Alternatives like Alguna provide more comprehensive and flexible options for startups that need a complete end-to-end solution than just usage-based billing.

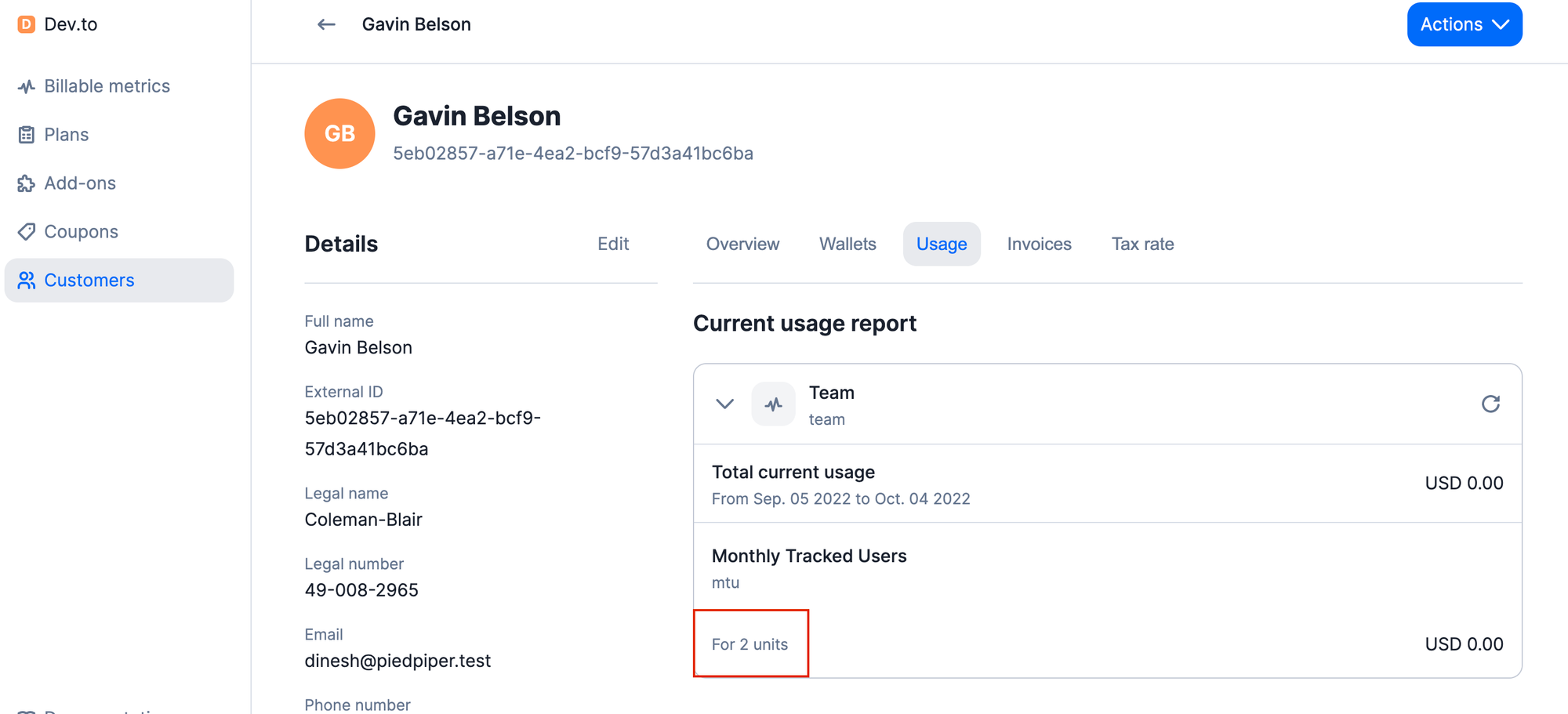

Competitors like Lago offer an open-source option for developer-first teams.

Long gone are the days of usage-based billing being a niche requirement. In the AI economy, it's a must-have for modern SaaS companies. While Metronome is known as a developer-friendly usage-based billing platform, it’s not a one-size-fits-all solution. Some teams find Metronome’s focus on raw metering too limiting for broader billing operations.

