• Revenue leakage quietly drains profits in SaaS, AI, and subscription-based companies.

• Prevent revenue leakage by conducting regular revenue leakage audits, eliminating manual processes, and automating your billing workflows.

• Leading SaaS, AI, and fintech teams use unified quote-to-cash systems to minimize leakage and ensure every dollar earned reaches the bank.

Revenue leakage doesn’t make headlines (although it should), but it quietly erodes the bottom line of even the fastest growing SaaS and AI companies.

It’s the money you’ve earned but never collected that goes unnoticed in error-prone manual processes, billing mishaps, untracked usage, and spreadsheet chaos. For companies running complex pricing models or hybrid GTM motions, these gaps add up fast.

In fact, revenue leakage could hit $100B annually by 2030 if companies keep relying on disjointed stacks instead of end-to-end AI monetization platforms.

In a time where every dollar of ARR counts, revenue leakage isn’t just an accounting issue—it’s an operational one.

This article breaks down what revenue leakage is, where it hides inside modern SaaS and AI businesses, and how automation across quoting, billing, and revenue recognition can stop it before it starts.

What is revenue leakage?

Revenue leakage, or leakage of revenue, refers to the loss of potential or earned revenue that occurs when a company fails to bill, collect, or recognize revenue accurately—even though the service or product was delivered.

In simpler terms: it’s money you’ve earned but never actually get paid for because of billing mistakes, process gaps, or data oversights. Think of it like a leaky pipe: small drips of lost revenue that can add up quickly if left unfixed.

Formula to calculate revenue leakage

To calculate the amount of revenue leakage in dollars, you can simplify this to: Revenue Leakage = Total Potential Revenue - Actual Collected Revenue.

Unlike lost sales or churn, revenue leakage happens after you’ve already earned the revenue, through an active customer or delivered service, but fail to collect it for whatever reason.

In subscription-based models, the risk compounds as a single billing mistake can repeat every cycle, turning a minor leak into a steady stream of lost income.

Common types of revenue leakage

Revenue leakage can occur for many reasons, including breakdowns in billing and revenue operations.

Below are the most common causes of revenue leakage, along with examples that show how they typically occur in SaaS, AI, and fintech businesses.

Common causes and examples of revenue leakage

- Billing system gaps and manual errors

Manual billing and spreadsheets leave plenty of room for error, causing A missed invoice, an uncharged renewal, or a service that slips through can quietly drain earned revenue.

For example, a SaaS startup handling invoices manually might forget to bill one month of service, and just like that, the money’s gone. Failed subscription renewals, like an expired credit card that isn’t retried automatically, also add up.

In fact, involuntary churn from payment failures accounts for 20–40% of total churn in subscription businesses

- Discounting or pricing errors

Aggressive discounting and pricing mistakes are another common cause of revenue leakage. This often happens when sales teams offer one-off discounts or custom deals that aren’t properly tracked or reversed.

For example, a representative might grant a 3-month discount to close a deal, but if there’s no system in place to revert the price, that customer may stay on the lower rate indefinitely. Or, a customer may upgrade, but their billing information isn’t updated, so they continue to pay the old price.

- Contract mismanagement

Contracts define the terms under which customers are charged, including renewal dates, price escalations, usage fees, and penalties. But when those terms aren’t enforced, money is lost.

Common issues include missed renewals, where the team forgets to apply rate increases on the contract renewal date, and overlooked price uplifts, such as a 5% annual adjustment that never makes it into the billing system.

These leaks often arise from siloed processes, where sales may negotiate special terms that Finance or Operations never fully capture.

