SaaS billing software is more than a finance tool—it’s a growth engine. This has forced many revenue and finance teams to look for SaaS billing software that can manage that complexity at scale. And more crucially, do it with (unlimited) flexibility.

Billing errors can cost SaaS companies 1–5 % of total revenue and that 77 % of large software companies now incorporate consumption‑based pricing. This is something spreadsheets, legacy systems, and home‑grown billing tools simply can't handle.

That's why this article will help you evaluate SaaS billing software and explain why investing in the right solution delivers measurable ROI.

What is SaaS billing software?

SaaS billing software is a system that automates how software-as-a-service companies price, bill, invoice, collect payments, and recognize revenue from customers.

In plain English: it’s the engine that turns your pricing model into accurate invoices and predictable revenue—without spreadsheets or manual work.

What SaaS billing software actually does

A modern SaaS billing platform typically handles:

- Subscriptions: Monthly, annual, tiered, seat-based plans

- Usage-based billing: Metered usage (API calls, tokens, events, GBs, minutes)

- Hybrid pricing: Base subscription + usage, overages, add-ons, credits

- Invoicing and payments: Automated invoices, proration, upgrades/downgrades

- Dunning and retries: Failed payment recovery and churn prevention

- Taxes & compliance: VAT/GST/sales tax calculations

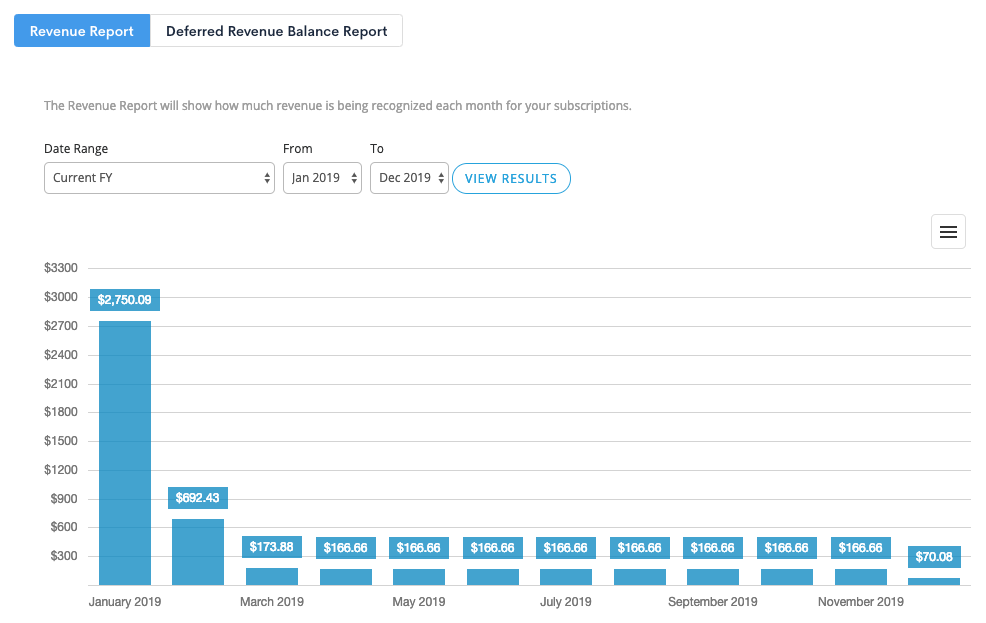

- Revenue recognition: ASC 606 / IFRS 15 compliant reporting

- Reporting: MRR, ARR, churn, deferred revenue, cohorts

Think of SaaS billing software as the system of record between your product, sales, and finance teams, turning what customers use and buy into what you bill and recognize as revenue.

5 reasons why SaaS billing software matters

Manual billing or outdated tools lead to revenue leakage, churn and wasted resources. With subscriptions, add‑ons, upgrades, downgrades and tiered plans, issuing every invoice manually becomes unsustainable.

Automated billing software solves these problems by:

- Protecting revenue: Automated platforms handle recurring charges, upgrades and downgrades and retry failed payments, reducing errors to almost zero.

