If you're running revenue operations at a fast-scaling SaaS or AI company, you already know the friction points: quotes getting stuck in approvals, contract terms lost in translation, manual billing errors, late payments, missed renewals.

These aren't just growing pains, they’re (daily) revenue blockers. As your deal volume and pricing complexity grow, spreadsheets, point tools, and duct-taped workflows won't cut it.

That’s where quote to cash software comes in.

Quote to cash software ties together everything from sales quotes to invoices to revenue recognition, giving you a clean, automated, and auditable flow from "Yes" to cash in the bank.

No more missed handoffs between sales, legal, and finance. No more rogue discounts or surprise churn from failed payments.

In this guide, we’ll break down what quote-to-cash software actually does, when scaling companies should implement it, and how top platforms like Alguna, Maxio, Chargebee, Zuora, and others compare, especially for B2B SaaS, AI, and fintech companies that are evolving beyond simple subscription models.

What is quote to cash? (and why it matters)

It directly impacts how fast you turn closed deals into cash as it spans all the revenue operations steps, including configuring pricing, generating quotes, getting contracts signed, invoicing, collecting payments, and recording revenue.

Under old siloed workflows, each step might live in separate spreadsheets and systems. This means deals get delayed, invoices go out wrong, payments fail, and revenue reporting becomes unreliable.

But when it’s automated and connected, you reduce pricing errors, prevent revenue leakage, speed up invoicing, improve cash flow, and give finance and revops a single source of truth.

What is quote‑to‑cash software?

Quote‑to‑cash, or quote to cash, software refers to a connected suite of tools that automates every step from the initial sales quote to final payment collection and revenue recognition.

Instead of juggling separate spreadsheets, quoting tools, email templates, and invoicing systems, quote to cash software orchestrate the entire revenue lifecycle, including quote creation, contract management, billing, payment collection and revenue recognition in a single, unified workflow.

By connecting CPQ (Configure-Price-Quote), billing, and revenue management, a quote-to-cash platform ensures data flows seamlessly from one stage to the next.

The goal? Zero manual handoffs.

When done right, this reduces errors and speeds up the sales cycle, giving your team real-time visibility into the whole process.

True quote to cash automation fixes that: companies with end-to-end quote-to-cash automation have seen deals close 30% faster and cash collection happen 40% sooner on average.

When to implement a quote-to-cash solution

How do you know it’s time to move from scrappy manual processes (or multiple point tools) to dedicated software that will accelerate your quote to cash cycles?

Here are some clear signs that your company is ready for quote to cash software:

- Quotes are slow or error-prone: If it’s taking too long for sales to get quotes out the door, or you’re finding frequent pricing errors and manual mistakes in quotes, it’s a red flag. Frequent “back-and-forth” to adjust pricing and rogue discounting are clear indicators you need a modern CPQ solution to enforce accuracy.

- Other teams feel the pain: The fallout from a broken quoting process hits Finance and beyond. For example, Finance might struggle to recognize revenue on a “creative” custom deal that sales closed. If billing and revenue recognition are messy because of how quotes/contracts are handled, it’s time to streamline Q2C.

- You’re leaving money on the table: Maybe sales is missing upsell or cross-sell opportunities, or giving inconsistent discounts that erode margins. A good quote to cash software can standardize your pricing and highlight where you could be charging more. It ensures you don’t lose revenue due to ad-hoc, unmanaged quoting processes.

- Lack of reliable SaaS metrics: If you can’t easily answer “What’s our current MRR/ARR?” or your team is manually cobbling together reports, you likely need a quote-to-cash tool that tracks recurring revenue metrics in real time. Modern quote to cash software becomes a source of truth for bookings, billing, and churn data.

- Growing sales team or deal volume: Once you have about ~5–6 sales reps, manual quoting becomes a bottleneck. More reps and more deals mean more chances for mistakes and delays. Rather than hiring a small army to manage quotes and billing, a Q2C platform lets you scale without adding headcount by automating those workflows.

Think of it this way: even a 10-person company uses software to run payroll, quoting and billing deserve the same treatment (even early on). - Introducing complex pricing or new models: If your business is adding usage-based pricing, complex bundles, or custom terms that are hard to handle in spreadsheets, it’s a good time to implement a Q2C solution. These platforms excel at handling sophisticated pricing rules and ensuring nothing gets overlooked.

- Preparing for audits or big milestones: If you’re chasing a major funding round or prepping for an IPO, having controlled and auditable quote-to-cash processes is crucial. Quote-to-cash software provides the governance and documentation (approvals, versioned quotes, etc.) that auditors and investors love to see.

The earlier you lay that foundation, the easier it is to scale revenue without chaos.

9 key features to look for in a quote-to-cash tool

Not all quote-to-cash platforms are the same. Some focus more on the CPQ (quoting) side, others on billing and revenue, and some offer end-to-end quote-to-cash.

As a scaling SaaS or AI company, here are the key features and capabilities you should prioritize:

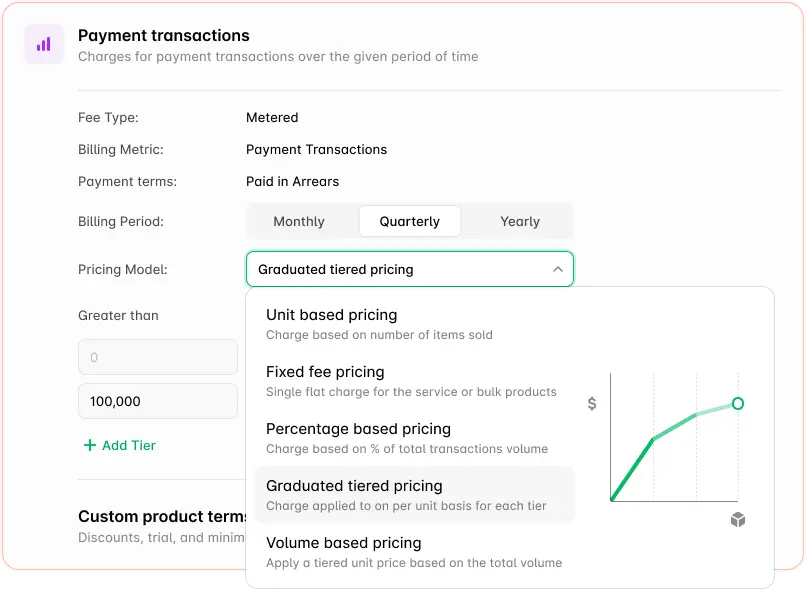

- Support for complex pricing models: Ensure the platform can handle your pricing strategy. This includes one-time fees, recurring subscriptions, tiered plans, volume-based pricing, and usage-based billing (critical for many AI and fintech models).

