This article was updated on February 17, 2026 to include: TL;DR section on vendors, customer reviews from G2, improved FAQ section, and additional internal resources.

Specialized usage based billing software is essential: Managing a usage-based billing model manually (or with basic tools) is error-prone and labor-intensive.

Top usage based metering and billing software to know: This guide compares leading platforms including Alguna’s end-to-end quote-to-revenue automation and open-source options like Lago.

Usage based billing can unlock growth and customer value, but it requires the right tooling. The best usage based billing software for SaaS enables you to “set it and forget it” by automating complex usage calculations and billing rules behind the scenes.

Since usage based pricing (UBP) has gone mainstream, naturally, usage based billing has followed. With steady adoption since 2018, usage based pricing saw a notable jump from 45% in 2021 to 63% by early 2023 according to a survey by OpenView Partners.

Aligning price with value, the pay-as-you-go flexibility appeals to customers as it offers a lower barrier to entry and fairness in pricing.

This is where usage based billing software comes in. It does all the heavy lifting, from ingesting product usage data, rating it against pricing plans, generating invoices, and even handling revenue recognition.

In this deep dive, we’ll start with the fundamentals of usage based billing. What it means, how it works, and why it’s become so popular. Then we’ll explore the best usage based billing software available today.

TL;DR: Best usage-based billing software for SaaS

- Alguna: Choose if you want an end-to-end quote-to-revenue platform (CPQ + usage + invoicing + rev rec) with no-code flexibility, especially for AI, fintech, and multi-entity SaaS.

- Stripe Billing: Choose if you’re already on Stripe and you need a fast, simple way to launch basic metered billing while you validate the model.

- Orb: Choose if you’re a high-growth API or AI company with big event volumes and you need real-time usage + flexible pricing, and you have engineering support.

- Metronome: Choose if you’re enterprise-leaning, developer-first, and need extremely scalable, precise usage rating for complex contracts (with a heavier implementation).

- Lago: Choose if you want open-source control and no revenue tax, and you’re comfortable owning more of the engineering and hosting burden.

- m3ter: Choose if you’re scaling beyond simple subscriptions and need enterprise-grade metering, strong integrations, and real-time visibility (often paired with other tools).

- Chargebee: Choose if you’re small-to-mid SaaS adding basic usage components to a subscription business and want an established “billing suite” with broad integrations.

- Zuora: Choose if you’re a global enterprise with extreme complexity (multi-entity, multi-currency, deep compliance) and you can stomach longer timelines and higher cost.

- Maxio: Choose if finance-led reporting and SaaS metrics matter as much as billing, and your usage billing needs are solid but not “hyperscale real-time.”

What is usage based billing?

Usage based billing refers to the infrastructure that allows you to track usage events, apply pricing rules, generate invoices, and collect payments based on your usage based pricing strategy.

Simply put, customers are billed according to how much of a product or service they consume during a specific billing period. If you use more, you pay more; if you use less, you pay less. (The clue is really in the name.) This contrasts with traditional subscription or license models where you pay a fixed recurring fee regardless of usage.

Usage based billing is also known as metered billing, consumption billing, or pay-as-you-go billing.

Pricing = the “what and how much”

Billing = the “how to meter, charge, and collect”

Key characteristics of usage based billing

- Variable charges: The core of UBB is a variable fee tied to a usage metric. For example, a SaaS email API might charge $0.10 per 1,000 emails sent. At the end of the month, the customer’s bill is calculated based on actual emails sent. If they send 500k emails, they pay $50; if they send 5 million, they pay $500.

This variable component can stand alone or be paired with a base subscription fee (hybrid pricing model). - Defined usage metrics: Billing is based on measurable usage metrics tied to your product’s value. Common metrics include API calls, data volume, number of transactions, compute hours, etc. It’s crucial to choose metrics that customers understand and equate to value.

The metric should scale with the customer’s usage of the product (for instance, cloud storage might bill per GB stored). - Metering and tracking: Usage must be metered (recorded) continuously. This requires instrumenting your product or service to log consumption events. Accurate data collection is the foundation, because if usage isn’t tracked correctly, billing will be wrong.

Advanced billing systems can ingest and process usage events in real-time or batches, often via APIs or data streams. - Billing cycles and aggregation: Usage can be billed in different cycles (e.g. monthly, quarterly). Within each cycle, the platform will aggregate all usage events per customer and apply the pricing rules.

Some usage-based models bill in arrears (after usage is incurred), while others use prepayments/credits or mid-cycle thresholds.

- Pricing models: The execution of usage based billing depends on the complexity of your usage based pricing model. Usage-based pricing isn't a one-size-fits-all setup.

There are multiple models:- Simple usage rate: A flat per-unit price (e.g. $X per API call). Billing must reliably meter every unit and apply the fixed charge.

- Tiered or volume pricing: The per-unit price changes once customers pass certain thresholds (e.g. $0.10 per GB for the first 100 GB, $0.08 for the next 400 GB). Billing must calculate which tier applies in real time.

- Tiered plans with included usage: A hybrid subscription where customers get an allotment (e.g. 1,000 units/month) and pay overages beyond it. Billing needs to reset counters each billing cycle and apply overage rules accurately.

- Prepaid with overages: Customers pay upfront for a block of usage, with charges if they exceed the balance. Billing must manage credits, drawdowns, and overage logic seamlessly.

- Custom metrics or formulas: Advanced setups charge based on multiple attributes or formulas (e.g. compute hours × storage × region). Billing should support complex rating rules (custom SQL-based metrics, multi-attribute pricing) without forcing engineering to build one-off workarounds.

- Customer visibility: An important aspect is transparency. Customers should ideally have real-time visibility into their usage and costs so they’re not blindsided by a bill. Many usage-based billing platforms provide customer portals or dashboards to track usage, or at least support sending usage reports and alerts (e.g. “you’ve used 85% of your monthly quota”).

What are the benefits of usage based billing?

For customers, usage based billing offers cost efficiency and fairness, you simply pay proportional to value received. Plus, there will be no bill shock when the invoice arrives.

For vendors, it can boost revenue growth and retention. Fast-growing SaaS and AI companies have leveraged usage based models to drive high expansion revenue from existing customers.

For example, data warehouse company Snowflake famously uses consumption pricing and achieves net dollar retention (NRR) around 158%. This means existing customers spend 58% more each year, on average. Usage based pricing naturally enables this expansion as customers find more value and increase usage.

- Kyle Poyar, Growth Unhinged

What are the disadvantages of usage based billing?

UBB isn’t a magic bullet. It introduces variability in revenue (which makes it harder to forecast), and customers might have unpredictable bills if their usage spikes.

Enterprise buyers sometimes worry about cost uncertainty with pure pay-as-you-go. As a result, many companies adopt hybrid models, combining subscriptions with usage components in an effort to get the best of both worlds.

But it’s not an either/or situation. Many UBB companies still have subscriptions or free quotas in place alongside metered charges.

Best usage based billing software: Comparison overview

To help you scan the landscape, here’s a side-by-side comparison of some of the best usage based billing software solutions in 2026.

We’ve highlighted what each platform is best for, along with pros and cons, and a note on pricing.

⚠️ Always check vendor websites for the most recent features and pricing.

| Platform | Best for | Pros | Cons | Pricing |

|---|---|---|---|---|

| Alguna | AI, fintech and multi-entity SaaS looking to unify multiple solutions under one platform | Flexible pricing, unified CPQ + usage based billing, no-code, native integrations with all major CRMs and ERP systems | Newer entrant, B2B focus | Starts at $699/month (no % of revenue). White glove onboarding and migration included. |

| Stripe Billing | Startups with simple usage needs | Easy if already on Stripe, developer-friendly | Limited scale/flexibility, % fee adds up fast, requires dev resources | 0.7% of revenue billed |

| Orb | High-growth PLG, API/AI companies | Built for scale, real-time usage, flexible pricing | Sales-led only, more dev-heavy | Starts at $749 - $3490 per month + additional usage and integrations |

| Metronome | Scale-ups and enterprise PLG | Real-time, supports complex contracts | Custom pricing, heavier implementation (requires dev) | Custom annual contracts (likely starts at ~$10k) |

| Lago | Dev teams and cost-conscious startups | Open-source, no revenue tax, flexible | Self-hosting overhead, fewer features unless paid | Free (self-host) or paid cloud |

| m3ter | Mid-to-large SaaS with complex billing | Enterprise-grade, integrates with Salesforce/ERP | Too complex for small startups, custom setup | Custom (subscription model) |

| Chargebee | Small-to-mid SaaS adding usage | Easy setup, full suite, free tier | Clunky, not for huge scale, revenue overages | $599/month (up to $100k in billings) + overages |

| Zuora | Large enterprises, multi-entity | Extremely powerful, full revenue suite | Expensive, long implementation | ~$50k+/year, enterprise |

| Maxio | Growth-stage B2B SaaS | Integrated billing + SaaS metrics, great for revenue recognition | Less flexible at scale, three combined products, dated UX/UI | $599/month (up to $100k in billings) |

Best usage based billing software: In-depth reviews

Now, let’s dive deeper into each of the platforms mentioned above. We’ll explore what makes each usage based billing platform unique, notable features, and considerations to keep in mind.

