Zoho Billing (previously Zoho Subscriptions) is a popular billing tool for SMEs, particularly in the UK. It covers the basics including recurring billing, invoicing, and subscriptions, but many SaaS teams quickly outgrow it.

As pricing becomes usage-based, contracts become more custom, and revenue workflows more automated, finance and RevOps teams often start searching for a Zoho Billing alternative that can scale with them.

This guide compares the best Zoho Billing alternatives for SaaS and AI companies, including Alguna, Chargebee, Stripe Billing, Paddle, Maxio, and Zuora.

We’ll cover why teams move on from Zoho, what to look for in a replacement, and which platform fits which stage of growth.

TL;DR: Which Zoho Billing alternative should you choose?

Choose the right platform based on how you sell, price, and scale.

• Choose Chargebee if you’re mostly subscription-led with light usage and want a proven billing system with many integrations.

• Choose Stripe Billing if you’re early-stage or developer-led and want maximum API control over billing logic.

• Choose Recurly if subscriptions are your core model and churn reduction and retention are top priorities.

• Choose Paddle if you want a merchant-of-record to handle tax and compliance for global sales.

• Choose Maxio if you’re finance-led and need strong SaaS metrics, reporting, and usage billing in one system.

• Choose Zuora if you’re a large enterprise with complex global billing needs and can support heavier implementation.

Zoho Billing overview

Zoho Billing is part of the Zoho Finance suite. It automates invoicing, manages recurring billing and oversees subscription management, helping small and growing businesses simplify billing from invoice creation to payment tracking and reporting.

Key features include:

- Subscription and recurring billing: Handle one‑time invoices or automated recurring billing, including trial management, proration and dunning management.

- Automation and revenue recognition: Automate billing tasks and support revenue recognition compliance.

- Flexibility across industries: Supports SaaS, ecommerce and professional services with customizable workflows.

- Integrations: Connects with other Zoho apps and third‑party payment gateways such as Stripe and PayPal.

Despite its strengths, user feedback suggests limitations, so let's take a look at the (real) reasons teams turn to alternatives.

Why look for Zoho Billing alternatives?

Modern pricing models: Zoho Billing supports basic subscription and usage‑based billing, but advanced monetization (e.g., hybrid plans, complex usage or AI‑driven pricing) may require workarounds.

Enterprises or AI‑driven SaaS platforms increasingly need flexible models that support one‑time, recurring, usage‑based, tiered and hybrid pricing.

Deep integrations: Growing SaaS companies operate a complex stack of CRM, ERP, data warehouse and product‑led growth tools. Best‑in‑class billing platforms offer deep APIs, webhooks and large marketplaces for low‑code or no‑code integrations.

⚠️ Limited integration options can create manual work and data silos.

- Zoho Billing user on G2

Compliance and analytics: Global SaaS firms must manage tax compliance, revenue recognition and accurate financial reporting. Leading platforms embed tax calculation, multi‑jurisdiction support and AI‑driven analytics.

Buyers often look for alternatives that handle these natively.

• "Sometimes a subscription will fail and without constant checking, it would be missed."

• "I wish it would autorequest payment from users. Right now, I manually send emails and follow up emails asking users to click a link to put their credit card info on a third party site."

• Lacking some customization features and metrics don't always seem to update correctly.

Requirements to look for in a Zoho Billing alternative

When evaluating replacements, SaaS finance and RevOps leaders should prioritize the following capabilities.

- Flexible pricing and hybrid billing models: Support one‑time, recurring, usage‑based, tiered, and hybrid plans, with proration and mid‑cycle upgrades/downgrades.

- Automated invoicing and payment processing: Provide scheduled invoicing, multi‑format outputs and integration with major payment gateways. Intelligent dunning (smart retries and personalized outreach) reduces revenue leakage.

- Tax compliance and revenue recognition: Automate sales tax and VAT calculations, support ASC 606/IFRS 15 standards and include audit trails.

- Integrations & API flexibility: Offer deep APIs, web hooks and connectors for CRM, ERP, analytics and product‑led growth tools; enable low‑code integration and custom workflows.

- Customer self‑service: Provide customer portals where subscribers can update payment methods, upgrade/downgrade or cancel.

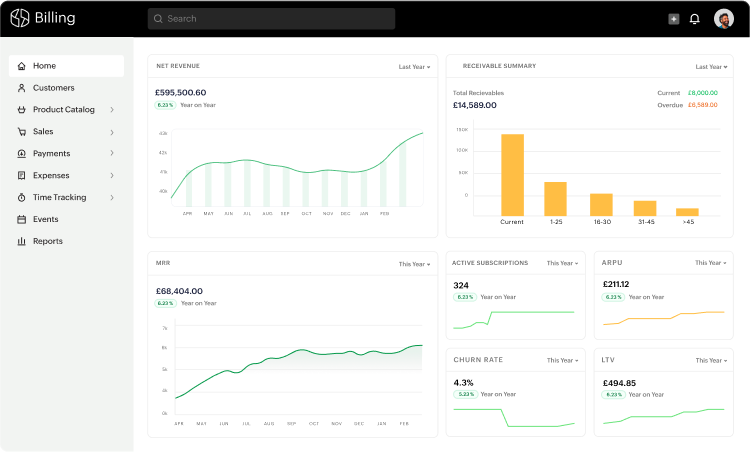

- Analytics and scalability: Deliver real‑time metrics (MRR, churn, LTV) with exportable reports and support multi‑entity or high‑volume operations.