- Improving efficiency: Modern systems reduce bill run times by 40–95 % and can process 400 000+ invoices per hour. Hudl saved over 100 hours per month and Box scaled revenue from $3 M to over $500 M using automated quote‑to‑cash workflows.

- Ensuring compliance: Home‑grown systems create IT burdens and expose businesses to compliance risks; the average cost of non‑compliance can reach $14 M. SaaS billing software automatically calculates taxes and supports ASC 606/IFRS 15 revenue recognition.

- Enabling growth: Hybrid pricing models deliver 21 % median revenue growth versus 13 % for pure subscriptions. Billing platforms support multiple pricing structures and allow you to launch new plans without lengthy engineering projects.

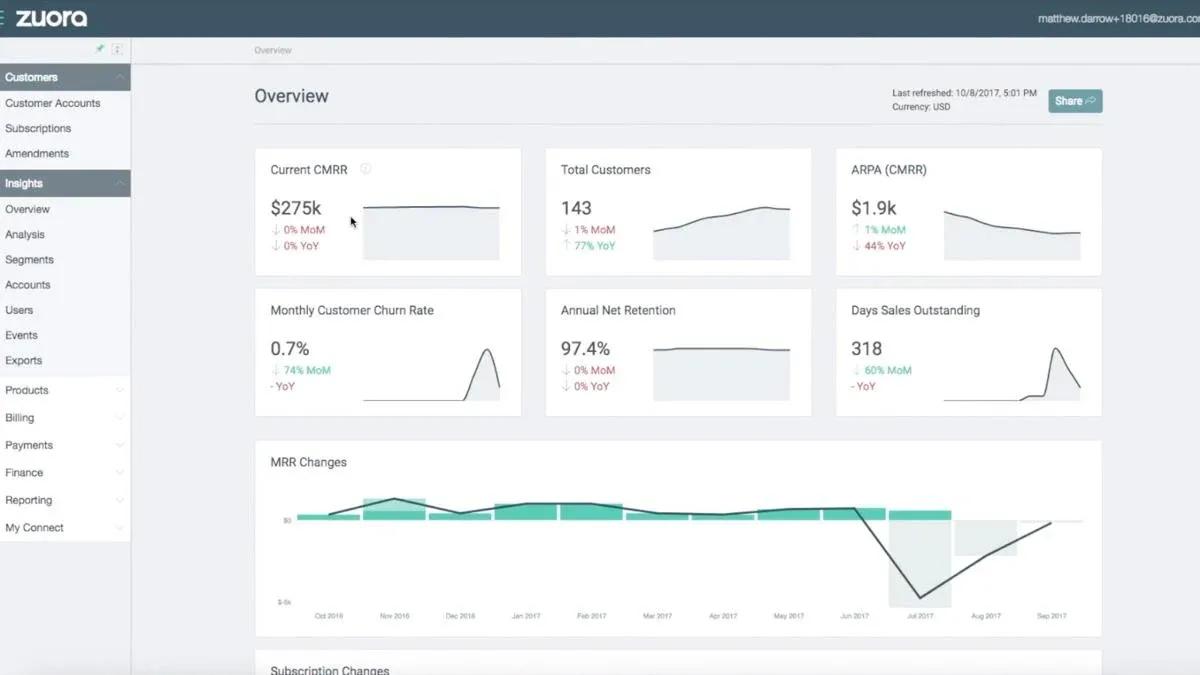

- Providing metrics: Platforms offer dashboards to track monthly recurring revenue (MRR), churn, deferred revenue and other KPIs.

Key capabilities of SaaS billing software

| Capability | Why it matters |

|---|---|

| Subscription account management | Your platform should automatically update accounts when customers pause, upgrade, or cancel. |

| Accurate invoicing | Clear invoices that support cards, bank transfers, and digital wallets help customers pay seamlessly. |

| Dunning & churn prevention | Smart retry logic and automated reminders recover missed payments. |

| Usage-based rating | Real-time metering and flexible pricing tiers allow you to monetise API calls, tokens, or compute time. |

| Revenue recognition & accounting | Built-in ASC 606/IFRS 15 compliance ensures revenue is booked correctly and tax rules are applied automatically. |

| Reporting & analytics | Dashboards should show MRR, churn, deferred revenue, and other KPIs. |

| Integrations | Seamless integration with your CRM, product, payment gateways, and general ledger reduces manual reconciliation and keeps customer and billing data aligned. |

| Multi-currency & tax support | If you sell globally, ensure the platform supports multiple currencies and automatically calculates VAT/GST. |

Different types of SaaS billing software: Evaluating your options

Not all SaaS billing software is built the same, and choosing the wrong type can lock you into manual work, pricing limitations, or painful re-platforming later.