This section will help you understand which usage based billing solution might be the best fit for your business model and team.

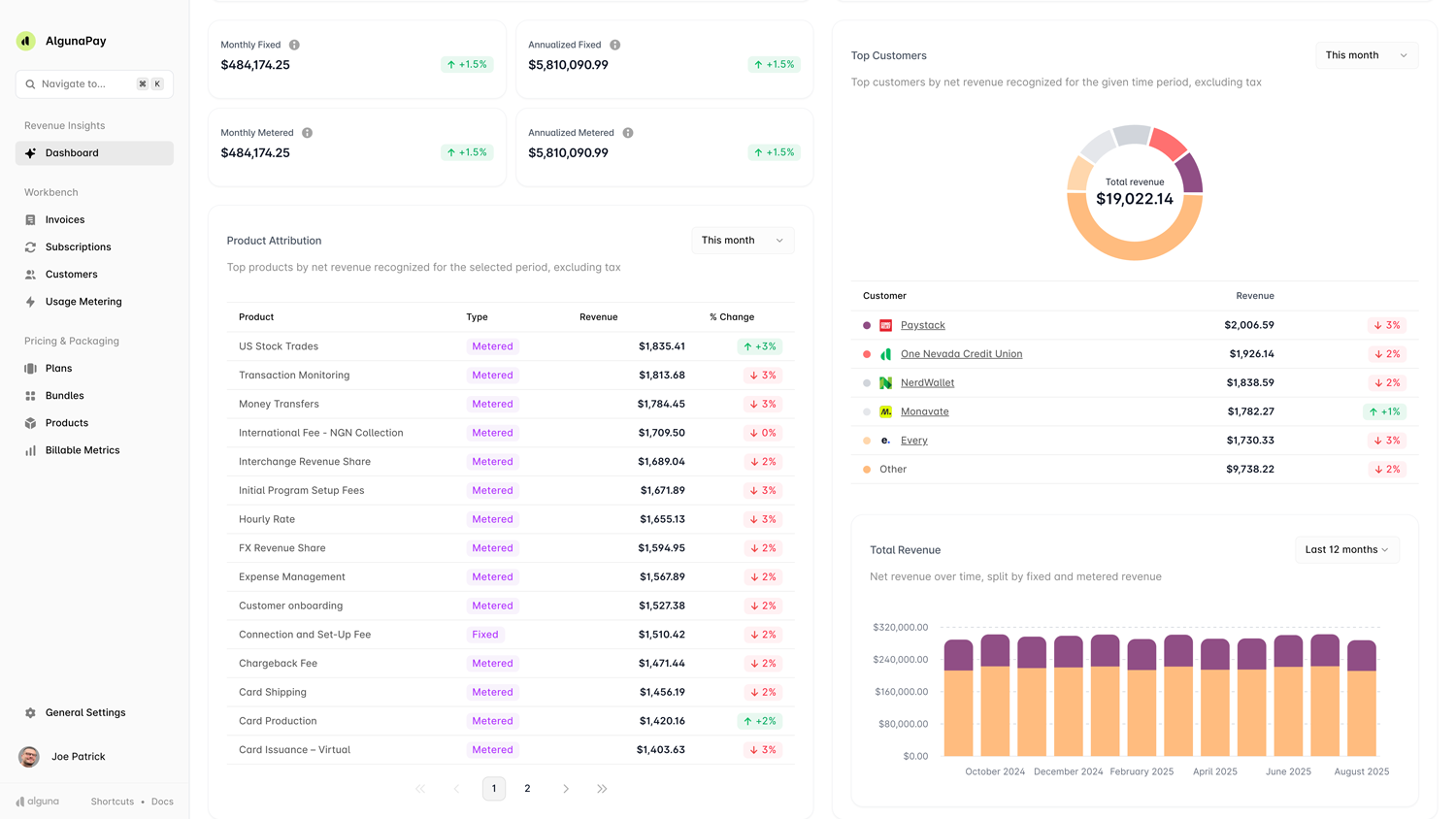

1. Alguna: Best usage-based billing software for SaaS and AI companies

Backed by Y Combinator, Alguna is a modern pricing, quoting, and billing platform that unifies the entire quote-to-revenue process for AI, fintech, and SaaS companies.

It’s designed to handle both product-led growth at scale (self-serve, high-volume usage) and enterprise sales complexity (custom contracts, negotiated usage based pricing) in one unified system.

Think of Alguna as an all-in-one revenue platform: it combines CPQ (Configure-Price-Quote) capabilities, usage metering, subscription billing, invoicing, and revenue recognition. It even includes built-in e-signature so you never have to leave your workspace to get contracts in front of customers.

- Shane Curran, CEO at Evervault

Read the case study

Key strengths

- Capture every event with real-time usage metering: Alguna captures every usage event the moment it happens whether that’s API calls, tokens, data, or something else. This means finance teams never have to wait for batch jobs or reconcile data across multiple products (or spreadsheets), ensuring accurate, up-to-date billing data at all times. Plus, customers have complete visibility on usage in their customer portals.

- Launch and experiment with flexible pricing models: From prepaid with overages to tiered, graduated, pay-as-you-go, or hybrid subscriptions, Alguna supports all major usage-based pricing models and AI pricing models. New plans can be launched without engineering effort, giving GTM teams the agility to test and adapt.

- Set up hybrid and credit-based billing: Alguna makes it simple to combine subscriptions, usage charges, and one-off add-ons on a single invoice. Native credit and token support also enables modern AI agent pricing models or prepaid consumption bundles.

- Offer transparent invoicing and co-terming: Customers see live usage dashboards and projected charges in-platform, reducing billing disputes and improving trust. Alguna also automates co-terming, proration, and consolidated invoicing to keep billing consistent as contracts change.

- Automate revenue recognition and compliance: Beyond billing, Alguna automates revenue recognition for variable consideration, dunning, and smart payment retries. With built-in ASC 606/IFRS 15 compliance, finance teams can close books faster while cutting revenue leakage.

- Connect to the rest of your tech stack: Alguna offers native integrations with table stakes CRMs including Salesforce and HubSpot along with accounting tools like QuickBooks, Xero, and NetSuite for financial reporting. Webhooks and API are available for custom needs.

Considerations

- Newer entrant: Alguna came out of Y Combinator in summer 2023 to challenge legacy players that couldn’t keep up with monetization and market changes.

- Not always the best fit for simple setups: Alguna is built to handle complex usage-based billing and evolving AI monetization models. For very early-stage companies offering a single low-cost subscription it may be too soon.

Pricing: Plans start at $699 per month and include white glove onboarding and migration. Transparent pricing with no hidden fees.

Still stitching together usage data and invoices?

Alguna replaces brittle scripts, manual workflows, and point tools with a unified usage-based billing engine that's built for scale.

Ideal use cases:

Alguna is purpose-built for companies where monetization complexity grows quickly. It shines in industries where usage-based models are standard and pricing needs to adapt at high velocity:

- AI companies: Alguna is the perfect platform for usage based billing for AI companies monetizing tokens, API calls, or agent usage. Alguna makes it easy to launch hybrid models (subscriptions + usage) and track consumption in real time, a critical ability when the rules of pricing change every few months.

- Fintech platforms: Perfect for businesses charging per transaction, payment volume, or assets under management. Alguna automates billing flows, co-terming, and revenue recognition while keeping compliance and auditability front and center.

- SaaS companies: Designed for B2B SaaS teams moving beyond simple flat-rate pricing. Whether you’re layering usage fees on top of subscriptions, selling credits, or blending PLG and sales-led growth, Alguna centralizes it all into a single quote-to-cash flow.

