The quote to cash process has one job: to drive revenue for your business. It's the process that turns a signed deal into real revenue in your bank account and accurate numbers in your financial statements.

In SaaS, this is where growth either compounds or quietly leaks.

You close the deal.

Then someone manually fixes the quote.

Billing does a workaround.

Revenue recognition happens in a spreadsheet.

Collections follow up on invoices that never matched the contract in the first place.

If any of that sounds familiar, your quote to cash process isn't broken because your team isn't on top of things. It's broken because SaaS monetization has evolved faster than your internal systems.

Want clean data, faster closes, and fewer revenue surprises? Then this guide is for you. We'll cover:

- Quote to cash process meaning

- The full quote to cash process steps

- A practical quote to cash process flow and flowchart

- How to automate quote to cash process (without creating audit risk)

- 3 companies modernizing quote to cash processes

What is a quote to cash process?

In plain terms: it's everything that happens after “we sent the quote” until the money hits your bank account and finance can close the books without chasing down mismatched terms.

Quote to cash process meaning

If we break the quote-to-cash process down further, it involves the alignment of three truths across the lifecycle of a customer:

- Commercial truth: What the customer agreed to buy

- Operational truth: What you delivered and measured

- Financial truth: What you billed, collected, and recognized

When those three truths drift apart, you get:

- Invoice disputes

- Revenue leakage

- Long close cycles

- Renewal friction

- Audit stress

In modern SaaS, especially with hybrid and usage-based pricing, this alignment is a prerequisite to long-term growth.

Why the quote to cash process matters for SaaS

SaaS companies deal with recurring revenue, hybrid pricing models and frequent product updates.

Without a robust quote to cash process, you risk:

- Revenue leakage from incorrect pricing, misapplied discounts or unbilled usage. Studies suggest leakage can cost 4–20 percent of revenue.

- Siloed systems that require manual re‑keying between sales, billing and finance. Forrester found that 89 percent of revenue‑management leaders report their billing tools are isolated from revenue‑driving functions.

- Slow cash collection as invoice errors cause disputes and delays.

- Audit issues if revenue is recognized incorrectly or contract terms are not captured.

Why quote to cash breaks first in SaaS

SaaS complexity stresses traditional processes in predictable ways:

- Usage-based and hybrid pricing models

- Multi-year contracts with ramps and co-terms

- Multi-entity and multi-currency operations

- Frequent packaging and pricing changes

- Revenue recognition requirements under ASC 606 and IFRS 15

Most companies optimize the “sales part” of the lifecycle and underestimate everything that happens after signature.

The result is fragmented systems, manual handoffs, and shadow spreadsheets. Finance ends up reconciling mismatches that started in quoting. RevOps ends up troubleshooting revenue questions that should have been automated.

Modern billing and revenue automation are increasingly viewed as strategic capabilities, not back-office plumbing. Teams that modernize consistently report faster closes, improved renewal accuracy, and fewer billing disputes.

