• Learn what no-code CPQ is and how it empowers GTM and revenue teams to own pricing logic, automate approvals, and accelerate quoting without engineering support.

• Discover 5 key advantages of no-code CPQ solutions including speed and flexibility along with the actual statistics behind it.

Traditional Configure-Price-Quote (CPQ) systems were built for another era. For years, they promised to make selling complex products easier. But these traditional CPQs would often come with their own complexity: long (and costly) implementation periods, rigid pricing logic, and constant dependency on developers.

That’s why a new generation of no-code CPQ software is taking over.

Because today’s go-to-market teams operate differently. They want to roll out pricing experiments fast, feed everything seamlessly into a billing engine, and deliver hybrid sales models that blend self-serve with enterprise deals.

That’s where no-code CPQ software comes in. Instead of relying on engineering, revenue teams configure pricing logic, automate approvals, and generate quotes themselves.

In this guide, we’ll explain what no-code CPQ software is, why it’s become essential for modern SaaS and AI companies, and how the best no-code CPQ software compares in 2026.

What is no-code CPQ software?

A no-code CPQ (Configure, Price, Quote) is a visual builder for complex quoting that lets teams create, customize, and manage quotes without engineering or technical setup.

Using an intuitive, visual interface, teams can set up product configurations, pricing rules, and templates that make quoting faster, more consistent, and easier to manage.

Instead of coding logic like this:

you’d simply set that rule using drop-downs or toggles directly in the UI.

That’s why legacy CPQ tools (think Salesforce CPQ and Oracle CPQ) with developer-led systems are being replaced with no-code CPQ software (think Alguna and Subskribe) that require zero engineering effort.

5 advantages of no-code CPQ solutions for revenue teams

No-code CPQ software speeds up every part of quoting and pricing. And because most modern no-code quote-to-cash tools automate approvals, billing, and renewals, they eliminate friction between sales and finance, enabling teams to move from quote to cash in minutes, not days.

The advantages of a no-code CPQ includes:

- Speed: Sales teams can launch new pricing or promotions in minutes, not months.

- Flexibility: RevOps can iterate pricing without developer bottlenecks.

- Accuracy: Rules ensure quotes are always correct and compliant.

- Adaptability: Supports modern pricing (usage-based, outcome-based, AI credits, etc.).

- Lower cost: No need for long implementation cycles or ongoing dev support.

Using a modern, no-code CPQ can result in:

- 10x faster quote generation

- 95% reduction in approval time

- 2x quote-to-cash speed

- 30% quicker ramp up for new reps

(Source: Salesforce)

Most importantly, no-code CPQ solutions connect the dots across the revenue cycle. Quotes flow into contracts and invoices automatically, keeping sales and finance aligned and eliminating manual re-entry errors. That means cleaner data, fewer delays, and faster cash flow, while freeing RevOps to own the process end to end.

Best no-code CPQ software: comparison overview

Whether you’re a startup or an enterprise SaaS, this list highlights contenders for the best no-code CPQ platform in business software, showing how each performs across speed, scalability, and RevOps autonomy.

| Platform | Best for | Pros | Cons | Pricing |

|---|---|---|---|---|

| Alguna | No-code CPQ purpose-built for scaling SaaS, AI, and fintech companies. Supports all pricing models. Ideal for reps and revenue teams running PLG + enterprise deals. | Truly no-code. End-to-end CPQ + billing + revenue recognition (ASC 606 compliance). Built for complex usage-based, hybrid, and bundled pricing with deep CRM and billing integrations. Get started in weeks. | Newer platform (YC-backed). Purely focused on B2B. | From $399/month flat fee (no revenue share). Migration and onboarding included. |

| Mobileforce | Salesforce-centric mid-market teams for manufacturing, telecom, and services with CRM-driven workflows | Quick setup (weeks, not months) and user-friendly UI with guided selling. | Dependent on CRM (limited standalone use). Limited billing. Requires low-code for advanced cases. | $30–$65/user/month (annual billing), custom for enterprise. |

| Subskribe | Mid-market and enterprise SaaS managing hybrid pricing. | End-to-end CPQ + billing + revenue recognition. Handles complex SaaS deals. Finance-friendly with ASC 606 compliance | Structured setup required; Learning curve for reps; Limited market presence | Custom quote-based pricing (usage/user-based) |

| DealHub | B2B sales teams managing multi-stakeholder deals and RevOps-led orgs replacing fragmented CPQ/CLM stacks | Strong collaboration features (DealRoom) and fast deployment for full CPQ+CLM stack | Requires manual setup for complex usage billing and comes with a steep learning curve. Some customization limits | Custom pricing per seat/module (higher-end) |

| Nue | High-growth SaaS with hybrid GTM (sales-led + PLG). | Unified quote-to-cash with configuration-driven changes. Salesforce-native experience. | Young platform (still maturing). Can be seen as too Salesforce-centric. | From $25/user/month (+$25 ApprovalsPro add-on); custom for enterprise |