Some tools are designed for simple subscriptions, others for developer-led usage billing, and a growing category supports complex hybrid and enterprise pricing models out of the box.

Quote-to-revenue solutions

Quote-to-revenue (Q2R) solutions go beyond billing alone. They connect the entire commercial flow, from how deals are quoted, approved, and contracted, through to billing, collections, and revenue recognition into a single, automated system.

Instead of treating quoting, billing, and finance as separate tools (and teams), quote-to-revenue platforms are designed to eliminate handoffs and ensure that what sales sells is exactly what finance bills and recognizes. Top contenders in this category include legacy players like Zuora and modern platforms like Alguna.

Developer‑centric platforms

API‑first platforms like Stripe Billing provide deep flexibility. They support smart payment retries, hybrid and usage‑based billing, automated revenue recognition and a self‑serve customer portal.

These tools are ideal for companies with engineering resources who need to customise billing flows or split payments across multiple parties.

Enterprise‑grade revenue platforms

Larger SaaS companies often need multi‑entity management, advanced revenue recognition and sophisticated product catalogues. Legacy players like Chargebee, for instance, provides automated compliance, usage‑based billing and hierarchical billing structures. Meanwhile, modern tools like Alguna offer a flexible quote-to-revenue platform that was purpose-built for SaaS.

When customer acquisition costs rise, retention becomes vital—platforms like Recurly use AI‑driven dunning and machine‑learning algorithms to recover about 12 % of lost revenue and reduce involuntary churn.

Hybrid and usage‑based platforms

Usage‑based billing aligns cost with customer value. Research indicates that hybrid models deliver higher revenue growth. Usage‑based systems meter consumption in real time (e.g. API calls, compute hours, tokens) and aggregate events into invoices with tiered, volume or prepaid structures. Popular platforms include Metronome, Orb, and Alguna.

They benefit customers by lowering up‑front commitments and vendors by naturally expanding revenue. However, usage billing introduces forecasting complexity and requires accurate metering and proactive communication to prevent bill shock.

Buyer checklist: How to identify the best SaaS billing software for your business

Before committing to a SaaS billing software, answer these questions:

- Does it integrate with your existing CRM, product and accounting stack? Seamless integrations cut manual reconciliation and maintain a single source of truth.

- Can it handle your pricing model? Look for support for fixed subscriptions, usage‑based charges, prepaid credits and hybrid plans.

- How does it manage taxes and compliance? Ensure automated calculation of VAT, GST and sales tax across jurisdictions and compliant revenue recognition.

- What dunning and retention tools are available? Intelligent retries and personalized reminder workflows prevent involuntary churn.

- What level of onboarding and support do you need? Some platforms offer out‑of‑the‑box configuration and all‑in‑one functionality, while others require developer resources.

Manual billing isn’t just inconvenient, it’s expensive. Lost revenue from billing errors often equates to up to $100 000 per year for a $2 M ARR company. The average cost of non‑compliance can exceed $14 M, and technical backlogs can delay new pricing plans for months.

Top 6 SaaS billing software in 2026

Note: Pricing reflects 2025/26 public information and may change. Always check vendor websites for the latest features and most up-to-date pricing.

