Long quote-to-cash (Q2C) cycles slow revenue, create forecasting blind spots, and drain finance and RevOps teams with manual work.

For modern SaaS, AI, and fintech companies, especially those using usage-based or hybrid pricing, the old mix of standalone CPQ tools, billing systems, spreadsheets, and rev rec software simply doesn’t scale.

That’s why teams are actively searching for the best platforms for accelerating quote-to-cash cycles: solutions that automate everything from pricing and quoting through billing, invoicing, collections, and revenue recognition.

This guide compares the leading platforms in 2025 (and beyond) and explains which tools actually shorten time-to-cash—versus those that just move the bottleneck downstream.

What is quote-to-cash (and why acceleration matters)

Quote-to-cash is the end-to-end revenue workflow that starts when a deal is quoted and ends when revenue is recognized and cash is collected.

It typically includes:

- Pricing and CPQ

- Contracting and amendments

- Billing and invoicing

- Usage metering (for consumption models)

- Payments and collections

- Revenue recognition and reporting

When these steps live in separate tools, delays compound:

- Quotes take days to approve

- Billing errors trigger rework and disputes

- Revenue recognition lags behind reality

- Cash collection slips

Quote-to-cash vs quote-to-revenue

Quote-to-cash (Q2C) covers the operational flow from creating a quote to collecting payment. It focuses on sales execution and cash collection: pricing, CPQ, contracts, billing, invoicing, and payments.

Quote-to-revenue (Q2R) goes one step further. It includes everything in quote-to-cash plus revenue recognition and reporting, ensuring revenue is accurately recognized under ASC 606 / IFRS 15 as deals change over time.

What to look for in a quote-to-cash platform

Before comparing quote to cash platform vendors, here’s what actually drives faster Q2C cycles:

- Unified quote-to-revenue architecture

One system for pricing, CPQ, billing, usage, and rev rec—no Frankenstack. - Flexible pricing and CPQ

Support for subscriptions, usage-based pricing, credits, tiered pricing, ramps, and custom billing schedules without engineering work. - Automated billing and invoicing

Invoices generated automatically from signed quotes and actual usage, not spreadsheets. - Real-time usage metering

Critical for AI, API, and consumption-based products. - Revenue recognition built in

ASC 606/IFRS 15 compliance without exporting data to another tool. - Low operational overhead

RevOps and finance teams should move fast without waiting on developers.

Quick comparison: Quote-to-cash acceleration platforms

Quote-to-cash acceleration platforms typically fall into two buckets.

There are a few companies modernizing quote-to-cash processes, such as Y Combinator backed Alguna.

Then there are legacy players like Zuora and Chargebee that, unlike Alguna, weren't purpose-built for modern quote-to-cash processes, but rather, are trying to change direction to be more flexible to cater to modern day AI monetization and quote-to-cash needs.

| Platform | End-to-end Q2C | Flexible CPQ | Usage-based pricing | Built-in rev rec | Speed to value |

|---|---|---|---|---|---|

| Alguna | ✅ Yes | ✅ Advanced | ✅ Native | ✅ Native | 🚀 Fast |

| Salesforce Revenue Cloud | ✅ Yes | ✅ Strong | ⚠️ Limited | ⚠️ Add-ons | 🐢 Slow |

| Zuora | ✅ Yes | ⚠️ Limited | ⚠️ Complex | ✅ Strong | 🐢 Slow |

| Chargebee | ✅ Yes | ❌ Basic | ⚠️ Partial | ⚠️ Add-ons | ⚡ Medium |

| Maxio | ✅ Yes | ❌ Limited | ❌ Minimal | ✅ Strong | ⚡ Medium |

5 best platforms for accelerating quote-to-cash cycles (2025)

Modern quote-to-cash acceleration isn’t about speeding up one step, it’s about removing friction across the entire revenue lifecycle. The best platforms in 2025 unify pricing, CPQ, billing, usage, invoicing, and revenue recognition so deals move from quote to cash without manual handoffs or revenue leakage.

Below are the five best platforms for accelerating quote-to-cash cycles, based on flexibility, automation depth, and real-world impact for SaaS, AI, and fintech teams.