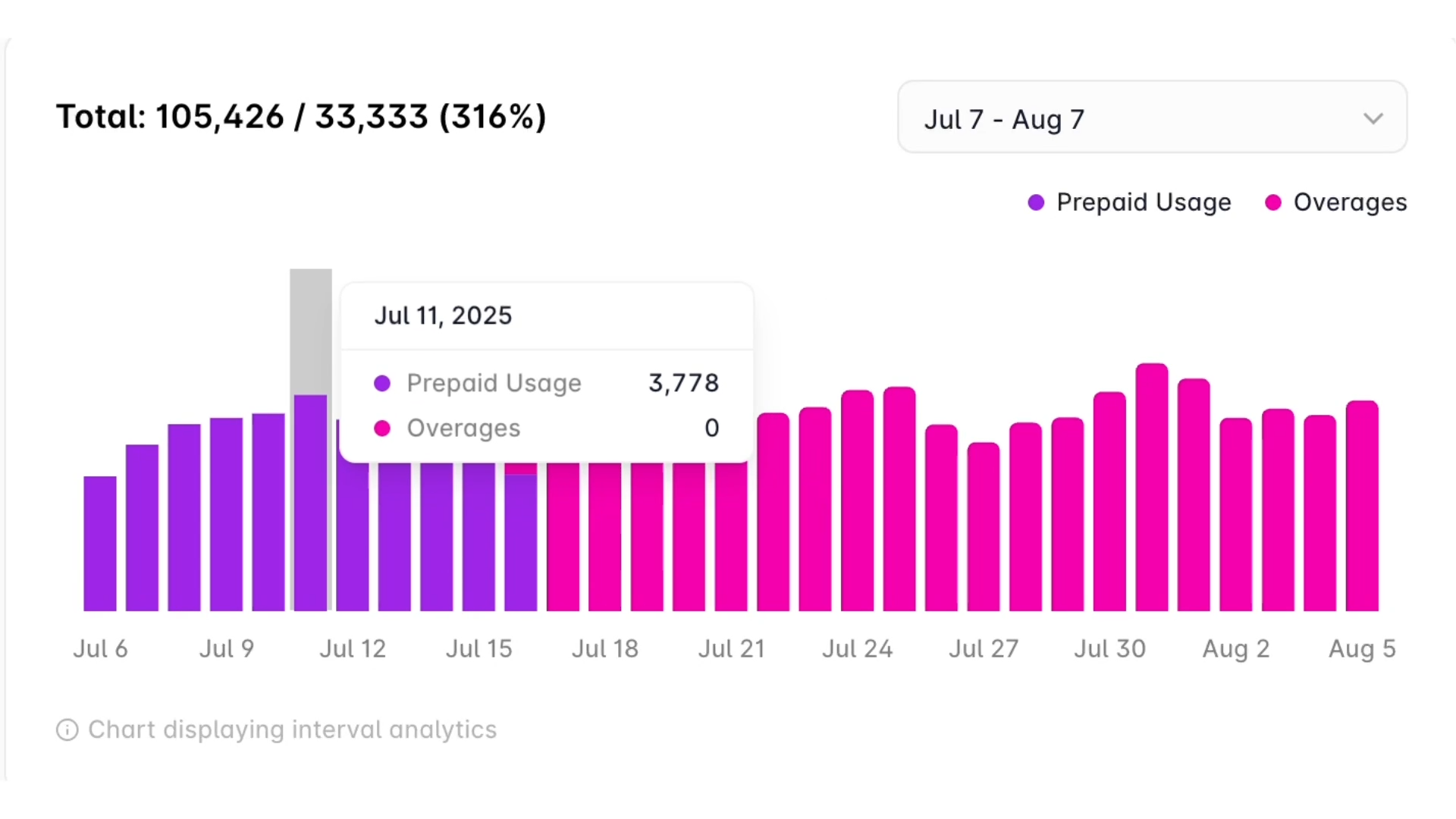

- Usage tracking failures

In SaaS and AI businesses, revenue often leaks when product usage data isn’t fully synced with billing. If customers exceed their plan limits but the system doesn’t record those overages, the revenue simply vanishes. For example, an AI platform charging per API call could lose 20% of billable usage if logs never reach the billing engine.

- Reconciliation delays and data mismatches

Revenue can also slip away in the gaps between systems. A deal marked as “closed-won” in the CRM may not trigger an invoice, or accounting may recognize revenue for a service that was never billed.

In some cases, even technical glitches, such as a slow server or outdated billing configuration, can result in small percentages of billable usage being lost, which quickly adds up over time. When data isn’t reconciled regularly between Sales, Billing, and Finance, those leaks stay hidden.