Modern quote to cash solutions should support subscriptions, consumption-based charges, or hybrid combos out of the box. For example, if you charge per API call or AI compute hour, the system should meter usage and incorporate it into quotes and invoices seamlessly. - Configure-Price-Quote automation: A strong CPQ engine is vital for sales efficiency. This means guided quoting tools where reps can configure custom bundles or terms, apply the right discounts (with approval workflows), and generate error-free quotes in minutes.

Look for features like dynamic pricing rules, approval routing for discounts, and the ability to generate professional proposals/orders for e-signature. Ease of use is key here, ideally, you want no-code CPQ software. - Integrated contract management and e-signature: For sales-assisted deals, it helps if the quote-to-cash platform can turn approved quotes into contracts and capture signatures (or at least integrate with e-signature tools). This removes the friction of manually creating contracts from a quote.

- Subscription billing and invoicing automation: A core quote-to-cash system will automate all billing once a deal is closed. When a quote is signed, the platform should automatically generate invoices per the contract terms – with correct pricing, proration, taxes, etc.

Look for support for recurring subscription invoicing as well as one-off charges, free trials, and any usage charges. The billing engine should handle things like upgrades, downgrades, refunds, and renewals without manual effort. This ensures what was sold is what gets billed and paid. - Payment processing and dunning: Getting cash in the door is part of quote-to-cash. Top platforms integrate with payment gateways (e.g. Stripe, Braintree) to accept credit card, ACH, or other payments. Dunning features (automated retry of failed payments, payment reminders, etc.) are extremely valuable – they directly reduce involuntary churn.

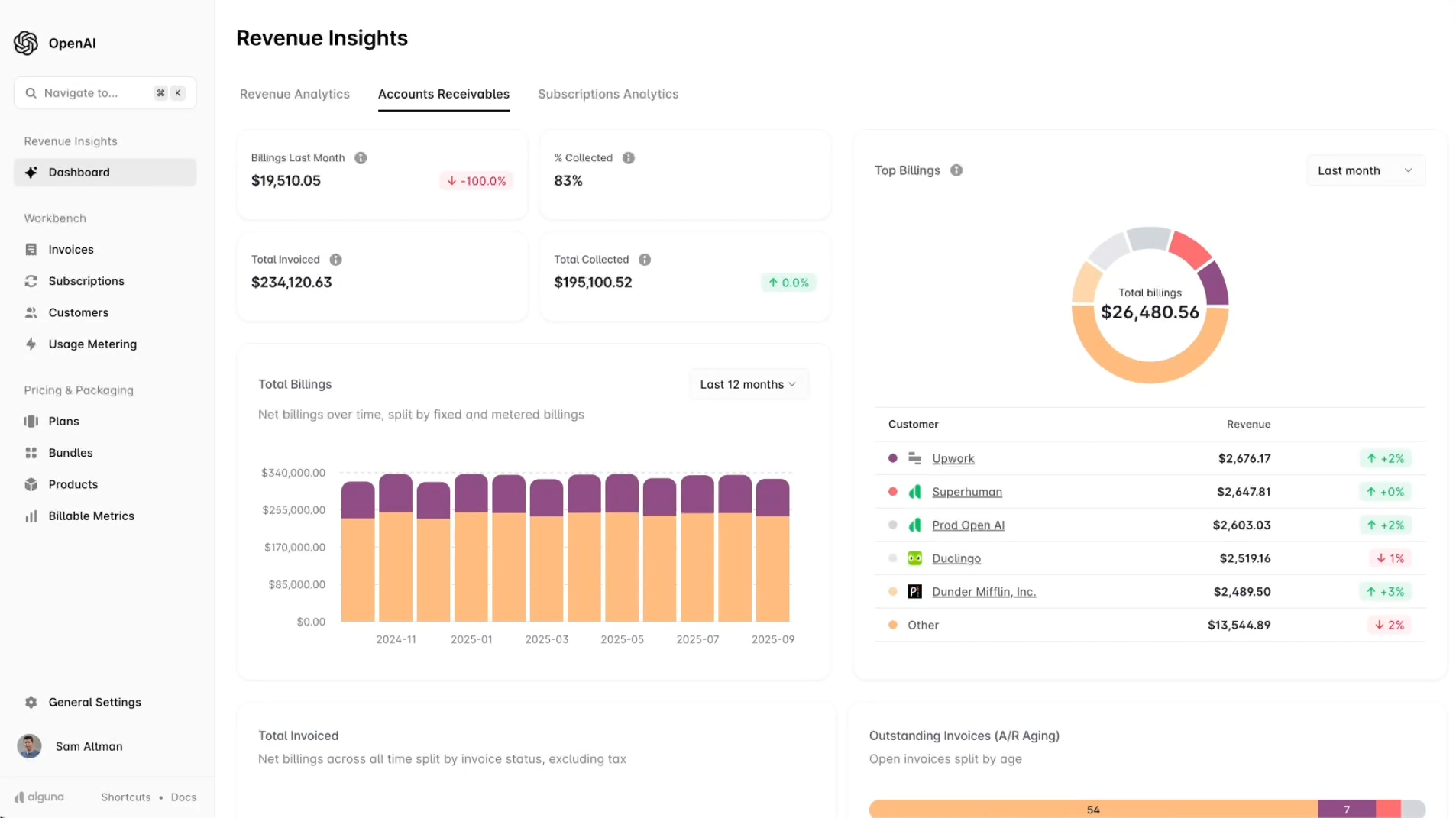

- Revenue recognition and reporting: Finance teams at SaaS companies care about ASC 606 / IFRS 15 compliance – so your Q2C tool should help automatically recognize revenue as you deliver your service. Many quote-to-cash platforms (especially those targeting SaaS) include revenue recognition modules or integrations, so you can generate deferred revenue schedules and ensure compliance from day one.

Along with that, you’ll want strong analytics and SaaS metrics reporting. Out-of-the-box dashboards for MRR, ARR, churn, LTV, and so on are a big plus for a growing subscription business. The system should become a source of truth for key revenue numbers, helping both Finance and RevOps make decisions. - Integration with CRM and other systems: A quote-to-cash solution must play nicely with your existing revenue stack. At minimum, it should sync with your CRM (like Salesforce or HubSpot) so that customer and deal data flows in both directions. This avoids duplicate data entry – e.g. when a quote is won, it should auto-update the opportunity in CRM and kick off provisioning in your product or an ERP update.