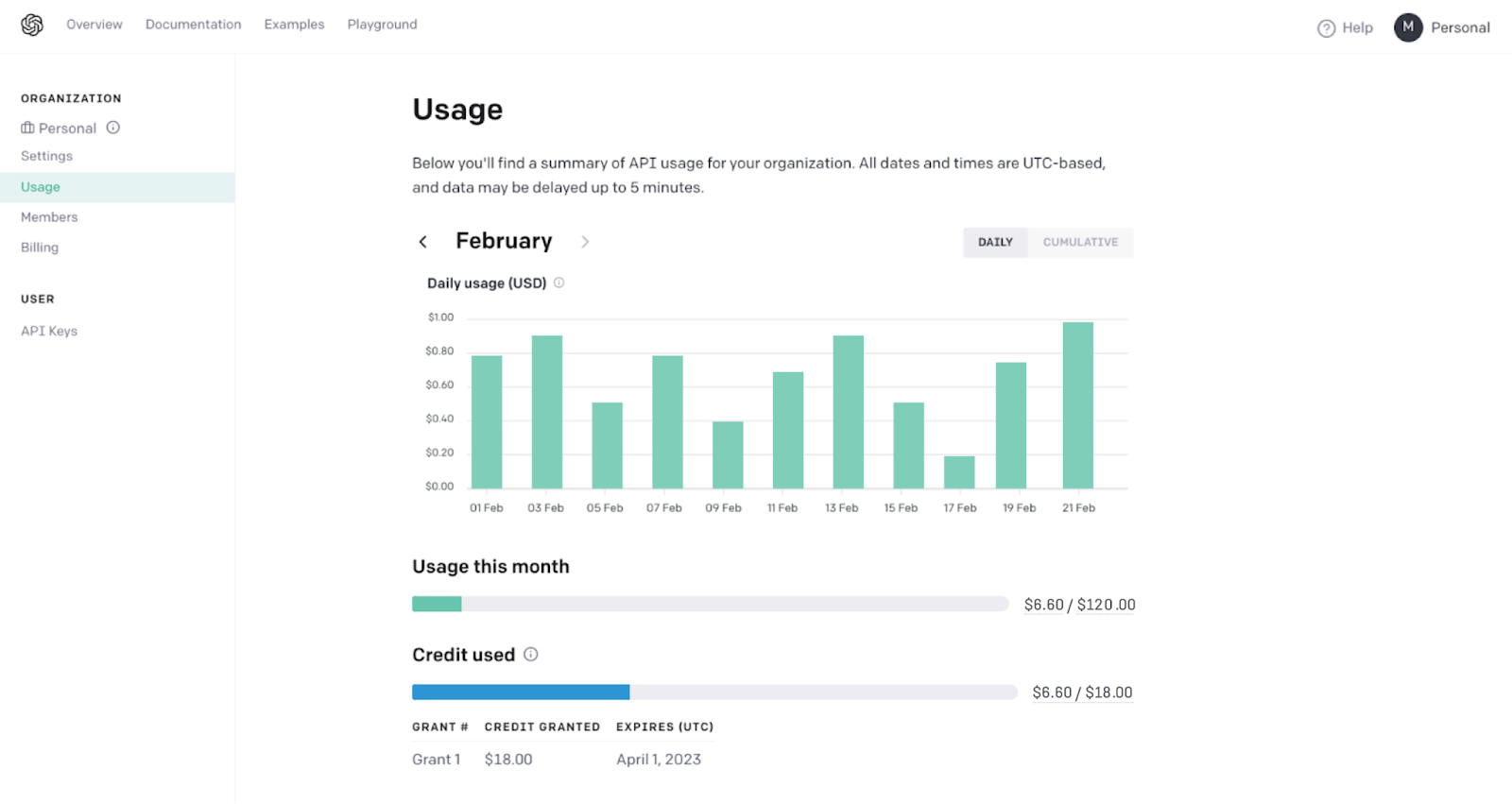

2. Stripe Billing: Best for getting started with usage based billing

Stripe Billing is the add-on product from Stripe that handles recurring subscriptions and usage based billing on top of Stripe’s payment processing platform.

Many early-stage startups consider Stripe Billing as they typically already use Stripe for payments and it’s a quick way to start charging subscriptions or metered fees without adopting a new vendor. That said, depending on how quickly you scale, companies sooner or later run into growing pains, ending up with significant billing bottlenecks.

Key strengths

- Easy integration for existing Stripe users: If your product already uses Stripe to collect payments, turning on Stripe Billing is straightforward. You can manage products, pricing, and customers via the Stripe Dashboard or API.

- Developer-friendly API and docs: Stripe is famous for a great developer experience. Stripe Billing is no exception – it provides clear APIs for creating subscription plans, recording usage, and generating invoices.

- Core billing functionality covered: Stripe Billing can handle recurring subscriptions (with trials, proration, etc.) and metered billing. Notably, it supports tiered pricing models, usage caps, and per-seat pricing through its pricing configuration.

"Operational tooling: clear subscription and invoice objects, webhooks for state changes, usage aggregation, and dashboard workflows for corrections without custom scripts."

Read the full review on G2

Limitations to consider

- Features mainly focused on simple SaaS billing: Stripe Billing covers most standard needs, but it lacks advanced functionalities that specialized platforms offer. For instance, there’s no built-in support for complex hierarchical accounts.

- Lacks flexibility when changing pricing or metrics: Stripe’s model ties usage records to predefined products and prices. If you later want to change how you bill (say you want to start charging per user per GB, combining two metrics, or you decide to break a product into regional usage), you often have to create new products and plans in Stripe and migrate subscribers.

- Cost scales with revenue: 0.7% of billing volume is small at first, but if you’re doing millions in usage-billed revenue, this fee can exceed the cost of other platforms. For example, at $10M in annual usage charges, Stripe would take ~$70k. At that scale, a flat-fee platform or in-house solution might be more economical.

Pricing: Stripe Billing’s standard pricing is 0.7% of the billed volume (0.5% at Scale tier with custom pricing, 0.7% pay-as-you-go). For example, if you invoice $1,000 to a customer, Stripe takes $7. This is on top of payment processing fees.

Ideal use cases

- Very early-stage startups or small businesses: Great when you need to implement usage based billing quickly and simply, especially if usage volumes are not astronomically high.

- Good interim solution while you validate your usage-based model: Quick to get started, but as your business scales in complexity or volume, you may need to plan for an eventual migration to a more specialized platform due to Stripe’s limitations.

