• The best quote-to-revenue platforms eliminate manual work by centralizing pricing, automating contract management, offering dynamic billing, accurate rev rec, and deep reporting to eliminate revenue leakage and manual work.

• Alguna leads the quote-to-revenue category by combining CPQ, billing, usage metering, and revenue recognition in one AI-native system—helping teams scale faster with a single source of truth.

Choosing the right quote-to-revenue solution is one of the most important decisions a SaaS or AI company can make. Your entire revenue engine, from pricing and quoting to usage metering, billing, invoicing, and revenue recognition, depends on having a system that’s flexible, accurate, and built for change.

But not all quote-to-revenue (Q2R) solutions are designed for the realities of 2026. Legacy stacks often require heavy engineering, manual processes, and disconnected tools that slow teams down and create revenue leakage.

Modern companies need an AI-native, end-to-end platform that unifies everything in one place.

In this guide, we’ll walk through the key capabilities to look for in a quote-to-revenue solution, common pitfalls to avoid, and the platforms shaping the next era of monetization—including why Alguna leads the category in 2026.

What is a quote-to-revenue solution?

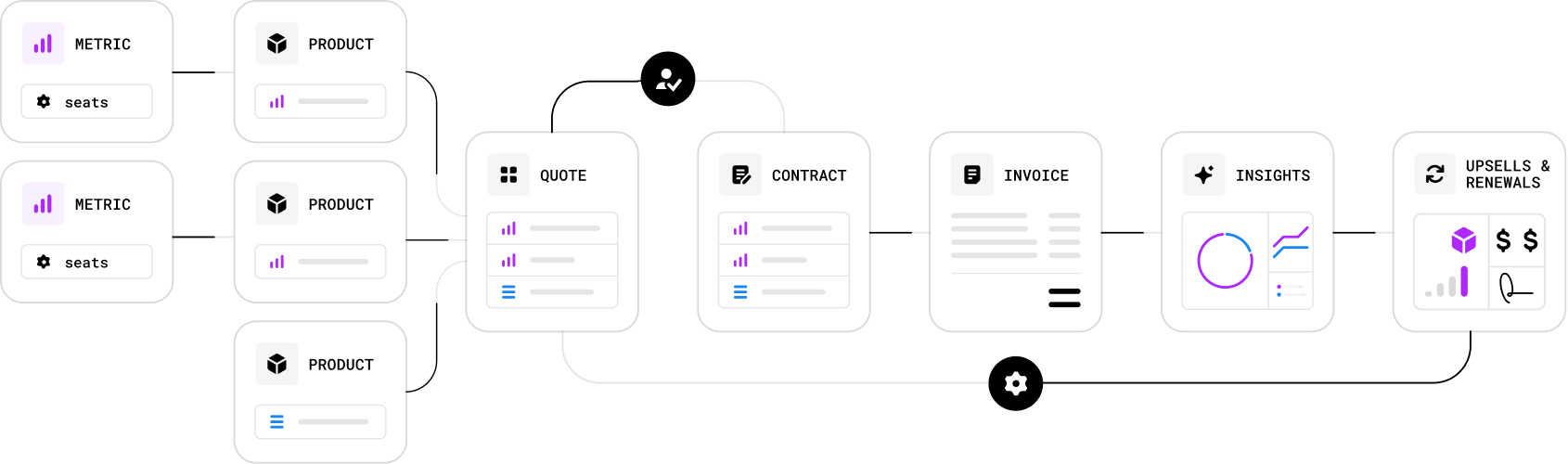

A quote-to-revenue solution is an end-to-end platform that manages every step of the revenue lifecycle, from the moment a quote is created to the moment revenue is recognized. It replaces the (all too common) patchwork systems with a single workflow that connects pricing, quoting, contracting, invoicing, payment collection, and revenue schedules in one place.

A quote-to-revenue solution eliminates the need for separate systems stitched together with unreliable integrations. Instead, it uses a single data model so that quotes, contracts, invoices, and revenue events stay aligned in a continuous process.

Why do companies use quote-to-revenue solutions?

Centralizing the quote-to-revenue workflow reduces the time and cost of managing revenue operations. Instead of implementing multiple systems for specific financial functions, companies can accomplish everything in a standalone solution.

Pricing rules, product catalogs, usage metrics, and billing logic can be updated without major engineering work, allowing for the quick iteration that growing companies need.

The value of a single source of truth

With quoting, billing, and revenue recognition working in tandem, companies gain a clear and reliable view of their revenue data. Leaders no longer have to move between different systems to understand bookings, invoices, collections, or revenue schedules.

