Revenue reconciliation is the process of matching what was sold to what was billed, what was collected, and what was recognized as revenue.

In a traditional subscription model this was tedious, but still manageable. The AI era has changed this and revenue reconciliation in modern SaaS has exploded in terms of complexity.

Hybrid pricing (subscription + usage), proration, mid‑cycle amendments, credits and overages, multiple payment processors and global entities introduce layers of data that spreadsheets simply cannot handle.

Manual reconciliation not only slows your finance team but also introduces revenue leakage, audit risk, and poor forecasting.

This guide explains why automating reconciliation is essential and compares the best solutions for 2026.

What is revenue reconciliation?

Revenue reconciliation is the process of matching what you sold, billed, and collected with what you recognized as revenue in your accounting system, so finance can confirm every dollar is accurate, complete, and compliant.

What is automated revenue reconciliation?

Automated revenue reconciliation is the use of software to automatically make sure that every dollar from contract → invoice → payment → revenue matches.

Why revenue reconciliation needs automation

Finance teams spend countless hours manually pulling invoices from billing system, usage reports from product databases, payments from processors, and revenue journals from the general ledger.

The result is often mismatched data, inconsistent timing and a backlog of unreconciled transactions. Automated reconciliation uses technology to align data sources, match transactions, and flag exceptions.

Automation not only reduces costs and errors but also provides real‑time insights, strengthens compliance with ASC 606 / IFRS 15 and frees the team to focus on analysis rather than data cleanup.

5 reasons to automate:

- Revenue leakage and cash flow: Missed invoices, unbilled usage (that's often stuck in spreadsheets), and under‑billing are common when reconciliation is manual.

- Compliance: Auditors expect accurate revenue recognition. Automated matching and audit trails reduce risk.

- Complex pricing: Usage‑based and AI‑driven pricing models require dynamic calculations. Tools built for these models ensure the right logic is applied.

- Time and productivity: Systems like HighRadius claim up to a 90 % automation rate with AI agents, resulting in a 30 % reduction in days to close the books.

7 key features of revenue reconciliation platforms

Automated revenue reconciliation tools vary widely (we'll go through the different types in the next section), but as far as automation goes, you'll want to look for the following capabilities:

- Contract‑to‑invoice matching: Capture pricing terms from customer contracts and automatically generate invoices. Platforms like Alguna use AI to extract data from contracts without manual data entry.

- Usage‑to‑invoice reconciliation: Map usage metering data to billing rules, no matter the pricing model. Your recenue reconciliation tool should support seat‑based, tiered, and pay‑as‑you‑go pricing, capturing usage through integrations and producing compliant invoices.

- Payment‑to‑invoice matching: Automatically match payments from processors like Stripe or ACH to invoices and apply credits or adjustments.