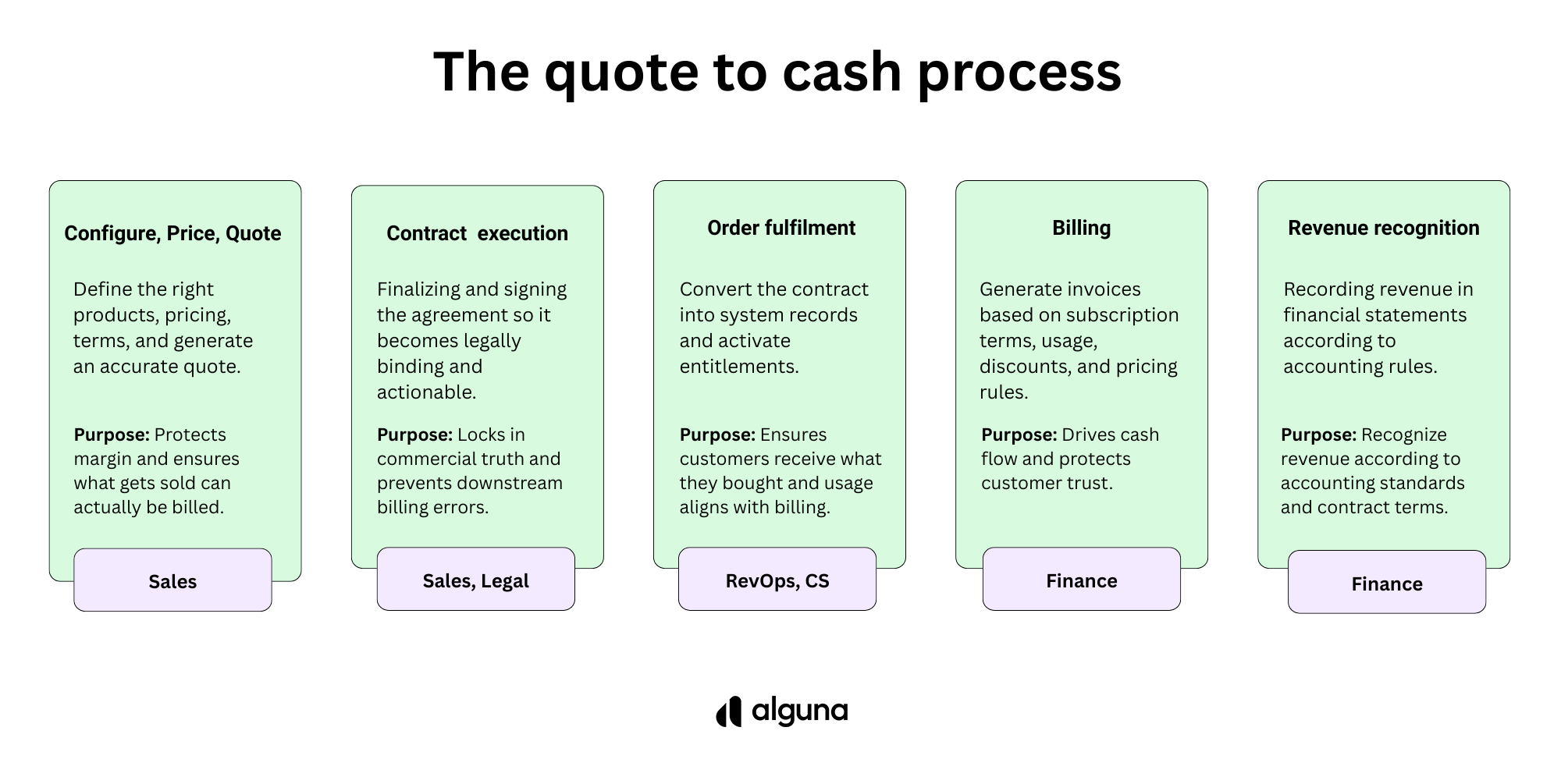

Quote to cash process flow chart

Understanding the quote to cash process in theory is helpful. Seeing it visually is where clarity really clicks.

A quote to cash process flow chart maps the journey from opportunity to revenue recognition, showing how data, ownership, and accountability move across sales, RevOps, finance, and customer success.

Use the flow chart below to identify handoffs, surface bottlenecks, and ensure your commercial, operational, and financial truths stay aligned from quote to cash.

In the next section, we break down the quote to cash process step by step.

Quote to cash process: Step-by-step overview

Your quote to cash process shouldn't come with any surprises. We're looking for fewer handoffs, clean closes, and less friction between sales and finance.

This is a practical, end-to-end quote to cash process you can use to lay the foundation of quote to cash at your company.

⚠️ The below steps will vary depending on the size of your team.

Set the foundation before you scale

Goal: Make sure your systems can represent how you (actually) sell.

Do this:

- Standardize your product catalog and SKUs

- Define pricing rules (discount floors, approval thresholds)

- Define billing rules (proration, co-terms, invoicing timing)

- Define entitlements (what the customer gets and how access is granted)

- Decide your systems of record (CRM, contract system, billing, ERP, rev rec)

Output: A catalog and policy baseline that quoting, billing, and accounting can all trust.

Step 1: Qualify and scope the deal

Owner: Sales, SalesOps, RevOps

Goal: Capture the deal structure early so finance is not reverse-engineering later.