Look for other integrations too: accounting software (QuickBooks, NetSuite, Xero) for passing invoice/revenue data, payment gateways as mentioned, and even data warehouses or SaaS metrics tools if needed. - Workflow automation and collaboration: Consider how the tool facilitates your team’s workflows. Some modern quote to cash platforms have Slack or email integrations to notify teams of approvals or to allow one-click quote approvals in Slack, etc.

Others have AI assistants that can, say, adjust a quote or retry a payment automatically. While not mandatory, these ease-of-use features can drive adoption – sales reps and finance analysts will actually use the system if it fits into their daily work style (for example, one platform offers Slack-based approvals and even manages collections via Slack bot). - Scalability and compliance: Finally, ensure the solution can scale with you. If you plan to expand internationally, look for multi-currency and tax support (e.g. VAT/GST handling, localized invoice formats). If you anticipate high volume (thousands of customers or invoices), choose a platform proven to handle large scale.

Security and compliance (SOC 2, GDPR, etc.) should be solid, especially if you handle sensitive financial data. Essentially, pick a solution that won’t just solve today’s needs but can support your company as it doubles or triples ARR.

With these features in mind, let’s compare some of the top quote-to-cash software platforms that scaling SaaS and AI companies are using today. We’ll look at what each offers, their strengths, and who they’re best suited for.

Comparison overview: Best quote-to-cash automation solutions

| Platform | Best for | Feature highlights | Pricing |

|---|---|---|---|

| Alguna | Scaling SaaS and AI companies needing flexible, hybrid and usage-based monetization |

Unified no-code CPQ, usage metering, billing, and revenue recognition No-code pricing configuration Built-in hybrid and consumption pricing Real-time revenue visibility |

Starts ~ $699/month Custom enterprise pricing |

| Maxio | Mid-market SaaS companies focused on financial operations |

Subscription billing and collections Revenue recognition compliance SaaS metrics dashboards Integrated CPQ module |

Starts ~ $599/month Scales with billing volume |

| Chargebee | SaaS companies prioritizing recurring billing and dunning |

Flexible subscription billing Strong payment gateway integrations Automated dunning workflows Revenue recognition add-on |

Starts ~ $599/month Revenue-based fees after threshold |

| Zuora | Enterprise organizations with global, complex pricing |

Enterprise-grade CPQ and billing Multi-currency and tax compliance Advanced revenue recognition High-volume invoice processing |

Custom pricing, est. $50-$150k/year Typically enterprise-level contracts |

| DealHub | Mid-market teams needing interactive CPQ and deal collaboration |

CPQ + contract lifecycle management Digital DealRoom experience Salesforce integration Subscription management |

Per-user pricing Custom packages. Min $10k/year |

| Agentforce Revenue Management | Salesforce-centric mid-size to enterprise teams |

AI-powered quoting agents Unified product catalog Subscription and asset lifecycle management Billing and revenue analytics inside Salesforce |

~$150–$200 per user/month Requires Salesforce licenses |

Top quote-to-cash software solutions for SaaS companies

1. Alguna: Modern quote to cash tool for fast-moving revenue teams

Alguna is a modern quote-to-cash platform (Y Combinator-backed) that aims to unify the entire revenue cycle for SaaS and AI startups. It’s a no-code, all-in-one solution that covers everything from CPQ to usage metering, billing, and revenue recognition in one system.

Alguna is designed so that non-technical teams can manage complex pricing and billing without needing engineering support. For example, Alguna supports subscriptions, usage-based charges, and hybrid pricing models out-of-the-box, making it a good fit for AI companies with consumption-based pricing or SaaS teams experimenting with usage billing.

Strengths:

- Unified platform: Alguna combines quoting, contract setup, usage tracking, invoicing, and revenue recognition in one tool. This means your quote flows straight through to an invoice and into revenue reports automatically.

- No-code configuration: Built with non-engineers in mind, Alguna lets you configure pricing models, discount rules, and billing schedules via UI. Finance and ops teams can tweak plans or set up new pricing without writing code. This empowers RevOps to make changes quickly when your pricing or packaging evolves.

- Usage-based billing and AI focus: A standout is Alguna’s support for usage metering and consumption-based pricing. It’s well-suited for AI/ML companies that charge per API call, token, or other usage metrics. The platform can meter usage and incorporate it into billing in real time.

- Native integrations across your revenue stack: Seamlessly connects with leading CRMs, payment gateways and accounting systems, ensuring quotes, usage data, invoices and revenue schedules stay synchronized without manual reconciliation.

- Fast deployment: Because it’s designed for simplicity, Alguna can typically be implemented in 2-4 weeks. You won’t need months of professional services to get started, which is a plus for smaller companies that need quick time-to-value.

“Once I sign up a customer and we get them deployed, everything’s on autopilot—I don't have to think about it anymore.”

- Juan Burgos, Co-founder and CEO at Haven AI

Read the case study

Considerations:

- Alguna is a newer entrant with a smaller (yet growing ecosystem) and may not yet have the extensive third-party integrations or the enterprise track record of some larger players.

- Built for scaling companies, Alguna is likely not a fit for smaller companies and very early stage startups

Pricing: Alguna offers plans starting at around $699/month with no billing volume ceilings or revenue cuts.

2. Maxio: Finance-led quote to cash solution

Maxio is a quote-to-cash solution tailor-made for B2B SaaS financial operations. Formed by the merger of SaaSOptics and Chargify in 2021, Maxio combines a powerful subscription billing engine with revenue management and SaaS analytics.

In 2025, Maxio even launched its own CPQ module (after acquiring RevOps.io) to extend from billing into the quoting process.

Strengths:

- All-in-one financial ops: Maxio covers the full spectrum from quoting (via Maxio CPQ), to subscription management, invoicing, collections, and even revenue recognition. It’s one of the more comprehensive platforms, often eliminating the need for separate billing systems or spreadsheet-based revenue tracking.

