• Designed well it reduces costs by 15-20% by removing errors, speeding up approvals, and improving forecast accuracy across Sales and Finance.

• SaaS and AI companies are moving to unified quote to cash solutions like Alguna to eliminate manual errors and increase win rates.

Manual quote to cash processes aren’t just outdated, they’re costly.

Every spreadsheet, every email, and ever manual handoff adds friction that slows down deals and cuts into margins.

According to McKinsey, streamlining the quote to cash process can reduce end-to-end costs by 15% to 20%. A statistic that underscores the real financial consequences of inefficiency across revenue workflows, and in particular, quote to cash automation.

That’s why RevOps, Finance, and GTM teams are rethinking how revenue moves through their organization. Quote to cash automation connects quoting, billing, and revenue management into a single flow, replacing disconnected tasks with a faster, more reliable process.

In this guide, we’ll define quote to cash automation, explain how it works, and share why it’s becoming essential for modern revenue teams.

We’ll also explore the most common quote-to-cash automation solutions SaaS and AI companies use today—from end-to-end platforms to flexible, integrated stacks.

What is quote to cash automation?

Quote to cash (Q2C) automation streamlines the entire revenue cycle, from quoting and contracting to billing, payment, and revenue recognition.

Instead of juggling disconnected tools and spreadsheets, companies use a single connected system that keeps data flowing across Sales, Finance, and RevOps.

Under legacy workflows, each step lived in isolation: Sales built quotes in spreadsheets, Finance re-entered data, and approvals lagged in inboxes.

Automation unifies those steps so every system speaks the same language, letting teams move faster, reduce errors, and gain real-time visibility across the revenue cycle.

How to automate quote to cash processes: Step-by-step overview

Quote to cash automation can be broken into many smaller steps depending on your process and setup.

Here, we’ll look at four key stages of the quote to cash process and see how automation transforms each step.