By aligning your Zoho Billing alternatives with these requirements, Finance and RevOps teams can choose a platform that scales with growth and reduces manual work.

Comparison: Leading Zoho Billing software alternatives

| Vendor | Key strengths / notable features (keywords) | Ideal for |

|---|---|---|

| Alguna | Modern CPQ & billing platform; connects quote-to-cash, supports usage-based and custom pricing, automates invoicing and revenue recognition | Growth-stage SaaS looking for a unified quote-to-revenue system |

| Chargebee | Centralizes usage data, automates charge calculations and provides transparent billing breakdowns; modular architecture for hybrid pricing | AI-driven or usage-based SaaS needing flexible billing and strong dunning |

| Stripe Billing | Offers recurring, usage-based and sales-negotiated contracts; flexible pricing models, AI-based Smart Retries to reduce involuntary churn; supports 135+ currencies | Startups or scaleups wanting a developer-friendly, global billing API |

| Recurly | Allows flexible plan configuration and high-converting checkout flows; automates payment retries and churn mitigation; offers self-service portals and AI-powered insights for retention | High-volume subscription businesses needing churn reduction and global scale |

| Paddle | Merchant-of-record model: handles payments, tax & compliance; provides smart payment routing, localized checkouts and subscription management | SaaS & app businesses seeking an all-in-one platform with tax handling |

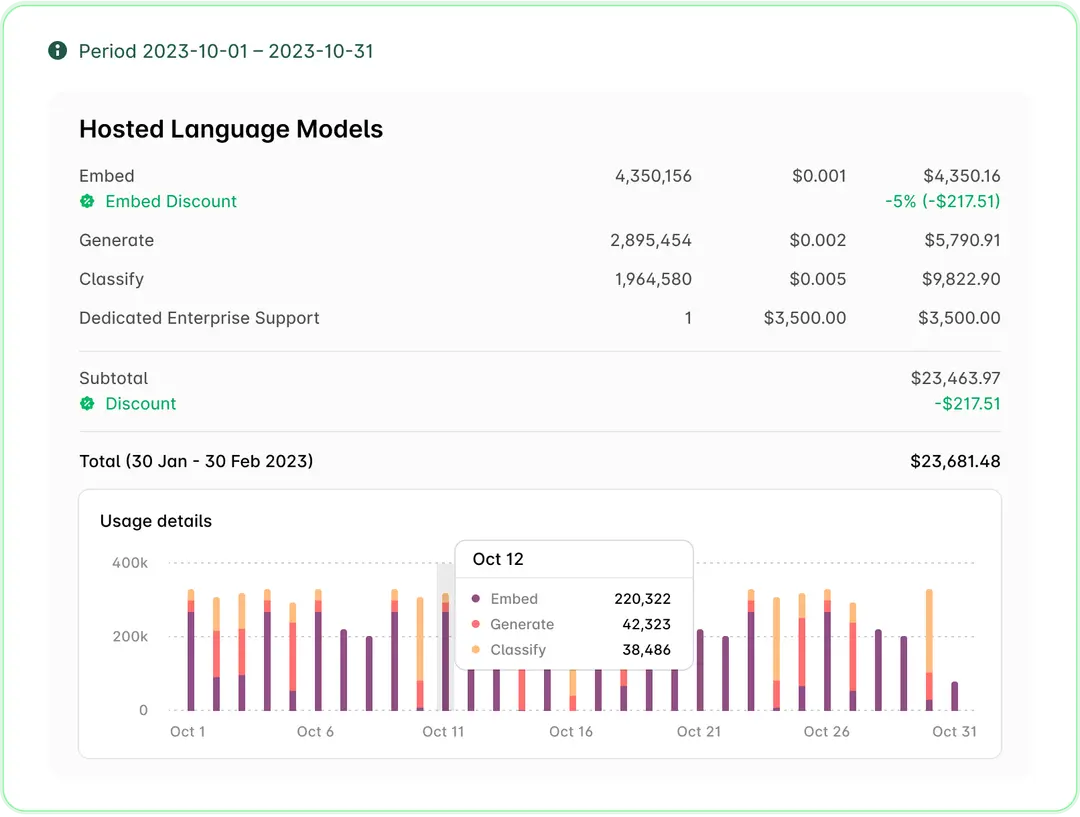

| Maxio | Usage-based billing platform with customizable product catalogs; supports per-unit, tiered, volume, flat and hybrid pricing with thresholds and overages; ingests usage data via API/batch and automatically meters and invoices customers; unifies billing, tax, payments, collections and revenue recognition and offers analytics and backtesting | SaaS & AI companies seeking flexible usage billing, real-time metering and unified revenue operations |

| Zuora | AI-ready monetization catalog enabling dynamic pricing, bundles and feature entitlements; multi-currency support; flexible billing schedules and proration rules | Enterprises needing sophisticated pricing, CPQ integration and global operations |

Alguna: Quote-to-revenue built for modern SaaS and AI companies

Alguna is a modern quote-to-revenue platform designed for SaaS and AI companies with complex, evolving SaaS monetization and AI pricing models.

Unlike traditional billing tools that start in finance, Y Combinator backed Alguna unifies CPQ, billing, usage metering, and revenue workflows in a single system, ensuring what’s sold is exactly what gets billed.