Do this:

- Confirm customer entity, currency, tax context

- Confirm pricing model (subscription, usage, hybrid)

- Confirm contract term, ramp, and billing frequency

- Confirm any nonstandard terms that trigger approvals

Output: Clean opportunity record with the fields finance will need later.

Step 2: Configure the quote

Owner: Sales, RevOps

Goal: Build an accurate, policy-compliant offer.

Do this:

- Select products, packages, add-ons

- Apply pricing rules and discount guardrails

- Add usage assumptions (if applicable)

- Ensure proration and co-terms are correct

Output: A quote that can convert to an order without manual edits.

Step 3: Route approvals (Deal desk)

Owner: Deal desk, RevOps, finance (as needed)

Goal: Approve exceptions before signature.

Do this:

- Route approvals for discounting, contract length, payment terms, custom clauses

- Log the reason and approver for audit trail

- Freeze the approved version for contracting

Output: Approved commercial terms with documented exceptions.

Step 4: Contract and execute

Owner: Legal, Sales, RevOps

Goal: Turn the quote into an executable agreement with structured metadata.

Do this:

- Generate order form from quote

- Negotiate redlines

- Capture key data as fields (not only in the PDF):

- Start date, end date, renewal

- Billing cadence, payment terms

- Ramp schedules, credits, usage rates

- Termination and refund terms (if any)

- Execute via e-sign

Output: Signed contract plus structured contract metadata.

"Over the past year, I've learnt that Quote-to-Cash is no longer a finance process — it’s a customer experience engine.

I’ve seen first-hand how operational excellence, AI, and data-driven decision-making can fundamentally change how internal and external customers experience billing, renewals, and support.

The biggest shift? Moving from siloed execution to Strategy & Operations leadership — treating Quote-to-Cash as a value stream that directly impacts customer trust, speed, and satisfaction.

Embedding AI into day-to-day decisioning, designing the right KPIs, and giving leaders real-time visibility has been a game-changer.

Transformation isn’t just about tools — it’s about clarity, cadence, and execution."

Read more on LinkedIn

Step 5: Sales to finance handoff

Owner: RevOps, billing ops, revenue accounting

Goal: Confirm the deal is ready to book and bill.

Do this:

- Validate quote → contract match

- Validate required fields are present:

- Legal entity, currency, tax treatment

- Invoice schedule and payment method

- Performance obligations notes (if needed)

- Confirm any manual steps (services, implementation fees)

Output: “Finance-approved” deal package that can be booked without rework.

Step 6: Create the order and activate the subscription

Owner: RevOps, billing ops, IT (if integrated)

Goal: Convert contract to system objects.

Do this:

- Create subscription or order record in billing system

- Generate invoice schedule

- Sync customer master data (addresses, tax IDs, payment method)

- Set renewals and co-term logic

Output: Active subscription with a billing schedule and customer record.

Step 7: Provision entitlements and onboarding

Owner: Product, customer success, implementation

Goal: Deliver what was sold, tied to what will be billed.

Do this:

- Activate entitlements based on contract line items

- Start onboarding milestones

- Ensure any services work is tracked if billable or tied to revenue recognition

Output: Customer access and delivery aligned to contractual terms.

Step 8: Capture usage and rate it (if applicable)

Owner: Product, data engineering, finance ops

Goal: Turn usage into billable quantities that customers can trust.

Do this:

- Define meters and usage event schema

- Validate usage completeness and timeliness

- Apply rating rules (tiers, credits, included units, overages)

- Provide customer-visible usage reporting to prevent disputes

Output: Rated usage ready for invoicing.

Step 9: Invoice generation

Owner: Billing ops

Goal: Produce accurate invoices on time.

Do this:

- Apply subscription charges plus rated usage

- Handle proration, mid-cycle changes, credits

- Calculate taxes correctly

- Generate invoice and deliver via email and portal

Output: Invoice issued with correct amounts and line item detail.

Step 10: Collections and payments

Owner: AR, finance ops

Goal: Turn invoices into cash with minimal manual follow-up.

Do this:

- For card or ACH: automate retries and dunning

- For invoiced terms: run reminder sequences and collections workflows

- Track aging and dispute status

- Apply cash quickly once received

Output: Cash collected and applied to the right invoice.

Step 11: Revenue recognition and close

Owner: Revenue accounting, controller

Goal: Recognize revenue correctly and close faster.