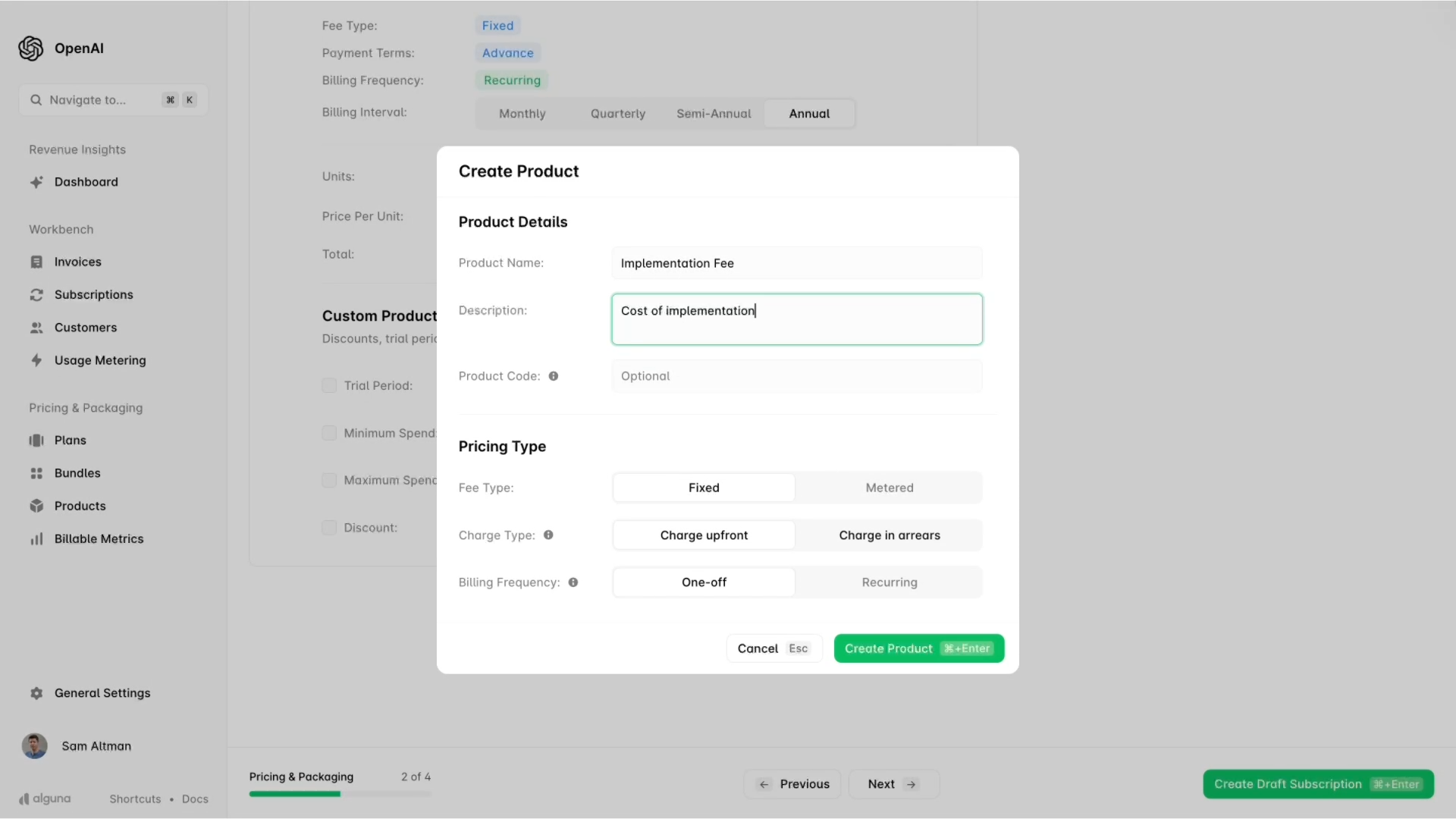

Step 1: Configure, price, and quote (CPQ)

The quote to cash process starts with creating the quote. This is a stage that seems simple, but it’s often the most error-prone. If you’re doing it manually, this means juggling spreadsheets, pricing tables, and versioned email threads.

This stage covers:

- Configure the quote (offer): This is where the salesperson or system defines what’s being sold; the product(s), service(s), and commercial terms. The goal is to build a quote that’s accurate, compliant, and tailored to the customer’s requirements without manual back-and-forth.

- Generate the price: Calculate the final price based on pricing model(s), discounts applied, taxes, and internal policies. The goal is to generate an accurate price without manual recalculation.

- Present the quote to your customer: The quote is shared with the customer in a professional, transparent, and easy-to-sign format. The goal is to deliver a frictionless experience from proposal to close—enabling customers to review, approve, and sign faster.

| Step | Objective | Key activities | Tools involved |

|---|---|---|---|

| Configure | Tailor the offer | Select products and packages; set terms (start date, billing cycle, term length); enforce rules/dependencies; add bundles/add-ons; define contract details. | CPQ / CRM |

| Price | Calculate value accurately | Apply pricing models (subscription, usage, credits, outcomes); handle discounts/approvals; calculate taxes, currencies, and revenue recognition; validate compliance. | Pricing engine / Revenue automation |

| Quote | Present and close | Generate branded proposals/order forms; collect e-signatures; provide clear pricing breakdowns and terms; sync back to CRM, billing, and finance systems. | CPQ / E-sign / Billing platform |

With a CPQ (Configure, Price, Quote) tool handling configuration and pricing logic, the heavy lifting is done for you. The rep enters the customer’s requirements, and the system automatically configures the right products, bundles, and discounts, then generates a polished quote in minutes. Pricing rules, approval thresholds, and product compatibility are baked in, so there’s no guesswork or re-entry errors.

Modern CPQ tools connect directly to your product catalog and CRM, meaning every quote reflects the latest pricing and configurations. What once took days of back-and-forth can now happen in a single sitting with no spreadsheets (and no “quote_version 9_final.pdf” attachments).

AI-powered CPQ platforms take this even further, applying machine learning to analyze deal history, recommend optimal pricing, and flag anomalies before they reach customers.

- Juan Burgos, CEO at Haven AI, on using Alguna to automate their quote to cash process

