• See how modern tools unify pricing, billing, usage, and revenue recognition into a scalable, leak-free engine.

• Explore the leading SaaS revenue management platforms.

Modern SaaS companies are juggling recurring billing, usage-based charges, multi-entity reporting, and complex contract terms, and traditional billing systems simply can’t keep up.

SaaS revenue management has emerged to tackle this, ensuring every dollar earned is accurately billed, collected, and reported — increasingly crucial given that revenue leakage could hit $100B annually by 2030 if companies keep relying on disjointed stacks.

As a result, demand is growing for SaaS revenue management platforms that automate these processes, plug leaks, and provide finance teams with a single source of truth. The SaaS industry is also shifting toward AI-driven monetization. As AI-powered products deliver value in new ways, like completing tasks autonomously, companies are moving beyond static seat-based pricing to more dynamic usage-based and hybrid models.

This guide explores what SaaS revenue management is, why it matters, and how modern software helps SaaS businesses optimize revenue.

What is SaaS revenue management?

SaaS revenue management is the end-to-end process of managing and optimizing recurring revenue. It goes beyond just basic billing, covering pricing, quoting, billing, collections, usage metering, revenue recognition, and reporting. All this ensures that every dollar earned is accurately captured throughout the entire customer revenue lifecycle.

Unlike one-time sales, SaaS revenue is recurring and often usage-based, with constant changes from renewals, upgrades, downgrades, and contract adjustments. This creates far more opportunities for revenue leakage, especially in subscription businesses. Effective SaaS revenue management requires systems that automate continuous billing cycles, track usage, apply dynamic pricing, and handle mid-term changes without manual work.

A modern platform also supports proration, deferred revenue schedules, and compliance (ASC 606/IFRS 15), serving as the financial source of truth that keeps billing, revenue, and reporting aligned.

Why revenue management matters more than ever in B2B SaaS

Billing and revenue management for B2B SaaS has become increasingly important because the mechanics of how SaaS companies make money have fundamentally shifted.

- Pricing complexity has exploded. SaaS is no longer a simple monthly subscription. Most companies now run hybrid models that blend subscriptions with usage-based or consumption-based pricing. With AI-driven products, usage can spike or dip unpredictably, making manual tracking of events like API calls or data volume both risky and slow. Without modern tools, companies end up overcharging, undercharging, or being unable to launch new pricing models when the market demands it.

- Contracts and discounts have become highly customized. Enterprise deals often include negotiated rates, volume discounts, trials, and bespoke terms that require precise tracking. Without automation, companies accumulate dozens of one-off variants, and even minor oversights, like a promotional discount that never expires, can quietly drain tens of thousands in revenue.

- Global scale adds another layer of complexity. As SaaS companies expand into new regions or operate multiple business units, they face different currencies, tax rules, and reporting standards. Finance leaders need consolidated, real-time ARR across entities, but stitching data together from disconnected systems or spreadsheets is slow, error-prone, and unsustainable.

- RevOps now demands automation and accuracy. Fragmented billing processes and spreadsheets introduce errors, slow cash collection, and create millions in unbilled or uncollected revenue. Automated quote-to-cash systems reduce human error, accelerate invoicing, and provide audit-ready clarity that supports faster, cleaner growth.

4 core components of SaaS revenue management

Modern SaaS revenue management rests on a few core components — the capabilities every complete revenue management SaaS solution needs to handle:

- Recurring and event-based billing: SaaS companies rarely bill just one way anymore. Most run hybrid models: a subscription fee plus variable usage such as API calls, data processed, or transactions. Managing all of this in one system is crucial. This is exactly where vendors offering end-to-end SaaS revenue management for recurring and event-based billing add the most value.

Modern platforms meter usage in real time, apply the right tiers or rates automatically, and roll everything into a single accurate invoice, whether you charge per token, per minute, or per request. - Pricing, discounts, and customization: Pricing evolves quickly, especially as AI products change how value is delivered. Teams need the ability to roll out new plans, adjust usage tiers, or run time-limited discounts without pulling in engineering. No-code pricing configuration makes that possible.

Today’s SaaS revenue management platforms offer customizable pricing and discount management, ensuring plans, tiers, and promos are applied (and retired) accurately. This reduces leakage and gives SaaS companies the flexibility to tailor enterprise deals and iterate on monetization quickly. - Contract lifecycle and mid-cycle changes: SaaS contracts rarely stand still. Upgrades, add-ons, downgrades, and renewals happen constantly, and each change must flow cleanly into billing and revenue recognition.