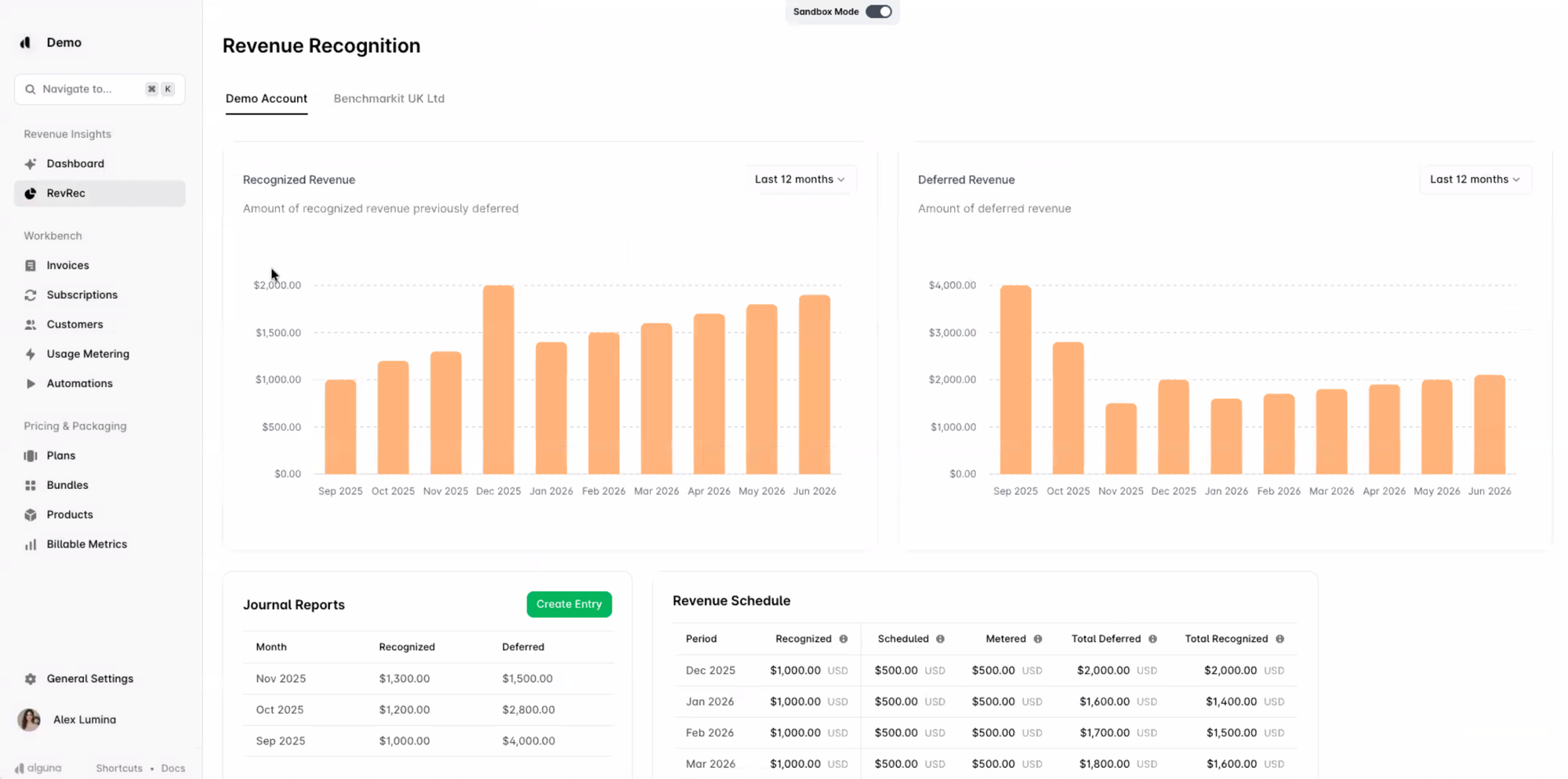

- Revenue recognition: Ensure that revenue journals are posted correctly under ASC 606/IFRS 15. Platforms like Tabs and Alguna automatically generate revenue schedules using contract and billing data.

- Exception management and audit trails: Flag discrepancies, provide explanation fields and maintain a complete audit trail. Look for tools with real‑time alerts, exception workflows, and automatic journal posting.

- Integrations: Your revenue reconciliation tool should connect seamlessly with CRM, billing systems, payment processors, ERPs and data warehouses.

- Compliance and controls: Look for SOC II compliance, role‑based access and robust reporting.

3 categories of automated revenue reconciliation tools

Automated revenue recognition tools generally fall into three buckets:

- Quote to revenue (Q2R) platforms

- Billing + revenue recognition

- Accounting-first tools

Below, we've picked out two of the best tools in each category.

1. Quote‑to‑revenue platforms

Often the first choice for SaaS and AI companies, these end‑to‑end platforms automate the entire quote-to-revenue cycle. They ingest complex contracts, extract pricing logic, calculate usage and generate invoices, orchestrate collections, and feed revenue schedules to your general ledger.

Their automated components minimize revenue leakage by honoring tiered pricing, volume discounts, overages, mid‑term changes and multi‑year ramps.

Examples include:

- Alguna: Purpose-built for SaaS, AI and fintech companies with complex usage-based models or hybrid pricing

- Chargebee: Popular quote-to-revenue platform for subscription-first SaaS

We'll dive deeper into these platforms in the next section.

2. Billing + revenue recognition platforms

These platforms focus on automating how usage, subscriptions, invoices, and revenue schedules are calculated and recorded. They sit between your product usage data, billing engine, and accounting system to ensure what gets billed is what gets recognized.

They automate revenue recognition under ASC 606 and IFRS 15, reconcile invoices to usage and contracts, and generate compliant revenue schedules without spreadsheets or manual journal entries.

Examples include:

- Zenskar: Designed for usage-based and hybrid pricing with real-time metering and automated revenue recognition

- Maxio: Strong finance-led billing and revenue recognition platform for B2B SaaS

These tools are ideal when billing and accounting need to stay tightly aligned, even if quoting happens elsewhere.

3. Accounting-first reconciliation platforms

These tools start from the general ledger and work backward. Instead of managing pricing or billing logic, they focus on matching transactions across systems, invoices, payments, bank statements, and sub-ledgers, so finance teams can close the books faster and with fewer errors.

