• Stripe Billing is widely used, but it’s not always the best fit for every business due to cost, support, and limitations as you scale.

• Top Stripe Billing alternatives include Alguna (best for unified revenue operations), Tabs, Lago, Maxio, and more—each excelling in specific areas like usage-based billing, churn reduction, or enterprise compliance.

• Evaluate alternatives carefully based on your business model, pricing complexity, integration needs, and growth plans.

• This guide compares Stripe Billing alternatives with a focus on features, pricing, and real customer reviews.

If you’re feeling boxed in by Stripe Billing, you’re not alone. While Stripe is a popular choice for startups, its limitations—like rising fees, rigid pricing models, and vendor lock-in—can become roadblocks as you scale.

The good news is that there’s plenty of Stripe Billing alternatives around. There’s a whole new generation of billing platforms as well as legacy players designed to give you more flexibility, automation, and control over your revenue operations.

In this article, we’ll explore six Stripe Billing alternatives that can help unlock your next phase of growth. But first, let’s take a closer look at the pros and cons of Stripe to determine whether you actually need to replace it.

Stripe Billing: Pros and cons

The beauty of Stripe lies in its quick setup. Early-stage companies can start collecting revenue through basic subscriptions and invoicing in no time, making it ideal for product-led growth (PLG) models.

But there’s an obvious threshold. As companies hit a certain maturity level and scale—usually around $1-3M in ARR—growing pains start to crop up.

While its suite of APIs is highly regarded by developers, Finance, RevOps, and Growth teams don’t want to rely on engineering resources to build their revenue engines and experiment with pricing models.

| Pros 👍 | Cons 👎 |

|---|---|

| Developer-friendly interface: Easy to set up and get started | Rising percentage fees: Transaction and billing fees can add up, especially as you scale |

| Supports multiple payment methods: Credit cards, ACH, and more | Vendor lock-in: Deep integration with Stripe’s ecosystem makes switching providers challenging |

| Flexible billing models: Handles recurring, usage-based, tiered, and one-time payments | Limited mixed billing periods: Difficult to combine, for example, annual contracts with monthly overage charges in one subscription |

| Automated invoicing and dunning: Reduces manual work and involuntary churn | Event-based architecture limitations: Not ideal for complex B2B billing or high-volume event-driven models |

| Global reach: Supports 135+ currencies and international payments | Integration limitations: Seamless integration with non-Stripe payment providers (like PayPal or Adyen) is not possible |

| Strong compliance and security: PCI DSS, automated tax calculations, GDPR support | Cumbersome Product Catalog management: Managing multiple IDs (products, customers, subscriptions) can be complex at scale |

| Detailed analytics and reporting: Real-time insights on revenue, churn, and customer metrics | API rate limits: Up to 100 operations per second, which can bottleneck fast-growing or high-volume businesses |

| Self-service customer portal: Customers can manage their subscriptions and billing details independently | Payout delays: Funds from transactions may take several days to be deposited, affecting cash flow |

| Easy integration with third-party tools: Connects with CRM, accounting, and analytics platforms | Limited customer support: Primarily email-based, with phone support restricted to certain cases |

| Scalable for startups and enterprises: Grows with your business, automates complex workflows | Higher international and currency conversion fees: Additional charges for cross-border payments and currency exchange |

Comparison overview: Stripe Billing alternatives

If you’re looking for Stripe Billing alternatives, chances are you’ve outgrown the platform. While Stripe’s payment infrastructure is a global powerhouse, it’s not a purpose-built billing solution that can handle the needs of scaling SaaS companies, and in particular, AI monetization.

The good news? There are plenty of alternatives that offer unique strengths—often at a better price, with more support, or with features designed for your specific use case.

| Platform | Best for | Pros | Cons | Pricing |

|---|---|---|---|---|

| Alguna | Unifying self-serve PLG and custom enterprise subscription management | No-code automation, unified pricing, quoting, and billing across pricing models, real-time analytics, modern UX, easy setup, replaces multiple tools | Newer platform, missing deeper integrations | Starts at $399/month (includes white glove migration and onboarding) |

| Maxio | Revenue recognition | Revenue recognition, SaaS metrics, strong integrations, scalable for high-growth SaaS | Can be complex to implement, support can be slow, requires a lot of custom integrations to get started | Revenue based tiers, starts at $1k a month |

| Chargebee | B2C subscription management | Robust subscription management and dunning, multiple payment gateway integrations, global tax management (VAT, sales tax) | Expensive as the business grows, advanced revenue recognition and financial management not as strong as Maxio, limitations in analytics and reporting | Starts at $7,188/yr for up to USD 100K billing/month |

