• This guide compares leading subscription billing software including Alguna, Stripe Billing, Chargebee, Maxio, Recurly, and Zuora.

• Learn how to evaluate subscription billing software by automation, scalability, reporting, and total cost of ownership, and find the best fit for your business.

Determining the best subscription billing software for your company specifically depends on your business model and pricing strategy.

The subscription economy isn’t going anywhere—but the playing field has changed.

Today, Finance and RevOps teams expect billing systems that offer complete quote-to-cash automation, prevent revenue leakage, reduce manual work, and adapt instantly to pricing changes.

That’s why we’ve compared the leading subscription billing software, from legacy enterprise systems to modern, AI-native solutions like Alguna, to help you find the best fit for your business.

What is subscription billing software?

Subscription billing software manages recurring billing, invoicing, and payment collection for businesses that charge customers on a weekly, monthly, or annual basis. It helps automate everything from initial signup and proration to renewals, upgrades, downgrades, and cancellations.

Instead of manually tracking invoices, renewals, and payments, it centralizes and automates these workflows to ensure accurate, timely, and scalable billing cycles.

Also known as recurring subscription billing software, automated subscription billing software, or online subscription billing software it centralizes subscription operations, covering the entire customer lifecycle, from free trials and renewals to cancellations and mid-cycle changes.

For modern SaaS, fintech, and AI companies, manual billing creates revenue leakage, compliance risk, and poor customer experiences.

Subscription billing software ensures:

- Accuracy: Eliminates human error in invoices and renewals.

- Scalability: Supports thousands of accounts without additional headcount.

- Visibility: Gives finance and RevOps teams real-time insights into MRR, churn, and lifetime value.

- Flexibility: Supports any pricing model (usage-based, hybrid, credit-based), including AI pricing models without code.

6 key features of modern subscription billing management software

Modern automated billing subscription software goes beyond simply collecting payments.

As SaaS and AI companies scale, they face growing complexity, from usage-based pricing and multi-entity reporting to revenue compliance and analytics.

That means they’re looking for platforms that go beyond just, e.g., monthly subscription billing software.

Instead, these companies will want the features that come with today’s fully automated subscription billing software.

1. Automated invoicing

At its core, automated subscription billing software eliminates manual invoice creation. It automatically generates and sends invoices at the right time for each customer, whether they’re billed monthly, annually, or based on usage.

This includes handling:

- Proration for mid-cycle upgrades or downgrades

- Credit notes and adjustments for overages or refunds

- Custom invoice templates that reflect each customer’s contract terms

This level of automation ensures consistency, accuracy, and faster collections — especially as customer counts scale into the thousands.

Haven AI went from spending 30–40 minutes per contract to wrapping them up in less than 5 minutes.

Read case study

2. Payment processing and collections

Integration with payment gateways (like Stripe, Adyen, or PayPal) allows recurring payments to happen seamlessly.

Billing systems store and manage payment methods, trigger automatic retries on failed transactions, and reduce churn caused by expired cards.

More advanced tools add:

- Dunning workflows to automate reminders and retries

- Multiple payment methods (ACH, credit card, wire, etc.)

- Automated reconciliation between payments, invoices, and ledgers

3. Subscription and lifecycle management

Every customer’s journey changes over time. It’ll likely involve upgrades, add-ons, pauses, and cancellations. Subscription management ensures these transitions are reflected accurately without manual intervention.

This includes:

- Automating plan changes mid-cycle

- Supporting trial-to-paid conversions

- Tracking customer-specific terms, discounts, and renewals

- Keeping CRM and billing data in sync

In complex B2B setups, lifecycle management also connects with contracts, quotes, and product catalogs — creating a single source of truth for revenue data.

4. Usage-based and hybrid billing

Modern SaaS and AI-native businesses increasingly combine subscription tiers with usage-based components (e.g., API calls, compute hours, tokens processed).

Advanced subscription billing software:

- Collect real-time usage data via APIs or integrations

- Apply dynamic pricing rules and thresholds

- Support multiple pricing models, including credit-based, tiered, or pay-as-you-go

- Automatically generate invoices that align with actual usage

This flexibility allows finance teams to test new pricing strategies without engineering support, something that's increasingly critical to stay competitive.

5. Revenue recognition and compliance

To comply with accounting standards like ASC 606 and IFRS 15, revenue needs to be recognized over time, not all at once.

Subscription billing software automates this by:

- Deferring revenue correctly across billing periods

- Handling multi-element arrangements (bundled products or services)

- Generating audit-ready reports for finance teams

This not only ensures compliance but also gives leadership clear insight into recurring and deferred revenue streams.

6. Analytics, reporting, and insights

Beyond billing, these systems deliver powerful analytics that drive strategic decisions.

Dashboards track metrics like:

- Monthly Recurring Revenue (MRR)

- Churn and expansion rates

- Average Revenue Per User (ARPU)

- Cash collection efficiency

For RevOps and finance leaders, these insights connect operational performance to business outcomes — showing not just how revenue is booked, but how it grows.

Glyphic was struggling with a multi-tool setup that resulted in reporting discrepancies and revenue uncertainty.

After consolidating billing and analytics in Alguna, they gained full visibility into MRR and revenue movements.

Read case study

Best subscription billing software for SaaS companies: Comparison overview

| Platform | Best for | Key features | Limitations | Pricing |

|---|---|---|---|---|

| Alguna | AI and usage-based SaaS needing combining subscriptions with usage. | End-to-end quote to cash platform. Build and send quotes in minutes for subscriptions, usage-based pricing, or hybrid models. | Newer platform (launched 2023), B2B focus | Starts at $699/mo. No revenue share. Fast implementation and white-glove onboarding. |

| Stripe Billing | Early-stage SaaS with simple plans already on Stripe. Developer-led teams comfortable building custom logic. | Quick to get started. Great APIs/docs. Unified with Stripe Payments. | Limited flexibility for complex billing. Engineering needed for advanced scenarios. | 0.7% of revenue + Stripe processing fees. |

| Chargebee | SaaS with standard subscription models. | Feature-rich, friendly UI for non-technical teams, robust integrations (CRM/ERP/tax/gateways) | Customization can require engineering. Advanced features gated to higher tiers. Long implementation. | Starts at $599/month (annual) up to $100K MRR with 0.75% overage. Enterprise custom. |

| Zuora | Enterprise companies with complex subscription billing needs. | Extremely powerful if configurated right. Global, enterprise-ready (multi-entity/currency/tax). | Expensive. 3–6 month implementations. Requires specialized admin/RevOps. | Typically starts ~$50,000/year + implementation; scales by volume/customers; modules (e.g., RevPro) add cost. |

| Maxio | Finance-driven SaaS or mid-stage B2B with complex contracts. | Solid rev data and compliance. Comprehensive SaaS KPI dashboards. No-code for common billing tasks. | Limited flexibility for complex/hybrid pricing. Clunky UI + learning curve from merged products. | Starts at $599/month up to $100K MRR. |

| Recurly | Mid-market companies on recurring revenue models. | User-friendly and quick to launch. Strong dunning and payment recovery. Flexible gateway options and routing. | Limited customization for complex pricing. Lighter on finance (no built-in rev rec). | Custom based on transaction volume. |

6 best subscription billing software: Deep dive

There are dozens of subscriptions billing software tools on the market, but a few platforms consistently stand out for SaaS and AI companies.