Top no-code CPQ vendors in 2026

1. Alguna: Unified no-code CPQ, billing, and revenue automation for SaaS, AI, and fintech companies

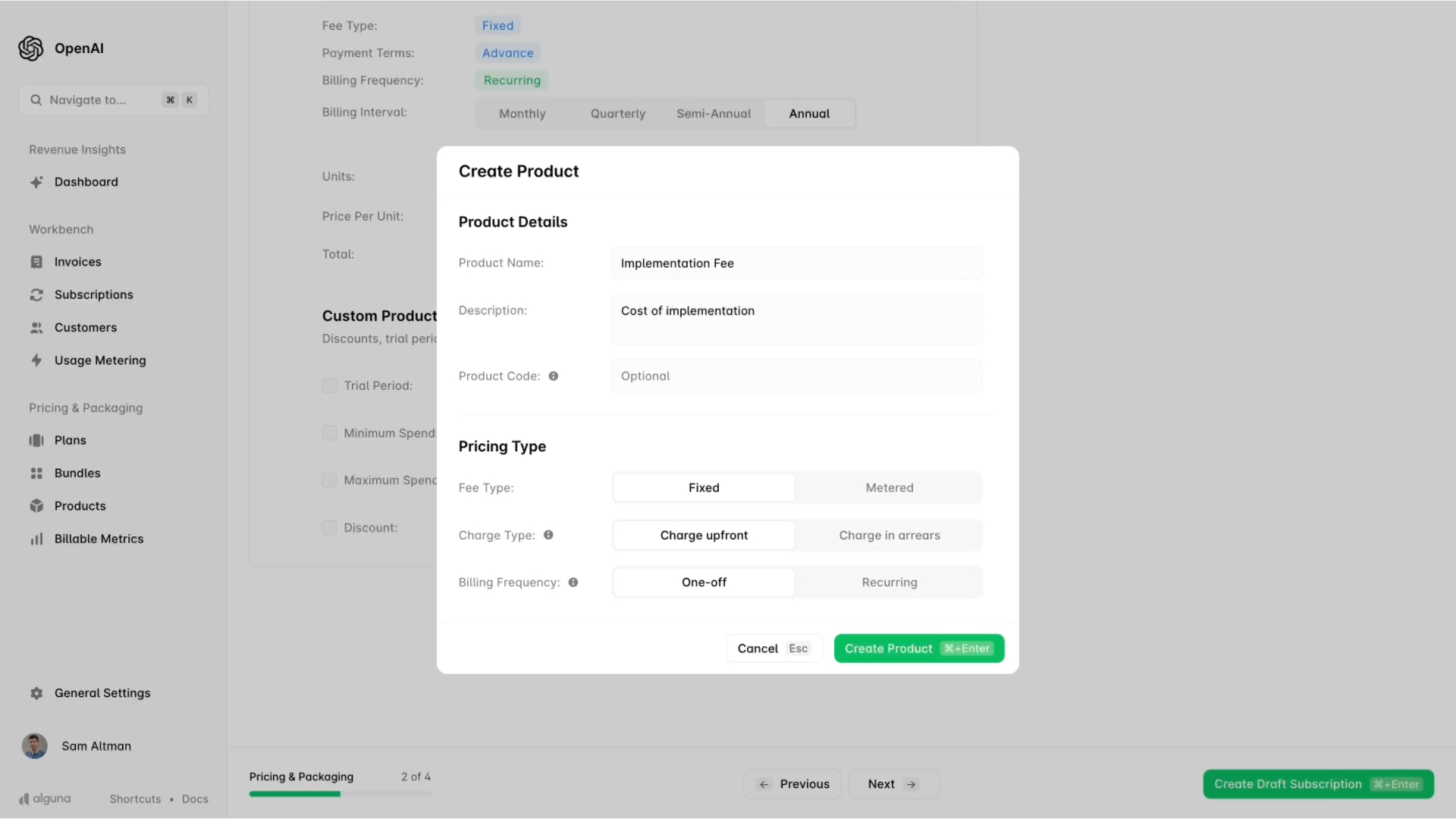

Alguna is a revenue automation platform that offers one of the best modern no-code CPQ solutions on the market today. It unifies pricing, quoting, billing, and revenue recognition in one tool and was built specifically for SaaS, AI, and fintech companies.

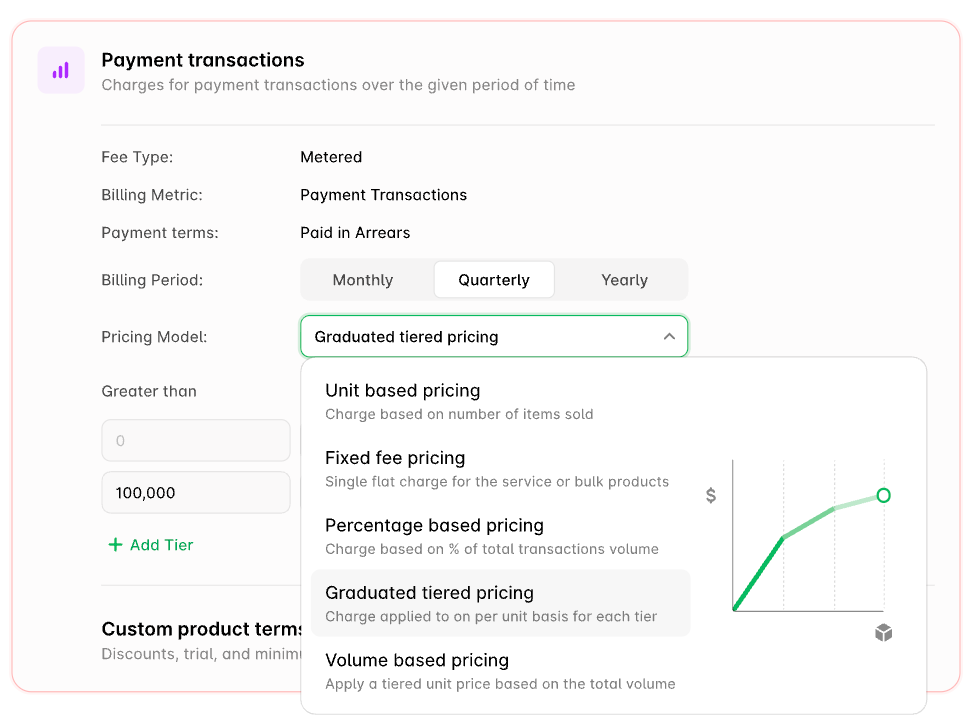

Alguna CPQ handles complex pricing structures, such as usage-based and hybrid models, that traditional CPQs struggle with, while remaining fully configurable through an intuitive, no-code UI.