Alguna supports usage-based, subscription, hybrid, prepaid, and custom enterprise pricing, with flexible catalogs that allow finance and RevOps teams to model real-world deal structures without engineering work.

- Marc Koskela at ComplyAdvantage

Read case study

From Alguna CPQ, quotes created by sales flow directly into billing and invoicing, reducing quote-to-invoice drift and manual cleanup.

Where Alguna stands out is flexibility and speed. Pricing changes, new metrics, ramps, credits, and custom terms can be launched quickly, making it well-suited for companies still experimenting with monetization or selling complex enterprise deals.

Alguna is enterprise ready and handles multi-entity billing, tax compliance, and fx rates all under one roof. Out-of-the box integrations are available at no additional cost for both CRMs (e.g. HubSpot, Salesforce) and ERPs (e.g. NetSuite).

Why consider Alguna:

Alguna is a strong Zoho Billing alternative for SaaS and AI companies that need tight alignment between sales, RevOps, and finance, especially when pricing is complex, usage-driven, or still evolving.

👉 Book a demo with Alguna to see how finance and RevOps teams streamline billing, reduce manual work, and gain real-time revenue visibility.

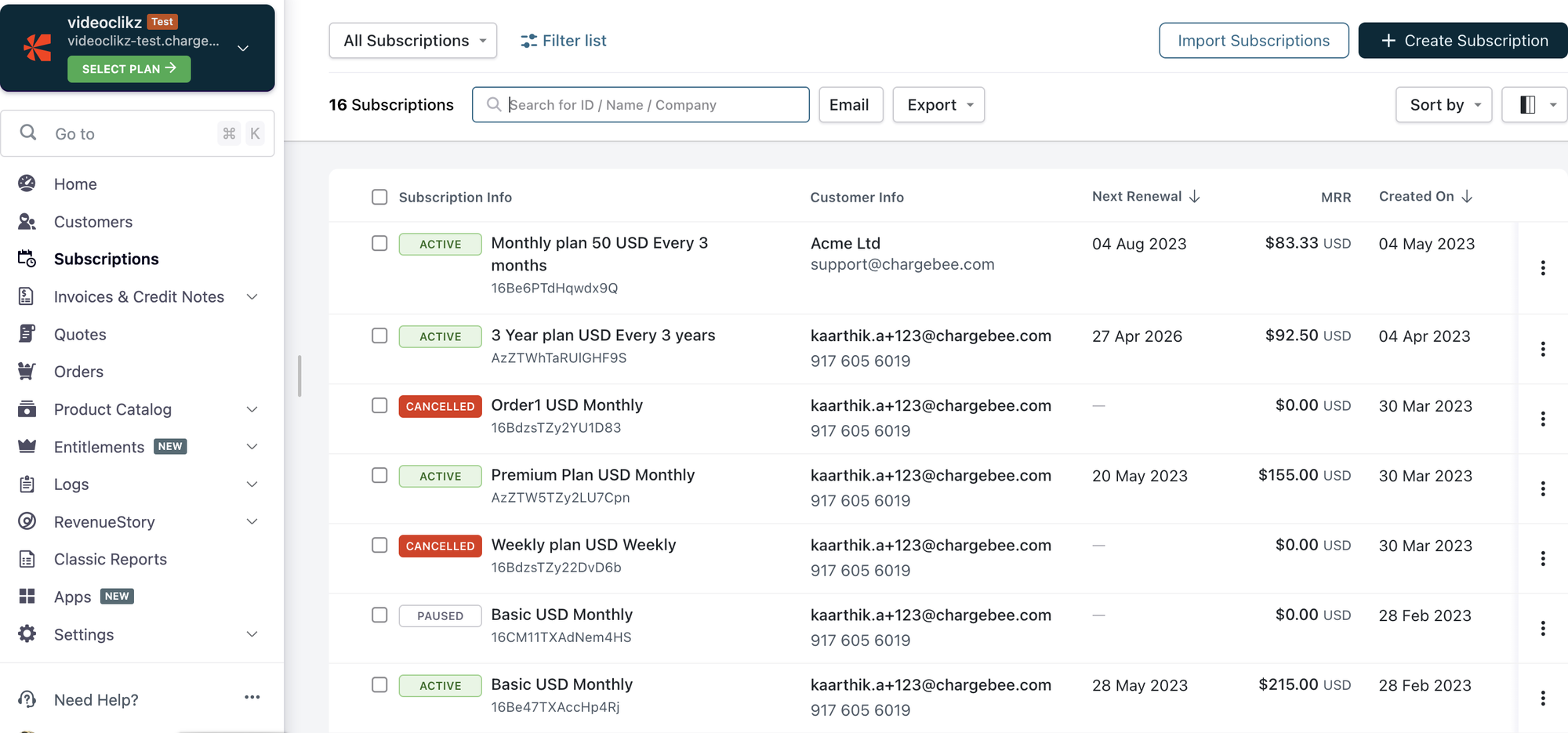

Chargebee: Best for subscription-first SaaS and media companies

Chargebee is a widely adopted subscription billing platform that supports recurring billing, invoicing, and increasingly, usage-based pricing. It’s commonly used by SaaS companies that start with straightforward subscription models and later layer in usage or hybrid pricing.