Below is a detailed comparison of the best billing software for subscription businesses, including their features, pros and cons, who they’re best for, and pricing.

Alguna: Best subscription billing software for SaaS companies

Backed by Y Combinator, Alguna is a modern, end-to-end monetization platform that offers comprehensive subscription billing software that’s purpose-built for today’s SaaS, fintech, and AI companies using hybrid models.

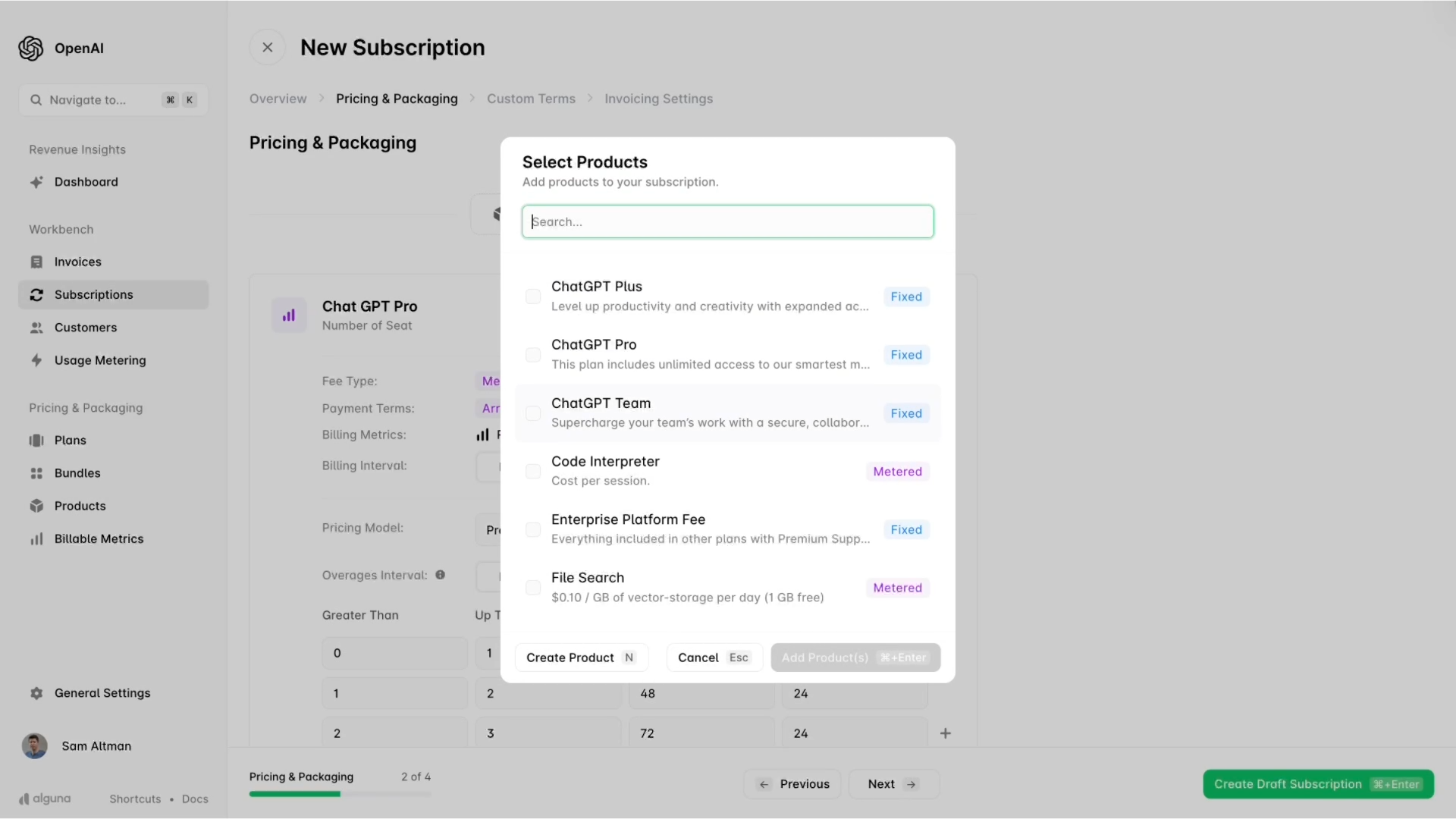

It unifies pricing configuration (CPQ), subscription and usage billing, payments, and revenue recognition in a single system, giving revenue teams a single source of truth.

Designed from the ground up for SaaS, AI-native, and usage-based subscription models, Alguna handles complex billing logic, such as API calls, credits, or consumption tiers, as easily as standard subscriptions.

Key features:

- Recurring billing engine: Automates subscription invoicing and payments at scale, including co-terming across plans and automatic proration for mid-cycle upgrades/downgrades.