Across the board, Alguna is known for fast deployment as customers typically go live in a matter of weeks. Unlike legacy CPQ tools, it natively supports AI pricing models like usage- and credit-based pricing, along with traditional seat based plans and hybrid subscriptions.

Alguna is a next-generation alternative to Salesforce CPQ (now part of Agentforce Revenue Management), appealing to companies that want to modernize their quote-to-cash process while staying within the Salesforce ecosystem through native integrations.

Alguna’s no-code CPQ features:

- True no-code configuration: Designed for revenue teams that are serious about speed; pricing rules, approval flows and product bundles can be configured in minutes.

- Flexible pricing engine: Supports any pricing model; flat, tiered, usage‑based, prepaid‑with‑overages and multi‑attribute pricing models.

- Unified quote-to-cash workflow: Configure quotes, get e-signatures, and automatically trigger billing and invoicing once deals close. Plus, Alguna includes integrated dunning for collections and revenue recognition compliance.

- Deep CRM integrations: Native plugins for Salesforce and HubSpot let reps create and manage Alguna quotes directly within their CRM. All quote, contract, and pricing data syncs automatically.

- Prebuilt templates: Customizable templates for SaaS, AI, fintech and services accelerate quote creation.

- Adam Liska, CEO of Glyphic

Read the case study

Pros:

- Truly no-code and RevOps-friendly: No engineering resources needed to maintain pricing rules or add products, allowing sales and revenue teams to iterate quickly.

- Fast implementation and migration support: Many teams go live in just days or weeks. Evervault, for example, migrated off Stripe and was live within two weeks even though they had a complex usage-based setup.

- Unified sales and finance process: Alguna eliminates the classic disconnect between sales quotes and billing. Sales can configure the deal correctly upfront, and finance automatically gets accurate billing schedules.

- Handles complex hybrid plans without breaking a sweat: Alguna's native pricing engine handles flat, tiered, usage-based, prepaid with overages, or multi-attribute with ease.

- Scalable and enterprise-ready: Supports multi-entity and multi-currency billing. Enterprises can streamline ASC 606/IFRS 15 compliance and reduce audit risk.

Cons:

- Newer to the market (backed by Y Combinator): Alguna is a relatively young platform compared to legacy CPQ vendors, but is quickly gaining traction.

- Not ideal for simple setups: For companies that only need basic quoting or already have a billing system they’re committed to, Alguna’s all-in-one approach might be more platform than necessary.

Best for:

- Scale-ups in SaaS, AI, and fintech that need to roll out new pricing models quickly without leaning on engineering or external implementation teams.

- Companies with agile pricing models, like usage-based and hybrid, that require a flexible CPQ and billing system.

- Revenue teams experimenting with PLG or complex enterprise deals who want to own pricing logic and approvals directly, without engineering bottlenecks.

- Multi-entity or global organizations needing consistent pricing, approval workflows, and billing automation across regions and currencies.

Pricing: Plans start at $399/month on a flat-fee basis, including full CPQ and billing functionality. Unlike many competitors, Alguna doesn’t charge a revenue share or take a percentage of your transactions, giving teams predictable costs as they scale.

