• Real-time usage metering is no longer optional. Legacy tools batch-process data, while modern metered billing software like Alguna and Metronome capture events instantly for accurate, transparent billing.

• Scalable infrastructure matters. As AI and usage data volumes explode, teams need metered billing platforms that can grow with them — without code, complexity, or engineering bottlenecks.

More companies are adopting usage-based pricing and charging customers by how much they use a product rather than a flat fee. (Although, subscriptions are alive and well!)

This approach, known as metered billing or usage based billing, aligns revenue with customer value and can boost retention and expansion revenue (companies with usage-based models report 28% higher net retention on average than those with purely fixed subscriptions).

If you’re part of a SaaS, AI, or fintech team evaluating metered billing software tools, this guide is for you. We’ll explain what metered billing is and why it matters for modern business models and compare popular metered billing software options like Alguna and Orb.

What is metered billing (and why is it important)?

Metered billing is a billing model in which businesses charge customers based on how much of a product or service they consume.

It’s akin to how utilities charge per kWh of electricity or per gallon of water in that you pay only for what you use.

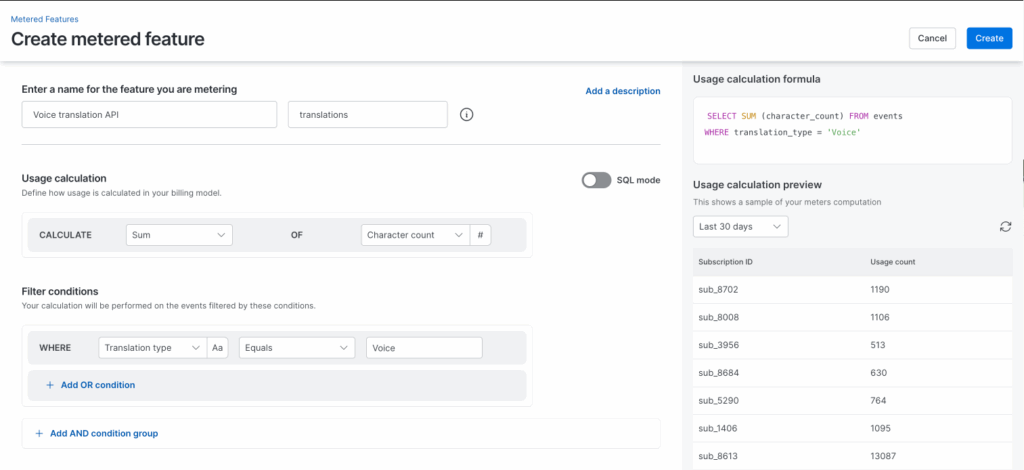

In software, this might mean billing per API call, per gigabyte of data, per user active, or any unit of value the service delivers.

Why metered billing is popular

This model has surged in popularity among AI, SaaS and cloud companies because it creates a fair, flexible pricing structure. For customers, metered (usage-based) pricing lowers the barrier to entry – they can start small and only pay as their usage grows.

For providers, it aligns revenue directly with customer value: as customers get more value and use the product more, they naturally pay more. This often leads to improved customer retention and growth.

For example, usage-based pricing tends to increase Net Revenue Retention (NRR) by enabling expansion revenue (as customers grow or succeed, their bills increase correspondingly).

- Khozema Shipchandler, at CFO Twilio

Best metering and billing software: Comparison table

Compare the best metering and billing software including legacy players like Zuora and Chargebee along with challengers that are gaining momentum, such as Alguna and Orb.

This highlights how they stack up on key aspects like real-time metering, scope, ideal use case, and pricing.

| Platform | Real-time metering | Quote-to-cash scope | Best for | Pricing |

|---|---|---|---|---|

| Alguna | Yes, real-time, high-volume event capture | Full (CPQ + Billing + RevRec) | SaaS, AI, and fintech scale-ups needing flexible metering capabilities and a unified end-to-end platform | Starts at $399/month (no % of revenue). White glove onboarding included. |

| Stripe Billing | Partial (usage tallied per period) | Billing only (subs and usage) | Early-stage or simple usage scenarios | 0.7% of revenue billed |

| Orb | Yes, built for high-volume real-times | Billing only (backend service) | Tech-heavy API/infrastructure companies | Starts at $749 - $3490 per month + additional usage and integrations |

| Metronome | Yes, enterprise scale events | Billing only (metering focus) | Large-scale SaaS with strong engineering teams | Custom annual contracts (likely starts at ~$10k) |

| Lago | Near real-time (self-hosted) | Billing only (open-source core) | Dev-oriented startups valuing open-source control | Free (self-host) or paid cloud |

| m3ter | Yes, real-time dashboards | Billing only (integrates to CRM) | B2B SaaS scaling usage complexity | Custom (subscription model) |

| Amberflo | Yes, real-time to invoice | Billing and analytics | AI/cloud platforms with heavy usage, needing speed | Usage-based fees (per events/meters) |

| Chargebee | No, usage aggregated per cycle | Billing + subscriptions (some add-ons) | SaaS SMEs with standard subscription+overage models | $599/month (up to $100k in billings) + overages |

| Zuora | Partial – supports usage but not instant | Full (Billing, optional CPQ, RevRec) | Enterprises with very complex, global billing | ~$50k+/year, enterprise |

| Maxio | No, standard billing cycles | Billing + CPQ + SaaS analytics | SaaS firms needing billing + finance reporting | $599/month (up to $100k in billings) |

10 metered billing software platforms built for the AI economy

There’s a growing ecosystem of metered billing software to help companies measure exact usage while maintaining billing transparency with customers.

They range from no-code unified revenue platforms like Alguna and lightweight add-ons (e.g. Stripe Billing) to enterprise metering platforms (like Metronome) and older players like Chargebee or Zuora.

Below we compare some of the most popular metered billing software options on the market, and where each shines or falls short.

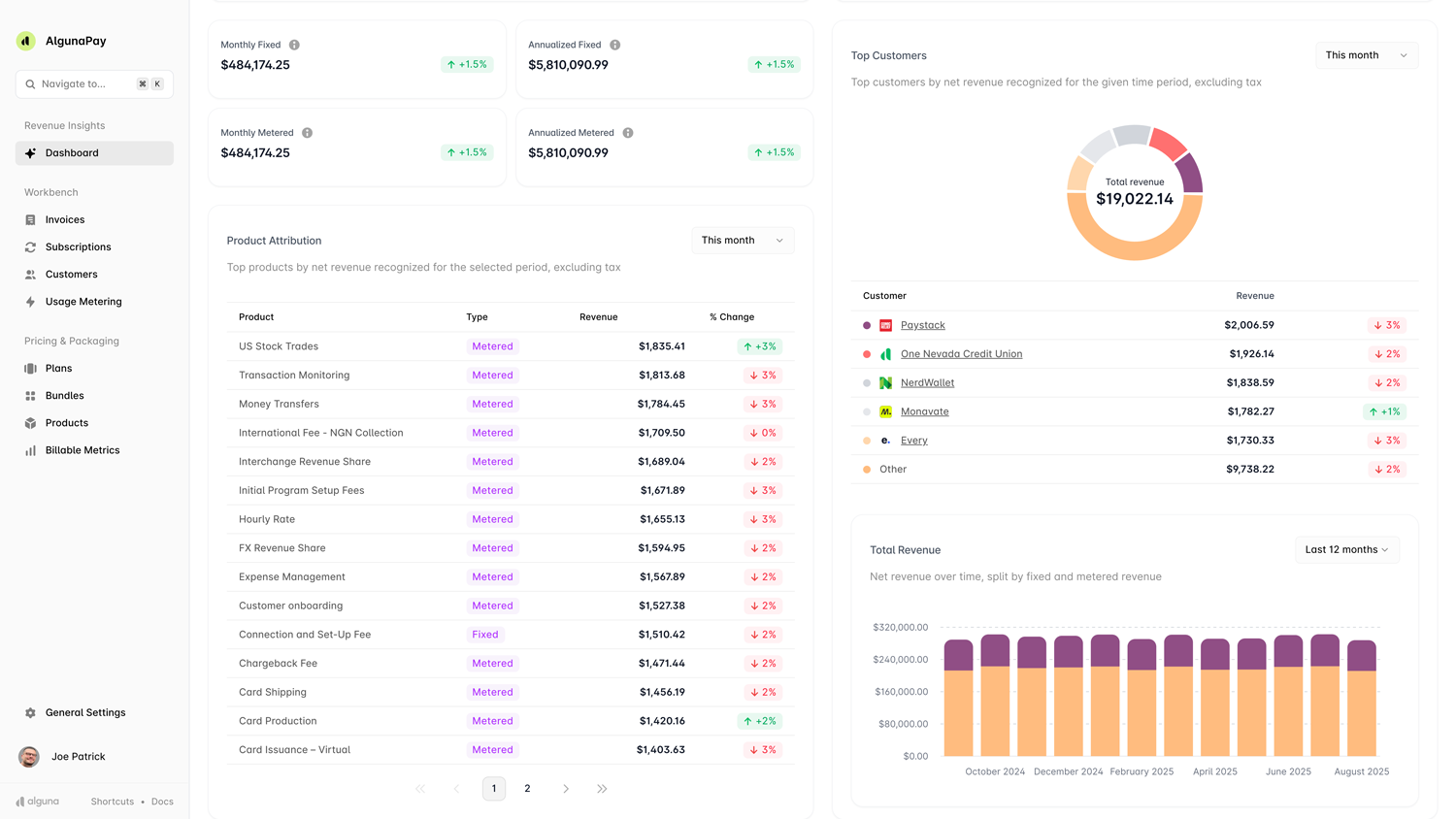

1. Alguna – Purpose-built metering and billing software for SaaS, AI, and fintech companies

Alguna is a modern pricing, quoting, and billing platform that unifies the entire quote-to-revenue process for AI, fintech, and SaaS companies. It’s designed to handle complex metered billing and evolving AI monetization models.