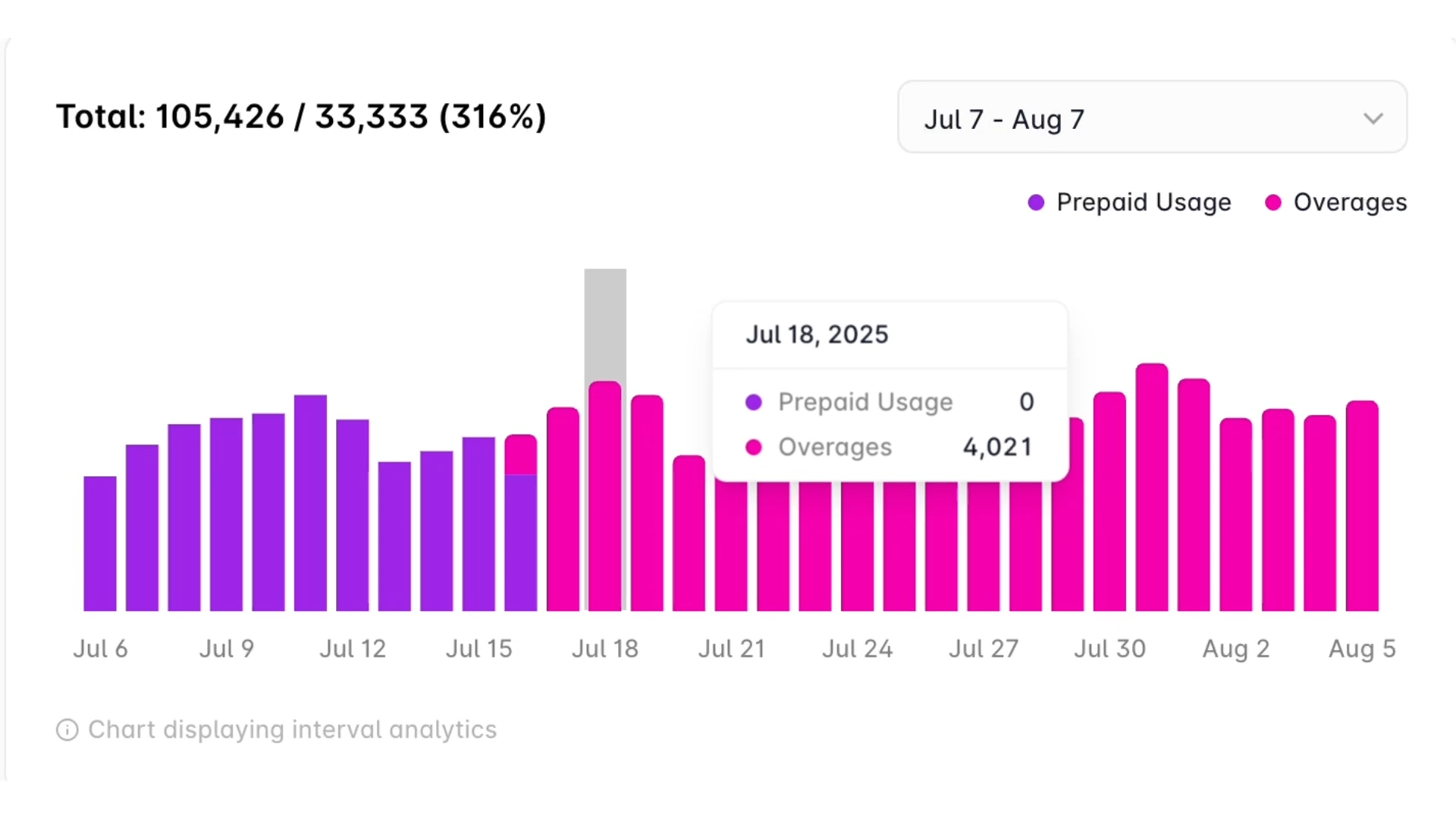

- Real-time usage metering and rating: Define any usage metric (API calls, tokens, compute credits, etc.) and meter it in real-time, applying pricing logic such as tiered rates or prepaid credits automatically. All of this can be configured no-code or via API.

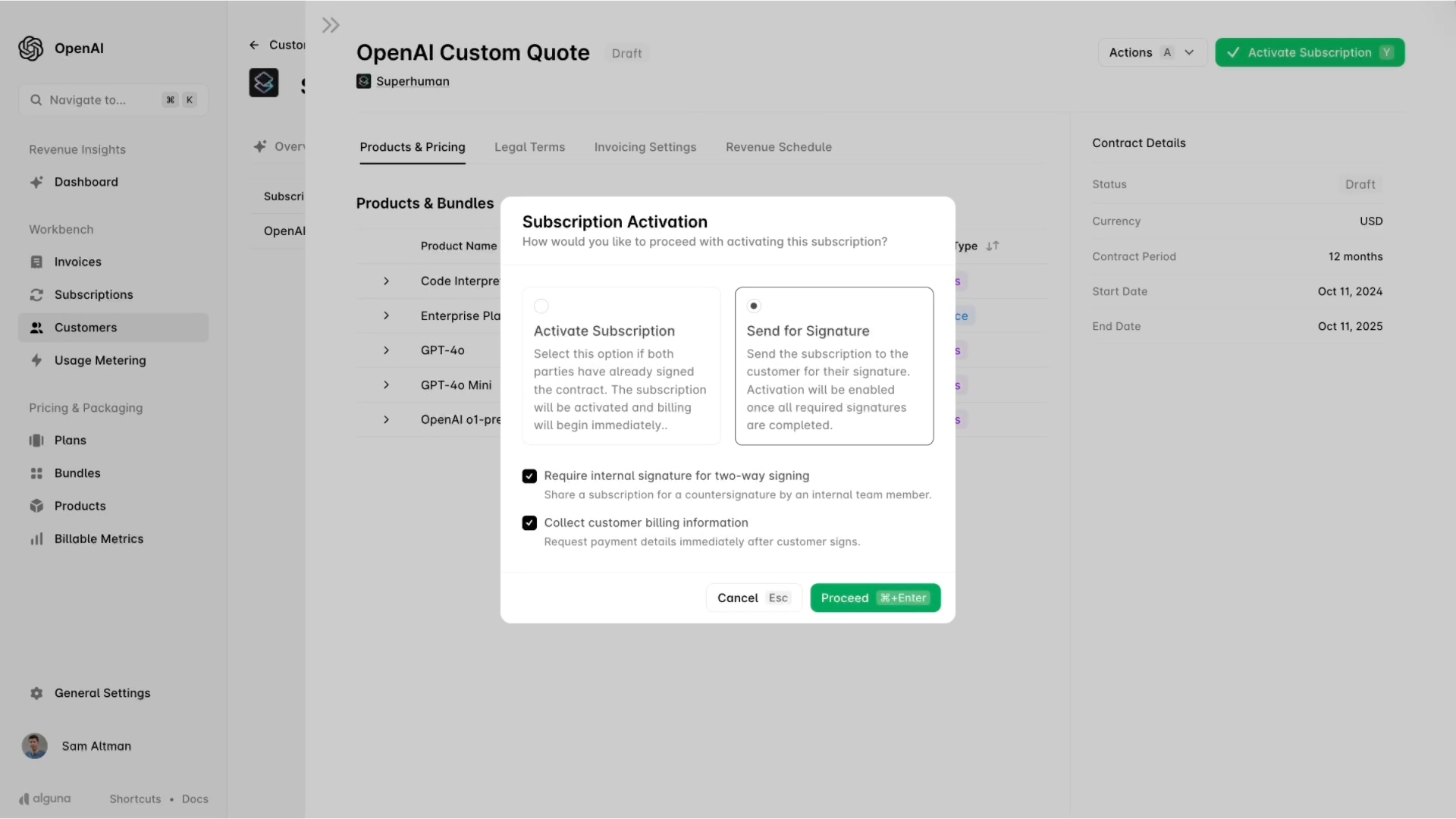

- Automated quote-to-cash workflow: With built-in no-code CPQ and e-signature, sales teams can create quotes that convert directly into live subscriptions or usage contracts with no manual setup required.

- Multi-entity, multi-currency, multi-model: Alguna supports multiple entities, currencies, and billing models (subscriptions, one-off, usage, or hybrid) simultaneously.

- Integrated payments and dunning: The platform connects with Stripe or other gateways for card, ACH, and wire payments, and automates retries, reminders, and dunning.

- Revenue recognition and analytics: Alguna automates ASC 606–compliant revenue recognition, deferred revenue schedules, and financial reporting. Built-in dashboards for MRR, ARR, churn, and cohort analysis provide finance teams with a comprehensive view, eliminating the need for external BI tools.

- Robust integrations: Connects seamlessly with CRMs, accounting tools, and tax systems, making it easy to build an end-to-end billing workflow without extra infrastructure.

Pros:

- No-code and agile: RevOps and product teams can launch or update pricing in minutes with no engineering needed. Evervault, for example, eliminated dev bottlenecks completely after moving pricing and billing into Alguna.

- Built for usage-based and AI monetization: Handles complex billing logic like metered overages, consumption tiers, and credit-based AI models out of the box, ideal for companies billing per API call, GB, or AI task.

- Unified data, fewer errors: With CPQ, billing, and revenue in one system, teams can gain a single source of truth for revenue, improving reporting accuracy and confidence.

- Fast implementation and hands-on support: Most customers go live in weeks, not months. White-glove migration and direct Slack support come standard.

Cons:

- Newer platform: Launched in 2023 by ex-Primer and ex-Dojo founders (Y Combinator-backed).

- Not a fit for early-stage startups: If your billing isn’t that sophisticated (yet), you probably don’t need Alguna at this stage.

Best for:

- AI and usage-based SaaS companies that need to meter and charge for consumption in addition to subscriptions.

- Scaling B2B and AI companies that are transitioning from a basic billing setup (e.g., Stripe + manual processes) to an all-in-one solution for subscription billing and revenue automation.

