Disconnected quoting, contract, and billing systems create friction. You have probably felt it in delayed deal cycles, manual contract uploads, invoice mismatches, or revenue recognition clean up.

And you know one thing clearly: If signature is not embedded in the quote-to-cash flow, cash gets delayed.

Companies that reduce quote-to-cash friction improve cash flow velocity by up to 20 percent.

This guide breaks down what to look for and compares four serious end-to-end quote0to-cash platforms with eSignature options:

- Alguna: Best quote-to-cash platform for scaling SaaS or fintech companies with usage-based or hybrid pricing

- Zoho Billing: Best for SMBs with straightforward billing

- Agentforce Revenue Management: Best for Salesforce-centric companies

- Zuora: Best for global enterprises

What a modern quote-to-cash platform should offer

A true quote-to-cash platform should cover:

- Configure price quote

- Quote generation

- Contract or order creation

- Embedded signature

- Subscription or order activation

- Billing and invoicing

- Revenue recognition

If signature happens outside the system and has to be re-uploaded manually, you do not have end-to-end quote to cash.

You have a patchwork.

As McKinsey noted in a 2024 B2B revenue operations study, high performing companies “digitize the full quote to cash workflow rather than optimizing isolated steps.”

That includes signature. Now let’s look at how each platform approaches it.

Comparison snapshot: Quote-to-cash platforms with eSignature options

| Platform | Embedded e-signature flow | Integration based e-signature | Best for |

|---|---|---|---|

| Alguna | Yes | Optional | Scaling SaaS, AI, and fintech |

| Zoho Billing | Yes (via Zoho Sign) | No external dependency required | SMB to mid-market |