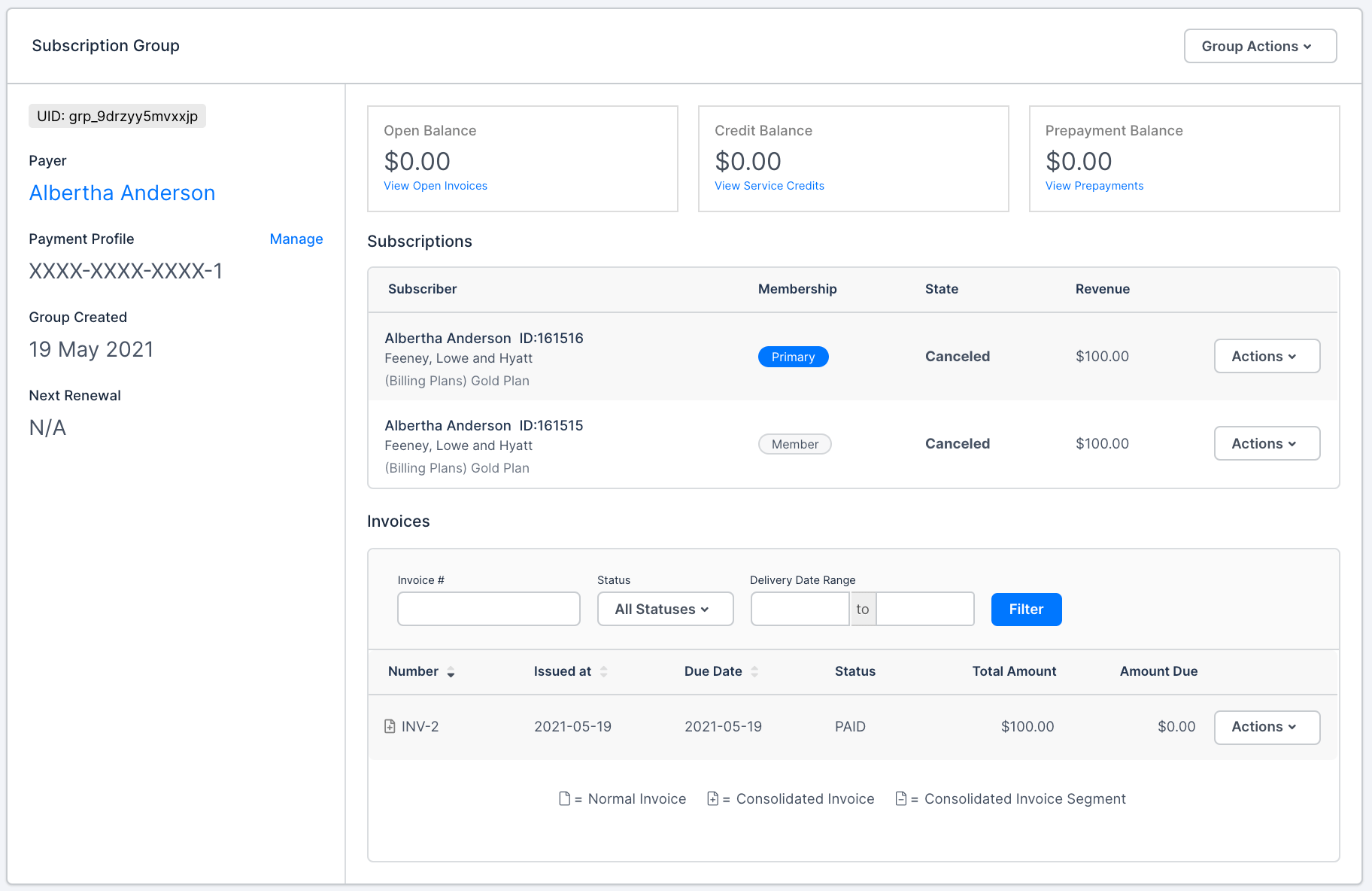

- Rich subscription billing features: Coming from the Chargify lineage, Maxio handles complex recurring billing scenarios well. It supports a variety of pricing models, including recurring subscriptions, usage-based pricing, tiered plans, ramp deals, milestones.

- Built-in SaaS analytics: A big selling point of Maxio (inherited from SaaSOptics) is its dashboarding and metrics. It provides out-of-the-box reports for MRR/ARR, churn, customer lifetime value, cash vs. revenue, and more.

- Revenue recognition compliance: Maxio includes robust ASC 606/IFRS 15 revenue recognition capabilities. As soon as a deal is closed, it can generate revenue schedules and ensure your accounting for subscription revenue is compliant.

- Integrations with sales and finance systems: Maxio offers native integrations to popular tools like Salesforce (CRM) and Stripe (payments). It can sync customer and invoice data to your ledger or CRM, reducing double-entry.

Considerations:

- Maxio is a finance-oriented platform, which means it may feel a bit complex or “heavy” to set up compared to newer lightweight tools.

- Some users note the UI isn’t as modern or intuitive in areas (a legacy of its older components).

- Implementation can take several months, especially if you have complex billing rules to configure, t’s not an instant self-serve setup.

- Maxio’s focus is more on billing and finance. While its CPQ capabilities exist, they are newer, so if you need extremely advanced sales quoting workflows, you might evaluate that aspect.

Ideal fit: Mid-stage SaaS companies (roughly $5M–$50M ARR) that have outgrown basic billing systems often turn to Maxio. It’s ideal if your Finance team wants a single source of truth for billing, revenue, and SaaS metrics.

Pricing: $599/month for growth-stage plans (scaling up for larger billing volumes).

