• Discover five leading tools to reduce revenue leakage from complex contracts in the USA: Alguna, Chargebee, Maxio, Zuora, and Sage Intacct.

• Learn how each stacks up on automation, scalability, reporting, compliance, and total cost of ownership.

Revenue leakage has quietly become one of the biggest hidden costs in US subscription and SaaS companies.

Between contract misalignment, manual billing, and missed renewals, businesses lose an estimated 3–5% of topline revenue every year. And what sounds like a small percentage actually represents millions.

The kicker? This happens without companies realizing it.

Much of that leakage starts with complex contracts.

That's why in this post, we review five top tools that help US based companies detect, prevent, and recover revenue leakage from complex contracts.

Whether you’re managing multi-year SaaS agreements, usage-based billing, or complex renewals, these solutions show how automation and integrated data can finally close the gaps that spreadsheets can’t.

What causes revenue leakage in complex contracts?

Revenue leakage often creeps in when complex contracts bundle multiple products, services, and pricing terms. The more moving parts, the easier it is for billable items to slip through the cracks.

Here are the most common causes of revenue leakage in complex contracts:

- Siloed systems: When contracts, billing, and usage data reside in separate tools, manual data entry results in missed or delayed invoices.

- Missed renewals or unbilled usage: Teams often overlook or forget to account for price increases or customers exceeding usage limits during the renewal process.

- Misaligned pricing terms: Without automated enforcement, it’s easy to misapply custom deals and time-bound discounts.

- Poor visibility into contract changes: Contracts evolve with add-ons, amendments, and new seats, but many of those updates never reach billing. Sales might approve an upgrade, yet finance never invoices it.

- Operational inefficiencies and human error: Manual billing invites mistakes, typos, forgotten renewals, or spreadsheet miscalculations that can persist for months.

How to detect and prevent revenue leakage in complex contracts

Stopping revenue leaks starts with early detection and proactive prevention. Here are several strategies and tools US companies can use to identify leaks and plug them before they grow:

- Use AI for contract data extraction and audits: AI tools can scan executed contracts, extract key terms like pricing or renewal dates, and instantly compare them to what’s in your billing system. Unlike humans, AI never misses a clause or forgets a rate change; it enforces contract-compliant billing around the clock.

- Automate quote-to-cash workflows: Quote-to-cash (Q2C) automation integrates CRM, CPQ, billing, and revenue recognition, ensuring that once a deal closes, invoicing and accounting processes occur automatically. This closes gaps between systems and eliminates spreadsheet-based billing errors.

- Sync billing with revenue recognition and accounting: Integrating billing with your accounting or revenue recognition system helps reconcile what’s been earned with what’s been billed. Real-time dashboards compare bookings, billings, and collections, instantly highlighting anomalies and catching issues early.

- Monitor usage and renewals in real-time: Track consumption against contract entitlements to trigger alerts or auto-charges for overages. Use renewal reminders and automated workflows to prevent missed renewals or expired discounts. With real-time monitoring, every renewal and usage event is captured and billed.

- Run regular revenue-leakage audits: Audits comparing contracts, invoices, and collections can reveal hidden gaps, like customers with active service but no invoices, or uplift clauses that have never been applied. Some companies use an internal earned-versus-billed report to quantify leakage each quarter and spot weak links.

5 tools to reduce revenue leakage from complex contracts in the USA: Comparison overview

Many software platforms have emerged to help companies plug revenue leaks, especially for those managing complex contracts.

Below is a high-level comparison of five leading tools to reduce revenue leakage from complex contracts, outlining their core focus, key strengths, and pricing.

| Tool | Core focus | Best for | Key strengths | Pricing |

|---|---|---|---|---|

| Alguna | AI-native quote-to-cash automation | Scaling SaaS, FinTech, AI companies | Unified billing + CPQ + contracts; no-code automation; US focus | From $399/month (includes onboarding) |

| Chargebee | Subscription billing | Mid-market SaaS | Flexible invoicing; strong dunning; limited contract sync | From $599/month |

| Maxio | Finance automation | Growth-stage SaaS | Accounting integration; strong reporting; less agile for hybrid pricing | From $500/month |

| Zuora | Enterprise billing | Large enterprises | Highly scalable; advanced reporting; complex to implement | Custom pricing (enterprise tier) |

| Sage Intacct | Financial management and revenue recognition | Accounting-focused teams | Excellent GAAP compliance and reporting; weaker on contract-to-cash automation | From $400/month (customized by modules) |

