Plenty of billing and revenue platforms have burst onto the scene in recent years, and there’s certainly no shortage of Chargebee alternatives.

With legacy platforms struggling to offer the flexibility needed when it comes to pricing, invoicing, and billing, solutions like Alguna, Subscript, and others are stepping in to help companies experiment with pricing, invoice accurately, and get paid on time.

Compare household names like Stripe and Recurly to challengers like Alguna to find the best Chargebee alternative for your needs.

Not sure where to start? Jump to our decision guide to familiarize yourself with the criteria to consider when evaluating alternatives to Chargebee.

Top Chargebee competitors: Comparison overview

Get a side-by-side comparison of the leading Chargebee competitors as we highlight their strengths, key differentiators, and pricing to help you quickly identify which alternative aligns best with your business goals.

| Platform | Best for | Pros | Cons | Pricing |

|---|---|---|---|---|

| Alguna | Unified revenue management for B2B companies | No-code automation, unified pricing, quoting, billing, real-time analytics, modern UX Replaces multiple tools | Newer platform, missing deeper integrations | Free tier available. Paid plans start at $699 per month. White glove migration and onboarding included |

| Orb | Usage-based billing | Pricing flexibility, source of truth for invoicing, great customer support | Feature gaps in billing capabilities beyond usage based, lacking subscription management for complex deals | Starts at $749 scales quickly based on volume |

| Stripe Billing | Best for developer-first teams and simple B2C subscriptions | Global reach, 135+ currencies, advanced APIs, rapid integration, AI-powered automation | Can get expensive at scale, limited for complex subscription scenarios | Starts at 0.8% of your revenue |

| Recurly | Churn reduction and analytics | Best for B2C subscriptions, Advanced dunning, robust analytics, multi-currency/gateway support | Analytics could be deeper, custom pricing may be expensive for small firms, difficult to switch over | A % of your revenue plus add-ons for integrations |

| Maxio | Revenue recognition | Deep revenue recognition, SaaS metrics, strong integrations, scalable for high-growth SaaS | Can be complex to implement, support can be slow, requires a lot of custom integrations to get started | Revenue based tiers, starts at $1k a month |

| Subscript | SaaS metrics and analytics | Robust SaaS metrics, cohort analysis, actionable dashboards, easy integration | Not a full billing platform (analytics-focused), requires integration with other tools and limited billing support | Starting at $8k per year to $100k |

| Sage Intacct | Integrated accounting for multi-entity billing | GAAP-compliant billing, audit-ready reporting, accounting integration | Reporting customization can be limited, learning curve for non-finance users, long migration process | Starts at $25k |

| Subskribe | Modern CPQ | Flexible CPQ platform with with intuitive interface | Newer platform, limited third-party integrations, limited billing capabilities for complex deals | Custom pricing based on seats and revenue. Closer to $20k per year |

| Zuora | Enterprise compliance | Enterprise compliance, flexible pricing, global tax, deep CRM/ERP integrations | Complex implementation, clunky UI, can be expensive, difficult to switch, limited usage based capabilities | Starts at $50k per year + implementation and integration costs |