- Companies experimenting with pricing models and want to mix subscriptions, usage-based pricing, or hybrid models while supporting multi-tier, seat-based, and prepaid with overages.

Pricing: Plans start at $699/month on a flat-fee basis, covering everything from CPQ to subscription and usage billing.

Unlike legacy vendors that charge a percentage of revenue or add hidden fees, Alguna uses transparent, predictable pricing that scales with your business

Stripe Billing: Simple recurring subscription billing software for startups and small SaaS

Stripe Billing (part of Stripe’s ecosystem) offers billing subscription software that lets businesses quickly set up recurring billing and invoicing on top of their existing Stripe payments, making it a natural choice for startups already using Stripe to accept credit cards.

Developer-friendly and API-first, Stripe Billing is ideal for teams that want to launch simple subscriptions fast without adding a third-party billing system. A SaaS company, for example, can use Stripe’s API to create customers and plans while Stripe automatically handles recurring charges, invoicing, and receipts.

Key features:

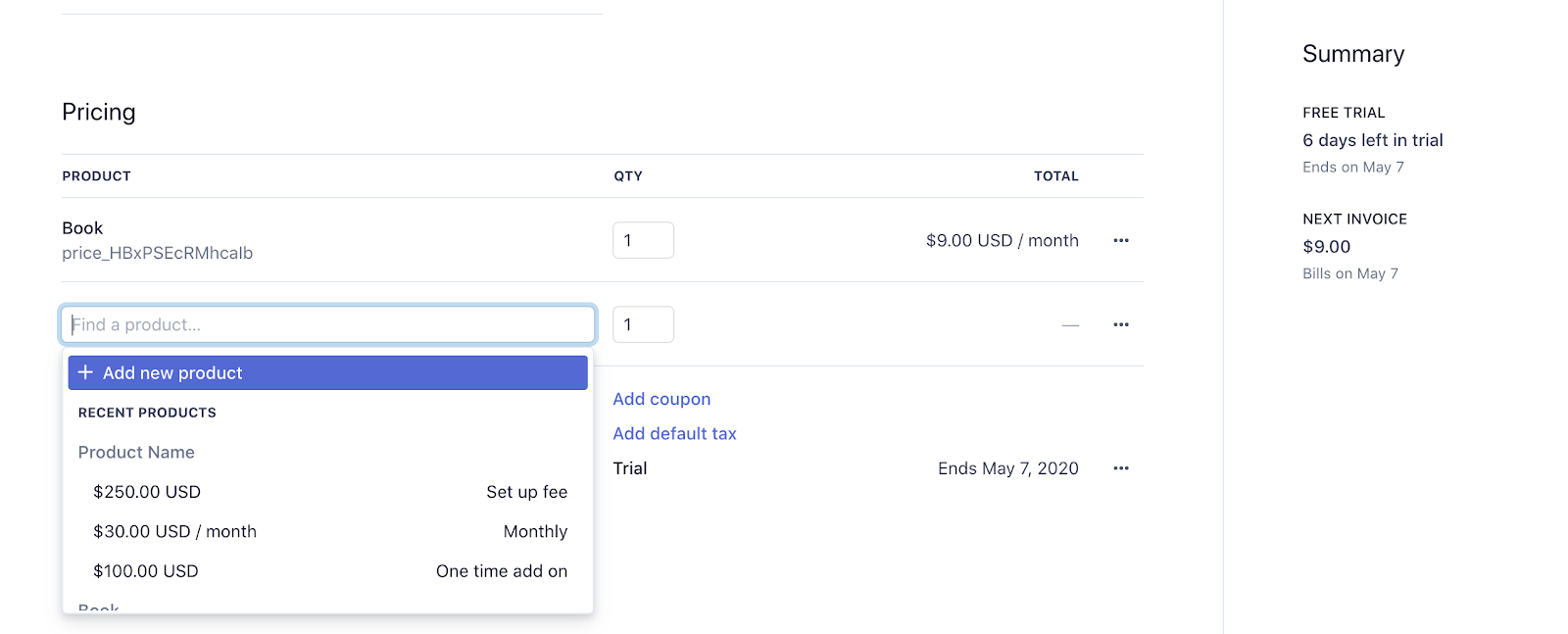

- Subscription and plan management: Create and manage subscription products through the Stripe Dashboard or API, setting pricing (monthly, annual, or trial) and automating upgrades, downgrades, or cancellations.

- Payments integration: As part of the Stripe ecosystem, Billing uses Stripe Payments natively with no extra gateway required. It supports multiple payment methods, including credit cards, ACH, and wallets like Apple Pay.

- Customer portal and invoicing: A hosted billing portal lets customers update payment details and view invoices. Stripe also automates invoice delivery, receipts, and dunning emails, with Smart Retries (ML-based) to recover failed payments.

- Integrations and extensions: Stripe offers extensive APIs, webhooks, and a growing App Marketplace, making it easy to connect Billing with CRMs, accounting systems, or custom workflows.

Pros:

- Easy to implement: Stripe’s APIs and documentation are excellent. Developers can launch a subscription setup in days with no sales process or setup fees.

- Unified with payments: Billing runs natively on Stripe’s payment rails, so subscriptions, payments, and compliance all live in one system.

- Ideal for straightforward use cases: For startups with simple monthly or annual plans, Stripe handles scale easily without added complexity or cost.

Cons:

- Limited flexibility for complex billing: Stripe Billing isn’t built for advanced or customized billing models. Teams often struggle with hybrid pricing, overages, or multi-part invoices, which forces them to implement manual workarounds.

- Requires engineering for advanced needs: Stripe is developer-focused. Tasks like prorations, custom discounts, or seat-based usage adjustments require coding or manual updates.

- Gaps in revenue management and compliance: Stripe doesn’t handle revenue recognition, deferred revenue, or multi-entity consolidation natively. It’s ideal for simple, early-stage setups, but falls short once finance teams require deeper reporting or audit-ready compliance.

Best for:

- Early-stage SaaS startups with simple billing needs, especially those already using Stripe for payments. If you only need a few standard plans and value quick setup, Stripe is an easy fit.

- Developer-led teams that want full API control and are comfortable building custom billing logic will also find Stripe to be a powerful and flexible solution.

Pricing: Stripe Billing charges 0.7% plus Stripe’s standard payment processing fees (typically 2.9% + 30¢ per card transaction).