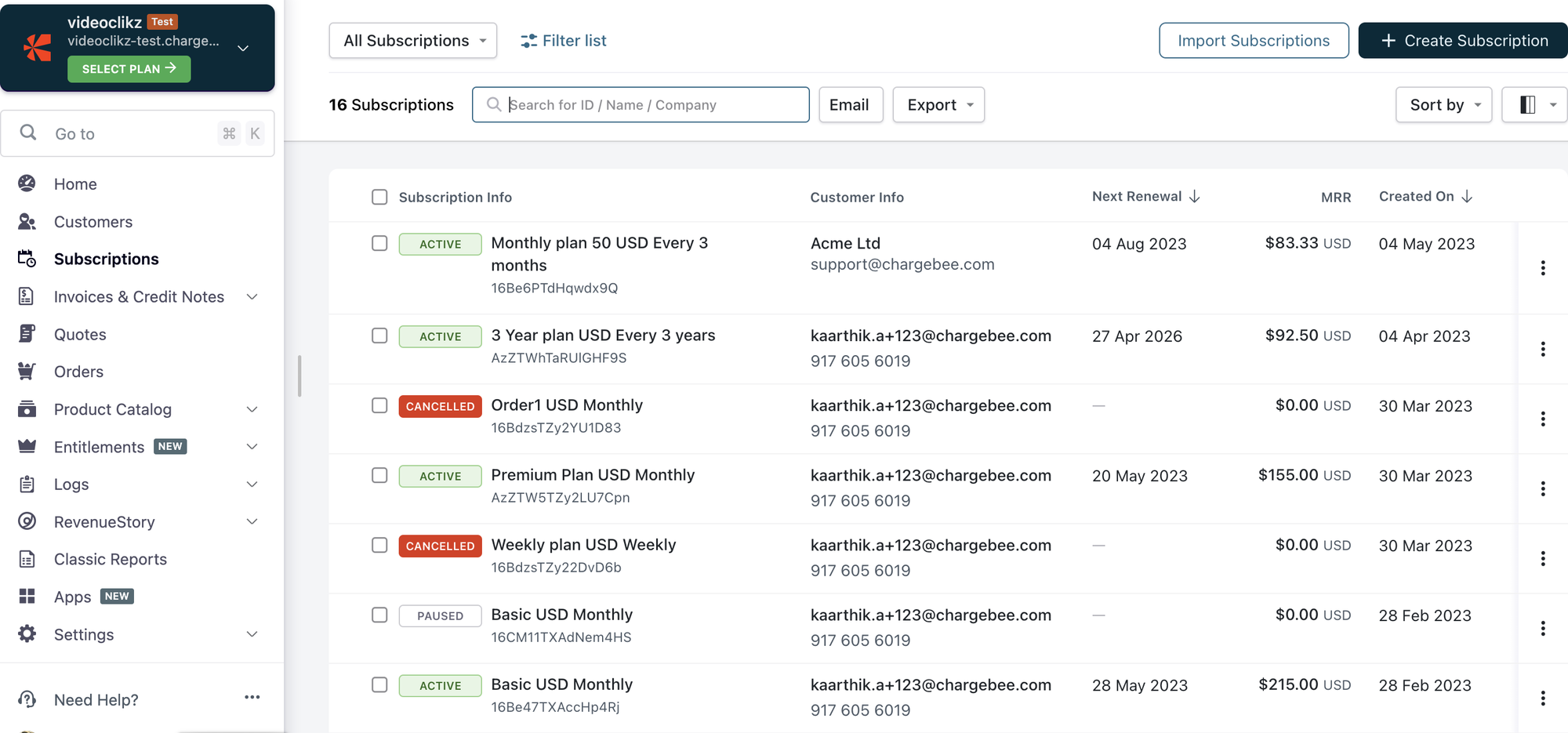

3. Chargebee: Subscription-led quote-to-cash tool with a lightweight CPQ

Chargebee is one of the most popular subscription management platforms, especially among SaaS startups and mid-market companies.

Chargebee focuses on managing the entire subscription lifecycle, from signup to invoicing to revenue recognition. It’s not a full CPQ system, but it offers some quote creation tools and is often used alongside a separate CPQ for sales-led deals.

Strengths:

- Strong subscription lifecycle management: Chargebee makes it easy to create and manage subscription plans, trials, upgrades/downgrades, cancellations, and renewals.

- Flexible pricing and billing models: The platform supports a wide range of billing models including flat-rate subscriptions, tiered pricing, volume-based pricing, one-time add-ons, and even hybrid usage-based billing.

- Payments and dunning automation: Chargebee integrates with dozens of payment gateways (Stripe, Braintree, PayPal, etc.) and automates payment collection. Its dunning system is a highlight and will automatically retry failed payments with smart logic and send email reminders.

- Revenue recognition and compliance: Chargebee offers a revenue recognition module and can generate schedules for deferred revenue, helping with GAAP compliance for subscription fees.

Considerations:

- Chargebee primarily addresses the “cash” part of quote-to-cash. It’s superb at billing and collecting money, but it doesn’t have a full-fledged sales quoting/configuration module (its “CPQ” features are fairly basic, mostly generating quotes or hosted checkout pages).

- Companies with a complex sales quoting process might need to integrate Chargebee with a CPQ like Salesforce CPQ.

- Chargebee’s pricing model is often a percentage of revenue after a certain threshold. For example, it has a free tier for early-stage startups, but once you exceed a revenue limit, it might charge around 0.75% of billing as a fee. This can become significant for very high volumes.

Ideal fit: Scaling SaaS companies with standard subscription models. If your focus is on recurring billing, payments, and keeping churn low via dunning, Chargebee is a top contender. Just be mindful that if you need heavy CPQ or custom deal workflows, you’ll likely use Chargebee alongside another tool.

Pricing: Paid plans from $599/month. Note that some of Chargebee’s more advanced capabilities (like its revenue recognition, advanced analytics, or priority support) are only in higher-tier plans, meaning as you grow you might have to upgrade to the Enterprise plan to get all features.

