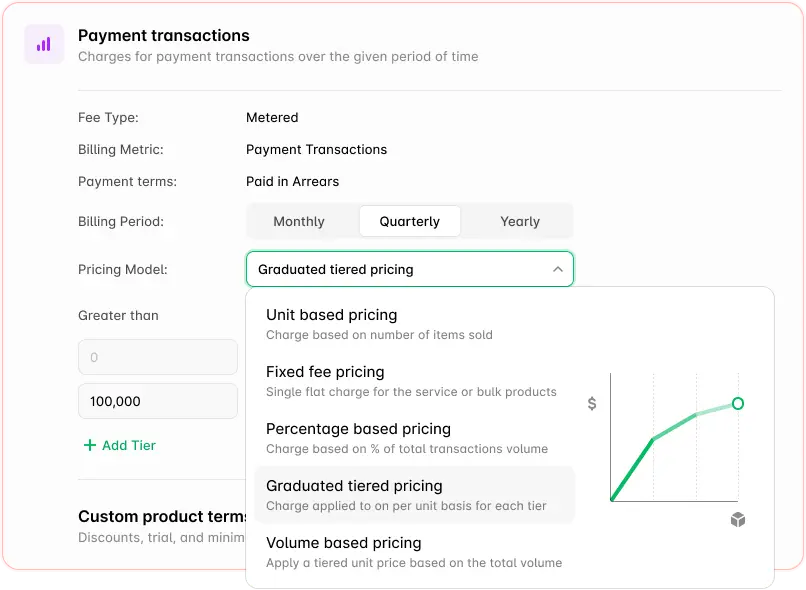

Flexible billing models

Tiered pricing rarely exists in isolation. Your billing infrastructure should support multiple pricing models simultaneously, including:

- Flat subscriptions with included usage

- Pay-as-you-go usage pricing

- Tiered or graduated volume discounts

- Committed-use or prepaid capacity models

- Hybrid pricing that combines several of the above

Enterprises may require annual contracts with custom terms, while startups often prefer monthly or even weekly billing cycles.

Modern SaaS billing software should support different billing cadences per product or customer without manual intervention or one-off workarounds.

Flexibility here isn’t a “nice to have.” It’s what lets pricing evolve as your market matures.