Alguna: Best SaaS billing software for quote-to-revenue

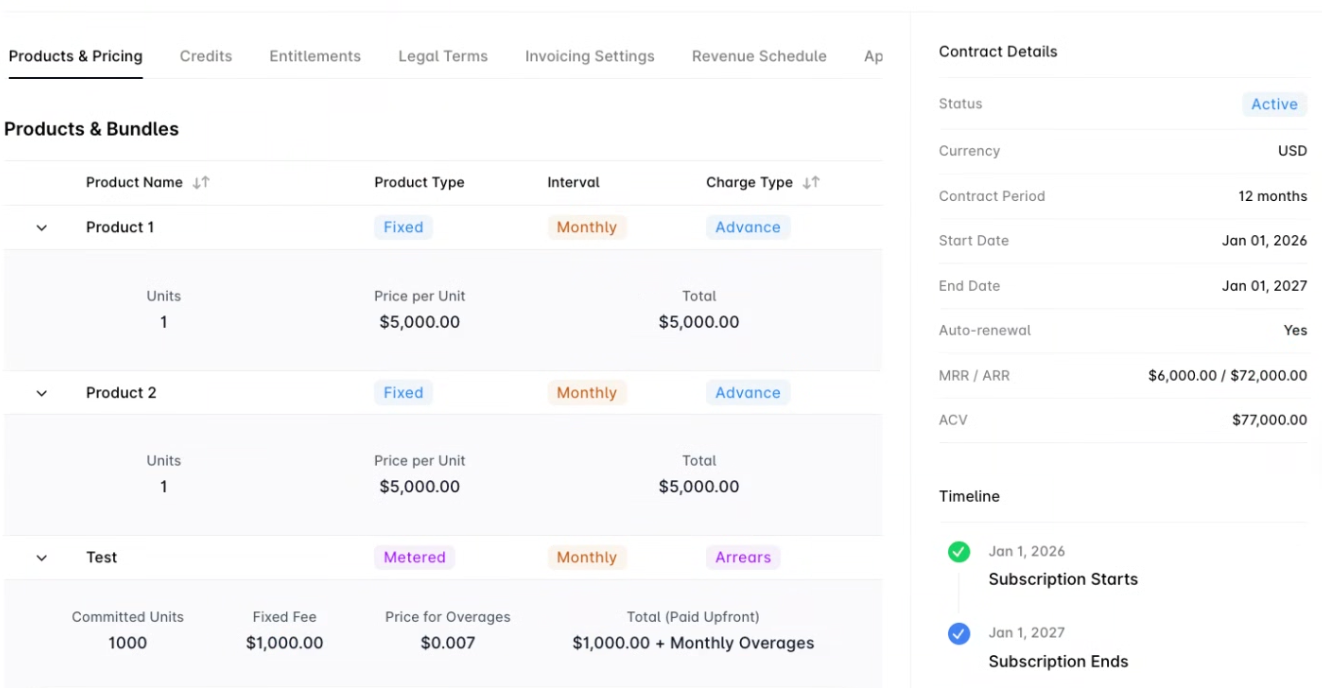

Alguna is an AI-native quote-to-revenue platform built specifically for modern SaaS, AI, and fintech companies with hybrid pricing models. Unlike legacy billing tools that bolt CPQ or revenue recognition on later, Alguna is designed for SaaS from end-to-end: from quoting and pricing, through usage metering and billing, to automated revenue recognition.

It’s purpose-built for companies that sell hybrid, usage-based, credit-based, or custom enterprise deals and want a single system that sales, finance, and RevOps can trust.

Best for

- B2B SaaS, AI, and fintech companies

- Sales-led or hybrid GTM motions

- Usage-based, credit-based, or mixed pricing models

- Teams looking to replace spreadsheets + disconnected tools

Key strengths

- True quote-to-revenue flow: CPQ → billing → revenue recognition in one platform

- No-code CPQ for modeling usage tiers, bundles, credits, ramps, and custom terms

- Native usage metering with real-time rating and invoicing

- Automated ASC 606 / IFRS 15 revenue recognition tied directly to the quote

- Single source of truth for sales, finance, and RevOps

- Fast implementation (2-4 weeks) compared to legacy enterprise suites

Limitations

- Newer platform compared to long-standing incumbents

- May be more than needed for very simple, self-serve subscription businesses

Pricing

- Paid plans from $699/month. Free tier available. Onboarding and migration included.

Why teams choose Alguna

Alguna is often selected by SaaS teams that have outgrown basic billing tools but don’t want the weight, cost, or rigidity of legacy enterprise stacks. For companies monetizing AI, APIs, or complex contracts, Alguna offers a modern, flexible alternative that keeps pricing, billing, and revenue in sync as your business scales.