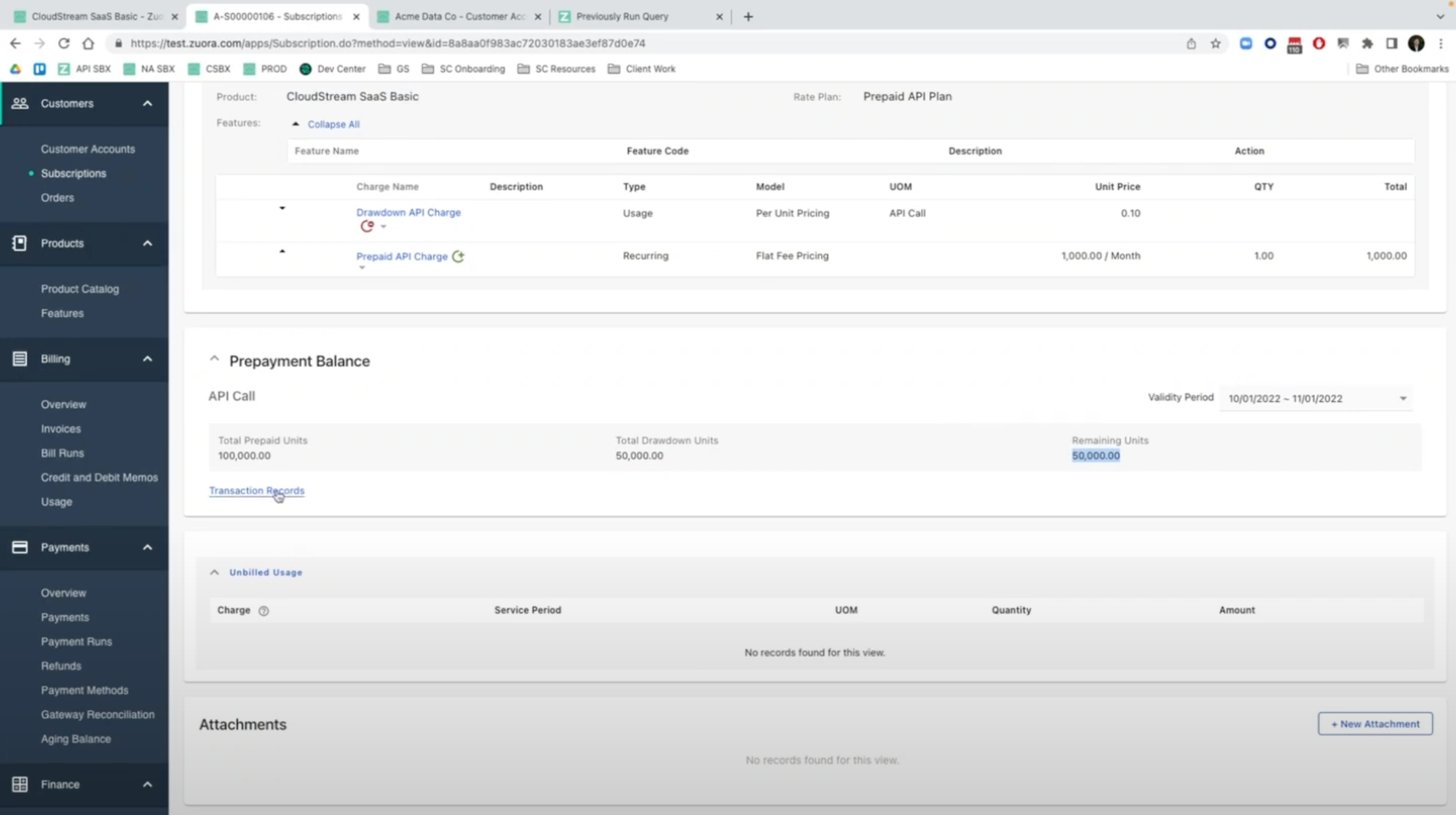

4. Zuora: Advanced quote-to-cash solution for enterprise teams

Legacy player Zuora is often synonymous with “enterprise subscription billing.” It’s a heavyweight quote-to-cash platform built for large, complex businesses, particularly those in the subscription economy.

Zuora offers a suite of products including Zuora Billing, Zuora CPQ, Zuora Revenuem that together cover quoting, billing, and revenue automation for companies with at-scale operations. If you have thousands of customers, multiple product lines, or global billing needs, Zuora is designed to handle that complexity.

Strengths:

- Comprehensive feature set: Zuora has a very extensive feature list. It can model almost any pricing and subscription structure. Its Zuora CPQ module allows sales to configure multi-year, multi-product deals (often used in Salesforce as an add-on). The Zuora Revenue module (formerly RevPro) handles advanced revenue recognition for complex contracts.

- Global billing and payments: For companies operating in many countries, Zuora is built with internationalization in mind. It supports multiple currencies, global tax calculations (VAT/GST compliance), and has 40+ pre-built payment gateway integrations to accept payments in various regions.

- Scalability and reliability: It’s designed to be an “enterprise-grade” system with the security, audit logs, and reliability that large firms expect.

- Ecosystem and integrations: Zuora integrates deeply with Salesforce (its CPQ plugs into Salesforce as “Zuora Quotes” for example) and also with ERP systems. Many enterprises use Zuora to bridge Salesforce and an ERP like NetSuite or SAP.

Considerations:

- Zuora’s advantages come with trade-offs, including cost and complexity. It is often one of the more expensive quote-to-cash options on the market.

- The implementation is not trivial. A standard Zuora project might take 2–3+ months, and usually requires significant configuration by solution architects or consultants.

- The learning curve is steep and you’ll likely need at least one admin or developer with Zuora expertise to manage it long-term.

- Zuora’s interface and flexibility often assume you have defined processes and it’s not as nimble or quick to change as some newer SaaS-focused tools. If you don’t have a dedicated billing/revenue operations team, adopting Zuora can be challenging.

Ideal fit: Enterprise SaaS or IoT/telecom/fintech companies that have very complex billing requirements or large scale should consider Zuora. It shines when you need a rock-solid system of record for millions of dollars in subscription revenue across perhaps tens of thousands of customers.

Pricing: Custom enterprise. Subscription plans are quote-based, as a rough ballpark, a base Zuora deployment can start around $75k per year and go up from there for larger implementations.