| Agentforce Revenue Management | No | Yes | Enterprise |

| Zuora | No | Yes | Global enterprises |

1. Alguna: AI‑native quote‑to‑cash platform with native eSignature flow

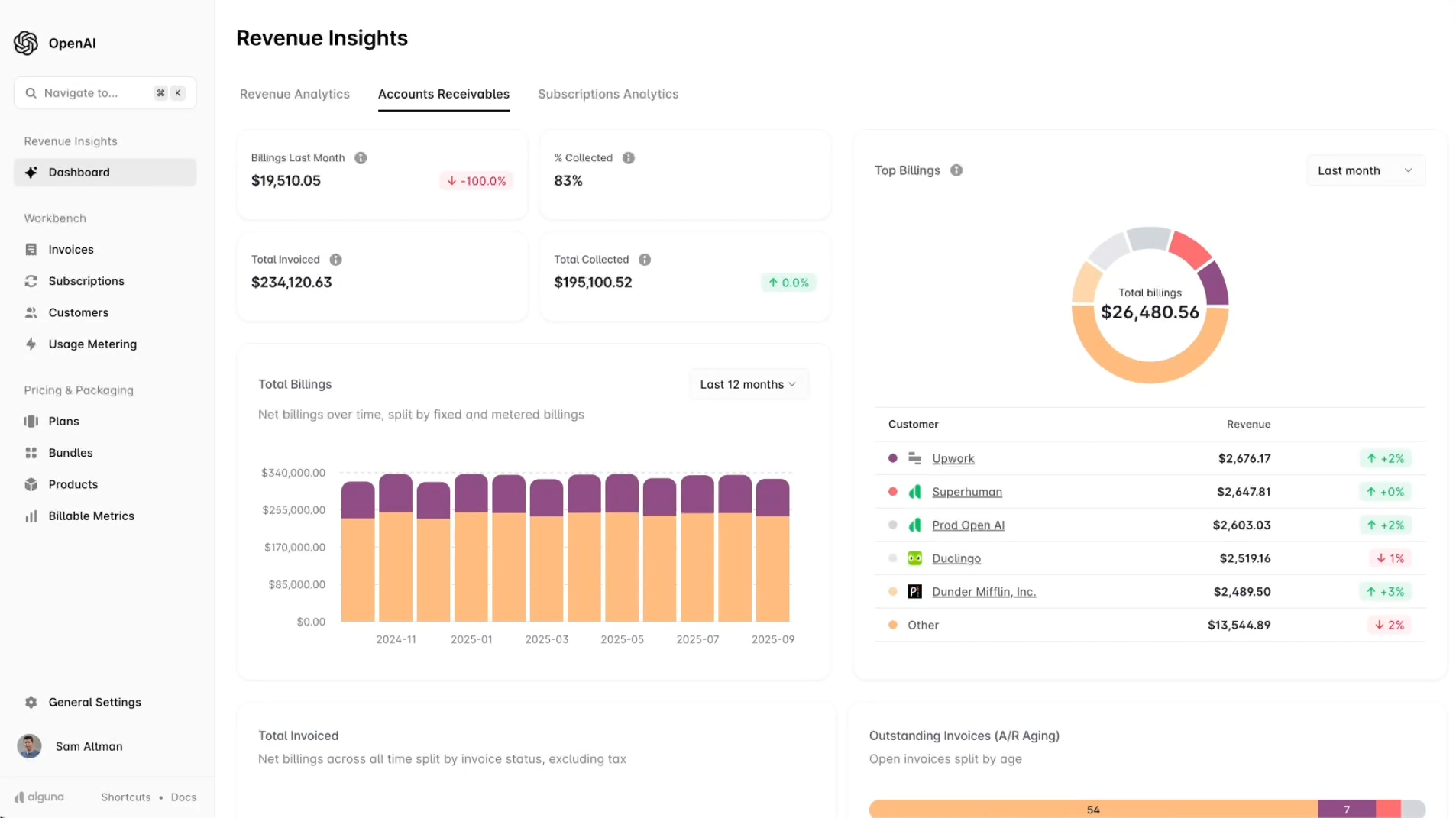

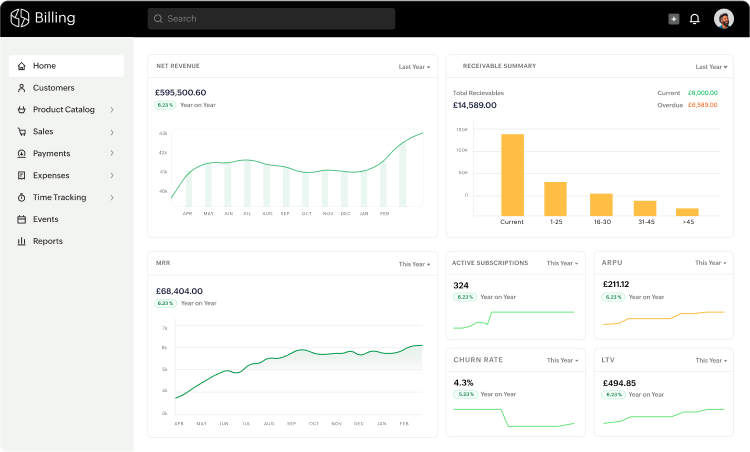

Y Combinator backed Alguna is an AI‑native quote to cash platform designed by experienced fintech operators. It was purpose-built for SaaS, AI, and fintech companies unifying CPQ, usage metering, billing, invoicing, payments, and revenue recognition in a single source of truth.

Strengths and differentiators

- Unified workflow: Alguna’s AI‑native platform covers CPQ, contract generation, embedded e‑signature, invoicing, and ASC 606/IFRS 15 compliant revenue recognition in one workflow.

- Built‑in e‑signature: Because e‑signing is integrated, quotes convert directly into contracts and subscriptions without manual uploads. Approval rules and notifications keep deals moving.

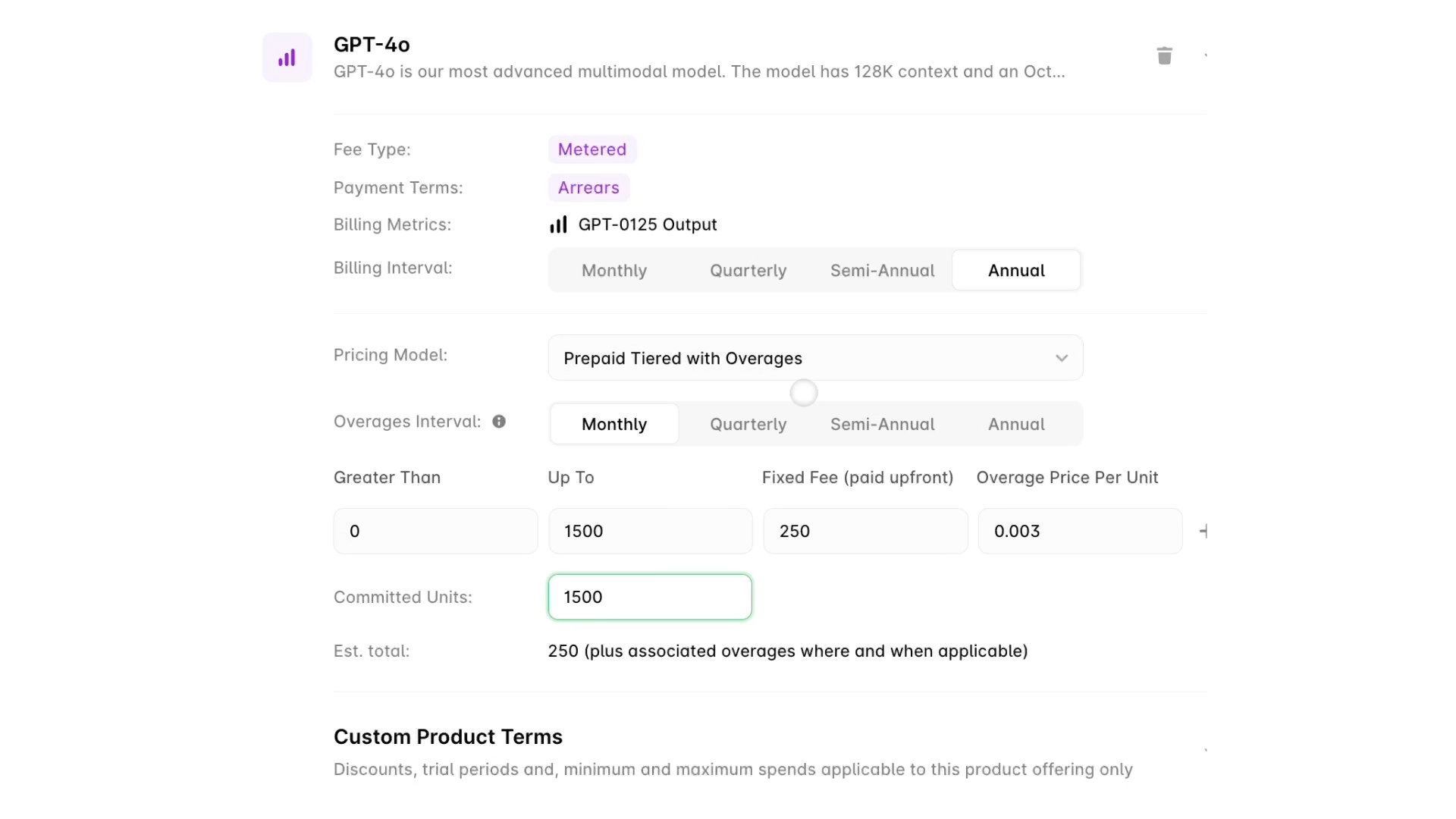

- No-code CPQ: Make pricing changes without relying on engineering. Apply SaaS and AI pricing models with real-time usage metering and deep CRM and ERP integrations.

- Usage‑based billing: Automated usage tracking ensures every billable item is captured, addressing revenue leakage from missed overage charges.

Limitations

Alguna is a newer entrant (YC S23) compared with legacy players, so its ecosystem of third‑party integrations is still maturing. It's optimized for scaling SaaS, fintech and AI companies, so may not be a fit for very early stage startups.

