SaaS, AI, and fintech companies are scaling faster than legacy billing tools can handle. With subscriptions, usage-based pricing, hybrid models, and multi-currency operations, spreadsheets and outdated systems quickly turn into a revenue bottleneck that's causing errors, delays, and millions lost to leakage.

Modern teams are upgrading to flexible billing and revenue management software to streamline the entire quote-to-revenue cycle.

Below, we break down what billing and revenue management really is, why it matters, and how the top platforms stack up.

What is billing and revenue management?

Billing and revenue management is the overall discipline of how a company charges customers and accounts for revenue. It defines what you bill, how you bill it, and how revenue is recognized.

This includes pricing models, billing, usage metering, invoices, payments, revenue recognition, and reporting. Think of it as the strategic framework for your entire revenue operation.

In SaaS, this often takes the form of subscription billing and revenue management systems that unify pricing, invoicing, usage, payments, and revenue recognition (rev-rec).

How does this compare to billing and revenue cycle management?

Billing and revenue cycle management, however, is the operational process that moves money from contract to cash.

It focuses on how the work gets executed: generating charges, sending invoices, collecting payments, reconciling transactions, and posting revenue. It’s the step-by-step workflow that keeps billing accurate, timely, and compliant, reducing errors and preventing revenue leakage.

Why companies need modern billing and revenue management software

Modern SaaS, AI, and fintech companies are upgrading to modern billing and revenue management software for a few key reasons:

- Preventing revenue leakage: Older tools often miss usage overages, prorations, or extra seats. Modern platforms close these gaps by automating every billable event and update.

- Scaling without breaking: Growth brings complexity: more products, custom enterprise deals, and international expansion. Homegrown systems can’t keep up with this.

Haven learned this quickly. Once they had multiple products and ~20 customers, the founder spent Fridays reconciling across multiple tools and spreadsheets. After upgrading, Haven cut time spent on billing by 80% and gained real-time visibility into receivables. - Supporting hybrid pricing models: Today’s monetization mix includes subscriptions, usage, add-ons, prepaid credits, and one-off fees. These hybrid models aren’t something traditional subscription tools were built for.

Evervault moved off Stripe Billing because it couldn’t handle their encryption API’s usage-based pricing model. Modern platforms support hybrid pricing natively, which is crucial for AI companies whose revenue is driven by consumption. - Adapting pricing quickly: Pricing in AI changes fast. As Aleks Đekić, CEO of Alguna, puts it, “Pricing for AI is getting rewritten every 90 days. Legacy stacks can’t adapt.”

Modern platforms let teams launch new plans, tiers, or credit models in minutes with no engineering required. Changes are reflected automatically across quotes, invoices, and revenue schedules. - Handling global and compliance requirements: Multi-currency billing, localized tax/VAT, and ASC 606/IFRS 15 revenue recognition become essential as companies expand.

Modern billing platforms include this out of the box. Platforms like Alguna, for example, ship with multi-entity support and ready-to-use revenue recognition schedules so finance teams stay audit-ready.

Traditional systems vs. modern billing platforms

Traditional billing systems are typically stitched together from multiple tools: a subscription app here, an invoicing tool there, spreadsheets for revenue schedules, and often a homegrown usage tracker. This fragmentation leads to manual reconciliation, inconsistent data, and frequent billing mistakes.

Modern billing and revenue management platforms take the opposite approach: they automate the entire quote-to-cash flow, reduce manual admin, and scale with your pricing model.

Instead of having finance teams manually interpret contracts, generate invoices, and chase unpaid invoices, modern systems use automation and AI to handle these tasks. They’re also far more flexible and built to handle hybrid and usage-based pricing, while legacy or in-house systems typically require engineering work for even minor updates.

Top billing and revenue management software: Comparison overview

Below, we compare leading revenue management and billing solutions. The table highlights what each platform is best for, its key pros and cons, and pricing at a glance.

| Platform | Best for | Pros | Cons | Pricing |

|---|---|---|---|---|

| Alguna | AI- and usage-driven SaaS, B2B SaaS with hybrid/complex pricing, mid-market replacing fragmented stacks | Built for complex SaaS/AI billing, end-to-end revenue management, fast pricing iteration, unified workflows, no-code, quick implementation | Newer entrant, not ideal for very early-stage startups | Free tier. Paid plans from $699/month. Flat pricing, no revenue cut. |

| Stripe Billing | Early-stage SaaS using Stripe, developer-led teams, simple subscription businesses | Developer-friendly, unified payments + billing, low upfront cost | Expensive at scale (0.7% fee), limited complex billing, add-ons required for advanced features | 0.7% recurring revenue fee + Stripe processing fees |

| Chargebee | Mid-market SaaS scaling beyond basics, global or compliance-focused teams | Comprehensive subscription features, business-friendly UI, Strong integrations | Expensive at scale, key features locked behind Enterprise, Setup requires planning | From $599/month + 0.75% overages, add-ons cost extra |

| Maxio | SaaS $5M–$100M ARR, finance-driven, audit-ready teams | Unified billing + rev rec + analytics, deep SaaS metrics, strong Salesforce alignment | Steep learning curve, higher cost for small teams, legacy-feel UI | From $599/month, higher tiers scale with volume |

| Tabs | Enterprises with complex, multi-product pricing, teams needing strict governance and audit-ready financial workflows | Automates AR workload, fewer billing errors, AI-native contract ingestion | Narrow scope vs full billing, newer entrant, setup required for ingestion | $1,500/month, higher tiers custom |

| Zuora | Large/enterprise SaaS with complex pricing; Companies requiring strict governance | Enterprise-grade controls, huge ecosystem, strong sales–finance alignment | High total cost, long implementations, requires dedicated admin | Typically ~$50k/year+, six figures with add-ons |

| Sage Intacct | Mid-market SaaS using Intacct ERP, finance-led orgs needing compliance | Unified billing + GL, native ASC 606, mid-market friendly | Less flexible billing, finance-centric UI, higher implementation cost | Custom pricing; Many mid-market setups ~$20k–$60k+/year |

| Salesforce Revenue Cloud | SaaS heavily using Salesforce, sales-led teams with complex quoting | Native Salesforce integrations, strong B2B quoting workflows, usage + subscription support | Clunky UI, heavy implementation, add-ons often required, | $150–$200/user/month + paid add-ons |

8 top billing and revenue management solutions: Deep dive

Next, let’s take a closer look at each platform in the table, starting with Alguna and then moving on to other billing and revenue management solutions.

Alguna: The AI-native billing and revenue management platform built for modern SaaS

Alguna is a modern, AI-native billing and revenue management platform built for B2B SaaS, AI, and fintech companies. It replaces the fragmented billing stacks that cause revenue leakage by unifying pricing, quoting, billing, payments, and revenue recognition in a single system, without custom engineering.

Alguna stands out in usage-based and hybrid billing, supporting metering for API calls, AI token consumption, and other granular usage alongside traditional subscriptions.

With integrated CPQ, real-time usage tracking, automated invoicing, and ASC 606-ready revenue recognition, Alguna makes it easy to roll out new pricing and ensures what’s quoted, billed, and recognized is always in sync.

Key features:

- Flexible pricing and packaging: Supports subscriptions, usage-based billing, one-off fees, prepaid credits, and hybrid models. Revenue teams can launch or tweak pricing plans quickly without engineering.