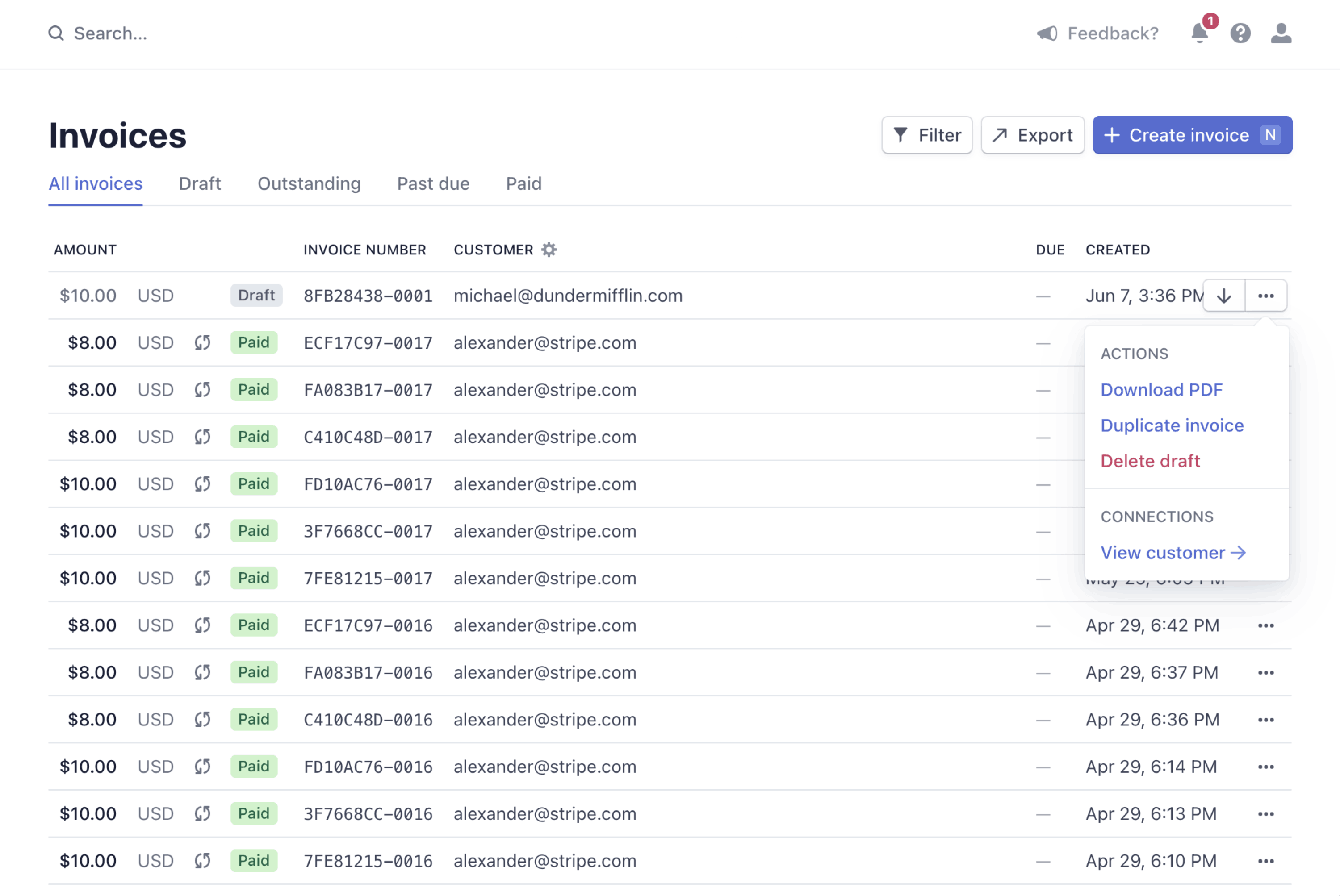

Stripe Billing: Developer‑centric software for basic SaaS billing

Stripe Billing is the industry standard for API‑first billing. It offers unmatched flexibility for technical teams and supports simple subscriptions as well as complex usage‑based models.