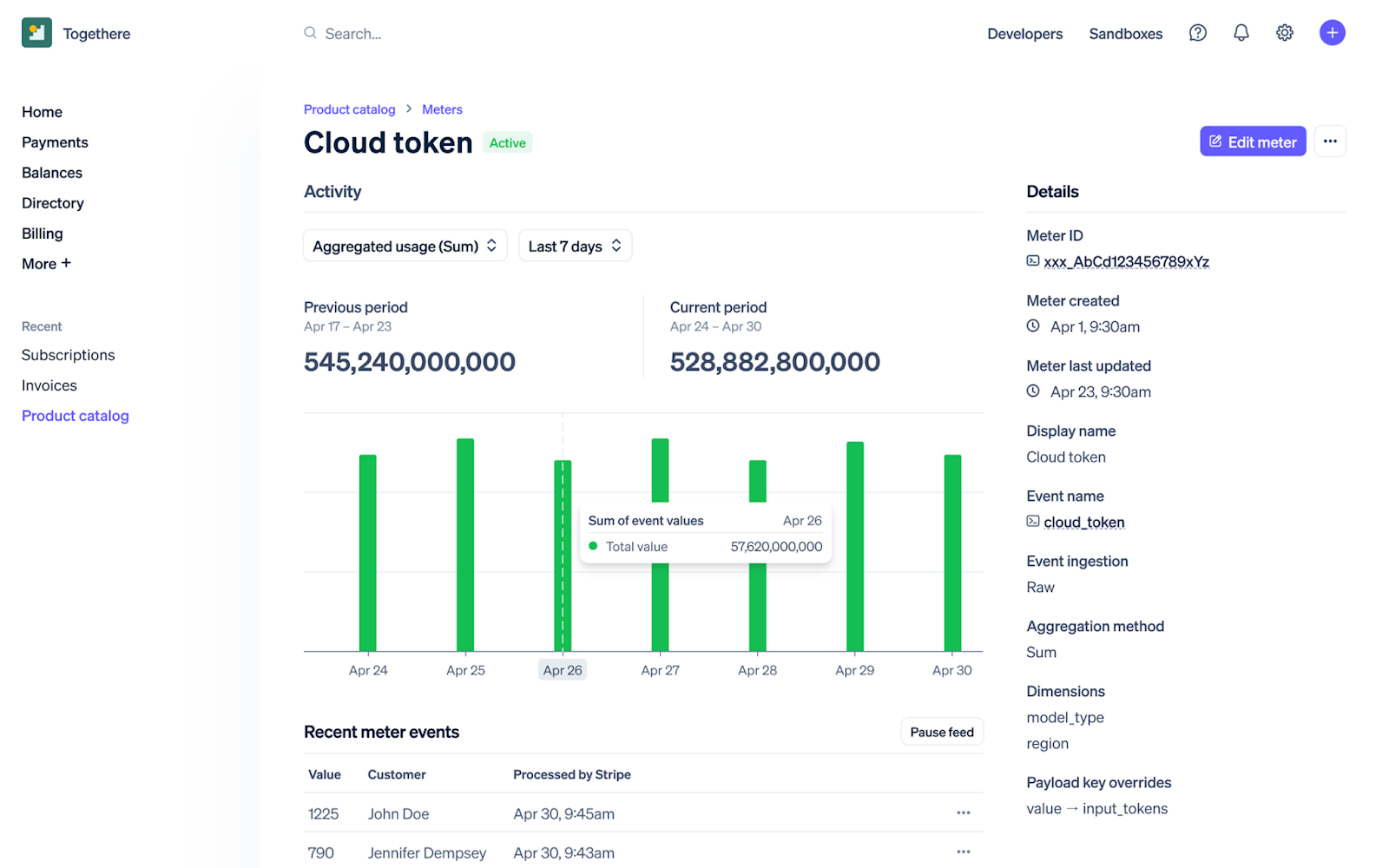

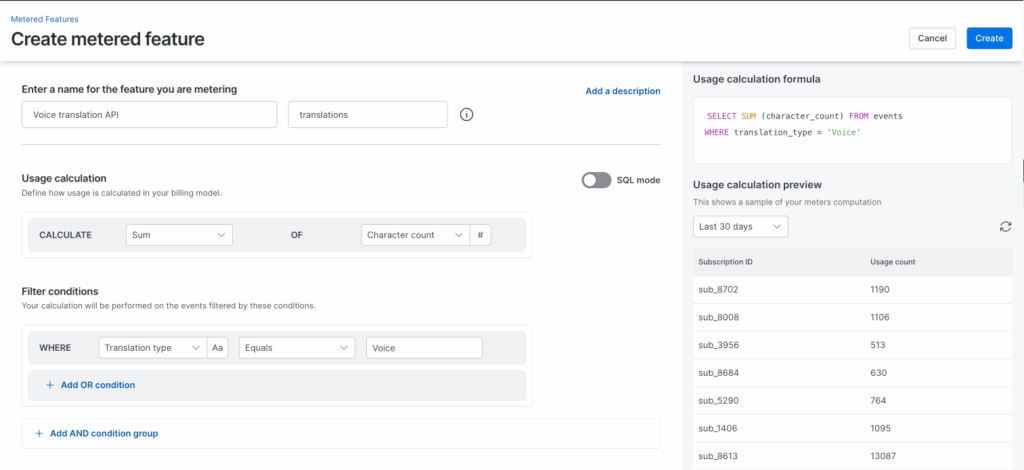

3. Orb: Great option for usage based billing for API products

Orb is a usage based billing platform aimed at API companies with huge event volumes and complex pricing needs. It’s relatively new (founded in 2021), but has gained traction among high-growth startups, particularly in developer tools and infrastructure sectors–companies where billing huge amounts of usage in real-time is mission-critical.

Key strengths

- Deep usage metering capabilities: Orb was designed from the ground up for high-volume usage data. It can capture millions of granular usage events, transform them into billable metrics, and handle complex rating logic. This makes it especially attractive for infrastructure-style companies where scale and accuracy are paramount.

- Flexible pricing experimentation: Orb gives RevOps and product teams the ability to model and test different usage-based pricing structures without heavy engineering input. Tiered, graduated, or prepaid consumption models can be configured quickly, which helps companies iterate on monetization as their product and market evolve.

- Developer-friendly APIs: Orb has a strong focus on developer experience, with robust APIs and documentation. For engineering-led companies that want to tightly embed billing logic into their product, Orb provides the tooling to connect raw usage data directly into the billing engine.

"Despite having a dedicated billing team to manage our usage-based billing scenarios, we faced numerous challenges earlier. Leveraging Orb to help with our billing and pricing allowed us to redirect our top engineers to focus on other critical aspects of our product."

Read the full G2 review

Limitations to consider

- No built-in payment processing or UI components: Orb focuses on the backend of billing. It integrates with payment gateways (like you can use Stripe for actual charging), but Orb itself doesn’t process payments. Similarly, it doesn’t come with a hosted checkout or extensive customer portal.

- Complexity requires implementation effort: While Orb is powerful, using it to full potential means you’ll be actively managing billing as a part of your product. Defining metrics with SQL, setting up alerts, syncing to your data warehouse are all great capabilities, but they assume you have people (engineers, billing ops) who will configure and maintain them.

- Newer entrant: Orb is a younger company relative, and as with any newer platform, you’ll want to ensure they meet your compliance and reliability needs.

Pricing: Starts at $749-$3490 per month + additional usage and integrations. Importantly, Orb does not charge a % of your revenue.

Ideal use cases

- API or infrastructure companies: If you have high data volumes, dynamic pricing, and a need for real-time transparency then Orb empowers technical teams to treat billing as an extension of their product.

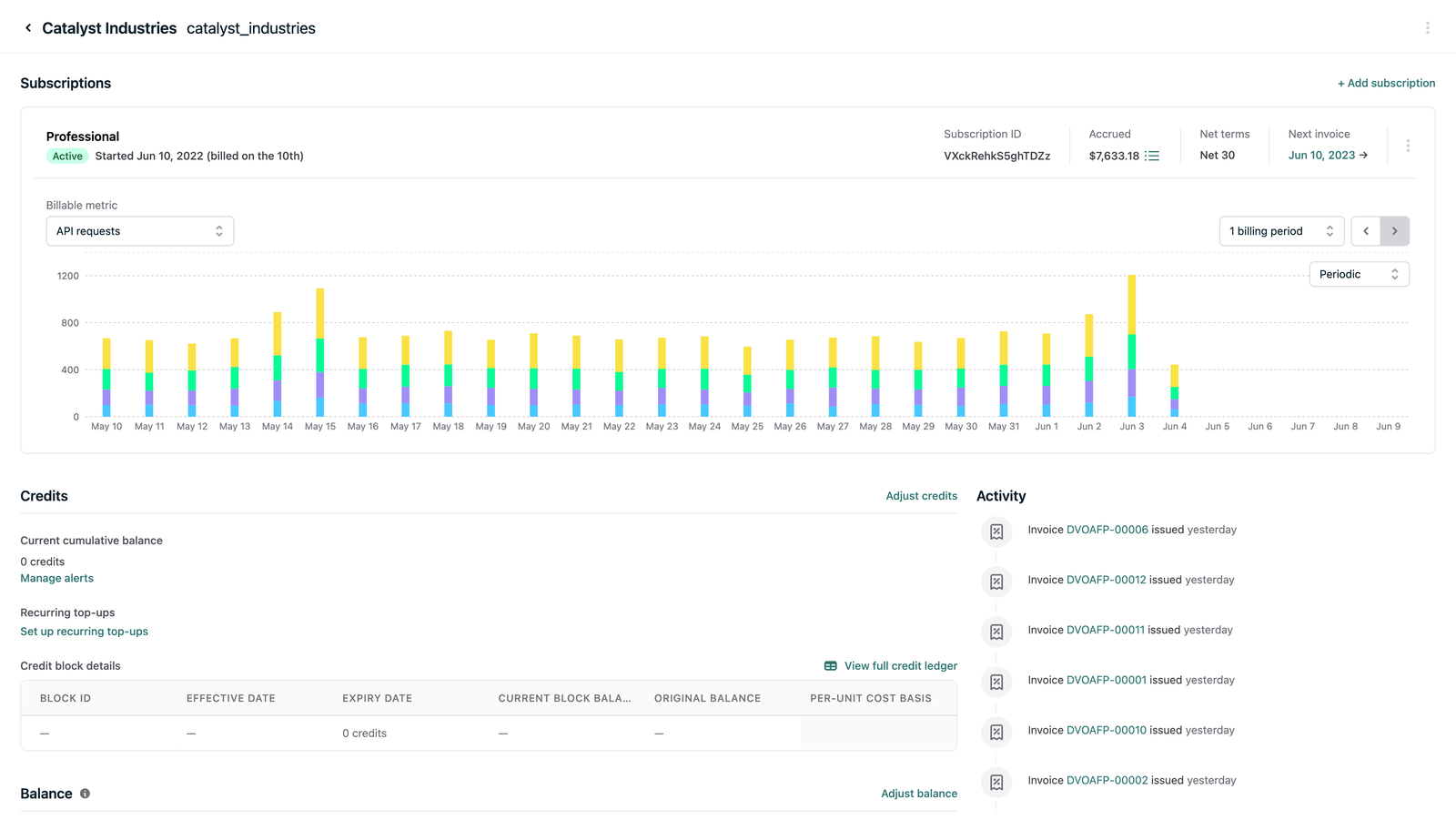

4. Metronome: Best usage based billing software for enterprise

Metronome is one of the leading usage based billing platforms, built specifically for companies that need precision, scalability, and developer-first infrastructure. Unlike legacy systems that retrofit usage billing onto subscription engines, Metronome was designed from day one to process millions of usage events.