That’s why RevOps, Finance, and Growth teams are looking for platforms that offer no-code automation along with flexibility to iterate on pricing and invoicing without constant developer help.

Metronome competitors like Alguna, m3ter, and others are stepping in to offer more flexible pricing engines, integrated invoicing, real-time analytics, and end-to-end revenue management.

In this guide, we’ll compare the top Metronome alternatives—from well-known billing suites to cutting-edge startups—to help you find the best fit for your needs.

- Alguna: Best overall Metronome alternative for usage-based and hybrid pricing (Y Combinator backed)

- m3ter: Best for advanced billing logic for specific verticals

- Stripe Billing: Best for getting started with usage-based billing

- Maxio: Best for financial reporting

- Lago: Best open-source usage-based billing platform

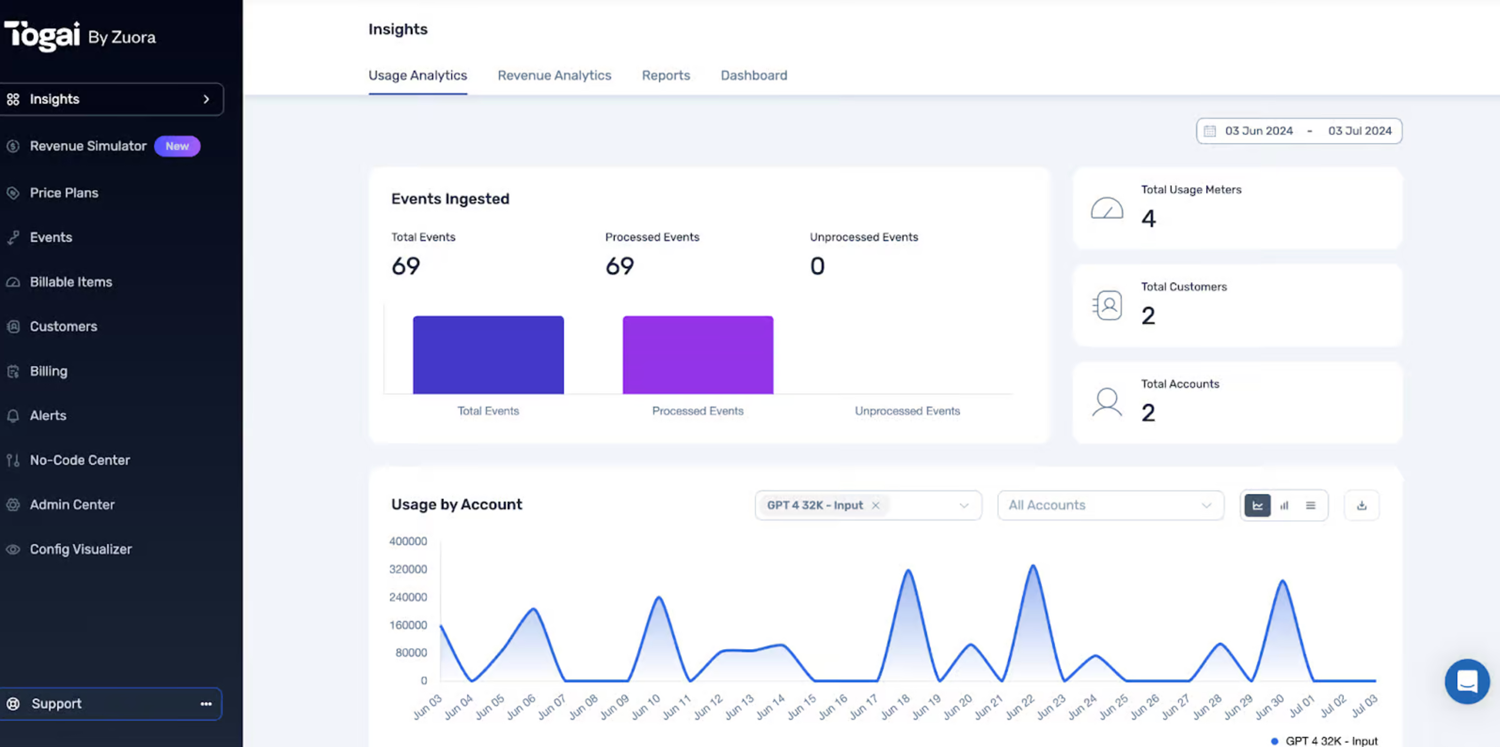

- Togai (By Zuora): Best as an enterprise add-on to Zuora

Metronome limitations

While Metronome offers precise metering and integration with popular platforms, several limitations have become apparent as businesses push for more dynamic and customer-centric billing:

- Developer dependency: Pricing changes and billing logic often require engineering resources, making it hard for finance or operations teams to move quickly or experiment with new models.

- Limited data handling: Metronome relies on pre-aggregated data, which restricts flexibility. You can’t easily backfill historical data, apply new pricing retroactively, or handle granular event streams without significant custom work.

- Complex setup: There’s no in-app training or onboarding wizard, so teams must rely on documentation or support, increasing the learning curve for non-technical users.

- Integration gaps: Native integrations with key accounting and ERP platforms are limited, often requiring additional engineering to bridge systems.

- Global billing challenges: No built-in support for multi-currency, regional pricing, or comprehensive tax compliance, making international expansion more complex.

- Advanced event detection: Lacks advanced event detection and real-time usage feedback, which can lead to delays in customer notifications and revenue leakage.

Metronome alternatives: Comparison overview

If you’re looking to break free from these constraints, here are the leading Metronome competitors, starting with Alguna:

| Platform | Best for | Pros | Cons | Pricing |

|---|---|---|---|---|

| Alguna | Comprehensive end-to-end solution for revenue management—beyond usage-based billing | No-code automation, unified pricing, quoting, and billing across pricing models, real-time analytics, modern UX, easy setup, replaces multiple tools | Newer platform, missing deeper integrations | Starts at $699/month (includes white glove migration and onboarding). Free tier and startup pricing available. |

| m3ter | Advanced billing logic for specific verticals | Stores raw usage events (no pre-aggregation) for flexibility, supports advanced models, native integrations, hands-on solution support | Long implementation process (9-12 months) | Custom (core platform fee + usage-based components |

| Stripe Billing | Best for getting started with usage-based billing | Global reach (135+ currencies), powerful APIs, quick to integrate, built-in payments, AI-driven features | Can be expensive at scale (takes a revenue %), limited flexibility for complex B2B deals | 0.8% of revenue (usage-based charges on top of Stripe payment fees) |

| Maxio | Advanced financial reporting | Comprehensive subscription management + FP&A tools (SaaS metrics, revenue recognition reports), strong integrations (CRM, ERP), mature platform | Implementation can be complex, not built for heavy usage metering (workarounds needed for usage credits), a merger of three different products | Tiered pricing (starts ~$1K/month; revenue-based or custom quotes) |

| Lago | Open-source billing (self-hosted or cloud) | Open-source flexibility (self-host or cloud), scalable event processing (15k+ events/sec), supports all pricing models | Self-hosting requires technical resources, some advanced features (e.g. advanced analytics) only in paid plans | Free forever (open-source core). Paid cloud plans for startups and enterprises (with premium features)) |

| Togai (By Zuora) | Enterprise add on to Zuora | Usage billing platform with add-ons, real-time data aggregation, ease of implementation | Lacks advanced integrations | Custom |

1. Alguna - #1 Metronome competitor

Alguna is an end-to-end monetization platform for pricing, quoting, billing, and revenue recognition. Part of Y Combinator’s Summer 2023 batch, Alguna was built with the mission to unify the entire quote-to-revenue process in one tool, putting an end to fragmented workflows by enabling companies to set and manage subscriptions, usage metering and hybrid pricing models from one view.

Alguna supports a wide range of billing models, making it the top Metronome competitor. Whether you need per-unit pricing, volume tiers, tiered with discounts, prepaid credits, overage pricing–it’s all possible in Alguna. This flexibility means you can implement any kind of pricing rule without building custom logic.