Read the case study

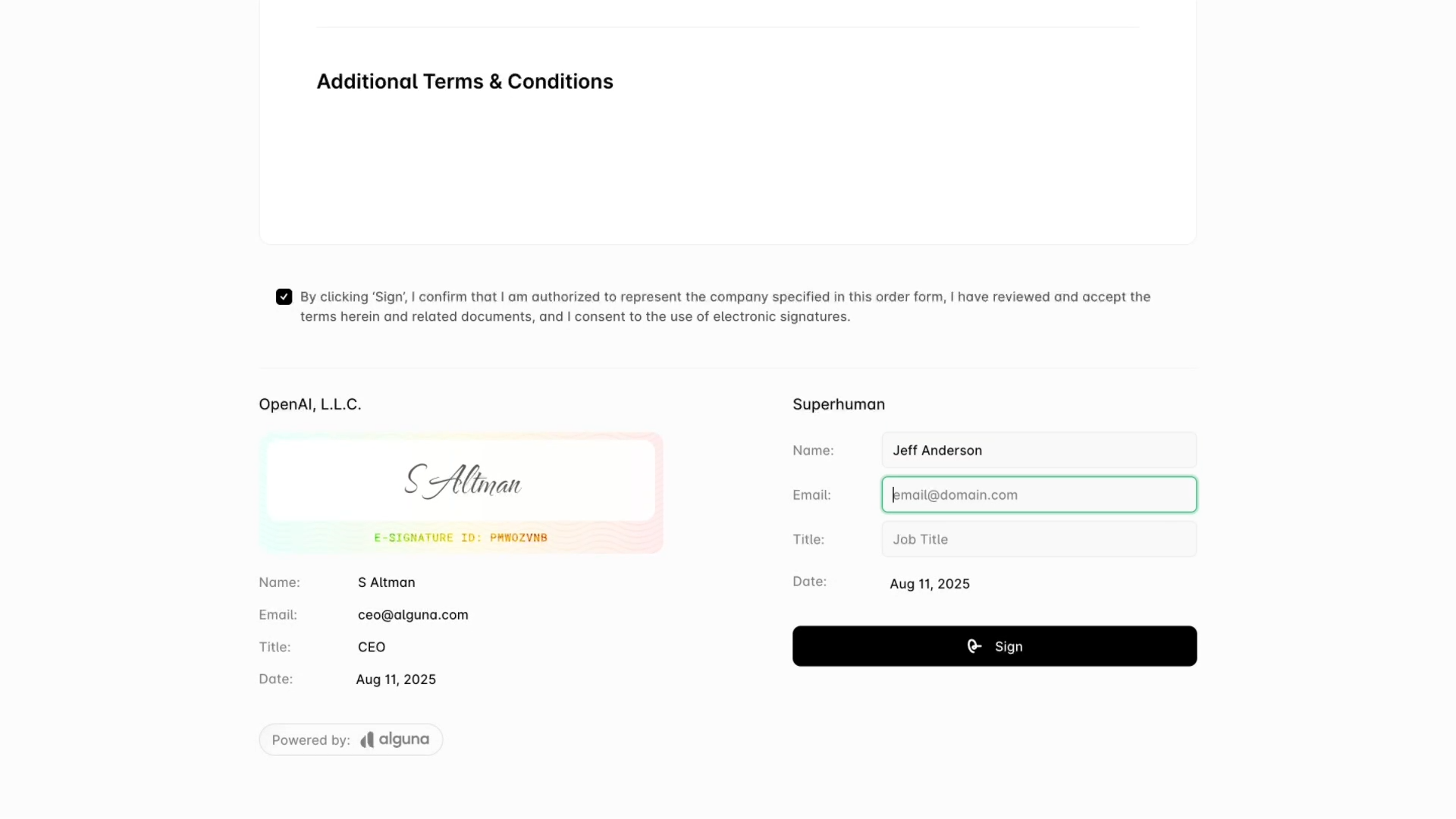

Step 2: Contract management

Once the quote’s accepted, the next challenge is turning it into a signed deal. This stage is where manual workflows usually break down: lost emails, stalled approvals, and inconsistent contract terms.

Digital contract management replaces that chaos with integrated contract management and digital signature tools. The platform automatically converts the approved quote into a contract, populating all details, like products, pricing, and terms, without anyone retyping them.

This is where approval rules are built in. For example, discounts above 20% might automatically route to a manager, while standard deals are instantly approved.

Instead of chasing signatures, your team gets notifications the moment an approval or signature is completed, which keeps deals moving.

Billing and invoicing

When a deal closes, billing is where manual processes often start to leak revenue. Finance teams pull numbers from CRMs, sales emails, PDFs, and invoices get delayed or miscalculated.

Integrated billing ensures that once a contract is executed, the system generates an invoice with accurate pricing, taxes, and payment terms. Finance no longer has to reconcile information manually or wait for handoffs from Sales.

Payment gateways can be integrated to automatically send, process, and track invoices. Late payments trigger reminders or automated dunning emails, keeping cash flow steady without anyone having to watch the clock.

By automating billing, companies eliminate revenue leakage and maintain consistent, predictable cash cycles.

