• Explore what to expect from automated revenue management solutions like Alguna and others

• Share a vendor checklist for choosing the right revenue management solutions company that's the best fit for your company's growth stage

• Compare five of the top rated automated revenue management solutions in 2025—with Alguna as the AI-native, end-to-end option for SaaS and AI companies

If you work in finance, RevOps, or as a founder, you’re probably feeling the shift in how revenue works. Pricing is moving from simple subscriptions to hybrid pricing and usage-based models, your product team wants to experiment faster, and your board wants clean, audit-ready numbers every month.

That’s where top rated automated revenue management solutions come in.

Revenue management software exists to automate the revenue lifecycle. Instead of stitching together billing tools, spreadsheets, and a separate revenue recognition engine, an automated revenue management software solution centralizes pricing, quoting, billing, usage metering, collections, and rev rec in one place.

That's why this guide is designed to help you shortlist the top rated automated revenue management solutions for modern SaaS and AI companies.

But first, let's cover the basics.

What is revenue management software?

You can think of revenue management as the operating system for how your company earns money.

It answers questions like:

- What do we bill for?

- Seats, API calls, tokens, volume tiers, add-ons?

- When do we bill?

- Upfront, in arrears, on anniversaries, on usage thresholds?

- How do we recognize revenue?

- Ratably, on delivery, on milestone, or based on usage?

A revenue management solution turns that strategy into repeatable, automated workflows.

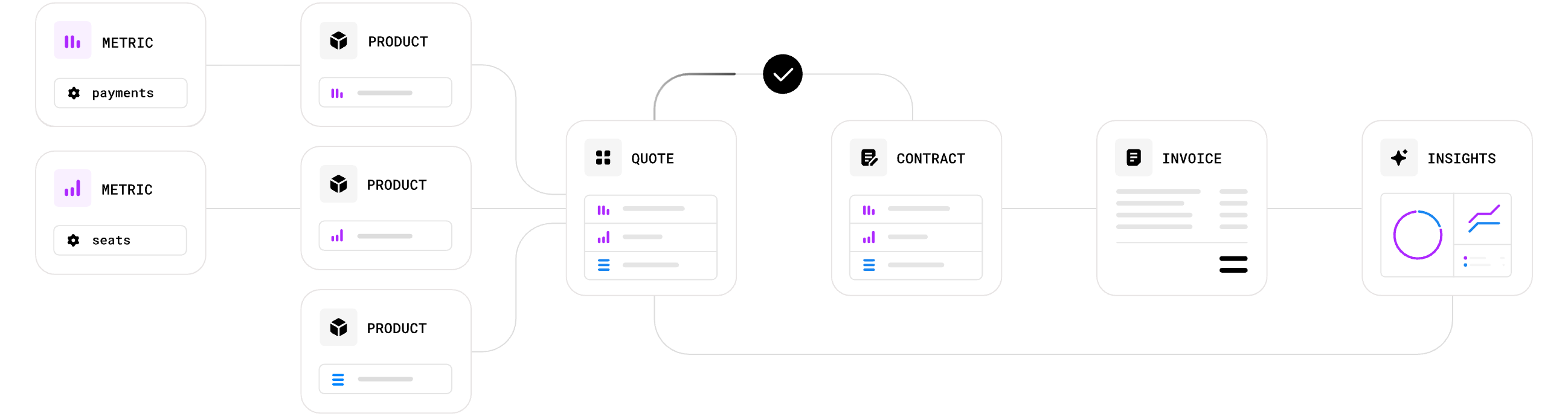

The full quote-to-revenue lifecycle

Modern teams are moving away from fragmented tools toward end-to-end revenue management solutions that cover:

- Pricing and packaging

- Defines plans, add-ons, usage metrics, discounts, and bundles.

- Supports hybrid models that combine subscriptions and metered usage.

- Quoting and contracts

- Generates quotes, approvals, and contracts with accurate pricing and terms.

- Keeps everything in sync with your CRM and ERP.

- Billing and invoicing

- Rates every billable event (seat, API call, token, etc.).

- Generates invoices automatically, including taxes, proration, and credits.

- Collections and dunning

- Automates reminders, retries, and failed payment workflows.

- Reduces manual chasing and Days Sales Outstanding (DSO).

- Revenue recognition and reporting

- Applies ASC 606-compliant policies automatically.

- Feeds your general ledger with clean, consistent data.

- Gives finance, leadership, and investors real-time visibility.