| Tabs | Streamlined invoicing | Automate contracts, and invoicing, easy-to-use interface, CRM and payment gateway integrations | Less established than competitors, limited advanced features for complex billing needs, missing integrations | Custom |

| Lago | Developer-led teams | API-first, developer-friendly, transparent, predictable pricing, full control over billing logic and infrastructure | Requires technical resources and developer expertise to implement, limited out-of-the-box integrations, smaller user community and support base | Free self-hosted and limited version, cloud hosted premium version based on revenue tiers (from $1,000-$3,000 a month) |

| Zuora | Enterprise compliance | Enterprise compliance, flexible pricing, global tax, deep CRM/ERP integrations | Complex implementation, clunky UI, can be expensive, difficult to switch, limited usage based capabilities | Starts at $50k per year + implementation and integration costs |

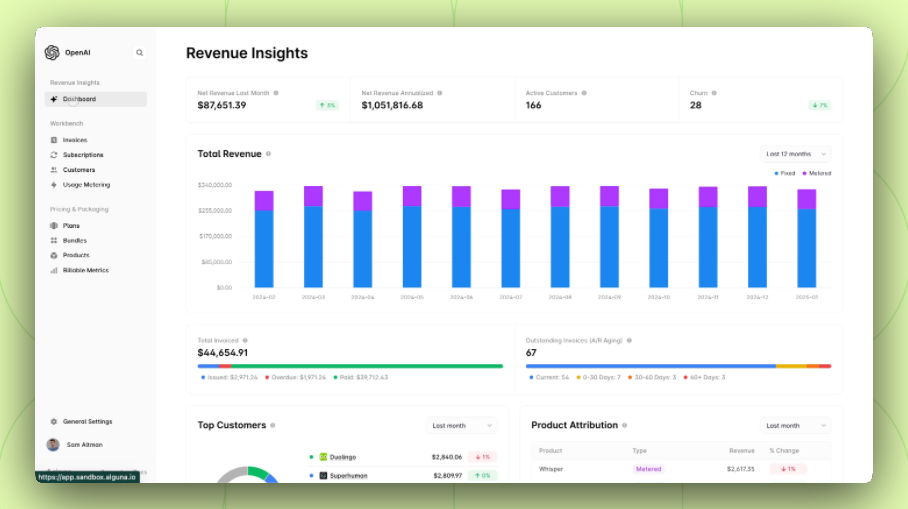

1. Alguna – Best Stripe alternative for unifying revenue workflows

Backed by Y Combinator, Alguna is a modern billing and revenue management platform designed for scaling SaaS, fintech, and AI companies. It consolidates pricing, quoting, and billing into a single no-code platform, streamlining revenue workflows and enabling quick experimentation with pricing models.

It’s ideal for companies looking to eliminate manual workflows and unify their revenue lifecycle in one platform.

Overview

Founded: 2023

HQ: San Francisco, CA and London, UK

Feature release cadence: Features shipped weekly

Pros:

- No-code automation: Automate repetitive billing, metering, and revenue processes quickly and easily without any technical expertise.