The platform offers metered billing, tiered pricing, and automation around invoicing, payments, and dunning. Chargebee also integrates with a broad ecosystem of payment providers, tax tools, and accounting systems, making it a familiar choice for teams scaling internationally.

Chargebee tends to work best when pricing structures stay relatively standardized. As pricing logic becomes more bespoke and includes custom metrics, deal-specific terms, or complex enterprise agreements, teams may encounter operational overhead or reliance on engineering to maintain billing accuracy.

Why consider Chargebee:

Chargebee is a solid Zoho Billing alternative for SaaS companies with subscription-first or light usage-based models that want a proven billing system and broad integration ecosystem.

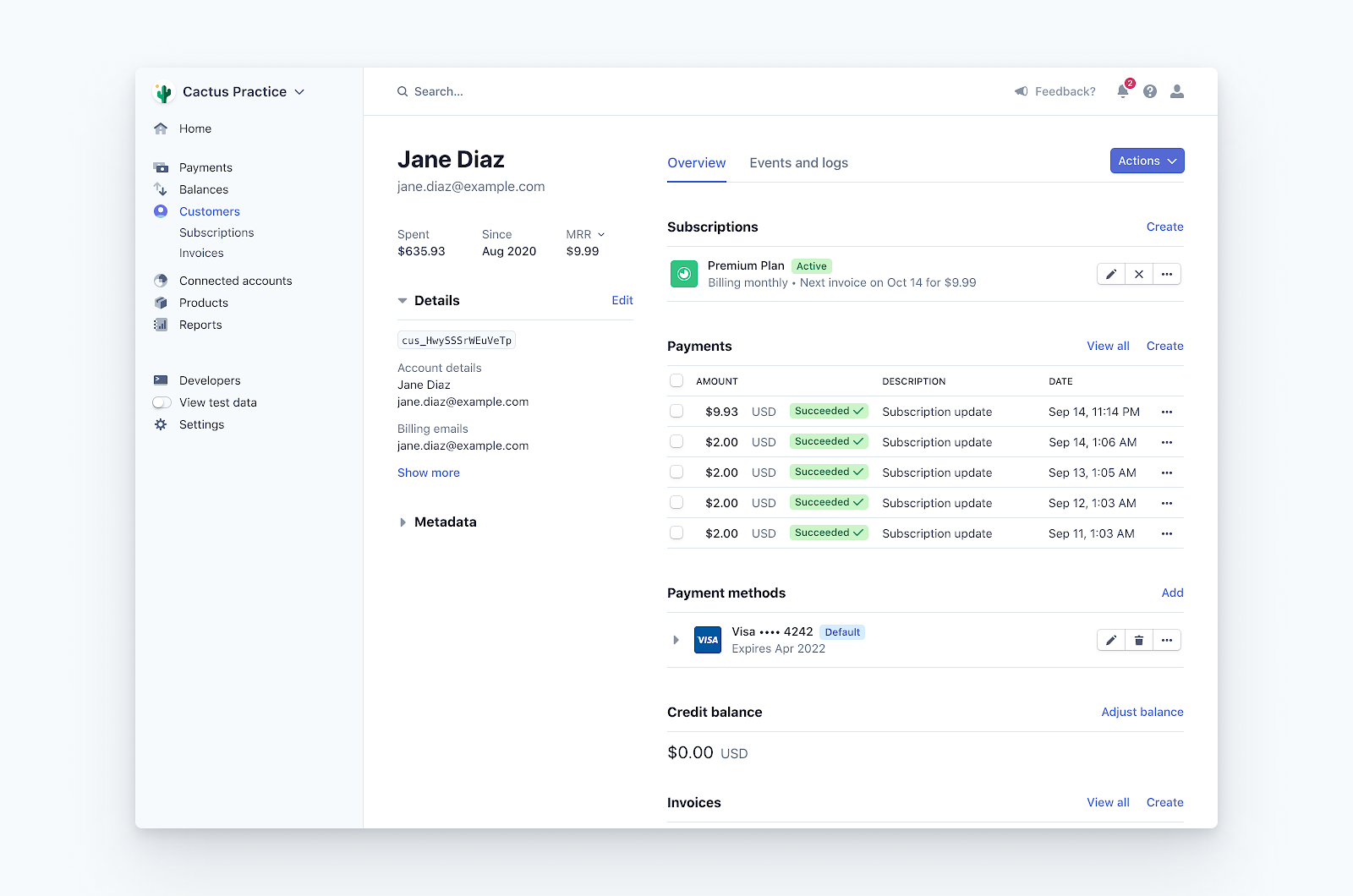

Stripe Billing: Best for developer-led teams

Stripe Billing is part of Stripe’s broader payments platform and is designed for companies that want maximum control via APIs. It supports subscriptions, usage-based billing, tiered pricing, and custom contracts, tightly coupled with Stripe’s payment processing capabilities.

The platform excels in flexibility for engineering-led teams. Usage events can be tracked programmatically, invoices generated automatically, and pricing logic embedded directly into product workflows. Stripe Billing also benefits from Stripe’s global payments reach, currencies, and payment methods.

However, Stripe Billing is not a full quote-to-revenue solution. CPQ, complex deal management, and finance-led workflows often require additional tooling or custom development, which can increase long-term maintenance costs.