For engineering-heavy teams, it offers the control and flexibility needed to launch and evolve monetization strategies quickly.

Key strengths

- Granular usage metering and flexibility: Metronome excels at handling complex data streams, making it ideal for API-driven SaaS and infrastructure companies. Its billing engine can ingest millions of usage events, apply sophisticated pricing rules (like tiered, volume-based, or prepaid credits), and generate precise invoices.

- Scalable, developer-friendly infrastructure: Unlike older billing tools, Metronome was built from the ground up to handle scale. Its strong API surface and event-driven architecture mean engineering teams can integrate usage tracking and billing logic directly into their product workflows. For technical teams that value control and extensibility, this makes Metronome one of the strongest usage based billing platforms available.

- Mary Pat Colandro, Senior Engineering Manager at AssemblyAI

Limitations to consider

- Engineering dependency: While powerful, Metronome requires significant developer resources to implement and maintain. Companies without strong engineering bandwidth may find the setup and ongoing adjustments burdensome.

- Narrower scope than full quote-to-cash platforms: Metronome is excellent for usage metering and billing but doesn’t cover broader needs like CPQ (configure-price-quote), contract management, or revenue recognition. Finance and RevOps teams may need to stitch together additional tools.

Pricing: Metronome’s pricing is custom often starting in the low tens of thousands per year for mid-stage startups and scaling up for large enterprise deployments.

Ideal use cases

- API-first SaaS companies: Products like developer tools, infrastructure, and data platforms often monetize based on API calls, compute hours, or storage. Metronome’s event-driven architecture is well-suited for this level of granularity.

- Fast-scaling startups with strong engineering teams: Companies with a dedicated technical team can leverage Metronome’s robust APIs to embed billing directly into their product. This gives them the flexibility to experiment with new pricing models without being bottlenecked by legacy tools.

- Enterprises needing transparent, high-volume usage billing: Organizations with thousands of customers and complex usage datasets benefit from Metronome’s ability to meter, price, and invoice at scale with accuracy, while maintaining the financial rigor required by finance teams and auditors.

5. Lago: The best open source usage-based billing software

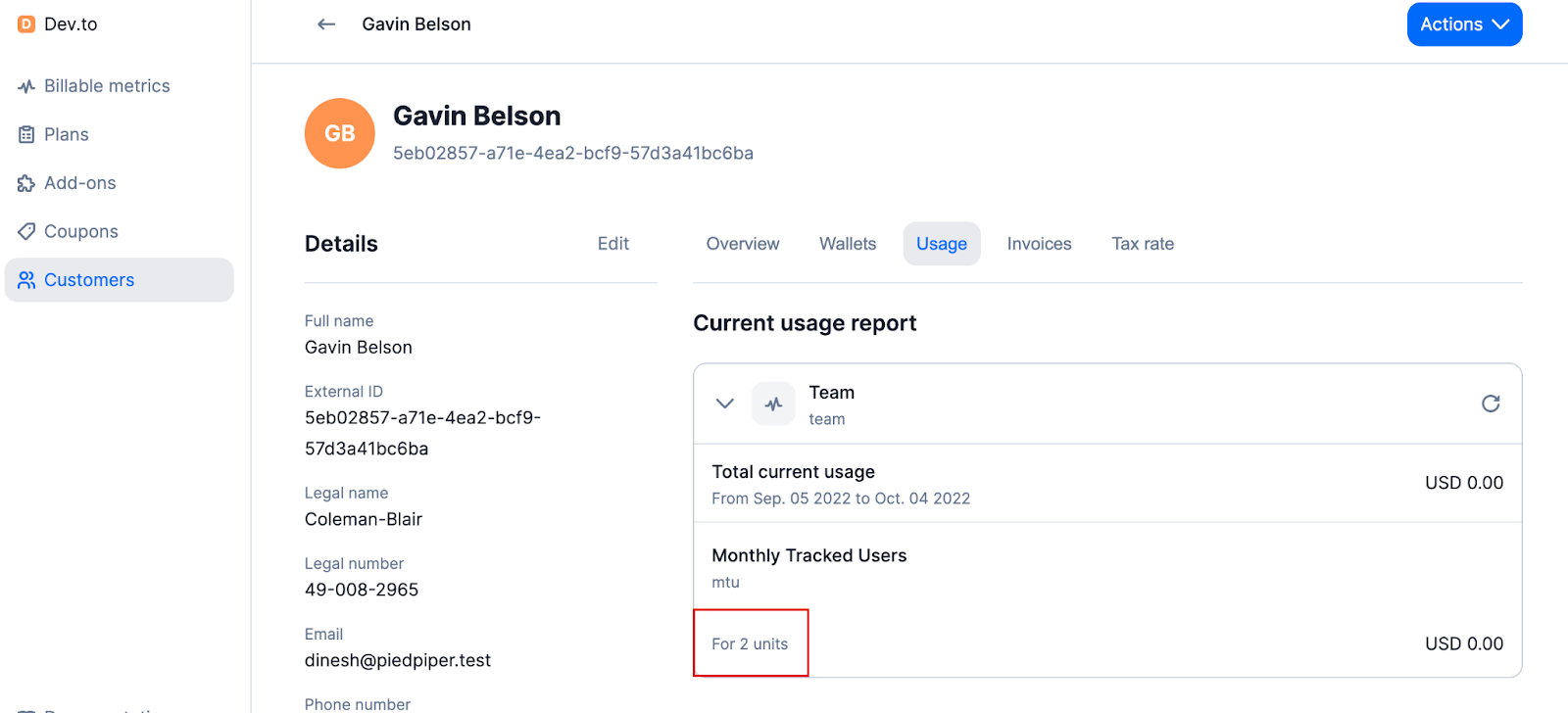

Lago is an open-source usage based metering and billing software that has rapidly gained popularity, especially among developer-oriented startups. Launched in 2022, offers similar capabilities to Stripe and Chargebee (metered billing, subscriptions, etc.), but without the vendor lock-in or transaction fees.

Key strengths

- Open-source transparency and flexibility: Lago stands out by being fully open source, meaning teams can inspect the code, customize workflows, and avoid vendor lock-in. For companies that want to tailor their billing to unique use cases or align pricing with proprietary product metrics, this level of transparency is a major advantage over black-box billing providers.

- Self-hosting and data ownership: Many SaaS and fintech companies handle sensitive customer and usage data. Lago allows teams to self-host the billing system, keeping all data within their own infrastructure. This appeals to businesses with strict compliance requirements or those operating in regions with tight data sovereignty rules.

- Developer-first modularity: Lago provides APIs and SDKs that make it easy for engineering teams to integrate usage metering, pricing, and invoicing into their product stack. Because it’s modular, companies can adopt Lago as a lightweight billing engine at first, then expand its role as their pricing models grow more complex.

"Lago gives us full control over our billing stack while staying developer-friendly. The fact that it’s open-source and self-hostable was a game-changer for our team, especially with GDPR constraints and growing infra complexity."

Read the full G2 review

Limitations to consider

- Higher engineering overhead: Lago’s flexibility comes with responsibility. Self-hosting and customizing the system requires significant developer resources compared to plug-and-play billing solutions.

- Less feature depth out-of-the-box: While Lago is strong on transparency and control, it lacks some of the advanced revenue automation (e.g., CPQ, revenue recognition, quote-to-cash workflows) found in full-stack platforms like Alguna or Maxio.

Pricing: Free self-hosted limited version or cloud premium version based on revenue tiers (from $1,000-$3,000 a month).

Ideal use cases

- Startups with plenty of engineering bandwidth: Early-stage companies that want to control costs and avoid SaaS lock-in can start with Lago, leveraging its open-source flexibility while tailoring it to their needs.

- Companies with strict compliance or data residency needs: Businesses in regulated industries (e.g., fintech, healthcare) benefit from self-hosting Lago to keep sensitive billing and usage data fully in-house.