Modern systems automate proration, co-terming, credits, and revenue schedule updates so amendments don’t turn into manual cleanup projects. Everything, from the initial quote to mid-cycle changes, stays aligned. - Consolidated reporting and multi-entity revenue: As SaaS businesses expand across products and regions, getting a unified revenue view becomes harder. Finance leaders need one clear picture of ARR, MRR, usage, collections, and deferred revenue, and not five spreadsheets.

Modern SaaS revenue management platforms offer consolidated reporting across multiple business units, giving finance teams real-time visibility into ARR, usage, and deferred revenue without stitching numbers together manually.

What does SaaS revenue management software actually do?

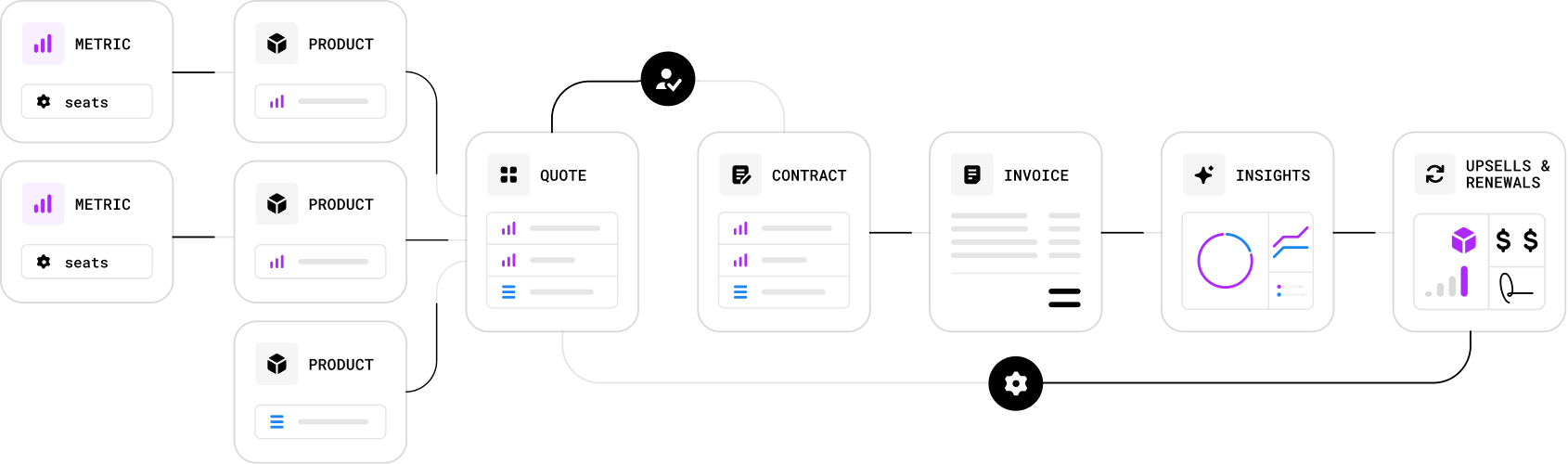

At a high level, SaaS revenue management software, or SaaS business revenue management software, acts as the financial operating system for a subscription business. Instead of juggling separate tools for quoting, billing, invoicing, payments, revenue recognition, and reporting, it brings these workflows together into one automated platform. The result is a single source of truth for everything in the quote-to-cash cycle, from how products are priced to how revenue is recognized and reported.

In practice, that looks like:

- A deal closes in your CRM → the subscription, usage terms, and discounts are created automatically in billing.

- Product usage flows in as events → the platform meters, rates, and adds charges to the next invoice.

- Month-end hits → revenue is recognized automatically, and reports are ready without manual reconciliations.

- A customer upgrades mid-term → proration, credits, and new revenue schedules are handled without spreadsheets — the exact type of complex contract change that revenue management SaaS vendors are built to streamline.

While these platforms typically cover a broad set of features, such as product and pricing configuration, quote and order management, recurring and usage billing, payment collection, compliance, and integrations, two areas matter most for modern SaaS teams: end-to-end automation and revenue analytics & insights.