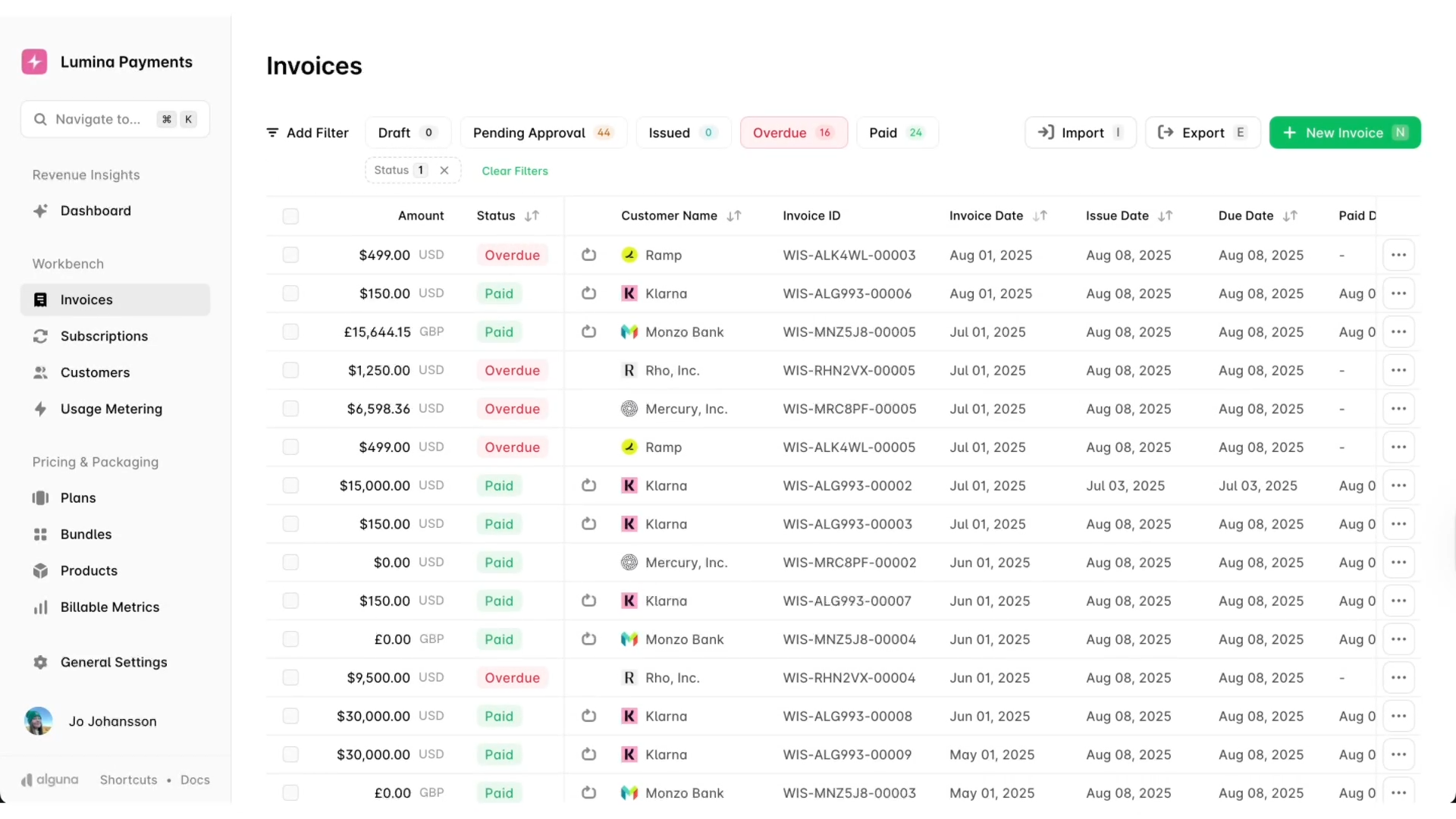

Invoice generation and payment processing

As you scale, manual invoicing quickly becomes a bottleneck.

Automated invoice generation should produce clear, auditable invoices that include:

- Subscription charges

- Usage broken down by feature or endpoint

- Credits, adjustments, and discounts

- Applicable taxes

- Clear payment instructions

Payment processing should support multiple methods, including credit cards, ACH, wires, and region-specific options for international customers, while enabling saved payment methods and automatic retries.

Well-designed dunning workflows matter more than most teams expect. Smart retry logic combined with escalating notifications can recover 10–15% of failed payments that would otherwise turn into involuntary churn.

Customer self-service portal

A self-service billing portal reduces support load and increases expansion revenue.

At minimum, customers should be able to:

- View real-time usage and current tier

- Upgrade or downgrade plans instantly

- Manage payment methods securely

- Download invoices and usage reports

- See upcoming charges before billing

Strong portals go further by visualizing usage trends, projecting costs, and sending proactive alerts at 50%, 75%, and 90% of quota usage. When customers understand their spend, they’re far less likely to experience bill shock.

One-click upgrades with automatic proration remove friction from expansion. Simply put: the easier it is to spend more with you, the more customers will.

