• Understand why multi-entity billing matters for global SaaS teams managing multiple currencies, tax rules, and complex revenue operations.

• Get a practical checklist to choose the right billing system for scalability, compliance, and faster month-end close.

Multi-entity billing is quickly becoming a critical capability for growing SaaS companies. The moment you spin up a second entity, expand into a new region, or start billing in multiple currencies, what used to be a simple invoicing flow can suddenly turn into a maze.

Instead of one clean set of subscriptions and reports, you’re juggling different tax rules, bank accounts, and charts of accounts — often in tools that were only ever designed for a single entity.

For many finance teams, that shift looks like this: more entities → more spreadsheets → more reconciliation → more chances to miss something. It’s not just frustrating; it slows down decisions and makes closing the books a lot harder than it needs to be.

In this post, we’ll cover what multi-entity billing is, why it matters, the challenges it creates, and the best multi-entity billing platforms for growing SaaS companies.

What is multi-entity billing and why it matters for SaaS

Multi-entity billing lets companies manage invoicing, payments, taxes, and revenue recognition across multiple subsidiaries or regions in one system. Instead of operating each entity separately, a multi-entity platform centralizes billing while honoring local currencies, tax rules, and compliance requirements. This becomes crucial the moment a SaaS company expands, opening an international office, adding a new business unit, or growing through acquisition.

For most SaaS teams, multi-entity billing becomes a priority after Series A or during global expansion. A U.S. parent with a European subsidiary, for example, must bill in different currencies, apply different tax regimes, and meet separate accounting standards. Without multi-entity support, finance teams end up stitching together multiple billing setups and manually consolidating reports, which slows down the close and increases the risk of errors.

Ultimately, multi-entity billing matters because it provides SaaS companies with a unified and accurate financial picture, enabling them to scale their operations without their billing processes becoming chaotic.

Key challenges multi-entity companies face

Running billing across multiple entities introduces complexities that single-entity businesses never encounter:

- Intercompany transactions and transfer pricing: Entities often invoice each other, and tracking these transactions (and eliminating them for consolidated financial statements) can be messy without automation. Spreadsheet-driven processes often lead to errors, reconciliation issues, and headaches related to transfer pricing compliance.

- Multiple tax jurisdictions: Each entity faces different tax rules, invoice requirements, and filing obligations. A modern multi-entity billing platform’s tax jurisdiction features must automatically apply the correct VAT, GST, or sales tax per entity to avoid compliance issues and manual corrections.

- Currency conversion and revenue recognition: Multi-entity SaaS companies collect revenue in multiple currencies and must consolidate into a base currency while managing FX gains/losses. Deferred revenue schedules also vary by entity, making alignment slow and prone to error when handled manually.

- Manual consolidation and reporting: Extracting financial data from separate systems can extend the month-end close by 15+ days and introduce a high risk of errors. Siloed data makes it challenging for finance leaders to access a timely, unified view of the company's performance.

The best multi-entity billing platforms for growing SaaS companies: Overview

To navigate multi-entity billing, you need a platform that can handle complexity without adding friction. Below is an overview of six multi-entity billing platforms for growing SaaS companies, comparing their key features, pros and cons, ideal use cases, and pricing.

| Platform | Best for | Pros | Cons | Pricing |

|---|---|---|---|---|

| Alguna | Scaling SaaS/AI companies, finance teams replacing patchwork systems, usage-heavy products. | True multi-entity, flexible pricing, no-code automation, consolidated insights, fast setup | Newer market entrant (Y-combinator backed), not ideal for very early-stage startups | Starts at $399/month, no revenue cut. Free starter tier available. |

| Stripe Billing | Early-stage SaaS, developer-led teams | Fast setup, developer-friendly, integrated with Stripe Payments | No multi-entity, weak tax/compliance, fragmented at scale | 0.7% of recurring revenue + payment processing |

| Chargebee | Mid-market SaaS; Teams managing 1–2 entities | Strong subscription management, multi-currency support, user-friendly UI | Separate sites per entity, limited cross-entity automation, complex global setup | $599/month + 0.75% overages, multi-entity on enterprise tier |

| Maxio | Finance-heavy SaaS, companies with stable pricing | GAAP/IFRS compliance, deep financial reporting, SaaS-native workflows | Long implementation, rigid pricing changes, steep learning curve | $599/month, multi-entity on higher tiers |

