Finance leaders are navigating a world where subscription revenues, multiple legal entities and global operations intersect.

The subscription billing management market is booming—analysts project it will grow from US$8.51 billion in 2025 to US$32.86 billion by 2034, a compound annual growth rate (CAGR) of 16.2 %.

Meanwhile, usage‑based pricing (UBP) has moved from niche to mainstream as 85 % of surveyed software companies have adopted UBP, and 77 % of the largest software companies incorporate consumption‑based pricing.

So what does this mean for finance teams? Well, they're jobs got slightly more complicated as they must handle complex billing rules, multiple currencies, fx rates, and intracompany transactions across several subsidiaries.

To help you align your subscription strategy with multi‑entity realities, this guide explains key concepts (multi‑entity management, consolidation and reporting), highlights data on the operational pain points and benefits of automation, and provides actionable best practices for billing across entities.

What is a multi‑entity company?

A multi‑entity (or multi entity) organization operates through two or more distinct business units under common ownership or control.

These units can be wholly or partially owned subsidiaries, franchises, or divisions that share brand and resources but maintain separate legal identities.

The finance team must balance entity‑level autonomy with company wide standardization as each unit may have its own chart of accounts, bank relationships and compliance rules, yet all must roll up into a unified financial picture.

Multi‑entity billing

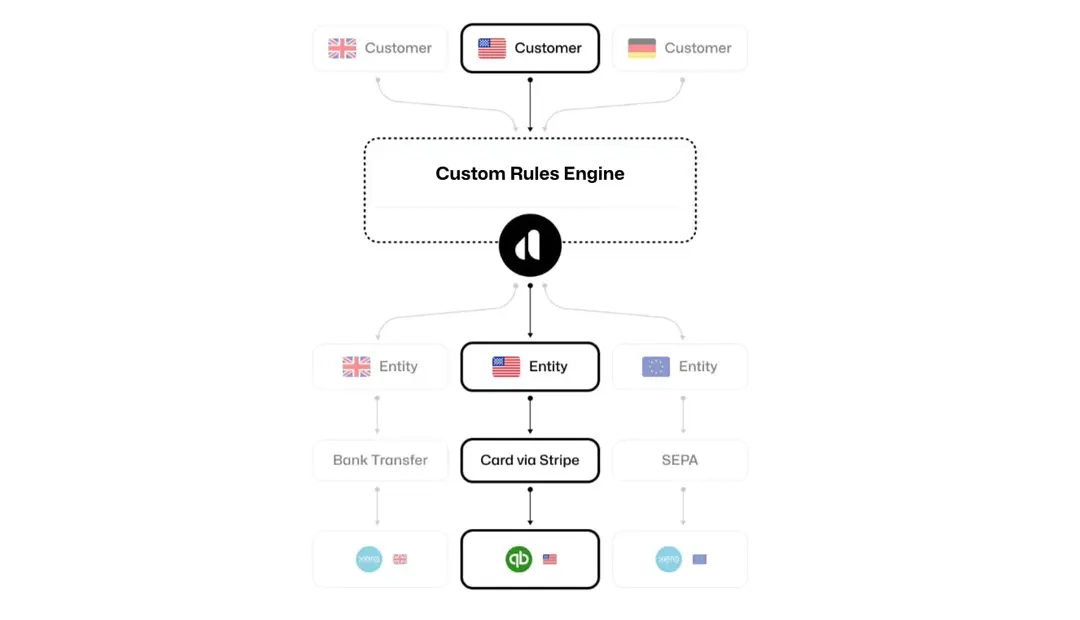

Multi-entity billing is the operational framework that manages how customers are billed across multiple legal entities while preserving the correct legal, tax, and revenue boundaries. It ensures each invoice reflects the right entity, currency, tax treatment, and contract terms, while still enabling a unified customer experience and centralized finance operations.

Standard billing treats all customers as belonging to a single entity; multi-entity billing allows each legal entity to bill independently but coordinates those bills so finance teams can reconcile, report, and scale without manual workarounds.

Read more: 6 multi-entity billing platforms for growing SaaS companies

Multi‑entity accounting

Multi‑entity accounting is the financial framework that unifies disparate records while preserving appropriate boundaries. It provides entity‑specific insights and an enterprise‑wide view to support capital allocation and performance analysis.

Standard accounting treats a business in isolation; multi‑entity accounting maintains separate books for each entity but consolidates them for reporting and decision‑making.

Multi‑entity reporting vs. consolidation

- Multi‑entity reporting maintains separate financial statements for each entity, preserving their individual identities. It is used by entity managers and local regulators.

- Multi‑entity consolidation combines financial data from multiple entities into a single set of statements, eliminating intercompany transactions to prevent double counting. It is required by GAAP and IFRS and used by group executives, investors and regulators.

Both reporting and consolidation present challenges: managing currency translations, eliminating intracompany transactions and reconciling disparate systems.

Why multi‑entity billing matters

Growing subscription complexity

The subscription economy’s growth is coupled with adoption of consumption‑based pricing. Enterprises are moving to UBP to align revenue with customer value, while 64 % of Forbes’ next billion‑dollar startups leverage it.