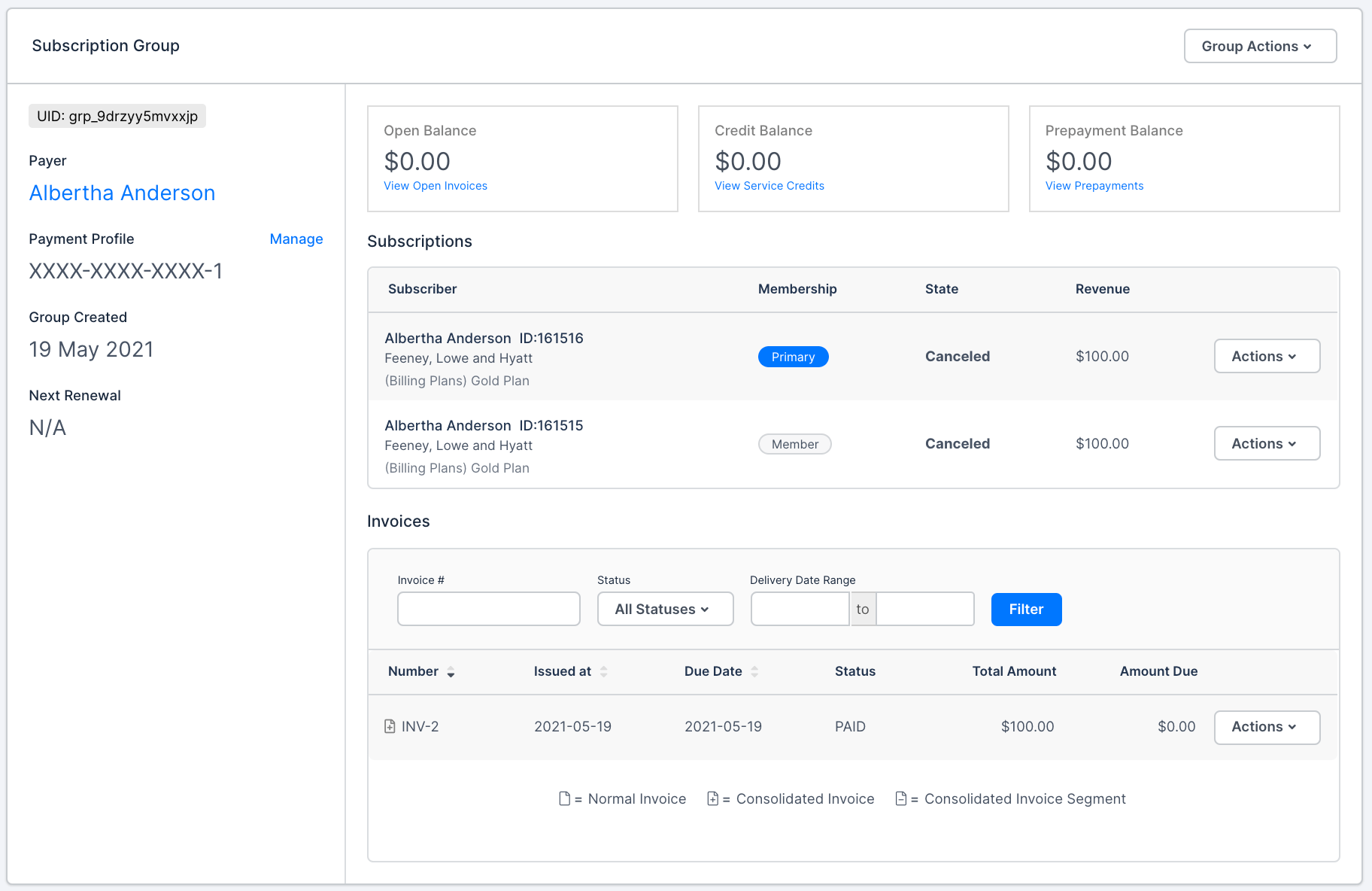

Chargebee: Subscription billing management software for mid-market SaaS

Chargebee is popular with mid-market SaaS companies scaling beyond manual invoicing. It automates the full subscription lifecycle, from trials and upgrades to invoicing, payments, and renewals, through a clean, user-friendly interface that doesn’t require heavy developer input.

Designed for mid-market B2B SaaS, Chargebee offers built-in dunning, proration, tax handling, and integrations with tools like Salesforce, HubSpot, and NetSuite. It also supports multiple payment gateways and currencies, making it a solid fit for companies expanding globally.

Key features:

- Subscription automation: Chargebee manages the full subscription lifecycle, from creating products and pricing plans (including multiple billing frequencies, add-ons, and coupons) to automating invoices, payments, upgrades, downgrades, and trial management with built-in proration.

- Invoicing and quotes: Supports both automated card payments and manual invoicing. Sales teams can generate quotes that instantly convert into active subscriptions, thereby reducing the need for handoffs between sales and finance.

- Integrations and reporting: Chargebee integrates with CRMs (Salesforce, HubSpot), ERPs (QuickBooks, NetSuite), and multiple payment gateways (Stripe, Braintree, GoCardless). Its analytics dashboard tracks MRR, churn, and revenue by product, while the optional RevRec module automates ASC 606-compliant revenue recognition and journal entries.

Pros:

- Feature-rich and scalable: Covers nearly all recurring billing use cases out of the box, from proration and multi-currency support to automated invoicing, which saves significant developer time.

- Easy for non-technical teams: Its intuitive dashboard lets finance and support teams manage subscriptions, apply changes, and issue refunds without engineering help.

- Robust integrations: Connects seamlessly with CRMs, accounting tools, and tax systems, making it easy to build an end-to-end billing workflow without extra infrastructure.

Cons:

- Customization can require engineering: Handles most billing needs out of the box, but it can be rigid for complex workflows. Advanced or unusual pricing models often require developer time to extend via API or custom integrations.

- Feature gating by plan: Some advanced features, such as multi-entity management, deeper analytics, or specific integrations, are reserved for higher tiers, prompting growing teams to upgrade to more expensive plans.

- Implementation effort: Setup and migration take time. Configuring products, testing, and cleaning up legacy data can require several weeks, making it less “plug-and-play” than lightweight tools like Stripe.

Best for:

- Growing SaaS companies ($1M–$50M ARR) with standard subscription models (monthly, annual, or add-on plans that want a dependable, automated billing system without enterprise overhead.

- Non-software subscriptions, such as marketplaces, IoT services, or subscription boxes that need flexibility in billing frequency and one-off charges.

Pricing: Starts at $599/month (billed annually) for up to $100K in MRR, with 0.75% overage fees beyond that. Enterprise plans are custom.