- Real-time usage metering: APIs capture usage events as they happen and feed them directly into billing. Finance teams can monitor accrued usage before invoices are issued.

- Integrated CPQ and quoting: Sales can configure deals, generate quotes, and manage contract signatures directly in Alguna. Because CPQ ties into billing, what sales sells is exactly what finance bills.

- Automated invoicing and payments: Invoices send automatically, with support for cards, ACH, and bank transfers. Alguna handles proration, consolidated invoices, payment retries, and dunning out of the box.

- Revenue recognition and compliance: ASC 606/IFRS 15–aligned revenue schedules are generated automatically, including support for multi-element arrangements and multi-currency.

- No-code automation and integrations: Includes a no-code workflow engine and integrates with Salesforce, NetSuite, and other systems via API.

Pros:

- Built for complex SaaS and AI billing: Alguna excels at advanced pricing models (usage-based, hybrid, credit-based) that many legacy systems can’t support.

- End-to-end automation: Replaces multiple tools by unifying CPQ, billing, payments, and revenue recognition to reduce billing time.

- Fast adaptation and AI-era focus: Built for rapid pricing iteration, enabling teams to launch or change monetization models in minutes. Its AI-native design positions it for future AI-driven features and automation.

- White-glove implementation: Alguna offers guided migration and onboarding to help teams transition from legacy systems quickly. For instance, Glyphic was fully running in about three weeks.

- Unified data = fewer errors: With quoting, billing, usage, payments, and revenue in one system, RevOps and finance teams get a single source of truth. This reduces discrepancies, helps with audits, and ensures contract changes always flow through to invoices and revenue schedules.

- Adam Liska, Co-founder and CEO at Glyphic

Read the case study

Cons:

- Newer entrant: As a 2023 YC-backed platform, Alguna is still early in its market maturity.

- More than early-stage startups need: Alguna is built for scaling SaaS and AI companies with evolving pricing and revenue management needs. Very early-stage teams with simple billing may not yet require its full CPQ, usage billing, or rev-rec capabilities.

Best for:

- AI and usage-driven SaaS companies that need to bill for variable consumption, token usage, or fast-changing AI pricing models.

- B2B SaaS teams with hybrid or complex pricing structures that have outgrown Stripe, Chargebee, or spreadsheet-based billing.

- Mid-market companies replacing fragmented quote-to-cash tools with a unified, automation-first revenue platform.

Pricing: Alguna offers a free Starter tier for small teams, with paid plans starting at $699/month for the full quote-to-revenue solution.

Pricing is flat, so companies avoid the percentage-based fees common in other platforms. Higher tiers add capacity and advanced features, but none introduce per-transaction or revenue-share charges.

Book a customized demo with our founders.

Stripe Billing: The developer-first subscription billing and revenue management platform for early-stage SaaS

Stripe Billing is Stripe’s subscription and invoicing module, popular with developer-led startups because it extends Stripe’s API and dashboard to support recurring charges, simple subscriptions, and basic usage billing. It’s easy to set up: teams can launch billing in a few API calls or directly through the dashboard.

However, Stripe Billing is intentionally lightweight. It works well for straightforward pricing models, but as companies add multiple products, hybrid pricing, complex discounts, or custom contracts, it often requires significant custom logic or third-party tools. Many growing SaaS companies eventually outgrow Stripe Billing once their monetization and operations become more complex.

Key features:

- Recurring subscription management: Create products and plans, automate recurring charges across multiple intervals, and support trials, initial fees, and basic proration.

- Usage-based billing: Report usage each billing period and let Stripe apply charges automatically.

- Invoices and quotes: Generate PDF invoices and convert accepted quotes into active subscriptions, offering lightweight CPQ functionality.

- Payments and smart retries: Built on Stripe Payments with global payment methods and machine–learning–based Smart Retries to recover failed payments.

- Customer self-service portal: Hosted portal for customers to manage payment info, view invoices, and handle subscription changes without custom development.

Pros:

- Developer-friendly and fast to launch: Stripe’s API and documentation make it easy to add subscriptions or simple usage billing in days, especially for teams already using Stripe Payments.

- Unified payments and billing: Billing sits directly on top of Stripe’s global payment infrastructure, simplifying reconciliation and supporting a wide range of payment methods without extra integrations.

- Low upfront cost for early-stage teams: With no required monthly fee and percentage-based pricing (0.7%), Stripe Billing is inexpensive at low volume and scales with revenue, making it attractive for startups.

Cons:

- Percentage-based pricing gets expensive at scale: Stripe Billing’s 0.7% fee on recurring revenue (plus Stripe’s payment processing fees) grows quickly as ARR increases, making it costly for mid-market or high-volume SaaS companies.

- Limited support for complex billing models: Stripe handles simple subscriptions well but struggles with advanced scenarios such as multi-product contracts, parent–child accounts, usage rollovers, and intricate revenue recognition, often requiring custom code or external tools.

- More advanced features require add-ons or engineering: Capabilities like Stripe Tax, advanced invoicing, or revenue recognition add extra cost, and many pricing or catalog changes require developer involvement rather than no-code configuration.

Best for:

- Early-stage SaaS companies already using Stripe Payments and needing a fast, simple way to launch subscriptions or basic usage billing.

- Developer-led teams that prefer an API-first billing workflow and are comfortable building custom logic as needed.

- Simple subscription businesses with straightforward monthly or annual plans that don’t require advanced pricing or complex revenue operations.

Pricing: Stripe Billing applies a 0.7% fee on all recurring revenue, in addition to Stripe’s normal payment processing rates (e.g., 2.9% + 30¢ for cards). Because pricing is entirely percentage-based, costs rise as your ARR increases, which can become expensive for growing SaaS companies or multi-entity teams operating across several Stripe accounts.

Chargebee: The flexible subscription billing platform for scaling SaaS revenue teams

