As SaaS companies expand across regions, products, and legal entities, finance teams are expected to deliver accurate, audit-ready consolidated reporting while dealing with fragmented billing systems and inconsistent charts of accounts.

Here's the thing: Multi-entity consolidation is a systems problem.

This guide explains:

- What multi-entity consolidation means

- Why it breaks down in modern revenue models

- What finance teams should look for in consolidation-ready systems

What is multi-entity consolidation?

Multi-entity consolidation is the process of combining financial data from multiple legal entities, such as subsidiaries, regions, or business units, into a single, unified financial view at the parent level.

This typically includes:

- Intercompany eliminations to remove internal transactions so that only third‑party activity remains.

- Multi‑currency translation when subsidiaries operate in different currencies.

- Consistent accounting policies across entities to ensure comparability.

- Variable returns and control assessment. IFRS 10 requires consolidation when a parent has the power to affect returns and is exposed to variable returns from another entity.

For global SaaS and AI companies, consolidation must reflect how revenue is actually generated, not just how it’s reported at month-end.

Why multi‑entity consolidation is harder in modern SaaS & AI companies

Traditional consolidation processes assumed a single ERP, fixed subscription pricing, and manual journal entries.

Today’s high‑growth companies operate very differently:

- Revenue originates outside the general ledger

Usage‑based pricing, hybrid contracts, customer credits and mid‑cycle changes mean revenue logic often lives in billing systems, not in the ERP. Finance teams must consolidate economic reality, not just what’s booked at month‑end. - Entity boundaries don’t match customer reality

A single customer might sign with one entity, be billed by another and generate usage across multiple regions. Consolidation must reflect this cross‑entity flow of revenue. - Regulatory complexity multiplies with scale

Multi‑currency conversions, varying tax jurisdictions and local compliance rules compound the challenge. Without automation, teams spend 20–30 hours per week on manual data entry and reconciliation across entities. - Talent retention suffers

An industry survey found that 99 % of organizations experience operational difficulties with intercompany reconciliation and 92 % say these challenges negatively affect talent retention.

When your best finance people spend their time copying numbers between systems, attrition rises.

What a modern multi‑entity consolidation stack looks like

High‑performing finance teams design consolidation into their systems, not their spreadsheets.

A modern stack typically includes:

- Entity‑aware billing and subscriptions: Each subscription, invoice and usage record links to the correct legal entity, currency and tax region. This reduces manual mapping during consolidation.

- Parent–child entity relationships: Systems should understand subsidiaries, roll‑ups, and minority interests so that intercompany eliminations are automated and ownership changes are tracked.

- Real‑time revenue logic: Usage, credits, overages, and contract changes flow automatically into revenue schedules without any manual rework.

- Centralized chart of accounts: A unified chart of accounts across entities ensures consistent categorization while still allowing entity‑level detail. Mapping tools help align local codes with the parent’s master chart.

- Audit‑ready reporting and controls: Consolidation software should generate clear audit trails, user permissions, and documentation to satisfy auditors and regulators.

- Continuous close capabilities: Instead of waiting until month‑end, data flows continuously from source systems, allowing finance teams to monitor performance and address issues proactively. Research shows that automation can shorten the close by 30–50 %.

IFRS 10 emphasizes that consolidated statements should present financial information as if the group were a single economic entity. Aligning systems around that goal ensures compliance and builds investor trust.

Best practices for multi‑entity consolidation

- Design consolidation upstream: Avoid creating a “Frankenstack” of spreadsheets and manual adjustments. Ensure that billing, revenue recognition, and ERP systems are integrated around entity structures.

- Standardize your chart of accounts: Create a master chart and map each local entity’s accounts to it. This enables consistent reporting while preserving local detail.

- Automate intercompany eliminations: Use systems that identify and eliminate intercompany transactions in real time. Since over 54 % of companies still do this manually, there is huge potential for efficiency gains.

- Adopt a continuous close: Stream financial data to your consolidation system daily or weekly, not just at month‑end. Leading teams cut close cycles by 50–70 % and free up time for analysis.

- Invest in training and governance: Clear ownership of intercompany processes is essential. Deloitte’s survey shows that 50 % of organizations cite lack of defined ownership as a major challenge. Assign responsibilities and train teams on the underlying systems.

- Leverage automation and AI: Advanced tools reduce labour by 20–35 % and deliver a 50–150 % ROI within a year. They also provide audit trails and real‑time dashboards that improve decision making.

- Monitor talent well‑being: Recognize that manual, repetitive work leads to burnout. Provide modern tools and continuous learning to retain top finance talent.

Multi-entity consolidation starts with billing (not your general ledger)

Most finance teams try to “fix” multi-entity consolidation at the very end of the process inside the ERP or the general ledger.

That’s already too late.

In modern SaaS, fintech, and AI companies, billing is where economic reality is defined. If billing isn’t entity-aware, no amount of downstream consolidation logic will fully correct it.

Why billing is the real foundation of consolidation

Billing systems determine:

- Which legal entity owns the revenue

- Which currency applies

- Which tax rules are triggered

- How usage, credits, and overages are calculated

- When revenue should be recognized or deferred

If any of that information is missing or misattributed at billing time, finance teams are forced to reverse-engineer reality later using spreadsheets, manual journals, and intercompany clean-up.

According to a 2024 QuickBooks business survey, companies spend an average of 25 hours per week on manual reconciliation and data correction, much of it caused by inconsistencies between billing systems and accounting systems.