Alguna serves as an all-in-one revenue platform, combining real-time usage metering, flexible pricing management, subscription billing, invoicing, and even built-in e-signature for contracts. The platform handles both product-led self-serve scale and complex enterprise contracts in one system with ease.

This breadth allows companies to automate even very complex metered billing setups while maintaining accuracy and compliance.

Pros:

- Real-time usage ingestion and metering: Captures every usage event (API calls, tokens, data, etc.) the moment it happens, ensuring up-to-date and accurate billing data.

- Extremely flexible pricing models: Supports all major usage-based pricing structures (prepaid with overages, tiered, graduated, pay-as-you-go, hybrid subscriptions) without engineering effort.

- Unified quote-to-cash platform: Combines CPQ, metered billing, subscriptions, one-off add-ons, credits, and revenue recognition in one tool. Automates tricky tasks like co-terming, proration, and compliance (ASC 606/IFRS 15) out-of-the-box.

- Integrations: Out-of-the-box connectors for Salesforce, HubSpot, NetSuite, QuickBooks, and Stripe—ensuring full quote-to-cash automation.

- Fast implementation: Alguna’s customers go live within weeks with full migration and white-glove onboarding at no additional cost.

Cons:

- Newer entrant: Launched in 2023 (Y Combinator-backed).

- Not ideal for very early-stage startups: Alguna is built for complex, evolving monetization. Very early-stage startups with a single simple subscription plan might find it too robust for their needs.

Key features:

- Real-time usage metering: Ingests product usage instantly, syncing with your CRM and accounting stack without delays.

- No-code configuration: Flexible pricing setup for flat, tiered, volume, hybrid, or credit-based models. New plans or changes can be launched quickly by go-to-market teams.

- Prepaid credit and drawdown support: Handles committed spend and wallet-style credit balances natively.

- Multi-entity support: Manage usage and metered billing across multiple business units, currencies, or geographies.

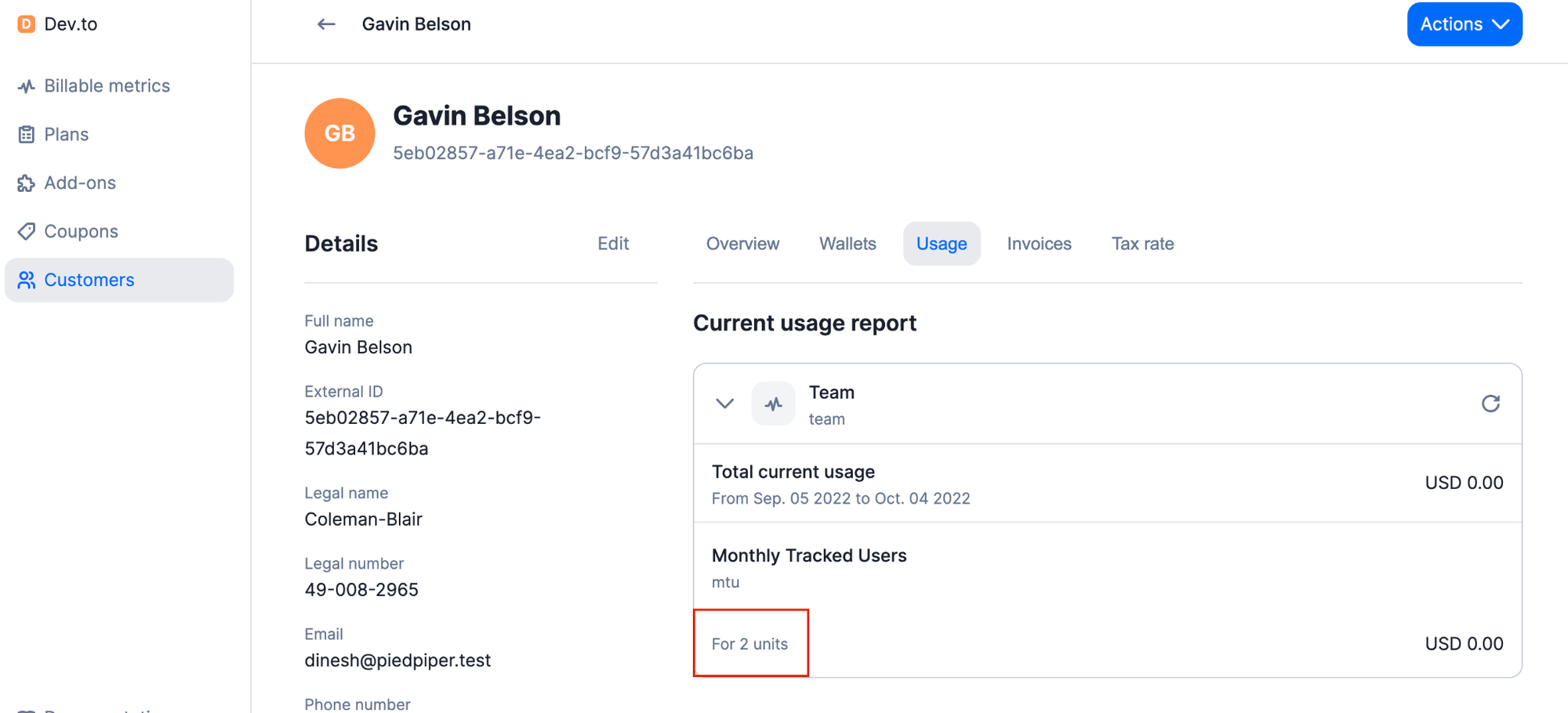

- Customer transparency: Automatically generated, line-item invoices and dashboards help customers understand exactly what they’re billed for.

This makes Alguna especially strong in scenarios where usage metering for SaaS billing needs to tie seamlessly into the rest of the revenue operations stack.

Best for:

- High-growth B2B SaaS, AI, and fintech companies scaling from self-serve to enterprise.

- Teams that need to manage hybrid plans, custom contracts, and evolving usage-based pricing in one platform with integrated CPQ, e-sign, and billing.

- Finance and RevOps teams who want a no-code way to adjust pricing, automate billing, and stay fully aligned across systems without relying on engineering.

Alguna’s platform shines for teams that need to experiment with pricing frequently or combine subscriptions with high-volume usage metrics in real time. (e.g. AI platforms billing per API call/token, fintech apps charging per transaction, or SaaS companies blending product-led growth usage with enterprise contracts.)

Pricing: Plans start at $399/month, with no percentage-of-revenue fees. This includes dedicated onboarding and migration support to get up and running. All pricing is transparent (no hidden fees).

Evervault was growing fast. But that growth soon revealed deep cracks in their billing infrastructure. Using a mix of in-house metering, Stripe Billing, spreadsheets, and DocuSign, they were struggling to manage fast-moving usage contracts and flexible customer deals.

With Alguna, billing no longer lives in silos and usage data is being ingested automatically. Today, both Evervault and their customers can monitor usage and billing continuously, eliminating billing surprises and improving transparency.

“Alguna enables complex usage-based billing for us in a way that other products can’t.”