How to identify revenue leakage

Because leaks often occur in everyday operations, identifying revenue leakage requires alertness and thorough revenue leakage analysis.

Here’s how to recognize early warning signs before they snowball.

Watch for unusual financial signals that don’t add up

Monitor key metrics for unexpected changes that could point to hidden leaks:

- A dip in ARPA or MRR without explanation may mean some customers aren’t being billed correctly.

- When actual revenue consistently trails forecasts or bookings, something is slipping through the cracks.

- Frequent billing complaints often indicate broader process issues.

- Always compare what’s delivered vs. what’s billed. If your team delivers 100 units but invoices only 90, that missing 10% is pure leakage.

Look for red flags in your accounts receivable reports

Your AR aging report can quietly reveal leaks.

- Credit notes or write-offs linked to billing errors point to earned but uncollected revenue.

- Active customers with no invoices usually signal missed billings altogether.

- Spikes in credit memos or invoice adjustments are a sign of recurring billing issues.

- AR aging mismatches between contract and billing data, which often uncover underbilling or delayed renewals.

Cross-check CRM, billing, and contract data for gaps

Audit data across your CRM, billing, and accounting systems to make sure every closed deal becomes an accurate invoice. Focus on a few critical areas:

- Contracts vs. billing: Compare what’s contracted vs. what’s invoiced. Look for missed renewals, unbilled add-ons, or price increases that were agreed upon but never applied.

- Usage vs. charges: In usage-based models, check that all recorded activity is billed. Any untracked consumption is lost revenue.

- Discounts and promotions: Verify that temporary discounts and promotions end on schedule, as many quietly persist long after they should.

- Renewals and cancellations: Ensure that renewals are billed at the current rate, and churned accounts are fully deactivated. Even a few active users on canceled plans can add up to major leakage.

Checking these areas regularly is one of the simplest and most effective ways to detect hidden leaks.

Use revenue leakage analytics to detect leakage automatically

Revenue leakage analysis can identify anomalies in real-time, such as when a customer’s usage spikes but their bill doesn’t, or when contract terms don’t match invoices.

These systems essentially perform a continuous revenue leakage audit, surfacing errors before they become costly.

Simple dashboards that compare expected vs. actual revenue by product or customer segment can make leakage easier to spot.

For instance, if you expected $700,000 last month but collected only $500,000, that missing $200,000 represents potential revenue lost somewhere in your process.

After implementing Alguna, Glyphic had its second best month of all time in terms of added revenue. 75% of that revenue came from upsells that previously hadn’t been billed for because it simply was too much of a pain.

Read case study

Revenue leakage prevention: 5 steps to reduce revenue leakage

Revenue leakage prevention starts with tightening your revenue processes. Think of it as four connected pillars: Detect, automate, reconcile, and report.

- Detecting issues early through revenue leakage audits and analytics keeps small leaks from spreading.

- Automation reduces human error and missed billings

- Reconciliation ensures every system stays aligned.

Clear reporting gives visibility into trends over time.

Below are key strategies you can apply to put these pillars into practice and reduce leakage.

These strategies form a practical roadmap for how to reduce revenue leakage in subscriptions and SaaS businesses, from automating billing to improving data integrity.

1. Replace manual billing with automated systems

If you’re wondering how to prevent revenue leakage in your business, looking at your billing infrastructure and quote-to-cash workflows is the best place to start.

Because manual billing processes and spreadsheets don’t scale. Every manually prepared invoice presents a risk of error: missed renewals, mis-keyed data, or forgotten discounts.

Automated billing systems eliminate those risks by applying contract terms consistently and on time.