These pricing models often involve usage tiers, overages, commitments and hybrid structures that differ by entity or region.

Multi‑currency and tax challenges

Operating across geographies introduces multiple currencies, tax regimes and invoicing requirements. Multi‑entity billing systems must apply the correct VAT or GST per entity and automatically convert currencies using appropriate exchange rates. Without automation, finance teams rely on spreadsheets and manual reconciliations, which are prone to error and take significant time.

Now, let's talk numbers. Because manual reconciliation is costly.

Research shows a typical 1,000‑person company spends 100,000 person‑hours annually on account reconciliation, roughly 100 hours per employee per year, with the bulk devoted to manual data entry and cross‑referencing.

Manual reconciliation takes around 8 days compared with 3 days for automated systems. These inefficiencies are amplified in multi‑entity structures; each subsidiary requires separate reconciliations, multiplying the total time.

The direct labour cost can reach US$3–5 million annually.

Impact on the close process

The month‑end close is a key pain point. In a 2025 benchmark survey, half of finance teams took longer than five business days to close, and only 18 % closed in three days or fewer. The biggest delays came from reconciling fragmented data and correcting manual errors.

Cash reconciliation alone takes 30+ hours each month, according to a finance manager at a SaaS company. Another accountant noted, “We’re still exporting data from three systems just to match it in Excel. It’s painful.”.

The steepest cost? Manual work also hurts morale as 91 % of investment firms rely too heavily on manual tasks and spreadsheets when reconciling accounts.

The business case for automation

Automation can dramatically reduce close times. Automated reconciliation and consolidation solutions can reduce close times by 30–50 % or even 70 %. Companies report closing books in 3–5 days instead of 10–15 days after automation.

Automation also improves forecast accuracy as unified planning platforms can boost forecasting accuracy by 34 % by centralizing data across entities.

7 best practices for multi‑entity subscription billing

The following best practices combine lessons from finance leaders and industry research to help finance teams manage multi‑entity billing more effectively.

- Avoid duplicating invoice logic per entity.

Define invoice logic, subscription plans, discounts, usage tiers and tax rules, once at the global level. Apply local formatting and compliance rules per entity to reduce maintenance and avoid conflicting setups. - Use shared product definitions with localized pricing.

Create global product definitions with standard measurement units and usage metrics. Allow each entity to set its own pricing so you maintain consistent reporting while supporting local market conditions. - Set clear ownership rules for customers and contracts.

Specify which entity owns each customer and its revenue. Use geography‑based rules or account‑level tagging to automate ownership and avoid confusion during reconciliation and tax filings. - Align intracompany workflows from the start.

When one entity sells and another fulfills, define how revenue and costs will be allocated at the contract level. Automating this logic early prevents manual journal entries and delays later. - Standardize reconciliation routines across entities.

Build a common month‑end checklist—bank reconciliation, deferred revenue tracking, accounts receivable/payable aging—for all entities. A uniform close cadence accelerates consolidation and simplifies audits. - Design reports to roll up by entity and region.

Move beyond basic consolidation. Set up dashboards that allow you to slice metrics by entity, geography or product line so performance trends are clear and board reporting is effortless. - Limit access and workflows by entity.

Implement role‑based access controls that are entity‑aware. Restrict teams to the books and billing workflows relevant to their region to maintain compliance and reduce risk.

Selecting a multi‑entity billing platform

When evaluating subscription billing software, finance leaders should look for capabilities that address multi‑entity complexity:

| Feature | Why it matters |

|---|---|

| Built‑in multi‑entity support | The platform should handle separate books for each entity and provide both entity‑level and consolidated views. |

| Intercompany automation | Automate intercompany transactions, eliminations and journal entries to reduce errors and accelerate close cycles. |

| Multi‑currency & tax compliance | Support currency conversions, apply local tax rules and generate compliant invoices and tax reports. |

| Role‑based access and approval workflows | Define custom workflows and permissions by entity, department and transaction type. |

| Integration with existing systems | Seamless integration with your ERP, CRM and payment processors avoids data silos and process delays. |

| Scalability & flexibility | Choose software that scales with new entities, products and pricing models; look for no‑code configuration and support for usage‑based pricing. |

6 SaaS billing software with multi-entity support

Multi-entity management isn't easy if you're stuck in spreadsheets doing manual reconciliation.