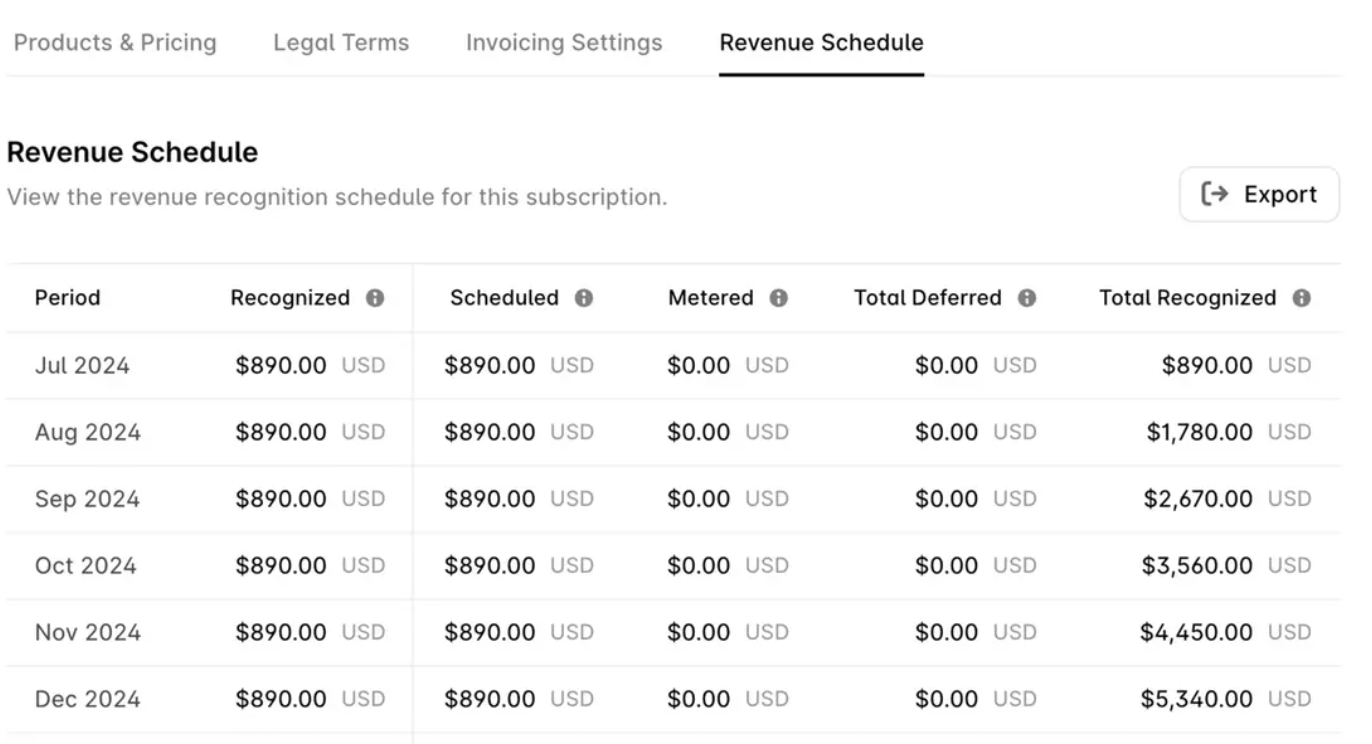

Revenue recognition

The final step is recognizing revenue in compliance with accounting standards like ASC 606 and IFRS 15. This part is notoriously complex,

Smart revenue systems manage this automatically, allocating and recognizing income based on delivery or time. If a customer prepays $12 000 for a 12-month contract, the system automatically schedules $1 000 per month.

When billing or contract terms change, the system updates recognition schedules in real time. Finance gains instant visibility into deferred and recognized revenue, helping teams close faster and audit cleanly.

Together, these four stages create a unified, automated revenue cycle, and that’s exactly why companies are moving fast to automate.

5 reasons companies automate quote to cash processes

Automation solves the many problems of manual quote to cash workflows, which introduce errors and delays, by unifying data and streamlining handoffs from quote to cash.

Here’s how:

1. Eliminate manual errors with connected data

When every quote, contract, and invoice lives in a different system, mistakes are inevitable. A small typo or misapplied discount can ripple through the entire process, delaying deals and eroding trust.

Connected platforms synchronize data across systems and automatically enforce pricing rules. Teams gain confidence knowing every quote is accurate and every invoice aligns perfectly with the deal that started it. The result: fewer disputes, cleaner reporting, and far less time wasted chasing errors.