Key features:

- Smart payment retries using machine learning to recover about 9 % more revenue

- Hybrid and usage‑based billing via real‑time Meters API

- Automated revenue recognition compliant with ASC 606 and IFRS 15

- Self‑serve customer portal for upgrades and invoice management

- Global tax automation across 100+ countries

Pricing:

- Stripe Billing’s standard pricing is 0.7% of the billed volume (0.5% at Scale tier with custom pricing, 0.7% pay-as-you-go).

Ideal for: Early stage startups with engineering resources who need a highly customizable billing engine or must split payments across multiple parties.

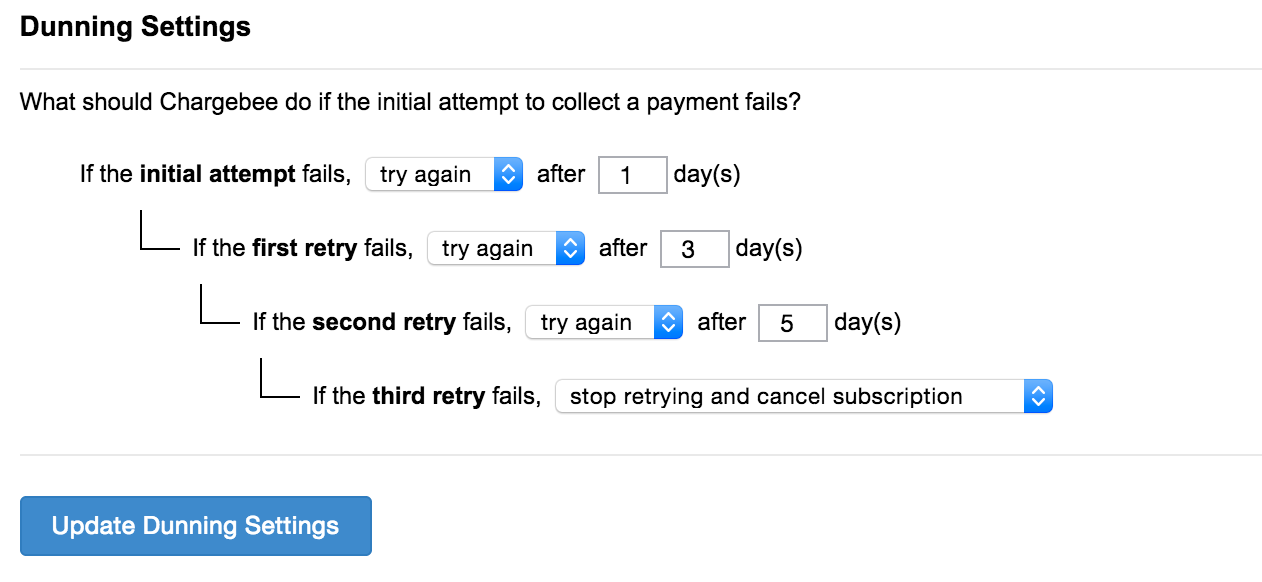

Chargebee: Best for basic SaaS subscription billing

Chargebee goes beyond billing to act as a revenue‑management platform for mid‑market and enterprise SaaS companies. It handles complex scenarios such as multi‑entity management and hierarchical billing structures.

Key features:

- Advanced revenue recognition automating ASC 606/IFRS 15 compliance

- Product catalog 2.0 for complex bundles and ramp deals without coding

- Smart dunning and retention tools that save 10–20 % of churning customers

- Usage‑based and hybrid billing support

- Deep Salesforce integration and multi‑entity management

Pricing:

- Free for the first $250 K of cumulative billing, then 0.75 % on billing

- $599/month for billing volume up to $100 000 per month plus 0.75 %

- Custom pricing for enterprise plans

Ideal for: B2B SaaS companies with sales‑led contracts, global subsidiaries or complex pricing strategies.