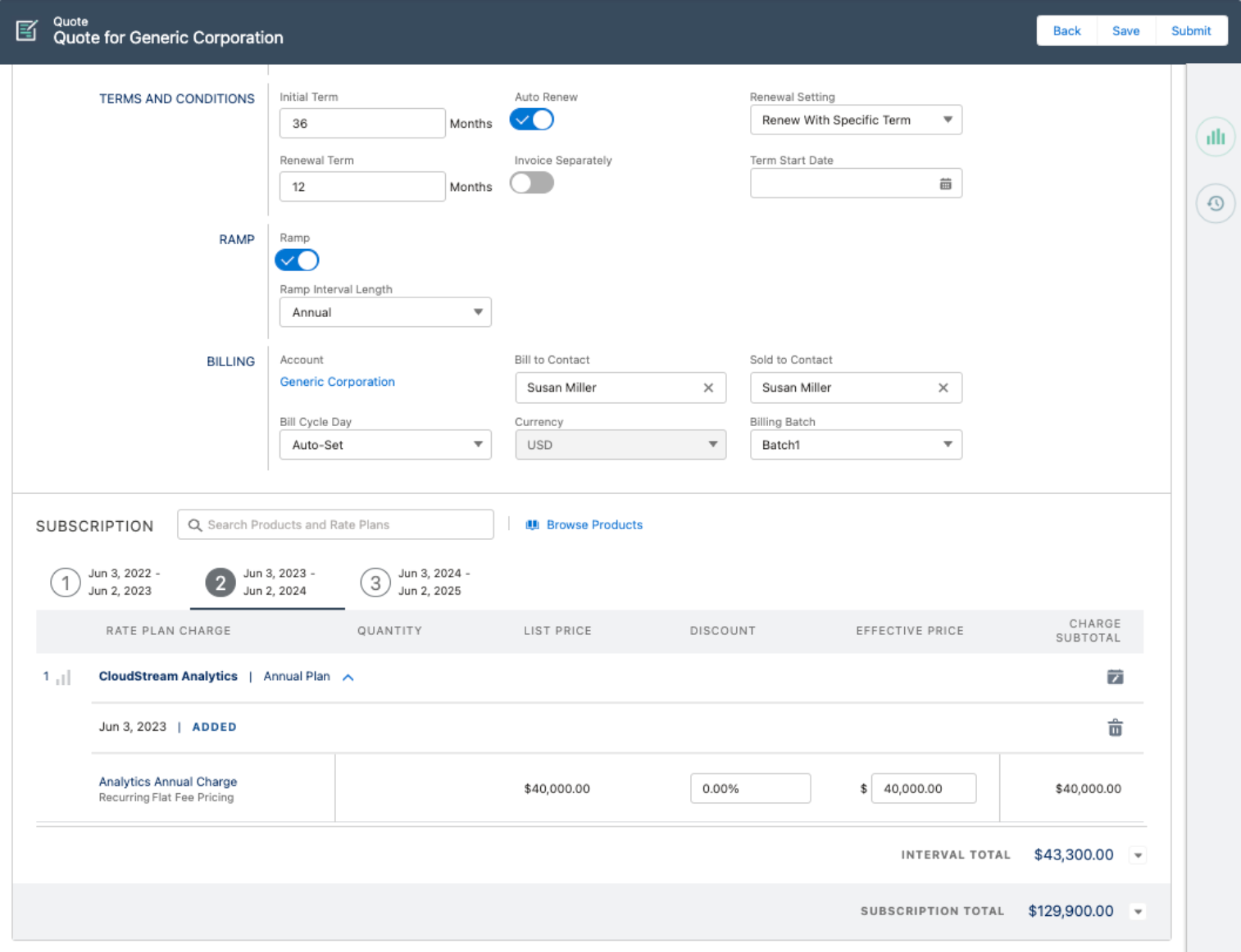

- Self-Serve & Enterprise contracts: Unlike Stripe Billing that is mostly focused on PLG, Alguna allows you to manage complex enterprise deals and self-serve in one place.

- Unified pricing, quoting, billing: Consolidate pricing, quoting, and billing in a single platform.

- Real-time analytics: Make informed decisions on the go with real-time revenue and billing analytics. Track (actual) usage and payments without waiting for reports.

- Modern UX: Intuitive interface designed for efficiency and quick adoption across teams.

- Replaces multiple tools: Save time and reduce complexity while saying goodbye to software bloat by consolidating pricing, quoting, billing in one platform.

- Dedicated customer support: Personalized support from a knowledgeable team dedicated to your success.

Cons:

- Newer platform: Comes with limited integrations.

- Focused on B2B: May not be a good fit for businesses not operating in the B2B SaaS, fintech, or AI space.

Pricing: Starts at $399 per month. White glove migration and onboarding included.

Feature highlights:

- Unified revenue operations: Manage pricing, contracts, invoicing, and billing in a single platform.

- Flexible pricing engine: Ability to have flexible modern pricing models baked into the platform.

- Powerful metric engine: Enables businesses to define any metric relevant to their billing using an extensible query engine, providing immense flexibility.

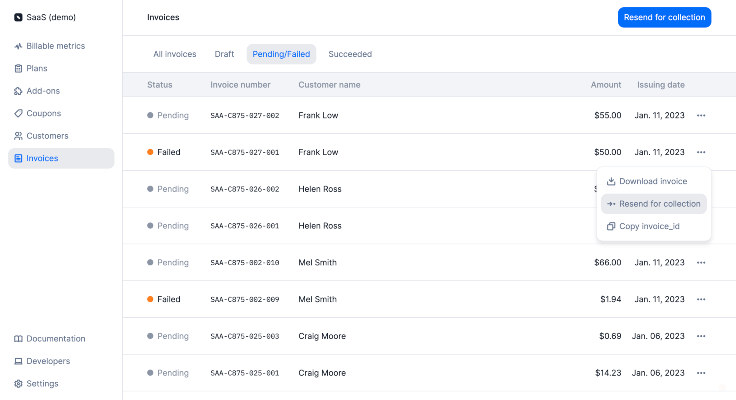

- Billing management: Manage recurring setups and collect payments directly in the platform.