2. Accelerate deal cycles with automated approvals

If you’ve ever waited days for an email approval, you know how easily momentum dies. Manual approvals and disconnected workflows slow everything down, often right when the buyer is ready to move.

Automated routing and built-in approval flows move deals forward instantly, linking quotes directly to billing so nothing sits idle in someone’s inbox.

3. Capture every dollar with accurate, usage-based billing

In complex pricing models, it’s easy to miss billable items: untracked add-ons, unbilled overages, forgotten renewals. That’s revenue quietly slipping away.

With automation, every chargeable item is captured from quote to invoice. ComplyAdvantage, for example, eliminated revenue leakage by using software to automate usage-based billing, which ensured every customer event was recorded, billed, and recognized on time. Accuracy here doesn’t just prevent errors; it protects margins.

- Marc Koskela, Director Growth Marketing at Comply Advantage

Read the case study

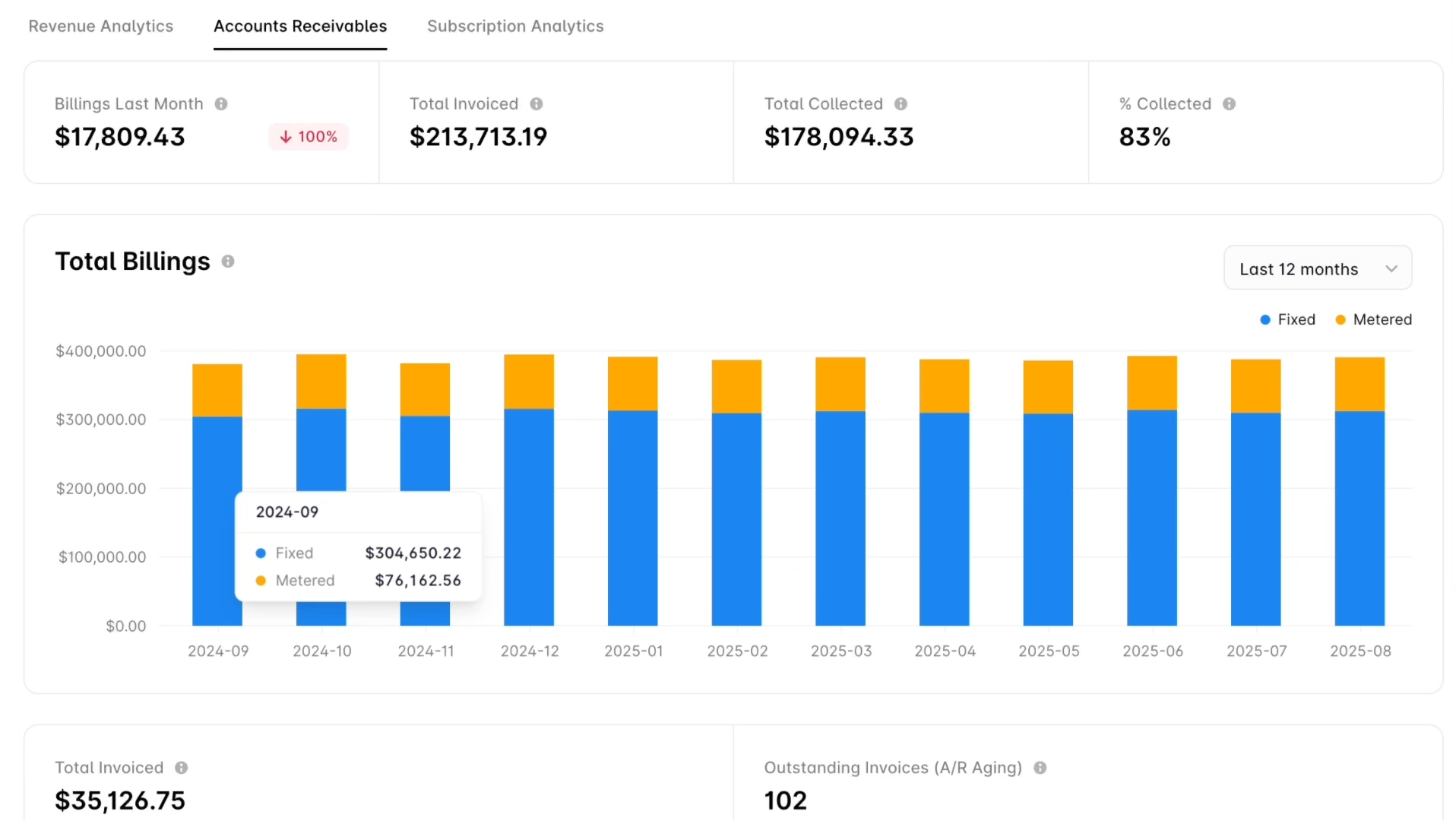

4. Speed up cash flow with real-time invoicing

Disconnected systems often leave Finance waiting for Sales to hand off signed deals, delaying invoices, stretching cash flow, and making forecasting painful.