They automate transaction matching, exception handling, and audit trails, but typically do not understand contracts, pricing models, or usage data natively.

Examples include:

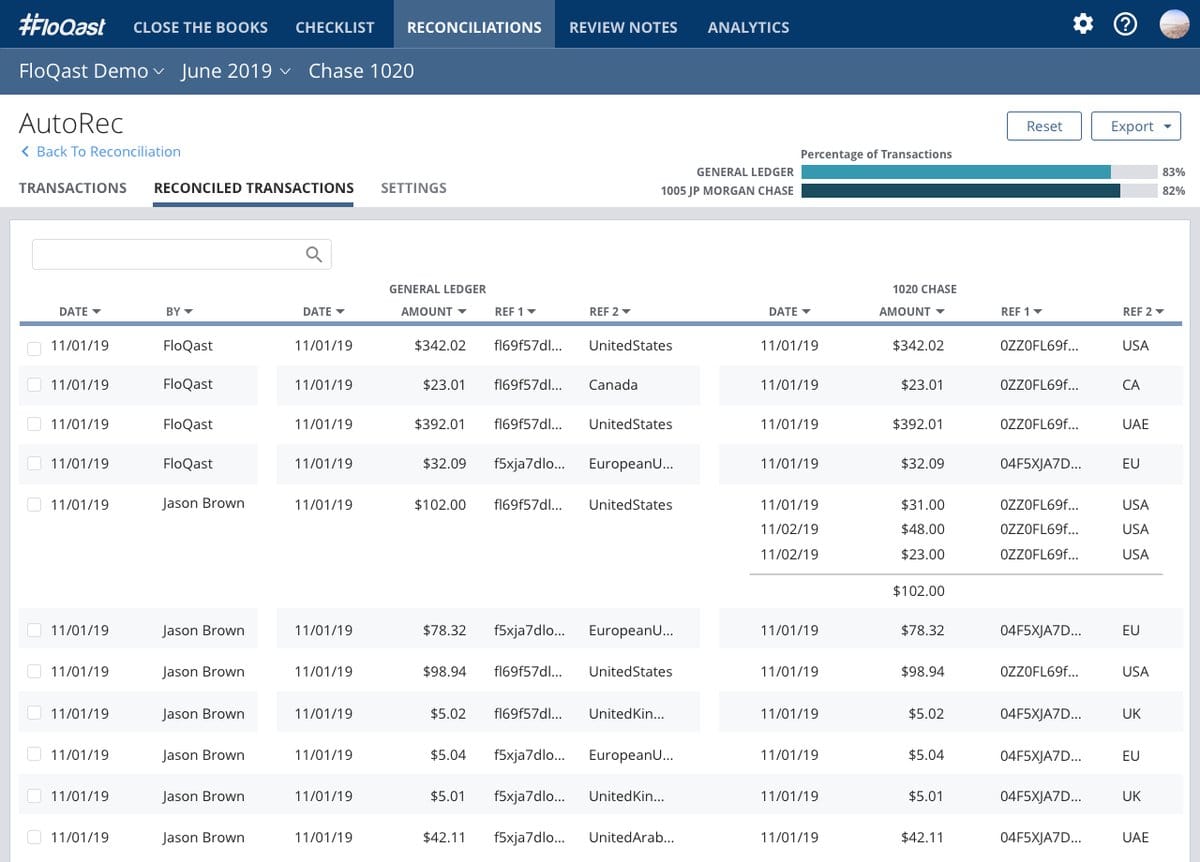

- FloQast: Account reconciliation and close management for accounting teams

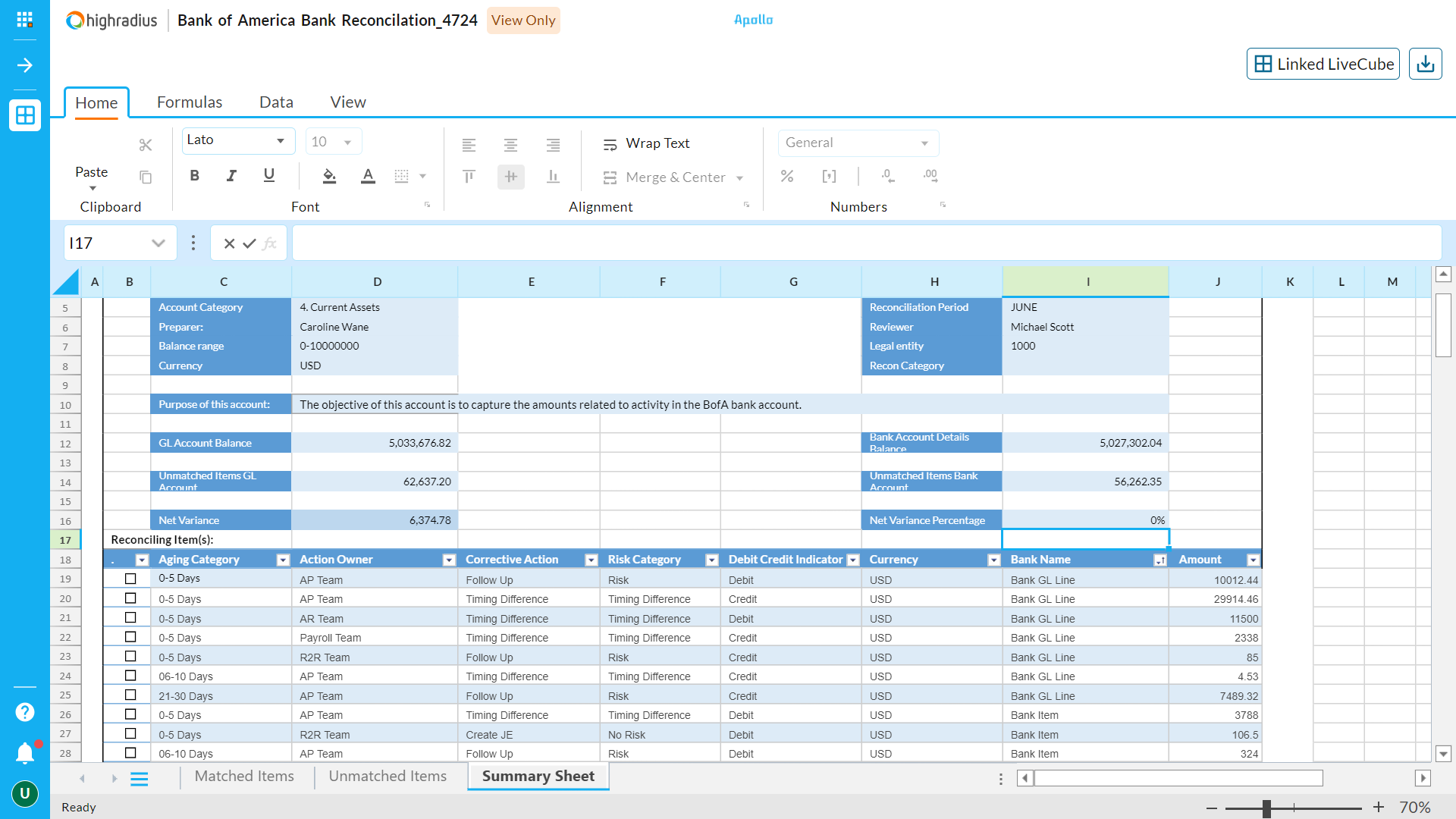

- HighRadius: AI-driven reconciliation, journal entries, and financial close automation

Comparison overview: 6 tools for automating revenue reconciliation

| Platform | Category | What it automates | Pricing model support | Best for |

|---|---|---|---|---|

| Alguna | Quote-to-revenue platform | CPQ, contracts, usage, invoicing, collections, revenue recognition | Subscriptions, usage-based, hybrid, credits, outcome-based | AI, SaaS & fintech companies with usage or hybrid pricing |

| Chargebee | Quote-to-revenue platform | Subscriptions, usage billing, invoicing, dunning, revenue recognition | Subscription-first with usage add-ons | Mid-market SaaS |

| Zenskar | Billing + revenue recognition | Usage metering, invoicing, RevRec, collections | Usage-based, hybrid, tiered pricing | Usage-based SaaS |

| Maxio | Billing + revenue recognition | Billing, revenue recognition, dunning, reporting | Subscription + metered | Finance-led SaaS teams |

| FloQast | Accounting-first reconciliation | GL reconciliations, close management, transaction matching | Pricing-agnostic | Accounting teams trying to close faster |

| HighRadius | Accounting-first reconciliation | Cash application, matching, journal entries, close automation | Pricing-agnostic | Enterprises with high transaction volume |

Deep dive: 6 best tools for automated revenue reconciliation

Not all revenue reconciliation tools are truly automated. Many handle billing, payments, or accounting, but very few connect contracts, usage, invoices, and revenue in one continuous system.

It's important that you identify where automation is needed and where it would make the biggest difference.

1. Alguna

Designed by experienced fintech operators, Y Combinator backed Alguna was purpose-built to automate the entire quote-to-revenue workflow for SaaS, AI, and fintech companies.