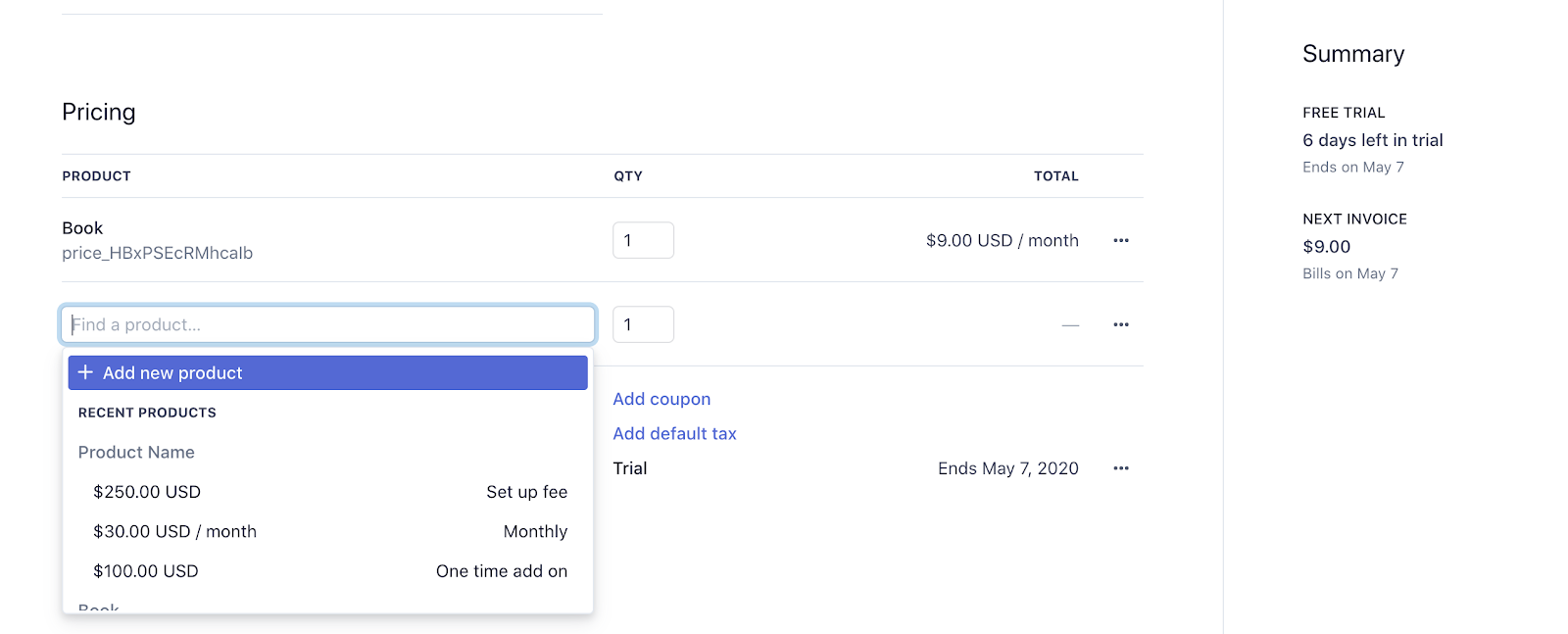

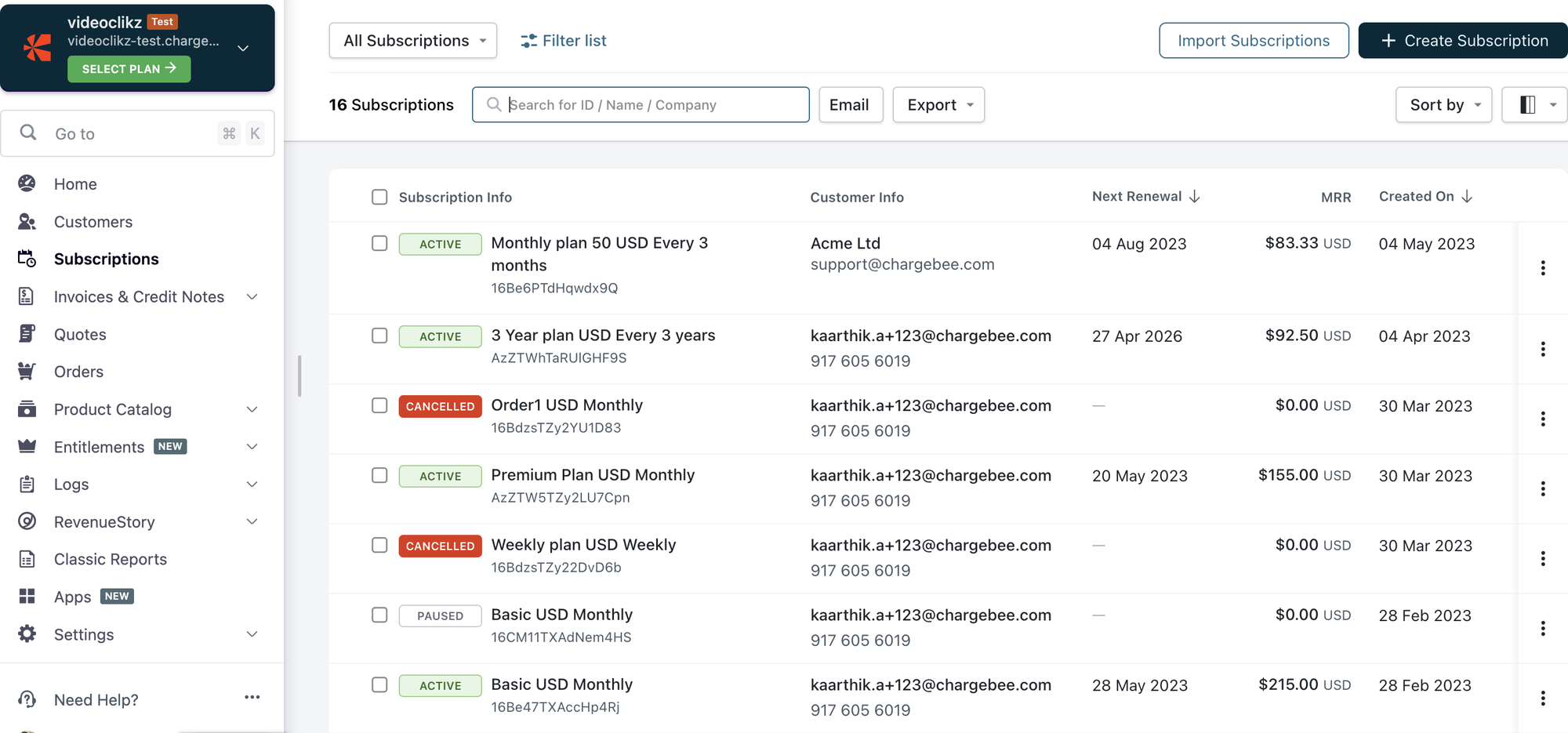

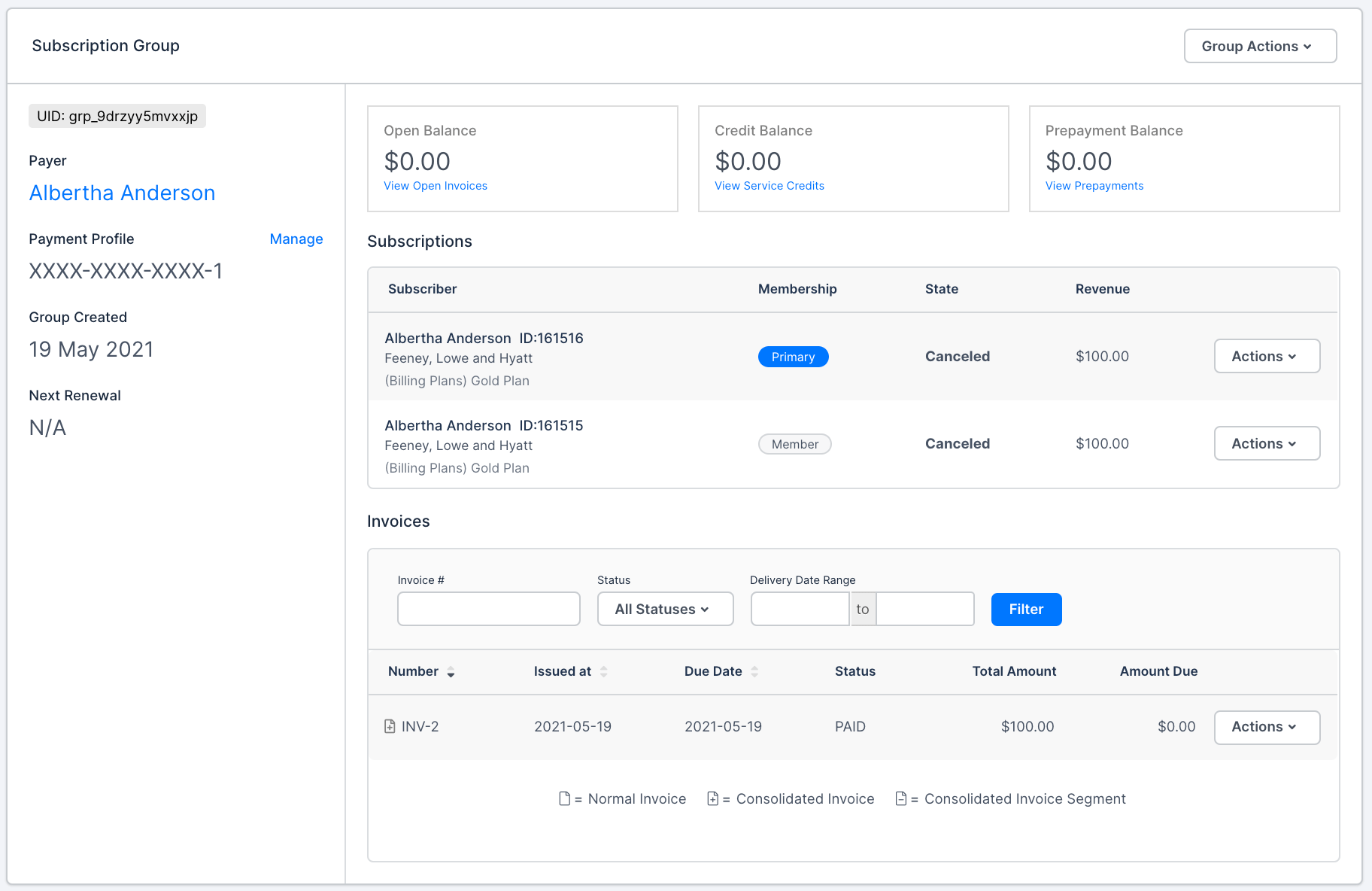

Chargebee is a widely used subscription billing and revenue management platform that offers greater flexibility than basic tools like Stripe Billing, without the complexity of enterprise systems. It gives scaling SaaS companies a business-friendly UI to manage subscriptions, invoicing, discounts, and payment workflows with minimal engineering involvement.

Its integrations with tools like QuickBooks, Xero, and Salesforce make it easy for finance and RevOps teams to sync billing with downstream systems.

With built-in dunning, multi-gateway support, and optional modules for revenue recognition (RevRec) and churn reduction (Chargebee Retention), it’s a strong fit for subscription-heavy SaaS companies that want solid automation and control without jumping to a heavyweight platform like Zuora.

Key features:

- Advanced subscription and pricing management: Configure complex plans with tiered, volume, or usage-inclusive pricing, plus trials, addons, and multiple active subscriptions per customer.

- Automated invoicing and payments: Generate invoices automatically, charge stored payment methods, and connect to a wide range of gateways.

- Proration, mid-cycle changes, and dunning: Automatically prorate upgrades/downgrades, schedule plan changes, and run configurable dunning workflows to recover failed payments.

- Revenue recognition and compliance (RevRec): Optional GAAP/IFRS-compliant revenue recognition module that automates deferred revenue schedules and reporting

Pros:

- Comprehensive subscription feature set: Chargebee covers most SaaS billing needs out of the box, reducing the need for custom development and making it easy for teams to manage trials, coupons, proration rules, and complex pricing through configuration rather than code.

- Business-friendly UI for operations: Finance, support, and RevOps teams can manage subscriptions, credits, invoices, and customer changes directly in Chargebee’s interface, minimizing reliance on engineering.

- Strong ecosystem and integrations: With mature connectors for accounting, CRM, and tax systems, and a well-documented API, Chargebee slots easily into existing SaaS stacks and supports extensive extensibility.

Cons:

- Pricing becomes expensive at scale: After outgrowing the free tier, paid plans start high and include a 0.75% revenue overage fee, which can make Chargebee costly for fast-growing SaaS companies.

- Key features locked behind Enterprise: Advanced capabilities such as multi-entity management and account hierarchies are only available on the Enterprise plan, forcing mid-market teams to upgrade for a single needed feature.

- Learning curve and setup effort: While more approachable than enterprise tools, configuring Chargebee to match your pricing and migrating existing subscriptions can require time, planning, and careful onboarding.

Best for:

- Mid-market SaaS companies scaling past basic billing tools and needing a reliable, UI-driven platform to automate subscriptions and invoicing.

- Global or compliance-focused SaaS businesses that need multi-currency billing, tax handling, and optional ASC 606–ready revenue recognition without adopting a heavy enterprise system.

Pricing: Chargebee’s Performance plan starts at $599/month for up to $100,000 in monthly billings, with a 0.75% overage fee applied beyond that. Advanced capabilities and add-ons, such as revenue recognition, are available on higher-tier plans and may increase total costs.

Maxio: The subscription management and revenue operations suite for finance-led teams

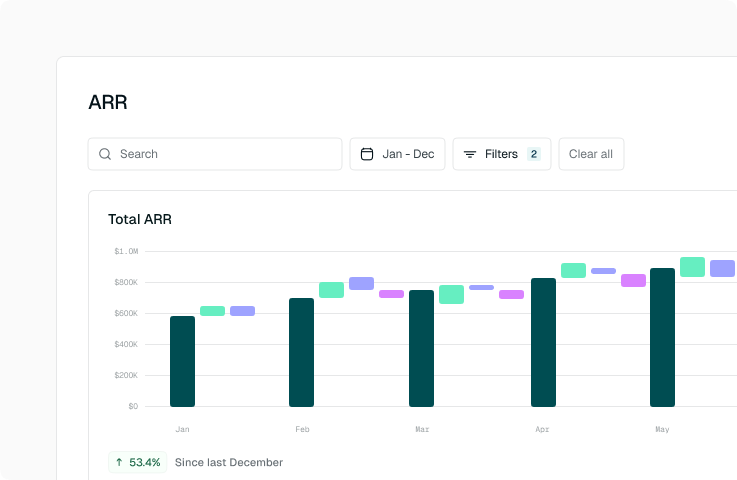

Maxio is a unified billing and financial operations platform created from the merger of Chargify, SaaSOptics, and more recently RevOps.io. By combining subscription management, invoicing, GAAP-compliant revenue recognition, and SaaS analytics into a single system, it provides growing B2B SaaS companies with a single source of truth for billing and financial reporting.

Finance teams gain built-in visibility into metrics like MRR, churn, deferred revenue, and cash flow, without relying on spreadsheets or multiple disconnected tools.

Maxio is best suited for SaaS companies that need more structure and compliance than basic billing tools can offer, but don’t want the overhead of a full ERP. Its strength lies in tying billing directly to financial reporting and forecasts. The tradeoff is that the platform is broad and can take time to configure and fully adopt, making it feel closer to an ERP-lite than a lightweight billing system.