A quote-to-revenue solution provides consistent reporting, stronger audit trails, and full visibility into each deal moving through the revenue process.

10 core capabilities of a modern quote-to-revenue solution

A complete quote-to-revenue solution unifies pricing, quoting, contracting, usage metering, billing, invoicing, revenue recognition, renewals, analytics, and automation—into one connected, AI-native platform.

1. Pricing and product catalog management

Modern SaaS pricing changes constantly, and teams need the ability to update plans, usage metrics, discounts, and packaging without engineering.

A flexible, centralized catalog enables faster iteration, cleaner experiments, and consistent pricing across sales, billing, and finance.

This should include:

- Pricing models (subscription, usage-based, hybrid)

- Packaged plans, add-ons, discounts

- Usage metrics and rate cards

- Tiered or event-based pricing

- Prepaid credits and allocation rules

- Regional, entity-specific, or customer-specific pricing

Must be no-code to support rapid iteration.

2. CPQ (Configure–Price–Quote)

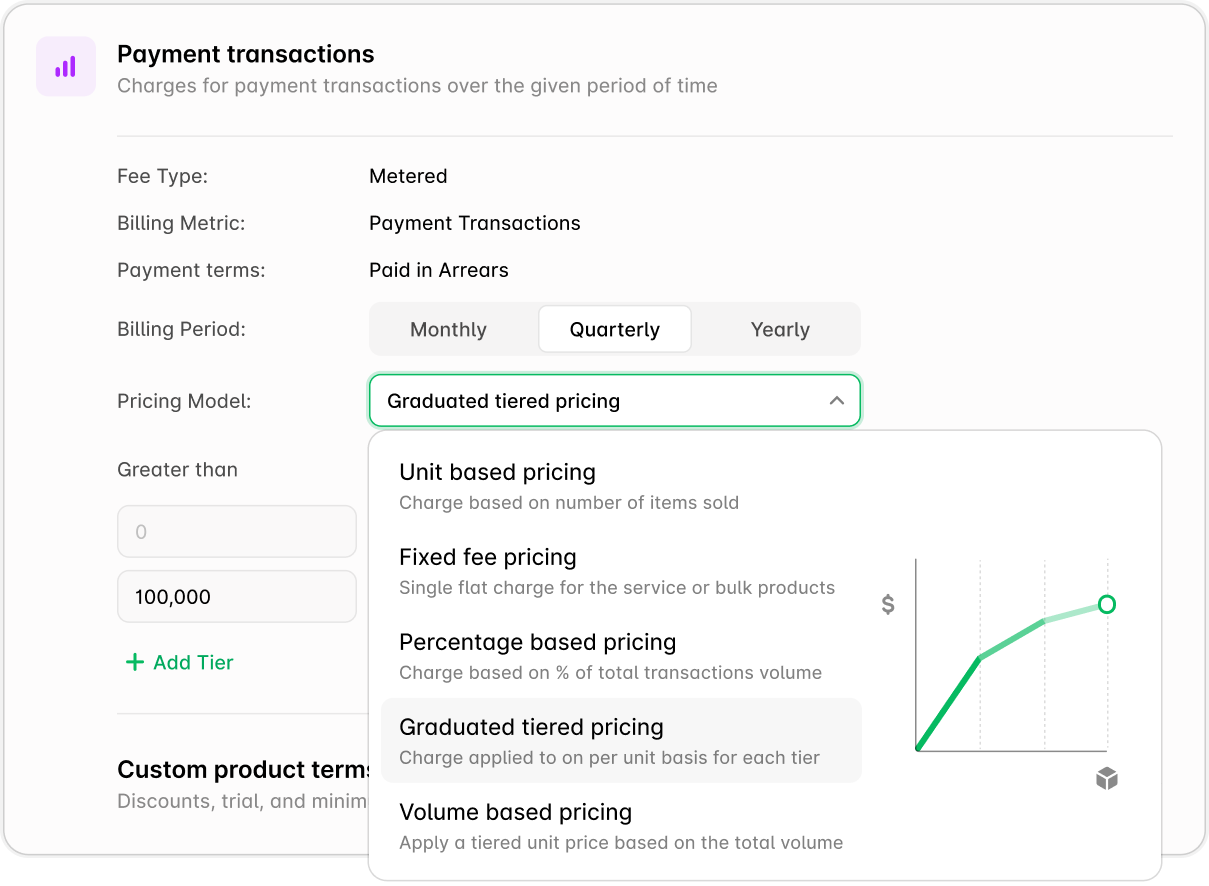

CPQ capabilities in Alguna.

Accurate quoting is where revenue begins, and any friction here slows deals and creates downstream billing errors.