Do this:

- Create revenue schedules from contract and invoice data

- Handle modifications (upgrades, downgrades, extensions)

- Reconcile billed, collected, deferred, and recognized balances

- Maintain audit trail for approvals, credits, and adjustments

Output: Accurate revenue reporting and a smoother close.

Step 12: Renewals and expansion loop

Owner: Customer success, account management, RevOps

Goal: Make renewals predictable and expansion easy.

Do this:

- Trigger renewal quoting based on contract dates

- Use adoption and usage signals to drive expansion offers

- Ensure co-terms and pricing uplift policies are enforced

- Avoid renewal friction by keeping billing clean

Output: Renewal and expansion motions built on trusted data.

3 companies modernizing quote-to-cash processes

Modern SaaS companies are rethinking the quote to cash process as core revenue infrastructure, not just back-office operations.

Below are three companies helping SaaS businesses modernize quote-to-cash by reducing manual work, aligning sales and finance data, and automating the journey from contract to cash.

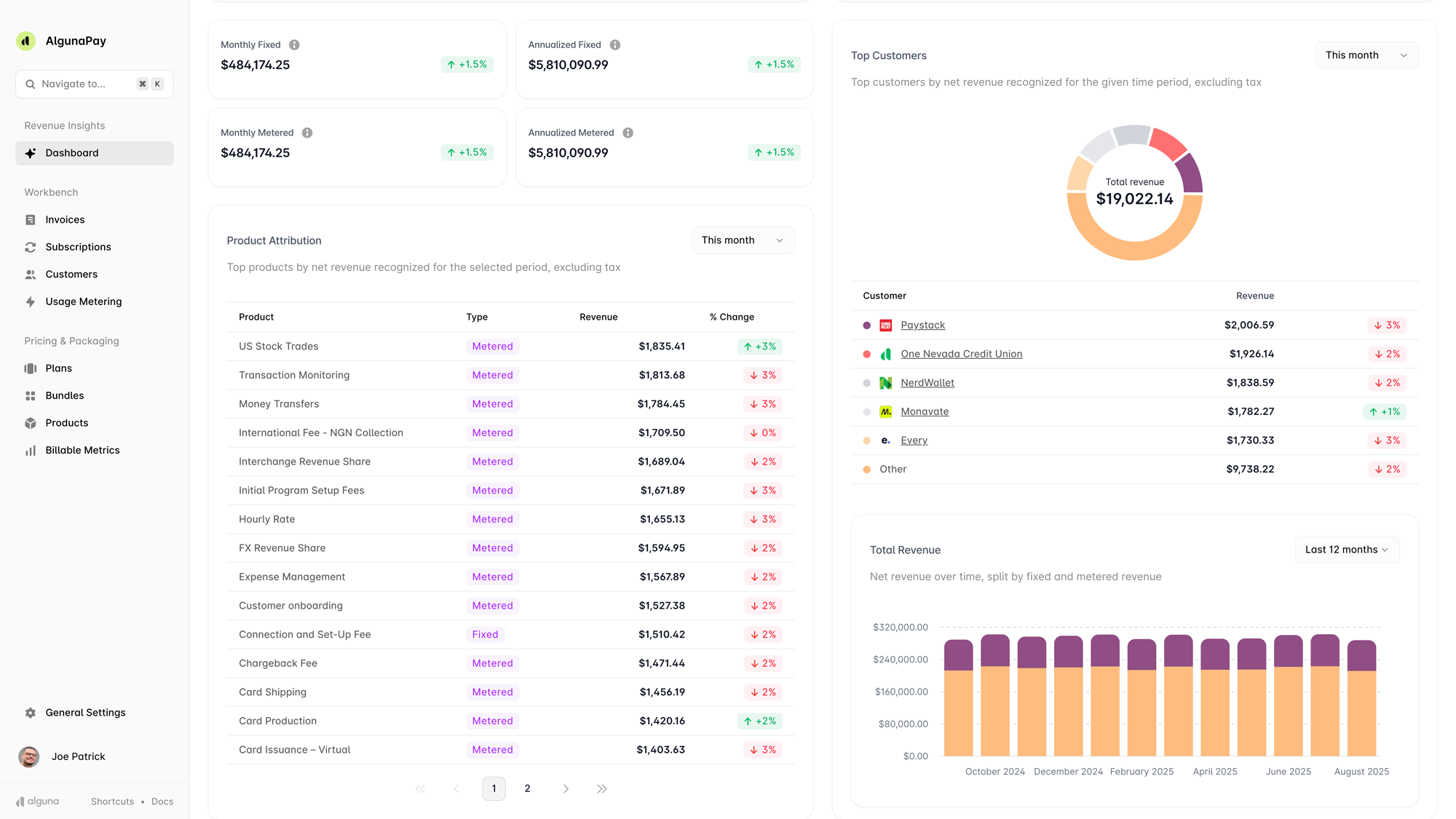

1. Alguna: Unified quote to cash for SaaS, AI, and fintech

Alguna offers an all‑in‑one, no‑code quote‑to‑cash platform built for fast‑moving SaaS and AI startups.

It unifies CPQ, usage metering, billing, and compliance-ready ASC 606/IFRS 15 revenue recognition in a single system, allowing quotes to flow straight through to invoicing and revenue reporting.

Teams can configure pricing models and discount rules without code, and the platform supports subscriptions, consumption pricing, outcome-based pricing, and hybrid pricing. This makes Alguna ideal for SaaS companies with hybrid pricing models and AI/ML companies with complex usage-based models.

Native integrations with popular CRMs, payment gateways and accounting tools keep data in sync, and customers cite the "billing autopilot" experience, as once a customer is deployed, billing and revenue recognition run automatically.

Backed by Y Combinator, Alguna was purpose-built for modern SaaS companies with complex pricing models.