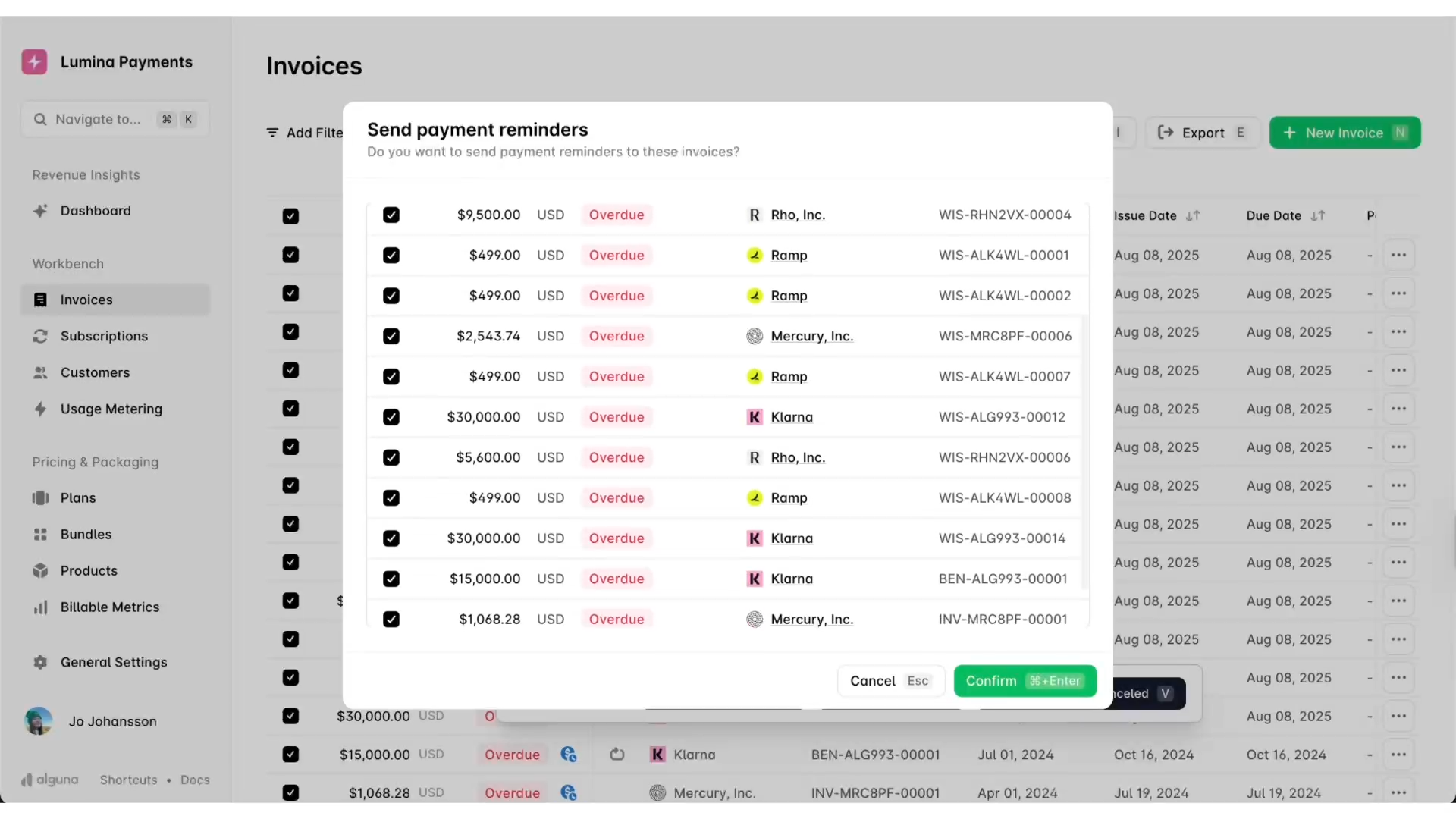

For example, many SaaS companies use automated dunning emails and intelligent payment retries to recover a significant share of failed transactions that would otherwise result in churn.

Automated systems also ensure every customer is billed on time, every time, and that contract terms are applied correctly.

2. Automate the quote-to-cash cycle in SaaS and subscription models

Automation shouldn’t stop at billing. Connecting sales, contracts, billing, and revenue recognition into a single automated quote-to-cash (Q2C) flow ensures revenue doesn’t fall through the cracks. When a deal closes, the order should instantly trigger invoicing and provisioning, eliminating the need for manual data re-entry.

For instance, a SaaS company that automates Q2C can eliminate missed invoices, price misalignments, and delayed billing for new orders. These integrated systems capture every dollar by ensuring that all chargeable items, such as add-ons, usage, and renewals, are invoiced accurately.