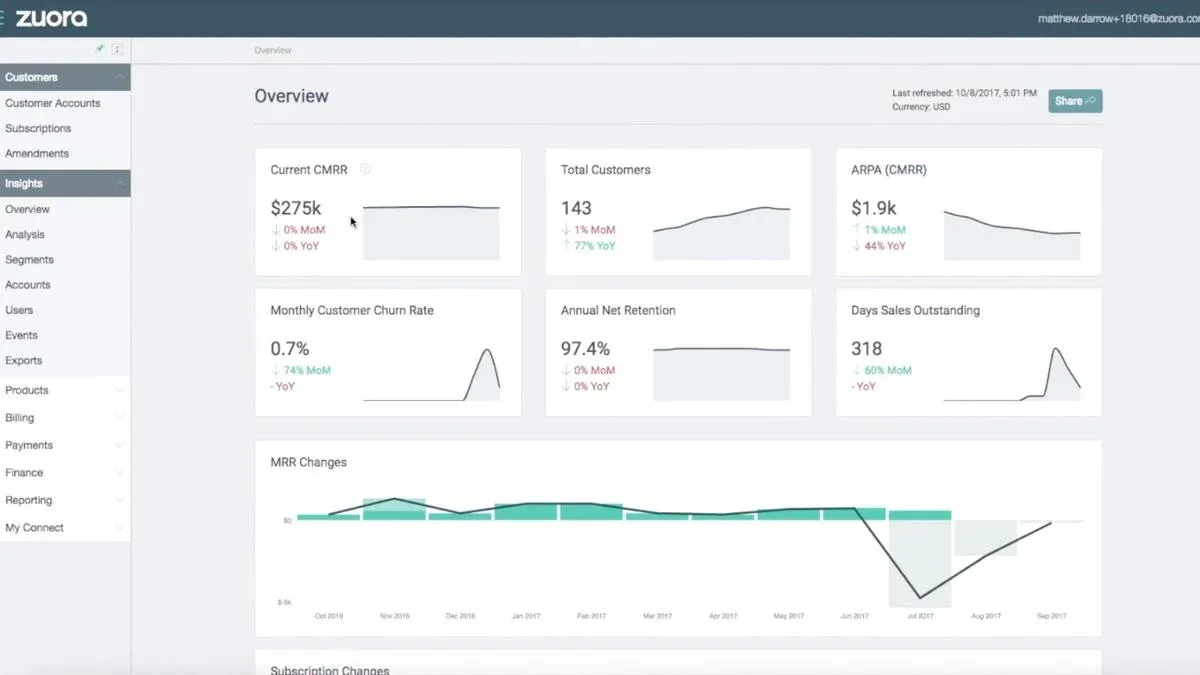

| Zuora | Large enterprises with complex global billing | Highly scalable, strong multi-entity, extensive customization | Long implementation, complex to maintain, high cost | ~$50K/year + plus implementation fees |

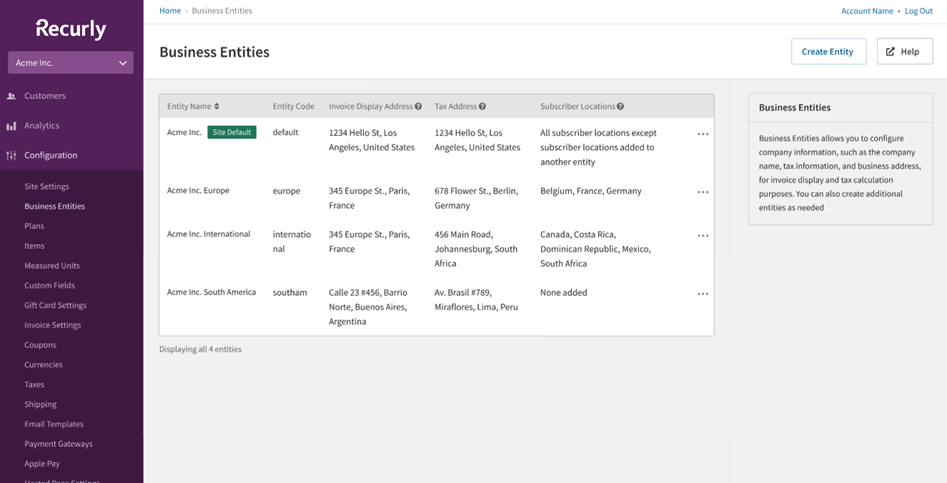

| Recurly | Single-entity SaaS, churn-sensitive businesses | Excellent dunning, multi-gateway support, fast to implement | No multi-entity, no native revenue recognition, limited usage billing | Custom pricing |

6 best multi-entity billing platforms for scaling SaaS companies: Deep dive

Managing billing across multiple entities, currencies, and product lines is one of the biggest operational hurdles for scaling SaaS companies. Legacy tools weren’t built for multi-entity complexity, often leaving teams stuck with manual work, fragmented data, and compliance risks as they expand.

Below, we break down the 6 best multi-entity billing platforms for scaling SaaS companies that help high-growth companies streamline global operations, automate financial workflows, and unify revenue across every region and business unit.