The best billing and revenue management solutions don’t just automate one piece of the puzzle. They create a single system of record for contracts, usage, invoices, and revenue, which is exactly what automated revenue management platforms like Alguna are built to do for B2B SaaS and AI companies.

5 common revenue management challenges

Most teams don’t switch systems because they love doing big migrations. They switch because the pain of staying put becomes unbearable.

Here are the most common revenue management challenges we see when teams are still relying on legacy tools or spreadsheets.

1. Manual workflows that don't scale

- Finance teams exports CSVs from Stripe or CRM every month

- RevOps build complex spreadsheets to simulate revenue schedules

- Engineering asked to hard-code pricing logic because tools can’t keep up

This creates slow month-end close, high error rates, and a heavy dependency on a few “Excel heroes.”

2. Disconnected billing and revenue recognition

When billing and revenue recognition live in separate systems, you get:

- Mismatches between invoiced amounts and recognized revenue

- Extra reconciliation steps every month

- Higher audit risk and more back-and-forth with external auditors

A modern billing and revenue management solution keeps billing events and revenue schedules in one unified data model, so every invoice, usage event, and contract change is reflected downstream.

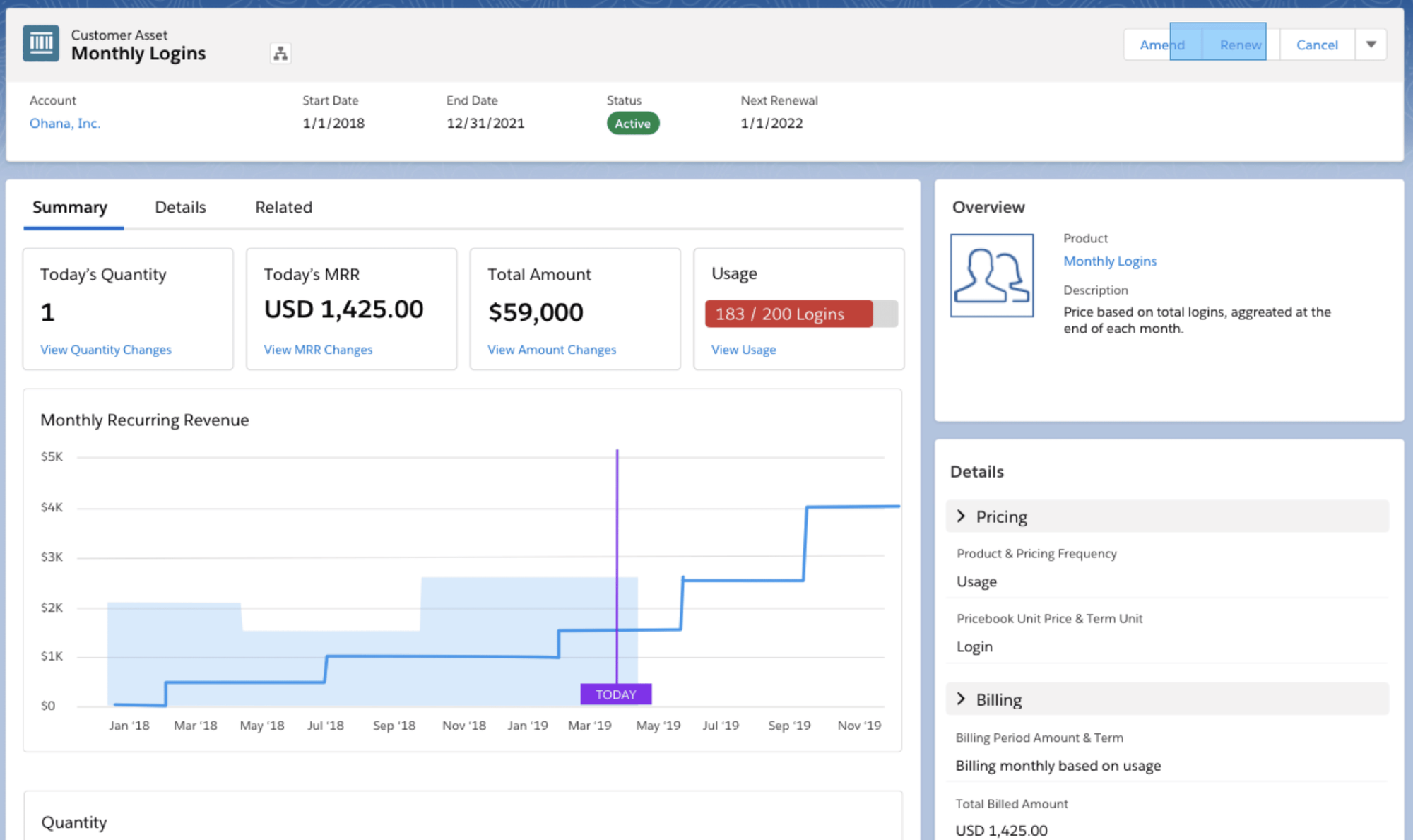

3. Recurring revenue complexity

Most SaaS and AI companies now have:

- Recurring subscriptions

- Usage-based add-ons

- One-off setup fees or professional services

Managing this mix manually is painful. A recurring revenue management solution should support all of these in a single contract—without finance needing to rebuild spreadsheets every time pricing changes.