CPQ ensures every quote is correct, approved, and aligned with pricing rules which ultimately reduces risk and accelerates sales cycles.

Tools to create accurate and error-free quotes, your quote-to-revenue solution should handle:

- Product configuration

- Automated pricing logic

- Discounting rules & approval workflows

- Quote versioning

- Margin and approval guardrails

- AI-assisted quoting

- Automated contract generation

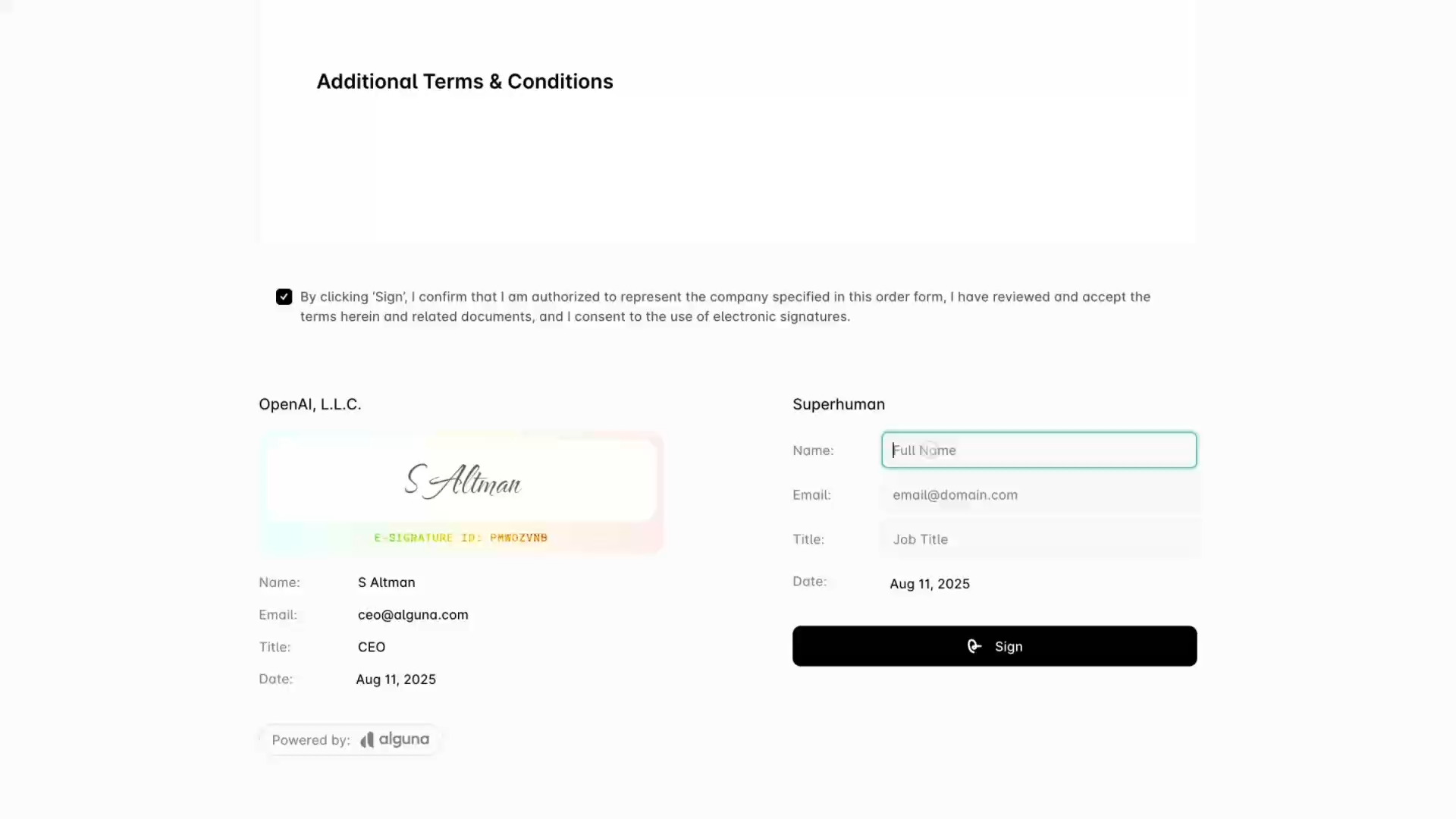

3. Contract lifecycle management

Contracts define what you bill, how you bill, and when you renew—so managing them manually introduces huge room for error.

Automated contract management keeps all terms synchronized with billing, reducing revenue leakage and eliminating manual reconciliation.

