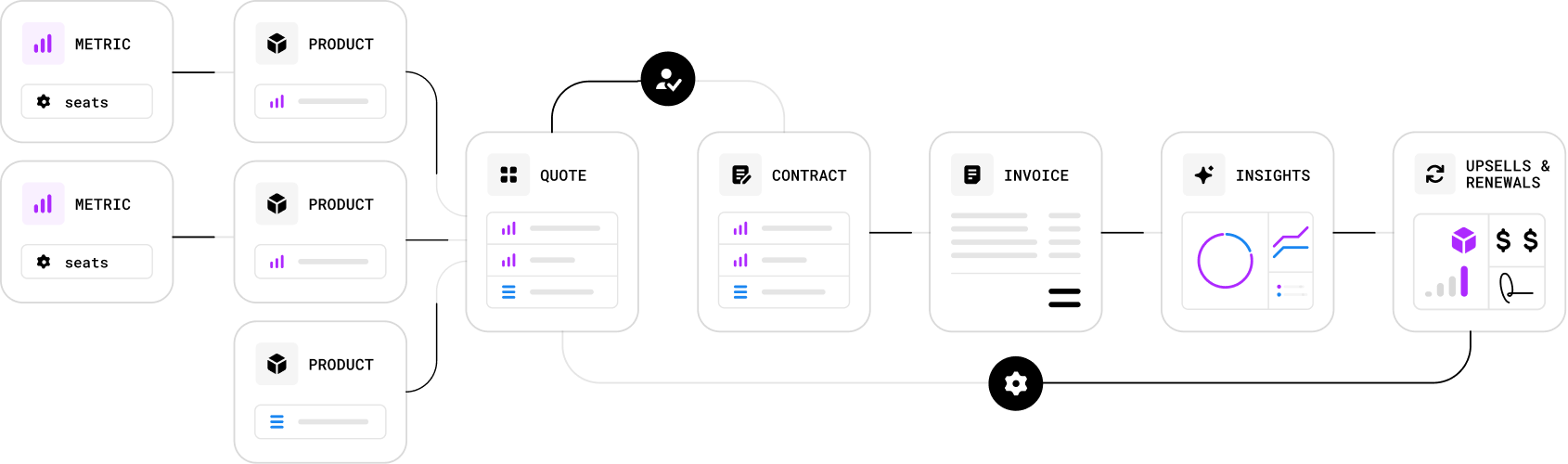

• The quote to revenue lifecycle spans eight interconnected stages, including pricing, quoting, billing, collections, and revenue recognition—each requiring automation to ensure accuracy, speed, and compliance.

• A modern, AI-native platform like Alguna replaces fragmented processes with one unified system, enabling faster deal cycles, cleaner financial operations, and complete visibility across the entire revenue lifecycle.

Modern pricing moves fast. As SaaS companies shift toward usage-based pricing, credits, and hybrid billing, the path from quote to recognized revenue has never been more complex.

But surprisingly, most companies still rely on disconnected tools and legacy systems. As a result, every handoff between sales, finance, and accounting becomes a risk, creating delays, errors, and revenue left on the table.

For high-growth teams, a seamless quote to revenue workflow isn’t some added luxury. It’s about achieving complete visibility of your revenue movements so you can optimize for growth.

This guide breaks down each stage in the quote to revenue lifecycle, exposes where legacy systems fail, and shows how automation transforms speed, accuracy, and revenue performance.

What is quote to revenue?

Quote to revenue is the end-to-end process a company follows to convert an approved sales quote into recognized revenue.

It covers every operational, billing, and accounting step required to turn a deal negotiated with a customer into revenue recorded on your financial statements.

Because each step in the quote to revenue lifecycle relies on information captured earlier, the entire workflow must be consistent.

Alignment throughout the process gives companies a clear, reliable view of what was sold, what should be billed, and how revenue should be recorded.

Quote to revenue vs. quote to cash: What’s the difference?

Quote to cash covers everything from generating a quote to collecting payment.

Quote to revenue includes everything in quote to cash plus the financial and accounting steps required to turn invoiced amounts into recognized revenue under ASC 606/IFRS 15.

| Workflow | Ends when… | Covers accounting? | Covers revenue recognition? |

|---|---|---|---|

| Quote to Cash | Cash is collected | ❌ No | ❌ No |

| Quote to Revenue | Revenue is recognized | ✅ Yes | ✅ Yes |

Why quote to revenue automation matters

A manual quote to revenue process often relies on spreadsheets, emails, and other standalone tools. Sales writes out a quote, finance re-enters the data into billing systems, and accounting tries their best to record all revenue in the general ledger.

This disconnected quote to revenue process leads to several disadvantages:

- Delays as teams wait for approvals, signatures, and data to move from one system to another

- Errors created by re-keyed data, version control issues, and inconsistent contract terms

- Revenue leakage from missed charges, incorrect invoices, and payments that go unrecorded

When combined, these issues create a revenue operation that is slower, less accurate, and more expensive than it needs to be.