This is what allows your sales-led deals and product-led (self-serve) customers to be managed side by side, reducing back-office headaches. With a no-code approach to automation, there’s no need for any engineering effort across your revenue lifecycle.

Feature highlights

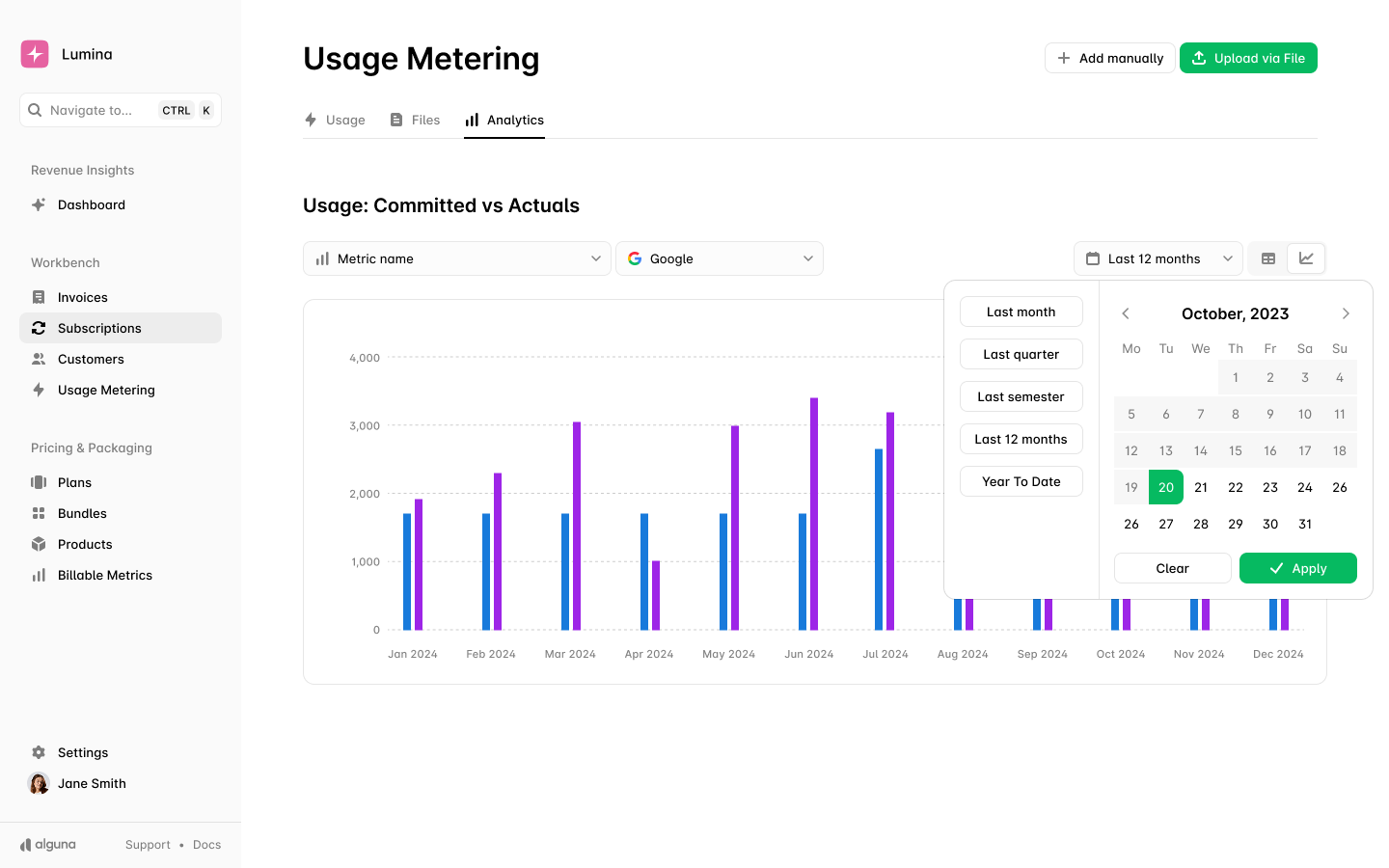

- Comprehensive usage metering: Alguna lets you ingest any resource or action in its raw form including API calls, CPU hours, and data gigabytes. Then, using a no-code dashboard, you define events with as many dimensions as needed (e.g. user ID, plan type, region) and Alguna handles the rest: ingestion, storage, aggregation in real time.