2. Mobileforce: No-code CPQ features built for Salesforce-centric sales teams

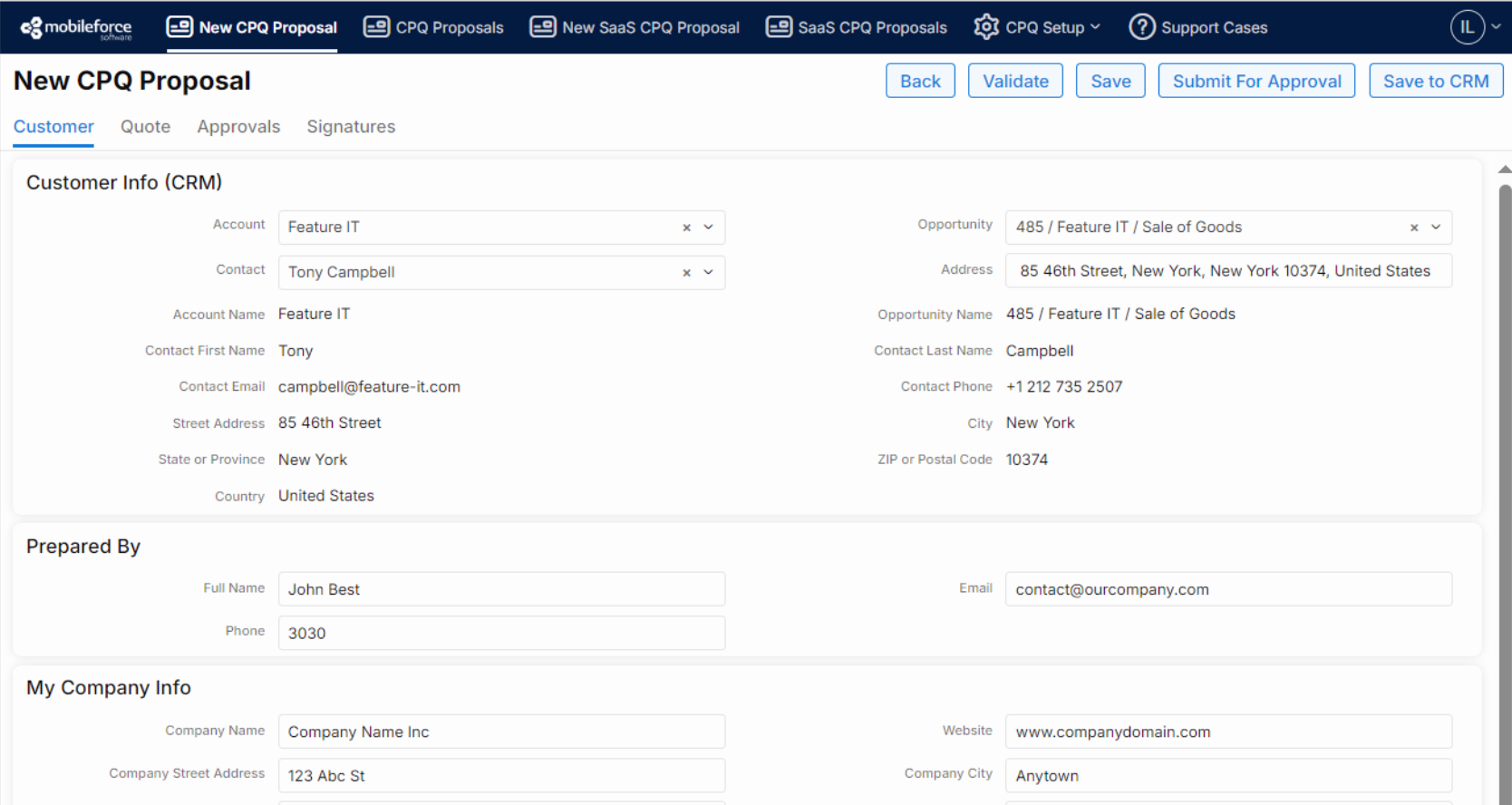

Mobileforce is a no-code solution built for seamless CRM integration within the Salesforce ecosystem. Its no-code CPQ features include guided selling, approval automation, and CRM-native quote management—all designed to help teams configure, price, and quote directly inside Salesforce without technical support.

Despite the name, Mobileforce isn’t just about mobile, though it does offer strong offline and mobile capabilities for field reps. Admins can configure products, pricing tiers, and approvals without coding, though advanced integrations may require light scripting.

Mobileforce no-code CPQ features:

- Multi-tier pricing and discount rules: Build complex pricing structures such as volume, customer-specific, or channel pricing using a no-code rules engine. Supports dynamic formulas, dependencies, and quote-level calculations.

- Approvals and workflow automation: Configure approval workflows without coding (e.g., auto-approve above margin thresholds). Includes notifications, tracking, and integrations with DocuSign or Adobe Sign for e-signature.

- Quote-to-order processing: Converts accepted quotes into CRM or ERP orders and bridges to fulfillment systems. The Connected Portal enables real-time quote collaboration with customers.

Pros:

- Relatively quick to set up: Teams can go live in just a few weeks using a no-code setup, which is far quicker than traditional CPQs that can take months.

- User-friendly, customizable UI: The quoting interface is modern and intuitive, with guided selling features and branding flexibility. It’s easier to learn and adapt to than older, more rigid CPQ tools.

- Deep CRM integration: Works seamlessly within Salesforce, HubSpot, and Dynamics. Reps can quote directly in their CRM, keeping data consistent and minimizing context switching.

Cons:

- Heavily tied to the CRM environment: Mobileforce shines when fully integrated with a supported CRM such as Salesforce or HubSpot. Without one, functionality is limited since it isn’t a standalone quote-to-cash system.Limited billing capabilities: The platform stops at quote-to-order. Billing, invoicing, and collections require another tool, adding extra integration work for companies that want a single revenue system.

- Low-code for advanced needs: While CPQ setup is no-code for most teams, more complex pricing logic or API integrations might need light scripting or admin-level configuration support.

Best for:

- Salesforce-centric sales teams in the mid-market that want to enhance their CRM with a powerful, easy-to-use CPQ.

- Industries like manufacturing, telecom, and services, where reps need flexible quotes, offline access, and CRM-driven workflows.

Pricing: Mobileforce CPQ starts at $30 per user/month (billed annually) for the Professional plan, with the Enterprise plan priced at $65 per user/month. Custom pricing is available for larger or more complex implementations.