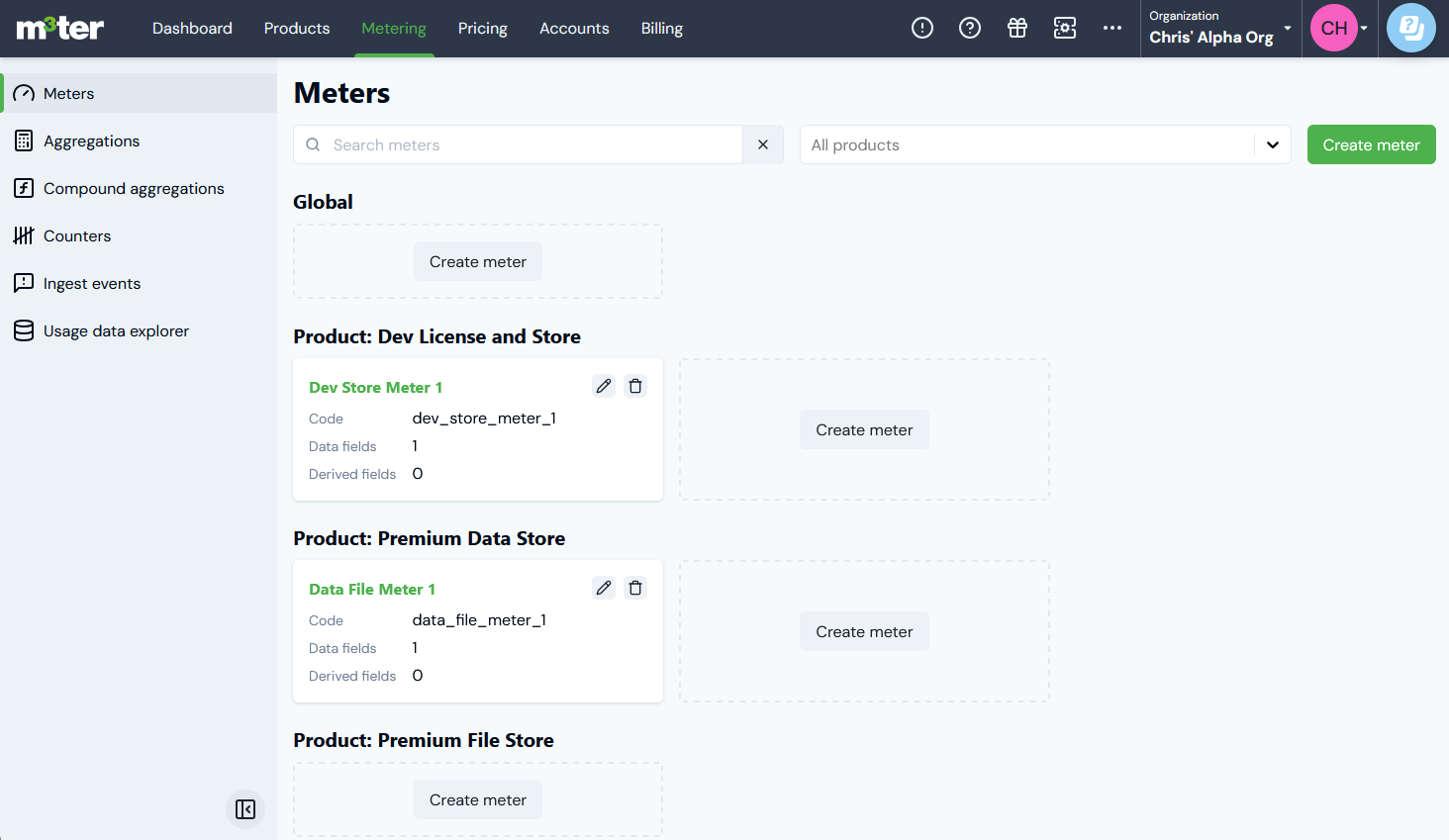

6. M3ter: Best for infrastructure platforms

m3ter (pronounced “meter”) is a UK-based startup that provides a usage metering and billing platform geared towards B2B SaaS scale-ups. Founded in 2020, m3ter’s focus is to help software companies roll out and manage complex usage-based pricing with ease.

With a strong emphasis on precision and real-time data, m3ter is quickly becoming a go-to platform for companies scaling beyond simple subscriptions.

Key strengths

- Robust usage data handling: m3ter puts a lot of emphasis on its metering and rating infrastructure. It will ingest, enrich, and store raw usage events at scale, and crucially, it keeps the unaggregated data so you can audit and change how you compute charges later.

- Strong integrations across the revenue stack: A key strength of m3ter is its ability to connect with tools that teams already use such as Salesforce, HubSpot, NetSuite, and payment gateways. This creates a unified revenue workflow where usage data flows into quotes, invoices, and accounting automatically, reducing manual reconciliation and errors.

- Real-time visibility and analytics: Unlike many billing systems that only surface data at invoice time, m3ter provides live dashboards and analytics. This gives go-to-market, finance, and product teams immediate insights into customer consumption trends, enabling proactive account management and better forecasting.

"What I like most about M3ter is the roadmap acceleration it provides across our entire quote-to-cash process. The platform doesn’t just handle metering and billing; it streamlines operations for multiple stakeholders, from finance to sales and product teams."

Read the full G2 review

Limitations to consider

- Complex implementation: Because of its configurability, m3ter can require a longer setup time compared to simpler tools like Alguna or Stripe Billing.

- Not a full quote-to-cash system: While excellent at usage metering and pricing, m3ter doesn’t cover end-to-end workflows (e.g., CPQ, e-signature) and usually needs to be paired with other systems for a complete solution.

Pricing: m3ter doesn’t list their pricing publicly, but they’re likely tailor pricing to client size and usage.

Ideal use cases

- AI and infrastructure platforms: Companies monetizing by API calls, compute hours, or tokens can rely on m3ter’s real-time metering to ensure billing reflects actual consumption with accuracy.

- Mid-market SaaS companies scaling pricing complexity: When a business outgrows flat subscriptions but doesn’t want to rebuild billing infrastructure, m3ter offers the right balance of flexibility and reliability.

7. Chargebee: Best for companies with basic usage based billing needs

Chargebee is one of the well-known subscription billing platforms that has been around for over a decade. It primarily targets SaaS, e-commerce, and other recurring revenue businesses.

While Chargebee started with subscription focus, it has added usage-based billing features (often termed “metered billing” in Chargebee) to cater to SaaS companies adopting hybrid models.

Key strengths

- All-in-one subscription management: Chargebee covers the entire lifecycle of subscription billing: recurring invoicing, trials, upgrades/downgrades, cancellations, dunning (retrying failed payments), coupons, proration—you name it. This is great for a SaaS that has a combination of fixed subscription components and usage components.

- Rich ecosystem of integrations: Chargebee connects with dozens of payment gateways, CRMs, and accounting platforms. This broad integration landscape reduces friction for finance, sales, and support teams by ensuring billing data flows seamlessly across the revenue stack.

- Compliance and global readiness: One of Chargebee’s strengths is its baked-in compliance features. From automated tax calculation (including VAT/GST handling) to PCI compliance and revenue recognition, Chargebee is designed for companies that need to scale globally without building compliance processes from scratch.

"I appreciate Chargebee's straightforward interface, especially considering all the functionality it offers. It’s a huge time saver and ensures everything is accurate. I like that it automatically handles tax calculations so we're accurately invoicing our customers. It's really cool how we can add our own plans and define what those subscriptions entail, catering for various anomalies in the billing process."