– Shane Curran, CEO at Evervault

Read case study

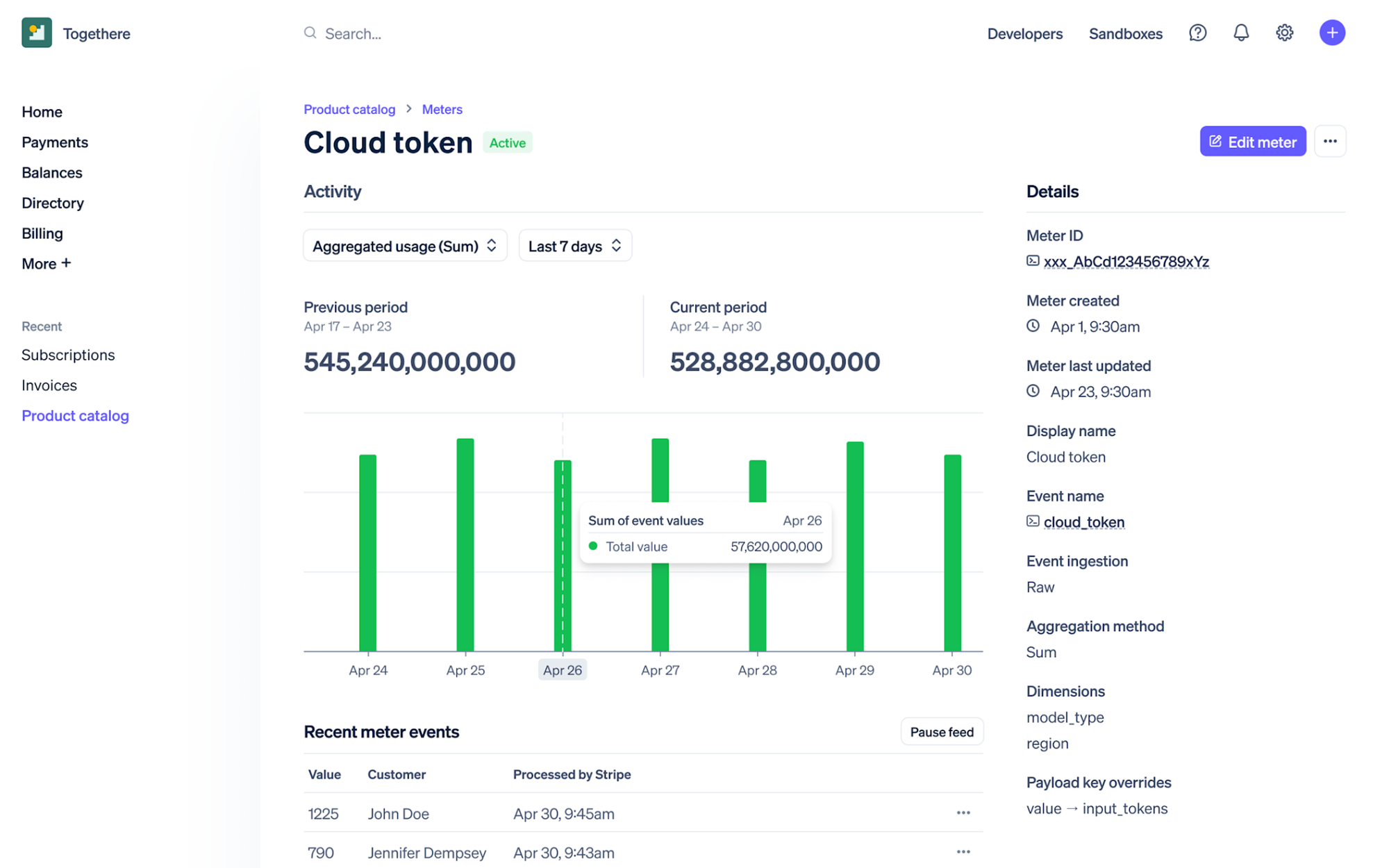

2. Stripe Billing – Best for getting started with metered billing

Stripe Billing is an add-on to the Stripe payments platform that handles recurring subscriptions and simple metered billing on top of Stripe’s payment processing.

It’s often the first choice for startups since it integrates seamlessly if you’re already using Stripe to collect payments.

With Stripe Billing, teams can quickly set up subscription plans or per-use charges via the Stripe Dashboard or API, making it a convenient way to implement usage-based billing for SaaS without adopting a whole new system.

However, as companies grow, they may encounter Stripe Billing’s limitations in flexibility and advanced features.

Pros:

- Seamless Stripe integration: Extremely easy to enable for existing Stripe users. You can manage products, prices, customers, and usage all within the familiar Stripe interface or API, with minimal setup.

- Developer-friendly APIs and docs: Stripe provides excellent documentation and clean APIs. Developers praise how straightforward it is to record usage and generate invoices programmatically.

- Covers core billing needs out-of-the-box: Supports basic recurring subscription features (trials, proration, coupons) and simple metered billing (including tiered pricing, usage caps, per-seat add-ons) without custom work. For many early-stage SaaS products, this feature set is sufficient to launch.

Cons:

- Limited flexibility for complex models: Geared towards standard SaaS billing, Stripe Billing lacks some advanced capabilities of specialized platforms. For example, it doesn’t support complex account hierarchies or multi-attribute usage pricing. Changing your pricing model or metric often requires creating new products/plans and migrating customers.

- Revenue-based fees: Stripe Billing charges 0.7% of billing volume (on top of payment processing fees). This is simple at first, but at scale it can become expensive. (E.g. $10M in annual billed revenue would incur ~$70k in Billing fees.) High-volume SaaS businesses might outgrow this cost structure.

- Not a full quote-to-cash solution: Stripe focuses on payment collection. It lacks native tools for complex invoicing workflows, advanced dunning beyond basics, or built-in analytics. Teams needing extensive billing customizations, or features like revenue recognition, will find Stripe Billing’s scope limited.

Key features:

- Subscription and usage setup: Easy creation of plans with recurring or metered components via dashboard or API.

- Tiered and volume pricing: Supports basic pricing tiers, volume discounts, and threshold alerts.

- Integrated payments: Unified customer, payment, and invoice data through Stripe Payments.

- Automation and webhooks: Automate renewals, proration, and billing updates through Stripe’s API ecosystem.

Best for:

- Teams already using Stripe Payments that want to enable simple metered billing quickly.

- Very early-stage startups or small businesses that need to implement simple usage-based billing with minimal overhead.

Pricing: 0.7% of billed volume on Stripe’s standard plan. For example, billing a customer $1,000 would incur a $7 fee. These fees are in addition to Stripe payment processing fees (e.g. 2.9% + 30¢ on credit card charges). There’s no monthly base fee for Stripe Billing; you pay as a percentage of revenue.

3. Orb – Great option for metered billing for API products

Orb is a metered billing platform designed for developer-centric, API-first companies that need to meter and price at massive scale.

Founded in 2021, Orb offers powerful metering and rating engines and expects engineering teams to deeply integrate billing into their product workflows. This makes Orb very flexible and scalable for technical use cases, though it means non-engineering teams may rely on developers to manage billing logic.

Pros:

- Deep usage metering capabilities: Designed from the ground up to handle high-volume, granular event data. Orb can ingest millions of usage events (e.g. API calls, compute cycles) and transform them into billable metrics with complex rating rules. It’s built for scale and accuracy, which is paramount for infrastructure-style SaaS products.

- Flexible pricing experimentation: Orb lets teams model and test different pricing structures (tiered, graduated, prepaid, etc.) without heavy engineering work. RevOps or product managers can configure pricing changes quickly, enabling fast iteration as your product and market evolve.

- Developer-friendly APIs and tooling: Orb prioritizes a great DX (Developer Experience). It provides robust APIs, webhooks, and documentation, so engineers can tightly embed usage tracking and billing logic into your app. This is ideal if you want billing to feel like an extension of your product (with custom metrics, real-time usage feedback, etc.).

Cons:

- No built-in payment processing or UI: Orb focuses on the billing backend. It does not process payments itself or provide a hosted checkout/customer portal UI. You’ll need to integrate Orb with a payment gateway (e.g. use Stripe for charging cards) and build or use another solution for customer-facing billing UI.

- Requires engineering investment: To unlock Orb’s full power, you need developers to configure and maintain it. Setting up custom SQL-defined metrics, alerting, data warehouse syncs, etc., assumes you have engineering and billing-ops resources. For companies without a dedicated team to manage billing as part of the product, Orb’s flexibility can turn into complexity.

- Young company considerations: Orb is a newer platform (still a startup itself), so companies should ensure it meets their compliance, security, and reliability requirements. As with any newer vendor, some features may be evolving, and you’ll want to vet SLAs and support.

Key features:

- Real-time usage ingestion: Streams and aggregates events at scale for accurate, high-frequency billing.

- Custom pricing models: Define metrics via SQL or API for maximum flexibility across product lines.

- Event-level transparency: Every invoice item maps back to its original event for complete auditability.

- API-first architecture: Full control for engineering teams to embed billing in products or dashboards.

Best for:

- API-first, data, or infrastructure platforms where billing must scale with usage volume.

- Technical SaaS teams that treat billing as part of the core product experience.

Pricing: Subscription fee + usage-based. Orb’s pricing starts around $749 up to $3,490 per month (tiers based on features and support), plus additional fees tied to usage volume and add-on integrations.