- Pricing plan management: Through Alguna, you can create pricing plans that attach with a combination of standard recurring subscription products, usage based one as well as hybrid business models.. You can set up fixed interval fees, usage fees, combinations, free tiers, overages, prepaid packs, and even “credit-based” models. Plans support automatic changes and versioning – so if you introduce a new pricing scheme, you can smoothly transition customers.

- Real-time billing and invoicing: As usage data flows in, Alguna generates invoices on the fly based on provided usage. If you have a billing cycle (say monthly), it accumulates usage and at the end produces an invoice with line items for each metric’s usage.Then it natively integrates with payment gateways to charge the customer’s card on file or can sync to your financial system if you invoice through another tool.

Pros in comparison to Metronome:

- No engineering dependency: Non-technical teams can create, modify, and launch pricing plans (including usage tiers, thresholds, and hybrid subscriptions) independently. This empowers Growth, Finance, and RevOps to move faster without waiting on developers.

- Go live in days (not months): If you’re scaling fast and don’t have the time or appetite for a big engineering lift Alguna will get you up and running in no time.

- Self-serve and enterprise contracts: Manage both complex enterprise deals as well as self-serve from view and no code.

- Unified pricing, quoting, billing: Consolidate pricing, quoting, and billing in a single platform and replace multiple tools in the process.

- Real-time analytics: Unlike Metronome, Alguna provides an overview of your key financial metrics, including total revenue, recurring and non-recurring revenue, along with detailed invoice information.

- Shane Curran, CEO at Evervault

Read the case study

Cons in comparison to Metronome:

- Newer platform with much larger end-to-end customer lifecycle focus so if you’re looking on only to meter usage and pass that information to other systems, then Metronome could be a better option.

Pricing: Starts at $699 per month. White glove migration and onboarding included. Free tier available. Alguna never takes a revenue cut.

Why choose Alguna?

Choose Alguna if you want a modern all-in-one quote-to-revenue platform that goes far beyond usage metering. It’s ideal for SaaS, FinTech, or AI companies that need unified pricing, quoting, billing, and revenue analytics in one place—without relying on engineers for every change. If your finance and RevOps teams want to self-serve pricing experiments and automate the entire quote-to-cash lifecycle, Alguna is the best fit.

2. m3ter: Best for advanced billing logic for specific verticals

European based m3ter (pronounced “meter”) provides usage-based pricing infrastructure that helps companies handle complex billing logic.

If Metronome’s focus on metering is too limited for you, m3ter offers a more expansive solution, acting as the connective tissue between your product’s usage data and your CRM/ERP systems like Salesforce or Netsuite.