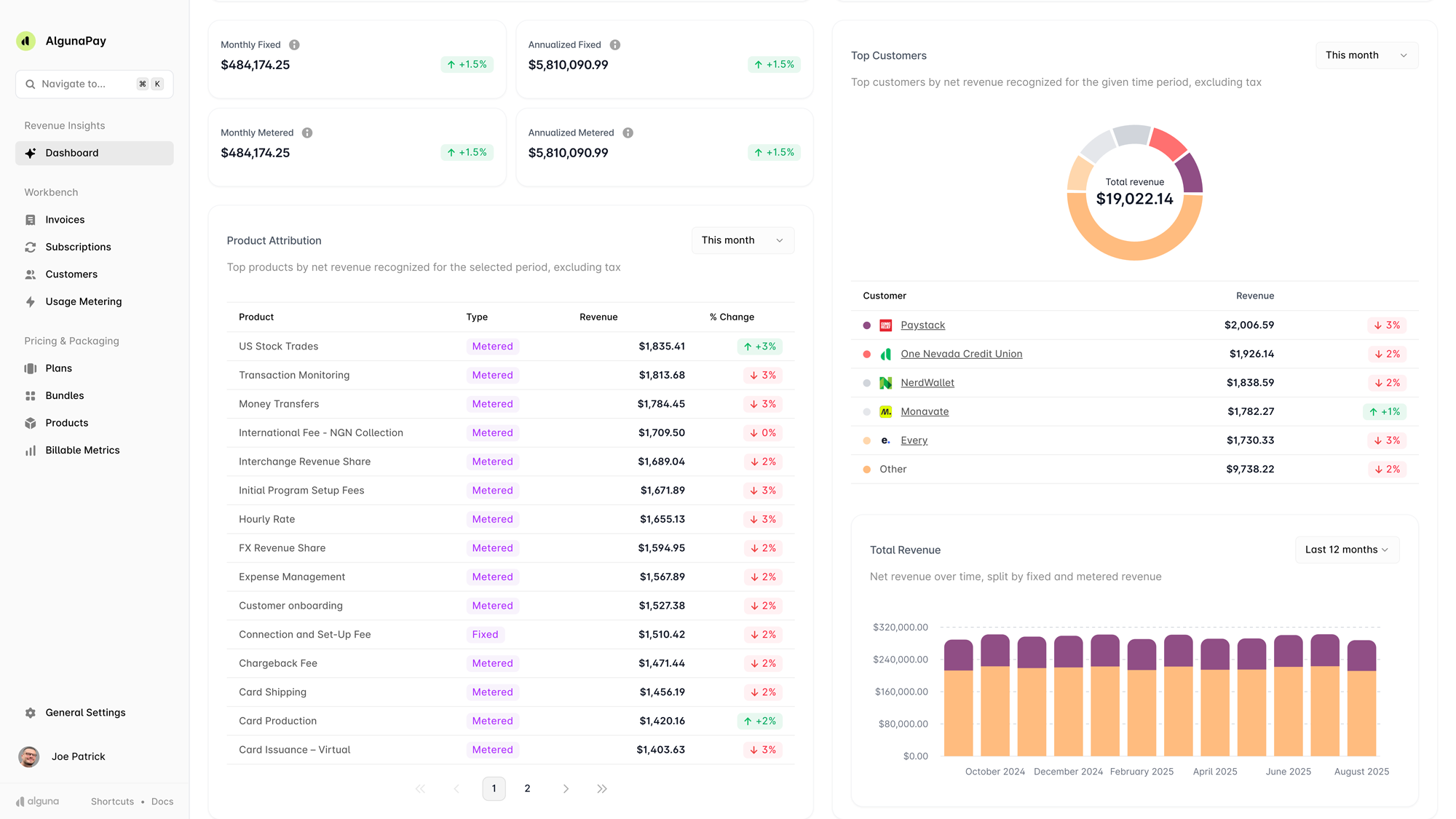

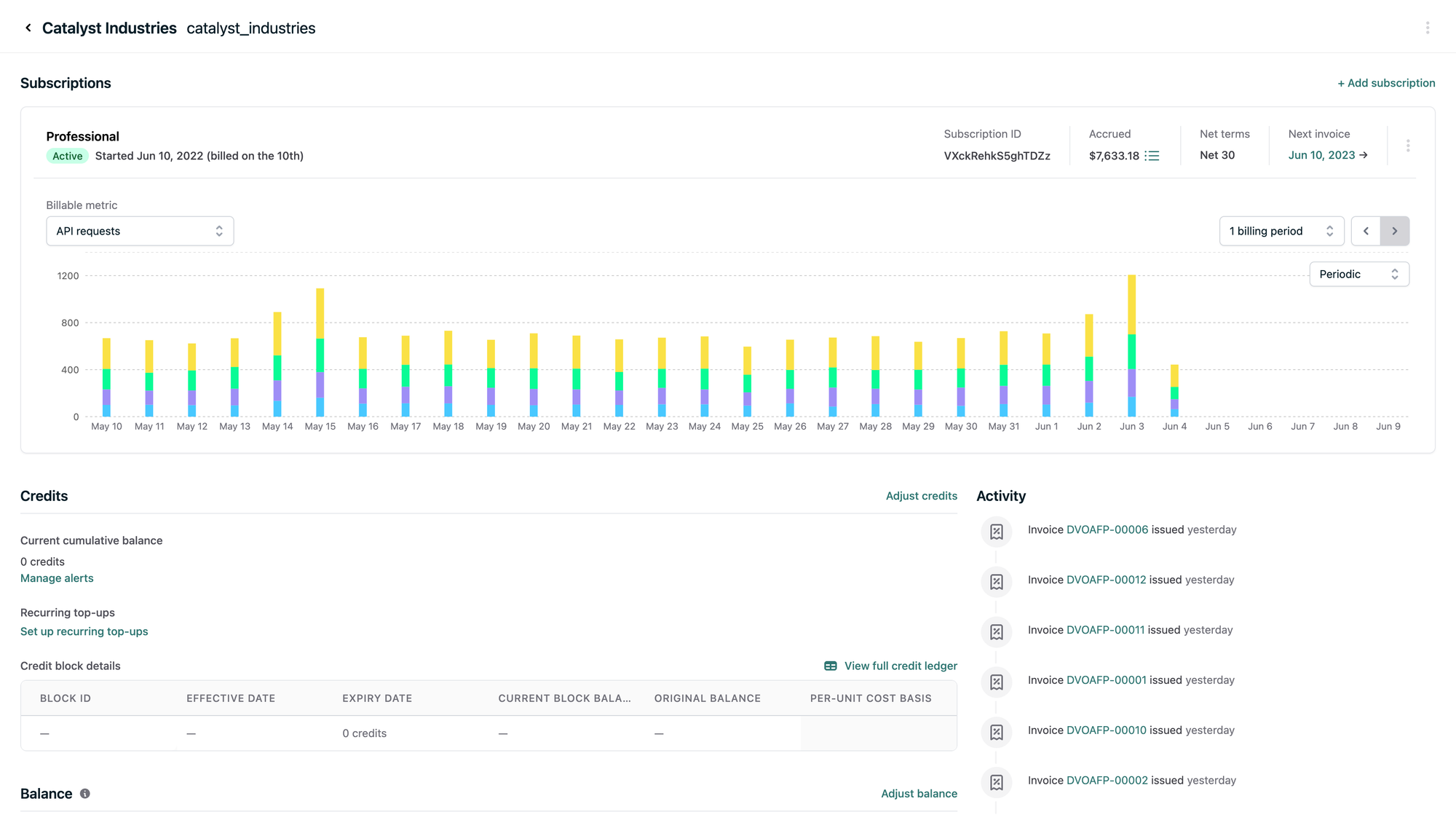

1. Alguna: Best overall Chargebee alternative

Part of Y Combinator’s Summer 2023 batch, Alguna entered the market with big ambitions.

The goal? To unify the entire customer revenue lifecycle in an end-to-end platform. From self-serve signups to custom contracts, from payment collection to revenue recognition, Alguna allows companies to have a single source of truth for all aspects of SaaS revenue management.

Designed for modern SaaS, fintech, and AI companies, the platform eliminates manual workflows and scales with hybrid growth models. Alguna enables fast-moving companies to run no-code experiments with pricing changes, billing for subscriptions and complex contracts, streamline invoicing with integrated payments, and deep financial reporting support.