- Unified Payment Collection: Collect payments directly via chosen payment processor or Alguna BankPay directly in the platform.

- Multi-entity Support: Ability to orchestrate invoices and billing based on different legal entities that your company is set up with.

- No-code automation: Configure complex pricing without engineering resources.

- Customer portal: Provides a hosted, brandable portal for customers to easily manage their subscriptions and payment details, view and pay invoices, and change their legal details.

- API First Business and Additional Integrations: Sync with CRMs (Salesforce, Hubspot, Zoho), and accounting tools (QuickBooks, Xero, Netsuite).

Why choose Alguna?

Ideal for B2B SaaS, fintech, and AI companies that need end-to-end quote to revenue automation and flexibility beyond Stripe Billing’s capabilities.

Outgrown Stripe? Try Alguna.

Book a demo to get a closer look at Alguna's advanced capabilities and automate your revenue workflows, from contract to cash.

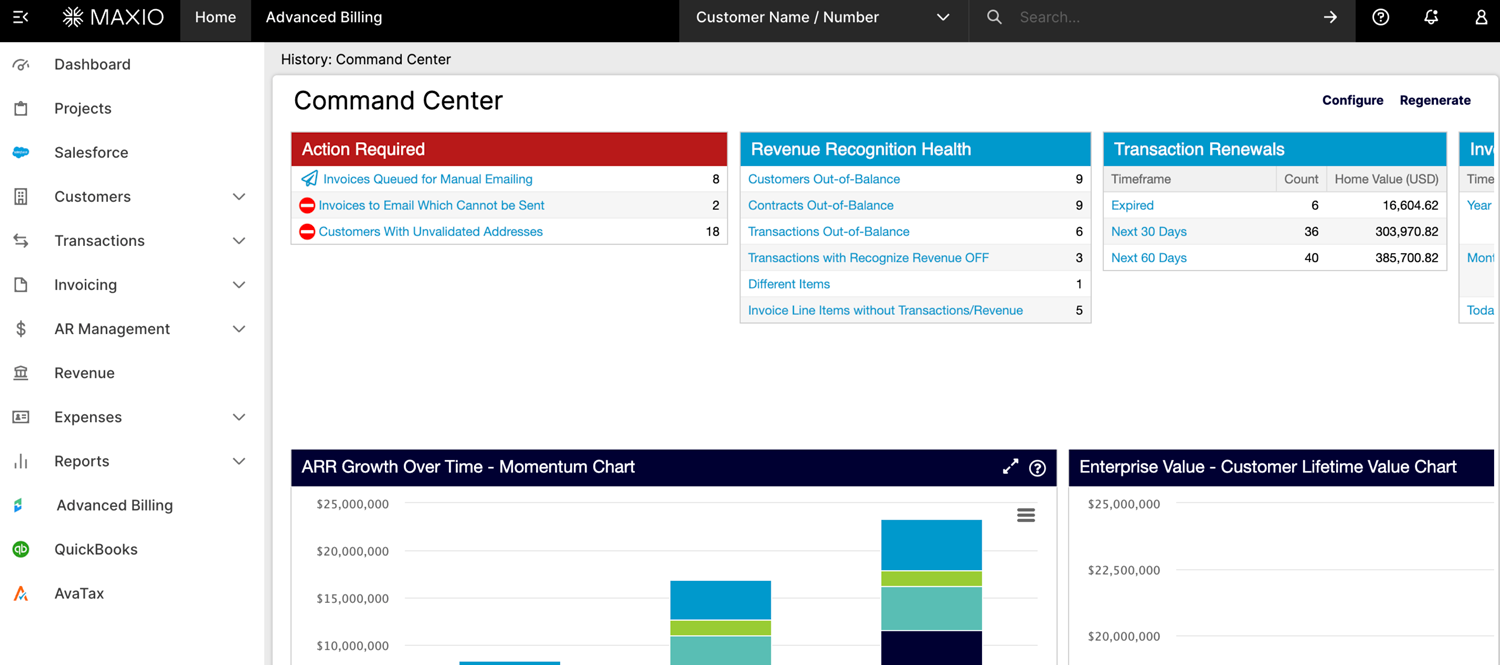

2. Maxio – Best for revenue recognition

Maxio, formed from the merger of SaaSOptics and Chargify, is a financial operations platform for SaaS businesses. It specializes in automating revenue recognition, invoicing, and ensuring GAAP/ASC 606 compliance. While it’s known for its revenue recognition capabilities, customers are often frustrated by its lack of flexibility when it comes to subscription management. It's also far behind competitors like Alguna when it comes to support for AI pricing models.