- Shane Curran, CEO at Evervault

Read the case study

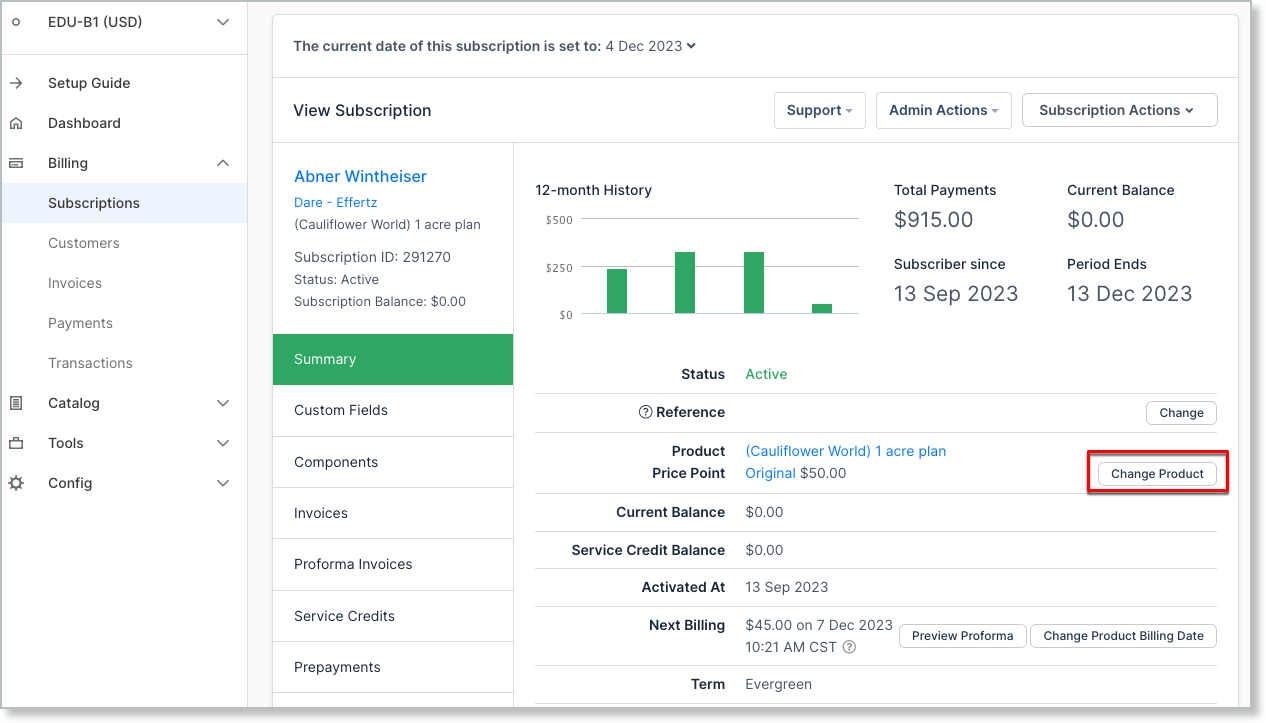

Maxio: Finance‑led quote to cash solution

Born from the merger of SaaSOptics and Chargify, Maxio expands beyond CPQ to streamline the entire revenue lifecycle.

It covers quoting via Maxio CPQ, subscription management, invoicing, collections and automated revenue recognition. Its heritage gives it deep support for complex recurring billing scenarios such as usage‑based pricing, tiered plans and ramp deals.

Maxio also includes built‑in SaaS analytics (MRR, churn, cash vs. revenue) and compliance‑ready revenue recognition, and it integrates with Salesforce and Stripe to reduce double entry.

Mid‑market SaaS firms often adopt Maxio to replace spreadsheets and gain a single source of truth for billing and revenue.