Key features:

- Flexible subscription and billing management: Supports multiple pricing models, proration, addons, coupons, and multiple subscription schedules per customer.

- Automated invoicing for B2B workflows: Generates invoices automatically, supports net payment terms, and works with major payment gateways like Stripe and Authorize.net.

- Built-in revenue recognition: Automates ASC 606/IFRS-compliant revenue schedules, including partial-period recognition and multi-element arrangements, helping finance teams close the books faster and stay audit-ready.

- CRM and accounting integrations: Syncs with Salesforce, QuickBooks, Xero, and Intacct to connect sales, billing, and finance workflows, plus offers APIs for additional integrations and customer portal access.

Pros:

- Comprehensive financial operations: Maxio unifies billing with GAAP-compliant revenue recognition and SaaS financial reporting, enabling finance teams to analyze MRR, churn, and deferred revenue in a single system.

- Deep SaaS analytics: Its dashboards and forecasting tools deliver investor-ready metrics such as ARR movements, cohort analyses, and revenue waterfalls, building on the strong analytics foundation from SaaSOptics.

- Strong alignment between sales and finance: Integrations with Salesforce and CPQ workflows ensure deal terms flow directly into billing and invoicing, reducing manual re-entry and accelerating cash collection.

Cons:

- Steep learning curve and heavier setup: Maxio’s breadth of features can feel overwhelming, and fully configuring billing, revenue recognition, and reporting often requires significant onboarding.

- Higher cost for smaller teams: Pricing starts at $599/month for lower tiers and increases with scale, making Maxio expensive for early-stage or cost-sensitive companies, especially when onboarding for more complex implementations is factored in.

- More complex and less modern interface: While functional, the UI carries legacy from its pre-merger products and can feel slower or more cumbersome than newer billing tools, making some workflows more click-heavy or less intuitive.

Best for:

- SaaS companies between roughly $5M and $100M ARR that need structured billing, GAAP-compliant revenue recognition, and deeper financial reporting than basic tools can provide.

- Finance-driven organizations or audit-ready teams that want billing, revenue schedules, and SaaS metrics unified in one platform.

Pricing: Maxio’s pricing typically starts around $599/month for the Grow plan (covering up to $100,000 in monthly billings), with higher tiers required for greater volume and more advanced capabilities.

Tabs: AR and billing automation platform for contract-based businesses

Tabs is a contract-to-cash platform that automates invoicing and accounts receivables. Instead of relying on manual data entry, Tabs uses large language models to read signed contracts, extract billing terms, and create accurate invoice schedules automatically.

It’s designed for B2B companies with custom agreements where every deal looks slightly different and billing errors or missed invoices are common.

By automating invoicing, reminders, and collections, Tabs eliminates much of the manual work finance teams handle after a deal closes. It ensures customers are billed exactly as contracted and payments are followed up consistently, making it a strong fit for companies with high contract volume or complex AR workflows.

Key features:

- AI-powered contract ingestion: Tabs reads signed contracts using large language models to extract billing terms, eliminating the manual data entry typically handled by AR analysts.

- Automated billing schedules: Once contract terms are parsed, Tabs automatically generates accurate invoice schedules and keeps them in sync with each contract’s duration and payment structure.

- Invoice generation and delivery: Tabs produces invoices on schedule and sends them directly to customers or their AP portals, helping teams avoid missed or late invoices.

- Payments and reconciliation: The platform accepts ACH, credit card, and bank payments, then automatically matches incoming payments to the correct invoices to keep AR clean and up to date.

- Dunning and collections automation: Tabs manages follow-ups for overdue invoices, sends reminders, escalates when needed, and provides AR dashboards so teams can track what’s owed and what’s at risk.

Pros:

- Major reduction in AR workload: Tabs automates contract ingestion, invoice creation, and collections, eliminating the manual data entry and follow-up work that typically consumes entire AR teams.

- Fewer billing errors and less revenue leakage: By extracting billing terms directly from contracts, Tabs ensures every obligation is invoiced accurately and on time, reducing the risk of missed renewals, incorrect charges, or unbilled revenue.

- AI-native approach to unstructured contracts: Tabs excels in environments where each deal is unique, using LLMs to interpret complex contract language that traditional billing tools require humans to configure manually.

Cons:

- Narrower focus than full billing platforms: Tabs excels at contract-to-cash automation but does not replace a full subscription management system, making it less suitable for high-volume, self-serve SaaS that relies on instant signups and credit card billing.

- New entrant with limited track record: As a young AI-first platform, the platform may require additional validation steps or human review to ensure contract parsing is accurate, which can make larger or risk-averse organizations cautious.

- Implementation still requires setup: Teams must connect contract storage systems and feed documents into Tabs, and initial tuning may be needed for bespoke contract templates or messy data, which can increase early onboarding effort.

Best for:

- Large or fast-scaling enterprises with complex pricing models and multi-product subscription operations.

- Companies that need strict governance and audit-ready financial workflows tightly integrated with Salesforce and ERP systems.

Pricing: Tabs offers a published Launch plan at $1,500/month, with Growth, Scale, and Enterprise tiers priced via custom quotes. Higher tiers unlock more advanced AR automation, support for usage, and workflow configuration.