Overview

Founded: 2012

HQ: Atlanta, GA

Feature release cadence: Bi-annual

Pros compared to Stripe Billing:

- Comprehensive subscription management suite

- Best-in-class revenue recognition (GAAP-compliant)

- Strong financial reporting and SaaS metrics out-of-the-box

- Mature, proven product (from Chargify + SaaSOptics)

- Robust integrations with CRMs and accounting software

Cons compared to Stripe Billing:

- Still dealing with two disjointed products after the merger

- Implementation can be complex and time-consuming

- Support can be slow if not paying extra

- Usage-based billing requires an integration and is not as straightforward

- UI feels dated compared to modern competitors like Alguna

- Price point is significantly higher than Stripe Billing

Pricing: Revenue based tiers, starts at $1k a month + per integration + support + implementation

Feature highlights:

- Automated revenue recognition (GAAP, ASC 606)

- Advanced invoicing and dunning

- Real-time SaaS metrics and analytics

- Deep CRM/accounting integrations

Why choose Maxio?

Maxio is ideal for companies with complex financial operations and strict compliance requirements.

- Alison L., Director of Finance

Read the full review on G2

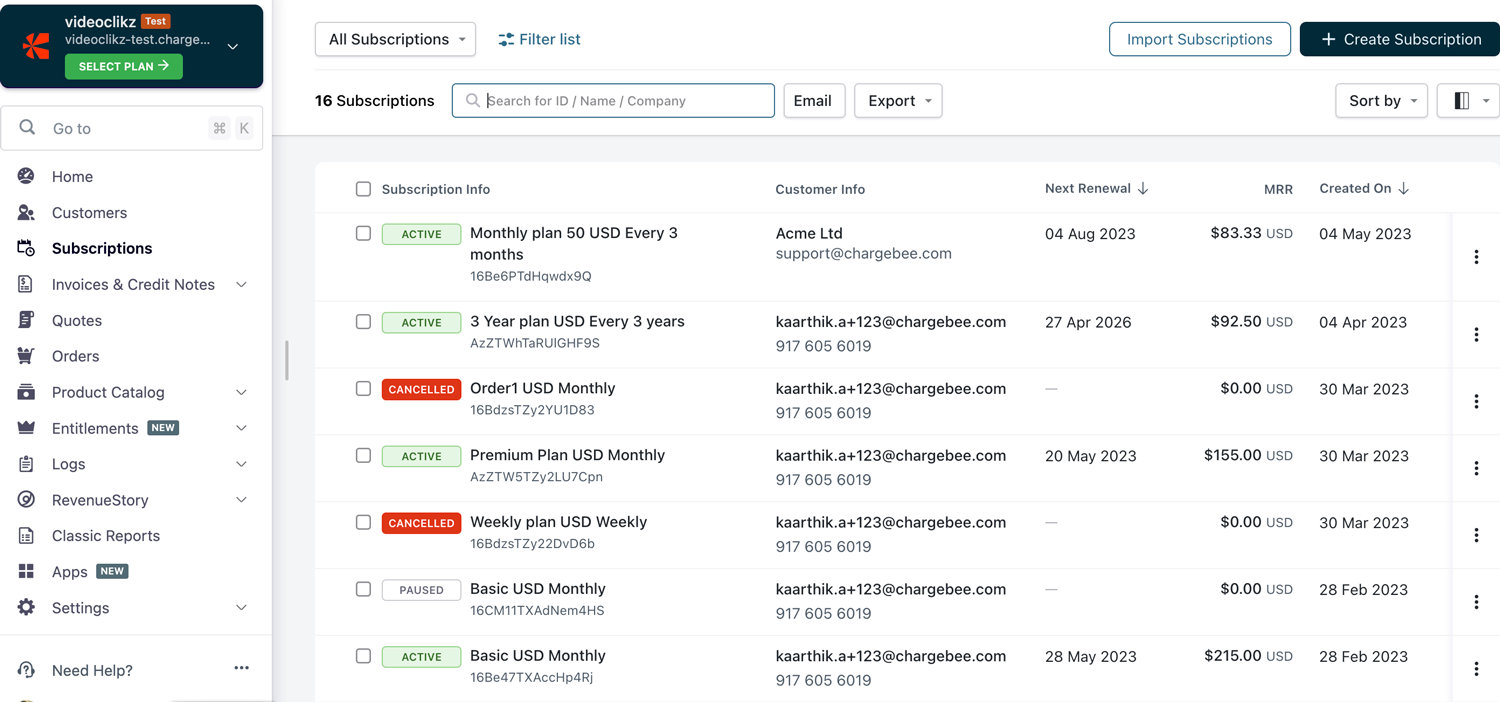

3. Chargebee – Best for B2C subscription management

Chargebee is a well-established subscription billing platform trusted by global SaaS and e-commerce companies. It offers comprehensive tools for managing subscriptions, trials, upgrades, and global payments.

Overview

Founded: 2011

HQ: San Francisco, CA

Feature release cadence: Quarterly

Pros in comparison to Stripe Billing:

- More flexible subscription workflows (e.g., upgrades/downgrades, add-ons, trials)

- Better revenue operations tools (invoicing, credit notes, taxes)

- Payment gateways and agnostic Tax integrations

- More pre-built integrations with ERPs, CRMs, and analytics tools

- Focus on B2C

Cons in comparison to Stripe Billing:

- More configuration needed upfront

- Usage-based billing capabilities are simpler

- Can get expensive as you scale

Pricing: Starts at $7,188/yr for up to USD 100K billing/month

Feature highlights:

- Subscription management and dunning

- Global tax and payment support

- Strong CRM and accounting integrations

- Self-service customer portals

Why choose Chargebee?

Chargebee is a reliable choice for organizations that prioritize global scalability in subscription management.