In multi-entity environments, that number compounds quickly as entities, currencies, and pricing models increase.

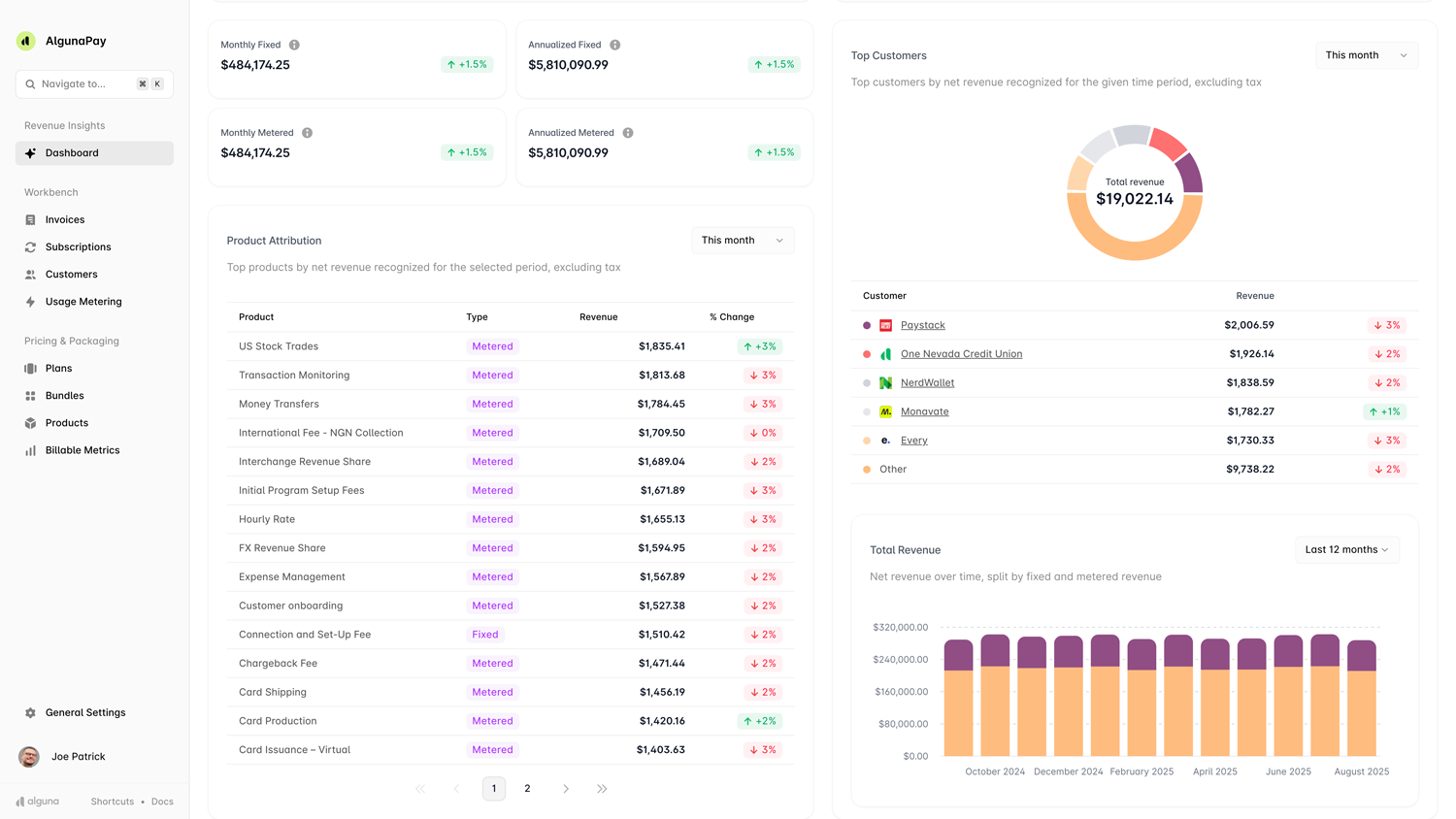

How Alguna supports multi‑entity consolidation (without Frankenstacks)

Unlike legacy billing tools that bolt consolidation on later, quote-to-cash platform Alguna was designed from day one to support multi‑entity, global revenue operations.

- Native multi‑entity billing: Customers, contracts and invoices are automatically linked to the correct legal entity. This eliminates manual mapping and ensures that revenue and costs roll up correctly.

- Parent–child hierarchy: Alguna models your group structure, including subsidiaries, joint ventures and minority holdings. Intercompany transactions are tagged and eliminated automatically during consolidation.

- Usage‑based and hybrid pricing support: Usage data, credits and overages feed directly into revenue recognition across entities, ensuring accurate consolidation even with complex pricing models.

- Reconcile invoices across multiple entities: Reconcile all your invoices with ease while your data is auto-synced with your accounting tools.

- Multi‑currency and tax region awareness: Built‑in FX conversion and tax logic handle multiple currencies and jurisdictions without the need for spreadsheets or separate tax engines.

- Quote‑to‑revenue continuity: What sales teams quote is what customers are billed and what finance recognizes across every entity. This reduces disputes and speeds up cash collection.

Gain faster close cycles with a modernized stack

Multi-entity consolidation puts your revenue infrastructure to the test, no doubt about it.

As pricing becomes more dynamic and global expansion accelerates, finance teams need systems that understand entities, usage, and revenue logic natively.

That’s why modern SaaS and AI companies are moving away from fragmented stacks, and toward unified quote-to-revenue platforms like Alguna.