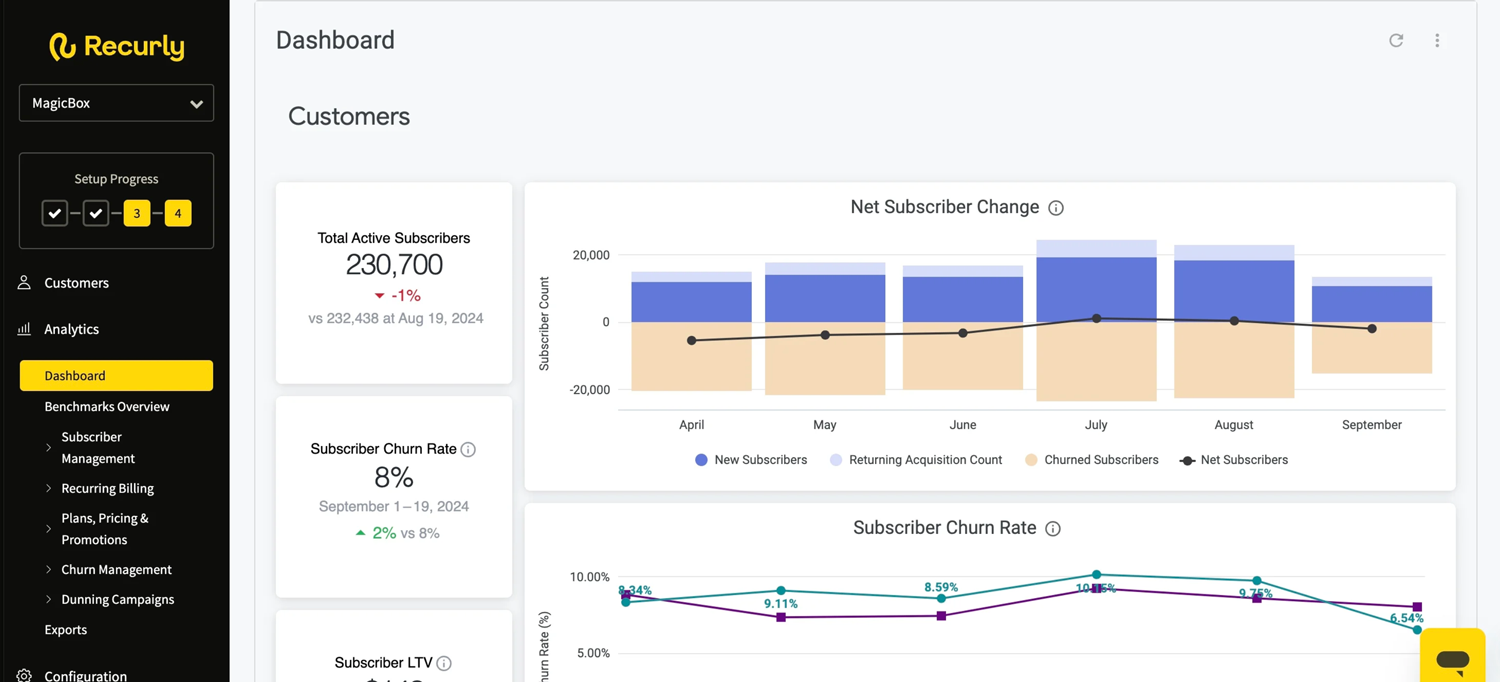

Recurly: Retention‑focused SaaS billing software

Recurly focuses on customer retention. It leverages machine learning to recover failed payments and reduce involuntary churn.

Key features:

- Intelligent retries that ping cards at optimal success moments

- Recurly Compass AI for retention strategies and pricing experiments

- Wallet‑free card updates via Visa/Mastercard networks

- Advanced dunning with personalized email sequences

- Machine learning that recovers roughly 12 % of lost revenue

Pricing:

- Starter plan: $220/month (free for the first three months)

- Professional and Elite plans: custom pricing

Ideal for: High‑volume B2C subscription businesses, streaming services and mid‑market SaaS companies processing over $50 K per month.

Zuora: SaaS billing software for enterprise

Zuora offers an enterprise‑grade billing solution for established businesses transitioning to or scaling subscription models. It’s recognized for automating complex billing cycles and supporting extensive integrations.