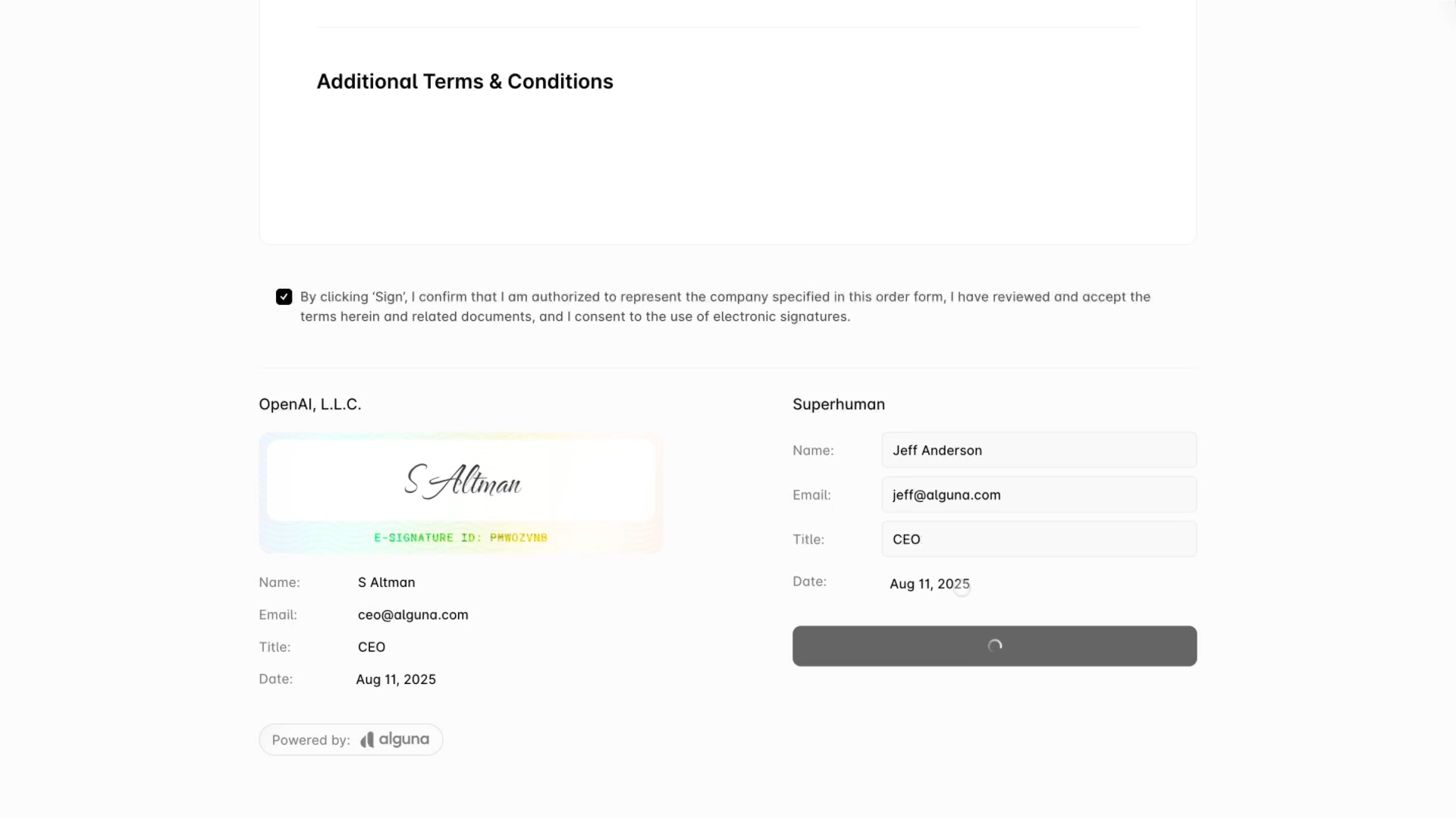

How eSignature works in Alguna: Step-by-step overview

End-to-end eSignature in Alguna.

Alguna handles eSignature natively as part of the quote-to-cash workflow.

Step-by-step, here's what happens:

- Configure a customer quote in Alguna CPQ

No matter your pricing model, you can create and sell product bundles that combine one-off setup fees, recurring subscriptions, and usage-based services within one quote.