Why Alguna is the best tool to reduce revenue leakage from complex contracts (USA)

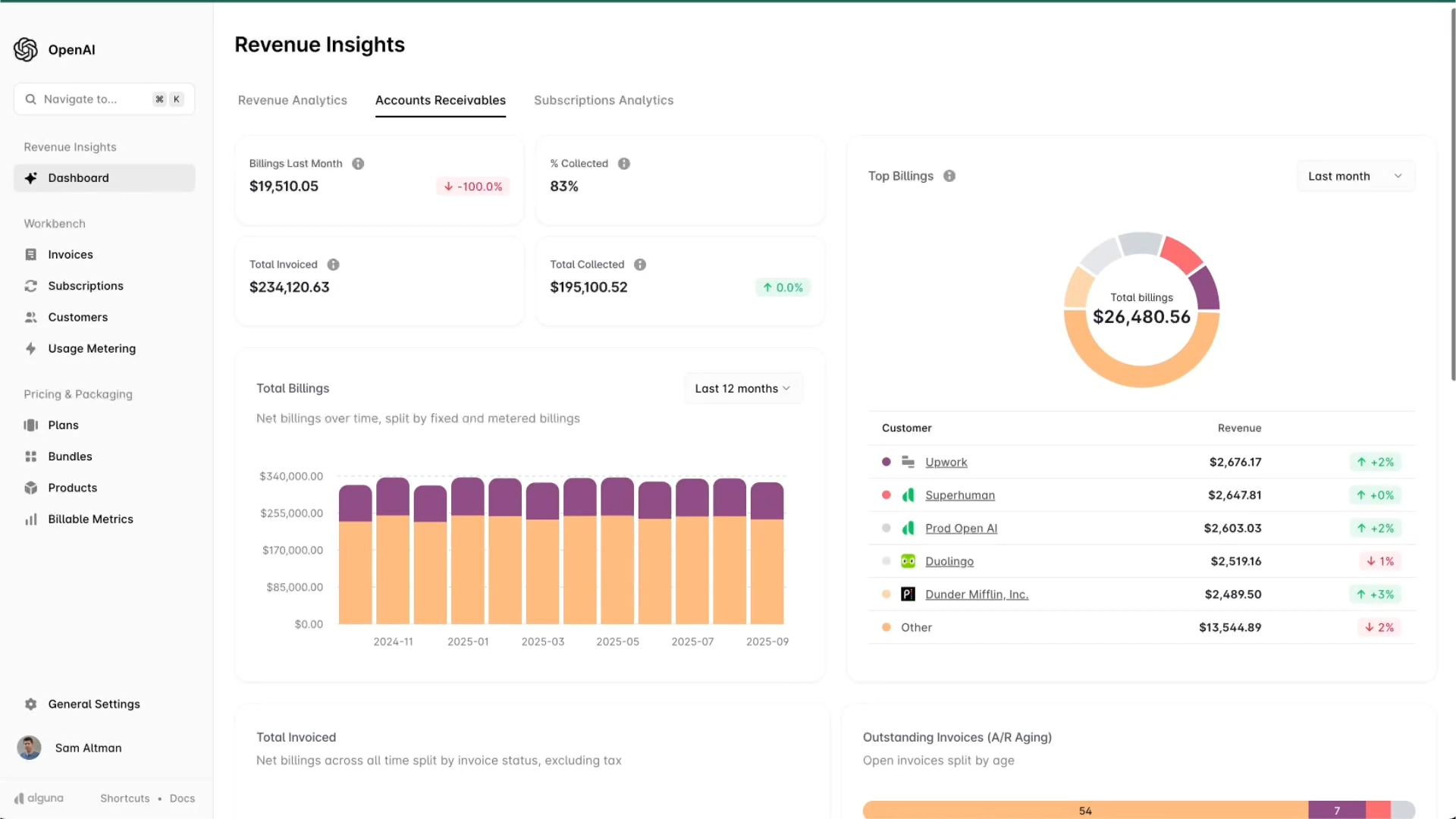

Alguna is an AI-native quote-to-cash platform that unifies quoting, contracts, billing, and revenue recognition in one place, eliminating leakage from complex and hybrid contracts.