Alguna: AI-native multi-entity billing platform without the complexity

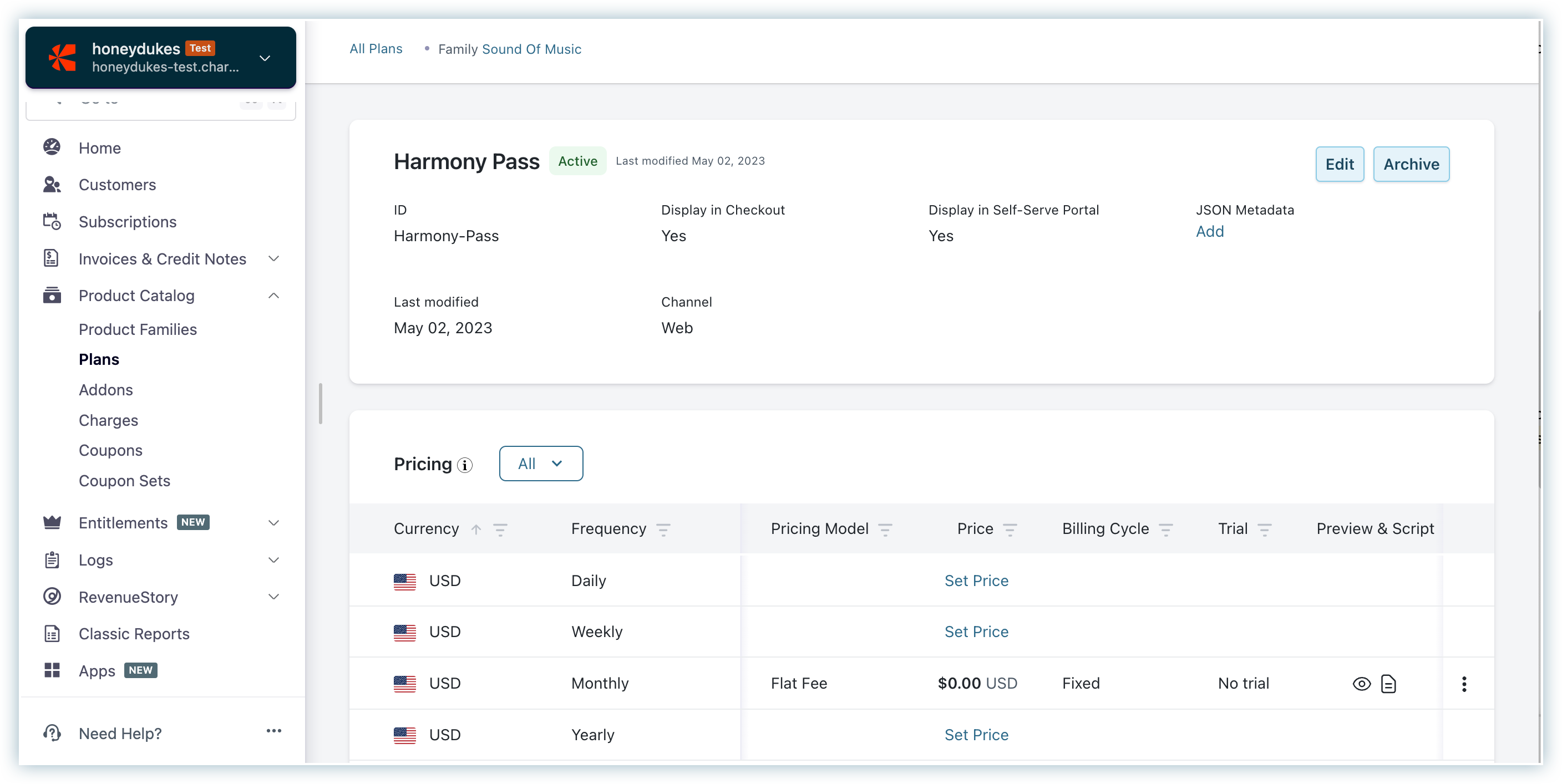

Alguna is a modern multi-entity billing platform built to support scaling SaaS and AI companies. As a purpose-built monetization platform, it unifies pricing and quoting (CPQ), recurring billing, usage metering, payments, and revenue recognition in a single platform.

Unlike legacy tools, Alguna is designed for multi-entity operations from the outset, enabling finance teams to manage multiple subsidiaries or business units with entity-level controls and a consolidated global view. It excels for companies with innovative pricing models (usage- or outcome-based) and hybrid sales motions, making it a strong choice once you’ve outgrown basic billing and need a flexible, scalable platform.

Key features:

- Unified quote-to-cash across all entities: Manage quoting, contracting, billing, payments, and revenue recognition in one system with no separate instances or manual stitching.

- Flexible pricing configuration (no code): Support for subscriptions, usage-based billing, one-off charges, prepaid credits, outcome-based pricing, and hybrid models — all with no code.

- Real-time usage metering: Ingest events (API calls, consumption metrics, transactions, etc.) in real time and bill them instantly or on a defined schedule.

- Entity-specific settings with centralized visibility: Each entity can have its own currency, tax rules, invoice templates, and accounting policies, while still rolling up into a consolidated dashboard.

- Automated ASC 606/IFRS 15 revenue recognition: Generate accurate, audit-ready revenue schedules at both the individual entity level and the consolidated group level.

- Entity-level tax automation: Alguna includes multi-entity billing platform tax jurisdiction features that let each entity apply its own tax rules, IDs, and compliance workflows automatically, whether that’s VAT in the EU, GST in APAC, or sales tax in the U.S.

- Smart multi-entity logic: Built-in support for intercompany transactions, FX conversion, and automatic eliminations to keep consolidated reporting clean.

- Enterprise-grade compliance and governance: Multi-currency, multi-tax, GAAP/IFRS-aligned workflows delivered through an intuitive, cloud-based interface.