End-to-end automation

The biggest value of revenue management software is removing manual work from the entire quote-to-cash process. Once a deal closes, the system handles everything automatically: creating invoices, applying usage charges, managing proration for mid-cycle changes, updating renewals, and recognizing revenue on the right schedule.

No spreadsheets, no hand-calculations, no “Did we invoice that customer?” moments. This automation improves accuracy, accelerates cash collection, and gives finance teams back hours each month that were once spent reconciling numbers or fixing billing mistakes.

Revenue analytics and insights

The second pillar is visibility. Modern platforms don’t just track transactions; they turn them into insights. The best SaaS revenue management analytics tools in 2025 offer real-time dashboards, cohort analysis, usage trends, forecasting, churn signals, and revenue segmentation.

Because they capture every invoice line item and usage event, they give RevOps and finance teams a far deeper understanding of how revenue is performing, where growth is coming from, and where risks are emerging. Instead of stitching spreadsheets together at month-end, leaders always get up-to-date intelligence they can act on instantly.

5 key benefits of SaaS business revenue management software

- Reduced revenue leakage: Automated billing and accurate usage metering ensure every charge is captured and applied correctly, preventing missed invoices, outdated discounts, and spreadsheet slip-ups.

- Faster quote-to-cash: When quoting, invoicing, usage billing, dunning, and payment collection run automatically, cash comes in sooner. Companies see shorter DSO, faster month-end close, and fewer internal bottlenecks. Sales and finance teams spend less time fixing billing issues and more time on high-value work.

- Higher accuracy and fewer manual errors: Software enforces pricing rules, correctly applies proration, and keeps revenue schedules in sync with contracts. This reduces disputes, prevents restatements, and creates audit-ready financials that teams can actually trust, without spreadsheet gymnastics.

- Real-time revenue visibility: Modern platforms centralize ARR, MRR, usage trends, collections, and deferred revenue in one place. Instead of waiting for month-end reports, RevOps and finance get live dashboards that show how revenue is performing across products, regions, and entities, and where risks are emerging.

- Greater GTM agility: With no-code pricing configuration, teams can launch new plans, adjust usage tiers, and run promotions without engineering support. This flexibility is especially valuable in the AI era, where usage patterns shift quickly and monetization needs to adapt just as fast.

These benefits span every team: finance gets greater accuracy and compliance, RevOps gets faster, more predictable cycles, sales gets fewer billing escalations, and leadership gets clear revenue intelligence.

Over time, the right software becomes a competitive edge: better billing, better decisions, and a revenue engine that actually scales.

Leading SaaS revenue management platforms

Choosing the right platform for billing and revenue management for B2B SaaS has become harder as pricing models grow more complex and usage billing becomes the norm.

The market now offers a wide range of revenue management SaaS platforms, each built to solve different parts of the quote-to-cash process.

Below is a breakdown of the leading options, including their core strengths, ideal use cases, and pricing at a glance.

| Platform | Core strength | Ideal for | Pricing (indicative) |

|---|---|---|---|

| Alguna | AI-native flexibility for complex usage-based billing, unified quote-to-cash automation (CPQ, billing, rev rec in one unified no-code platform). | High-growth SaaS, AI, and fintech companies needing customizable pricing, usage metering, and multi-entity support. | Starts at $399/month with no revenue cut. Includes white-glove onboarding and migration. |

| Chargebee | User-friendly subscription billing with broad integrations; robust dunning and invoicing. | Startups and SMBs with straightforward subscription models or early scale. | Pricing starts at $599/month for the first $100k in billings. |

| Maxio | Comprehensive billing + revenue management with strong analytics and revenue recognition. | Mid-market SaaS needing advanced financial reporting, ASC 606 compliance, and usage billing. | From $599/month; higher tiers scale with volume. |

| Recurly | Easy-to-implement subscription management with excellent dunning and churn reduction. | Small to mid-size SaaS, B2C, streaming, or e-commerce. | Custom pricing based on transaction volume. |

| Sage Intacct | Full financial suite with subscription billing; strong multi-entity consolidation and GAAP compliance. | Established SMBs to mid-enterprise needing ERP-level financial controls. | Custom pricing; many mid-market setups ~$20k–$60k+/year. |

| Stripe Billing | Developer-friendly billing with global payment support. | Small SaaS and startups already using Stripe; simple or DIY billing needs. | 0.7% recurring revenue fee plus Stripe processing fees. |

| Tabs | AI-powered revenue automation; contract-to-cash with AI (contract reading, automated rev rec). | Scaling SaaS/finance teams wanting AI-driven billing and revenue recognition. | $1,500/month Launch; higher tiers custom. |

| Zuora | Enterprise-grade subscription management; highly customizable workflows and ecosystem. | Large enterprises with complex global monetization strategies (telecom, large SaaS). | ~$50k/year+, and six figures with add-ons. |