Overview

⭐️ Founded: 2023

📍 HQ: San Francisco, CA and London, UK

📆 Feature release cadence: Features shipped weekly

👍 Pros:

- No-code automation: No technical expertise required. Automate repetitive billing, usage metering, and revenue processes quickly and easily.

- Unified pricing, quoting, billing: Consolidate all your pricing, quoting, and billing into a single platform. Simplify complex billing scenarios and deliver consistent and accurate invoices.

- Real-time analytics: Make informed decisions on the fly with real-time revenue and billing analytics. Track usage and payments without having to wait for reports.

- Modern UX: Enjoy a sleek, intuitive interface designed for speed and efficiency. Reduce training time and increase adoption with a modern, user-friendly experience.

- Replaces multiple tools: Reduce tech stack bloat by consolidating pricing, quoting, billing in one platform, saving time and reducing complexity.

- Dedicated customer support: Get personalized and proactive support from a knowledgeable support team dedicated to your success.

👎 Cons:

- Newer platform

- B2B focus

💰 Pricing: Starts at $699 per month. White glove migration and onboarding included. Free tier available for smaller teams.

Feature highlights:

- Unified revenue operations: Manage pricing, contracts, invoicing, and billing in a single platform.

- API first business and additional integrations: Sync with CRMs (Salesforce, Hubspot, Zoho), and accounting tools (QuickBooks, Xero, Netsuite).

- Flexible pricing engine: Ability to have flexible modern SaaS and AI pricing models baked into the platform.

- Powerful metrics: Enables businesses to define any metric relevant to their billing using an extensible query engine, providing immense flexibility.

- Billing management: Manage recurring setups and collect payments directly in the platform.

- Unified payment collection: Collect payments via chosen payment processor or Alguna BankPay directly in the platform.

- Multi-entity support: Ability to orchestrate invoices and billing based on different legal entities your company is set up with.

- No-code automation: Configure complex pricing without engineering resources.

- Customer portal: Provides a hosted, brandable portal for customers to easily manage their subscriptions and payment details, view and pay invoices and change their legal details.

Why choose Alguna?

Ideal for B2B SaaS, fintech, and AI companies that need end-to-end quote to revenue automation and flexibility beyond Chargebee’s capabilities.

- Adam Liska, CEO and Co-founder at Glyphic AI

Read case study

2. Orb: Best for usage-based billing

Founded in 2021, Orb has quickly established itself as the go-to solution for usage-based billing predominately for API companies.

With a fully extensible billing engine and a commitment to weekly product updates, Orb has been gaining traction among businesses that require a simple billing solution.

Overview

⭐️ Founded: 2021

📍 HQ: San Francisco, CA

📆 Feature releases: Weekly minor updates + feature releases every 2-4 weeks

👍 Pros: Valued for its flexibility, allowing teams to launch and iterate on new pricing models as fast as they ship product features

👎 Cons: Requires technical resources for advanced use cases

💰 Pricing: Starts at $749-$3490 per month + additional usage and integrations

Feature highlights:

- Flexible usage-based billing: Specializes in processing raw usage events and defining custom billable metrics, supporting complex pricing structures like volume tiers, prepaid credits, and minimum commitments.

- Real-time metering and invoicing: Ingests usage data in real-time, allowing for instant calculation of invoices and providing up-to-date views of customer spending.

- Powerful metric engine: Enables businesses to define any metric relevant to their billing using an extensible query engine, providing immense flexibility.

- Automated price changes and renewals: Automates updates to monetization, allowing for scheduling future price changes for customer cohorts.

- Pricing experimentation: Offers tools to experiment with new pricing models and back-test scenarios against historical usage data

Why choose Orb as your Chargebee alternative?

Orb is purpose-built for SaaS and AI companies needing flexible, usage-driven billing and the freedom to experiment with pricing without engineering bottlenecks.