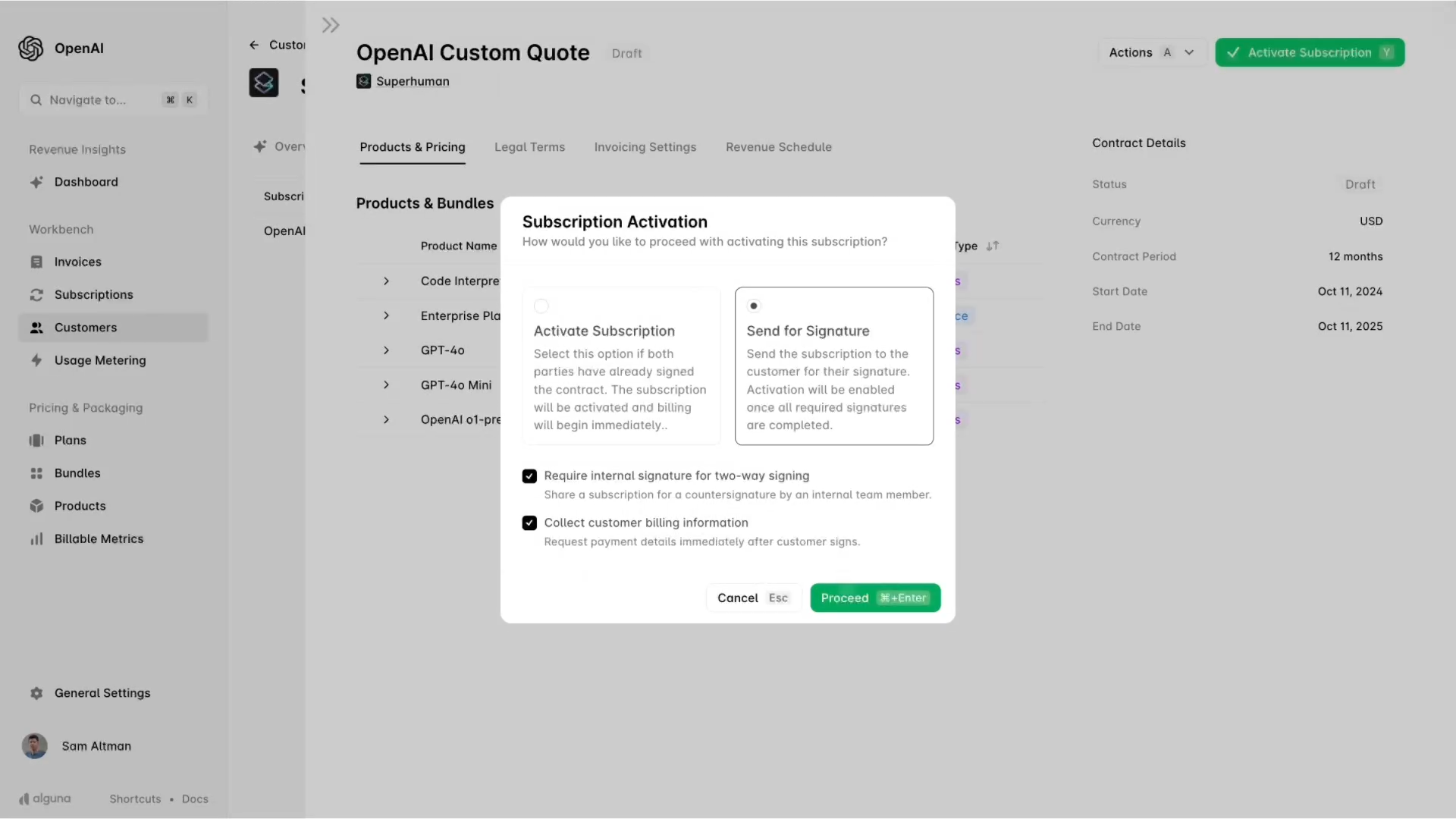

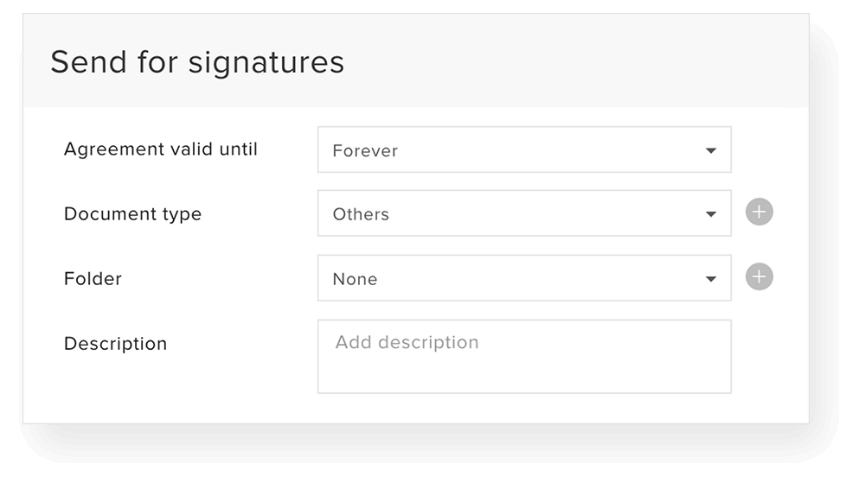

- Activate your subscription and send for signature

Once you're ready to activate a subscription, you can send the quote to the customer for signature. You can request two-way signing and also choose to collect billing information upfront.