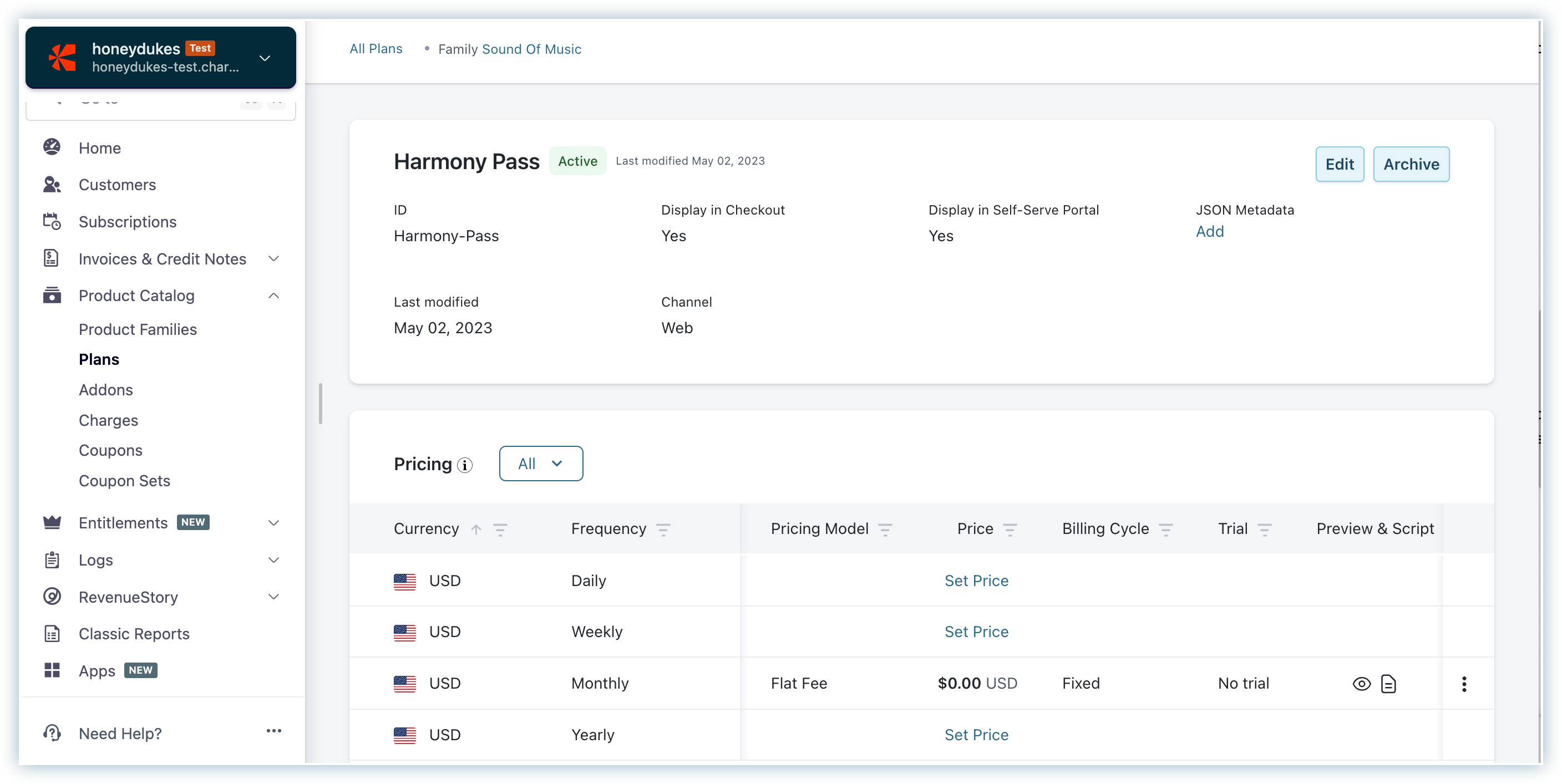

Chargebee: Subscription‑led quote to cash

Chargebee focuses on managing the entire subscription lifecycle from signup to invoicing and revenue recognition.

It offers flexible billing models and automates payment collection with built‑in dunning that retries failed payments and sends reminders. The platform’s revenue recognition module helps generate compliant schedules for deferred revenue.

Chargebee’s integration with Salesforce automates repetitive tasks, lets sales teams create accurate proposals within approved discount guidelines, shortens sales cycles and enhances collaboration between sales and finance; this integration drives more accurate revenue recognition and provides deep insights into sales performance.

Chargebee is popular with scaling SaaS companies that prioritize recurring billing and want strong payment‑gateway coverage

Frequently asked questions about the quote to cash process

What is the quote to cash process?

The quote to cash process is the end-to-end workflow that turns a configured and priced quote into collected payment and recognized revenue. It includes quoting, contracting, order creation, billing, collections, and revenue recognition.

How does ERP streamline the quote-to-cash process?

An ERP streamlines quote-to-cash by serving as the financial system of record, automating general ledger postings, managing accounts receivable, handling multi-entity accounting, and reducing manual reconciliation between billing and financial reporting.

How do companies automate quote-to-cash processes?

Companies automate quote-to-cash by integrating CRM, CPQ, contract management, billing, payments, and revenue recognition systems, embedding approval workflows, and using event-driven integrations so data flows automatically from quote to invoice to revenue reporting.

Which CPQ software offers the best quote-to-cash solution?

The best CPQ software depends on company size and complexity, but the strongest quote-to-cash solutions go beyond CPQ to unify pricing, billing, and revenue recognition in a single system or tightly integrated stack.