• Free trial: Yes.

• Pricing: Paid plans from $699/month. No revenue cut.

• Prominent customers: Evervault, ComplyAdvantage, Every.io

Alguna’s core reconciliation advantage is that it reduces the number of “translation points” in the workflow. A signed contract created via CPQ automatically becomes an active subscription and billing schedule, helping ensure what you bill what was quoted.

For usage-based and hybrid pricing, Alguna emphasizes a unified flow from CPQ + usage metering through billing and revenue recognition, so finance teams don't need to reconcile multiple disconnected systems.

Where Alguna helps most with revenue reconciliation:

- Prevents quote-to-invoice drift by turning signed deal terms into billing schedules

- Supports hybrid and usage-heavy pricing logic so usage lines reconcile cleanly to invoices

- Designed to minimize revenue leakage that often comes from mid-cycle changes, overages, credits, and ramps

“After moving to Alguna, finance and sales have become tightly coupled and are in lockstep.”

- Shane Curran, CEO at Evervault

Read the case study

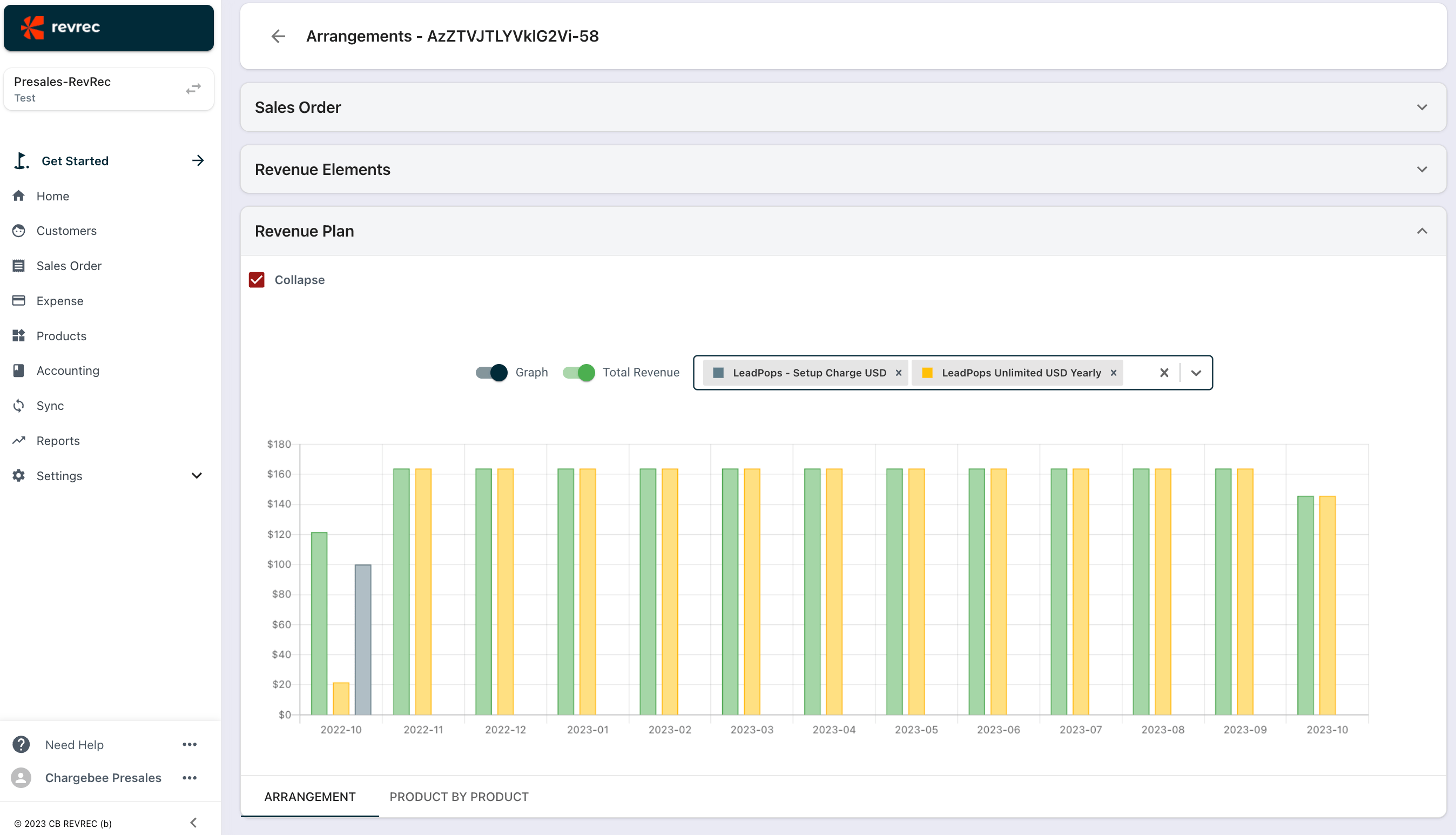

2. Chargebee

Chargebee is a quote‑to‑revenue platform used by media companies and subscription‑first SaaS teams to automate subscriptions, invoicing, dunning, and revenue recognition.