- Sam S., CEO, small business

Read the full review on G2

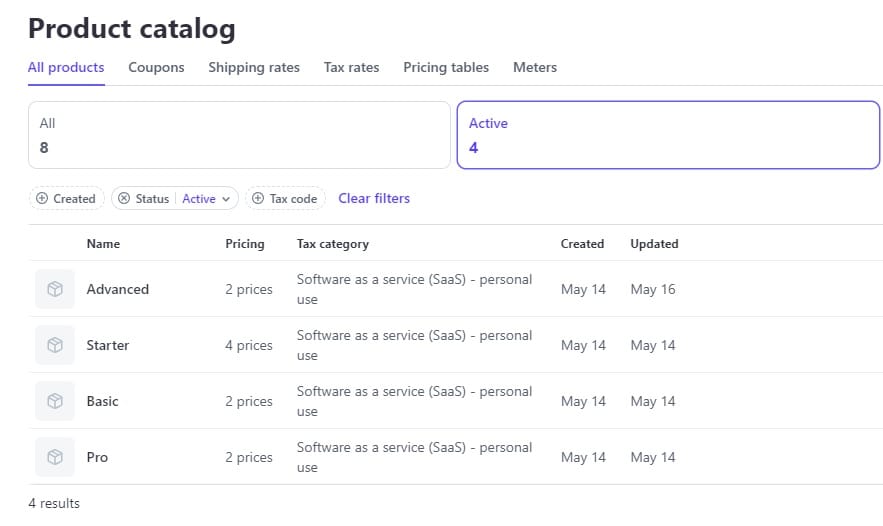

3. Stripe Billing: Best chargebee alternative for developer-first teams

Launched in 2011 and based in San Francisco, Stripe Billing is a household name to most people in tech.

A great Chargebee alternative, Stripe’s platform is renowned for its developer-first approach, offering powerful APIs and composable workflows that support everything from simple subscriptions to complex usage-based billing.

Overview

⭐️ Founded: 2011

📍 HQ: San Francisco, CA

📆 Feature release cadence: Quarterly major updates

👍 Pros: Offers scalability, global reach, and ease of use, making it a versatile option for various business sizes and models.

👎 Cons: The developer-first approach can be a downside for teams without technical resources. Another major downside is the cost. Stripe’s pricing model is based on a percentage taken on each transaction, which is the main source of customer complaints.

💰 Pricing: Starts at 0.8% of revenue (without payment processing)

Feature highlights:

- Integrated payment processing: Leverages Stripe's global payment infrastructure, supporting numerous payment methods and currencies, simplifying international sales.

- Flexible billing models: Supports standard recurring subscriptions, tiered pricing, and sophisticated usage-based billing through its Meters API for custom consumption tracking.

- Developer-first approach: Highly customizable via extensive and well-documented APIs, allowing businesses to build tailored billing workflows and integrate deeply with their applications.

- Automated invoicing and dunning: Handles automatic invoice generation, intelligent payment retries, and dunning management to maximize revenue recovery.

- Customer portal: Provides a hosted, brandable portal for customers to easily manage their subscriptions and payment details, enhancing transparency.

Why choose Stripe Billing as your Chargebee alternative?

Stripe is the global leader for payment processing, supporting 135+ currencies and offering industry-best APIs for custom billing workflows and integrations. It’s ideal for businesses with international customers and technical resources.

- Eric G. Director, small business

Read the full review on G2

4. Recurly: Best for churn reduction and subscription analytics

Founded in San Francisco in 2009, Recurly has become a trusted name for brands looking to launch, scale, and optimize subscription experiences.

Recurly’s mission is to help subscription businesses grow smarter and faster, making it a top choice for those prioritizing retention and analytics.

Overview

⭐️ Founded: 2009

📍 HQ: San Francisco, CA

📆 Feature release cadence:

👍 Pros: Multi-currency support, robust analytics, wide gateway compatibility

👎 Cons: Analytics could be deeper, interface can be complex for new users

💰 Pricing: Custom

Feature highlights:

- Churn management and revenue recovery: Utilizes machine learning for intelligent payment retries, customizable dunning campaigns, and proactive credit card updating to significantly minimize involuntary churn.