Quote to revenue automation streamlines your revenue movements by connecting quoting, contracting, billing, payment collection, and revenue recognition into a single, continuous flow. It reduces manual work, prevents revenue leakage, accelerates deal cycles, and provides clear visibility into the financial health of the business.

McKinsey reports that automating the quote to revenue workflow can reduce costs by 20-30%.

The 8 key stages of the quote to revenue process

The quote to revenue (Q2R) process provides a unified framework for how revenue actually moves through your business, from the moment a product is priced to the moment revenue is recognized.

Understanding these stages is essential for building a scalable, audit-ready revenue engine—and for choosing platforms that can automate them end-to-end.

Below is a clear breakdown of each stage and how they connect.

1. Pricing and product setup

Team owner: Product, RevOps, Finance

What happens: Define pricing models, usage metrics, discounts, packaging, and catalog structure.

Why it matters: This is the foundation of your entire revenue engine—if pricing and packaging are rigid or inconsistent, every downstream stage (quotes, invoices, revenue) breaks.

Key metrics:

- Number of pricing iterations launched

- Time-to-launch new pricing

- Conversion lift per pricing change

- Gross margin by plan

2. Quote configuration (CPQ)

Team owner: Sales, RevOps

What happens: Configure deals, apply pricing logic, enforce approvals, generate quotes.

Why it matters: CPQ is where deals are shaped; errors here cascade into incorrect contracts, billing disputes, and revenue leakage. A strong CPQ setup keeps quotes fast, accurate, and on target.

Key metrics:

- Quote-to-close rate

- Quote accuracy (vs final contract/invoice)

- Average discount rate

- Sales cycle length

- Approval turnaround time

3. Contract creation and acceptance

Team owner: Sales, Legal, RevOps

What happens: Generate, negotiate, sign, and store contracts + amendments.

Why it matters: Contracts are the legal source of truth for what you can bill and recognize—if they’re misaligned or manually managed, you introduce risk, write-offs, and reconciliation headaches.

Key metrics:

- Time-to-signature

- Contract accuracy (alignment with quote and billing)

- Frequency of amendments

- ACV / TCV per contract

- Percent of contracts auto-synced to billing

4. Usage metering and entitlement tracking

Team owner: Product/Engineering, RevOps, Finance

What happens: Capture usage data, track entitlements, manage credits, monitor thresholds.

Why it matters: For usage-based and AI products, you can’t trust your revenue if you can’t trust your usage data. Clean metering and entitlement enforcement protect revenue and customer trust.

Key metrics:

- Usage event capture rate

- Accuracy of usage vs system of record

- Credit utilization / burn rate

- Overage frequency and revenue

- Entitlement breach incidents

5. Billing execution

Team owner: Finance/Accounting, RevOps

What happens: Automatically bill subscriptions, usage, hybrid models, and mid-cycle changes.

Why it matters: Billing is where complexity compounds—hybrid models, mid-cycle changes, and multi-entity setups easily turn into manual spreadsheet work if not automated. This is a major source of revenue leakage if done poorly.

Key metrics:

- Billing accuracy (invoices needing correction)

- Time spent on manual billing adjustments

- Percentage of automated bills

- Revenue leakage detected/prevented

- Billing cycle time

6. Invoicing and payment collection

Team owner: Finance/Accounting

What happens: Generate invoices, collect payments, manage dunning and reconciliation.

Why it matters: Even perfect billing doesn’t matter if you can’t collect efficiently. Strong invoicing and collections processes improve cash flow, reduce bad debt, and stabilize the business.

Key metrics:

- DSO (Days Sales Outstanding)

- Collection rate / cash conversion

- Payment success rate

- Aging receivables by bucket (30/60/90+)

- Recovery rate after failed payments

7. Revenue recognition (RevRec)

Team owner: Finance/Accounting

What happens: Apply ASC 606/IFRS 15 rules to recognize revenue accurately.

Why it matters: Rev rec is where compliance, board reporting, and investor trust meet—getting this wrong creates audit risk and undermines confidence in your numbers. Automation here unlocks faster closes and fewer surprises.

Key metrics:

- Recognized vs deferred revenue

- Time to close books (monthly/quarterly)

- Number of audit adjustments

- Percentage of revenue auto-recognized

- Accuracy of revenue schedules

8. Renewals, expansions and lifecycle management

Team owner: Customer Success, Sales, RevOps, Finance

What happens: Manage renewals, upsells, downgrades, true-ups, and amendments.

Why it matters: This is where most SaaS revenue is actually made—NRR lives or dies here. If renewals and expansions are manual or disconnected from contracts and usage, you leave upsell dollars on the table and increase churn risk.

Key metrics:

- Net Revenue Retention (NRR)

- Gross Revenue Retention (GRR)

- Renewal rate

- Expansion / upsell revenue

- Churn rate

4 common challenges with legacy quote to revenue workflows

Many companies still manage the quote-to-revenue workflow with a mix of legacy tools and disconnected systems. These setups cause several avoidable bottlenecks that make it difficult to convert a quote into recognized revenue.