4. Multi-entity and multi-currency chaos

As you grow, you might spin up:

- Multiple entities for different regions

- Different currencies, tax rules, or banking relationships

Legacy tools often fall down here, leaving you with:

- Inconsistent data across entities

- Separate instances or manual workarounds

- Difficulty producing consolidated revenue reporting

This is where enterprise revenue management solutions like Zuora or Alguna’s multi-entity capabilities become increasingly important.

5. Limited visibility in legacy tools

Without a real-time picture of revenue, teams struggle to answer basic questions:

- What’s our ARR, MRR, and net retention by segment?

- How much revenue is tied to usage?

- How will new pricing impact revenue next quarter?

These revenue management challenges are exactly why automated, AI-native, end-to-end revenue management solutions have moved from “nice to have” to “essential.”

What to expect from modern revenue management solutions

If you’re evaluating a modern revenue management software solution, here’s what you should look for in 2026.

Automation across the billing and revenue lifecycle

At minimum, your revenue management solution should:

- Generate invoices automatically from contracts and usage

- Apply tax, discounts, and proration without manual work

- Create revenue schedules and post journal entries to your ERP

- Sync changes (upgrades, downgrades, extensions) to both billing and revenue

AI-powered revenue management automation

The next step is AI-powered revenue management automation:

- Automatically detecting anomalies in usage or billing

- Flagging potential revenue leakage

- Suggesting pricing or discount changes based on cohort performance

- Predicting revenue under different pricing scenarios

For most scaling SaaS and AI teams, AI-powered revenue management automation is the only realistic way to keep up with usage data and complex contracts without overwhelming finance and RevOps.

AI is not just a buzzword here. For modern AI and SaaS companies, it’s how you keep up with huge volumes of usage data and complex contract terms without turning your finance team into full-time data engineers.

Support for hybrid and usage-based pricing

With usage-based pricing adoption nearly doubling in the last five years, it’s critical your platform supports:

- Per-unit metrics (e.g., API calls, tokens, seats, storage)

- Tiered, volume, or staircase pricing

- Hybrid models combining subscriptions and usage

- Minimum commitments, overages, and credit-based pricing

Unified, “easy” revenue management

You’ll often see buyers search for easy revenue management solutions.

In practice, “easy” often means:

- No-code configuration for pricing, workflows, and rules

- Clear, opinionated defaults for rev rec policies

- A single UI and data model instead of toggling between 3–5 tools

- Short implementations measured in weeks, not quarters

How to choose a revenue management solutions company

Once you’re clear that you need one of the top rated automated revenue management solutions, the hard part is choosing the right revenue management solutions company.

Here’s a practical checklist to evaluate vendors.

1. Pricing model flexibility

Your revenue management software solution should support:

- Subscriptions, usage-based, and hybrid pricing

- Per-seat, per-unit, tiered, and volume-based models

- Discounts, credits, and ramped contracts

- Minimum commitments and overage logic

If every pricing experiment requires engineering or a new spreadsheet, it’s a red flag.

2. Integration depth: netsuite, salesforce, and your ERP

Look closely at:

- Native integrations with NetSuite, QuickBooks, or other ERPs

- How deeply it integrates with Salesforce or your CRM

- Whether it becomes the source of truth for product usage and billing

Maxio, for example, is known as a strong revenue management solution for NetSuite finance teams, while Alguna focuses on being the AI era quote-to-revenue engine for modern SaaS and AI companies.

3. Automation depth and AI capabilities

Ask:

- Which tasks are fully automated vs. semi-manual?

- Does the platform provide anomaly detection or predictive insights?

- Can it handle AI-powered revenue management automation at scale?

A true end-to-end revenue management solution should not require weekly CSV uploads or custom scripts to stay accurate.