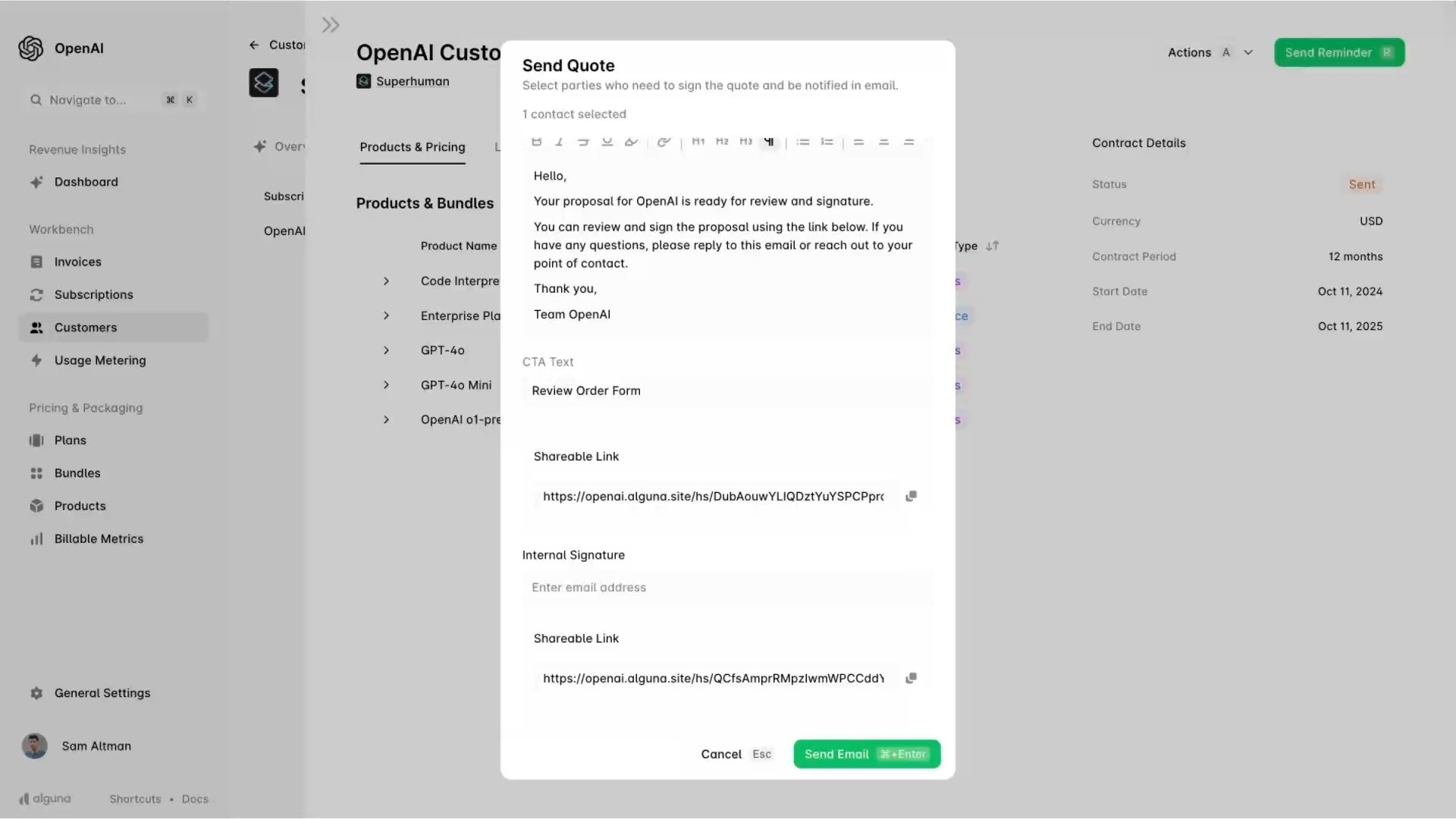

- Review the quote and customize your email before sending

Customize the email and send the quote to relevant contact(s) and include a shareable link.

- Your customer receives the polished quote for signature

Customers can review pricing, accept terms, and sign directly in-line, significantly speeding up time to close.

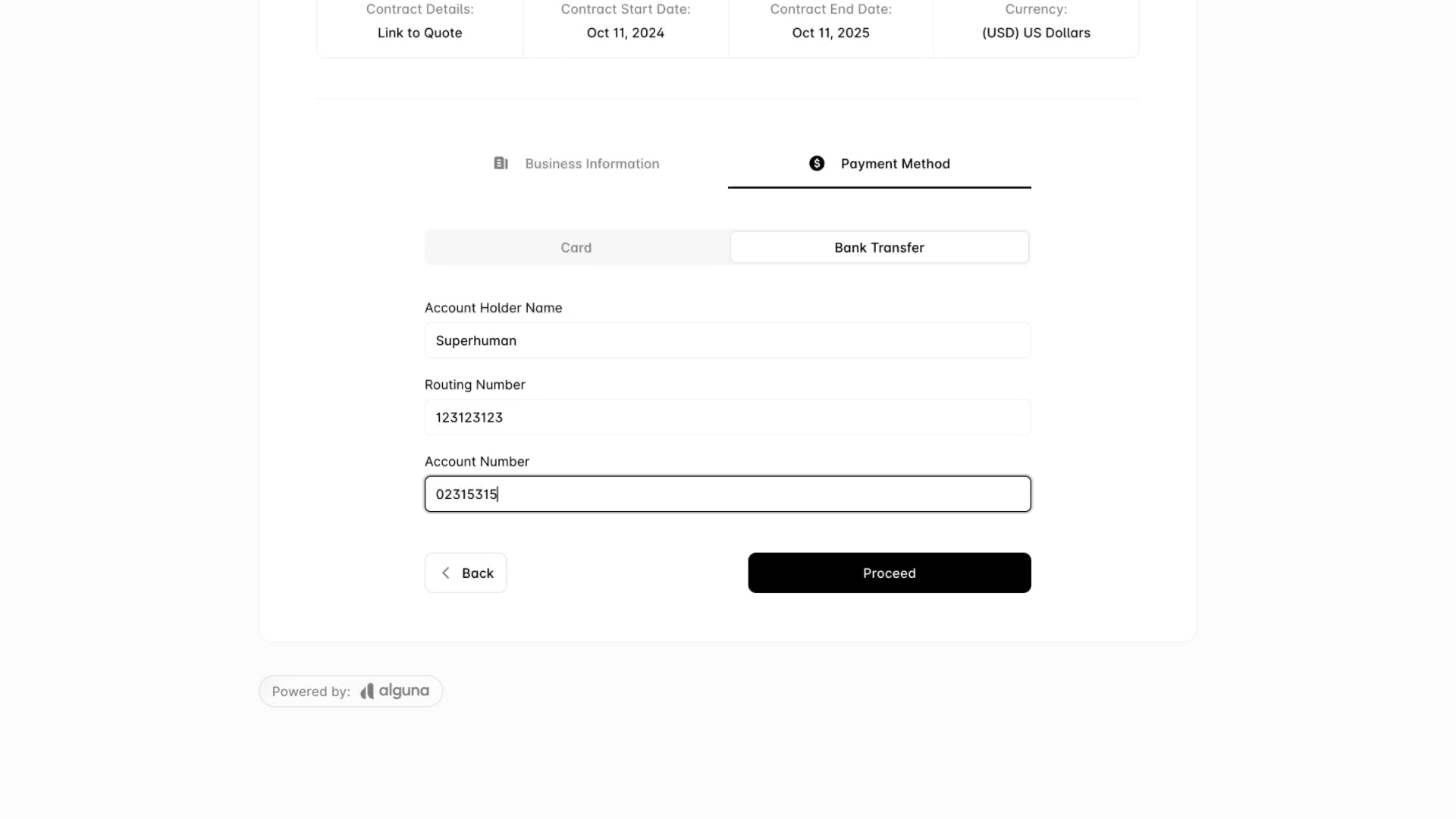

- Collect billing details upfront to make sure everything flows seamlessly downstream

Collect billing details upfront from your customers and watch quotes flow seamlessly downstream into billing.

Starting off with PandaDoc for contract management, Stripe for billing, and spreadsheets for financial calculations and investor updates, Juan Burgos at Haven was feeling the constraints of his fragmented system.

What had previously taken him 30-40 minutes in PandaDoc, now took him less than 5 minutes in Alguna.

“Using the Plans feature, I can easily create bundles, and the whole flow just works. It takes me under five minutes to send someone an agreement. I can hop off a demo, set up the plan, type in the customer info, and it’s done.”

Read the case study

In the simplest terms, the flow looks like this:

- A quote becomes a contract

- The contract is signed within the workflow

- The signed agreement activates the subscription

- Billing schedules are generated automatically

- Billing flows automatically into revenue recognition

No exporting. No rekeying. No reconciliation drift.