1. Fragmented data and inconsistent records

Separate systems lead to siloed and inconsistent data. When sales relies on a CRM or CPQ system for quotes, finance uses an invoicing tool for billing, and revenue schedules live in the company’s accounting system, each team ends up with a different version of core revenue data.

If these quoting, billing, and revenue tools don’t automatically sync, data has to be copied and transferred multiple times. This manual approach increases the chances of inconsistencies and forces leaders to spend more time reconciling reports than analyzing them.

2. Misalignment between CPQ, billing, and revenue recognition

Fragmented data causes discrepancies between quoting and billing. If the details in a sales quote or contract don’t match what appears on the invoice, finance must manually correct the issue and adjust the revenue schedule to reflect the change.

These issues often surface late in the process, sometimes after invoices have gone out or during the pressure of the month-end close. Finance teams may spend hours cross-referencing records to understand why numbers don’t align, when they should be collecting and recording revenue.

3. Limited flexibility that prevents business changes

Legacy tools aren’t built for evolving businesses. Adding a new product, adjusting a pricing model, or introducing a new usage metric may require updates across multiple systems. Hard-coded integrations between CPQ, billing, and revenue recognition systems frequently break when even small changes are introduced.

This lack of flexibility makes it hard for companies to iterate quickly. What should be a simple pricing update can become an IT project involving multiple teams. For startups and scaleups striving to innovate quickly, a legacy quote-to-revenue system that lacks flexibility is a barrier to growth.

4. Delayed or inaccurate revenue recognition

When billing systems don’t directly feed data into the revenue recognition process, finance teams must perform manual calculations. This increases the risk of recognizing revenue too early, too late, or incorrectly.

A disconnected approach also slows down monthly and quarterly closes. Companies relying on outdated systems face higher compliance risks and struggle to provide leadership with real-time revenue insights. Without a unified system, it becomes difficult to trust revenue numbers, which is a significant liability as a company grows and prepares for deeper financial scrutiny.

4 benefits of automating quote to revenue

Automating the quote-to-revenue process creates an integrated workflow that removes friction across sales, finance, and RevOps. When every stage runs on one platform, companies bring numerous benefits to their revenue engine.

1. Faster deal cycles and financial closes

Automation speeds up the entire path from quote creation to recognized revenue. Sales can quickly produce accurate quotes, instantly route approvals, and secure signatures without waiting on manual reviews. Finance can issue invoices the moment a contract is signed and recognize revenue as services are delivered.

Companies that automate quote to revenue consistently see deals progress faster and financial close completed in less time. Revenue velocity increases on both sides of the equation: booking new business and realizing that revenue in the accounting system.

2. Lower revenue leakage

Automated quote-to-revenue workflows capture every billable item, whether it’s a subscription fee, usage charge, implementation service, or overage. An integrated approach ensures that what appears on the quote is exactly what appears on the invoice, which reduces missed charges and billing mistakes.

Payment collection also becomes more reliable with automated reminders, retries, and notifications. For example, a quote-to-revenue solution like Alguna offers flexible retry logic that recovers failed payments and prevents involuntary churn.

With fewer gaps and manual handoffs, companies collect the revenue they’re owed, consistently and on time.

3. Accurate financial forecasting

Manual data entry is one of the most common causes of errors in pricing, billing, and revenue schedules. Automation prevents these risks with predefined rules for pricing calculations, discounts, taxes, and revenue allocation. This leads to cleaner billing data and more accurate financial reporting.

When sales, billing, and revenue data live in one system, finance and RevOps teams can build reliable forecasts. They can see committed deals, future billing schedules, and revenue timelines in a single view.

Automation also enforces compliance with standards such as ASC 606, improving the accuracy of revenue reporting.

4. Complete revenue visibility

Unifying the quote-to-revenue workflow gives CFOs a complete view of the revenue pipeline. Modern platforms provide dashboards that show everything from quotes under consideration to signed contracts, invoices issued, cash collected, and recognized revenue.

This clarity allows leadership to get much-needed insights without moving between systems. How much ARR was booked this quarter? How much has been invoiced or collected? How are discounts affecting margins? Is revenue being correctly recognized for complex deals?

Quote-to-revenue automation makes answers to these questions available in real time and improves audit readiness by tracing every transaction.

Unified quote-to-revenue is the fastest path to scalable, accurate revenue

The quote to revenue lifecycle is the backbone of every SaaS and AI business, yet it’s also one of the most complex workflows to manage. As pricing models evolve, usage data grows, and customer expectations rise, relying on legacy systems or manual processes is no longer sustainable.

Revenue teams need a unified, automated approach that ensures accuracy at every step—from the moment a quote is created to the moment revenue is recognized.

By aligning pricing, quoting, contracting, usage metering, billing, collections, and revenue recognition in one continuous flow, companies unlock faster sales cycles, cleaner financial operations, and complete visibility into their business performance.

The benefits are clear: less manual work, fewer errors, stronger compliance, and a revenue engine that can scale with confidence.

Discover Alguna, the AI-native quote-to-revenue platform for SaaS and AI companies

Automate quoting, billing, and revenue recognition while giving your team the flexibility to iterate on pricing and stay on top of financial performance.