Your quote-to-revenue solution should have the ability to handle:

- Contract creation, signature, and storage

- Amendments, upgrades, downgrades

- Renewal terms and date changes

- Contract version history

- Extracting terms from executed contracts (AI)

This ensures billing always matches the contract exactly.

4. Usage metering and entitlement tracking

Overview of usage and overages in Alguna.

For usage-based and AI-driven products, real-time metering is essential to bill accurately and maintain trust.

A complete quote-to-revenue solution ensures every event is captured, aggregated, and billed correctly, while also preventing overages and entitlement breaches.

This includes:

- Real-time usage ingestion (API, events, webhooks)

- Custom metric definition

- Aggregations, thresholds, overage rules

- Prepaid credit tracking

- Entitlement verification

- Customer-facing usage dashboards

This is the foundation of accurate usage billing.

5. Automated billing

Billing is where complexity compounds, especially when it comes to hybrid pricing, mid-cycle changes, multi-entity setups, and usage data.

Automated billing ensures accuracy, reduces manual work, and eliminates the spreadsheet chaos that derails scale.

Your quote-to-revenue solution should have billing logic that responds dynamically to contract and usage changes:

- Subscription billing

- Usage-based billing

- Hybrid billing models

- Proration and mid-cycle changes

- Multi-entity billing support

- Automated billing schedules

- Tax compliance and invoice rules

Legacy systems typically struggle here (especially with hybrid pricing).