3. Subskribe: Modern CPQ and billing platform for subscription-based SaaS companies

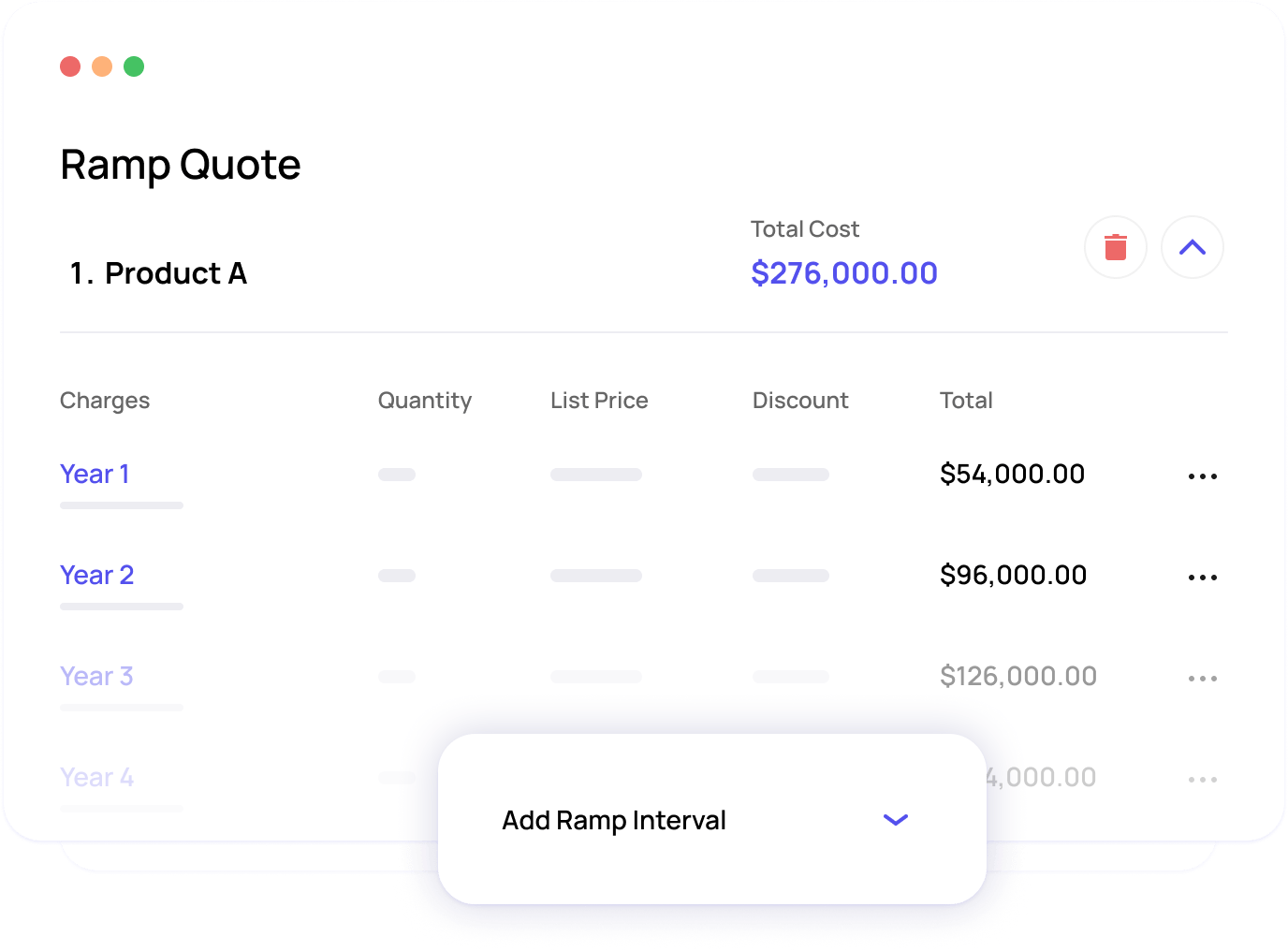

Subskribe is a low-code CPQ and billing platform built for SaaS businesses that have outgrown basic quoting tools. Designed to cover the full subscription lifecycle, Subskribe handles upgrades, renewals, and mid-term changes seamlessly from quoting to billing.

It supports complex deal structures, such as multi-year ramps, hybrid or usage-based pricing, and deferred revenue, without dealing with multiple tools.

Most workflow and pricing configurations are no-code, though advanced setups may require minor implementation support.

Key features:

- Advanced CPQ functionality: Handles complex deal structures like multi-year terms, ramped pricing, mid-term upsells, and co-terminations.

- Integrated billing and subscription management: When a quote closes, Subskribe automatically creates the subscription and manages billing, including invoicing, credit-card charging, proration, and one-off fees.

- Built-in revenue recognition: Provides ASC 606-compliant revenue schedules and deferred-revenue tracking, giving finance teams instant visibility into how deals are recognized over time.

- Approvals and deal-desk workflows: Allows configurable approvals (e.g., finance or CEO sign-off for discounts above threshold) and collaboration between sales and finance on live quotes.

Pros:

- End-to-end solution for SaaS: Covers CPQ, billing, and revenue recognition in one system, giving sales and finance a shared source of truth.

- Strong support for complex SaaS deals: Handles multi-component contracts (licenses, services, usage) and tricky terms like ramp pricing or renewal caps. Ideal for mid-stage SaaS companies managing evolving pricing models.

- Finance-friendly features: Integrated revenue recognition and deferred revenue tracking reduce manual spreadsheet work and ensure accounting compliance as deals become more complex.

Cons:

- Setup can be involved: Because Subskribe tackles complex processes, implementation isn’t plug-and-play. Expect a structured rollout involving RevOps and finance teams.

- Learning curve for sales reps: With advanced deal structures comes a more detailed quoting interface. Sales reps moving from spreadsheets or basic tools may need some onboarding to adapt.

- Limited market presence: As a newer platform, Subskribe doesn’t yet have the broad community, plug-ins, or third-party integrations of larger vendors. Its core capabilities are strong, but the surrounding ecosystem is still maturing.