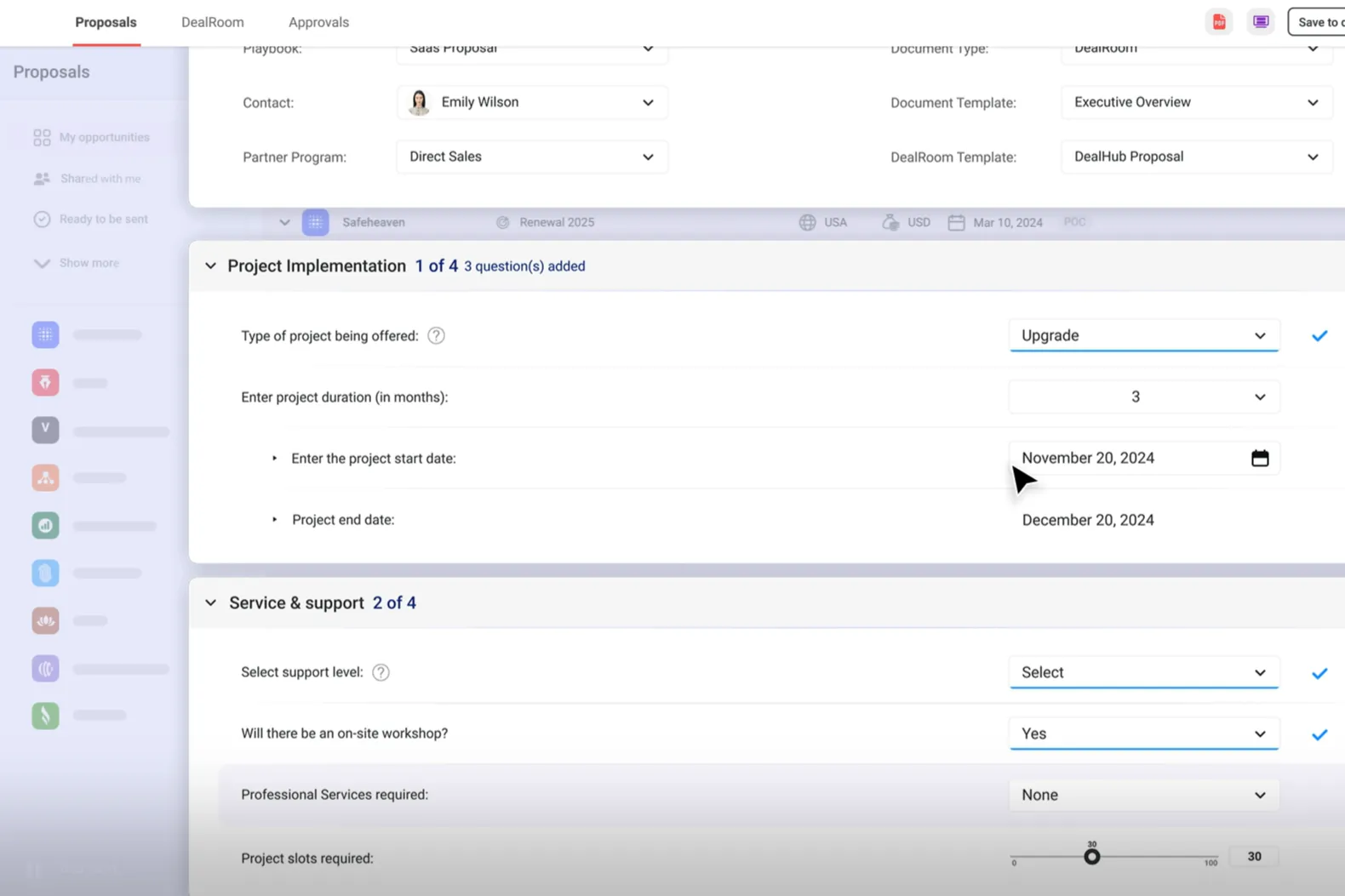

5. DealHub: Quote to cash solution for sales-heavy organizations

DealHub is a unified platform that brings together CPQ (Configure-Price-Quote), CLM (Contract Lifecycle Management), and Subscription Management in one solution.

It’s designed to streamline the entire sales engagement and quote-to-cash process, especially for B2B companies that require a lot of collaboration to close deals.

Strengths:

- Integrated CPQ + contract + billing: DealHub’s biggest selling point is that it eliminates the need to stitch together separate CPQ, contract management, and billing tools.

- Digital DealRooms for buyers: DealHub offers a unique Digital DealRoom concept. Instead of emailing PDFs back and forth, the buyer gets a link to a secure portal where they can view the proposal, ask questions via comments, adjust quantities (if allowed), and even sign the contract electronically.

- Subscription and renewal management: After acquiring Subskribe, DealHub can handle the subscription billing side as well (though this part is newer for them). They enable tracking of recurring revenue, managing renewals, expansions, and churn within the platform.

- Salesforce integration and data: DealHub has deep bidirectional integration with Salesforce CRM (and offers integration to others like HubSpot too). Quotes, line items, and contract data flow automatically, ensuring your CRM is always up to date with the latest deal terms.

- Recognition and innovation: The platform is known to be innovative (e.g., they were among the first to bring the DealRoom concept mainstream). They’re a good choice for companies that want cutting-edge sales tech coupled with revenue operations support.

Considerations:

- Because DealHub tries to do “everything” in one, it can be a large implementation itself. It’s still generally faster to deploy than an enterprise tool like Maxio or Zuora, but expect a few months of project time to roll it out properly, especially if you use all modules.

- Admins may face a learning curve, as the platform is broad (CPQ rules, contract templates, product catalogs, etc.). It’s noted that non-technical admins might find the initial setup complex, you may need a sales ops specialist to own it.

- Also, if your company doesn’t use Salesforce, you’ll want to ensure DealHub supports your CRM well (it does have a standalone mode, but it shines with Salesforce users).

Ideal fit: DealHub is great for mid-market and upper-mid-market SaaS companies that have complex deals and want to align Sales and Finance in one platform.

Pricing: In terms of cost, DealHub is typically priced per user (or per package) in the mid-to-high end for mid-market software, starting in the low hundreds of dollars per month per rep and going up based on features/users.

This can be a significant investment if you have a large sales team, but it can replace multiple tools.

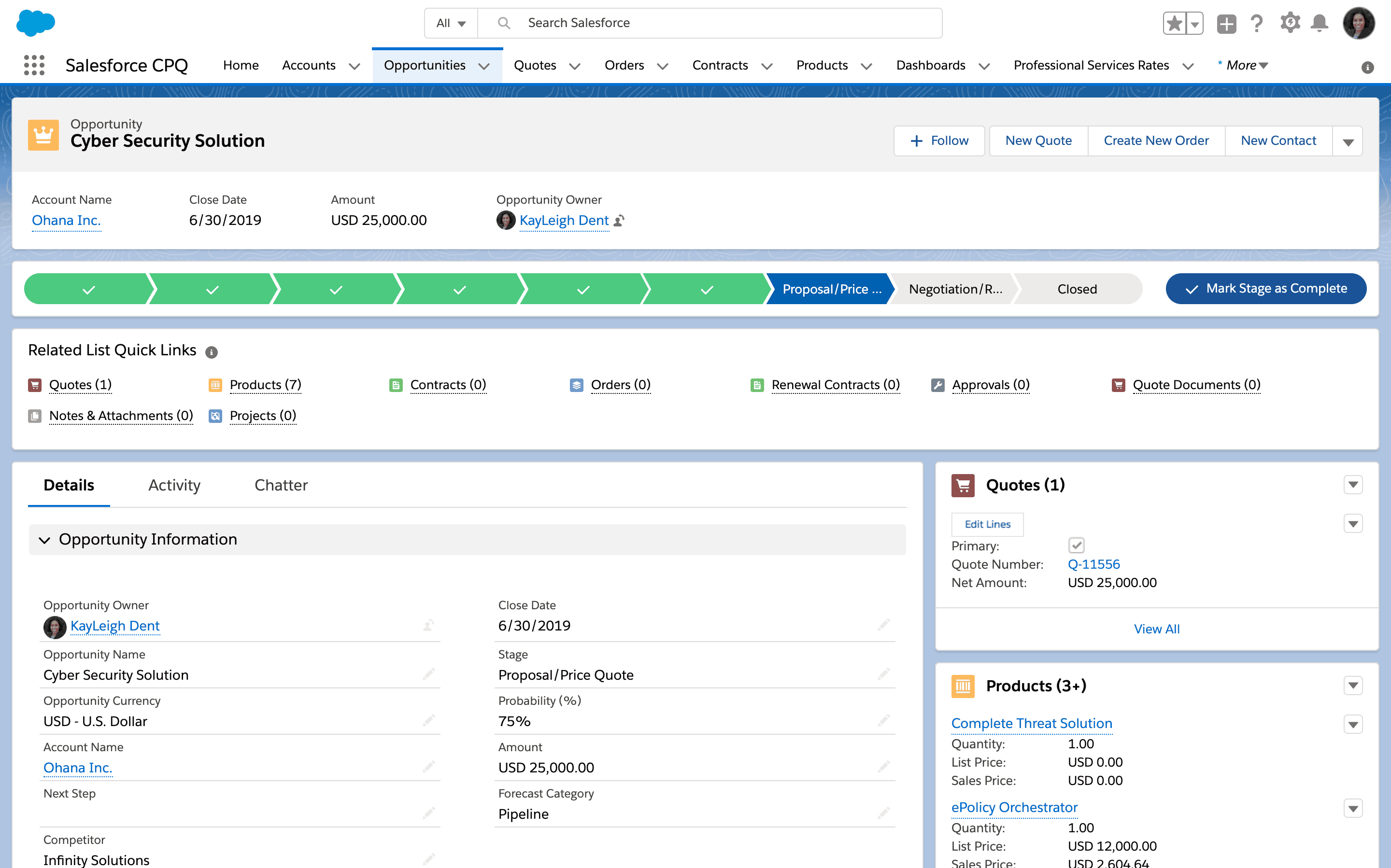

6. Agentforce Revenue Management (formerly Salesforce Revenue Cloud): Quote to cash system for Salesforce centric companies

Agentforce Revenue Management (ARM) is Salesforce’s next‑generation revenue platform. It combines autonomous AI agents with Revenue Cloud capabilities to manage quoting, contracts, billing and renewals on the Salesforce platform.