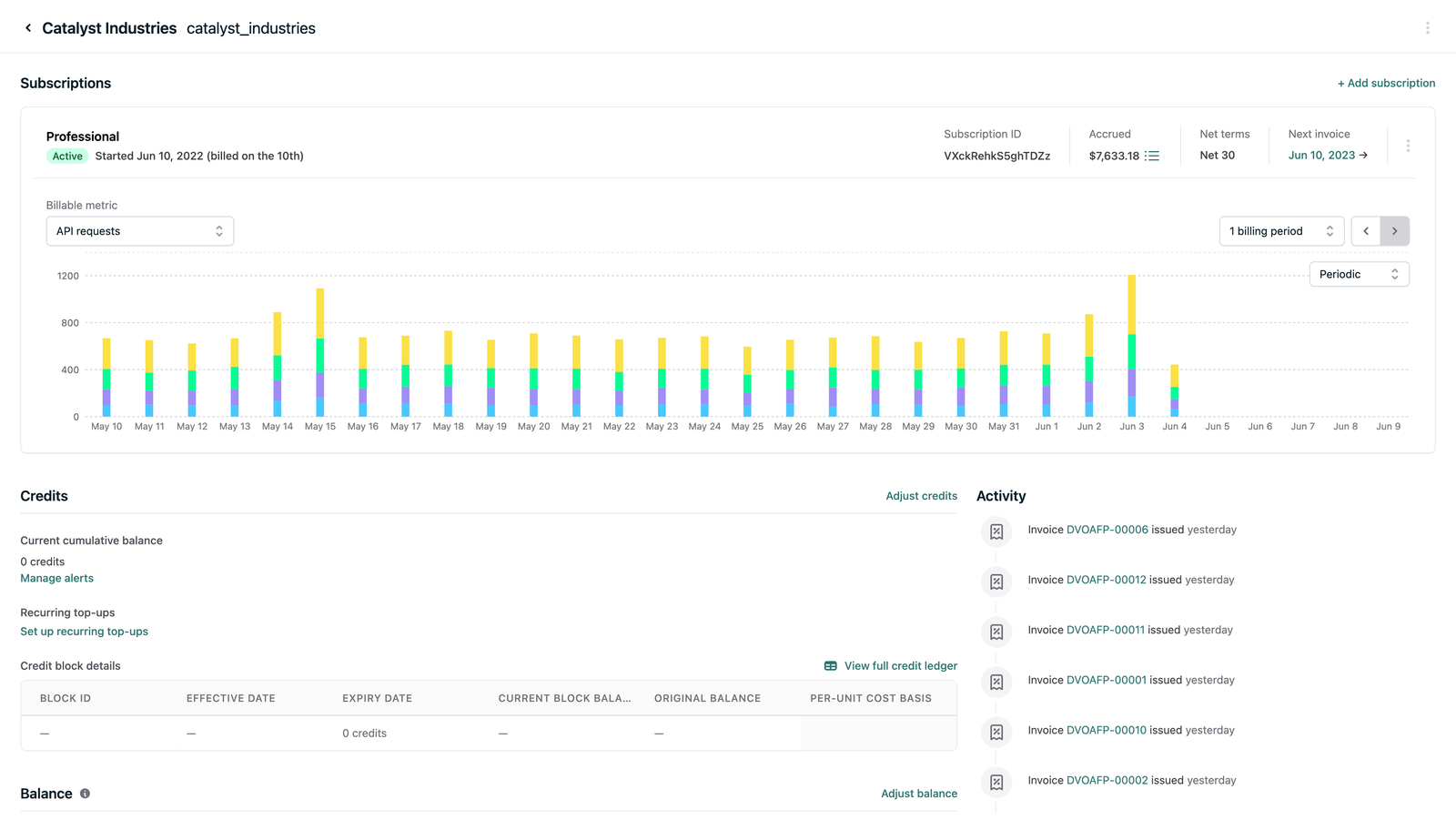

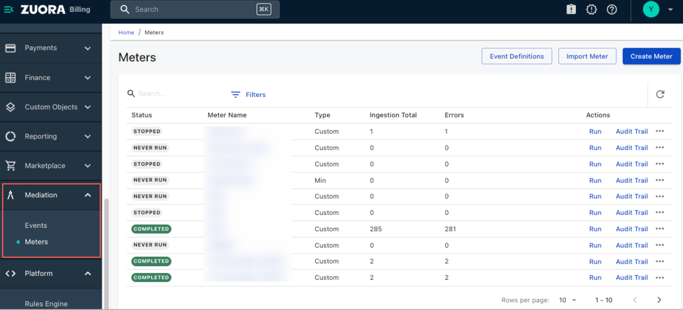

4. Metronome – Best metered billing software for enterprise

Metronome is a developer-focused, enterprise-grade metered billing platform built to handle high-volume, event-driven billing

Unlike legacy billing systems that added metered billing as an afterthought, Metronome was designed from day one to process massive streams of usage events with high fidelity. It's commonly chosen by engineering-heavy organizations.

Metronome provides a powerful metering engine and APIs, but it focuses narrowly on metered billing. It isn’t an all-in-one quote-to-cash tool, which means enterprises often integrate it with platforms like Alguna for things like CPQ and end-to-end-quote-to-cash automation.

Pros:

- Granular, high-scale metering: Metronome excels at ingesting millions of events and applying sophisticated pricing rules in real time. It supports tiered pricing, volume discounts, prepaid credits, and other complex rating scenarios out-of-the-box.

- Scalable and developer-friendly architecture: Metronome’s event-driven, API-first architecture lets engineering teams embed billing seamlessly into their product workflows It offers strong APIs, webhooks, and even infrastructure components (like an events pipeline) that align with modern microservice designs. For technical teams that want control and extensibility, Metronome provides a solid foundation to build on.

- Enterprise-grade features: The platform supports enterprise needs like account hierarchies (for multi-entity billing), audit logs, and compliance reporting.

Cons:

- Requires engineering resources: Metronome is powerful, but it’s not “plug-and-play.” Implementing it and maintaining custom integrations will require significant developer effort, especially to tailor it to your product’s specific usage data and to integrate with your wider tech stack. Companies without strong engineering bandwidth may struggle with the initial setup and ongoing changes.

- Narrower scope (not an end-to-end solution): Metronome focuses on metering and billing usage. It does not handle things like CPQ (Configure-Price-Quote for sales), contract management, or native invoicing/payment collection interfaces. Enterprises often need to connect Metronome with a CRM, a separate subscription management tool, or an ERP for a complete quote-to-cash process. This modularity gives flexibility but also means more integration work.

- Custom pricing and opacity: Metronome’s pricing is not public; typically it’s a custom enterprise contract (reportedly starting in the low tens of thousands of dollars per year for mid-sized startups and higher for large enterprises). The cost may include usage-based components (e.g. fees per event or per invoice).

Key features:

- Real-time event ingestion: Processes millions of usage events per minute with low latency and guaranteed delivery.

- Advanced pricing engine: Supports tiered, volume, prepaid, pooled, and “peak usage” models out-of-the-box.

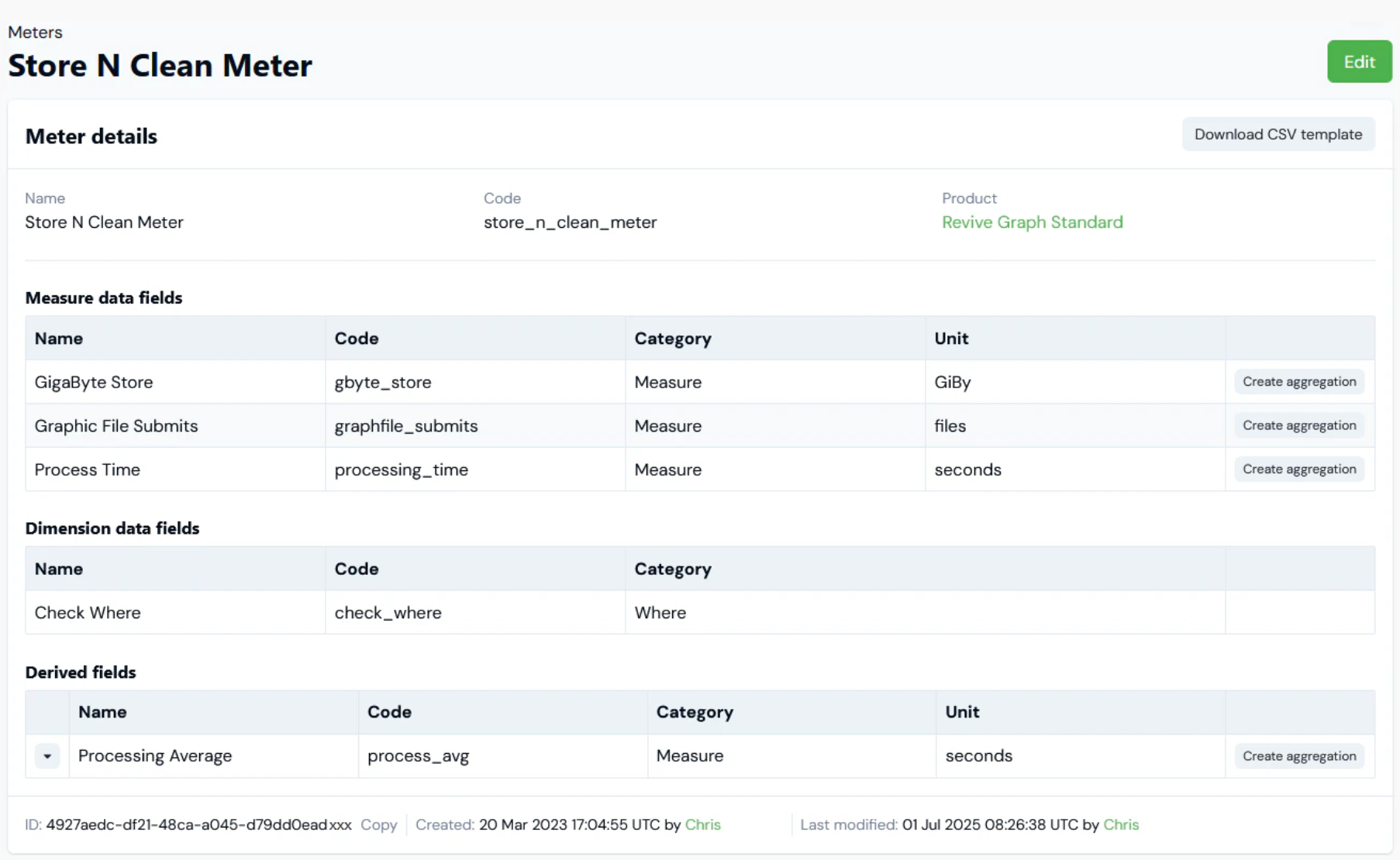

- Custom usage metrics: Define event-based or composite metrics using flexible logic and transformations.