- Francisco E., Customer Success Team Lead

Read the full review on G2

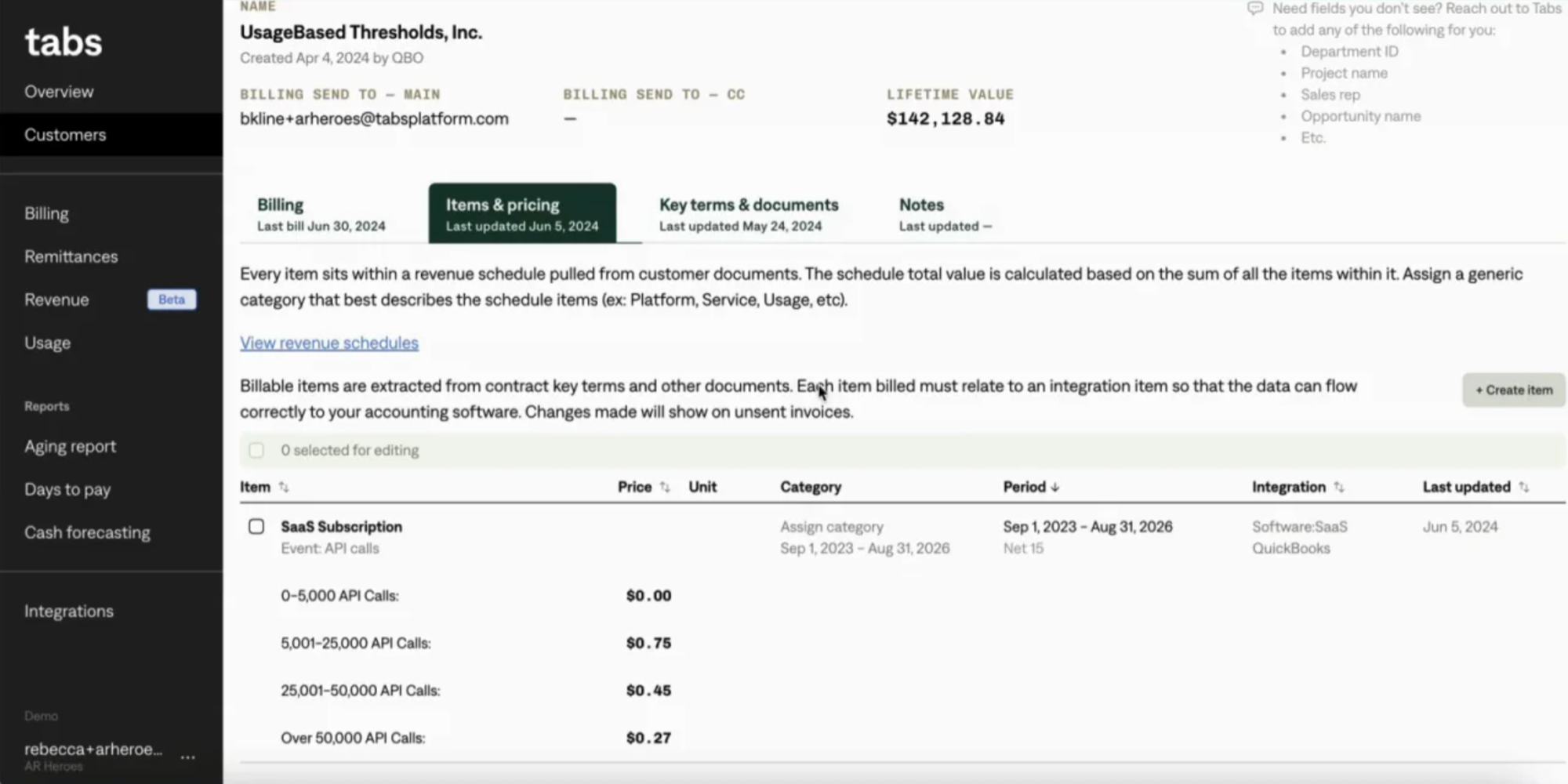

4. Tabs – Best for streamlined invoicing

Tabs is a quote-to-cash automation platform designed for SaaS and B2B companies. It streamlines the entire sales process, from proposal to payment, with automated quotes, contracts, and billing.

Overview

Founded: 2020

HQ: San Francisco, CA

Feature release cadence: Monthly

Pros compared to Stripe Billing:

- Easier to set up if you don’t need complex features

- Built-in usage billing without heavy developer effort

- Contract and revenue automation

- Integrated invoicing

- Clean, modern UI

- Focused on early-stage SaaS

Cons compared to Stripe Billing:

- Requires your end customers to create accounts with Tabs

- Limited usage-based metering capabilities

- Less enterprise feature depth (complex contracts, revenue recognition)

Pricing: Starts at $2,000 a month

Feature highlights:

- Automated contracts

- Billing and payment collection

- Customer self-service portal

- CRM and accounting integrations

Why choose Tabs?

Tabs is a good alternative for sales-led SaaS and B2B companies seeking to automate and accelerate their quote-to-cash process.

- Christian R., Head of Finance

Read the full review on G2

5. Lago – Best for developer-led teams

Lago is an open-source billing platform focused on usage-based and flexible pricing models. It is designed for developer-led teams that require full control over their billing logic and infrastructure.

Overview

Founded: 2021

HQ: Paris, France

Feature release cadence: Monthly

Pros in comparison to Stripe Billing:

- Open-source for free for self-hosted

- More flexible hybrid billing (usage + subscriptions)

- Better pricing models than Stripe Billing