But there are plenty of modern multi-entity billing platforms come with:

- Support for usage-based subscription billing

- Tax jurisdiction features

- Real-time currency conversion

- Fx reporting

- Consolidated financial reporting global operations

- Contract management renewals

- GAAP / IFRS compliance

- Deep API support

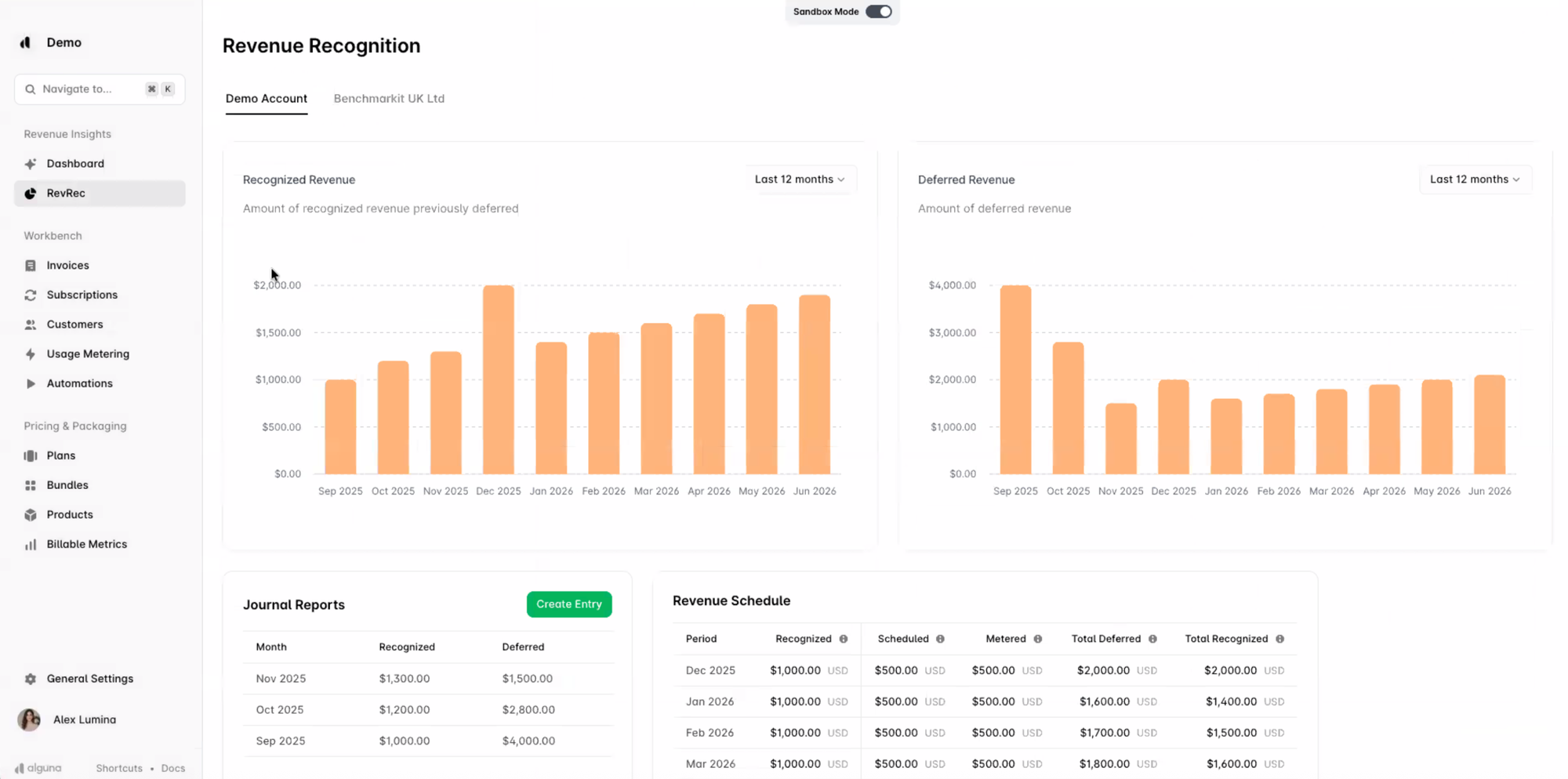

- Revenue recognition automation

Snapshot: Best billing platforms for multi-entity management

The strongest multi-entity billing platforms are those that handle multiple legal entities, currencies, taxes, fx rates, and usage-based subscriptions without forcing finance teams into spreadsheets or manual post-billing fixes.

Here’s a high-level snapshot finance leaders commonly reference:

- Alguna: Built for modern SaaS and AI companies with complex, usage-based and hybrid pricing. Strong multi-entity, multi-currency, and quote-to-revenue alignment in a single system.

- Zuora: A long-standing enterprise option with deep multi-entity and consolidation support, typically used by large, global organizations.

- Chargebee: Popular with scaling SaaS companies; supports multi-entity and multi-currency, with some limitations as complexity increases.

- Stripe Billing: Works well for simpler setups, but multi-entity billing often requires multiple accounts and manual coordination.

- Maxio: Combines billing and finance tooling with support for multi-entity structures, mainly for mid-market SaaS.

Read more: 6 multi-entity billing platforms for growing SaaS companies

Master multi-entity with modern platforms

As companies scale across regions, pricing models, and currencies, billing complexity compounds fast. Without the right systems, finance teams get stuck in manual reconciliations and slow closes.

The payoff for doing this well is real: modern billing platforms can dramatically shorten close times, improve forecasting accuracy, and deliver real-time visibility across entities.

Finance teams that standardize entity ownership, automate billing logic, and design for consolidation upfront don’t just reduce risk—they gain leverage. In a subscription economy that’s only getting more complex, mastering multi-entity billing is how finance moves from cleanup crew to strategic driver.