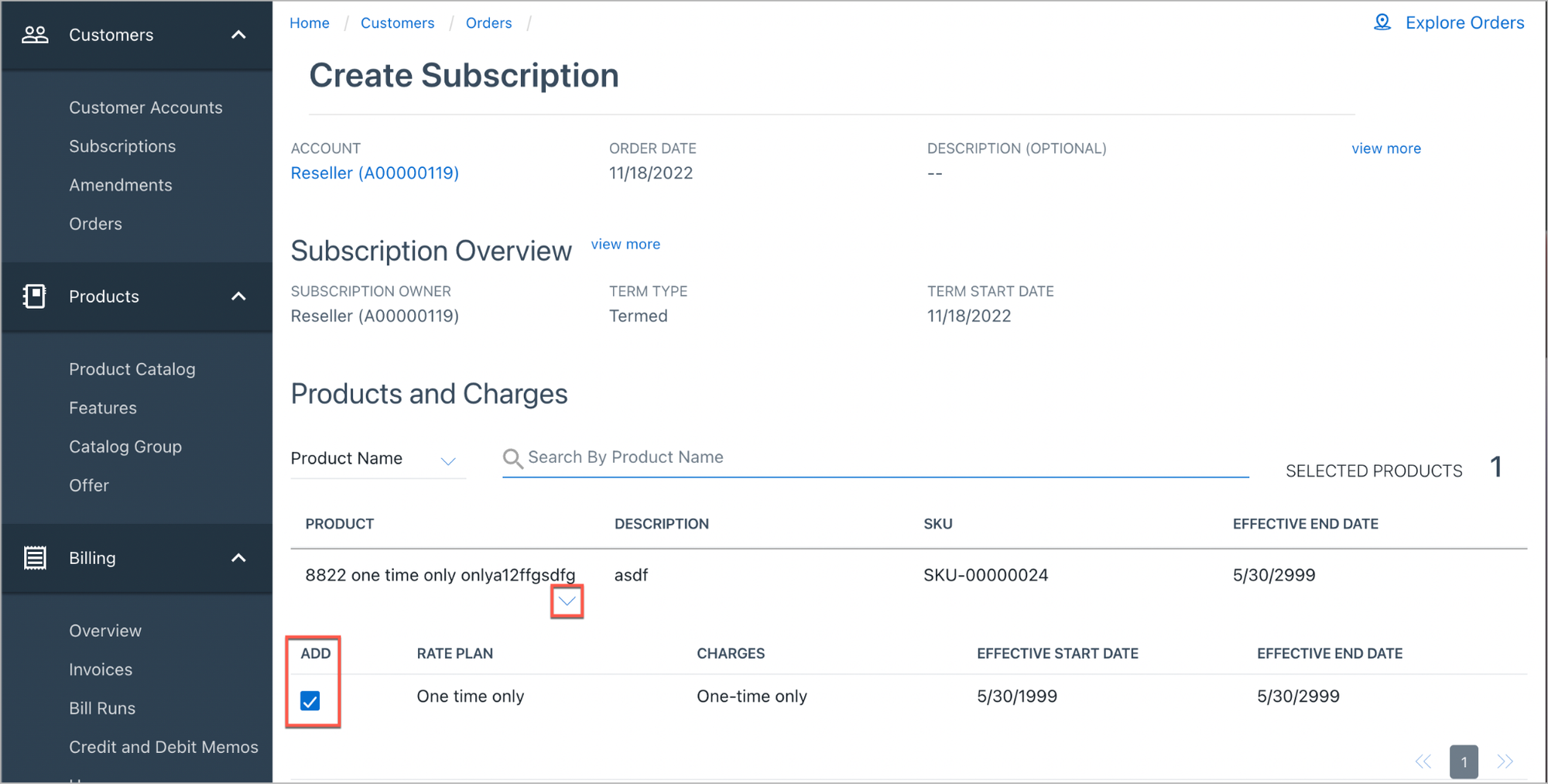

Zuora: Enterprise-grade subscription and revenue operations platform

Zuora is the enterprise standard for subscription billing and revenue management. Designed for complex, global businesses, it supports virtually any pricing model, recurring, usage-based, or hybrid, across multiple entities, currencies, and tax jurisdictions.

Zuora’s strength lies in its breadth: it unifies billing, payments, collections, and revenue recognition within a single, compliant platform trusted by large enterprises.

To avoid complexity, cost, and month-long implementation, modern RevOps teams typically opt for Alguna to get the same power and performance, but on a much faster and more flexible platform.

Key features:

- Product catalog and rate plans: Configure products with multiple charge types, tiered or volume-based usage, discounts, and multi-year ramp deals, enabling virtually any pricing or contract scenario.

- Subscription and order management: Zuora structures every subscription change (upgrades, renewals, cancellations) as an auditable “order.” This framework provides clarity and compliance across complex, long-term contracts.

- Revenue recognition: Automates ASC 606/IFRS 15 compliance, generating revenue schedules, SSP allocations, and journal entries. It’s designed for public or audit-sensitive companies needing precise financial reporting.

- Multi-entity and compliance: Supports multiple entities, currencies, tax rules, and regulatory requirements out of the box. SOC 1/SOC 2 compliance, role-based access, and granular permissions ensure enterprise-grade control.

Pros:

- Powerful and flexible: Handles virtually any subscription or pricing model, from one-time and recurring fees to complex, tiered usage and multi-year ramp deals

- Global and enterprise-ready: Supports multiple currencies, entities, and tax regimes, with built-in compliance (SOC 1/SOC 2, GDPR, SOX).

- End-to-end quote-to-cash: With add-ons like CPQ and Zuora Revenue, the platform encompasses the entire billing chain, from quoting and invoicing to revenue recognition, providing finance teams with a unified system and reducing integration overhead.

Cons:

- High cost and lengthy implementation: Zuora’s pricing starts around $50K/year and can easily reach six figures once add-ons and services are included. Implementation often takes 3–6 months and requires external consultants.

- Complex and resource-intensive: Operating Zuora typically requires a dedicated admin or trained RevOps engineer due to its steep learning curve, complex data model, and less intuitive UI for non-technical users.

- Limited agility: Changing pricing models or updating product catalogs can involve multiple configuration steps and sandbox testing, which slows down iteration for dynamic SaaS or AI companies.

Best for:

- Large or fast-scaling companies with complex billing needs and the resources to implement and maintain an enterprise-grade system.

- Highly regulated industries (telecom, finance, public companies) where auditability and reliability outweigh agility, and billing accuracy is mission-critical.

Pricing: Starts around $50,000 per year, with additional costs for implementation and integrations. Pricing scales by factors like billing volume, transaction count, and customer numbers.

Maxio: Subscription billing software with finance and analytics built in

Maxio was formed in 2021 from the merger of Chargify and SaaSOptics (adding RevOps.com in 2024). The platform combines Chargify’s billing automation with SaaSOptics’ revenue management and analytics strengths. The result is a unified platform that combines subscription billing, revenue recognition, and SaaS analytics.

It’s built for finance and RevOps teams that require clean billing data, automated compliance, and full visibility into key metrics such as MRR, ARR, and churn, without relying on spreadsheets or separate BI tools.

Key features:

- Subscription and billing management: Maxio supports creating plans, managing recurring billing, trials, proration, and discounts. It handles various pricing models (fixed, tiered, volume, or usage-based) and offers event-based billing via API for more advanced scenarios.

- Revenue recognition: Maxio automates revenue recognition, including monthly postings and GAAP/ASC 606-compliant reports, eliminating the need for a separate Revenue Recognition tool.

- SaaS analytics and dashboards: Includes built-in dashboards for ARR, MRR, CLTV, and customer metrics, effectively serving as a financial CRM. It also provides forecasts for cash flow and billing, which many CFOs and investors value.

Pros:

- Finance-oriented features: Maxio provides finance teams with reliable revenue data, seamless accounting synchronization, and audit-ready compliance. Users often highlight how it streamlines the month-end close and eliminates spreadsheet chaos with built-in revenue recognition and reporting capabilities.

- Comprehensive SaaS metrics: Maxio includes ready-made dashboards for core SaaS KPIs (ARR, MRR, growth, churn, and retention), offering instant visibility into business health without needing a separate analytics tool.

- No-code for common tasks: Finance and ops teams can manage most tasks, creating plans, issuing credits, or extending trials, directly in the UI. Integrations with QuickBooks and Salesforce are one-time setups, reducing reliance on engineering for everyday billing ops.

Cons:

- Limited flexibility in pricing models: Struggles with complex hybrid or frequently changing models. More intricate setups, such as mixing per-seat, usage, and overage charges, often require workarounds or custom configurations.

- Complex implementation: Requires extensive onboarding. Migrating contracts, configuring revenue rules, and ensuring data accuracy can be time-consuming and often require dedicated expertise or assistance from Maxio’s team.

- User interface and learning curve: The merged Chargify–SaaSOptics interface isn’t as intuitive as newer platforms like Alguna. Some workflows and reports take time to master, and training is often needed to fully leverage the system’s capabilities.