Metronome often acts as the “billing brain” that other systems feed into or pull from. It also provides analytics dashboards for usage and billing data, and can push usage data to customer-facing interfaces (some users pipe Metronome data into their own customer dashboards to give clients usage visibility).

Best for:

- API-first SaaS and enterprises with large-scale metered billing needs. Typical use cases include developer platforms, cloud infrastructure services, telecommunications or data platforms – anywhere you bill based on high-volume metrics like API calls, processing time, storage, etc.

- Fast-scaling startups that have strong engineering teams and need a highly reliable billing engine they can tweak and trust at scale.

Pricing: Custom enterprise pricing. Metronome does not publish prices, but it’s generally considered a premium solution. Pricing likely involves an annual platform fee (starting in the $10k–$50k+ range depending on company size) plus usage-based fees (e.g. charges per certain number of events processed). There may also be implementation fees or support tiers for enterprise clients.

5. Lago – The best open source metered billing software

Lago is an open-source metering and billing platform that has rapidly gained popularity among developer-oriented startups.

Launched in 2022, Lago offers many of the same capabilities as SaaS billing platforms (metered usage tracking, subscription management, invoicing, etc.) but with the benefit of no vendor lock-in or transaction fees.

Teams can self-host Lago or use a cloud version, giving them full access to the code and database. This transparency and control makes Lago a compelling choice for companies that want to tightly customize their billing or avoid the constraints of a closed SaaS billing service.

Pros:

- Open-source flexibility: Being fully open source means you can inspect and modify Lago’s code to fit your needs. It's highly customizable – companies with unique use cases can extend or tailor workflows that would be black boxes in proprietary systems. There’s also no risk of getting stuck if the vendor changes terms; you have the code.

- Self-hosting & data ownership: Lago can be deployed in your own infrastructure, which is a major advantage for companies with strict data compliance or residency requirements. Sensitive customer usage data stays in-house. This is attractive in fintech, healthcare, or EU-based firms concerned about GDPR, for example.

- Developer-first and modular: Lago provides clean APIs, SDKs, and a modular architecture for metering and billing. Engineers can integrate usage tracking into the product with relative ease. Because it’s modular, you can start with just the metering engine and gradually adopt more of Lago (e.g. billing, invoicing) as needed, which is great for incremental implementation.

Cons:

- Higher engineering overhead: The power of open source comes with responsibility – you’ll need developers to deploy, maintain, and upgrade Lago. There’s no fully managed service by default (unless you opt for Lago’s own cloud offering). For startups with limited engineering bandwidth, this overhead can be significant compared to a turnkey SaaS billing service.

- Less out-of-the-box depth: Lago is evolving quickly, but it may lack some advanced features or polish that mature commercial platforms have. For example, revenue recognition, a built-in quote-to-cash CRM integration, or a refined UI for non-engineers might not be as deep as in a paid product. Teams might need to build some functionality in-house or be comfortable without certain “enterprise” features initially.

- Support and community: While Lago has an active open-source community, official support or implementation help might not be as readily available (unless using the paid cloud version). Companies used to vendor support might need to rely on community forums or internal knowledge to troubleshoot.

Key features:

- Open-source billing engine: Full access to source code for customization and integration flexibility.

- Usage metering: Track and rate any event — API calls, minutes, tokens, transactions — with configurable metrics.

- Hybrid pricing models: Support for flat-rate, usage-based, and hybrid subscription plans with overage handling.

- Prepaid credits and wallets: Built-in logic for prepaid balances, credit drawdowns, and top-ups.

- Self-hosting or cloud: Choose full control via self-hosting or convenience via Lago Cloud (SaaS).

- APIs & webhooks: Developer-friendly APIs for metering, invoicing, and customer management.

Lago’s design appeals to developers who want a “billing engine” they can build around, with the confidence that they can always audit or modify the logic.

Best for:

- Startups and tech companies with sufficient engineering resources that want maximum control over their billing system.

- Teams who are wary of SaaS billing fees or limitations, and who maybe already have some billing built in-house that they want to replace with a more robust open-source solution.

- Companies in regulated or sensitive industries (fintech, govtech, healthcare) where self-hosting all customer data is non-negotiable.

Pricing:

- Open source version: Free. You can self-host Lago’s Community edition without license fees.

- Cloud premium: Lago offers a hosted version with support, typically priced based on your revenue or usage (reports indicate tiers from ~$1k up to $3k per month depending on volume). The cloud version includes managed infrastructure and priority support. Unlike some competitors, Lago does not take a percentage of your revenue – pricing is flat or tiered by usage, which can save money as you scale.

6. m3ter – Best metered billing solution for infrastructure platforms

m3ter (pronounced “meter”) is a UK-based usage metering and billing platform geared towards infrastructure or AI domains companies.

Founded in 2020, m3ter’s focus is to make rolling out complex usage-based pricing easier for software companies. It places a strong emphasis on precision and real-time data, aiming to be a drop-in metering and billing infrastructure that can handle large scale from day one.

This is not an end-to-end SaaS billing app with UI for every function, but rather a powerful backend service for usage-based monetization.

Pros:

- Robust usage data handling: m3ter can ingest, enrich, and store raw usage events at massive scale, and importantly it retains the unaggregated event data. This means you can always audit every usage record and even change how you compute charges later (and re-run billing on historical data if needed).

- Strong integrations across the revenue stack: m3ter comes with integrations for popular CRMs (Salesforce, HubSpot), ERPs/accounting (NetSuite, QuickBooks), and payment gateways.

- Real-time visibility and analytics: m3ter provides live dashboards and analytics on metered billing metrics. Go-to-market teams and finance can see usage trends as they happen, enabling proactive customer management (for example, seeing if a customer is trending toward an overage mid-period) and better forecasting.

Cons:

- Complex implementation: Due to its configurability, setting up m3ter can take longer and be more involved than simpler tools like Stripe Billing. Defining all your usage models, integrating data pipelines, and configuring integrations might be a significant project. Companies should be prepared for an implementation phase that may require solution engineering.

- Not a full quote-to-cash solution: m3ter focuses on usage metering/pricing and relies on other systems for things like CPQ, contract management, or sending invoices for payment It usually needs to be paired with a subscription management or billing presentation layer. If you need a one-stop-shop software, m3ter alone won’t cover everything as it’s best used as part of a larger billing architecture.

- Opaque pricing: m3ter does not publicly list prices. As a result, you’ll need to engage with their sales to get a quote tailored to your usage volume and company size. This often means pricing can be bespoke (and potentially higher for larger customers). Without public pricing, it can be hard to know the cost until fairly late in the evaluation process.

Key features:

- High-volume event ingestion: Processes large-scale usage data from multiple sources in real time.

- Flexible pricing logic: Supports tiered, multi-attribute, prepaid, and hybrid models with pricing-as-code flexibility.

- Event enrichment and transformations: Cleans and normalizes usage data before rating for complete accuracy.

- Auditability & traceability: Stores unaggregated event data for full replays and revenue verification.

- Integrations: Native connectors for Salesforce, HubSpot, NetSuite, QuickBooks, and common payment gateways.

Best for:

- AI and infrastructure platforms that monetize via usage metrics like API calls, compute hours, data volume, etc., especially when accuracy and real-time billing are critical.

- Also well-suited for mid-market SaaS companies that are outgrowing simple subscription billing and need to introduce more complex usage charges without rebuilding their entire billing system in-house.

If your business values a high degree of control and needs to scale billing as you handle more data (e.g., cloud services, AI APIs, developer tools), m3ter is an excellent choice to ensure billing reflects actual consumption with precision.

Pricing: m3ter’s pricing is not publicly disclosed. Expect a custom quote based on your usage volume (e.g., number of events metered per month) and possibly revenue scale. As an indication, many similar infrastructure billing services have base platform fees in the low thousands per month plus volume-based charges.