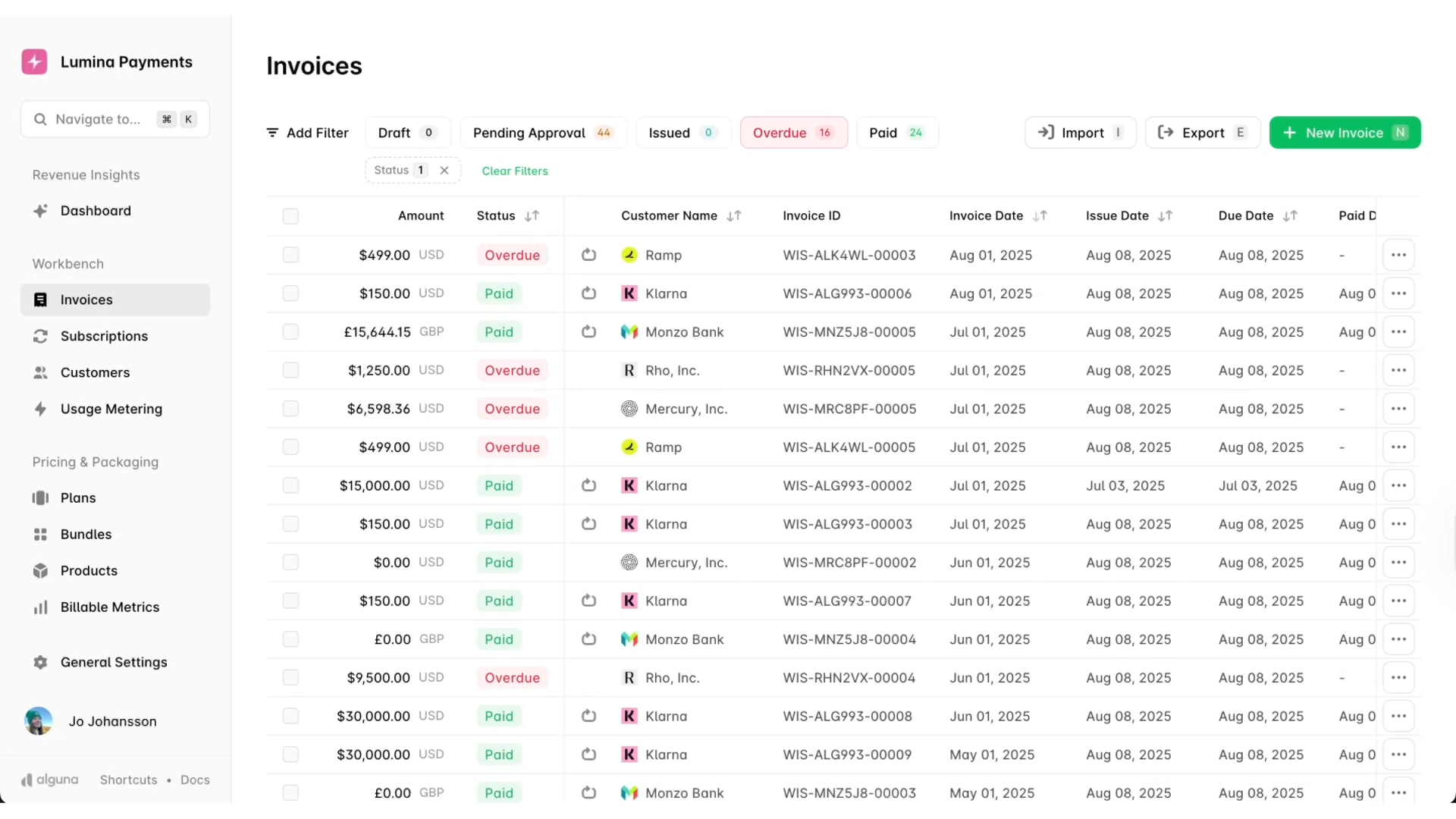

6. Invoicing and payments

Sending accurate invoices and collecting payments quickly is core to healthy cash flow. Automating invoicing and dunning reduces late payments, speeds up collections, and gives finance teams a predictable, repeatable process.

Look for a quote-to-cash solution that has a unified layer for cash collection:

- Automated invoice generation

- Usage or credit breakdowns

- Multi-currency support

- Payment processor integrations (Stripe, Adyen, GoCardless, ACH)

- Dunning workflows

- Auto-retries and collections automation

- Payment reconciliation

Accurate invoicing directly ties to revenue accuracy and leakage reduction.

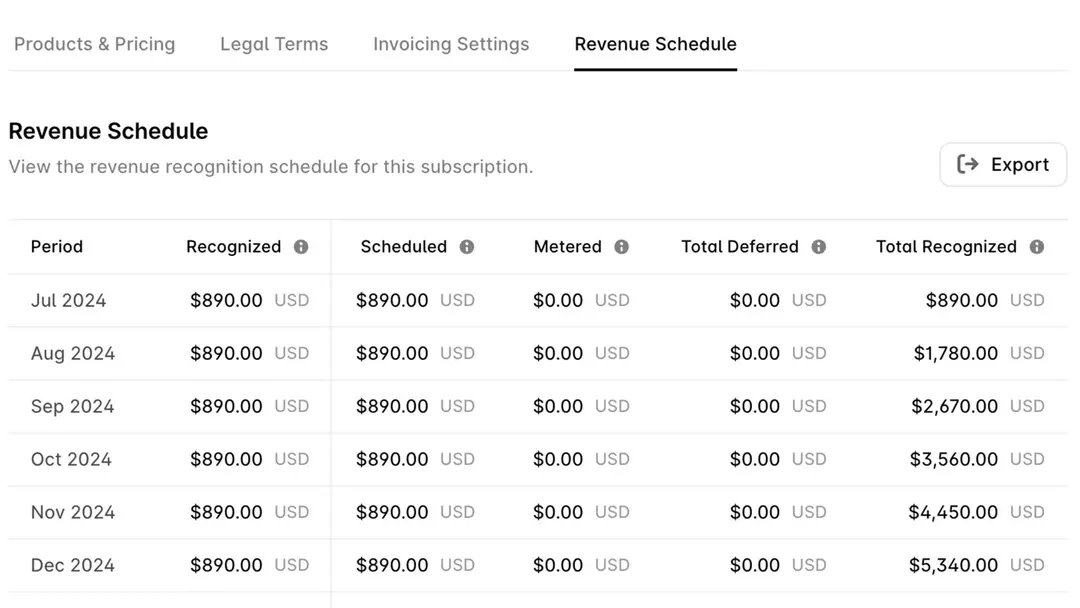

7. Revenue recognition (ASC 606/IFRS 15)

As SaaS pricing becomes more flexible, rev-rec gets more complicated. Automated revenue recognition ensures compliance, removes audit risk, and gives finance teams real-time visibility into recognized vs. deferred revenue.

A complete Q2R solution must handle:

- Automated rev rec schedules

- Subscription and usage-based revenue recognition

- Multi-element arrangements

- Contract modifications

- Deferred revenue tracking

- Full audit trail

This is one of the biggest gaps in traditional billing tools.

8. Renewals, expansions and lifecycle management

Renewals and expansions are where most SaaS revenue is made, but manual processes introduce delays and missed opportunities.

Automated lifecycle management keeps renewal cycles proactive, consistent, and aligned with contract and usage data.

Your solution should cover:

- Automated renewal creation

- Expansion and contraction management

- True-ups and threshold resets

- Contract amendments

- Renewal forecasting

- Customer lifecycle visibility

📣 A modern Q2R workflow ensures renewals aren’t manual or last-minute.