- Comprehensive subscription lifecycle management: Offers powerful tools for managing every aspect of the subscription journey, including trials, upgrades, downgrades, renewals, and cancellations.

- Advanced analytics and reporting: Provides deep, actionable insights into subscriber behavior, financial performance, and key SaaS metrics, helping businesses make data-driven decisions.

- Global payment optimization: Supports numerous payment gateways and multiple currencies, with smart routing to optimize payment success rates globally.

- Revenue recognition: Helps automate compliance with revenue recognition standards like ASC 606.

Why Recurly?

Recurly is ideal for businesses focused on maximizing retention and leveraging data-driven insights to grow recurring revenue.

- Divyanshu P., Associate, Marketing Automation

Read the full review on G2

5. Subscript: An analytics-forward alternative to Chargebee

Subscript is a Chargebee alternative that started out as an analytics tool, but has since changed direction with the goal of simplifying recurring billing for businesses.

While not as widely reviewed as some others, its focus on clear insights and efficient billing automation makes it a noteworthy contender for companies looking to gain better control over their subscription metrics.

Overview

⭐️ Founded: 2011

📍 HQ: San Francisco, CA

📆 Feature release cadence:

👍 Pros: Robust SaaS metrics, intuitive dashboards, actionable insights, easy integration with billing tools

👎 Cons: Not a complete billing platform, requires integration with billing systems

💰 Pricing: Starts at $8k to $100k per year with average cost of $24k with extra $3k for integration for smaller deals or 30% of annual fee.

Feature highlights:

- Subscription intelligence: Designed to help businesses dive deep into their subscription metrics, offering valuable insights into customer behavior and trends.

- Automated billing and payments: Automates billing cycles with precision, reducing manual errors and ensuring timely payment processing, supporting various payment gateways.

- Subscription lifecycle management: Excels in managing the full subscription lifecycle, including plan modifications, pauses, and cancellations.

- Customizable workflows: Supports custom workflows that trigger actions like renewal reminders and dunning processes to boost customer engagement and minimize churn.

- Integration capabilities: Offers APIs and pre-built connectors for smooth data exchange with CRM, ERP, and accounting systems.

Why choose Subscript?

Choose Subscript if you’re looking for a platform that gives you access to real-time, actionable analytics that provide instant visibility into your subscription metrics, usage, and revenue performance.

- Jodi F., CFO

Read the full review on G2

6. Maxio: Best Chargebee alternative for revenue recognition

Formed from the merger of SaaSOptics and Chargify in 2022 and headquartered in Atlanta, Maxio delivers robust financial operations for complex SaaS businesses.

Maxio focuses on streamlining revenue recognition, automating invoicing, and ensuring compliance with accounting standards.

Its deep integrations with Salesforce and QuickBooks make it the platform of choice for finance teams seeking accuracy and efficiency in subscription management.

Overview

⭐️ Founded: 2012

📍 HQ: Atlanta, GA

📆 Feature release cadence: Bi-annual major updates

👍 Pros: Deep revenue recognition, Salesforce/QuickBooks integrations, SaaS metrics reporting

👎 Cons: Can be complex to implement, support can be slow

💰 Pricing: Starts at $1k for platform plus add-ons for each integration and implementation as well as customer support.

Feature highlights:

- Unified financial operations: Beyond automated billing, Maxio provides strong capabilities for revenue recognition (essential for ASC 606/IFRS 15 compliance), expense management, and detailed SaaS metrics and analytics (MRR, ARR, churn).

- Complex contract and pricing support: Ideal for B2B environments with multi-year contracts, custom terms, and various pricing models including usage-based and hybrid approaches common in enterprise deals.

- Automated collections and dunning: Helps recover failed payments and reduce involuntary churn with sophisticated, automated dunning campaigns.

- Robust reporting: Delivers powerful financial reports and dashboards, offering deep insights for investors and internal stakeholders.