Why consider Stripe Billing:

Stripe Billing is a strong Zoho Billing alternative for developer-led SaaS companies that want granular control over billing logic and already rely heavily on Stripe for payments.

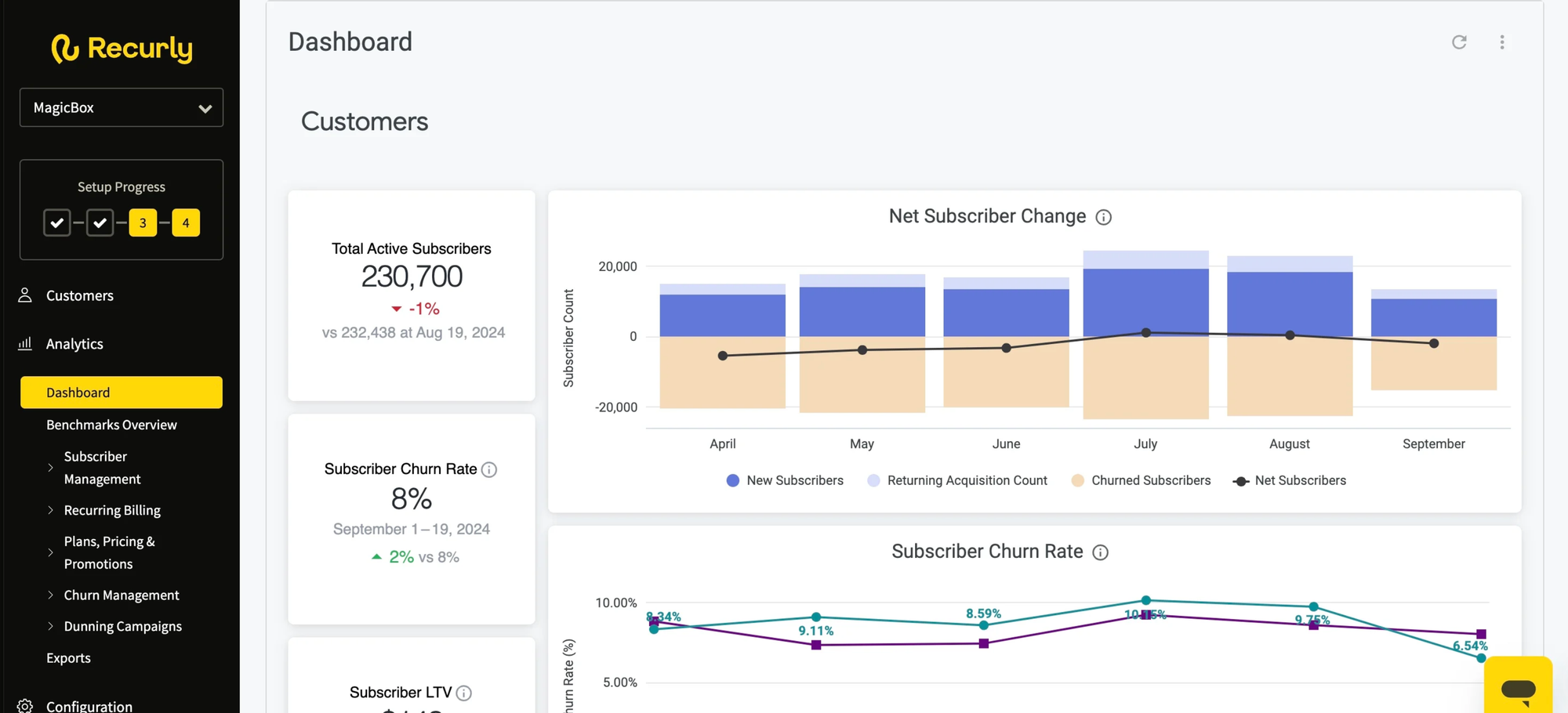

Recurly: Best for SaaS churn reduction

Recurly is a subscription management platform optimized around subscriber lifecycle management and churn reduction. It supports recurring billing, plan changes, retries, and customer self-service, with a strong emphasis on retention.

The platform provides flexible subscription configuration, customer portals, and automated dunning logic designed to reduce involuntary churn. Recurly is particularly popular with high-volume subscription businesses where retention and payment recovery materially impact revenue.

While Recurly does support usage-based billing, it is most effective when pricing remains subscription-centric. Highly customized usage models or enterprise-specific billing terms may require workarounds or external systems.

Why consider Recurly:

Recurly is a good Zoho Billing alternative for subscription-heavy SaaS businesses that prioritize churn reduction, subscriber experience, and payment recovery. Its emphasis on retention and intelligent retries makes it a strong alternative for businesses prioritizing subscriber lifetime value.