Read the full G2 review

Limitations to consider

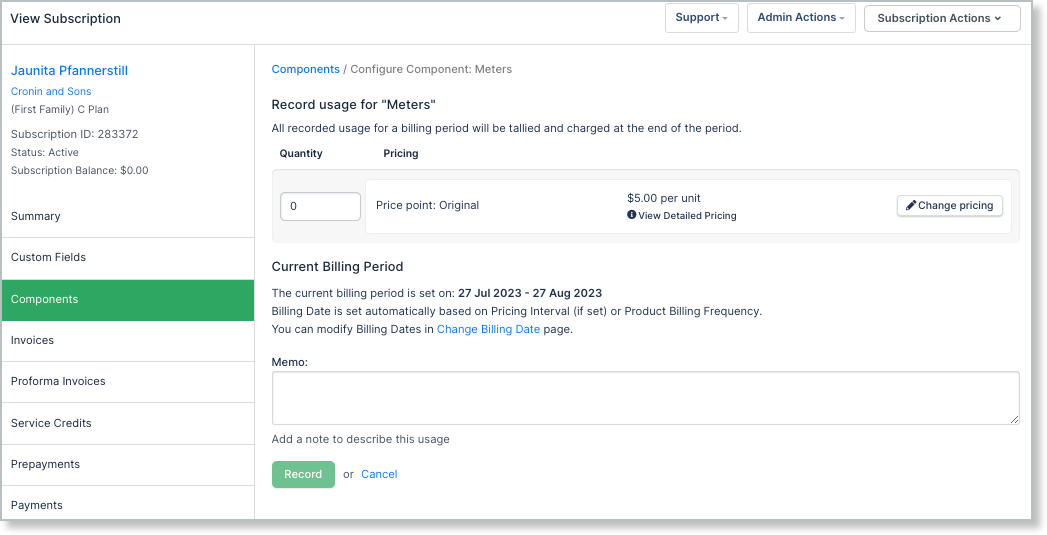

- Usage billing not as real-time or flexible: Chargebee’s usage billing is capable, but it’s essentially post-hoc aggregation. You have to send usage records (via API or import) to Chargebee, which then includes those in the next invoice. It may not handle very granular or high-frequency usage events (like AI tokens or per-API-call billing) as natively as platforms like Metronome or Alguna.

- Complex setup and overhead: Chargebee’s wide feature set comes with a steeper learning curve, and companies often need significant onboarding or support to configure it for advanced usage billing.

Ideal use cases

- Great option for small-to-mid SaaS companies: If you’re adopting usage-based billing in a relatively straightforward way (e.g., X units included, charge $Y per unit over), then Chargebee is a solid option. Startups typically use Chargebee to handle their subscriptions and light usage needs until they either outgrow it or their business model demands a switch.

Pricing: Starts at $599/month for $100K MRR in billings.

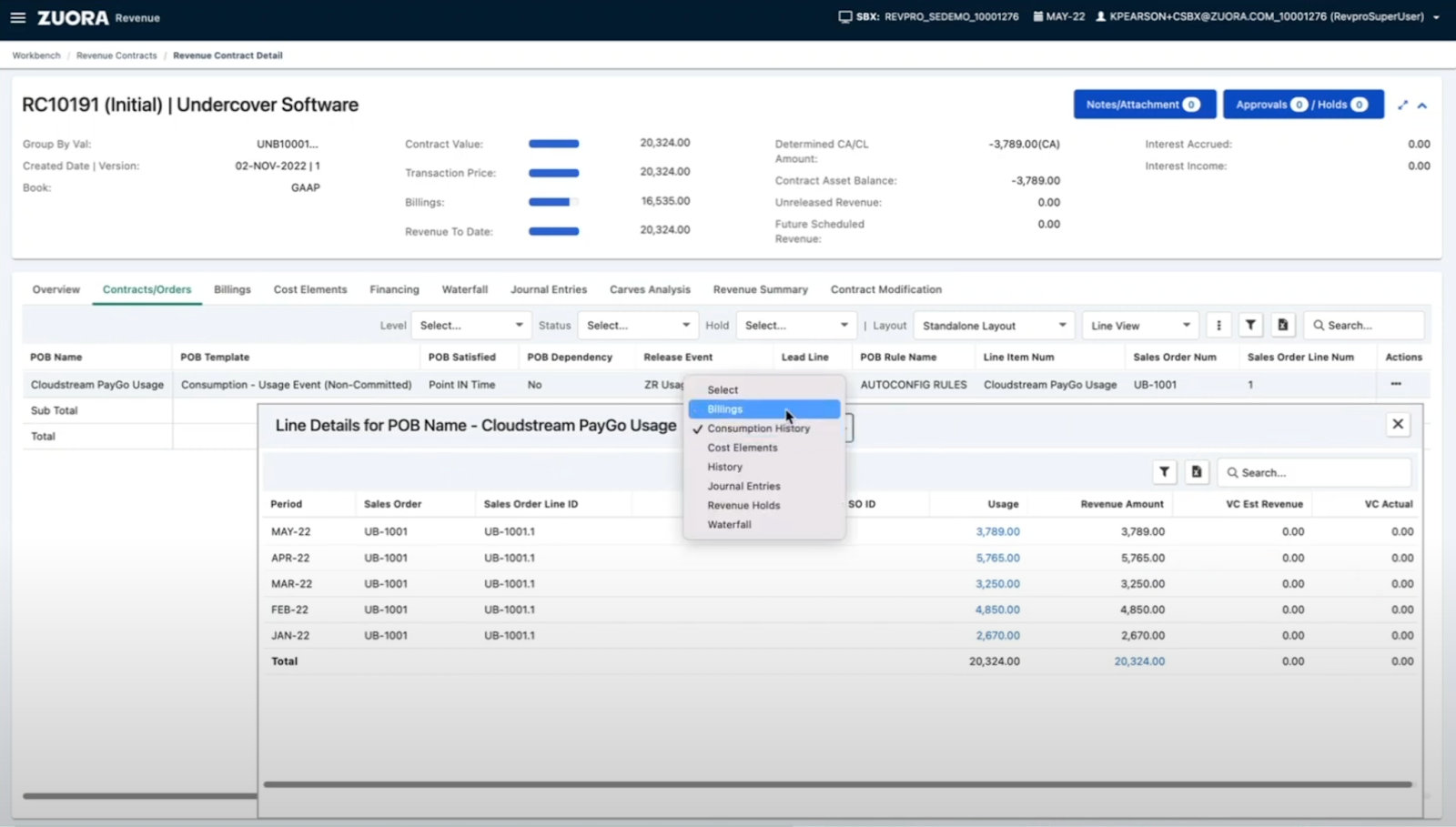

8. Zuora:Best for global enterprises

Zuora is one of the most established players in the subscription management space, widely adopted by large enterprises for complex billing and revenue operations.

While originally built around subscription models, Zuora has steadily expanded to support usage based billing at scale. For companies that already operate with legacy ERP systems and need global compliance, Zuora provides a robust usage based billing platform.

Key strengths

- Handles extreme complexity and scale: Zuora can support very complex pricing: multi-tier, multi-region, one-time charges, subscriptions, usage, minimum commits, overages, discounts, ramp deals – all in one customer account. It also supports advanced usage models like “peak usage” charges, pooled usage, and passthrough fees (charging customers for third-party usage).

- Multi-everything: Zuora supports multiple entities (subsidiaries), multiple currencies, multiple payment gateways, and can produce consolidated or separate financials. If your business sells across different regions or has multiple product lines requiring separate accounting, Zuora handles that (with Enterprise licensing). It’s built for global businesses with complex org structures.

- Robust revenue recognition: Its revenue automation capabilities are tightly aligned with accounting standards, giving finance teams confidence in compliance. Zuora makes it possible to automate recognition of variable consideration, deferred revenue, and multi-element arrangements—critical for companies under strict audit scrutiny.

"The flexible pricing models is the best thing about Zuora. Being able to support multi faceted pricing plans and renewals without a lot of manual work is what stands out. The dashboards and reporting capabilities give good visibility into metrics and KPIs."

Read the full G2 review

Limitations to consider

- High cost and long implementation: Zuora typically requires a large upfront implementation (often 3-6 months with a dedicated project team). They sometimes recommend using an implementation partner. This process can cost tens or hundreds of thousands on top of the software fees. The software itself, as noted, often starts around $50k/year and goes up fast.

- Complex, requires specialized knowledge: Operating Zuora is like using an ERP system and you’ll often need specialized Zuora administrators or training. The interface is powerful but not as slick or intuitive for a casual user. If your team doesn’t have experience, they will after implementing, but it’s a steep learning curve. Also, customizing things via Zuora’s scripting or APIs requires developer time.

- Slower agility: In a large enterprise context this may be fine, but if you’re in a dynamic environment needing quick pivots, Zuora can feel cumbersome. For instance, launching a new pricing model might involve configuring a lot of new product catalog items in Zuora and testing them thoroughly. It’s not something a startup would want to do every week.

Ideal use cases

- Enterprises with complex global operations (multiple subsidiaries, currencies, and tax jurisdictions).

- Companies layering usage on top of subscription revenue where contract management and renewals are equally important.

- Industries with strict compliance requirements, like telecom, media, or enterprise SaaS, where ASC 606/IFRS 15 compliance and deep auditability are non-negotiable.

Pricing: Custom. Estimate ~$50k per year.

9. Maxio (Chargify/SaaSOptics/RevOps.com): Best for revenue recognition

Maxio is the result of a 2021 merger between Chargify (subscription and billing platform) and SaaSOptics (subscription financial analytics and revenue management). In March 2025, they also acquired RevOps.com to further build out their capabilities. By combining these, Maxio aims to be a comprehensive revenue management solution for SaaS.