4. Multi-entity, multi-currency, and compliance

If you already have—or plan to have—multiple entities:

- Confirm support for entity-specific rules, currencies, and tax codes

- Check how consolidated reporting works

- Evaluate audit trails, approvals, and SOC/ISO certifications

This is where more enterprise revenue management solutions like Zuora play, but modern platforms like Alguna offer multi-entity support without the heavy enterprise overhead.

5. Time to value and implementation model

Finally:

- How long does implementation typically take?

- Do you get white-glove onboarding or are you on your own?

- How much engineering time does the vendor require?

Alguna’s customers often highlight how quickly they can get to value.

- Juan Burgos, Co-founder and CEO at Haven AI

Comparison overview: Top rated automated revenue management solutions

⚠️ Pricing details and features can change frequently. Treat this as directional and always confirm with the vendor.

| Platform | Best for | Pros | Cons | Pricing* |

|---|---|---|---|---|

| Alguna | AI and SaaS companies needing an AI-native, end-to-end billing and revenue management solution | AI-driven automation, unified quote-to-revenue, strong usage-based billing, multi-entity support, goes live in weeks | Best fit for SaaS and AI vs traditional telecom and media, not built for highly bespoke on-prem accounting | Paid plans start at $699/month. No revenue cut. Onoarding included. |

| Agentforce Revenue Management | Enterprises standardized on Salesforce | Deep Salesforce-native integration, strong workflow automation, enterprise controls | Heavy configuration, longer implementations, higher TCO | Custom pricing. |

| Chargebee | Startups and mid-market SaaS with recurring subscriptions | Mature subscription engine, good dunning, wide payment integrations | Usage metering is limited, rev rec can feel bolt-on, complex experiments require workarounds | $599/month for up to $100,000 in billings. |

| Maxio | Finance teams needing strong rev rec and reporting, often on NetSuite | Strong ASC 606 engine, detailed reporting, good for established SaaS | UI can feel dated, usage-based billing less flexible, implementations can be long | P$599/month for up to $100,000 in billings. |

| Zuora | Large enterprises needing enterprise revenue management solutions | Robust billing + payments + rev rec, broad ecosystem, multi-entity | Very heavy implementation, ongoing admin overhead, expensive for smaller teams | Enterprise contracts only. Estimate min. $50k/year. |

5 top rated automated revenue management solutions for scaling revenue teams

There are dozens of tools in this space, but for most SaaS and AI companies, the shortlist of top rated automated revenue management solutions often includes:

- Alguna

- Agentforce Revenue Management

- Chargebee

- Maxio

- Zuora

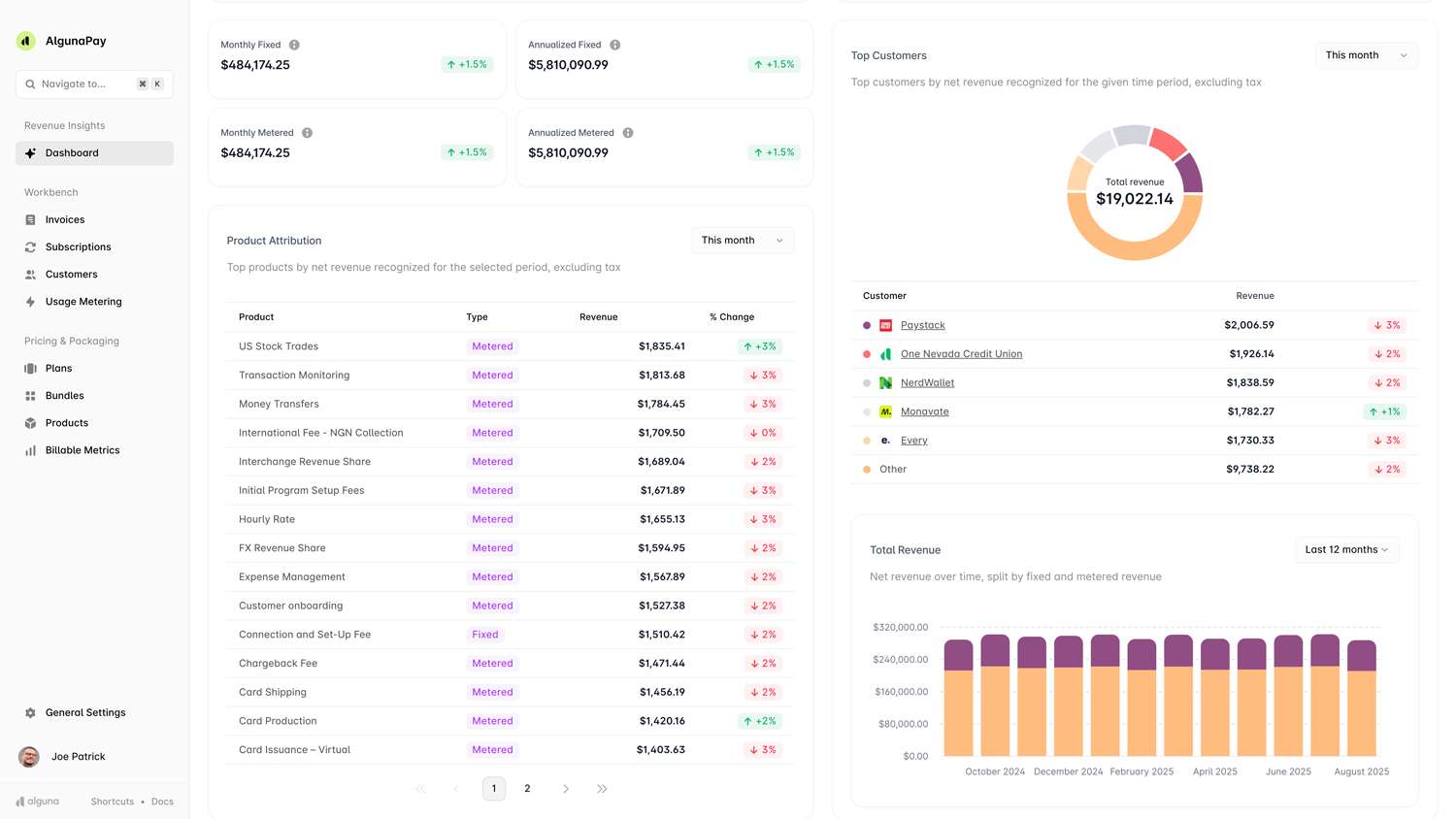

Alguna: AI-powered revenue management automation and insights platform

Alguna is an AI-native end-to-end revenue management solution that unifies pricing, quoting, billing, usage metering, invoicing, collections, and revenue recognition in a single system of record.

Purpose-built for B2B SaaS, AI, and fintech companies, Alguna is backed by Y Combinator and recently raised a $4M seed round to power the next generation of revenue automation.

Rather than patching together Stripe, point tools, spreadsheets, and a separate rev rec tool, teams use Alguna to:

- Launch new pricing models in minutes in a no-code, visual builder

- Eliminate revenue leakage by metering every billable event

- Automate ASC 606-compliant revenue recognition

- Give finance, RevOps, sales, and product a single source of truth for all revenue movements

Customers highlight both the flexibility and the partnership.

- Marc Koskela, Director, Growth Marketing at ComplyAdvantage

Key features

- Usage metering for any metric (e.g., API calls, tokens, storage)

- Automated dunning and collections—covered in detail in our guide to automated dunning tools

- End-to-end revenue recognition with ASC 606 support

- Multi-entity and multi-currency support out of the box

- Flexible, no-code pricing and packaging changes

- Real-time dashboards for ARR, MRR, usage, and cohort performance

Pros

- AI-native billing and revenue management solution

- Unified quote-to-revenue: pricing, quoting, contracts, billing, rev rec, and reporting

- Strong support for complex usage-based and hybrid pricing (ideal for AI workloads)

- Multi-entity and multi-currency support

- No-code configuration for pricing and workflows

- Fast implementation (often 2–4 weeks) with white-glove onboarding

Cons

- Optimized for SaaS, AI, and fintech which means it's less suited to e.g. legacy telecom or media billing

- Not designed for highly bespoke, on-premise-only accounting workflows

- Not suited for very-early stage startups with very simple billing setups

Best for

- Scaling SaaS and AI companies with complex usage-based or hybrid pricing

- Teams tired of maintaining revenue spreadsheets across billing, rev rec, and CRM

- Finance and RevOps leaders who want a single, AI-native revenue management solution instead of five disconnected tools

Pricing

Alguna offers transparent pricing with paid plans starting at $399/month. This includes white-glove onboarding and migration. Alguna never takes a revenue cut.

Agentforce Revenue Management (formerly Salesforce Revenue Cloud): Best for Salesforce-first enterprises

Agentforce Revenue Management (formerly Salesforce Revenue Cloud) is a Salesforce-native tool focused on enterprises that live primarily inside the Salesforce ecosystem.

Because it’s embedded in Salesforce, it can leverage native workflows, approvals, and reporting. That makes it appealing for teams that want a revenue management software solution that feels like an extension of their existing CRM.