By linking quoting and billing, invoices are generated the moment a deal is signed, and revenue schedules are updated in real time. It’s faster cash collection, lower Days Sales Outstanding (DSO), and a real-time view of where money is flowing (or stuck).

5. Keep everyone aligned with a single source of truth

When Sales, Finance, and Legal each rely on their own data, misalignment is inevitable. Deals stall, forecasts drift, and no one’s quite sure which version of the truth is right.

A unified quote-to-cash automation solution fixes that. Everyone works from the same live dashboard, which shows quotes, contracts, invoices, and payments.

For instance, Evervault achieved 100% usage transparency for customers and revenue teams after adopting a unified quote to cash workflow, eliminating spreadsheets and improving alignment between Sales and Finance.

- Shane Curran, CEO Evervault

Read the case study

Now, let's take a look at the types of quote-to-cash automation solutions SaaS and AI companies typically use.

Quote-to-cash automation solutions

There are two main types of quote-to-cash automation solutions available, each with distinct advantages and trade-offs.

1. End-to-end quote-to-cash automation solutions

2. Point-solution stacks

Quote-to-cash automation solutions: Overview

| Solution type | Best for | Overview | Example platforms |

|---|---|---|---|

| End-to-end Q2C platforms (including AI-Native variants) | Enterprises or fast-scaling AI, SaaS, and fintech companies that want full automation in one system. |

Unified revenue workflows combining CPQ, billing, and revenue recognition into a single system. Provides full visibility, fewer integration points, and consistent automation rules across teams. |

Alguna (AI-native) Maxio Salesforce Revenue Cloud (now ARM) Oracle CPQ Chargebee |

| Integrated / point-solution stacks | Mid-market or growing companies with existing CRM/ERP tools. |

Combines best-of-breed systems (e.g., CRM + billing + e-signature) for flexible automation through integrations or middleware. Easier phased rollout but requires more setup and maintenance. |

HubSpot + Chargebee + DocuSign, Zoho CRM + Xero + PandaDoc |

Quote-to-cash automation solutions: What you need to know

1. End-to-end Q2C platforms

These are unified systems, like Alguna, that manage the entire revenue workflow, from configuration and quoting to billing, payments, and revenue recognition, all in one place.

Because every module is integrated, you get consistent automation rules, a single source of truth, and fewer data sync issues. The result is a smoother flow from quote to cash without managing multiple vendors or connections.

Many enterprise suites and newer AI-native platforms now fall into this category. For example, Alguna offers a unified quote-to-cash solution that combines CPQ, billing, and revenue operations in a single system built for modern SaaS and AI companies.

2. Integrated and point-solution stacks

The other route is to combine best-of-breed tools. That means connecting your CRM, CPQ, billing, and e-signature systems via integrations or middleware.

This approach allows flexibility and lets you keep the tools your teams already use, but it requires more setup and maintenance. Automation is achieved through data syncing and workflow triggers (for instance, generating an invoice automatically when a deal is marked closed-won).

It’s a popular approach for growing mid-market companies that have solid ops or IT resources in place. However, as integrations multiply, so do the risks of data mismatches or process gaps, especially as deal volume and pricing models become more complex.

Once you understand the landscape, you'll be better equipped to choose the right fit for your business.

The future of revenue runs on quote to cash automation

By replacing spreadsheets and manual handoffs with connected, data-driven workflows, businesses gain speed, accuracy, and visibility across quoting, billing, and revenue recognition.

You don’t need to automate everything at once — start small, build momentum, and scale. The payoff is faster deal cycles, cleaner billing, and more predictable revenue.

As AI reshapes revenue operations, automation is no longer optional. Platforms like Alguna make it practical by unifying CPQ, billing, and revenue recognition in one end-to-end AI monetization platform built for modern SaaS and AI companies.