Alguna is the best fit for:

- Scaling SaaS companies

- AI companies with hybrid pricing

- RevOps teams that want speed and autonomy

- Finance teams that want fewer reconciliation points

If your priority is reducing quote-to-invoice drift and speeding up revenue activation, Alguna is built for that.

Book a personalized demo of Alguna and we will walk you through:

• How a quote becomes a contract

• How embedded eSignature activates the subscription

• How billing schedules are generated automatically

👉 Book your Alguna demo and see your quote-to-cash process end to end.

2. Zoho Billing + Zoho Sign: Integrated billing for growing businesses

Zoho Billing is part of the broader Zoho suite and pairs natively with Zoho Sign to provide a simple, secure signing experience. The integration allows users to generate and digitally sign invoices, quotes and credit notes directly from Zoho Billing.

Documents are tamper‑proofed with embedded digital signature certificates, and customers can sign anywhere on any device, accelerating approvals. The system also tracks signature progress so teams stay informed.

Strengths and differentiators

- Built‑in e‑sign for transactions: Users can create, sign and send invoices, quotes and credit notes in one workflow. This eliminates switching between tools and prevents signature duplication or forgery.

- Tamper‑proof documents and audit trail: Digital signature certificates make documents tamper‑proof, and the system provides visibility into where each document is in the signature process.

- Flexible billing engine: Zoho Billing handles one‑time invoices, subscriptions, metered billing and proration. The platform also offers reporting and analytics.

- Part of the Zoho ecosystem: The integration works seamlessly with Zoho CRM, Books and other apps, simplifying adoption for existing Zoho users.

Limitations

Zoho Billing’s revenue recognition features are basic compared with Alguna or Zuora, making it less suitable for complex ASC 606 scenarios. Scaling beyond the mid‑market may require additional integrations or customizations. A

dvanced CPQ logic (bundling, dependencies, AI‑driven pricing) is not included and must be built via Zoho CRM or third‑party apps.

How eSignature works

Zoho Sign supports embedded signing through API and iframe implementation.

That enables:

- In-app signing

- Mobile signing

- Audit trails

- Compliance with ESIGN and UETA

- Support for eIDAS in international contexts

Zoho publishes strong documentation around embedded signing and legal compliance, which reduces perceived risk for buyers.

Zoho is the best fit for:

- SMB to mid-market companies

- Organizations already standardized on Zoho CRM

- Businesses needing documented compliance support

If you are committed to the Zoho stack, this option makes sense.

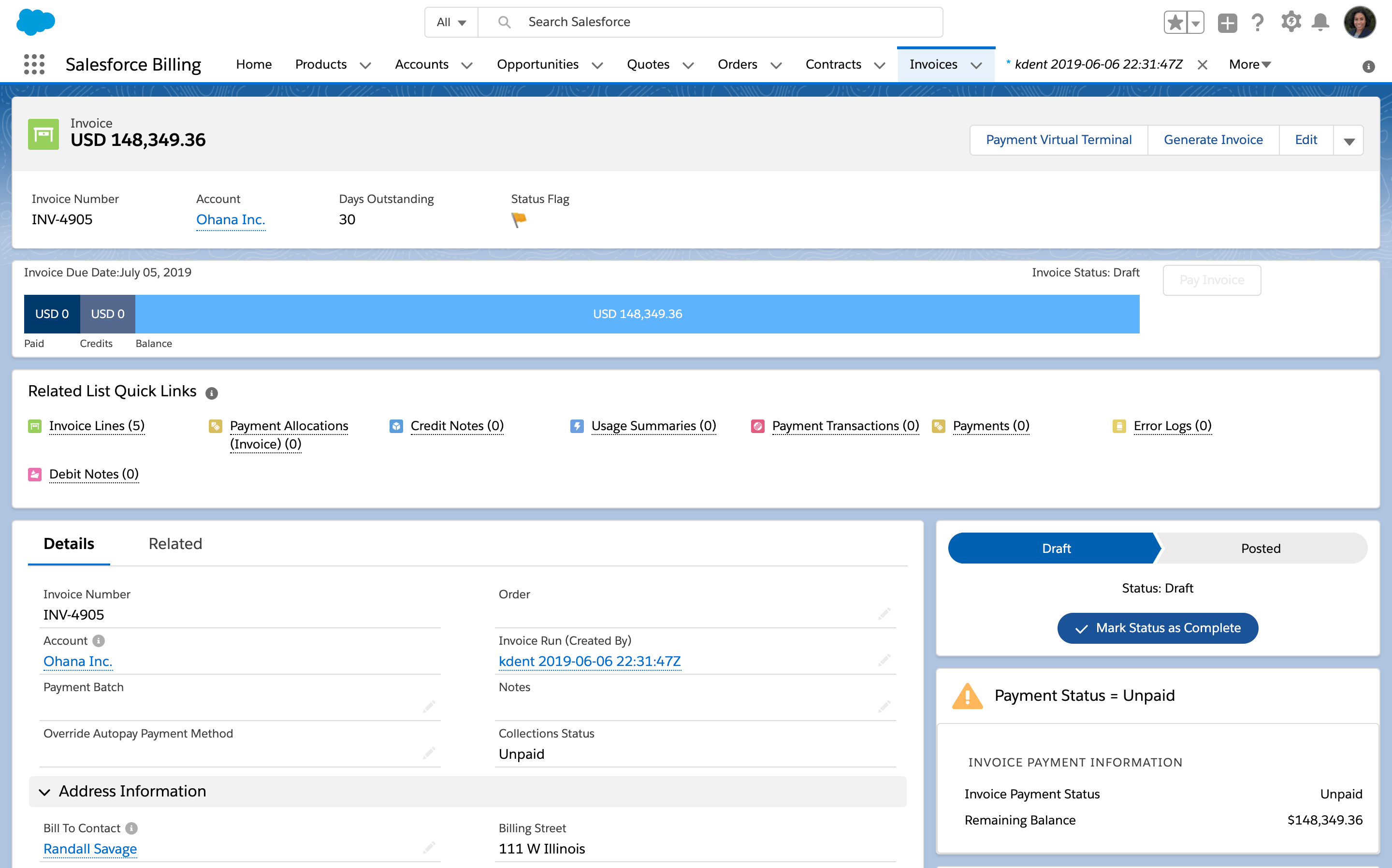

3. Agentforce Revenue Management (Salesforce Revenue Cloud) + DocuSign: Enterprise flexibility

Agentforce Revenue Management suite, formerly Salesforce Revenue Cloud, covers CPQ, contract lifecycle management, subscription management and billing.