Best for:

- Finance-driven SaaS companies: Maxio appeals to CFOs and Controllers who prioritize data accuracy, compliance, and audit readiness.

- Mid-stage B2B SaaS with complex contracts: Suited for companies managing hundreds of custom agreements but not yet at enterprise scale.

Pricing: Maxio’s pricing is comparable to Chargebee’s, starting at $599/month for up to $ 100,000 in monthly recurring revenue (MRR), with higher tiers available for larger volumes.

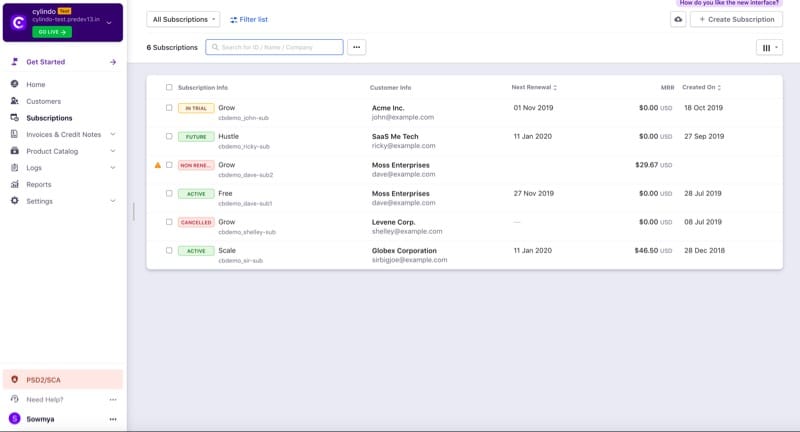

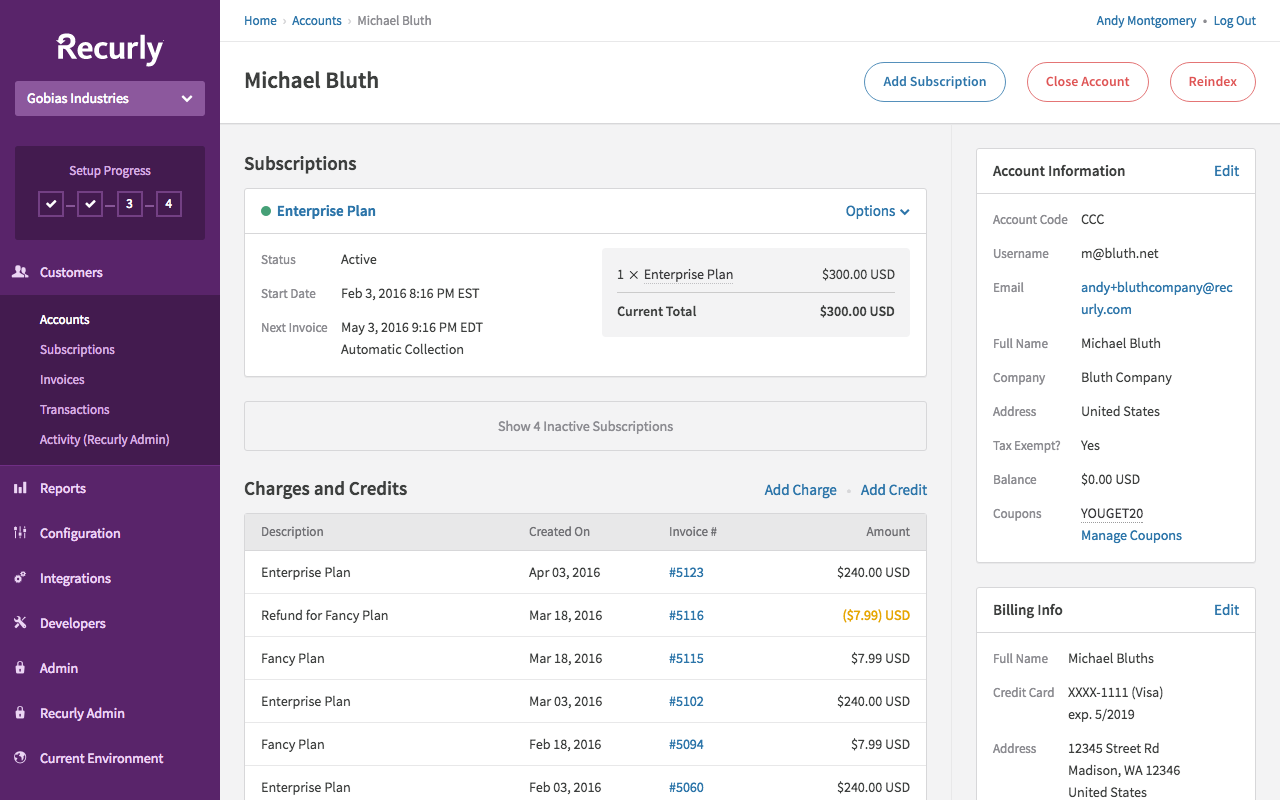

Recurly: Recurring billing and subscription management software for media companies and mid-market SaaS

Recurly is a long-standing subscription billing software known for its simplicity, speed, and strong performance in B2C subscription models, but also SaaS.

The platform focuses on quick integration, a clean checkout experience, and revenue optimization, especially through advanced dunning and retry logic that maximizes payment success rates.

Key features:

- Recurring billing and invoicing: Recurly automates the full subscription cycle, from recurring charges to invoicing, discounts, and free trials. It handles plan intervals, coupons, and net payment terms with ease, making it straightforward for both SaaS and consumer subscription models.

- Payment gateway flexibility: Recurly integrates with multiple gateways and can intelligently route transactions, avoiding lock-in to a single processor. It also supports alternative payment methods, such as PayPal and Amazon Pay, making it ideal for global and B2C subscriptions.

- Dunning and churn management: One of Recurly’s strongest features. Its adaptive retry logic and automatic card updates significantly reduce failed payments. Advanced dunning tools help recover revenue and minimize involuntary churn.

- Analytics: Built-in dashboards track key metrics, including MRR, subscriber growth, churn, and LTV, which is especially valuable for subscription-based consumer and media businesses focused on retention and growth trends.

Pros:

- User-friendly and quick to launch, Recurly is praised for its clean API and intuitive admin UI, enabling businesses to get up and running quickly without complex setup. It’s far easier to implement than heavy enterprise systems like Zuora, and most basic configurations require minimal developer input.

- High payment recovery success: Recurly’s adaptive dunning and automatic card updater significantly reduce failed payments, recovering a high percentage of otherwise lost revenue: a key advantage for businesses with large subscriber bases.

- Flexible payment options: It integrates with multiple gateways, including Stripe and PayPal, and can route transactions intelligently, ensuring uptime and optimizing payment success rates for global customers.

Cons:

- Limited customization: Recurly offers a strong core feature set but limited flexibility for complex pricing or custom billing logic. It’s less developer-extensible than Stripe and lacks the deep configurability of Chargebee for edge cases.

- Weaker multi-entity support: Managing multiple business units or B2B hierarchies can be cumbersome. Recurly works best for a single brand or product line; otherwise, you may need multiple accounts and manual consolidation.

- Light on financial depth: Recurly’s analytics focus on subscription metrics, not accounting or compliance. It lacks built-in revenue recognition, meaning finance teams must handle GAAP reporting through external tools or integrations.

Best for:

- Mid-market companies operating on recurring revenue models within the subscription economy.