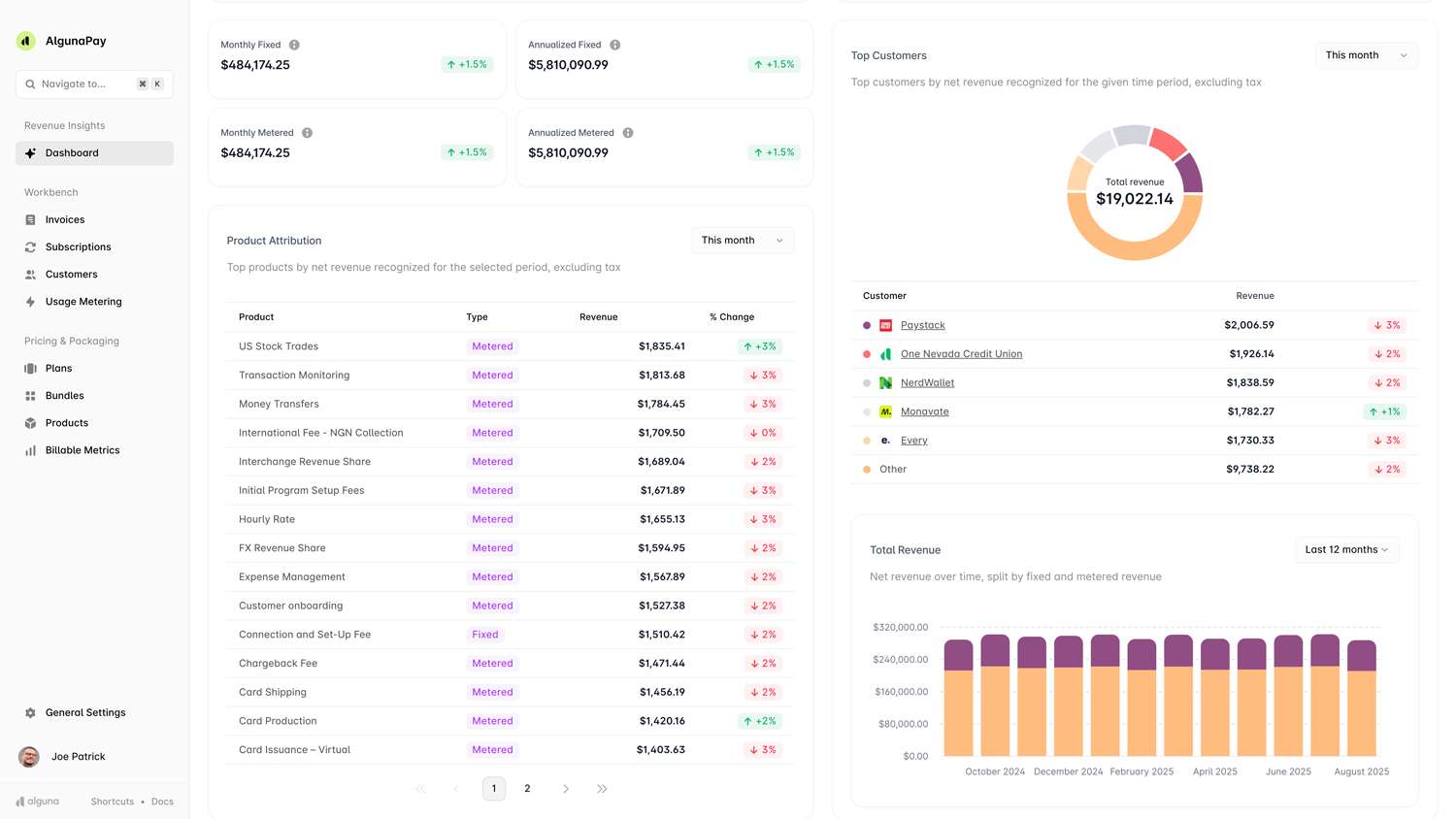

1. Alguna: Best overall platform for accelerating quote-to-cash cycles

Alguna is an AI-native, end-to-end quote-to-revenue platform built specifically for modern SaaS, AI, and fintech companies. Unlike legacy billing tools or point solutions, Alguna unifies CPQ, pricing, billing, usage metering, invoicing, and revenue recognition in a single system.