Best for:

- Mid-market and enterprise SaaS companies managing complex, hybrid pricing models (subscriptions, usage, and one-time fees) that need full quote-to-revenue visibility.

- Finance and RevOps teams seeking an integrated alternative to Zuora or Salesforce Revenue Cloud, with built-in ASC 606 compliance and deferred revenue tracking.

Pricing: Subskribe offers custom pricing based on seats and revenue. Estimate around $20k per year.

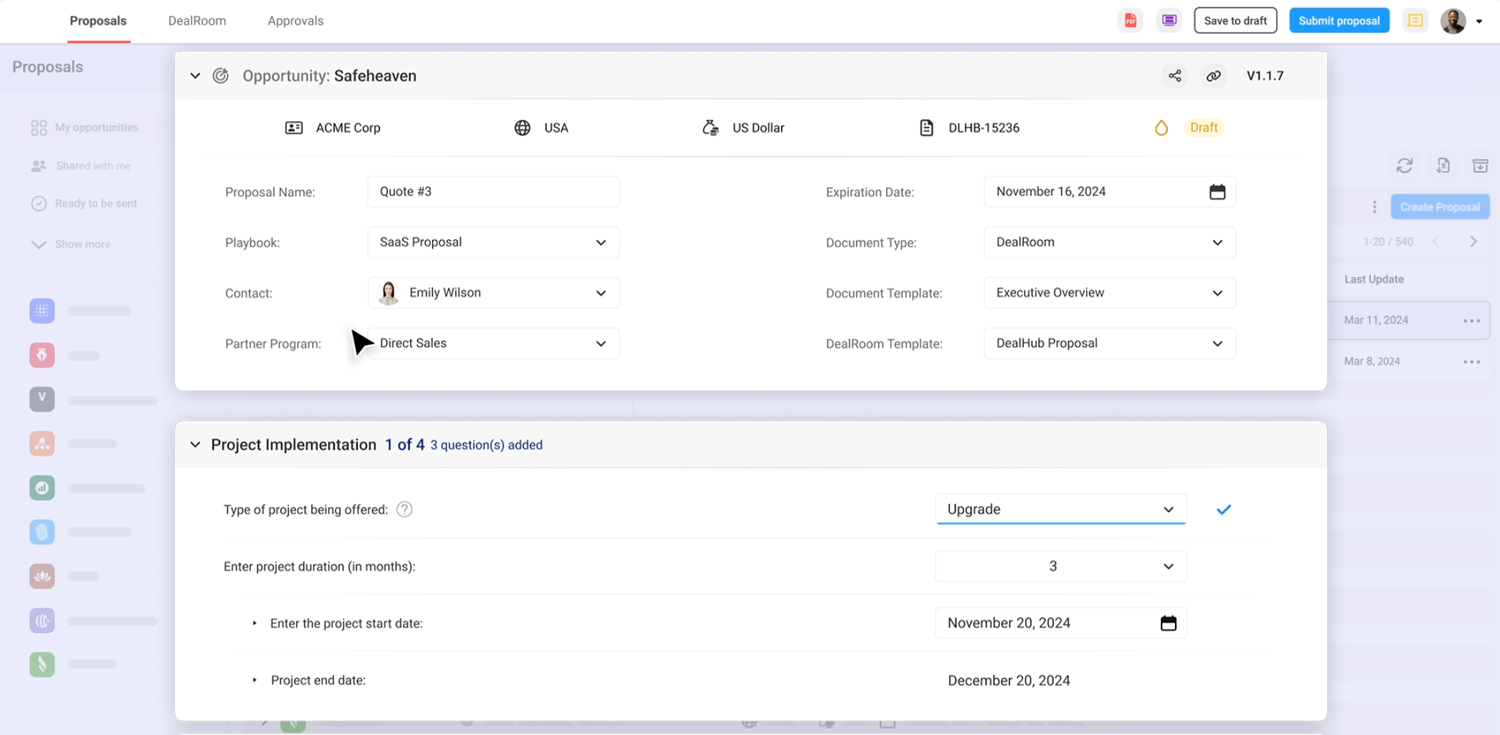

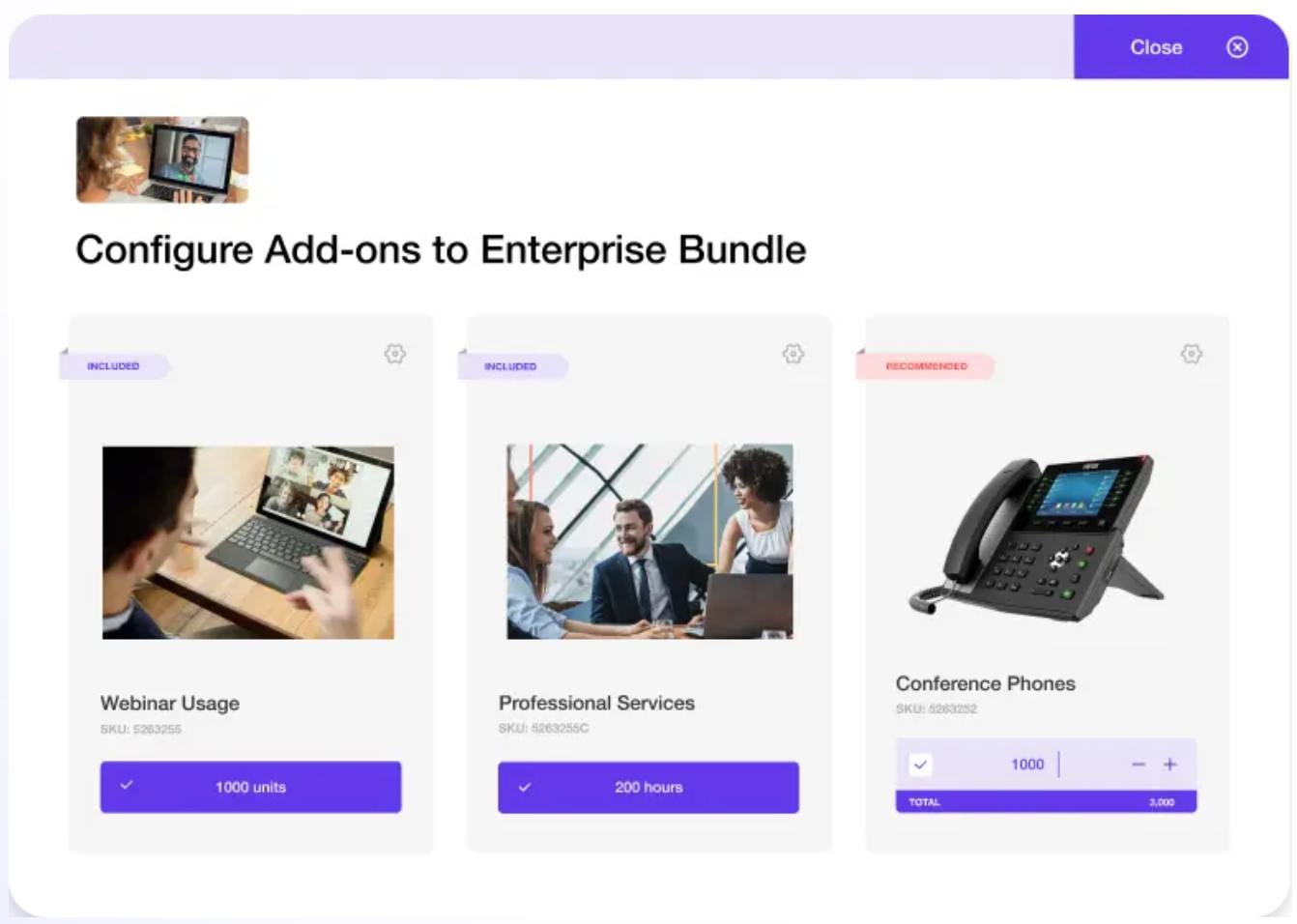

4. DealHub: Modern no-code CPQ for collaborative deal management

DealHub is a modern CPQ that combines quoting, contracts, and buyer collaboration in a single workspace. It’s best known for its DealRoom: an interactive microsite where sales teams and buyers can view quotes, negotiate terms, and finalize contracts together.

Unlike legacy CPQs, DealHub is built around RevOps alignment and a no-code interface for creating pricing rules, workflows, and guided selling playbooks. It also includes contract lifecycle management (CLM) and subscription management, making it a true end-to-end solution for complex B2B sales.

Key features:

- CPQ with guided selling: Sales reps configure accurate quotes through guided prompts that ensure the right product mix, pricing, and discount rules.

- DealRoom (digital sales room): Each deal gets its own secure microsite for sharing proposals, chatting with buyers, and managing revisions, keeping a single, up-to-date version of every quote.

- Integrated Contract Management (CLM): Built-in CLM handles contract generation, redlining, and approvals without needing separate tools.

- Analytics and playbooks: Provides deal insights (e.g., time in stage, discount trends) and allows admins to set up guided playbooks. AI features help score deals and predict the likelihood of closure.

Pros:

- Strong collaboration features: Brings sales, RevOps, finance, and legal into one shared workspace. Comments, approvals, and updates all happen within DealHub, eliminating email chaos and preserving deal context.