Pros:

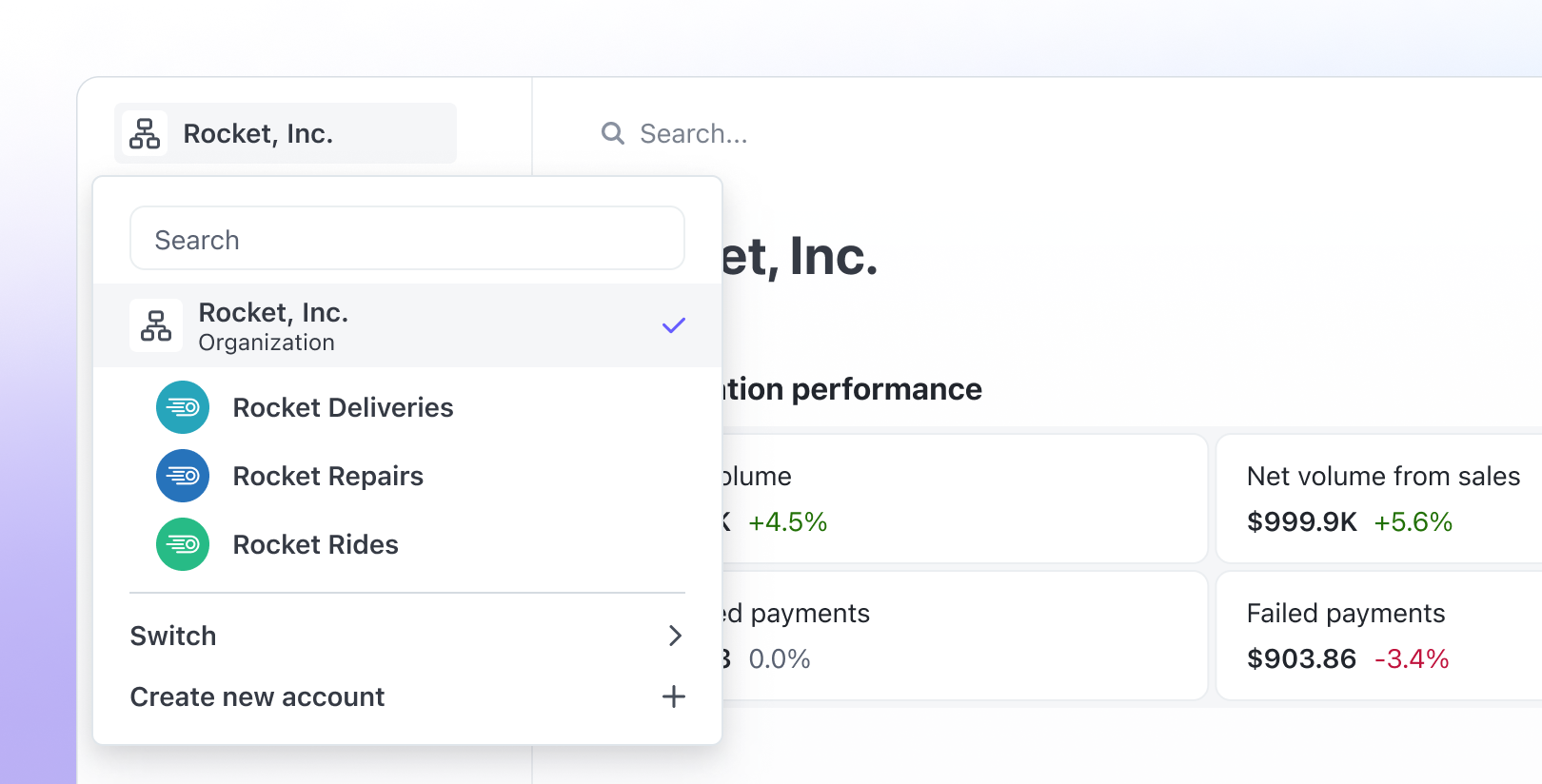

- Unified multi-entity management: Manage all entities in a single Alguna instance with no separate accounts or logins. Add new entities in minutes with currency, tax rules, and reporting configured automatically.

- Flexible, AI-native pricing: Supports usage-based, consumption-based, prepaid, and event-driven pricing out of the box, making it ideal for AI/ML and fintech products billing per API call, token, or transaction.

- No-code automation: RevOps and Finance can update plans, discounts, workflows, and even complex hybrid contracts without engineering involvement.

- Consolidated real-time insights: One dashboard shows MRR, ARR, usage, and revenue across all entities. This provides a clear overview of revenue movements.

- Fast implementation and easy scaling: Teams onboard quickly and efficiently. Evervault migrated from Stripe and went live in two weeks. Adding new products or entities doesn’t require re-architecting anything.

Cons:

- New market entrant: Launched in 2023 (YC-backed), Alguna is a relatively new platform.

- Not ideal for very early-stage companies: Alguna is designed for scaling SaaS and enterprise use cases. Early-stage startups with simple plans or basic billing needs may not yet require advanced CPQ and multi-entity capabilities.

Best for:

- Scaling B2B SaaS and AI startups operating globally or rolling out more complex pricing models.

- Finance teams looking to replace a patchwork of Stripe, Chargebee, and spreadsheets with one automated quote-to-revenue system.