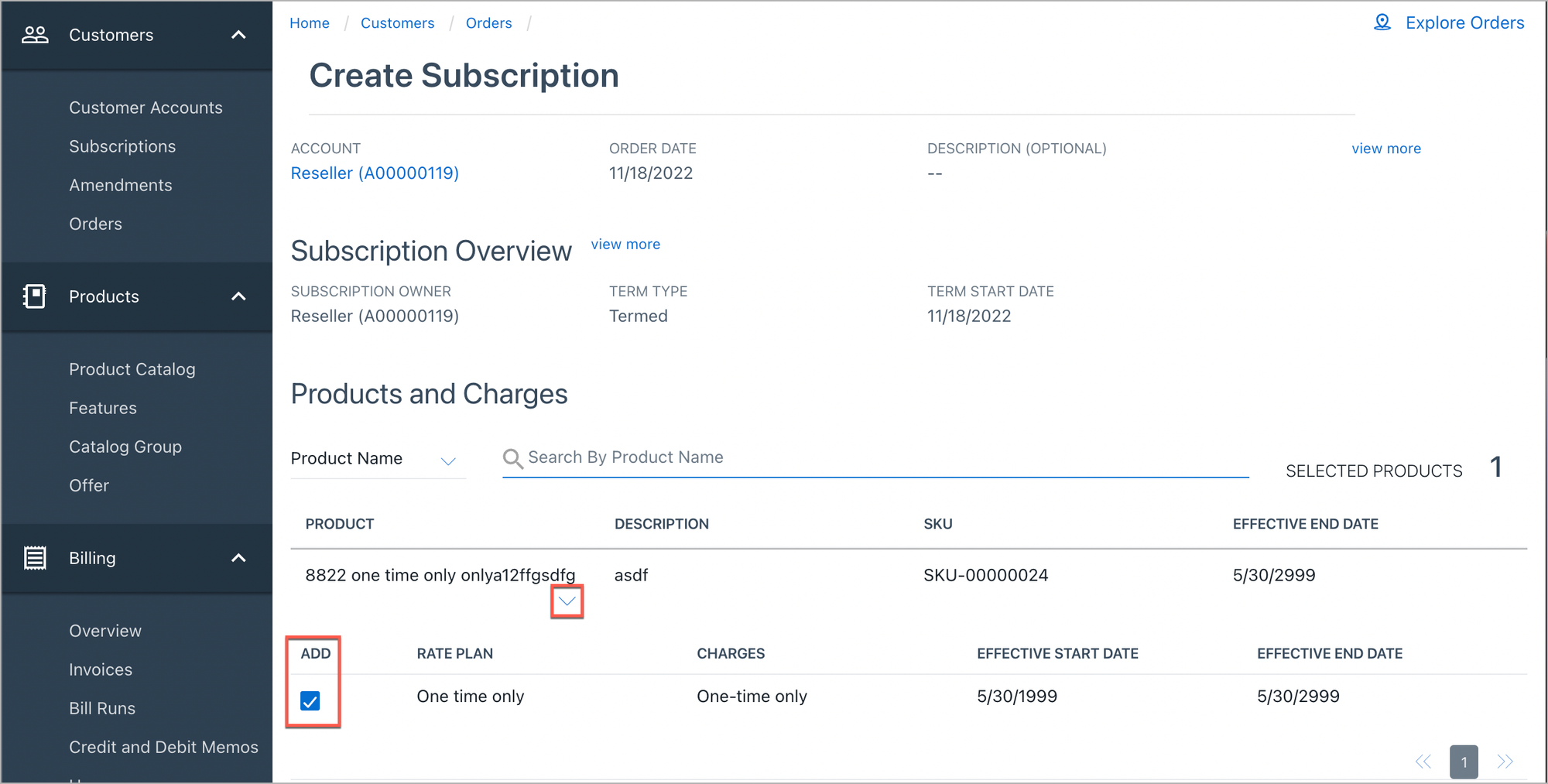

Zuora: The enterprise-grade monetization platform for complex global subscription businesses

Zuora is one of the most established enterprise billing and revenue management platforms, built to handle large-scale, highly complex subscription and monetization models. It supports global billing rules, multi-product catalogs, hybrid pricing, and deep ERP integrations, making it a common choice for enterprises across industries such as media, telecom, and high tech.

Designed for companies that need maximum flexibility and audit-grade financial accuracy, Zuora excels at powering complex quote-to-cash workflows and end-to-end revenue recognition. However, it is known for its complexity, long implementation cycles, and high cost, which makes it best suited for large organizations with dedicated finance and RevOps teams rather than lean or fast-moving startups.

Key features:

- Configurable pricing engine: Supports almost any pricing structure, including advanced usage models, tiered or volume-based rates, bundled offerings, and hybrid plans, through a flexible product catalog that adapts to complex monetization needs.

- Lifecycle-based subscription management: Treats every subscription event (upgrades, downgrades, renewals, cancellations) as a structured, time-stamped order.

- Scalable billing: Produces detailed, accurate invoices at high volume with automated proration, customizable billing cycles, and support for multiple charge schedules across large customer bases.

- Integrated revenue automation: Zuora Revenue handles ASC 606/IFRS 15 requirements end-to-end, including allocation across performance obligations, deferred revenue tracking, and automated revenue release schedules.

Pros:

- Enterprise-grade reliability and governance: Zuora is built for mission-critical billing at scale, with strict audit trails, robust permissions, and compliance workflows trusted by public companies and global finance teams.

- Rich implementation ecosystem: With thousands of certified admins, consultants, and integration partners, companies benefit from deep expertise and support during migrations, customizations, and long-term operations.

- Strong alignment between sales and finance: Zuora’s order-based architecture and native Salesforce integrations help eliminate manual re-entry, ensuring contracts flow cleanly into billing and revenue operations with fewer errors.

Cons:

- High total cost of ownership: Zuora is one of the priciest platforms in the category, with implementations often starting around ~$50k/year and rising into six figures once add-ons like Zuora Revenue or CPQ are included.

- Long, resource-heavy implementations: Going live typically takes several months and often requires consultants or professional services, especially when configuring a complex product catalog or integrating with ERPs and Salesforce.

- Requires dedicated expertise to manage: Zuora’s data model and configuration are complex enough that most companies need a trained admin or RevOps specialist. This can slow pricing iteration and makes self-serve changes difficult for non-technical teams.

Best for:

- Large or fast-scaling enterprises with complex pricing, multi-product catalogs, or heavy usage and intricate contract structures.

- Companies that require strict governance, audit-ready financial workflows, and tightly integrated quote-to-cash across Salesforce and their ERP.

Pricing: Zuora typically starts around $50,000 per year, with additional costs for implementation, integrations, and advanced modules. Overall spend increases with volume and feature usage, making it one of the higher-investment options in enterprise billing.