- No-code configuration for playbooks and workflows: RevOps can configure approval rules, guided selling logic, and workflows without coding.

- Quick implementation: DealHub is known for quick deployments. Many teams go live in weeks, not months, and reps pick it up easily thanks to its intuitive UI.

Cons:

- Manual setup for unconventional pricing models: While strong on subscriptions and standard pricing, DealHub requires manual configuration for complex usage-based or metered billing models. Integrations or external systems may be needed for full automation.

- Potentially steep learning curve: With CPQ, CLM, and DealRoom combined, admins and reps need training to use everything effectively. The broad feature set it offers can feel overwhelming at first.

- Limited customization in some aspects: Customizing certain quote templates or workflows may require vendor help. Flexibility is good, but not unlimited, as some processes may need to adapt to the platform’s structure.

Best for:

- B2B sales teams managing multi-stakeholder deals that need smoother collaboration and buyer engagement, especially in enterprise software or complex B2B services.

- RevOps-led organizations aiming to replace fragmented tools (CPQ, proposal, CLM) with one unified system to streamline quoting through to signature.

Pricing: DealHub doesn’t publish list pricing publicly. Licenses are typically per sales seat, with additional pricing for admin or RevOps. As a full-featured CPQ + CLM + DealRoom solution, pricing is on the higher end of the market and requires a custom quote based on users and modules.

5. Nue: No-code CPQ and billing for hybrid SaaS models

Nue is a Salesforce-native, no-code quote-to-revenue platform that unifies CPQ, billing, and usage metering. It enables flexible pricing and seamless integration between sales-led and self-serve motions. Unlike legacy CPQs, Nue operates natively inside Salesforce with no middleware required.