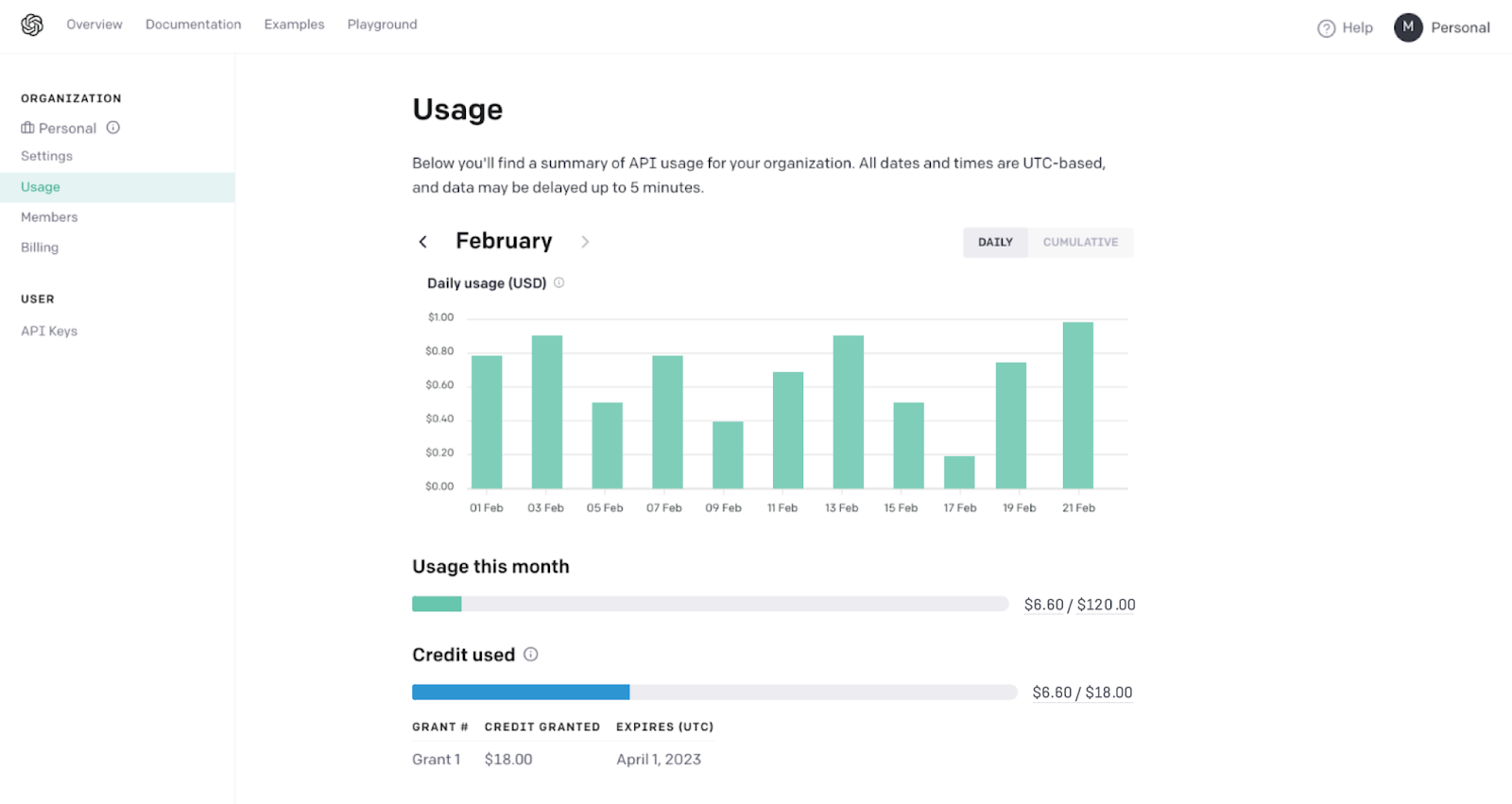

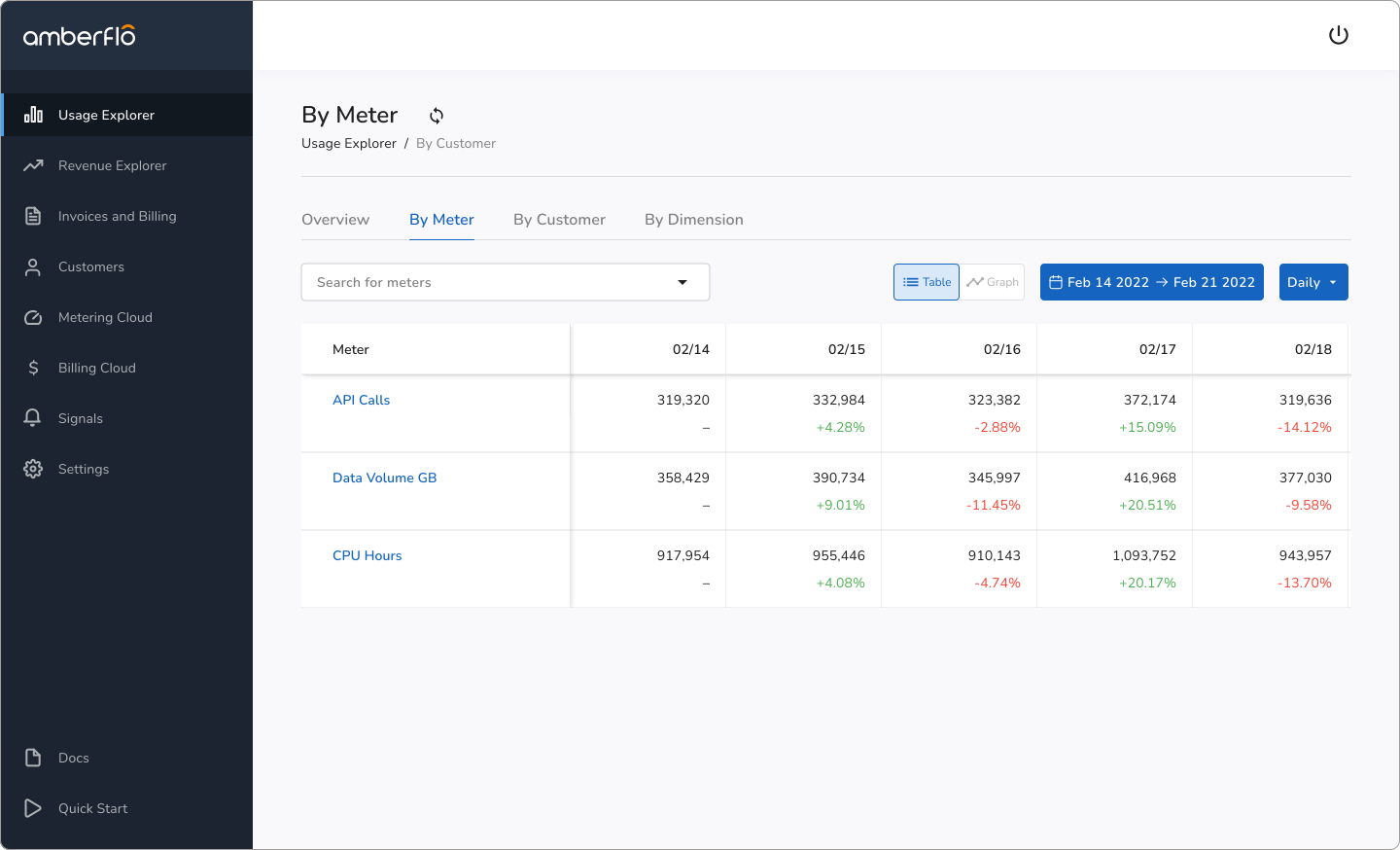

7. Amberflo – Best for real-time metered billing

Amberflo is a modern, cloud-native metered and usage-based billing platform founded by former AWS engineers. It’s designed to handle metering, rating, and invoicing at massive scale—ingesting millions of events in real time and converting them into billable units instantly.

Amberflo positions itself as a usage-first alternative to legacy billing systems, giving SaaS, AI, and cloud infrastructure companies the speed and transparency they need to monetize consumption-based models without building billing infrastructure from scratch.

Pros:

- Real-time metering at scale: Purpose-built for event streaming, Amberflo can meter any digital event (API calls, GPU minutes, transactions, tokens, etc.) instantly and bill accurately in real time.

- Transparent, usage-based architecture: Every charge can be traced back to the exact usage event — delivering “revenue-grade” auditability ideal for enterprise finance teams.

- No-code pricing configuration: Business and RevOps teams can create or modify pricing plans without engineering effort, accelerating time-to-market for new offers.

Cons:

- Limited quote-to-cash capabilities: Amberflo focuses on usage metering and billing; you’ll need to integrate with a separate CPQ or contract management tool for complex deals.Integration setup required: While APIs are robust, initial implementation can require thoughtful data mapping and engineering to connect your product’s usage data streams.

- Enterprise-oriented pricing: Amberflo’s flexibility and scalability make it a premium choice; early-stage startups may find it overpowered or costly for basic use cases.

Key features:

- Real-time usage metering: Event-based ingestion pipeline with instant rating and aggregation.