- Integrated with Stripe Payments

- No revenue-based fees if self-hosted

Cons in comparison to Stripe Billing:

- Requires engineering resources to deploy and maintain

- Limited payment gateway options

- Doesn’t support an end-to-end revenue lifecycle

Pricing: Free to self-hosted limited version, cloud premium version based on revenue tiers (from 1,000-3,000 a month)

Feature highlights:

- Open-source billing engine

- Usage-based, tiered, and hybrid pricing

- API-first, developer-friendly

- Transparent, predictable pricing

Why choose Lago?

Lago is ideal for organizations with plenty of engineering resources that prioritize flexibility, control, and open-source solutions in their billing stack.

- Eric Stadigh, Co-founder at Lune

6. Zuora – Best for enterprise compliance

Zuora is the industry standard for enterprise subscription billing and revenue automation. It’s designed for large, global organizations with complex compliance and integration requirements.

Overview

Founded: 2007

HQ: Redwood City, CA

Feature release cadence: Annual

Pros compared to Stripe Billing:

- Enterprise-grade compliance (ASC 606, IFRS)

- Global scale—multi-entity, multi-currency, advanced tax handling

- Global tax management

- Deep integrations, multi-entity support

- Different Payment Gateways

Cons compared to Stripe Billing:

- Very expensive—typically starts ~$50K/year

- Long implementation cycles (months, sometimes a year)

- Heavy and complex UI—requires training

- Overkill for simpler SaaS companies

Pricing: Custom - mid five figures + implementation

Feature highlights:

- Flexible pricing and packaging

- Automated billing and revenue recognition

- Subscription metrics and analytics

- Regulatory compliance and security

Why choose Zuora?