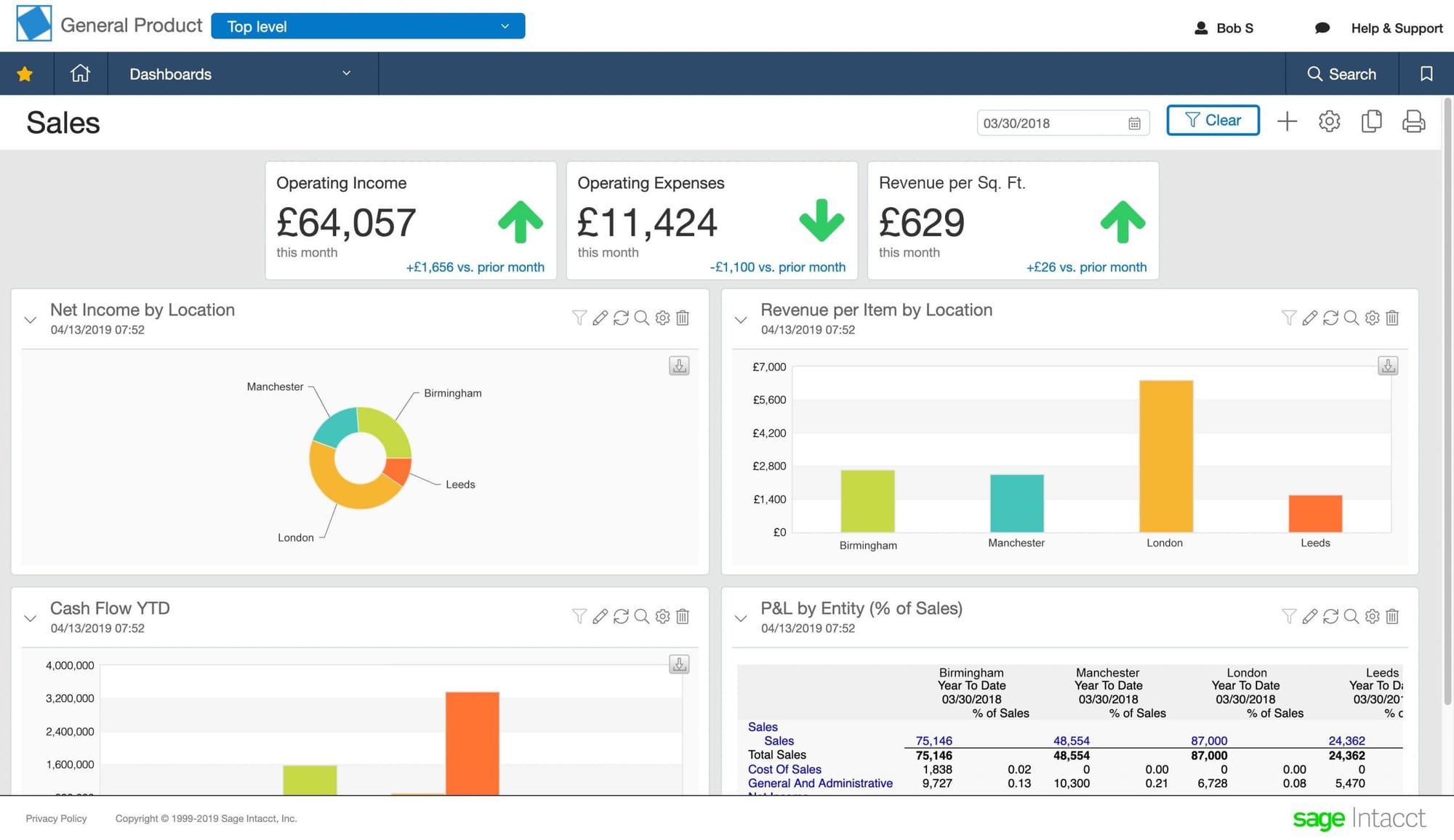

Sage Intacct: The accounting-native subscription and revenue management platform for finance-heavy teams

Sage Intacct is a mid-market cloud ERP with built-in contract and subscription billing, letting companies manage billing and revenue directly inside their accounting system. Because invoices, revenue schedules, and GL entries all live in one place, finance teams get cleaner reconciliation and stronger compliance.

It’s typically chosen by SaaS companies that have outgrown QuickBooks and want billing tightly integrated with their financials rather than a separate billing platform.

For teams prioritizing audit-ready revenue recognition and accurate financial reporting over complex pricing experimentation, Intacct’s unified approach is a strong fit.

Key features:

- Contract and subscription automation: Creates contract records with terms, pricing, renewals, and amendments, then auto-generates billing schedules, including proration, co-terming, and usage-based charges when usage data is provided.

- Recurring billing engine: Produces invoices on the correct cadence (monthly, quarterly, annual) with tiered pricing, scheduled changes, and automated invoice creation built directly into the finance system.

- Native, ASC 606–compliant revenue recognition: Automatically builds deferred revenue schedules, allocates contract value across performance obligations, and posts rev rec entries directly to the GL.

- Salesforce-to-Intacct contract sync: Closed-won deals flow from Salesforce into Intacct as contracts.

- Real-time financial reporting and multi-entity support: Provides dashboards for MRR and deferred revenue, consolidates multi-entity financials, and unifies billing, AR, and cash management inside the same accounting system.

Pros:

- Unified billing and accounting: With contracts, invoicing, revenue recognition, and the general ledger in one system, Intacct eliminates reconciliation work and gives finance a single, reliable source of truth.

- Audit-ready revenue recognition: Its native ASC 606 engine and built-in controls make compliance straightforward, reducing reliance on spreadsheets or external rev rec tools.

- Mid-market friendly: Intacct offers strong multi-entity support, Salesforce integrations, and robust reporting without the cost or complexity of a full enterprise ERP, making it a natural upgrade from QuickBooks.

Cons:

- Limited billing flexibility compared to dedicated platforms: Intacct handles core subscription and usage billing well, but it lacks the advanced pricing models, customer-facing portals, and experimentation tools found in modern billing systems.

- Finance-centric and less intuitive for cross-functional teams: Because Intacct is built as an accounting system, its UI and workflows can feel cumbersome to RevOps, support.

- Higher cost and slower implementation for smaller companies: Intacct requires a paid implementation partner, multi-module licensing, and multi-user fees, which can be expensive unless you’re adopting it as your primary accounting system.

Best for:

- Mid-market SaaS companies using or adopting Sage Intacct as their primary ERP and wanting billing, revenue recognition, and financial reporting in one unified system.

- Finance-led organizations that prioritize audit-ready compliance, multi-entity accounting, and tight control of billing and revenue schedules over rapid pricing experimentation or PLG-style workflows.

Pricing: Sage Intacct uses fully custom, quote-based pricing, but most mid-market deployments fall in a broad range of $9,000–$35,000 per year for core financials, with $20,000–$60,000+ common once you add Contract Billing, Revenue Management, and additional users.

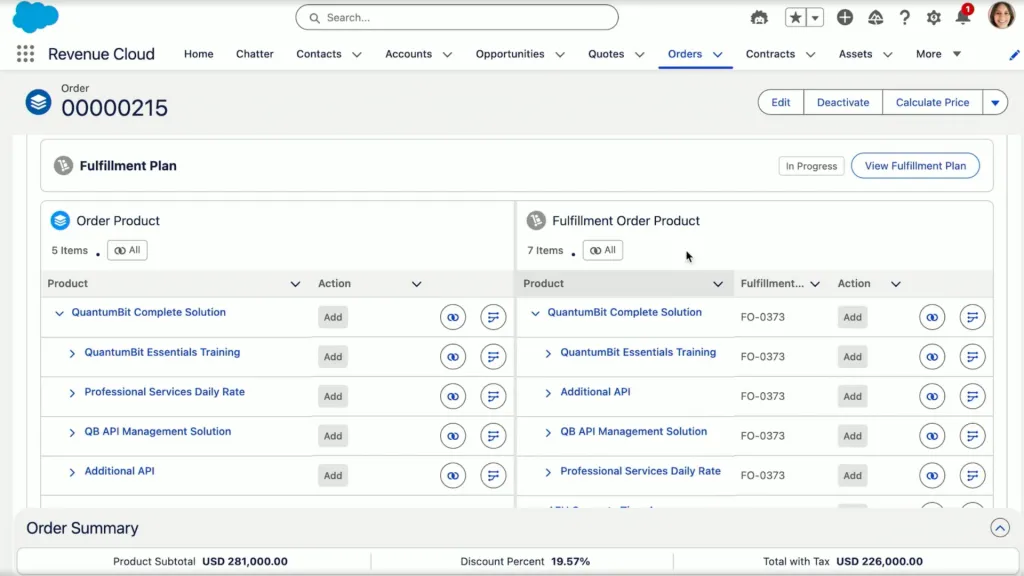

Agentforce Revenue Management: The CRM-integrated CPQ and billing platform for sales-led teams

Agentforce Revenue Management (previously Salesforce Revenue Cloud) is Salesforce’s end-to-end revenue management offering. It combines CPQ, subscription management, billing, and revenue recognition on top of the Salesforce CRM data model, with the goal of unifying quote-to-cash on a single platform.

It’s built for companies that already run heavily on Salesforce and want sales, RevOps, finance, and billing working from the same set of accounts, opportunities, contracts, and orders. In a typical flow, Salesforce CPQ is used to configure products and pricing, while Billing/Revenue Cloud handles invoicing, payments, and rev-rec once the order is created.

Key features:

- End-to-end quote-to-cash on Salesforce: Unifies catalog, CPQ, contracts, orders, assets, billing, and revenue recognition in one platform.