Why choose Maxio as your Chargebee alternative?

Maxio is trusted by B2B SaaS teams for streamlining invoicing, automating revenue recognition, and ensuring GAAP compliance.

- Andrea E., Controller

Read the full review on G2

7. Sage Intacct: Best for integrated accounting

Since its founding in 1999 in San Jose, CA, Sage Intacct has been the trusted backbone for finance teams seeking integrated accounting and subscription management.

With biannual updates, Sage Intacct ensures compliance, audit readiness, and seamless billing cycles—making it a favorite for organizations where finance and subscription operations must work hand-in-hand.

Overview

⭐️ Founded: 1999

📍 HQ: San Jose, CA

📆 Feature release cadence: Biannual

👍 Pros: GAAP-compliant billing, audit-ready reporting, accounting integration

👎 Cons: Reporting customization can be limited, learning curve for non-finance users

💰 Pricing: Custom

Feature highlights:

- Core financial management: Provides comprehensive accounting features including general ledger, accounts payable, accounts receivable, cash management, and reporting.

- Automated revenue recognition: Strong capabilities for automating complex revenue recognition rules (ASC 606/IFRS 15), crucial for compliance.

- Subscription billing and invoicing: Manages recurring billing schedules, automates invoicing, and handles complex pricing rules for subscriptions.

- Multi-dimensional reporting: Offers highly customizable dashboards and reports with multi-dimensional analysis, providing deep insights into financial performance across various business segments.

- Multi-entity and multi-currency: Excellent for businesses with multiple legal entities or international operations, simplifying consolidations.

Why is Sage Intacct a good alternative to Chargebee?

Sage Intacct’s strength is combining robust accounting with subscription billing, making it a favorite for finance teams needing audit-ready reporting and GAAP compliance.

- Mercedes L., Project Manager

Read the full review on G2

8. Subskribe: Best for complex contracts

Founded in 2021 in the San Francisco Bay Area, Subskribe is engineered for seamless, end-to-end quote-to-revenue workflows. Just like Alguna, the platform combines CPQ (Configure, Price, Quote), billing, and revenue recognition for SaaS companies.

Overview

⭐️ Founded: 2021

📍 HQ: Bay Area, CA

📆 Feature release cadence: Monthly

👍 Pros: Unified CPQ, billing, and revenue recognition, intuitive interface

👎 Cons: Newer platform, limited third-party integrations

💰 Pricing: Custom pricing based on seats and revenue. Estimate $20k per year.

Feature highlights:

- Powerful CPQ with approval workflows

- Automated invoicing

- Real-time analytics and reporting

Why choose Subskribe?

Subskribe is perfect for SaaS companies with fast-moving sales cycles and complex deal structures who want to automate the entire revenue process.

- Clayton B. Launch Program Lead

Read the full review on G2

9. Zuora: Best for enterprise-grade compliance

Zuora is the enterprise standard for subscription billing and revenue automation. It excels at supporting global operations, complex pricing, and deep integration with CRM and ERP systems.

Overview

⭐️ Founded: 2007

📍 HQ: Redwood City, CA

📆 Feature release cadence: Annual enterprise updates, continuous security/performance improvements

👍 Pros: Enterprise compliance, flexible pricing/packaging, global tax management, deep integrations

👎 Cons: Clunky UI, complex implementation, can be expensive

💰 Pricing: Starts at $50k + implementation and integration fees

Feature highlights:

- Flexible pricing and packaging

- Automated billing and revenue recognition

- Subscription metrics and analytics

- Regulatory compliance and security

Why choose Zuora as an alternative to Chargebee?

Zuora is best for large enterprises with multinational operations and rigorous compliance needs

- Betty G., Accounting Specialist

Read the full review on G2

Decision guide: How to evaluate Chargebee alternatives

There are plenty of things to think about when it comes to moving platforms. In this case, we've put together a list of things to take into consideration when evaluating alternatives to Chargebee.