What is the difference between quote to cash and order to cash?

Quote to cash begins at pricing and quoting and covers the entire lifecycle through payment and revenue recognition. Order to cash starts later, after an order is placed, and focuses primarily on fulfillment, invoicing, and collections.

Why does the quote to cash process break in SaaS?

It often breaks due to usage-based pricing, contract modifications, multi-entity operations, and siloed systems that require manual re-entry of data between sales and finance.

How long does it take to implement a quote-to-cash platform

Implementation timelines vary by complexity. Early-stage SaaS companies may implement in weeks, while mid-market and enterprise organizations may require several months depending on integrations and revenue recognition requirements.

What metrics indicate a healthy quote-to-cash process?

Key metrics include quote turnaround time, invoice accuracy rate, days sales outstanding, time to close the books, renewal rate, and revenue leakage percentage.

Quote to cash is your growth infrastructure

Hybrid pricing, usage-based billing, multi-year contracts, global entities, and strict revenue recognition rules have made monetization more complex than ever.

Companies that treat quote to cash as an afterthought end up fighting invoice disputes, reconciliation headaches, and renewal friction.

The companies will invest in their quote to cash processes, and treat it as infrastructure, will scale differently.

They will close faster.

They will invoice accurately.

They will recognize revenue with confidence.

They will renew without surprises.

In AI especially, where monetization models change quickly and usage can spike overnight, a fragile quote to cash process becomes a growth bottleneck.

A modern, automated, well-governed quote to cash process becomes a competitive advantage. If you want predictable growth, cleaner closes, and customer trust that compounds over time, this is the place to invest.