ARM automates revenue operations on a unified platform where AI agents generate quotes, manage renewals, monitor consumption and explain invoices, freeing reps to focus on customers.

Strengths:

- Agent‑first quoting: Sellers can request quotes by describing what they need; Agentforce generates accurate quotes instantly. Salesforce reports a 75 % decrease in quoting time and 87 % fewer clicks when using Agentforce.

- Unified product catalog and pricing: A single attribute‑based catalog reduces SKU proliferation and supports complex pricing rules.

- Product configurator: Constraint Builder lets non‑technical users configure complex products quickly.

- Asset lifecycle and subscription management: Real‑time visibility into subscriptions, amendments, renewals and churn metrics.

- Order automation and analytics: Workflows initiate fulfillment, compensation, revenue recognition and billing tasks, with dashboards for pricing, subscription and billing analytics.

- AI‑driven revenue orchestration: Agents support pricing decisions, contract changes, billing events and renewals.

Considerations:

- ARM is built for teams already invested in the Salesforce ecosystem.

- Implementation can be complex, and small companies may find the investment high relative to lighter‑weight tools.

- AI agents require well‑maintained product and pricing data.

Ideal fit: Mid‑size to large enterprise companies using Salesforce that handle subscriptions, usage‑based pricing, or complex enterprise deals.

Pricing: There isn’t a simple list price published for all Agentforce Revenue Management deployments, smaller teams can expect roughly $150-$200 per user per month for the core platform, with additional charges likely if you use AI agent features or buy consumption credits.

Remove revenue friction with quote-to-cash software

When your sales team is closing more complex deals, finance is juggling usage-based pricing and revenue schedules, and leadership is asking for cleaner forecasts, disconnected systems start costing you real money.

Deals stall. Invoices go out wrong. Renewals slip. Revenue reporting gets messy. And cash collection slows down.

The right quote-to-cash platform fixes that.

Whether you choose a lightweight, AI-native quote-to-cash tool like Alguna, a finance-focused system like Maxio, a billing leader like Chargebee, an enterprise powerhouse like Zuora, or an Salesforce solution like Agentforce Revenue Management, the goal is the same: Create a single, automated path from quote to cash that scales with your business.

No matter what, plan for the long term: the best quote-to-cash software is one that can grow with you for the next 5+ years. It’s often worth choosing a system you might “grow into” a bit, rather than something you’ll outgrow in a year.

If you're evaluating quote-to-cash solutions and want a modern, flexible platform designed for scaling SaaS and AI companies, it’s time to see Alguna in action.

👉 Book your personalized demo and discover how you can unify CPQ, usage-based billing and revenue recognition without the enterprise-level overhead.

Frequently asked questions about quote-to-cash software

What is quote-to-cash software?

Quote-to-cash software automates the entire revenue process from sales quote to payment collection and revenue recognition. It connects CPQ, contracts, billing, payments and reporting into one unified workflow so deals move from closed-won to cash without manual handoffs.

What problems does quote-to-cash software solve?

It eliminates pricing errors, manual invoice creation, delayed approvals, failed payment churn and disconnected revenue reporting. For scaling SaaS and AI companies, it reduces revenue leakage and speeds up time to cash.

When should a SaaS company implement quote-to-cash software?Typically when:

- You introduce complex pricing models like usage-based or hybrid pricing

- Your sales team grows beyond a handful of reps

- Finance is manually reconciling invoices and revenue schedules

- Reporting MRR, ARR and churn requires spreadsheets

- Deal velocity is slowing due to approvals or contract friction

If revenue operations feel reactive instead of scalable, it is time.

What is the difference between CPQ and quote-to-cash?

CPQ focuses only on configuring products and generating quotes.

Quote-to-cash includes CPQ plus contract management, billing, payment collection and revenue recognition. CPQ is one component of a full quote-to-cash system.

What is quote-to-cash software deferred revenue tracking milestone projects?

Quote-to-cash software deferred revenue tracking milestone projects refers to the ability of a platform to manage complex contracts where revenue is recognized over time or tied to specific delivery milestones. This is especially important for SaaS companies offering implementation services, multi-phase deployments or usage commitments. Advanced quote-to-cash solutions automatically generate revenue schedules, track deferred balances and align milestone billing with compliance requirements.

What is the top CPQ software for quote-to-cash efficiency?

The top CPQ software for quote-to-cash efficiency depends on your company stage and complexity. For startups and scaling SaaS teams, lightweight and no-code solutions can accelerate quoting and reduce manual billing work. Mid-market companies often prioritize tools that combine CPQ with subscription billing and revenue reporting. Enterprise organizations may look for deeply integrated Salesforce or global billing platforms. The best solution is one that minimizes approvals, eliminates pricing errors and seamlessly converts quotes into accurate invoices.

How long does it take to implement quote-to-cash software?

It depends on complexity:

- Lightweight platforms can go live in weeks

- Mid-market systems often take 1–3 months

- Enterprise solutions may require 3–6+ months with professional services

Implementation time usually correlates with pricing complexity and integration needs.

Can quote-to-cash software handle usage-based billing?

Yes. Modern platforms support subscriptions, usage-based pricing and hybrid models. This is especially important for AI and fintech companies charging per API call, token, transaction or compute unit.

Is quote-to-cash software only for enterprise companies?

No. While enterprise platforms like Zuora and Agentforce Revenue Management target large organizations, newer solutions are designed specifically for scaling SaaS and AI startups that need flexibility without enterprise overhead.

How much does quote-to-cash software cost?

Pricing varies widely:

- Startup-focused platforms may start under $500 per month

- Mid-market tools often range from $500–$2,000+ per month

- Enterprise systems typically require custom contracts

Total cost depends on user count, billing volume and integrations.