You likely don’t need a full revenue management system on day one, but most SaaS teams hit a point where manual workflows and basic billing start holding them back. If any of these feel familiar, you’re already there:

• You’re still stitching invoices together from your CRM, Stripe, and product logs.

• Mid-cycle upgrades, downgrades, or discounts regularly break billing or reporting.

• Finance spends days each month reconciling ARR across entities, spreadsheets, or tools.

• Pricing or packaging changes require engineering support and slow down GTM. You’re testing usage-based or AI-driven monetization and aren’t confident your stack can keep up.

When these symptoms show up, the issue isn’t effort but infrastructure. That’s when a modern revenue management platform becomes less “nice to have” and more “necessary to scale.

Why Alguna is the best SaaS revenue management software

Alguna stands out as an AI-native quote-to-revenue platform built specifically for the realities of billing and revenue management for B2B SaaS, where usage-heavy products, complex contracts, and rapid pricing iteration are the norm.

Instead of stitching together separate tools for CPQ, billing, usage metering, payments, and revenue recognition, Alguna unifies the entire quote-to-cash workflow into a single system. This alignment keeps quotes, invoices, cash collections, and revenue schedules perfectly in sync, eliminating the leaks and inconsistencies that plague fragmented stacks.

What makes Alguna different

- True flexibility for subscription + usage billing: Alguna lets teams launch any pricing model without engineering, including subscriptions, usage-based, credit-based, hybrid, or outcome-based. It meters and rates high-volume usage (API calls, inferences, tokens, custom events) in real time and feeds it directly into billing and revenue recognition.

- End-to-end automation across quote-to-revenue: Once a deal is created in CPQ, Alguna automates invoicing, proration, co-terming, payment retries, and ASC 606/IFRS-compliant revenue recognition.

- Built for contract complexity and multi-entity scale: Contracts change constantly. Alguna automates proration, credits, revenue schedule updates, and renewal alignment for every mid-cycle adjustment. It also supports multi-entity and multi-currency operations, enabling global SaaS teams to achieve consolidated reporting without manual consolidation.

- Designed for the AI monetization: AI-driven products require pricing to evolve fast. Alguna supports rapid pricing iteration, new usage metrics, outcome-based pricing, and dynamic billing logic. Alguna keeps pricing, usage, and revenue fully aligned as products evolve.

Who Alguna is best for

Alguna is ideal for SaaS and AI companies that:

- Rely heavily on usage-based or hybrid SaaS monetization

- Need to adapt pricing frequently without engineering

- Manage complex contracts or global multi-entity operations

- Have outgrown Stripe Billing, Chargebee, or mid-market tools

- Want revenue schedules, invoices, and usage to stay perfectly aligned

Backed by Y Combinator and quickly adopted by modern SaaS teams across startups and enterprises, Alguna is becoming the preferred platform for companies needing flexible, automated revenue automation that won’t bottleneck growth.

If your business needs to support complex billing scenarios or change pricing faster than engineering can build it, Alguna is a strong contender, and, in many cases, the only platform flexible enough for the AI-era monetization landscape.

Turning revenue management into a growth engine

Successful companies treat revenue operations as a strategic system. A system that supports experimentation, ensures accuracy, and removes friction across the entire revenue lifecycle.

Modern revenue management platforms make that possible. They eliminate leakage, automate the quote-to-cash process, and give teams real-time visibility into billing, usage, and ARR. Just as importantly, they provide the flexibility to adapt pricing, introduce new models, and keep revenue aligned with how products deliver value, especially in an AI-driven market where monetization changes fast.

Platforms like Alguna bring these capabilities together in a single automated workflow, unifying CPQ, billing, usage metering, payments, and revenue recognition.

The result is cleaner operations, faster iteration, and a revenue infrastructure that scales with the business rather than holding it back.

Get revenue management right, and it becomes the engine that powers predictable, sustainable growth.