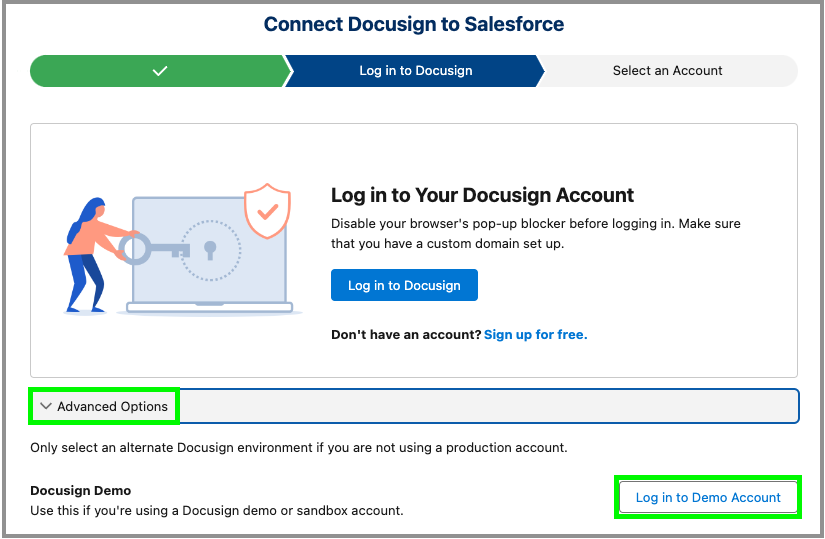

Because Salesforce does not offer a native e‑signature module, most customers integrate Docusign. Docusign’s integration for Salesforce lets teams prepare agreements, get them signed and update data without leaving Salesforce.

Strengths and differentiators

- Highly configurable CPQ: Salesforce CPQ supports advanced product configurations, pricing rules and discount approvals, making it suitable for complex B2B offerings.

- Rich ecosystem: Integration with Docusign extends signing across the entire Customer 360, and thousands of AppExchange partners provide specialized add‑ons.

- Enterprise‑grade governance: Role‑based permissions, audit trails and compliance features meet the needs of large organizations.

- Flexible contract lifecycle management: Docusign CLM for Salesforce automates contract generation, approval routing, collaboration and updates.

Limitations

Agentforce Revenue Management's quote‑to‑cash stack often requires multiple modules (CPQ, Billing, Subscription Management, CLM, Docusign) and third‑party integrations. Implementation can be lengthy and costly.

Licensing is complex and may require enterprise agreements. The need to assemble and maintain multiple systems increases the risk of data silos unless integration is carefully managed.

How eSignature works

Salesforce enables eSignature through integration with providers such as DocuSign.

Users can merge customer, product and pricing data to generate sales documents and complex quote forms, batch‑generate invoices from Salesforce Billing and send agreements for responsive signing on most devices.

The integration automatically pulls customer data into agreements and writes back signed data, enabling workflows across Sales Cloud, Service Cloud and Revenue Cloud. Docusign CLM adds contract lifecycle automation, including pre‑approved templates and legal workflows.

That enables:

- Sending contracts for signature from within CRM

- Mobile and remote signing

- Audit trails through the signature provider

- Enterprise grade compliance support

The key nuance: embedded signing experience depends on configuration and provider setup.

Best for:

- Enterprise organizations

- Complex approval structures

- Companies already embedded in the Salesforce ecosystem

If governance, reporting depth, and ecosystem scale matter more than simplicity, this is a strong contender.