With roots in subscription billing and financial operations, Maxio has expanded to support usage-based models, aiming to give finance teams deeper reporting and forecasting capabilities alongside billing. It’s a good fit for SaaS businesses that need both monetization flexibility and strong financial analytics.

Key strengths

- Integrated billing and finance analytics: Maxio’s big selling point is that you get both robust billing capabilities and rich financial reporting/metrics in one platform. SaaSOptics (now part of Maxio) was known for producing clean revenue schedules, ARR reports, cohort analyses, etc., from subscription data.

- Full spectrum of billing models: Chargify was quite flexible and that carries into Maxio. It supports usage-based billing (metered components), flat-rate subscriptions, annual contracts with true-ups, one-time charges, discounts, etc. For usage, Chargify historically allowed things like both pre-paid usage (with drawdown) and post-paid metered billing, as well as multiple usage components per plan.

- CPQ and sales-friendly features: Maxio offers a built-in Configure-Price-Quote module (from the Chargify side) to help sales teams create quotes for complex deals, including usage-based plans. This isn’t as easy-to-use as a no-code CPQ, but it helps bridge sales and billing. It also has a self-service portal where customers can log in to view invoices or update payment info.

"What I find most helpful about Maxio is the visibility into the transaction history of a customer as well as future projections of invoices and revenue at that customer level and for the company overall. The upside of Maxio is the reporting capabilities at both a high and detailed level and the variety of information you can generate."

Read the full G2 review

Limitations to consider

- Not as specialized for extreme usage or PLG experiments: Maxio can handle usage, but if you’re a cutting-edge PLG startup wanting to tweak usage pricing weekly or needing real-time event ingestion at tech giant scale, Maxio might not be the very best fit. It’s more tailored to companies who have relatively stable pricing strategies and want reliability and integrated financials.

- Legacy UI parts and learning curve: Since Maxio is the combination of three products, some users have noted that parts of the UI feel dated or inconsistent.

- Payments and taxes not fully included: Maxio integrates with payment gateways but doesn’t process payments itself (similar to Chargebee’s model). So you still need a Stripe, Authorize.net, etc., connected. It also likely relies on integrations for advanced sales tax/VAT handling (though it can store tax info and apply it).

Ideal use cases

- B2B SaaS companies: If you find Chargebee is not robust enough for your financial reporting needs, or you want to avoid the revenue share fees, and on the other hand you’re not ready for the heaviness of Zuora or the build-it-yourself nature of open source, Maxio is a strong contender.

It brings together operational billing and finance analytics in a way that few others do. For a CFO, having billing and ARR reporting in one tool is a dream.

Pricing: Identical to Chargebee, Maxio’s pricing starts at $599/month for $100K MRR in billings.

Checklist: 10 things to consider when evaluating usage based billing software

Choosing a usage-based billing platform is a significant decision that impacts your revenue operations, customer experience, and internal workflows.

Here’s a quick checklist to keep in mind as you evaluate usage based billing software:

SaaS billing software: Features for usage based pricing

- Pricing model flexibility

A billing system should support multi‑dimensional or hybrid pricing out of the box and adapt to your current and planned models. Check that it can handle combinations of volume and usage based dimensions. - Ease of pricing changes

Non‑technical teams should be able to launch pricing changes without engineering help. Look for no‑code tools (like Alguna) or intuitive interfaces that allow finance or product teams to modify plans quickly. - Revenue analytics and insights

A strong usage-based billing platform should give you clear visibility into revenue drivers, customer usage patterns, and churn risk. Look for built-in dashboards, cohort analysis, and exportable data that finance and product teams can use to guide pricing strategy, forecast ARR/MRR, and optimize margins. - Usage ingestion architecture

Platforms process usage data via batch uploads, streaming aggregation or raw event ingestion. Raw‑event architectures offer real‑time control and better agility; evaluate how the vendor handles high‑throughput events and whether it supports idempotency and backfills to avoid billing errors. - Real‑time reporting and transparency

Real‑time reporting across customers is crucial. Look for dashboards that let customers monitor spending, receive alerts and understand cost drivers to build trust and prevent surprise charges. - Integration and API quality

Billing sits at the intersection of product, CRM, finance and customer support. Evaluate API coverage, ergonomics and performance, and confirm that connectors exist for your CRM/ERP systems and can be extended. - Customization and extensibility

Your billing system must align with your go‑to‑market strategy, handle raw usage data and support multiple commercial models. Check whether you can create custom metrics or pricing terms without hitting platform limits. - Scalability and performance

As usage grows, the platform should ingest and rate events concurrently and handle spikes in volume without slowing down. Confirm throughput and latency metrics and ensure the vendor provides SLAs for uptime and API performance. - Compliance and auditability

Billing touches revenue recognition and financial reporting. Vendors serving late‑stage companies should offer SOC‑1/SOC‑2 certifications and have experience working with internal audit teams. Look for audit trails, backfill capabilities and robust error handling to maintain accuracy. - Total cost

Consider the total cost of ownership, including implementation, maintenance and transaction fees. Assess the vendor’s track record, customer references and implementation frameworks to ensure they can support your scale and provide fast deployment.

Frequently asked questions

What is usage based billing software?

Usage-based billing software automates the tracking, pricing, invoicing, and revenue recognition for products charged by consumption (e.g., API calls, tokens, seats, minutes).

Why is usage based billing important for SaaS companies?

It aligns revenue with customer value, reduces churn, and allows flexible pricing that scales with usage.

Do I need usage based billing if my company is still early-stage?

Not always. Very early startups with simple subscriptions might start with lightweight tools. But once pricing models diversify or volumes grow, usage-based billing software prevents errors and revenue leakage.

What's the average cost of usage-based billing software for SaaS?

Most usage-based billing platforms charge either a platform fee plus usage fees or a percentage of billing volume. Typical pricing ranges from $100–$2,000+ per month for startup plans to custom enterprise pricing based on transaction volume, revenue processed, or API usage. Infrastructure-heavy platforms may also charge for metering events or invoices generated.

Which industries benefit most from usage based billing?

AI, SaaS, and fintech companies tend to benefit the most, as their products are often consumption-driven.

What’s the best usage-based billing software for an AI product?

Alguna is the best choice for AI products because it unifies pricing, billing, and revenue reporting, helping teams test and roll out new models faster without engineering bottlenecks.

What’s the leading usage-based billing software?

There’s no single winner for every company, but modern SaaS and AI companies increasingly choose platforms designed for real-time usage metering and flexible pricing models.

What’s the best free usage-based billing software for startups?

If you want free and you have engineering bandwidth, Lago (self-hosted) is one of the best options because it’s open-source and avoids revenue-share fees.

Best tools for implementing usage-based billing in AI services?

Top platforms include Alguna, Metronome, and Orb. Alguna stands out for offering not just metering but also unified contract management and financial reporting for AI companies.

What are the best tools for implementing usage-based billing without coding?

Alguna’s no-code platform enables non-technical teams to configure plans, usage metrics, and invoicing without developer effort. Alternatives like Chargebee or Maxio offer some no-code options, but often with less flexibility.

What are the best options for SaaS revenue management that can handle real-time usage data ingestion and metering?

Alguna is a top choice for SaaS revenue management with real-time usage ingestion and metering, alongside strong alternatives like Metronome, Orb, and m3ter that also specialize in usage-based billing.

What are some of the best alternatives to traditional billing for consumption-based models?

Modern platforms like Alguna, Metronome, and m3ter provide real-time usage tracking and flexible billing logic. These alternatives replace manual spreadsheets and rigid subscription systems.

How do Stripe metered billing tools compare to other competitors

Stripe’s metered billing is simple to set up but limited for complex models or multi-entity setups. Competitors like Alguna and Metronome provide richer flexibility, integrations, and financial reporting.

What platforms offer unified billing for AI model API usage?

Alguna offers unified billing with usage metering, credits, and revenue recognition in one system. Other options like Orb and Metronome handle API usage, but focus mainly on metering.

Future proofing your usage based billing engine

The best usage based billing software depends on your company’s size, usage based billing model, and growth stage. While startups may value ease of setup, scaling SaaS, AI, and fintech companies need robust features like real-time metering, revenue analytics, automated revenue recognition, and global compliance.

By carefully evaluating your requirements and comparing leading platforms, you can choose a billing solution that not only keeps operations accurate but also unlocks pricing innovation and growth.

Full control over recurring and metered billing with Alguna

Design subscription plans, attach usage components, and set up overage rules with zero engineering support. Get up and running in weeks—not months.