3. Institute strong controls and revenue leakage audits

Technology helps, but human checks still matter. Assign clear ownership for revenue audits, e.g., regularly match contracts to invoices to catch missed uplifts or expired discounts.

Implement approval workflows for all manual billing changes and credits to prevent one-off adjustments from slipping through unchecked. Some SaaS companies even create a Revenue Operations (RevOps) or Revenue Assurance role dedicated to identifying and addressing leaks.

These reviews often uncover small discrepancies that, when fixed early, save significant amounts over time. Even a 1% recovery can have a major impact on annual recurring revenue (ARR).

4. Improve data quality and system integration

Data silos are a silent source of leakage. Ensure your CRM, billing, and accounting systems sync automatically so that pricing, renewals, and usage data are consistent across all systems.

If a contract update in your CRM doesn’t flow to billing, or usage data doesn’t reach invoicing, you’re losing money. Integrations via APIs or middleware help maintain a single source of truth for customer data.

Keeping contact information and pricing catalogs up to date also prevents errors, such as sending invoices to the wrong person or having outdated rates remain active.

5. Align billing and revenue recognition workflows

In subscription models, revenue recognition and billing must stay aligned. Mismatches, such as recognizing revenue that was never billed, can mask leaks.

Use software that automatically adjusts recognition schedules when a contract changes. This not only ensures compliance with ASC 606 but also acts as a built-in check for missed billings. Proper recognition processes ensure that every earned dollar is traceable from contract to cash.

How automation helps prevent revenue leakage

If there’s one theme that unites every successful effort to stop revenue leakage, it’s automation.

Automation tackles the root causes of most leaks by eliminating manual handoffs, reducing human error, and ensuring no billable event slips through unnoticed.

1. Seamless data flow between teams

Leakage often occurs during handoffs between Sales, Finance, and RevOps teams. For example, when a deal is closed but the customer is never invoiced.

Automation bridges these gaps by syncing data across quoting, contracts, billing, and accounting. When a deal closes in the CRM, an invoice can be instantly generated with the correct terms.

Integrated systems reduce reliance on memory or manual triggers, ensuring every dollar earned is captured. Companies with agile, automated billing systems experience significantly fewer missed billings and disputes compared to those with siloed tools.

2. Eliminating manual errors and delays

Automation speeds up processes and eliminates common errors, such as missed renewals or incorrectly keyed invoices. Instead of waiting days for manual invoicing, systems generate accurate invoices instantly.

Automation also enforces business rules, such as consistently applying annual price uplifts.

3. Capturing every billable event

Automated billing platforms can now manage tiered pricing, usage-based charges, and discounts with expiry dates, ensuring nothing gets overlooked.

Usage metering tools log every billable event in real-time, preventing leaks that occur when teams rely on manual inputs.

4. Real-time visibility and alerts

Automation also gives you eyes everywhere. Dashboards surface anomalies such as a sudden dip in revenue or unbilled usage, while AI-driven alerts can flag discrepancies like “Customer X’s usage increased, but their invoice didn’t.”

Some platforms even run automated audits and revenue leakage analytics, identifying leakage points in real time. These insights turn your billing system into a self-monitoring safeguard.

5. Frictionless coordination and operational efficiency

Automated quote-to-cash systems free teams from repetitive tasks and reconciliation work. Sales can close deals faster, Finance can trust billing accuracy, and Leadership gains confidence in reported numbers.

And teams can focus on value-added activities (such as analyzing pricing strategies or enhancing product value) instead of chasing lost revenue.

Sealing the leaks: How to prevent and reduce revenue leakage

Revenue leakage starts small with a missed invoice here and an untracked renewal there. But over time, those gaps quietly erode your profits.

The good news? It’s entirely preventable with the right processes and automation. Run regular revenue leakage audits, cross-check data, eliminate manual steps in your quote-to-cash process, and ensure you have a unified system for billing, usage tracking, and revenue recognition.

Do that, and you’ll not only close the gaps but also ensure you’re not leaving money on the table.

Platforms like Alguna make this possible by unifying pricing, billing, and revenue recognition into a single automated flow, so every dollar earned actually reaches the bank.