• Free trial: Yes.

• Pricing: 599/month - Up to $100,000 in monthly billings.

• Prominent customers: Conde Naste, Pret-A-Manager, Study.com

On the reconciliation side, Chargebee’s Revenue Recognition product is positioned as a transaction-based system that can produce revenue schedules and journal entries for downstream accounting/ERP systems.

Chargebee also highlights support for billing and lifecycle events (e.g., payments, credit notes, write-offs), which is key for reconciling AR movements and revenue schedules when contracts evolve.

Where Chargebee helps most with revenue reconciliation:

- Automates revenue schedules tied to sales orders/contracts under ASC 606 / IFRS 15

- Helps align billing + lifecycle events (payments, credit notes, write-offs) to revenue accounting

- Useful for teams where the biggest pain is “billing vs revenue recognition,” not necessarily CPQ drift

“After implementing Chargebee, we increased payment approval rates and reduced internal calls, supporting our growth without worrying about billing complexity.”

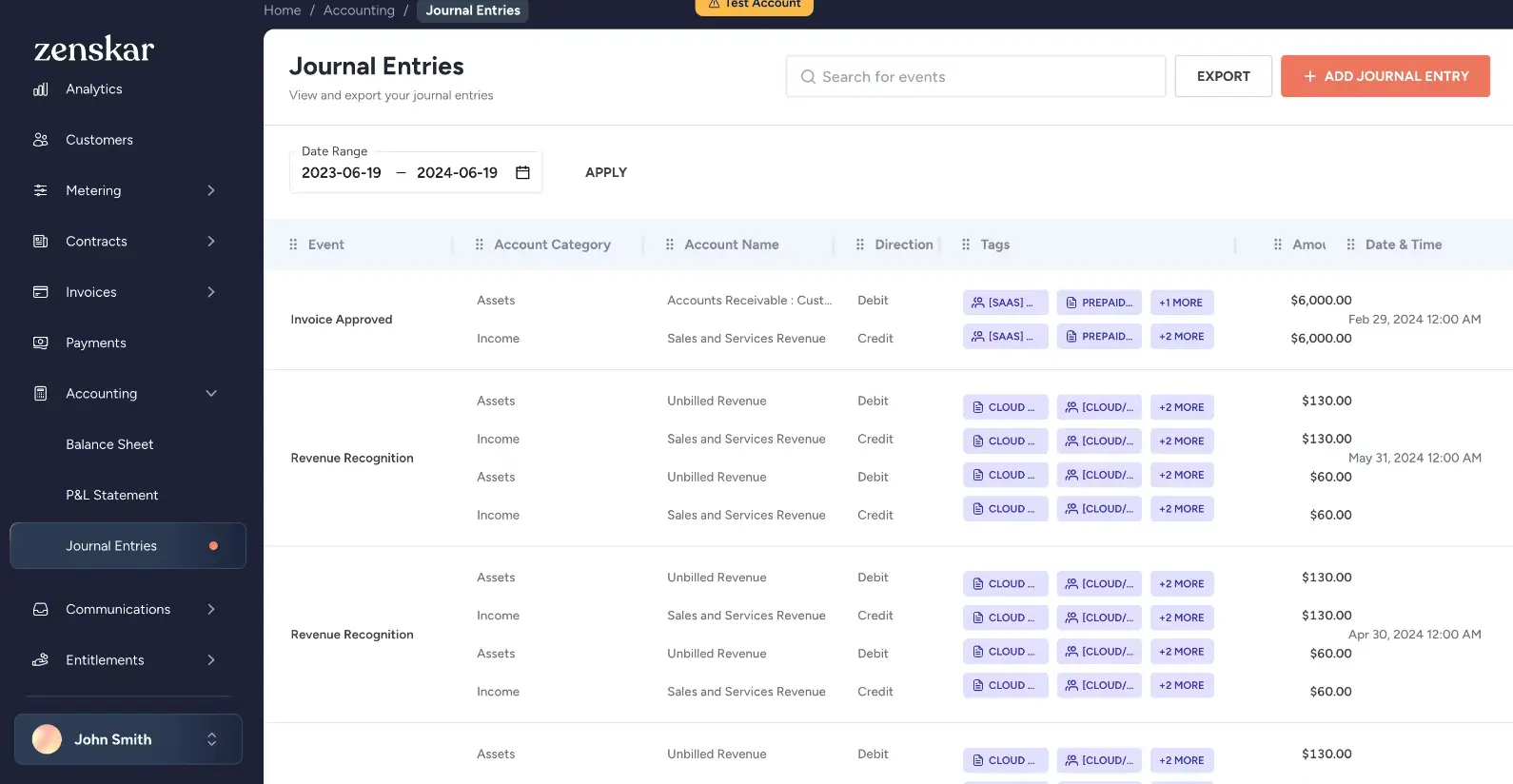

3. Zenskar

Zenskar is an order‑to‑cash platform built for usage‑based and hybrid pricing models, automating contract ingestion, billing and revenue recognition for modern SaaS companies.

• Free trial: Yes.

• Pricing: Plans start around $15 k per year with tiers for startup, mid‑market and enterprise

• Prominent customers: Pontera, Yembo, Vertice

Zenskar is geared toward usage-based and hybrid pricing companies that need billing and revenue accounting to stay aligned even as usage changes continuously.