Key features

- CPQ-style quoting and contract management inside Salesforce

- Workflow automation via Salesforce flows and approval chains

- Integration with downstream billing and rev rec tools

- Reporting and dashboards for bookings, billings, and revenue

Pros

- Deep Salesforce-native integration for quoting, approvals, and workflows

- Strong enterprise-grade controls and permissions

- Familiar UI for Salesforce-heavy teams

- Centralized customer and revenue data inside Salesforce

Cons

- Heavier configuration effort compared to modern platforms like Alguna

- Longer implementation cycles, which slows time to value

- Can be expensive at scale when you factor in Salesforce licensing and admin time

- Less attractive if your GTM stack isn’t already fully standardized on Salesforce

Best for

- Enterprises deeply committed to Salesforce as their system of record

- Organizations with internal Salesforce admins who can manage complex configuration

- Companies prioritizing tight CRM integration over a standalone easy revenue management solution

Pricing

Agentforce pricing is typically enterprise-only and quote-based. Expect a mix of Salesforce licenses, add-on modules, and professional services.

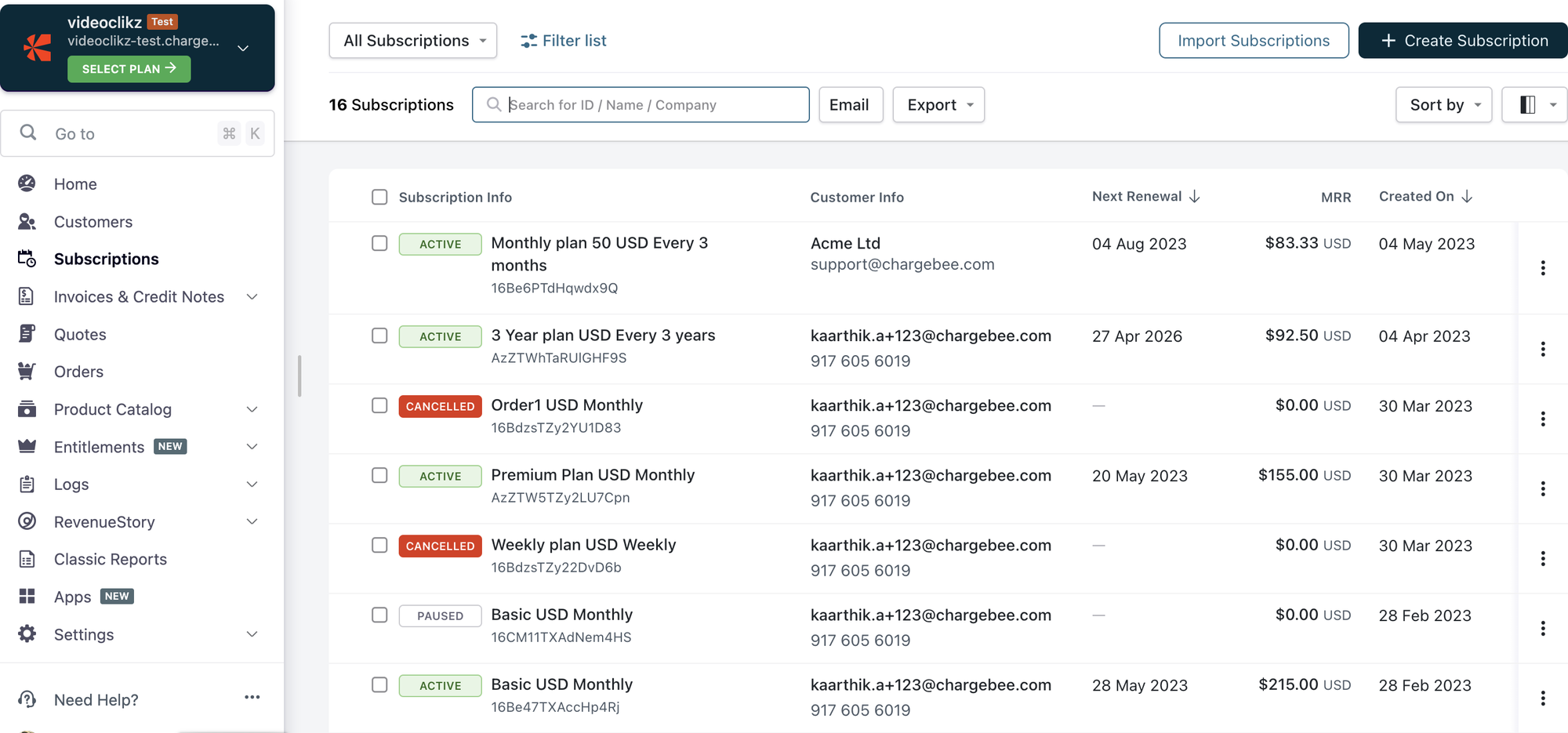

Chargebee: Best recurring revenue management solution for subscription-first SaaS

Chargebee is a well-known subscription management and recurring revenue management solution that has expanded into revenue recognition in recent years. For many startups and mid-market SaaS companies, it’s often the first “real” billing platform after outgrowing simple tools like Stripe.