- Flexible pricing engine: Supports tiered, volume, prepaid, and hybrid usage models.

- Customer usage portal: Embedded dashboards let customers monitor usage and charges in real time.

- Prepaid credit & drawdown support: Handles committed spend and wallet-style credit balances natively.

- Enterprise-grade auditability: Every billed unit links back to its originating event, ensuring transparency for both customers and finance.

- APIs & integrations: Connects easily to payment gateways, CRMs, and accounting tools.

Pricing: Amberflo uses a subscription-based model with pricing that scales by event volume and feature tier. Public pricing isn’t listed, but typical SaaS plans start around $1,000–$2,500/month for growth-stage companies. Enterprise plans are custom and include advanced features like multi-entity billing, SLAs, and dedicated support.

Best for:

- AI, SaaS, and cloud infrastructure companies that require real-time usage metering and elastic pricing at scale—particularly those monetizing via API calls, compute usage, or token-based billing.

8. Chargebee – Best subscription management with light metered billing

Chargebee is a well-known subscription billing platform primarily serving SaaS, e-commerce, and other recurring revenue businesses. While it started focusing on standard subscription management, Chargebee has added metered billing capabilities (often called “usage-based add-ons” in Chargebee) to support companies adopting hybrid pricing models.

It’s often praised for its rich feature set and integrations, though that breadth can introduce complexity. For straightforward usage billing (like an included allowance and overage fees), Chargebee is a solid, user-friendly choice.

Pros:

- All-in-one subscription management: Chargebee covers the entire lifecycle – recurring invoicing, trials, upgrades/downgrades, cancellations, dunning for failed payments, coupons, proration adjustments.

- Rich ecosystem of integrations: Chargebee natively integrates with dozens of payment gateways (Stripe, PayPal, Braintree, etc.), CRMs, accounting systems, and other tools.

- Compliance and global readiness: Chargebee has many built-in features for global business – automated tax calculations (including handling EU VAT, GST), support for multiple currencies, compliance with PCI for payments, and even revenue recognition modules.

Cons:

- Usage billing not real-time or highly flexible: Chargebee’s usage-based billing works via post-hoc aggregation, meaning you have to send usage records (via API or CSV import) to Chargebee, which then includes those in the next invoice. It’s fine for low-frequency metrics (e.g. monthly counts), but it’s not as instant or granular as some specialized usage billing platforms, like Alguna.

- Complex setup and learning curve: Chargebee’s wide array of features means configuration can be complex. Many companies report needing significant onboarding help to configure advanced scenarios. The admin UI, while powerful, has a lot of settings to navigate. For teams with straightforward needs, this complexity can be daunting.

- Cost scales with revenue (on lower plans): Chargebee’s pricing for the mid-tier plans includes a revenue-based component (e.g. the Rise plan starts $599/month for up to $100K MRR, then a percentage beyond that). While this is manageable, very cost-conscious companies might find the revenue share model less appealing at scale.

Key features:

- Subscription lifecycle automation: Manage the full customer journey — trials, renewals, upgrades, and dunning — automatically.

- Usage-based add-ons: Define metered components (e.g., per-API call or transaction) with postpaid or included-allowance logic. Typically works by defining a “metered component” in a plan (e.g. price per unit) and then each billing cycle, you push the usage quantity to Chargebee for it to calculate overages.

- Automated invoicing & collections: Generate, send, and reconcile invoices automatically with built-in payment retries.

- Customer portal & checkout: Hosted pages for sign-ups, plan changes, and invoice payments without custom development.

- Tax & compliance support: Automates regional tax handling and ensures PCI and GDPR compliance.

It’s well-suited for basic metered billing like “X units included, then $Y per additional unit.” Real-time usage visibility is not a primary feature (it’s more aggregate by billing period).

Best for:

- SaaS companies managing recurring subscriptions with light metered billing needs.

- Businesses operating across multiple regions needing multi-currency and tax compliance.

- Startups and mid-market companies not yet ready for complex metering.

Pricing: Starts at $599/month for the mid-tier plan (covers up to $100K MRR in billings). Chargebee’s pricing has tiers: for instance, the Rise plan ($599/mo) and the Scale plan ($999/mo for $200K MRR) with overage fees of 0.6–0.75% on revenue beyond the included MRR. Enterprise plans remove the percentage-of-revenue component in favor of flat fees.

Maxio (Chargify/SaaSOptics/RevOps) – Best for revenue recognition and analytics

Maxio is the result of a 2021 merger between Chargify (a subscription billing platform) and SaaSOptics (a subscription revenue management/analytics tool), later combined under the name Maxio. In March 2025, Maxio also acquired RevOps (CPQ tool), positioning itself as a comprehensive revenue management solution for SaaS.

Maxio aims to offer both robust billing capabilities and rich financial reporting in one platform. It supports metered billing (via metered components and prepaid drawdowns) but is especially noted for its integrated revenue analytics which many pure billing tools lack.

Pros:

- Integrated billing and finance analytics: Maxio’s big selling point is the unification of billing operations with financial reporting. It can produce clean revenue schedules, SaaS metrics (ARR, MRR, churn), and cohort analyses directly from your billing data.

- Flexible spectrum of billing models: Because it evolved from Chargify, Maxio supports a wide range of pricing models, including recurring subscriptions, one-time charges, multiple metered components per plan.

- Built-in CPQ and sales tools: With the RevOps acquisition, Maxio now also offers a built-in Configure-Price-Quote (CPQ) module for sales teams. This means sales reps can configure custom deals (including custom usage pricing or discounts) and generate quotes/invoices all within Maxio.

Cons:

- Not specialized for volume or PLG experiments: While Maxio can handle metered billing, it’s not as tailored to high-frequency event metering or rapid pricing iteration as some newer tools. If you’re a cutting-edge product-led growth startup tweaking prices weekly or dealing with billions of events, Maxio might not be the perfect fit.

- UI can feel dated or complex: Some users note that parts of Maxio’s interface still reflect its legacy components (Chargify/SaaSOptics) and aren’t completely unified. There can be a learning curve to navigate the system, especially as certain workflows might require hopping between “modules.”

- Payments and tax handling not native: Maxio typically requires integration with payment gateways (it doesn’t process payments itself, similar to Chargebee). Also, advanced sales tax/VAT handling might rely on integrations (though Maxio can store tax info and apply it, it’s not a fully automated tax engine).

Key features:

- Subscription and metered billing: Supports recurring, one-time, and usage-based charges. This includes postpaid metering and prepaid credit drawdowns.

- Revenue reporting and analytics: Native dashboards for ARR, churn, MRR, and deferred revenue tracking — no need for a separate BI tool.

- Revenue recognition compliance: Automates ASC 606/IFRS 15 recognition and integrates with accounting systems for month-end close.

Best for:

- B2B SaaS companies that need more advanced financial reporting than basic billing systems provide, but aren’t ready (or willing) to jump to heavy enterprise solutions like Zuora or an in-house build.

Pricing: Maxio’s pricing is reported to be similar to Chargebee’s. In fact, Maxio’s standard plan starts around $599/month for up to $100K MRR, with higher tiers for larger volumes. Unlike some competitors, Maxio typically does not take a percentage of revenue – it opts for flat monthly fees (which many finance teams prefer as you scale).

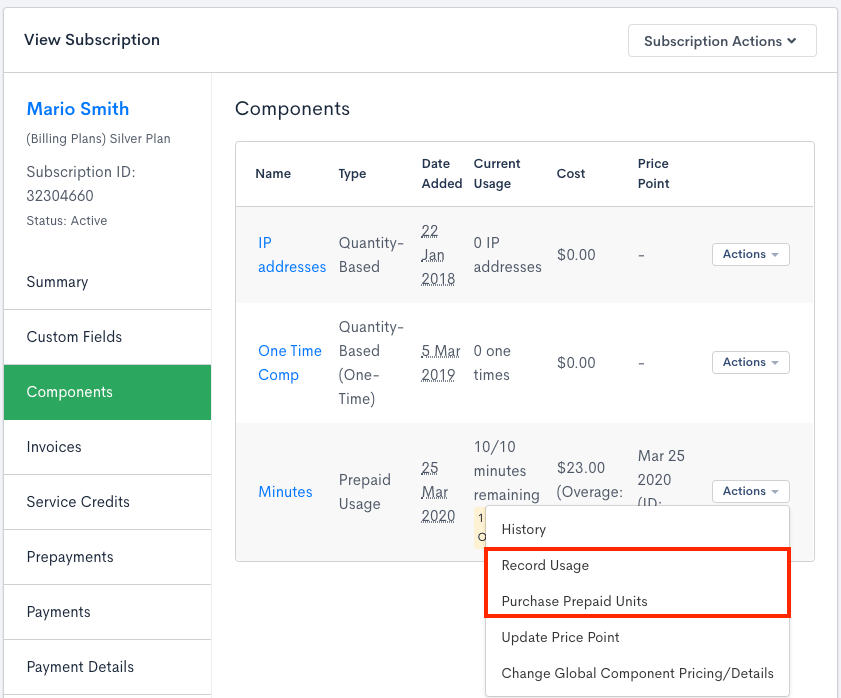

10. Zuora – Best for global enterprises

Zuora is one of the most established players in the subscription management space, widely adopted by large enterprises for complex billing and revenue operations Originally built around recurring subscription models, Zuora has over time expanded to support metered billing at scale.