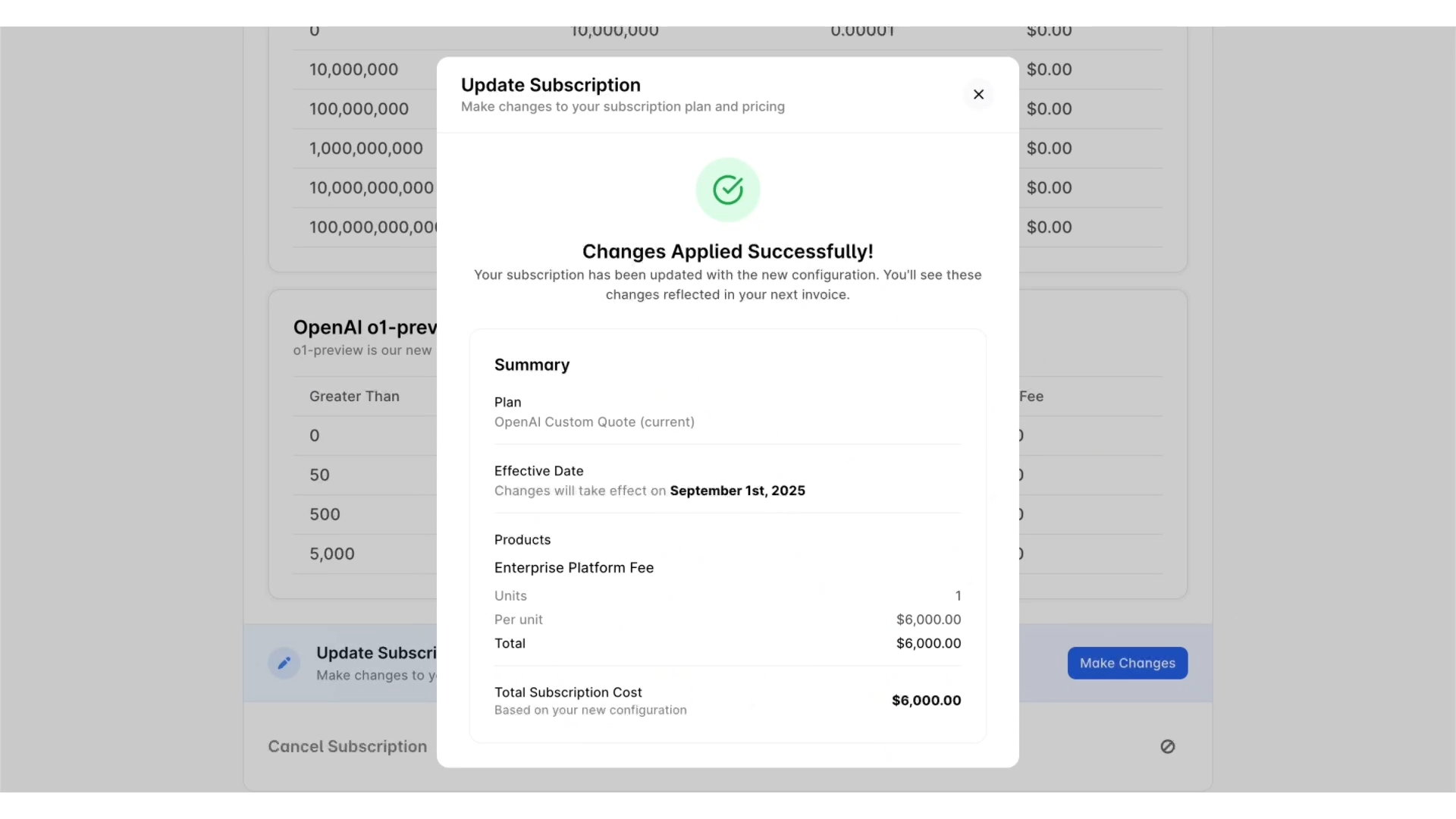

Proration and plan changes

Mid-cycle plan changes are a common source of customer frustration if handled poorly.

When a customer upgrades, they should receive credit for unused time on their current plan and pay only the prorated difference. Your system should support both:

- Immediate changes for customers who want instant access

- Scheduled changes that take effect at the next billing cycle

Downgrades typically apply at renewal to prevent gaming, though some companies allow immediate downgrades without refunds to preserve goodwill.

The right policy depends on your customer base, but your system must support whichever approach you choose, cleanly and transparently.