From a revenue reconciliation standpoint, Zenskar emphasizes automated revenue accounting with GAAP/ASC 606/IFRS 15 workflows, including audit trail support, contract amendments handling, and multi-entity ledgers — all common failure points during month-end close.

If your biggest reconciliation gaps are caused by usage complexity (e.g., metered events, tiering, mid-contract changes), the “billing → revenue schedule” alignment is the win.

Where Zenskar helps most with revenue reconciliation:

- Creates GAAP-compliant revenue schedules and journal entries from billing/usage events

- Handles contract amendments with recalculation logic and audit trail for changes

- Supports multi-entity ledgers for companies operating across entities/jurisdictions

“Zenskar’s automation significantly boosted our efficiency, freeing our team to focus on strategic projects instead of manual billing.”

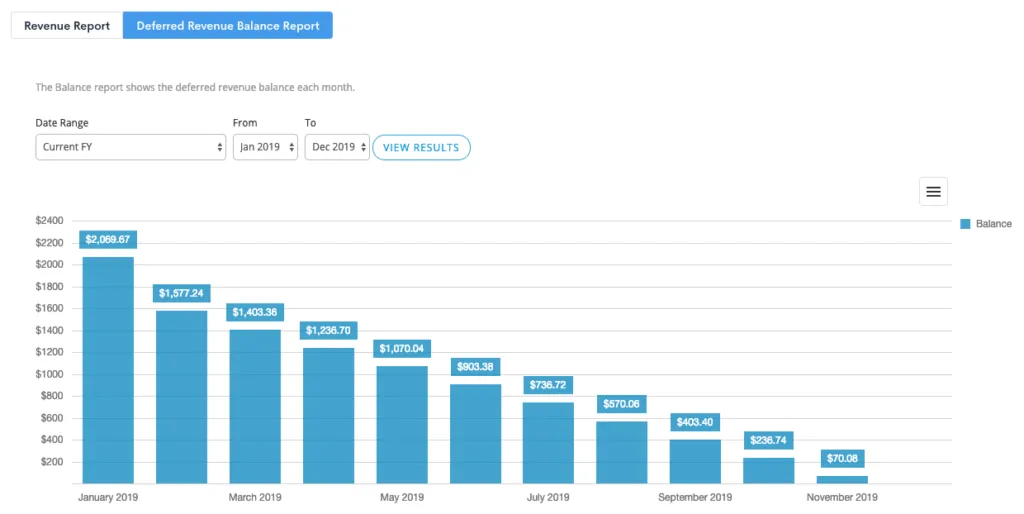

4. Maxio

Maxio (formerly SaaSOptics and Chargify) is a finance‑led billing and revenue recognition platform for B2B SaaS, automating recurring billing, and GAAP‑compliant RevRec with seamless ERP integrations.

• Free trial: Yes.

• Pricing: Starting at $599/month for up to $100k in billings. (Same as Chargebee.)

• Prominent customers: Stackline, SolarWinds, Retool

For revenue reconciliation, Maxio emphasizes automating revenue recognition under ASC 606/IFRS 15 and syncing invoices and SaaS payments into your GL (e.g., NetSuite, Sage, QuickBooks). This targets a common reconciliation bottleneck: manual invoice/payment posting and the downstream journal work.