Why Alguna ranks #1

- True quote-to-revenue platform (not just billing or CPQ)

- No-code pricing and CPQ for complex deals

- Native support for usage-based, hybrid, and AI pricing models

- Automated billing → invoicing → revenue recognition

- Designed to eliminate revenue leakage and manual work

Key strengths

- Flexible CPQ with ramped pricing, custom schedules, and amendments

- Real-time usage metering for APIs, tokens, credits, and consumption

- Automated, audit-ready revenue recognition

- Fast implementation with minimal engineering effort

Limitations

- Purpose-built for modern SaaS and AI pricing models (not ideal if you only need basic subscriptions)

Best for

- SaaS, AI, and fintech teams serious about accelerating quote-to-cash end-to-end, not just one step of it

Pricing

Alguna offers transparent pricing with paid plans starting at $399/month. This includes white-glove onboarding and migration. Alguna never takes a revenue cut.

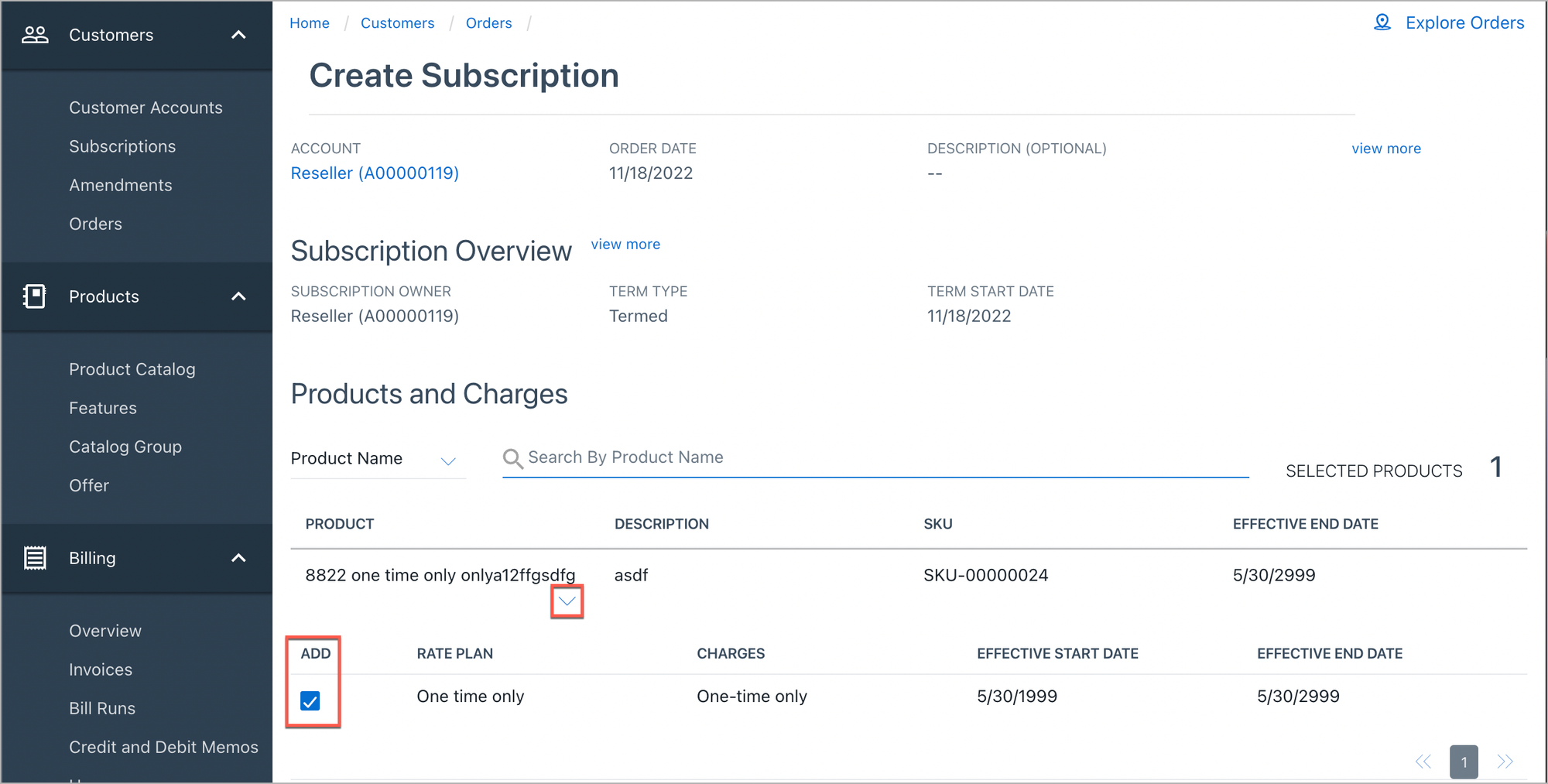

2. Agentforce Revenue Management (formerly Salesforce Revenue Cloud): Enterprise CPQ-led Q2C for companies already in the Salesforce ecosystem

Agentforce Revenue Management (formerly Salesforce Revenue Cloud) combines CPQ, contracts, and billing within the Salesforce ecosystem. It’s powerful but often complex and slow to implement.

Key strengths

- Deep Salesforce integration

- Strong CPQ and approvals for enterprise sales teams

Limitations

- Heavy customization and admin overhead

- Billing and rev rec often require additional tools

- Slower to adapt to usage-based or hybrid pricing

Best for

- Large enterprises already standardized on Salesforce

Pricing

Agentforce pricing is typically enterprise-only and quote-based. Expect a mix of Salesforce licenses, add-on modules, and professional services.