- Business fit: Does the platform specialize in your specific business model? Does it support SaaS, fintech, AI, or enterprise? A purpose-built tool that'll scale with your business should be at the top of your list.

- Feature velocity: How often does the team ship new features and respond to feedback? Look for a company with a team that not only responds to customer feedback, but ships at a frequency that's needed for the AI economy. Check change logs and product updates to make sure they're moving with momentum.

- Billing model flexibility: Can the platform support diverse pricing strategies? This includes simple subscriptions, granular usage-based billing (e.g., per API call, compute time, data volume), tiered pricing, one-time fees, and complex hybrid models. This is crucial for businesses with dynamic service offerings, especially in AI and SaaS.

- Scalability and performance: Can the platform reliably handle increasing transaction volumes and a rapidly expanding customer base without compromising accuracy or speed? Will it grow with your business and handle increasing complexity?

- Integrations: Does it seamlessly connect with your existing tech stack, including CRM, ERP, accounting software, and payment gateways? Robust API documentation is often a good indicator.

- Pricing: Understand the pricing structure – is it transparent, custom, or transactional? Does it offer good value for the features you need, and are there any hidden fees?

- Customer experience: Can the platform support customer self-service portals for managing subscriptions, viewing usage, and accessing invoices? This enhances transparency and reduces support burden.

Frequently asked questions about Chargebee alternatives

How does Maxio vs Chargebee compare when it comes to integration options with popular CRMs and ERPs?

Both integrate with Salesforce, HubSpot, NetSuite, and QuickBooks. Chargebee alternatives like Alguna also work seamlessly with the aforementioned CRMs or ERP systems.

What should I look for when comparing the user interface of Chargebee vs competitors?

Look for a modern, sleek UI that minimizes friction, provides clarity, and is centered around automation. Alguna offers a no-code UI, making it accessible for non-technical users.

For companies with multi-entity structures, how do Maxio vs Chargebee stack up in terms of consolidated financial reporting

Chargebee and Maxio handle compliance but need customization for consolidation. Alguna provides real-time multi-entity reporting out-of-the-box.

For enterprise needs, which platform is better: Chargebee or competitors?

Chargebee serves mid-market, while Zuora typically dominates the enterprise segment. Alguna delivers enterprise-grade features without the heavy cost and lock-in, serving seed stage to enterprise.

What are the strengths and weaknesses of Maxio vs Chargebee for scaling financial operations in rapidly growing SaaS companies?Maxio is strong in GAAP reporting, Chargebee in subscriptions, but both have limits in flexibility. Alguna combines both with faster scaling and automation.

Which subscription platforms are commonly used by e-commerce companies besides Chargebee?

Popular alternatives include Recurly, Stripe Billing, Zoho Subscriptions, Paddle, and Zuora.

Which platform, Maxio vs Chargebee, is better suited for B2B SaaS businesses looking for advanced revenue recognition capabilities?

Both offer compliance modules, but Maxio is best-in-class when it comes to revenue recognition.

How does Chargebee’s API flexibility compare to other billing systems?Chargebee’s API is solid but less customizable than open alternatives. Alguna combines a robust API with a no-code interface for full flexibility.

Which Chargebee alternative is the best option for usage-based billing?Chargebee supports metered billing but is limited. Alguna is built for usage-based and hybrid pricing, offering flexible, scalable billing models.

Build (and bill) for scale

While Chargebee remains a strong player, its lack of flexibility has become more and more apparent in recent years as new platforms have entered the market.

Subscription and billing management platforms have matured, offering a diverse range of Chargebee alternatives tailored to highly specific business needs.

Start by evaluating the (true) needs of your business against the strengths of the platforms discussed. Ultimately, you need to select a platform that will not only manage your bottom line—but also enable business growth.

Ready to find the ideal Chargebee alternative for your business?

Take a closer look at Alguna's advanced capabilities and discover the billing engine that reduces your back-office overhead.