- Usage-heavy or AI-driven products seeking to monetize metered consumption or event-based activity in real-time.

Pricing: Alguna offers a free Starter tier for early teams, while paid plans begin at $399/month for the full quote-to-revenue stack. Pricing is always flat and never tied to your billing volume, which is a meaningful advantage for multi-entity SaaS companies that would otherwise see rev-share fees compound across regions. Higher tiers unlock additional capacity and advanced features, but none introduce per-transaction charges or percentage-based billing.

Stripe Billing: Developer-friendly but limited for multi-entity scale

Stripe Billing is one of the most common starting points for SaaS companies because it’s fast to implement, developer-friendly, and tightly integrated with Stripe Payments. For single-entity teams charging straightforward subscriptions or light usage, Stripe delivers a smooth experience with minimal setup.

But once a company adds multiple entities or expands into new regions, Stripe’s limitations surface quickly. It wasn’t built with multi-entity structures in mind, meaning each entity typically needs its own Stripe account. This creates data silos, leads to manual reconciliation, and results in a lack of a consolidated view of revenue across the business.

Key features

- Developer-first APIs: Clean, well-documented APIs for creating subscriptions, recording usage, and generating invoices programmatically.

- Fast setup: Prebuilt checkout, customer portal, and lightweight subscription configuration ideal for early-stage teams.

- Basic usage metering: Support for metered billing through API-based usage reporting (though not real-time event billing).

- Simple subscription management: Tools for recurring billing, upgrades/downgrades, proration, and basic analytics.

Pros:

- Fast to implement: Stripe Billing is easy to set up, making it a strong choice for early teams that need to launch subscriptions quickly without heavy configuration.

- Developer-friendly: Clear APIs and strong documentation allow engineering teams to build custom billing workflows with minimal friction.

- Seamless payments integration: Billing integrates natively with Stripe Payments, providing teams with automatic access to global payment methods and card updater capabilities.

Cons:

- Not multi-entity capable: Each entity requires its own Stripe account, creating operational silos and preventing consolidated reporting or shared customer data.

- Limited tax and compliance features: More complex needs, such as multi-jurisdiction tax logic, GAAP/IFRS revenue recognition, or audit-ready workflows, require manual work or additional tools.

- Fragmented workflows at scale: As billing needs grow, teams often rely on spreadsheets or custom scripts for CPQ, usage tracking, and reporting, since Stripe doesn’t natively support more advanced SaaS workflows.

Best for:

- Early-stage SaaS startups with max two entities, straightforward pricing, and a need to get to market fast.

Developer-led teams that want full API control and prefer to build custom billing logic internally.

Pricing: Stripe Billing charges 0.7% of all recurring revenue on top of Stripe’s standard payment processing fees (typically 2.9% + 30¢ per card transaction).

There’s no flat-fee option, and costs increase as billing volume grows, which can become significant for scaling SaaS companies or multi-entity teams managing multiple Stripe accounts.

Chargebee: Multi-entity support and reliable subscription management

Chargebee is a widely used subscription billing and revenue management platform built for growing SaaS companies. It covers the core subscription workflows most mid-market teams need, from plan management and trials to proration, dunning, and invoice automation. It also offers an extensive integration ecosystem across CRMs, payment gateways, tax tools, and accounting systems.

Chargebee offers multi-entity support but it isn't optimal for growing SaaS companies. The platform manages each entity as a separate “site,” which creates operational silos and requires external consolidation. For companies with one or two entities, this can be manageable, however, it becomes increasingly complex as they scale globally.

Chargebee multi-entity features:

- Multi-currency and localization: Support for global currencies, localized pricing, and region-specific invoice templates.

- Robust subscription lifecycle management: Tools for trials, upgrades/downgrades, proration, pauses, add-ons, and one-time charges with consistent invoicing logic.

- Large integration ecosystem: Native integrations with Salesforce, HubSpot, QuickBooks, NetSuite, Stripe, Braintree, PayPal, Avalara, and more.

- Optional revenue recognition module: Add-on for ASC 606/IFRS 15 automated revenue schedules.

Pros:

- Feature-rich subscription management: Chargebee handles the full subscription lifecycle reliably, from trials and upgrades to proration, add-ons, and dunning, making it a strong choice for mid-market SaaS with established recurring billing needs.

- Multi-currency and localization support: Built-in tools allow companies to tailor pricing, invoicing, and currencies across regions, which helps teams operating internationally (even if true multi-entity remains siloed).

- User-friendly for non-technical teams: A clean admin UI enables finance, support, and RevOps teams to manage plans, customers, and billing workflows without engineering intervention.

Cons:

- Separate sites for each entity: A multi-entity setup requires multiple Chargebee instances, with no native consolidated reporting or unified customer data.

- Limited intercompany and cross-entity automation: Moving customers, managing intercompany charges, or maintaining consistent configurations must be done manually.

- Complex setup for a global scale: Maintaining multiple gateways, tax rules, and entity sites can require significant configuration effort or the services of external consultants.

Best for:

- Mid-market SaaS companies with standard subscription models and predictable billing workflows.

- Teams expanding gradually into multi-entity operations that can tolerate managing one or two separate Chargebee sites.