Designed by seasoned fintech product managers and engineers, Alguna was built for both speed and accuracy, giving RevOps and finance teams real-time visibility across every deal, subscription, and usage stream.

This reduces revenue leakage by:

• Automating contract imports from legacy systems or CRMs

• Keeping billing and revenue recognition fully in sync

• Maintaining human oversight where it matters

• Saving hours per contract (or entire headcount equivalents)

Learn more

Key features:

- AI-driven contract parsing: Use Contracts AI to digitize contract terms (pricing, discounts, renewals) to ensure no manual errors.

- Alguna MCP: Enable AI assistants to interact directly with your Alguna account using nmatutal language. For example, prompt it to “Show me all customers with unpaid overages this quarter,” and receive instant answers.

- No-code CPQ for hybrid pricing: Enables teams to configure complex pricing models, such as subscriptions and usage-based fees, without writing code.

- Unified quote-to-cash workflow: Opportunities won in the CRM flow directly into Alguna for invoicing and billing. Billing, payments, and revenue recognition are managed in one place, reducing siloed data and manual reconciliations.

- Real-time dashboards and alerts: Live dashboards show billing status, upcoming renewals, and any revenue at risk.

- Built-in compliance and audit trails: Financial reports are aligned with GAAP/IFRS standards, simplifying audits and streamlining the month-end close process.

Pros:

- Unified all-in-one platform: Eliminates separate CPQ, CLM, subscription billing, and revenue accounting tools, meaning fewer integrations and fewer leaks.

- AI and automation minimize errors: Automating contract interpretation and billing removes human error.

- Fast deployment and easy changes: A no-code design enables even non-engineers to launch complex pricing updates or new product bundles quickly.

- US based support and expertise: Dedicated US support and baked-in compliance (ASC 606, sales tax, etc.) ensure accuracy and peace of mind for companies operating in the US market.

- Complete revenue insight: By unifying sales, billing, and finance, Alguna delivers real-time visibility into earned, billed, and collected revenue, so leaks have nowhere to hide.

After implementing Alguna, Glyphic had its second best month of all time in terms of added revenue. 75% of that revenue came from upsells that previously hadn’t been billed for because it simply was too much of a pain.

Read case study

Cons:

- Newer platform: Founded in 2023 by former Primer and Dojo team members, backed by Y Combinator.

- Continuous evolution: As a fast-growing platform, Alguna releases new features frequently. While that means the product evolves quickly, users may encounter occasional UI updates or need to stay current with new capabilities.

Best for:

- High-growth SaaS, fintech, or AI companies with hybrid pricing models or multi-entity billing needs. Ideal for startups and scaleups that charge a base fee plus variable consumption.

- US based companies that need strong revenue recognition compliance (ASC 606) and responsive local support.

- RevOps and finance teams seeking autonomy from engineering, faster go-lives, and end-to-end visibility across contracts, billing, and revenue.

Pricing: Alguna offers a free starter tier, with paid plans starting at $399/month for the full platform, including white-glove onboarding and migration. Pricing is flat, predictable, and transparent with no revenue cut or hidden fees.

Building a leak-proof revenue engine for complex contracts

Revenue leakage in complex contracts isn’t just a finance problem; it’s a structural one. When quotes, contracts, and billing systems don’t speak the same language, money slips through unnoticed. But with today’s tools to reduce revenue leakage from complex contracts, U.S. companies are closing those gaps for good.

The solution lies in automation and alignment. Modern platforms like Alguna unify contract data, billing, and revenue recognition into one flow, so every term is enforced, every renewal billed, and every dollar collected. Instead of chasing leaks after they happen, you prevent them entirely.

Recover lost revenue instantly with Alguna

Finance and RevOps teams using Alguna cut time spent on billing by 80% and eliminate manual contract errors.