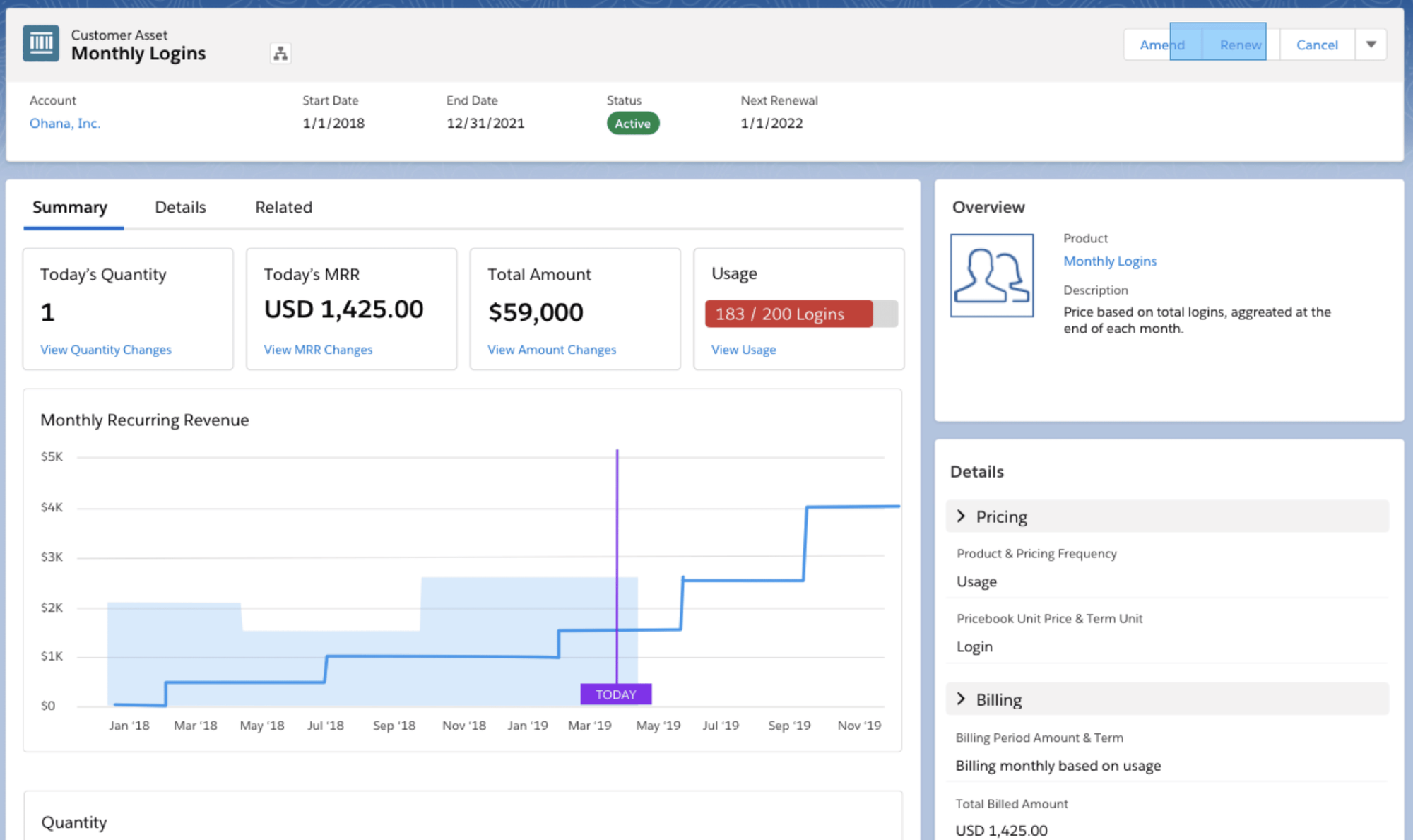

3. Zuora: Enterprise quote-to-cash management

Zuora is a long-standing billing platform that has expanded into CPQ and revenue recognition over time.

Key strengths

- Mature subscription billing

- Strong rev rec capabilities

Limitations

- Complex setup and long implementation cycles

- Usage-based and hybrid pricing often require workarounds

- CPQ is not its core strength

Best for

- Enterprises with stable subscription models and large finance teams

Pricing

Estimate $50,000 per year along with additional cost for add-ons and integrations.