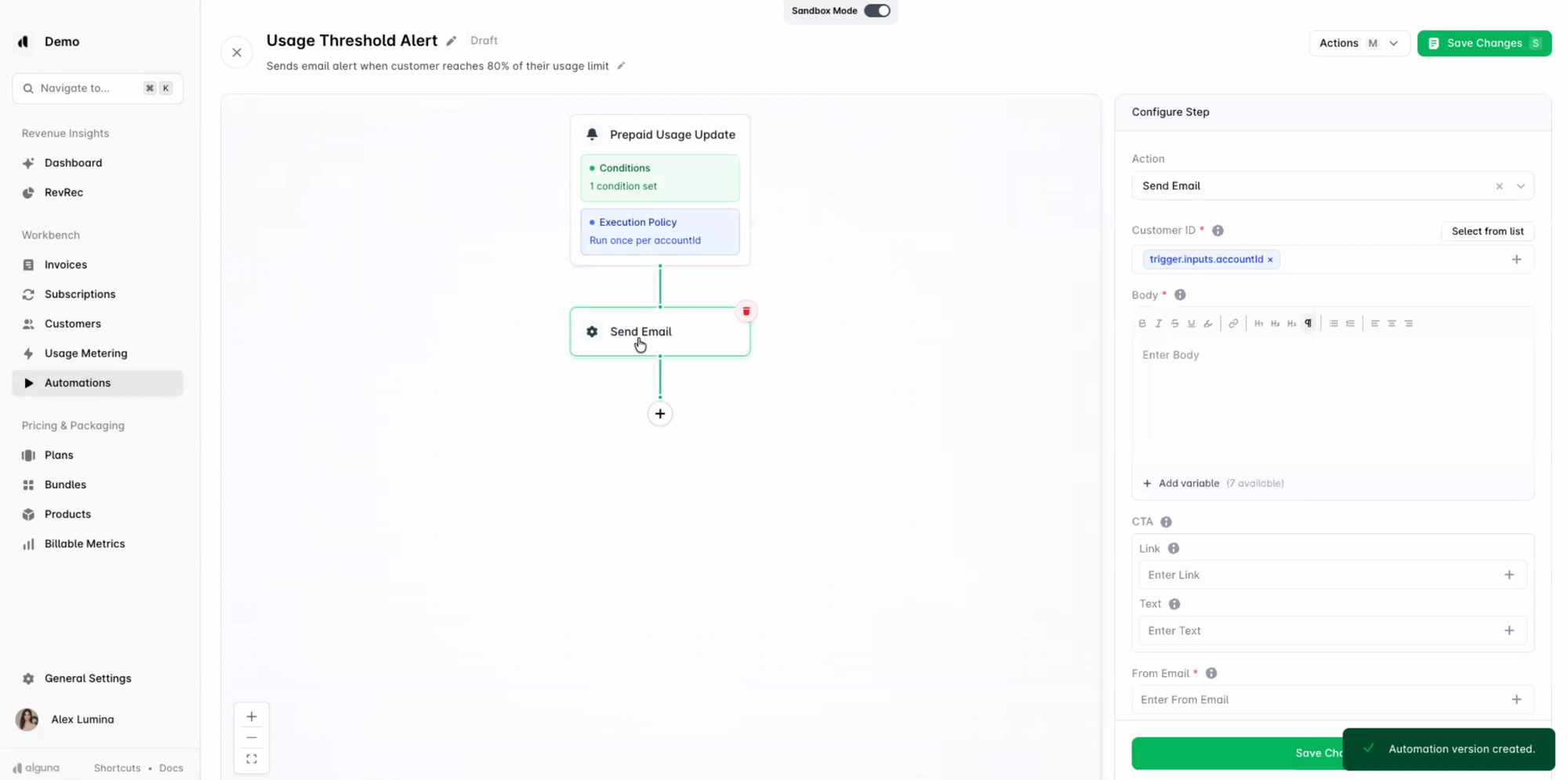

Usage alerts and quota management

No body likes bill shock. It can erode hard-earned trust in milliseconds.

Effective billing systems proactively notify customers when:

- They approach or exceed tier limits

- Usage patterns change unusually

- Estimated charges deviate from historical norms

Give customers control over how quotas behave:

- Soft limits that warn but allow continued use

- Hard limits that block requests

- Auto-upgrades that move customers to higher tiers automatically

Many AI companies also implement spend caps or “safety nets” to prevent runaway costs from bugs or abuse, pausing service automatically when thresholds are breached.