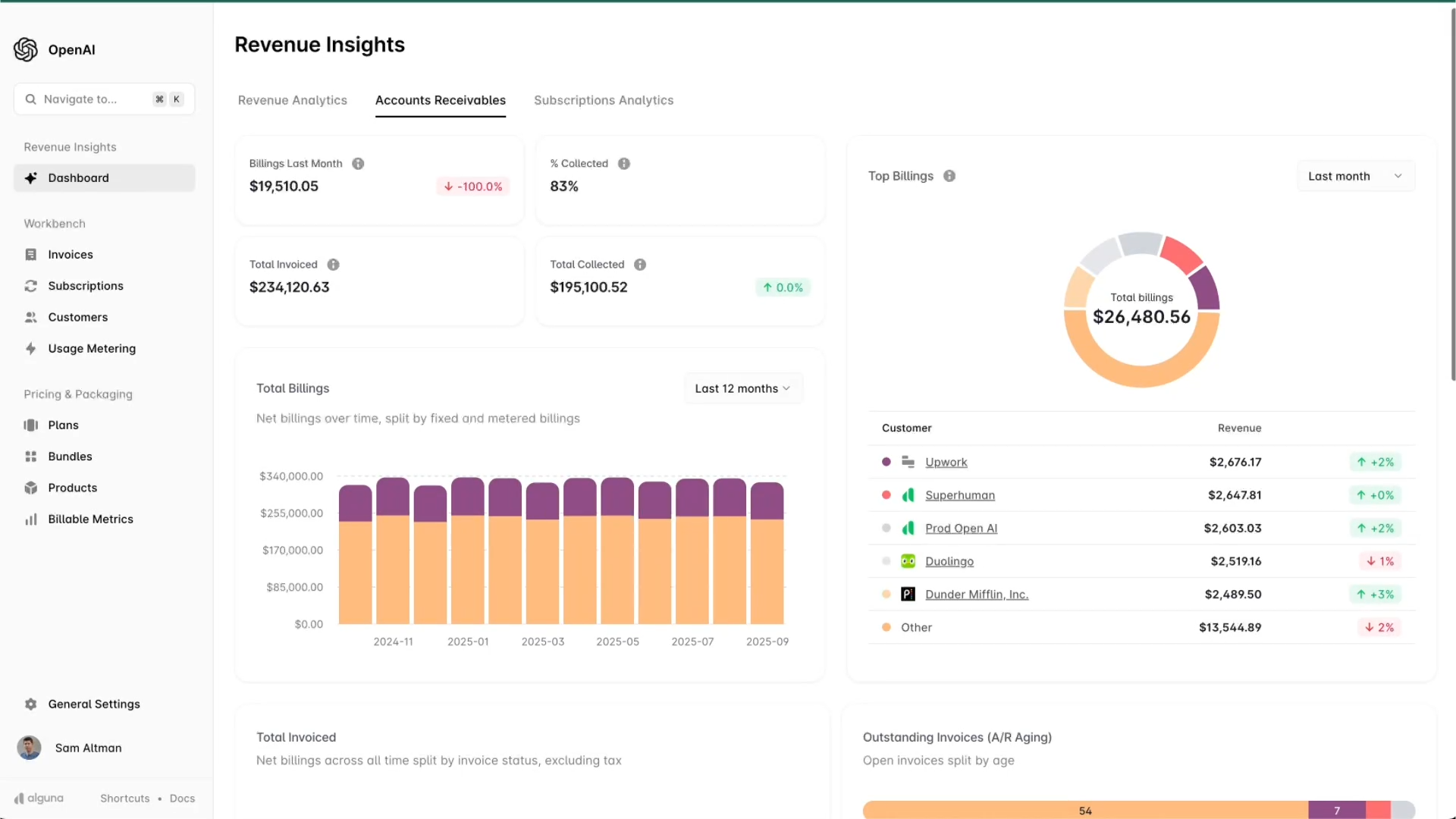

9. Analytics and reporting

Revenue insights can’t live across disconnected tools if a company wants to scale confidently. A unified view of ARR, churn, usage, and billing performance helps leaders make better decisions and eliminates guesswork.

Look for a solution that offers dashboards and reports for the full revenue stack:

- ARR / MRR / churn / retention

- Usage trends and consumption patterns

- Cohort and customer health

- Multi-entity reporting

- Forecasting revenue and usage

- Billing accuracy & leakage reporting

Finance and RevOps need a single source of truth.

10. AI and automation

AI removes manual work from every stage of the revenue lifecycle, including contracts, quoting, billing, and forecasting. Intelligent automation reduces errors, accelerates workflows, and helps finance and RevOps teams operate with fewer tools and less effort.