Key features:

- Built‑in functionality that reduces bill run times by 40–95 % and processes 400 000+ invoices per hour

- Supports 20+ payment methods and 40+ payment gateways

- Customizable billing cycles with notifications, coupon and trial management

- Real‑time dashboards and revenue recognition capabilities

- Integrations with financial software, CRMs and A/R platforms like Upflow

Pricing: Custom pricing. Estimate minimum $50,000 per year.

Ideal for: Large‑scale enterprises needing premium functionality and deep integrations.

Maxio: SaaS billing software for finance-led teams

Maxio targets B2B SaaS businesses with personalized billing workflows and segmentation options. It supports complex billing scenarios and offers add‑ons like targeted promotions and dunning prevention tools.

Key features:

- One‑to‑one billing workflows and segmented pricing

- Support for complex pricing plans and add‑ons to improve retention

- Customizable notifications at every stage of the customer lifecycle

- Integration with common billing and finance tools (see Maxio + Xero/NetSuite integration for details)

- Unified metrics and reporting for B2B SaaS operations

Pricing: Paid plans start from $599/month for up to $100,000 in billings.

Ideal for: B2B SaaS companies needing personalized workflows and advanced churn prevention.

Frequently asked questions about SaaS billing software

What is SaaS billing software?

It is a specialized platform that automates billing operations for software‑as‑a‑service businesses. It supports different pricing models—including subscriptions, usage‑based and hybrid plans—and manages invoicing, payments, proration and revenue recognition.

What’s the difference between subscription billing and recurring billing?

Subscription billing is a type of recurring billing based on fixed‑term plans (monthly, quarterly or annually). Recurring billing can include variable or usage‑based charges, such as billing per API call or per active user.

Which billing model is right for my SaaS business?

It depends on your product and customers. Fixed pricing tiers suit subscription billing, while fluctuating usage (e.g., data or seat‑based) may require recurring or hybrid models. Many SaaS companies evolve from simple subscriptions to complex hybrid structures as they scale.

When should I switch to new billing software?

If your current tool can’t support new pricing models, causes manual errors, lacks integration with your tech stack or struggles with global compliance, it’s time to upgrade.

What are the must‑have features in SaaS billing software?

Essential capabilities include automated invoicing, payment processing, dunning workflows, revenue recognition, multi‑currency support, integrations with CRM/ERP, real‑time analytics and flexible pricing model support.

What’s the best SaaS billing software for small teams or startups? Platforms like Stripe Billing and Chargebee are popular for smaller businesses because they are easy to set up, scale and offer transparent pricing. Outseta’s all‑in‑one approach is also attractive for bootstrapped founders.

Can billing software help reduce churn?

Yes. Many platforms offer automated dunning, failed payment retries, customizable notifications and integrations with CRM tools to retain customers and recover revenue. Recurly’s machine‑learning dunning, for example, recovers about 12 % of lost revenue.

Choosing the right SaaS billing software

SaaS billing is no longer a back-office concern. It’s a core growth system that directly impacts revenue accuracy, customer trust, sales velocity, and financial control.

As pricing models evolve—toward usage-based, hybrid, and custom enterprise deals—the cost of choosing the wrong billing software compounds quickly. Disconnected tools, manual handoffs, and brittle workflows don’t just slow teams down; they create revenue leakage, compliance risk, and painful re-platforming down the line.

The right SaaS billing software should do more than send invoices. It should:

- Support your current pricing model (and the one you’ll launch next year)

- Keep sales, finance, and RevOps aligned on a single source of truth

- Scale with complexity, not fight it

- Turn pricing decisions into accurate, automated revenue

For simple subscription businesses, lightweight billing tools may be enough—for now. But for SaaS, AI, and fintech companies selling complex, usage-based, or sales-led deals, modern quote-to-revenue platforms are increasingly becoming the default.

If your team is spending time reconciling quotes to invoices, fixing billing errors after deals close, or worrying about how today’s pricing decisions will impact revenue reporting tomorrow, that’s a clear signal your billing stack is holding you back.

Choosing the right platform now isn’t just about operational efficiency—it’s about future-proofing how your company monetizes, scales, and grows.