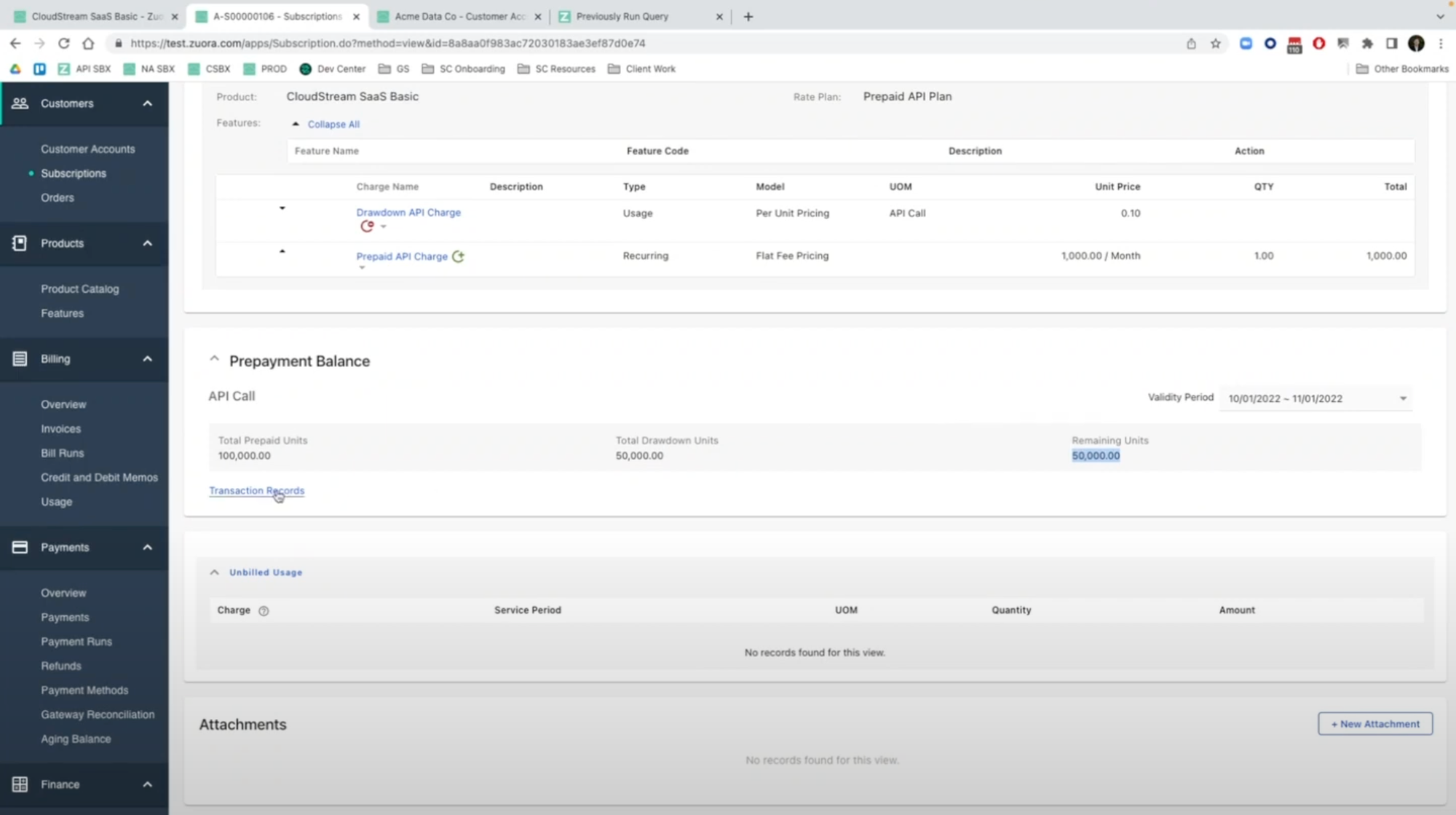

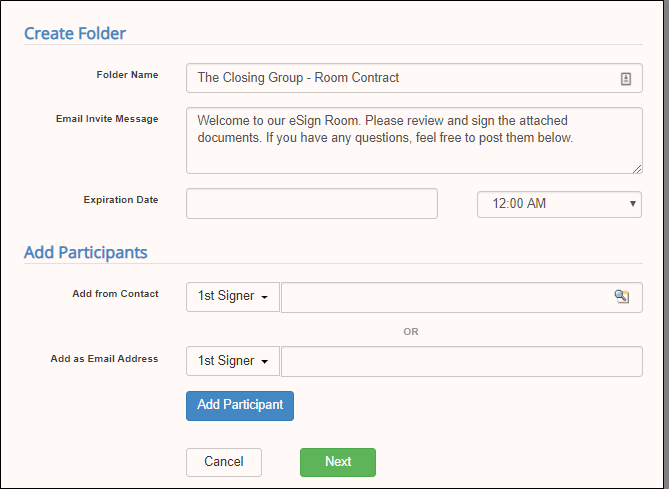

4. Zuora + Sertifi: Subscription billing powerhouse with integrated e-signing

Zuora is known for its subscription billing platform and advanced revenue recognition capabilities. It doesn't provide an internal e‑signature module, but its partnership with Sertifi fills that gap.

Zuora’s billing engine supports complex pricing models, multi‑currency and multi‑entity operations, and deep ASC 606 revenue recognition.

Strengths and differentiators

- Robust billing and revenue management: Zuora handles subscription, usage‑based and hybrid billing models, offers dunning management and automates revenue recognition schedules.

- E‑sign plus payment: Through Sertifi, contracts are signed and payment details captured in a single flow, accelerating cash collection.

- Global scale: Multi‑currency, multi‑entity and multi‑tax capabilities support global businesses.

- Developer ecosystem: Extensive APIs and an active partner community enable customization and integration with CRM, ERP and other systems.

Limitations

Zuora implementations can be resource‑intensive, often requiring specialized consultants and significant configuration. Without Sertifi or another e‑sign integration, users must manage signing externally.

Pricing can be high for smaller companies, and some organizations find the user interface less intuitive than modern SaaS tools.

How eSignature works

Zuora typically integrates with external eSignature providers rather than offering a native module.

For example, Sertifi’s integration with Zuora’s hosted payment technology allows users to capture customer e‑signatures and payments in one seamless interaction. Customers can sign agreements and submit payment details simultaneously, reducing friction and ensuring cash is collected as soon as the contract is executed.

This allows:

- Contract routing for signature

- Enterprise compliance support

- Integration into subscription activation workflows

As with Salesforce, embedded experience depends on integration architecture.

Zuora is typically best for:

- Mid-market to enterprise subscription businesses

- Companies with complex billing logic

- Finance teams prioritizing revenue recognition depth

4 questions that should drive your decision

At this stage, you are not comparing feature checklists. You are comparing risk and velocity.

Ask yourself these questions:

- Do we want signature natively embedded in our quote-to-cash engine?

- Are we comfortable managing integration complexity?

- Is our bottleneck quoting speed or billing complexity?

- How much revenue leakage can we tolerate?

Signature is the bridge between booking and billing. If it is fragile, everything downstream becomes fragile.

Choose a unified quote-to-cash system, not a patchwork of tools

If you are looking for quote-to-cash platforms with eSignature options, you shouldn't settle for a bolt-on signature tool.

You want a platform where:

- The quote turns into the contract

- The signature activates the subscription

- The billing schedule matches what was signed

- Finance doesn't need to reconcile disconnected systems

For SaaS and AI companies that value speed and autonomy, Alguna stands out because eSignature is embedded inside a unified quote-to-revenue workflow.

For enterprise scale governance, Agentforce Revenue Management and Zuora offer breadth and ecosystem depth.

For SMBs standardized on Zoho, Zoho Billing with Zoho Sign offers a documented embedded experience.

The right choice depends on whether your constraint is complexity, scale, or speed.

But one thing is consistent across high performing revenue teams: They treat quote to cash as a single system, not a series of tools.

Your quote-to-cash system should accelerate revenue, not delay it

If you're serious about reducing revenue leakage, shortening sales cycles, and eliminating manual handoffs between quoting, contracts, signature, and billing, it is time to evaluate your workflow as a single system.

Schedule your personalized demo with Alguna and see what modern quote-to-cash should feel like.