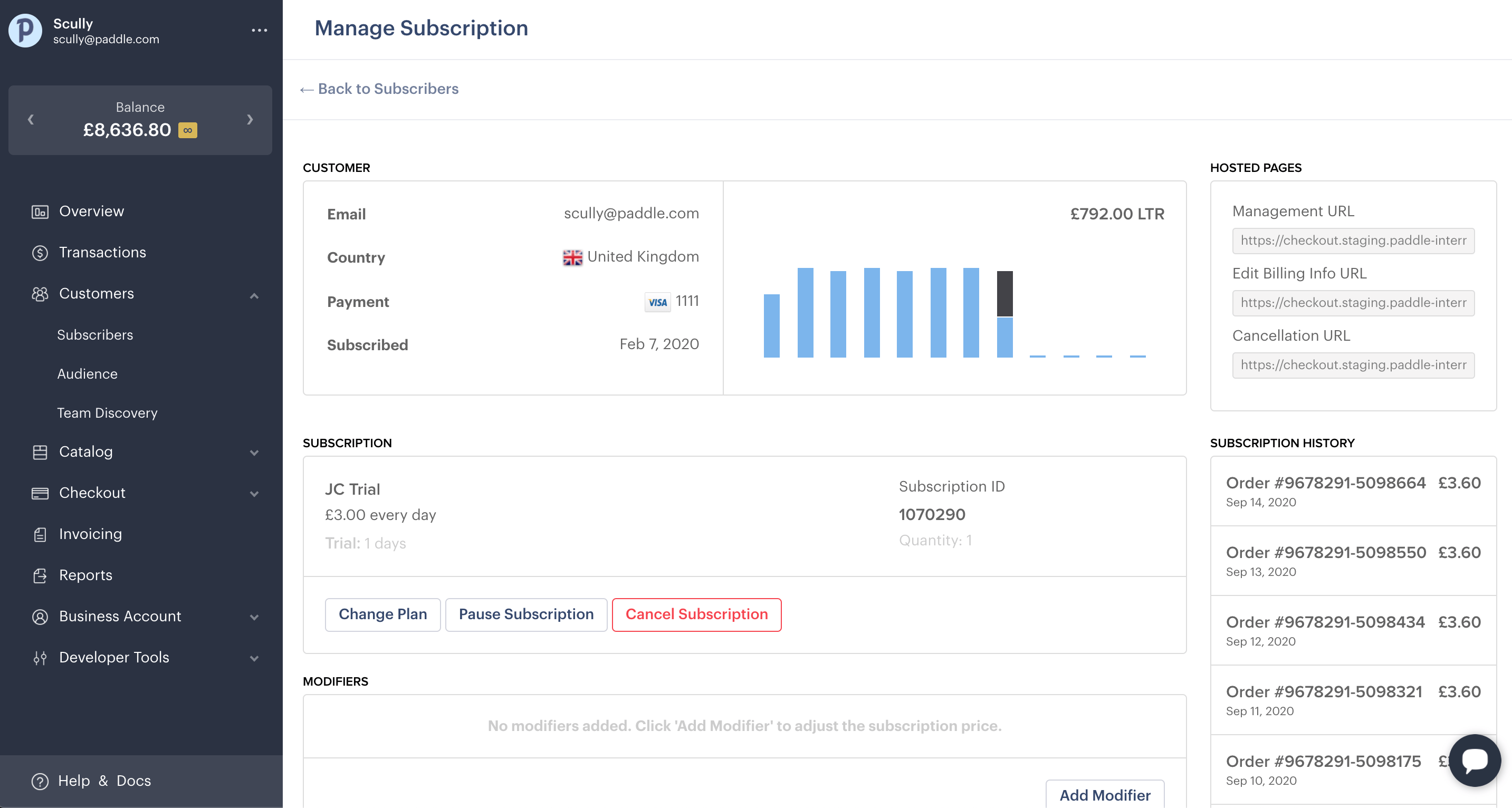

Paddle: Merchant of record for SaaS

Paddle is a merchant-of-record platform, meaning it takes responsibility for payments, sales tax, VAT, and compliance on behalf of the vendor. This significantly reduces operational and legal complexity for SaaS companies selling globally.

In addition to compliance, Paddle offers subscription billing, invoicing, localized checkouts, and payment optimization. The merchant-of-record model is particularly attractive for teams without dedicated tax or finance infrastructure.

The tradeoff is control. Because Paddle sits between the company and the end customer for payments and compliance, some flexibility around pricing, contracts, and enterprise billing workflows may be limited compared to direct billing platforms.

Why consider Paddle:

Paddle is a strong Zoho Billing alternative for SaaS and app companies that want to offload tax and compliance complexity while maintaining a simple billing setup. Startups without dedicated finance teams can offload tax and regulatory complexity, while still accessing localized payment methods and subscription features.