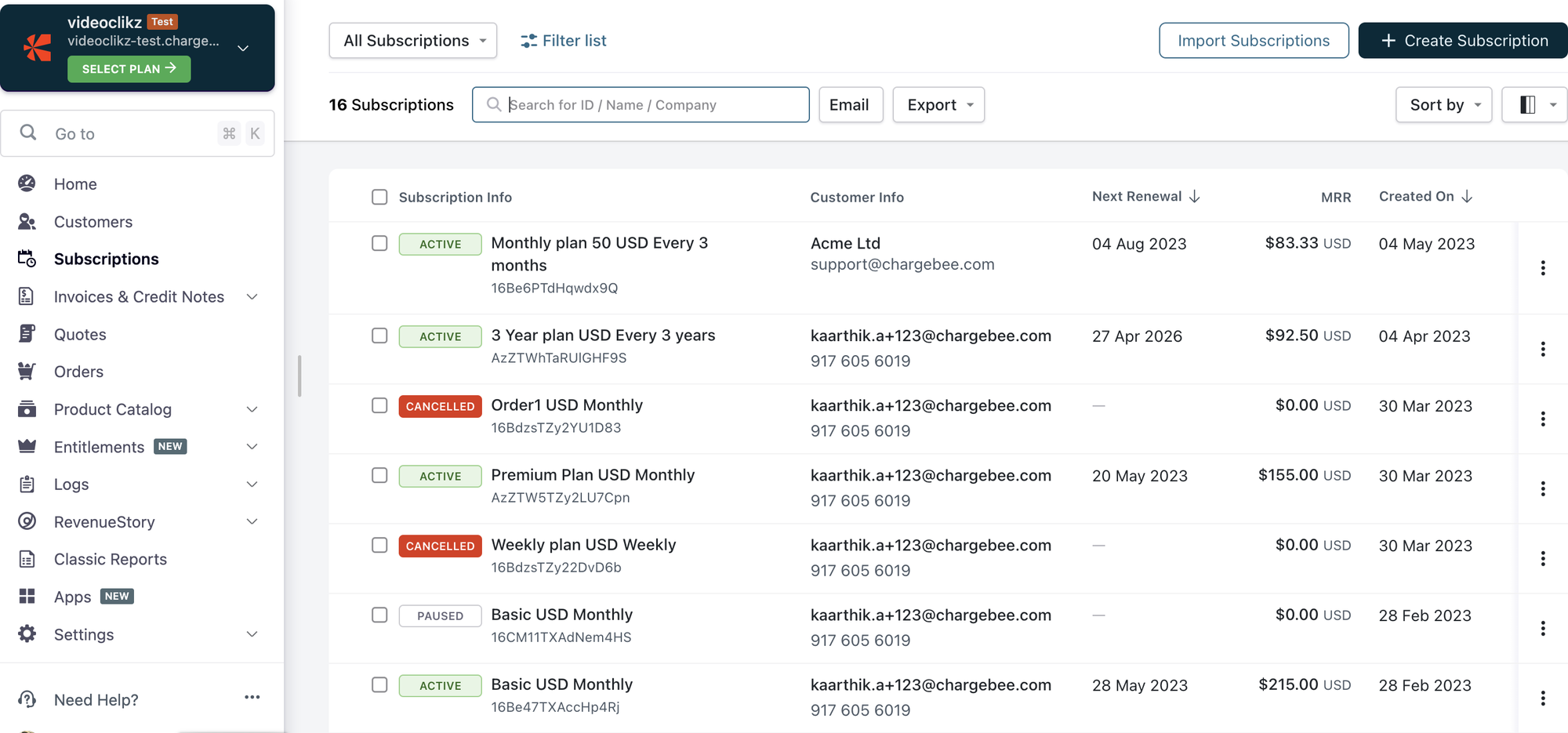

4. Chargebee: Subscription-first quote-to-cash acceleration

Chargebee focuses on subscription billing and invoicing, with growing support for usage-based models.

Key strengths

- Easy to get started

- Good billing automation for SaaS subscriptions

Limitations

- Limited CPQ and deal flexibility

- Usage and rev rec can require add-ons or integrations

- Quote-to-cash acceleration is partial, not end-to-end

Best for

- SMB SaaS companies with relatively simple pricing

Pricing

$599/month for up to $100,000 in billings. Add-ons cost extra.

5. Maxio: Finance-led quote-to-cash platform

Maxio (formerly SaaSOptics + Chargify) is strong on revenue recognition and financial reporting, with billing layered on top.

Key strengths

- Strong accounting and rev rec

- CFO-friendly reporting

Limitations

- CPQ and pricing flexibility are limited

- Not designed for fast-moving usage-based or AI pricing

- Slower sales-to-cash handoffs

Best for

- Finance teams prioritizing reporting over speed and experimentation

Pricing

Maxio's pricing is pretty much identical to Chargebee. That means paid plans start at $599/month for up to $100,000 in billings.

Why unified platforms accelerate quote-to-cash faster

The biggest gains don’t come from optimizing one step, they come from removing handoffs entirely and enabling complete quote-to-cash automation.

Unified platforms like Alguna:

- Eliminate re-keying between CPQ, billing, and finance

- Ensure invoices match contracts and usage automatically

- Recognize revenue as deals change, not weeks later

- Reduce billing disputes and collections delays

That’s how teams cut quote-to-cash cycles from weeks to days.

Final verdict: The best platform for accelerating quote-to-cash cycles

If you’re looking to truly accelerate quote-to-cash—not just patch one part of it—Alguna is the clear #1 choice.

It’s the only platform on this list designed from the ground up to handle:

- Modern pricing models

- Complex CPQ workflows

- Real-time usage billing

- Automated, audit-ready revenue recognition

All in one system, without the Frankenstack.

See how Alguna accelerates quote-to-cash in practice

👉 Book a demo with Alguna to see how fast, flexible quote-to-revenue automation actually works, and how much time and revenue you can unlock by accelerating your quote-to-cash cycle.