Enterprises choose Zuora when they require a holistic, extremely flexible billing and payments system that can tie into legacy ERPs, handle multiple business units, and meet strict compliance standards.

Pros:

- Handles extreme complexity and scale: Zuora can model almost any billing scenario in one customer account: multi-tier pricing, regional pricing variations, subscriptions + usage + one-time charges all on one invoice, minimum spend commitments with overages, discounts, ramp/deferred deals – you name it.

- “Multi-everything” capabilities: Large global enterprise features are built-in. Zuora supports multiple legal entities (subsidiaries), multiple currencies and taxation rules, integration with multiple payment gateways, and can produce consolidated or separate financial statements as needed.

- Robust revenue recognition and compliance: Zuora has strong revenue automation aligned with accounting standards. It can handle variable consideration, deferred revenue, multi-element arrangements, etc., in compliance with ASC 606/IFRS 15. This gives finance teams confidence that even complex usage-based or hybrid arrangements are being recognized properly.

Cons:

- High cost and long implementation: Zuora is known for its hefty price tag and the effort required to implement. Enterprise deals often start around $50k per year and can go well above that. Implementation projects typically take 3–6 months (sometimes with an external Zuora implementation partner). This upfront investment (both money and time) can be prohibitive for smaller companies. It’s not uncommon to spend tens of thousands on implementation services alone.

- Complex, specialized knowledge required: Operating Zuora can feel like operating a full ERP. Many companies end up needing a specialized Zuora administrator or extensive training for users. The interface, while powerful, is not as intuitive for casual users – it’s built for robust process adherence, not quick one-off changes.

- Slower agility: Because Zuora is so robust, it’s not the quickest to change. Launching a new pricing model or product in Zuora might involve significant configuration (setting up product catalog entries, rate plans, etc.) and thorough testing. In a dynamic startup environment, this can feel cumbersome.

Key features:

- Global multi-entity support: Manages multiple subsidiaries, currencies, and tax jurisdictions within one platform — ideal for international operations.

- Payments and collections management: Integrates with global payment gateways; supports automated dunning, refunds, and payment retries at scale.

- Enterprise security & compliance: SOC 2, GDPR, and ISO 27001 certified — trusted by public and regulated companies worldwide.

Best for:

- Large enterprises or scaling companies with complex global operations – for example, companies with multiple subsidiaries, selling in dozens of countries with different currencies and tax jurisdictions, and offering complicated pricing plans

- Industries with strict compliance (telecom, finance, public SaaS companies under SOX) often choose Zuora because of its auditability and track record. If your billing needs the power of an ERP and you have the budget and team to support it, Zuora is the gold standard.

Pricing: Enterprise custom pricing. As noted, expect a starting cost around $50k/year for a basic Zuora setup, scaling upward based on volume and modules. There is no percentage-of-revenue fee; it’s a flat subscription plus possible overage charges on things like invoice or payment count.

Checklist: Features to look for in metered billing software

Choosing the right metered billing platform can make or break your monetization strategy.

Use this checklist to evaluate whether a solution has the flexibility, accuracy, and automation your revenue operations need.

| Feature | What to look for | Why it matters |

|---|---|---|

| Real-time usage metering | Ability to track and rate usage events as they happen (no latency). | Ensures no consumption goes unbilled and provides up-to-the-minute visibility, helping avoid billing surprises and revenue leakage. |

| Flexible pricing rules | Support for diverse pricing models (per-unit, tiered, volume discounts, overages) and easy rule changes. | Allows tailoring of pricing to different customer segments and quick experimentation as your market evolves, without heavy re-engineering. |

| Customer usage dashboards and alerts | Real-time usage visibility for customers via self-service dashboards/portals, plus configurable alerts for thresholds. | Prevents “bill shock” by keeping customers informed of their consumption. Builds trust and transparency, reducing support tickets and disputes. |

| Credit and drawdown billing | Capability for prepaid credits or drawdown balances (customers pre-pay or commit funds, usage deducts from balance). | Enables popular models like prepaid usage and drawdowns – giving customers predictable spend limits while you secure upfront revenue commitments. |

| Quote-to-cash automation | Seamless flow from quote creation to invoicing and payment collection (quotes convert directly into subscriptions/invoices). | Removes manual handoffs between sales and billing, speeding up the sales-to-revenue cycle and ensuring customers are billed exactly as agreed. |

| Integrations (CRM, payments, accounting) | Pre-built integrations or APIs for CRM (e.g. Salesforce), payment gateways (e.g. Stripe), and accounting systems. | Keeps billing, sales, and finance data in sync to prevent manual errors and data silos, ensuring a smooth end-to-end billing process. |

| Reporting and revenue recognition | Detailed usage and billing reports, with support for proper revenue recognition of usage-based charges. | Gives finance teams clear insight into usage-based revenue and ensures compliance with accounting standards, aiding forecasting and audit readiness. |

| Pricing agility | Easy to adjust pricing and packaging (via UI or config, not code) and to roll out new pricing models without disrupting existing customers. | Allows quick responses to market changes and continuous pricing optimization. You can iterate on pricing strategy without long development cycles or billing errors |

| Auditability and transparency | Comprehensive audit logs for all usage and billing events, with detailed invoice line-items to verify charges. | Gives finance full confidence in billing data – every charge can be traced and verified. Eases audits and ensures transparent billing for internal and external stakeholders. |

Frequently asked questions: Metered billing software

How do Stripe metered billing tools compare to other competitors?Stripe Billing is great for simple, early-stage setups but lacks flexibility for complex usage models. Platforms like Alguna, Orb, and Metronome offer more real-time metering, pricing agility, and quote-to-cash automation.

What are the best metered billing solutions for SaaS companies?Top options include Alguna, Metronome, Orb, m3ter, and Chargebee. Alguna stands out for unifying CPQ, billing, and usage metering in one no-code platform.

Which is best between metered billing tools for subscription businesses?For traditional subscriptions with light usage, Chargebee or Maxio work well. For hybrid or usage-first models, Alguna and Metronome are better suited.

Top-rated systems for integrating metered/usage billing into QuickBooks recurring billing structures?Alguna, Chargebee, and Maxio all integrate natively with QuickBooks, syncing invoices and revenue schedules automatically.

What are the best options for SaaS revenue management that can handle real-time usage data ingestion and metering?Alguna, Metronome, and Amberflo are leading choices for live data ingestion and high-frequency usage tracking.

Top tools to implement metered, volume-based, or tiered usage-based billing without custom code?Alguna, Chargebee, and Maxio let GTM and finance teams configure plans without developer support. Alguna offers the most flexibility for no-code pricing changes.

Which usage-based billing tools support real-time metering and flexible pricing models?Alguna, Orb, Metronome, and Amberflo all support real-time event metering and complex pricing — with Alguna and Orb being the most configurable.

We just introduced usage-based billing; what tools ensure accurate metering and revenue recognition from day one?Startups typically choose Alguna for real-time metering and built-in revenue recognition, or m3ter for raw data precision.

Best SaaS revenue management tools for real-time usage data ingestion and metering in 2025?Alguna, Metronome, and Amberflo lead in performance and automation, with Alguna offering the most unified quote-to-cash workflow.

What recurring billing providers support usage-based billing and metered pricing for SaaS companies?Alguna, Chargebee, Maxio, and Stripe Billing support usage-based billing, but only Alguna combines real-time metering with integrated CPQ and e-sign.

Zuora vs. Stripe vs. Orb — which handles complex metering, hybrid subscriptions, and consumption models best?Zuora is best for large enterprises, Stripe for simplicity, and Orb for developer-heavy teams — but Alguna combines their strengths in one modern, no-code platform.

Why modern teams are moving to unified metered billing platforms

As pricing models evolve faster than ever, GTM, RevOps, and finance teams can no longer afford to manage metered billing and revenue across disconnected tools.

The days of spreadsheets, manual reconciliations, and developer-dependent updates are over.

Modern revenue teams are embracing unified metered billing software because they deliver one source of truth for usage, pricing, and revenue. The result? Faster go-to-market cycles, fewer billing errors, and total visibility into customer consumption and financial performance.

Platforms like Alguna take this even further by combining real-time usage metering, no-code pricing control, and end-to-end quote-to-cash automation into a single workflow. Instead of juggling multiple systems, GTM, RevOps, and finance teams can now manage pricing experiments, usage billing, and revenue recognition from one place—with no engineering bottlenecks.

If your company is scaling fast, experimenting with AI or usage-based models, or tired of reconciling fragmented billing data, a unified metered billing platform like Alguna isn’t just a nice-to-have—it’s the infrastructure your next stage of growth depends on.

Full control over recurring and metered billing with Alguna

Design subscription plans, attach usage components, and set up overage rules with zero engineering support. Get up and running in weeks—not months.