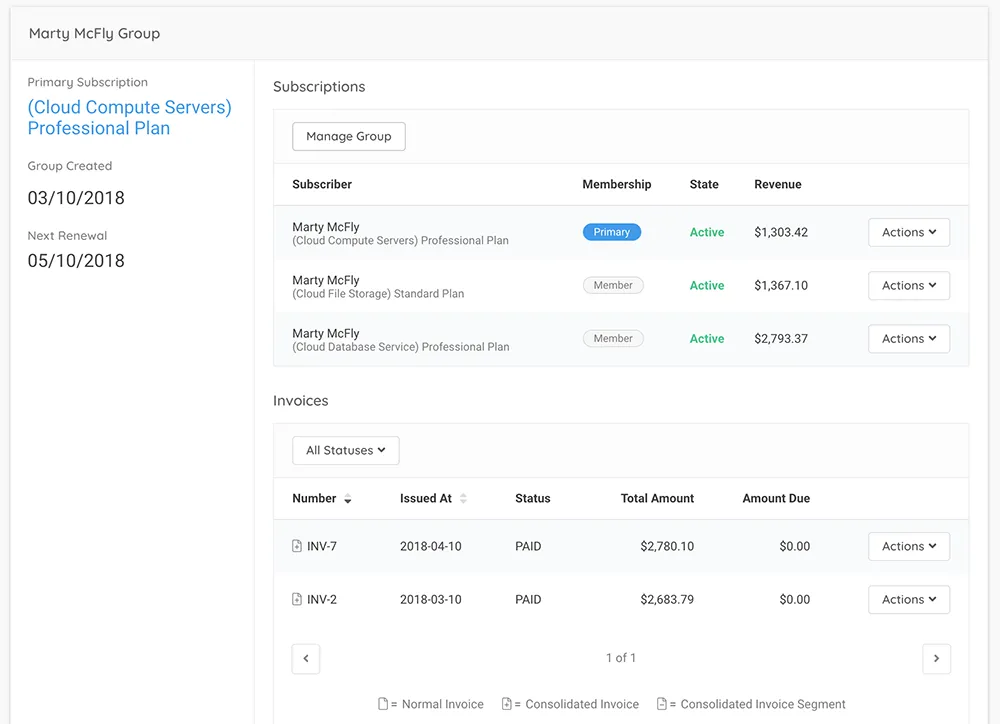

Maxio: SaaS billing with strong finance foundations

Maxio is a revenue management and billing platform built specifically for SaaS finance teams, formed from the merger of Chargify and SaaSOptics. It’s best known for combining subscription billing, usage-based billing, and financial reporting into a single system that supports growing SaaS companies as they scale.

From a billing perspective, Maxio supports usage-based, tiered, volume, flat-rate, and hybrid pricing models, with configurable thresholds, overages, and minimum commitments. Usage data can be ingested via API or batch uploads, and invoices are generated automatically based on the pricing logic finance teams define upfront.

Where Maxio stands out is on the finance and reporting side. The platform places a strong emphasis on SaaS metrics, revenue reporting, and compliance, helping finance teams maintain visibility into MRR, churn, deferred revenue, and recognized revenue as billing complexity increases.

That said, Maxio tends to work best for finance-led teams rather than sales-led or experimentation-heavy pricing organizations. Companies looking to rapidly iterate on pricing, tightly couple CPQ with billing, or support highly bespoke enterprise deal structures may find Maxio less flexible than newer quote-to-revenue platforms.

Why consider Maxio:

Maxio is a strong Zoho Billing alternative for SaaS and AI companies that need reliable usage-based billing paired with robust financial reporting and revenue visibility. It’s particularly well-suited for finance teams that want billing and SaaS metrics tightly aligned as pricing models mature.