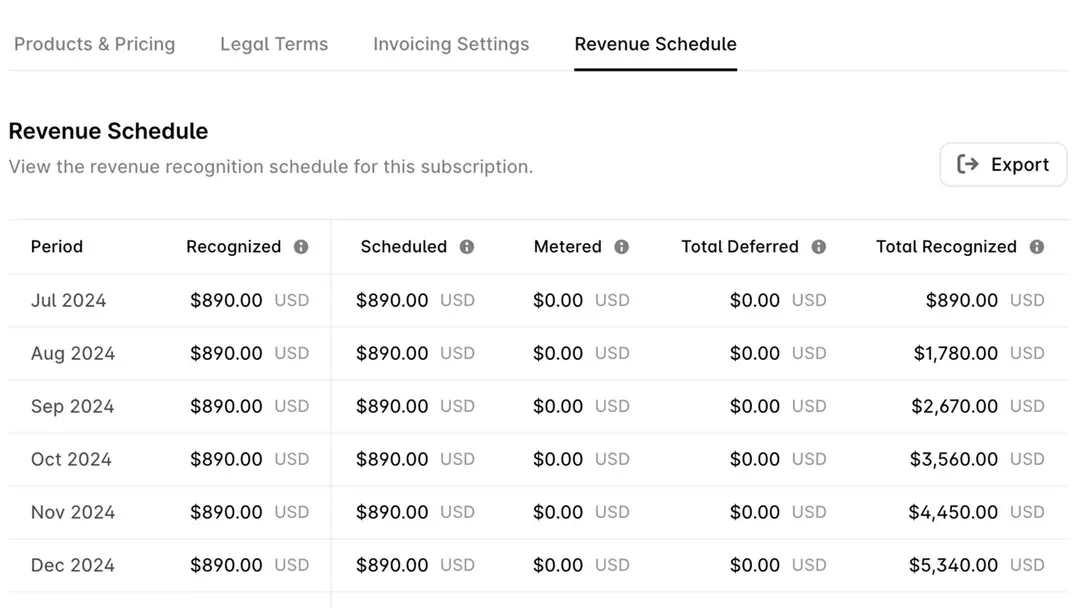

Revenue recognition and accounting

Tiered and usage-based pricing complicate revenue recognition.

Your billing system must:

- Track deferred revenue for prepaid subscriptions

- Recognize usage revenue when consumption occurs

- Handle credits, refunds, and contract changes correctly

Integrations with accounting systems like QuickBooks, NetSuite, or Xero reduce manual reconciliation and improve audit readiness.

Clear recognition policies, ratable for subscriptions, consumption-based for usage, are essential as you prepare for fundraising or audits.

Tax compliance and localization

Tax complexity scales faster than most teams expect.

Automated tax engines such as Avalara, TaxJar, or Stripe Tax help apply correct rates across regions and keep up with regulatory changes.

Supporting local currencies, region-specific invoice requirements, and compliant formats isn’t just about compliance, it directly impacts conversion and deal velocity in international markets.

Subscription lifecycle management

A complete billing infrastructure manages the full customer lifecycle, including:

- Free trials that convert automatically

- Grace periods before suspension

- Pausing and resuming subscriptions

- Cancellations with structured feedback

Lifecycle data powers better decisions. Tracking cohorts, expansion, contraction, and churn allows you to refine tiers and pricing over time, and identify where customers struggle or outgrow current plans.