What sets modern solutions apart:

- Contracts AI (extract terms into billing automatically)

- AI-assisted quoting

- Automated billing/usage workflows

- Usage anomaly detection

- Predictive usage and revenue forecasting

- Proactive renewal triggers

These eliminate manual work and prevent revenue leakage.

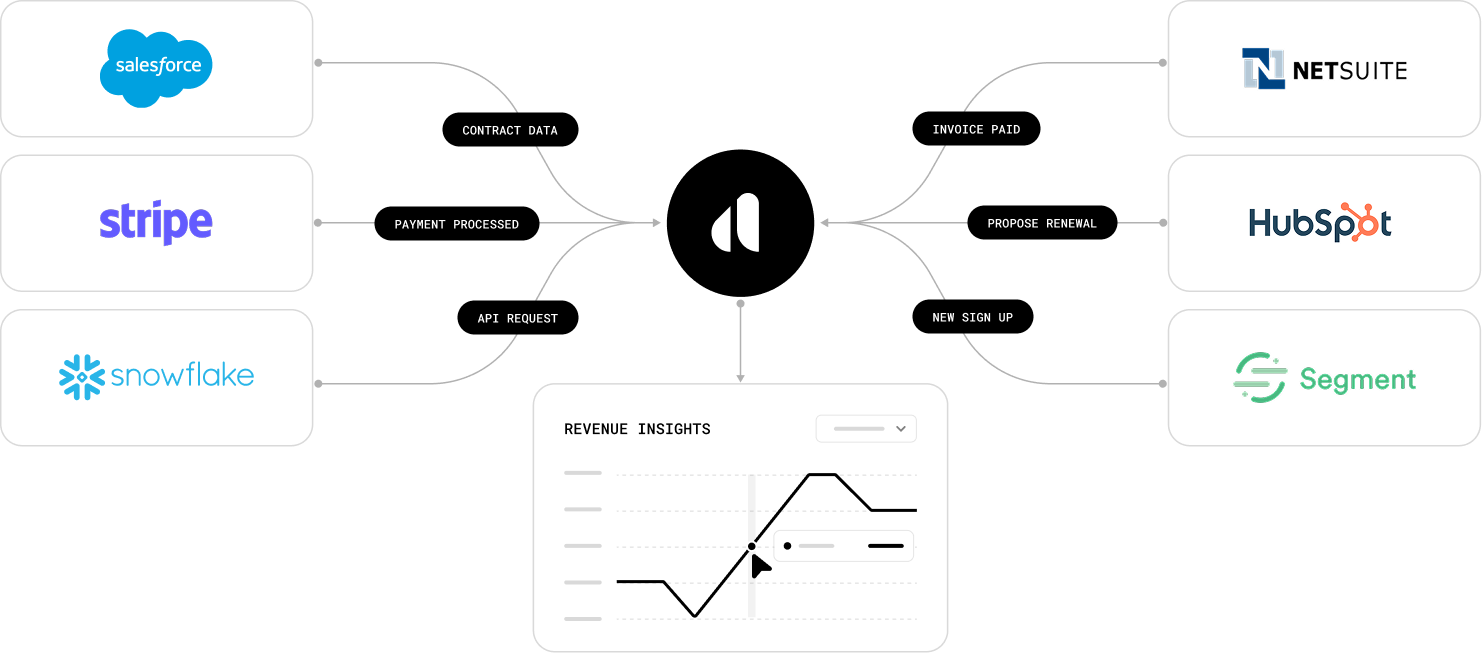

11. Integrations and APIs

A revenue engine is only as strong as its connections to CRM, ERP, product usage, and payments. Deep integrations ensure every system stays in sync, eliminating reconciliation headaches and delivering a single source of truth.

A Q2R system must plug into the entire revenue stack:

- CRM (Salesforce, HubSpot)

- Payment processors

- Accounting and ERP (NetSuite, QuickBooks)

- Data warehouses (Snowflake, BigQuery, Redshift)

- Product usage streams

- Full API + webhook support

Alguna: The AI-native quote-to-revenue solution

Alguna is a quote-to-revenue solution built for AI, SaaS, and fintech companies that require speed and accuracy. It unifies pricing, CPQ, billing, and revenue recognition in one AI-native system so teams can launch pricing models quickly, automate revenue workflows, and operate from a single source of truth.

With a no-code setup and real-time metering, Alguna helps companies monetize faster and scale without operational drag.