Where Maxio helps most with revenue reconciliation:

- Revenue recognition automation with compliance framing (ASC 606/IFRS 15)

- Syncing invoices and SaaS payments into the GL to reduce manual reconciliation and entry

- Strong fit when Finance wants standardized processes and reporting (especially for B2B SaaS)

“We close revenue in two days in large part because of Maxio. Maxio has allowed us to keep generalists instead of specialists.”

- Derek Vertrees, Director of Accounting

5. FloQast

FloQast is a reconciliation and close management platform built by accountants for accountants, centralizing reconciliations, automating transaction matching and accelerating the close process

• Free trial: No.

• Pricing: Estimate $12 k per year.

• Prominent customers: Deputy, Fanatics, SnapNurse

FloQast is best thought of as “reconciliation and close automation,” not a pricing/billing engine. It helps finance teams reconcile the GL against banks, cards, subledgers, and operational data sources — and do it with fewer spreadsheets.

For revenue reconciliation specifically, this matters most when your pain is high-volume matching and exception management (finding the small percentage of items that don’t tie out). FloQast promotes AI transaction matching to reconcile complex transactions across multiple data sources.

Where FloQast helps most with revenue reconciliation:

- High-volume transaction matching between GL and external data sources

- Exception-focused workflows that reduce manual reconciliation effort

- Ideal when you’re not replacing billing — you’re fixing close bottlenecks

"We were asked to close faster, going from seven or eight days down to five—leaving more time for strategic projects."

- Jennifer Tran, Controller at Deputy

6. HighRadius

HighRadius is an AI‑driven finance platform for large enterprises, automating cash application, transaction matching, journal posting and close processes with over 21 AI agents

• Free trial: No.

• Pricing: Not publicly disclosed. Subscription‑based SaaS with pay‑as‑you‑go model.

• Prominent customers: Unilever, Starbucks, Nike

HighRadius highlights AI transaction matching, automation rates, and workflows that surface exceptions while accelerating close.

The tool also emphasizes reconciliation modules like transaction matching and journal entry automation, and claims high auto-match and journal posting automation rates in its product materials.

Where HighRadius helps most with revenue reconciliation:

- Transaction matching at scale with automation + exception handling

- Journal entry automation and ERP posting workflows to reduce manual close work

- Strong for enterprises where reconciliation is more operational than pricing-driven

"HighRadius automated 95% of our reporting across 59 entities and reduced our close time by 75%, improving auto‑matching rates by 40%."

Frequently asked questions: Revenue reconciliation and automation

What is revenue reconciliation (meaning)?

Revenue reconciliation is the process of verifying that contracts, usage, invoices, payments, and recognized revenue all match—so reported revenue is accurate and audit-ready.

What are the best revenue reconciliation platforms for real-time data syncing?

The best platforms automatically sync CRM, product usage, billing, and accounting data in real time, so discrepancies are caught immediately instead of at month-end.

What is the best revenue reconciliation software for high sales transaction volumes?

High-volume businesses need systems that handle millions of usage events, invoices, and adjustments without manual intervention—typically platforms built for usage-based and API-driven billing, not traditional subscriptions.

Should you outsource revenue reconciliation?

Outsourcing can help in the short term, but it’s slow and expensive for usage-based or AI revenue. Automated systems are more reliable because they reconcile continuously, not after the month is closed.

What are the most user-friendly solutions for automating monthly revenue reconciliation?

The most user-friendly tools provide automated matching, clear exception reporting, and direct integrations with billing and accounting systems, so finance teams don’t need spreadsheets or custom SQL to close the books.

From accounting errors to complete revenue control

Revenue reconciliation used to be a month-end accounting task.

In the AI and usage-based era, it’s a real-time revenue control system.

When contracts, usage, invoices, and revenue live in different tools, every close becomes slower, riskier, and more expensive. Finance teams end up chasing numbers (instead of trusting them) while sales loses confidence in what they sold.

Ultimately, leaders lose visibility into what’s actually working.

Automated revenue reconciliation changes that. It gives you a single source of truth for how money is earned, billed, and recognized, even when pricing is dynamic, usage is unpredictable, and transactions are high volume.

If revenue is now driven by data, then reconciliation has to be automated.

Anything else is just guesswork dressed up as finance.

See automated revenue reconciliation in action

Still reconciling revenue across CRM, usage data, billing, and accounting by hand? Alguna unifies contracts, metered usage, invoicing, and revenue recognition in one real-time system—so every dollar lines up automatically.