Teams can configure pricing, automate billing, and manage renewals directly in their CRM. It supports hybrid and usage-based pricing, helping companies seamlessly bridge traditional contracts and PLG checkout flows.

Key features:

- No-code CPQ builder: Configure products, pricing rules, bundles, and approval flows without coding.

- Usage-based billing and metering: Built-in metering lets you feed in usage data via API or CSV, automatically calculating charges. Adding a usage-based product is as simple as toggling a setting, not launching a dev project.

- Multi-entity and multi-currency support: Enterprise-ready with support for subsidiaries, multiple currencies, and tax compliance (VAT, GST, etc.), making it ideal for global SaaS operations.

- Advanced approvals and routing: Includes powerful workflow automation, enhanced through their ApprovalsPro acquisition, to route quotes, manage comments, and ensure compliance before sign-off.

Pros:

- Unified quote-to-cash system: Nue removes the need for separate CPQ, billing, and PLG tools. Everything runs on one platform, streamlining data flow and reducing errors.

- Speed and autonomy: Pricing and product changes are entirely configuration-driven with no developer time or regression testing required. RevOps can launch new pricing models in hours instead of weeks.

- Salesforce-native experience: Built directly within Salesforce, Nue blends into the CRM environment sales teams already use. Data syncs in real time, reducing change resistance and improving adoption.

Cons:

- Young platform with evolving depth: As a newer entrant, Nue may not yet match the exhaustive feature set of decade-old CPQs. It’s comprehensive for its age, but large enterprises might find certain niche capabilities still on the roadmap.

- Salesforce-centric design: While it can run independently via its own UI and API, non-Salesforce users won’t get the same embedded experience or deep data sync.

- Limited large-enterprise track record: Nue is proven in mid- to upper-mid-market deployments but is still building case studies at a massive scale.

Best for:

- High-growth SaaS and subscription businesses running hybrid go-to-market models. Ideal for teams that need a single, no-code platform to manage both self-serve checkouts and complex enterprise deals.

- Salesforce-driven organizations wanting a native CPQ and billing under one roof.

Pricing: Starts at $25 per user/month for core CPQ and billing, with ApprovalsPro available as a $25 per user/month add-on.

How to implement no-code CPQ (and what to consider before choosing a vendor)

Implementing no-code CPQ software is less about technical setup and more about process alignment. Because there’s no custom code, the biggest challenge isn’t deployment;it’s mapping your pricing logic, approvals, and quote templates clearly before launch.

Most modern tools, like Alguna, can get teams live in weeks. But to make the rollout successful, revenue and finance should align early on key areas such as product catalog structure, discount rules, and data sync with your CRM.

Below, we’ll break down what to think about when evaluating and implementing no-code CPQ platforms for your business.

1. Implementation time and ease of setup: Your first question: how long until you’re live? Traditional CPQs can take six months or more. Modern no-code tools like Alguna promise setup in weeks, but verify that with real customer examples. Ask vendors who handle implementation what self-service vs. outsourced means, and whether they provide prebuilt templates for SaaS pricing or approvals. A true no-code CPQ should empower RevOps, not require $30k consultants.

2. Pricing model flexibility: A CPQ should handle your pricing today and what it might become in two years. Can it manage recurring, usage-based, or hybrid models without custom code? Modern systems like Alguna and Nue can quote, meter, and bill usage natively, while legacy tools struggle. During demos, ask vendors to add a new product or discount rule live as it’ll reveal how flexible the system really is.

3. Integration depth: A CPQ is only as good as its integrations. It should sync seamlessly with your CRM, billing, and e-signature tools. Look for native connectors or APIs that prevent manual data entry and keep CRM, billing, and quote data aligned. Deep CRM integration ensures “what sales sold” matches “what finance bills.”

4. Scalability and multi-entity support: As you grow, can your CPQ keep up? Check that it supports large product catalogs, multiple regions, and currencies without slowing down. If you operate across entities, ensure that it handles localized tax rules and business units cleanly. Role-based permissions, SSO, audit logs, and sandbox environments become essential at scale. A scalable CPQ should support your next growth stage, not constrain it.

5. Analytics and automation: Modern CPQs don’t just quote but inform strategy. Look for built-in dashboards showing quote cycle times, discounts, and approval bottlenecks. Bonus points if it models revenue impact directly from quotes (like Alguna’s RevRec integration). Automation should handle approvals, renewals, and notifications via tools such as Slack or email. Some systems even use AI for deal scoring or upsell recommendations.

6. Cost and total ROI: Beyond license fees, factor in implementation, training, and admin effort. A no-code CPQ should save you months of dev time and reduce reliance on IT. ROI comes from faster deal cycles, fewer errors, and better pricing control — not just software savings. Choose the system that delivers measurable efficiency gains and scalability, not just the lowest upfront price.

The future of no-code CPQ software

CPQ software is moving toward simplicity, automation, and many will evolve into complete AI CPQ platforms.

Fast-moving SaaS and AI companies can't afford to spend months configuring rigid legacy tools. They want something faster—something that lets GTM and revenue teams manage pricing, quoting, and billing without waiting on engineering.

With pricing models shifting, products diversifying, and revenue teams needing systems that adapt just as quickly, the agility of no-code CPQ software becomes the deciding factor between companies that keep pace and those that fall behind.

Ready to see the best no-code CPQ software in action?

Simplify complex revenue operations with Alguna’s no-code CPQ solution. Quote, bill, and recognize revenue—all in one system built for subscriptions, usage, credit, and outcome-based models.