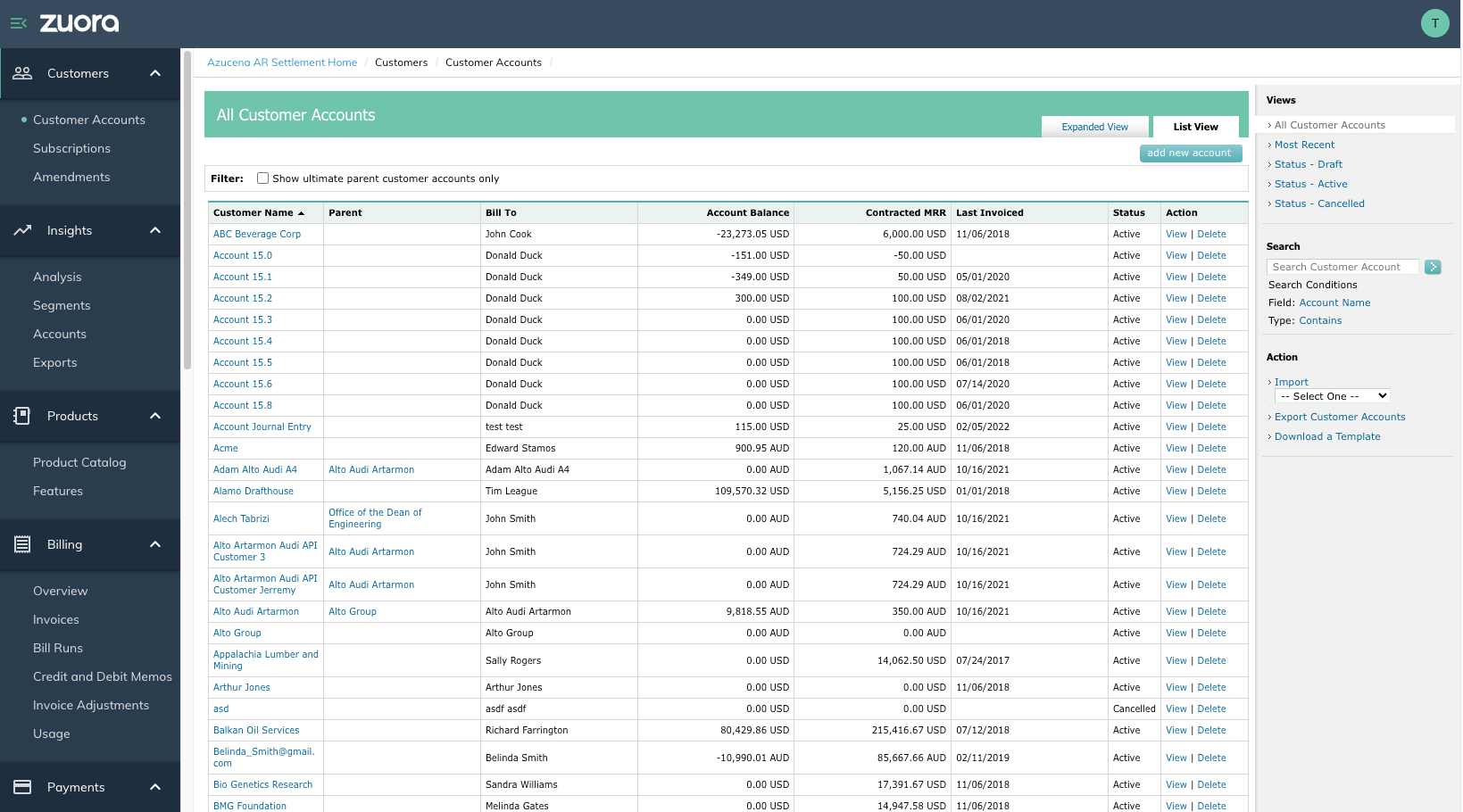

Zuora: Enterprise‑grade billing at global scale

Zuora is an enterprise billing platform built for large, global organizations with complex pricing and revenue models. A pioneer in subscription billing, it's now considered a legacy tool that's not as flexible and agile as younger, purpose-built platforms.

The platform is designed to handle scale and complexity, with deep support for proration, contract modifications, revenue recognition, and enterprise integrations. Zuora is often used by public companies or late-stage SaaS businesses with mature finance and IT teams.

The tradeoff is speed and simplicity. Implementation can be heavy, and pricing experimentation or rapid iteration may be slower compared to more modern, flexible platforms.

Why consider Zuora:

Zuora is a strong Zoho Billing alternative for large enterprises that need robust, compliant billing at global scale and can support a heavier implementation.

Choose the right billing platform for long-term growth

Zoho Billing remains a solid option for automating basic invoicing and subscription management. But as SaaS and AI companies scale, pricing becomes more dynamic, sales motions more complex, and finance requirements more demanding.

At that stage, billing is no longer just an operational tool—it becomes a critical part of your revenue architecture.

When evaluating Zoho Billing alternatives, RevOps and finance leaders should look beyond feature checklists.

The real question is this: can your billing platform can support how you sell today and how you’ll monetize tomorrow?

That means handling usage-based and hybrid pricing, eliminating manual handoffs between sales and finance, and automating the full quote-to-revenue lifecycle without constant workarounds.

If you’re looking for a Zoho billing alternative that meets flexible pricing demands and streamlines your quote‑to‑cash process, book a demo with Alguna.

Frequently asked questions (FAQ): Zoho Billing alternatives

What is the best Zoho Billing alternative for SaaS companies?

The best Zoho Billing alternative depends on your pricing complexity and growth stage.

For SaaS and AI companies with usage-based, hybrid, or custom enterprise pricing, platforms like Alguna offer more flexibility and end-to-end automation. Subscription-first businesses may prefer tools like Chargebee or Recurly, while enterprises often evaluate Zuora.

Why do companies switch from Zoho Billing?

Most companies move away from Zoho Billing as billing complexity increases. Common reasons include:

- Limited support for advanced usage-based or hybrid pricing

- Manual work around custom contracts, ramps, and credits

- Gaps in automation across quote, billing, and revenue workflows

- Limited integrations for complex RevOps and finance stacks

As billing becomes core to revenue operations, teams often need a more flexible and automated platform.

Is Zoho Billing good for usage-based pricing?

Zoho Billing supports basic usage-based billing, but it can struggle with more advanced use cases such as hybrid pricing, multiple usage metrics, complex overages, or enterprise-specific terms. SaaS and AI companies with sophisticated usage models often look for alternatives purpose-built for modern monetization.

What should I look for in a Zoho Billing alternative?

When evaluating a Zoho Billing alternative, finance and RevOps teams should prioritize:

- Support for usage-based, hybrid, and custom pricing models

- End-to-end automation from quote to invoice to revenue recognition

- Deep API and integration support for CRM, ERP, and data tools

- Built-in tax compliance and revenue recognition

- Real-time analytics for MRR, churn, and usage

These capabilities help reduce manual work and scale revenue operations reliably.

Which Zoho Billing alternative is best for usage-based or AI pricing?

For companies monetizing APIs, AI models, or consumption-based products, modern quote-to-revenue platforms like Alguna or finance-focused tools like Maxio are often a better fit than traditional subscription billing tools. These platforms are designed to handle real-time usage, complex pricing logic, and automation without heavy engineering involvement.

Can Zoho Billing support enterprise SaaS companies?

Zoho Billing can work for smaller or mid-market teams, but enterprise SaaS companies often require:

- Custom contract terms

- Multi-entity or multi-currency billing

- Advanced revenue recognition

- Tight alignment between sales and finance

At that stage, companies typically evaluate enterprise-grade tools like Zuora or modern quote-to-revenue platforms like Alguna that support multi-entity billing and are built for complex enterprise deals.

When does it make sense to replace Zoho Billing?

It usually makes sense to replace Zoho Billing when:

- Pricing becomes usage-based or hybrid

- Finance teams spend too much time on manual reconciliation

- Sales deals no longer map cleanly to invoices

- Billing changes require engineering support

These are strong signals that your billing system is limiting growth rather than enabling it.