Pricing: Chargebee’s Performance plan starts at $599/month for up to $100,000 in monthly billings, with 0.75% overage fees applied beyond that. Multi-entity support and consolidated reporting are only available on higher-tier enterprise plans, and additional modules, such as revenue recognition, are priced separately.

Maxio: Deep financial reporting, with multi-entity support that requires heavy setup

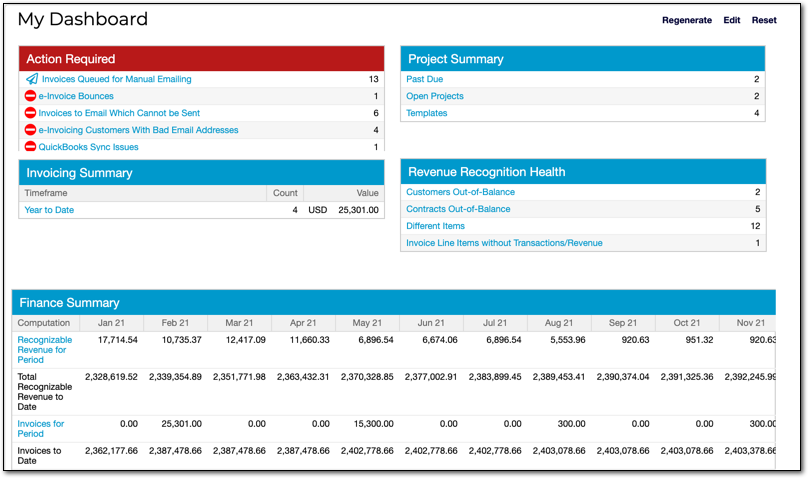

Maxio (formed from the merger of SaaSOptics, Chargify, and RevOps.io) is a finance-centric billing and revenue platform built for teams that prioritize GAAP/IFRS compliance, audit readiness, and granular SaaS metrics. It combines subscription management with powerful revenue recognition, deferred revenue automation, and detailed financial reporting.

Maxio also offers dashboards for key SaaS KPIs, including MRR, churn, and cohort analysis, making it a strong fit for CFOs and finance teams that need accuracy and structure.

However, Maxio's rigidity makes it less suited for usage-heavy or rapidly evolving pricing models, and implementation tends to be more complex than modern, product-led billing tools.

Key features:

- Advanced revenue recognition: Automates ASC 606 and IFRS 15 revenue schedules, allocates revenue across multiple performance obligations, and handles scenarios like annual prepaids recognized monthly.

- Deferred revenue and billing sync: Tracks deferred vs. recognized revenue in real time, updating schedules automatically as invoices are issued to keep financial statements accurate.

- Built-in SaaS metrics and analytics: Provides dashboards for MRR, ARR, churn, cohort analysis, LTV, and other core SaaS KPIs, giving finance teams ready-made reporting for internal reviews and board updates.

- Multi-currency and multi-entity (on higher tiers): Upper-tier plans support global entities, consolidated reporting, and multi-currency billing with automatic FX updates for more advanced financial operations.

- Finance-focused integrations: Connects with ERPs like NetSuite and QuickBooks, major CRMs, payment gateways, and its own Maxio Payments to streamline accounting.

Pros:

- Audit-ready financial accuracy: Maxio is built for strict GAAP/IFRS compliance, offering detailed audit trails and reliable revenue reporting, which is a major advantage for finance teams preparing for audits, fundraising, or an eventual IPO.

- Comprehensive financial and SaaS reporting: It provides deep reporting across revenue, deferred revenue, AR aging, and SaaS metrics (MRR, churn, expansion, cohorts), reducing reliance on spreadsheets or external BI tools.

- Purpose-built for B2B SaaS models: Maxio natively supports core SaaS workflows like annual billing with monthly recognition, co-terming, renewals, and seat-based pricing, which makes it a strong fit for traditional subscription businesses.

Cons:

- Complex and lengthy implementation: Maxio often requires months (not weeks) to fully configure, with significant upfront work involved in mapping products, revenue policies, and accounting rules. Many companies also require external support or consultants to implement it properly.

- Less flexible for pricing or workflow changes: Its finance-first structure makes updates slow; introducing new pricing models or adjusting billing logic can require support, engineering involvement, or careful reconfiguration, limiting agility for fast-moving SaaS teams.

- Steep learning curve: The platform is primarily designed for accountants, so non-finance users often find the UI and workflows more difficult to navigate compared to newer, more intuitive billing systems.

Best for:

- Finance-heavy SaaS organizations with dedicated accounting or RevOps teams that need strict GAAP/IFRS compliance, audit-ready reporting, and structured revenue processes across products or entities.

- Companies with stable, mature pricing models (annual contracts or seat tiers) that value accuracy and financial control over frequent pricing or billing experimentation.

Pricing: Pricing typically starts at around $599/month for the Grow plan (capped at $100,000 in monthly billings), with a required upgrade to the Scale plan for higher volumes or advanced features, such as multi-entity support. Pricing jumps significantly at the upper tiers, and unlike consumption-based tools, Maxio doesn’t offer more granular overage options.