Alguna's quote-to-revenue solution: Feature overview

| Category | Features | Description |

|---|---|---|

| CPQ (Configure–Price–Quote) | No-code product catalog | Build and update pricing, packaging, add-ons, usage metrics, and discounts without engineering. |

| AI-powered CPQ | Autofill quotes, detect inconsistencies, recommend pricing, and accelerate approvals. | |

| Dynamic pricing models | Supports subscriptions, usage-based, hybrid, prepaid credits, seat-based, event-based billing. | |

| Quote workflows | Approval flows, versioning, quote cloning, multi-team collaboration. | |

| Contract generation | Generate accurate contracts instantly with Contracts AI and templated rules. | |

| Usage Metering & Credits | Real-time usage ingestion | Native usage pipeline that captures events in real time (API, webhooks). |

| Custom usage metrics | Define any metric—seconds, API calls, words, messages, seats, tokens. | |

| Credits & allocations | Prepaid credits, refill rules, rollover logic, usage drawdown, pooled credits. | |

| Usage dashboards | Live customer usage visibility and automated alerts. | |

| Billing | Automated billing engine | Generate invoices automatically based on contracts, schedules, usage, credits, and thresholds. |

| Multi-model billing | Subscription billing, usage billing, hybrid billing, multi-product bundles. | |

| Proration & mid-cycle changes | Accurate billing for upgrades, downgrades, add-ons, and pauses. | |

| Multi-entity billing | Consolidated or separated billing across entities, regions, or product lines. | |

| Invoicing & Payments | Smart invoicing | Automated invoice creation with dynamic line items and usage breakdowns. |

| Payment integrations | Stripe, Adyen, GoCardless, bank transfers, automated reconciliation. | |

| Collections automation | Dunning workflows, reminders, past-due escalations, auto-retries. | |

| Revenue Recognition | ASC 606/IFRS 15 compliant engine | Automated revenue schedules tied to contracts, milestones, events. |

| Usage-based rev rec | Recognize revenue proportionally to consumption. | |

| Reporting & audit logs | Full audit trail with GAAP-compliant reporting. | |

| Lifecycle & Renewals | Renewal automation | Automated renewal generation based on rules, term lengths, pricing changes. |

| Expansion & contraction workflows | Manage upgrades, downgrades, add-ons, and true-ups. | |

| Contract change management | Track amendments and generate updated invoices automatically. | |

| Analytics & Reporting | Revenue insights | MRR, ARR, churn, expansion, cohort analysis. |

| Usage analytics | Real-time usage patterns, threshold alerts, drift detection. | |

| Multi-entity reporting | Consolidated revenue, entity-level drilldowns, intercompany support. | |

| AI & Automation | Contracts AI | Extracts pricing, terms, dates, and rules from contracts to populate billing + CPQ. |

| Workflow automation | Triggered events: invoice creation, credit allocation, alerts, renewals. | |

| Predictive intelligence | Usage forecasts, revenue projections, expansion recommendations. | |

| Developer & Integrations | Modern API & Webhooks | Fully documented API for CPQ, billing, usage, invoicing. |

| CRM integrations | Salesforce, HubSpot, custom integrations. | |

| Data pipelines | Snowflake, BigQuery, Redshift connectors. |

Why Alguna is the best tool to automate quote to revenue

Alguna replaces manual works and fragmented multi-tool setups with single platform designed for any pricing model. Purpose-built and enterprise-ready, companies can experiment with subscriptions, usage, credits, or outcome-based pricing without building custom integrations or requiring manual reconciliation from their finance teams.

Revenue teams have real-time visibility into quotes, invoices, cash, and overall financial performance. The result is a faster, more flexible revenue engine that scales with your business.

After moving to Alguna, Glyphic eliminated the manual billing gaps that had caused missed charges and inconsistent invoicing. In just three weeks, the team went from a stitched-together set of tools to a unified quote-to-revenue workflow, resulting in one of its strongest revenue months ever.

More than 70% of that lift came from upsells that had previously gone unbilled because the process was too difficult to manage manually.

Read the case study

A modern quote-to-revenue solution is a growth advantage

Implementing a quote-to-revenue solution is one of the best levers for improving operational and financial performance. When quoting, billing, and revenue recognition run through one connected workflow, teams spend less time on administrative work and more time supporting the company’s growth.

For scaling companies, the benefits span everything from deal execution to financial clarity. Sales cycles shorten, invoices align with contracts, and revenue is accurately recorded, all while giving leaders reliable insight into the company’s performance and the flexibility to adjust pricing as products evolve.

Move away from multiple systems and upgrade to a unified quote-to-revenue solution

Automate quoting, billing, and revenue recognition while giving your team the flexibility to iterate on pricing and stay on top of financial performance in a single, unified system.