- Subscription and usage support: Handles subscriptions, renewals, and usage-based billing with usage records, summaries, and ratings for consumption models.

- Automated billing and invoicing: Automates recurring, milestone, and hybrid billing, plus tax, invoice generation, and payment collection.

- Revenue recognition: Order-based rev-rec with rules and schedules to align with ASC 606/IFRS 15 and forecast deferred revenue.

Pros:

- Native Salesforce integration: Everything runs on the same CRM data model, which is a big win for sales-led organizations already standardized on Salesforce.

- Strong for complex B2B deals: Good fit for complex quoting, contract amendments, renewals, and multi-step approval workflows.

- Supports recurring and usage models: Built-in support for subscriptions and usage-based pricing (with the right configuration) for recurring or consumption-based businesses.

Cons:

- Implementation and admin-heavy: Often requires specialist partners or a dedicated Salesforce admin; implementations can be long and complex compared with lighter SaaS billing tools.

- Usage and billing complexity may need add-ons: More advanced usage scenarios often rely on additional products or consulting to get it right.

- Overkill for simple SaaS: For straightforward subscription businesses, Revenue Cloud can be more than is needed in terms of cost and complexity versus leaner billing platforms.

Best for:

- B2B companies already heavily invested in Salesforce CRM that want a CRM-native revenue management and billing solution.

- Sales-led organizations with complex quoting, discounting, contract, and renewal workflows.

Pricing: Salesforce Revenue Cloud starts at $150–$200 per user per month (billed annually), with advanced billing and revenue features requiring additional paid add-ons. Exact costs vary by edition and configuration and are usually finalized through a Salesforce sales quote.

Choosing the best billing and revenue management solution

Choosing the best billing and revenue management solution comes down to understanding your pricing model, scale, financial requirements, and internal capabilities. Here’s a practical way to evaluate platforms:

1. Business model and complexity: Simple subscription businesses can often start with tools like Stripe Billing or Recurly. As complexity increases (multiple products, hybrid pricing, enterprise contracts, or global customers), platforms like Alguna, Chargebee, or Maxio become a better fit. If you expect pricing to evolve quickly (common in AI-era SaaS), prioritize systems built for configurability and rapid iteration.

2. Pricing model flexibility: If you run usage-based, tiered, hybrid, or credit-based pricing, choose a solution with strong metering and rating capabilities. Alguna is built for usage-heavy and hybrid models; Chargebee and Maxio handle subscriptions well but may require customization for advanced usage. If your strategy involves frequent pricing experiments, look for no-code pricing updates and API-first extensibility.

3. Revenue recognition and compliance: If you need ASC 606/IFRS 15 compliance, audit-ready reporting, or multi-entity revenue schedules, focus on platforms with native rev-rec (Alguna, Maxio, Chargebee RevRec). Tools like Stripe or Recurly require supplements or manual work. The more regulated or global your business, the more important this becomes.

4. Integrations and ecosystem fit: Your billing platform must sync cleanly with your CRM, product usage data, payment processors, data warehouse, and accounting system. API-first platforms like Alguna or Stripe are strong for engineering teams; UI-driven tools like Chargebee or Maxio work well for finance-led organizations. Ensure the vendor has pre-built connectors for your core stack.

5. Team structure and ownership: If your finance or RevOps team owns billing, choose a platform that offers clear UI controls, no-code configuration, and strong reporting. If developers own the workflow, API-centric tools may work. Enterprise-grade platforms like Zuora or Salesforce Revenue Cloud may require a dedicated admin.

6. Scalability and performance: Ensure the platform can handle your future state, not just today’s billing volume. Look for case studies involving high event throughput (millions of usage events), multi-entity setups, or complex enterprise deployments. A platform that breaks at scale will create operational debt.

7. Budget and ROI: Tools range from percentage-of-revenue pricing (Stripe Billing at 0.7%) to fixed SaaS fees (Chargebee, Maxio) to enterprise contracts (Zuora). Your goal is ROI: reduced manual work, fewer billing errors, automated rev-rec, lower involuntary churn, and faster cash collection. Platforms like Alguna also reduce revenue leakage, especially in usage-heavy AI businesses.

Frequently asked questions about billing and revenue management software

1. How long does it take to implement billing and revenue management software?

Implementation timelines vary widely by platform and complexity. Lightweight tools like Stripe Billing or Chargebee can be set up in days or weeks. Modern platforms like Alguna typically onboard teams in a few weeks thanks to guided migration and a unified data model. More robust enterprise systems, such as Maxio, Zuora, or Salesforce Revenue Cloud can take several weeks to several months due to complex catalog design, integrations, and revenue recognition configuration.

2. What data should be sent from the product to the billing system for usage-based pricing?

Most usage-based models require sending event-level data (e.g., API calls, compute time, tokens, seats, transactions) with timestamps and customer identifiers. Modern platforms handle ingestion via APIs, streaming, or batch uploads and convert these events into billable charges at the end of the cycle.

3. Can billing and revenue management software replace my CPQ or quoting tool?

Many modern platforms include integrated CPQ capabilities (Alguna, Salesforce Revenue Cloud, Maxio) that allow sales teams to configure pricing, generate quotes, and send contracts for signature. For teams using standalone CPQ, billing platforms can sync deal terms to prevent manual re-entry.

4. How does billing software integrate with my CRM, ERP, and data warehouse?

Most platforms offer native connectors for Salesforce, HubSpot, NetSuite, QuickBooks, and Snowflake. Billing events, invoices, payments, and revenue schedules sync automatically, allowing RevOps, finance, and product teams to access unified revenue data without manual exports or reconciliation.

5. What’s the biggest risk when migrating billing and revenue operations to a new platform?

The most common risks are incorrect product catalog mapping, incomplete usage migration, and mismatched historical invoices or contract terms. Successful migrations require:

- A clean product catalog

- Accurate contract records

- Clear revenue schedules

- Properly mapped integrations

- Parallel testing before going live

The future of revenue management and billing is unified, automated, and AI-driven

Pricing is shifting from simple subscriptions to hybrid and usage-based models, global expansion adds currencies and tax rules, and boards expect clean, ASC 606–ready numbers. In that world, the wrong billing and revenue management software doesn’t just slow you down—it quietly leaks revenue, blocks pricing experiments, and turns month-end close into chaos.

The good news is that the new generation of billing and revenue management platforms solve these problems. Instead of stitching together Stripe, CPQ, spreadsheets, and a rev-rec plugin, you get one billing and revenue management solution to run the entire revenue cycle: quoting, usage metering, invoicing, collections, and revenue recognition. That means fewer errors, faster closes, and the freedom to ship new pricing in days, not quarters.

Alguna is built for that reality. It treats revenue management and billing as a unified, AI-era system: one place to define pricing, meter usage, automate invoices and payments, and generate audit-ready revenue schedules, without custom code or volume-based penalties as you grow.

If your team is spending more time wrestling spreadsheets than running go-to-market experiments, it’s probably time to upgrade your revenue management and billing stack.

AI-native billing and revenue management built for modern SaaS

See how Alguna unifies pricing, subscriptions, usage-based billing, payments, and revenue recognition into a single platform—so every dollar you earn is billed, collected, and reported automatically.