Pricing: Custom based on transaction volume.

What to think about when choosing the best subscription billing software for your company

Whether you run a lean SaaS startup or a scaling AI enterprise, here’s a checklist of considerations when comparing recurring billing and subscription management software:

- Supports both subscription and usage-based models: Even if you currently only run recurring plans, usage-based pricing is growing rapidly (nearly 60% of SaaS companies now use or are testing UBP).

The right system should handle both flat recurring fees and variable charges, from add-ons and overages to metered usage, so your billing stays flexible as your pricing evolves. - Flexible pricing configuration: Ensure the platform supports advanced models, such as tiered or volume-based pricing, custom contract terms, and easy plan edits. Your billing system should follow your pricing strategy, not constrain it.

- Strong integrations: The billing engine should integrate directly with your CRM (e.g., Salesforce, HubSpot), payment gateways, and accounting stack (e.g., QuickBooks, NetSuite), ideally utilizing APIs or native connectors.

A great system becomes the hub that links sales, finance, and support around a single view of customer revenue. - Scalability and performance: For businesses utilizing AI, IoT, or APIs, high throughput and reliability are crucial.

Look for platforms proven at scale, like Alguna Orb, Metronome, or Zuora, that can process large invoice volumes without slowing down, even during the month-end close. - Compliance and accounting readiness: Built-in ASC 606/IFRS 15 revenue recognition, tax handling, and automated reconciliation save finance teams hours and ensure clean audits.

If not built-in, ensure that the data exports cleanly into your revenue recognition (rev rec) or ERP system. - Multi-entity and global support: If you operate multiple brands, currencies, or legal entities, choose software that consolidates reporting while maintaining separate rules per region; otherwise, you’ll end up managing multiple systems.

- No-code vs. engineering control: If you’re short on developer resources, consider using no-code subscription billing software like Alguna, Chargebee, Recurly, or Maxio.

If your team prefers full control and customization, API-first options like Stripe, Orb, or Metronome may be a better fit, although they require ongoing engineering time. - Analytics and reporting: Decide whether you want built-in analytics or plan to push billing data to your BI tool. Even basic dashboards for MRR, churn, and expansion revenue can help teams move faster.

- Customer experience: A good billing platform also shapes how customers perceive you, from self-serve portals to clear invoices and reliable dunning. Real-time usage visibility reduces bill shock, while automated reminders prevent involuntary churn.

- Total cost of ownership: Go beyond list price. Consider setup time, maintenance, and potential headcount. A low base fee plus revenue percentage (like Stripe Billing’s 0.7%) may outgrow a flat enterprise fee at scale, while tools like Zuora might cost more upfront but save significant finance overhead later.

- Vendor support and roadmap: Fast support is critical when money’s on the line. Also, check the vendor’s pace of innovation: are they adding AI-native features or new AI monetization models that align with your roadmap?

- Trials and sandboxes: Before making a decision, test the platform in a sandbox or free trial environment. Run real scenarios with your finance and dev teams to test setup, workflows, and reporting.

Some companies even run two systems temporarily (e.g., Stripe for self-serve and another for enterprise invoicing) before consolidating once they determine which one fits best.

Try Alguna free

Frequently asked questions: Automated subscription billing software

What is the best subscription billing software?

The best subscription billing software depends on your company’s stage, billing complexity, and monetization model.

Alguna’s no-code monetization platform is a great option for fast-scaling SaaS and AI businesses that want to test pricing, automate workflows, and maintain accurate revenue data without any engineering overhead.

Which vendors offer usage-based billing and subscription management for fast-growing B2B SaaS companies?

Several vendors combine subscription management with usage-based billing. Chargebee, Maxio, and Recurly are well-known options that support recurring revenue and automation. Orb and Metronome focus more on usage-based billing precision and developer control.

Alguna stands out for offering real-time usage billing, subscription management, and automated revenue recognition in one no-code platform. It’s particularly well-suited for fast-scaling B2B SaaS teams that need flexibility without engineering overhead.

Which tools or APIs enable developer-friendly integrations in billing and subscription management systems?

Platforms like Stripe Billing, Orb, and Metronome are popular for their developer-first APIs and flexibility in embedding billing logic.

Alguna bridges that power with simplicity, offering open APIs, webhooks, and no-code controls in one unified platform. Developers can extend it freely, while finance teams manage workflows independently: a blend that is ideal for modern SaaS and AI startups.

When evaluating Maxio vs Chargebee, which offers more flexibility in customizing subscription plans and pricing models?

Chargebee excels in flexible subscription packaging and multiple pricing tiers. Maxio offers deep financial analytics and revenue automation for growing B2B SaaS companies.

Alguna combines both, giving teams maximum flexibility to customize and ship new pricing models using no-code configuration.

What are the main differences between Maxio and Metronome for B2B SaaS subscription management?

Maxio focuses on subscription billing, revenue recognition, and analytics, ideal for finance teams. Metronome is more developer-centric, designed for granular usage metering and API control.

Alguna, however, combines the strengths of both: no-code subscription management with real-time usage metering and automated revenue workflows. It’s purpose-built for modern SaaS and AI companies looking to unify finance and product operations.

Which billing platforms are best for managing hybrid subscription and usage-based billing scenarios?

Top hybrid-ready platforms include Zuora, Chargebee, and Orb, all of which support a mix of recurring and consumption-based billing.

Alguna, however, was purpose-built for hybrid monetization, unifying subscriptions and usage-based components in a single no-code platform.

What are the top subscription software solutions for managing complex usage-based billing models?

Popular choices include Chargebee, Maxio, Metronome, and Orb, which offer automation for metered billing. Alguna supports complex usage-based billing models in a unified platform that combines CPQ, usage metering, billing, and revenue recognition.

Are there multi-entity billing platforms that support both usage-based and subscription billing models?

Yes. Subscription billing software solutions like Zuora, Chargebee, and Maxio support multi-entity setups with currency and tax localization. Alguna also offers multi-entity management natively, allowing global businesses to manage subsidiaries, currencies, and tax rules under a unified billing and revenue framework, without extra configuration.

Which subscription billing software supports complex pricing structures such as usage-based, tiered, or hybrid models at scale?

Modern billing systems, such as Chargebee, Maxio, and Zuora, can support tiered and hybrid pricing at an enterprise scale.

Alguna, designed for today’s AI and SaaS businesses, brings these capabilities together in one platform, supporting real-time usage metering, dynamic tiering, and custom pricing logic without engineering involvement.

Scale faster with automated subscription billing software

Subscription billing software has become the backbone of modern SaaS and AI businesses. But as companies move toward more dynamic pricing and recurring revenue models, legacy billing processes simply can’t keep up.

Automated subscription billing software removes the bottlenecks that slow down growth, from manual invoice errors to missed renewals and delayed payments. It gives finance and RevOps teams the tools to run recurring revenue at scale, with full visibility and zero operational drag.

In 2025 and beyond, the fastest-growing SaaS and AI-native businesses will be the ones that treat billing as a growth engine, not an afterthought. Automation isn’t just about efficiency—it’s about enabling experimentation, faster pricing cycles, and predictable cash flow.

If you’re ready to eliminate complexity, reduce revenue leakage, and unify your entire quote-to-cash process, it’s time to see what Alguna can do.

Automated subscription billing built for the AI era

Discover how Alguna powers seamless subscription and usage-based billing—all in one platform.