Zuora is best for large enterprises that require robust compliance, global scalability, and deep integration with CRM and ERP systems.

- Betty G., Accounting Specialist

Read the full review on G2

FAQs: Stripe Billing alternatives

When should I consider switching from Stripe Billing?

If you’re running into limitations with flexibility, pricing models, automation, or integration needs, it’s a good time to start exploring alternatives.

Is migrating from Stripe Billing complicated?

Migration can be straightforward with the right planning. Many platforms offer migration and support, but the process depends on the complexity of your current setup.

Are Stripe Billing alternatives more cost-effective?

Some alternatives offer lower transaction fees, flat-rate pricing, or better value for complex billing needs. Always compare total costs based on your business model and volume.

Can I still accept global payments with alternatives?

Absolutely. Most leading alternatives support multi-currency payments and local payment methods, but capabilities vary—always check before committing.

What’s the most important feature to look for in a new billing platform?

Flexibility is key—choose a platform that adapts to your pricing, integrates with your existing tech stack, and automates your most critical revenue workflows without compromising on scalability.

Which Stripe Billing alternative tools provide comprehensive financial reporting and analytics?

Alguna provides real-time revenue analytics for instant insights. Maxio (formerly SaaSOptics) delivers in-depth financial reporting and built-in SaaS metrics, making it a strong alternative for companies needing advanced analytics.

Are there Stripe Billing alternative vendors that enable flexible, customizable pricing models?

Yes. Many of the alternatives mentioned support highly flexible pricing. For example, Alguna’s no-code pricing engine handles modern usage-based, tiered, or hybrid plans.

What SaaS-focused Stripe Billing alternative platforms automate collections and dunning processes?

SaaS-focused billing platforms like Alguna, Chargebee, and Recurly all include automated collection and dunning processes to handle failed payments and reduce churn.

For enterprise SaaS needs, does Maxio vs Stripe Billing support multi-entity financial reporting?

Maxio supports multi-entity financial reporting out-of-the-box. Its enterprise tier includes multi-entity consolidation and forecasting features for managing multiple entities. Stripe Billing does not natively provide multi-entity consolidation.

Do Maxio vs Stripe Billing offer revenue recognition features for compliance?

Maxio includes automated revenue recognition features for ASC 606/IFRS 15 compliance built into its platform. As do Stripe alternatives like Alguna. Stripe Billing by itself doesn’t handle revenue recognition, but offers it through a separate module.

What are the best Stripe Billing alternative platforms for B2B SaaS companies?

Alguna (focused on end-to-end quote-to-cash for B2B SaaS) and Maxio (geared toward complex SaaS financial operations and compliance) top alternatives for B2B SaaS companies. Other leading platforms include Chargebee and Zuora, which cater to B2B subscription businesses with more complex billing requirements and enterprise scale.

Which Stripe Billing alternative platforms offer automated revenue recognition for SaaS businesses?

Maxio is a prominent alternative that offers automated revenue recognition with GAAP/ASC 606 compliance for SaaS companies. Other modern billing platforms (e.g. Alguna) also include revenue recognition tools to help SaaS businesses comply with accounting standards.

Are there Stripe Billing alternative options that integrate with Salesforce and Hubspot?

Yes. The majority of competitors offer integrations with CRMs and ERP systems. For example, Alguna offers native CRM integrations to sync subscription and billing data with Salesforce and HubSpot out-of-the-box.

What are the top Stripe Billing alternative solutions with robust usage-based billing features?

Alguna supports robust usage-based billing with a flexible pricing engine to meter and bill usage in real time. Other top options include Lago and Orb, both which offer stronger native usage billing capabilities than Stripe’s basic usage feature set.

Don’t let bad billing stall your growth

Your billing platform should be a catalyst for growth, not a source of friction. If Stripe Billing is starting to feel limiting—whether because of pricing inflexibility, value, or integration headaches—it’s time to explore what else is out there.

Modern alternatives like Alguna are purpose-built to handle complexity, automate manual tasks, and adapt as your business scales. By choosing a solution that aligns with your unique needs, you’ll free up your team to focus on what matters most: delivering value, delighting customers, and scaling with confidence.

The right billing partner isn’t just a back-office upgrade—it’s a strategic advantage for your next stage of growth.

Outgrown Stripe? Try Alguna.

Book a demo to get a closer look at Alguna's advanced capabilities and automate your revenue workflows, from contract to cash.