Zuora: Multi-entity billing for enterprise (heavy complexity)

Zuora is one of the most established enterprise subscription billing platforms, built for large organizations with highly complex billing needs across multiple business units, geographies, and product lines.

Zuora supports global operations with multi-entity setups, multi-currency and multi-language billing, advanced pricing catalogs, usage rating, custom workflows, and enterprise-grade tax and revenue modules.

While Zuora can handle virtually any billing scenario, but the tradeoff is complexity. Implementations are lengthy, configuration requires deep expertise, and most teams rely on certified consultants or internal specialists to manage ongoing changes. It’s powerful, but very much an enterprise tool.

Zuora multi-entity features:

- Enterprise-grade subscription and usage billing: Supports sophisticated pricing models, large product catalogs, and highly configurable billing rules.

- Global multi-entity support: Can manage multiple entities or business units, each with its own currency, tax logic, and workflows, with the ability to consolidate at scale.

- Advanced workflow automation: Offers configurable workflows, event triggers, and custom billing logic for intricate enterprise processes.

- Zuora RevPro revenue automation: Separate module for ASC 606/IFRS 15 revenue recognition, multi-element arrangements, and audit-ready schedules.

- Extensive international capabilities: Multi-currency, multi-language, global tax handling, and support for diverse regulatory environments.

Pros:

- Highly scalable for complex enterprises: Built to support large, global organizations with sophisticated billing and compliance requirements.

- Robust multi-entity and multi-currency capabilities: Strong functionality for managing multiple business units, geographies, and reporting layers.

- Deep customization potential: Flexible workflows, advanced pricing configurations, and a modular product suite allow for detailed tailoring.

Cons:

- Long, resource-heavy implementation: Deployments often take months and typically require specialized Zuora consultants or trained internal teams.

- Complex to maintain: Introducing new products or pricing changes requires careful configuration, testing, and governance, which slows experimentation.

- High cost: Pricing typically starts around $50,000 per year, often scaling much higher for enterprise deployments.

Best for:

- Large enterprises with complex billing operations, multiple business units, and strict internal controls.

- Organizations with extensive RevOps and finance resources that can support heavy implementation and ongoing administration.

Pricing: Zuora typically starts around $50,000 per year, with additional fees for implementation, configuration, and integrations. Total cost scales based on billing volume, transaction counts, modules used, and the number of customers or entities you manage, making Zuora one of the higher-investment options in the enterprise billing space.

Recurly: Payment-optimized subscriptions with limited multi-entity scope

Recurly is a subscription billing platform known for strong payment optimization and churn reduction, making it a go-to for SaaS companies that prioritize reliable recurring revenue. It’s lighter and faster to implement than platforms like Chargebee or Zuora, with intuitive tools for subscription management, proration, renewals, and dunning.

However, Recurly isn’t built for multi-entity operations, as each entity requires its own account, with no native consolidation, intercompany support, or advanced revenue management capabilities. And while it supports multiple currencies and localized invoicing, finance teams still rely on an ERP for GAAP/IFRS compliance and multi-entity reporting. For mid-market teams wanting dependable recurring billing and strong payment recovery without a heavy lift, Recurly is a solid fit.

Key features:

- Smart payment optimization tools: Advanced dunning workflows, smart retry logic, and automatic card updater tools designed to maximize successful collections.

- Lightweight subscription management: Straightforward setup for plans, renewals, proration, coupons, trials, and basic usage charges.

- Flexible multi-gateway support: Integrates with multiple payment gateways and offers intelligent routing and fallback options.

- Multi-currency and localization: Supports a wide range of global currencies and localized invoice templates.Subscriber and revenue analytics: Includes built-in dashboards for MRR, churn, subscriber trends, and cohort analysis for quick and accessible insights into subscription performance.

Pros:

- Excellent payment recovery and churn reduction: Recurly’s advanced dunning workflows, smart retry logic, card updater, and ML-powered churn prediction significantly improve successful charge rates and reduce involuntary churn.

- Flexible, gateway-agnostic payments setup: Supports multiple payment gateways with intelligent routing and strong payment method coverage, giving teams more control and higher payment success than single-gateway systems.

- Fast, easy implementation: Known for quick setup, solid APIs, and an intuitive admin UI that lets smaller teams manage subscriptions, refunds, trials, and upgrades without heavy engineering involvement.

Cons:

- Weak multi-entity capabilities: Recurly isn’t designed for multi-entity structures, as each entity requires its own account, with no consolidated reporting, shared product catalogs, or intercompany logic.

- No native revenue recognition and accounting support: There’s no built-in ASC 606/IFRS 15 automation, so finance teams must rely on an ERP or manual processes for deferrals, accruals, and compliance.

- Basic usage and pricing flexibility: Usage-based billing is available, but it is limited; high-volume metered events, complex rating logic, or multi-element contracts often require workarounds or external tooling.

Best for:

- SaaS and digital subscription businesses that focus on reducing involuntary churn and need dependable, single-entity recurring billing.

- Teams want simple, low-lift subscription management without the complexity of enterprise-grade billing platforms.

Pricing: Custom based on transaction volume.

How to choose the right multi-entity billing platform

Choosing the best multi-entity billing platform comes down to clarifying your company’s stage, billing model, compliance needs, and internal capabilities.