Chargebee excels when you have straightforward subscriptions, want strong dunning and collections, and need integrations with multiple payment gateways.

Key features

- Subscription plan and add-on management

- Coupons, discounts, and trials

- Dunning, collections, and retry logic

- Revenue recognition module for ASC 606 compliance

- Integrations with CRMs, ERPs, and payment gateways

Pros

- Mature subscription and recurring billing engine

- Strong dunning and collections capabilities

- Wide range of payment gateway integrations

- Good ecosystem of documentation and community content

Cons

- Native usage metering is limited compared with AI-era tools like Alguna

- Complex, hybrid, or per-customer pricing experiments can be hard to model

- Revenue recognition can feel bolt-on rather than deeply integrated

- Implementation effort grows with pricing complexity

Best for

- Subscription-first SaaS with moderate complexity

- Teams that prioritize recurring billing and dunning over advanced usage metering

- Companies that may later graduate to more AI-native revenue management solutions

Pricing

$599/month for up to $100,000 in billings.

Maxio: Best revenue management solution for NetSuite finance teams

Maxio (often known from the Chargify + SaaSOptics + RevOps.io merger) positions itself as a robust revenue management software solution for SaaS finance teams, especially those on NetSuite.

It’s strongest in ASC 606 revenue recognition and detailed financial reporting. If your biggest pain is rev rec and reporting rather than pricing experimentation, Maxio is often on the shortlist.

Key features

- Revenue recognition engine compliant with ASC 606

- Deferred revenue schedules and forecasting

- Financial dashboards and SaaS KPIs

- Integrations with CRMs and billing systems

- NetSuite-focused workflows for finance teams

Pros

- Very strong ASC 606 revenue recognition capabilities

- Detailed financial reporting tailored to SaaS metrics

- Solid integrations with NetSuite and other ERPs

- Good fit for established, compliance-heavy SaaS orgs

Cons

UI/UX is often described as dated compared with newer tools

- Usage-based billing and complex pricing can require workarounds

- Implementations can be lengthy, especially for multi-entity setups

- Less friendly for non-finance stakeholders (e.g., sales, product)

Best for

- Mid-market SaaS companies with heavier compliance requirements

- Finance teams already living in NetSuite who want a dedicated revenue management solution for NetSuite

- Companies where rev rec is the primary pain point, more so than billing innovation

Pricing

Maxio's pricing is pretty much identical to Chargebee. That means paid plans start at $599/month for up to $100,000 in billings.

Zuora: Best enterprise revenue management solution for global teams

Zuora is a legacy player in the space, offering enterprise revenue management solutions for subscription and usage-based businesses. It offers a broad suite covering billing, payments, and revenue recognition, often used by large, global enterprises.

If you need enormous scale, complex multi-entity setups, and are comfortable with a heavier platform, Zuora is usually in the conversation.

Key features

- Subscription and usage-based billing

- Payment orchestration and collections

- Revenue recognition and ASC 606 compliance

- Multi-entity and multi-currency consolidation

- Broad integration ecosystem

Pros

- Highly robust billing, payments, and rev rec capabilities

- Designed for large, global enterprises with complex setups

- Mature ecosystem of partners, consultants, and integrations

- Strong multi-entity and multi-currency support

Cons

- Very heavy implementation projects (often months to more than a year)

- Requires dedicated admin or even a small internal team to manage

- Expensive for small and mid-market companies

- Can feel overpowered if you’re not a large enterprise

Best for

- Large enterprises with complex subscription operations

- Companies with multi-year contracts, many entities, and strict compliance needs

- Teams that can support a dedicated Zuora admin or SI partner

Pricing

Estimate $50,000 per year along with additional cost for add-ons and integrations.

Revenue management case study: Complete revenue visibility with Alguna

To make this concrete, let’s look at a revenue management case study from one of Alguna’s customers, Glyphic AI.