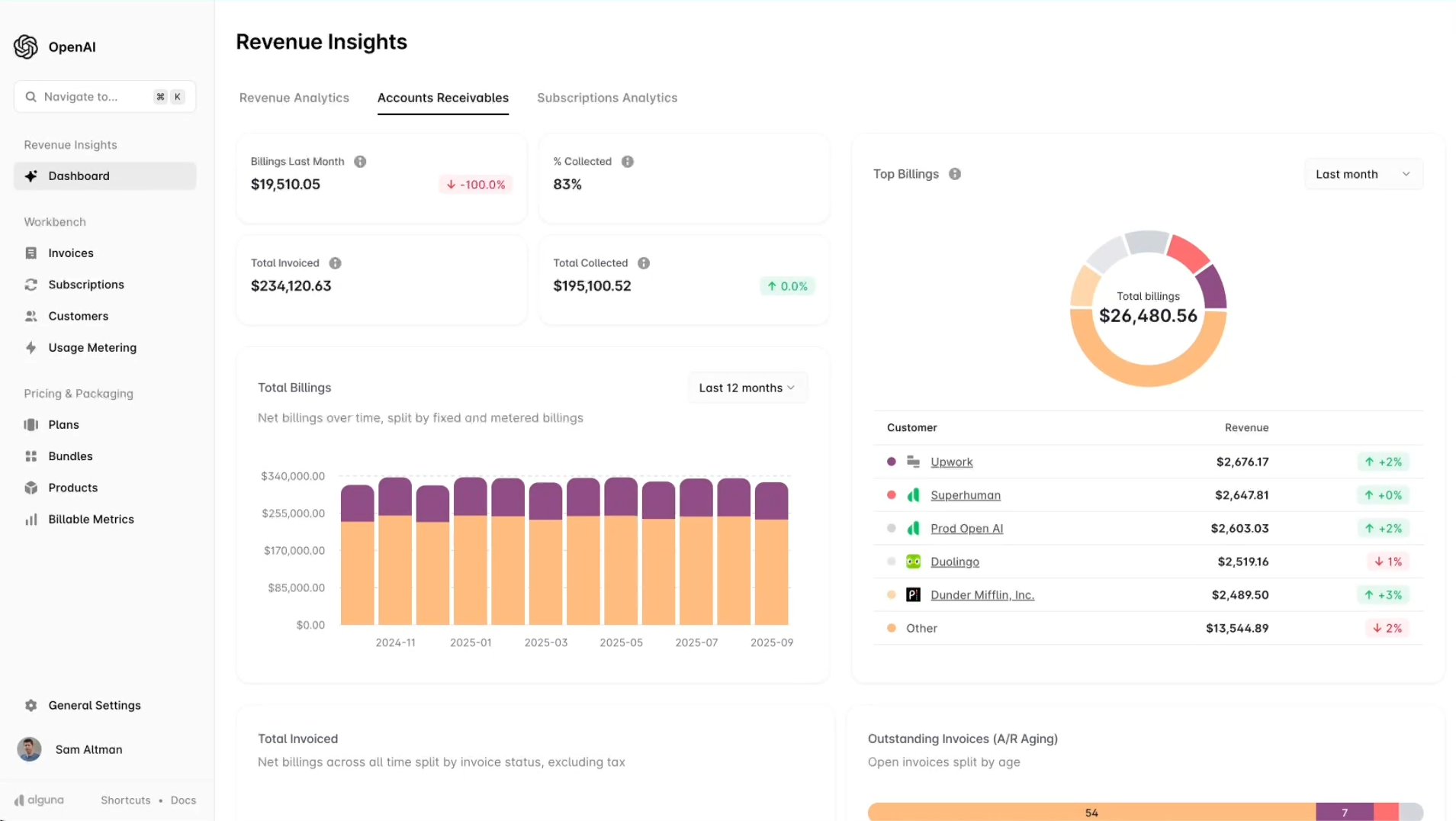

Reporting, analytics, and fraud prevention

Internally, billing analytics should provide real-time visibility into:

- MRR and ARR trends

- Tier migration patterns

- Usage by segment

- Payment success and failure reasons

Customer-facing reports should emphasize transparency, clear usage breakdowns, historical trends, and cost attribution by team or project.

At the same time, AI APIs are frequent fraud targets. Detecting anomalous usage, validating payment methods, and gating high-risk access protects both revenue and infrastructure without introducing unnecessary friction.

Scalability and reliability

Billing systems must scale flexibly without constant rework.

Design for horizontal scalability, idempotent operations, and safe retries to avoid double-charging. Use strong monitoring and alerting around billing-critical paths such as metering delays, invoice failures, tax errors, and payment issues directly impact trust and revenue.

Finally, stress-test under real conditions: end-of-month billing runs, sudden usage spikes, and recovery from partial outages.

Many billing failures only surface when systems are under pressure.

Tiered pricing only works if your billing can keep up

Tiered pricing isn’t just a pricing and packaging decision. It’s an operational commitment.

In AI businesses, where usage can spike unpredictably, pricing changes happen mid-cycle, and customers expect real-time visibility into spend, billing infrastructure becomes part of the product experience.

When it works, pricing feels fair, predictable, and scalable. When it doesn’t, it shows up as bill shock, revenue leakage, and churn, often long before teams realize where the problem started.

The companies that succeed with tiered AI pricing build billing systems that are:

- Usage-first, not retrofitted for consumption

- Flexible by default, not locked into a single pricing model

- Transparent to customers, not opaque or reactive

- Finance-ready, not patched together at month-end

This is why billing decisions made early tend to compound. Either into a durable growth engine or a structural constraint that slows every pricing experiment after.

If you want tiered pricing to drive expansion instead of friction, treat billing infrastructure as a strategic capability, not an implementation "detail." In the AI era, monetization doesn’t scale on ideas alone—it scales on systems that can handle reality.