1. Growth stage and scale: Single-entity startups with simple pricing often begin with Stripe or Recurly for speed and ease. Once billing complexity increases or manual work becomes painful, platforms like Alguna or Chargebee offer more structure. Enterprises with multi-business-unit operations may need tools like Zuora or Maxio, though modern alternatives can now deliver similar outcomes with less overhead.

2. Pricing model complexity: Straightforward subscriptions work on nearly any tool, but usage-based, tiered, hybrid, or outcome-based pricing requires more flexible systems. Alguna excels at usage-heavy and hybrid models; Chargebee handles standard subscription workflows; Recurly’s usage support is limited. If your strategy involves frequent pricing changes, prioritize platforms with strong configurability and support for no-code adjustments.

3. Multi-entity requirements: Define whether you simply need separate invoicing per entity or full consolidated billing and revenue visibility. True multi-entity platforms (Alguna, Zuora, Maxio, Chargebee) support separate tax rules, currency policies, and intercompany flows. Others require separate accounts or “sites,” creating silos that become unmanageable as you add more entities.

4. Compliance and reporting: If you need GAAP/IFRS revenue recognition, audit trails, or consolidated reporting, narrow your search to systems designed for financial rigor (Maxio, Zuora, Alguna). Tools without native rev-rec (e.g., Stripe, Recurly) require external ERPs or manual processes, which adds complexity.

5. Technical resources: Developer-led teams may prefer API-first tools like Stripe. Finance and RevOps–driven teams benefit from UI-heavy, no-code systems like Chargebee or Alguna. Zuora typically requires a dedicated admin or specialist. Match the platform to the skills and time your team actually has.

6. Budget and ROI: Pricing ranges from free tiers and percentage-based revenue fees (Stripe) to six-figure enterprise contracts (Zuora). The right choice depends on ROI: reducing involuntary churn (Recurly), automating complex rev-rec (Maxio), or eliminating spreadsheet-heavy multi-entity consolidation (Alguna). Consider both cost as a percentage of revenue and the time saved across Finance, RevOps, and Engineering.

Implementation best practices

Implementing multi-entity billing is a meaningful project, but a few foundational principles make the process far smoother and more scalable:

- Centralize your product catalog where possible: Use a shared product catalog across all entities, introducing local pricing or currency variations only where necessary. This maintains a consistent billing structure and simplifies global reporting.

- Set up entity-level tax rules correctly from the start: Each entity should have its own tax configuration, including local tax IDs, VAT/sales tax rules, exemptions, and invoice formats. Getting this right early prevents the need for manual corrections and compliance risks later.

- Automate FX and consolidated reporting: Choose a system that automatically applies exchange rates and rolls entity data into a single consolidated view. Avoid manual spreadsheets for currency translation or multi-entity reporting, as they won’t scale.

- Standardize billing workflows across entities: Align processes like invoicing cadence, upgrade/downgrade rules, and renewal logic. Consistency reduces configuration overhead, makes training easier, and strengthens compliance across all regions.

- Define reporting access and visibility upfront: Use role-based permissions so that teams only see the entities they manage, while still enabling leadership to access a consolidated view. Plan your reporting and dashboards early to ensure that both entity-level and global insights are easily accessible.

Frequently asked questions about multi-entity billing

How is multi-entity billing different from standard subscription billing?

Standard billing only supports one company at a time, with one set of products, taxes, and currency. Multi-entity billing provides the support you need to operate globally, including separate tax profiles, multiple currencies, localized product variations, and role-based permissions, all while automating intercompany logic and consolidating reporting. It’s designed to manage multiple subsidiaries in one system, so teams don’t have to maintain a patchwork of tools.

Can multi-entity billing handle usage-based pricing?

Yes, if the platform supports both usage metering and multi-entity operations. Modern systems, such as Alguna, Zuora, and Chargebee, can track usage, rate it, and bill the correct entity with the appropriate currency and tax rules. The key is that usage is correctly attributed to each entity.

How does Alguna help with multi-entity consolidation?

Alguna manages all entities on a single platform with entity-specific settings and a consolidated, single dashboard. It rolls up revenue, MRR/ARR, and revenue recognition schedules across entities in real-time, automates intercompany eliminations, and handles FX conversion for group reporting. Teams can view each entity independently or view the entire business with a single click.

The future of multi-entity billing is unified (and automated)

As SaaS companies expand globally, billing can either slow them down or accelerate their growth. Legacy systems weren’t designed for multiple entities, currencies, and tax profiles, resulting in manual work, scattered data, and cumbersome month-end closes.

Modern multi-entity platforms change that by unifying billing, revenue, and compliance in one system. They automate intercompany logic, apply the correct tax and currency rules automatically, and provide finance teams with real-time visibility across every region.

Alguna represents this new standard. With an AI-native architecture and unified data model, it lets companies add new entities, evolve pricing, and stay audit-ready without operational friction. Instead of stitching together tools, teams get one global source of truth for billing and revenue.

See how Alguna handles multi-entity billing in a single unified platform

Multiple entities, currencies, tax rules, and product catalogs? Run global, multi-entity billing without spreadsheets or custom code with Alguna.