Glyphic needed:

- A clear, real-time overview of revenue movements

- Support for modern, usage-heavy pricing

- A single system of record instead of juggling Stripe exports and spreadsheets

Alguna’s team made me feel completely at ease: they answered every question, laid out a clear migration plan, and kept me in the loop throughout. The process turned out to be far smoother than I expected, with most of the heavy lifting handled behind the scenes.”

- Adam Liska, Co-founder and CEO of Glyphic AI

Post-migration, Glyphic saw:

- Faster onboarding for new customers

- Smooth exports and invoicing (“everything just worked the way it should”)

- The ability to support self-service accounts that were previously too labor-intensive

This revenue management case study is a good example of what happens when you move from patched-together tools to an AI-native, end-to-end revenue management solution like Alguna.

Frequently asked questions: Automated revenue management solutions

Below are some of the most common questions we see from founders, CFOs, and RevOps leaders when they’re considering automated revenue management solutions.

What is an automated revenue management solution?

An automated revenue management solution is a platform that manages the full lifecycle of pricing, billing, revenue recognition, and reporting with minimal manual work.

Instead of spreadsheets and manual journal entries, you get:

- Automated billing and revenue schedules

- Real-time dashboards for ARR, MRR, and usage

- Built-in compliance (e.g., ASC 606)

Alguna is an example of an AI-native billing and revenue management solution designed specifically for SaaS and AI companies.

How is revenue management different from billing?

Billing is about sending invoices and collecting cash. Revenue management is broader, it includes:

- Pricing and packaging

- Quoting and contracts

- Usage metering

- Billing and collections

- Revenue recognition and reporting

A modern revenue management software solution should include billing, but also connect deeply to your pricing, contracts, and financial reporting.

Who owns revenue management in a SaaS company?

Ownership is usually shared:

- Finance owns revenue recognition and reporting

- RevOps owns process, systems, and GTM data

- Product and sales collaborate on pricing and packaging

That’s why an end-to-end revenue management solution like Alguna is so valuable, it gives all three groups a single system of record.

Do I need a separate tool if I already use Stripe Billing?

It depends on your complexity. For early-stage companies with simple subscriptions, Stripe Billing may be enough.

But once you introduce:

- Usage-based pricing at scale

- Multi-entity and multi-currency

- Complex contracts and commitments

- Strict audit and reporting requirements

You’ll likely need a dedicated revenue management solution that sits above payment processors. Our guide on Stripe Billing alternatives explores when this shift usually happens.

If you’re at that inflection point, it’s usually time to evaluate a few top rated automated revenue management solutions rather than relying on billing alone.

How long does it take to implement a revenue management platform?

For heavy enterprise revenue management solutions like Zuora, implementations can take many months and require external consultants.

AI-native platforms like Alguna typically go live in 2–4 weeks, with white glove onboarding and minimal engineering time.

The actual timeline depends on:

- Number of entities and currencies

- Complexity of existing pricing and contracts

- Data hygiene and migration scope

Will an automated revenue management solution work with my ERP and CRM?

Most modern revenue management solutions companies integrate with:

- ERPs like NetSuite, QuickBooks, and Xero

- CRMs like Salesforce and HubSpot

- Payment processors like Stripe, Adyen, and Braintree

You’ll want to verify integration depth, especially if you rely heavily on NetSuite or Salesforce. Alguna, for example, is designed to sit cleanly between GTM tools and your ERP as a unified quote-to-revenue layer.

The future of revenue management

Looking ahead, the future of revenue management is:

- AI-driven: Tools will increasingly detect anomalies, forecast revenue, and recommend pricing changes automatically.

- Usage-first: With 60% of companies either implementing or experimenting with usage-based pricing, consumption models are becoming the default.

- Unified and real-time: Teams will move away from fragmented billing and rev rec stacks toward a single, AI-native platform that gives them real-time visibility.

For SaaS and AI companies, the winners will be those who:

- Treat revenue as a product, not a back-office chore

- Use an AI-native, end-to-end revenue management solution to adapt pricing at the speed of the market

- Give finance, sales, and product a shared, accurate view of every dollar earned

See how an AI-native billing and revenue management solution can simplify your stack and unlock faster growth

If you’re comparing top rated automated revenue management solutions and want an AI-native platform built specifically for SaaS and AI companies, Alguna should be at the top of your list.

With Alguna, you can:

- Launch new pricing models in days instead of quarters

- Eliminate revenue leakage with precise, automated usage metering

- Automate billing and ASC 606 revenue recognition end to end

- Give your whole team real-time, trusted revenue insights