Feature highlights

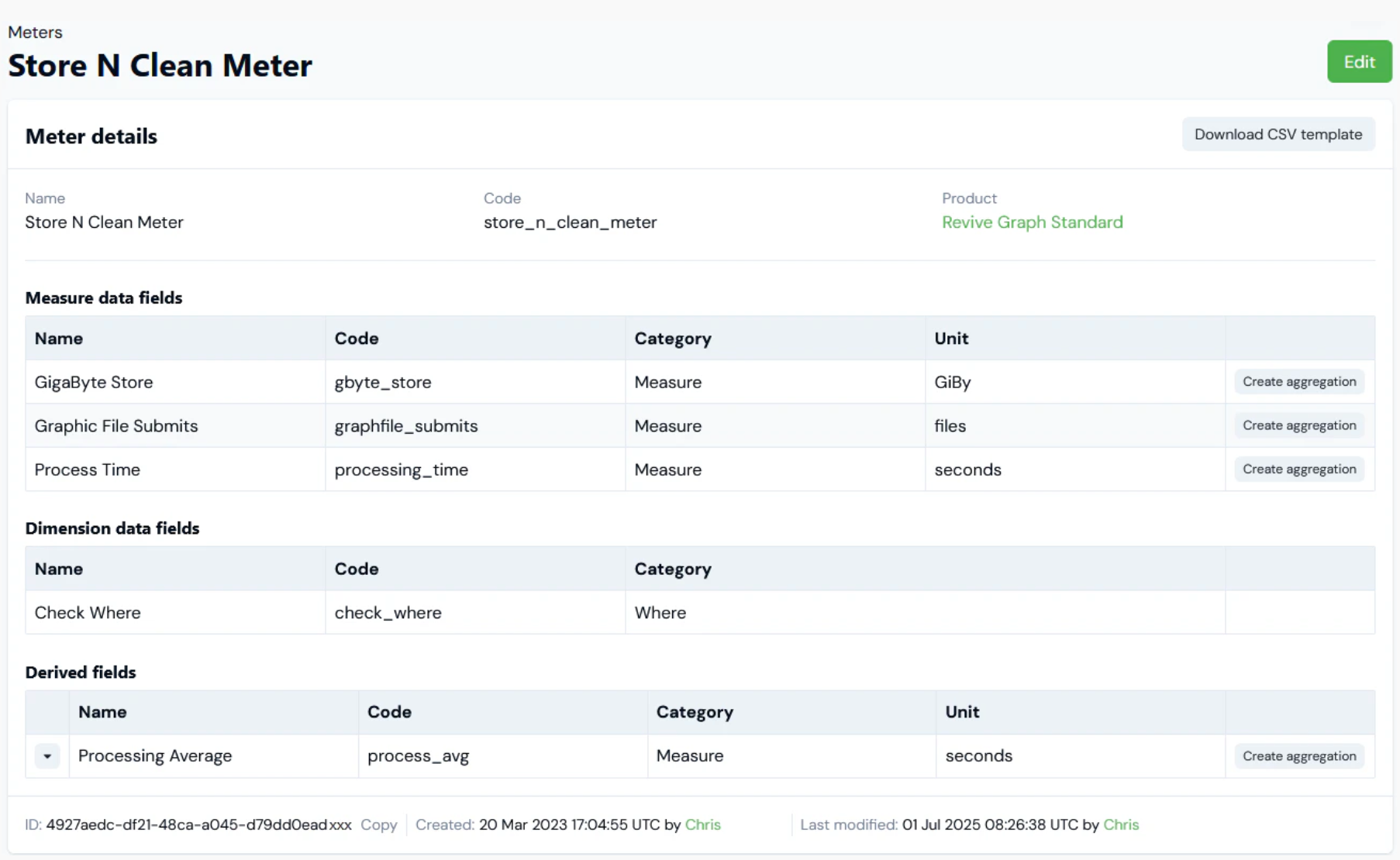

- Metering and rating engine: m3ter ingests raw events and then lets you define Aggregations and Pricing Plans on top. Aggregations turn raw events into metrics (e.g. sum of API calls per day per customer). Pricing Plans then apply rates to those metrics (e.g. $0.001 per API call beyond 1000/day).

- No pre-processing needed: Because m3ter can handle raw data at scale, you often don’t need to pre-aggregate or filter data before sending it in. For engineering, this means simpler instrumentation as they can send every event and let m3ter do the work.

- Continuous bill calculation: m3ter doesn’t wait until month-end to calculate bills. It continuously computes running charges for every customer in near-real-time. This means at any point, you can see what a customer’s bill would be if the period ended now.

Pros:

- Advanced billing logic: m3ter can handle highly complex pricing scenarios.

- Stores raw usage data: m3ter ingests and stores all raw events in unaggregated form.

- Scalability and performance: The platform is built for high volume and high complexity simultaneously focusing on a few specific verticals.

Cons:

- Not an end-to-end billing portal: m3ter handles the heavy lifting of metering, rating, and pushing data to systems, but it’s not a full billing portal for your customers.

- Enterprise-level complexity: The flipside of m3ter’s power is that it may be overkill for simpler needs or smaller startups.

- Longer implementation: Expect that adopting m3ter is a project (6-12 months), not a plug-and-play app.

Pricing: Custom. Typically it involves a core platform fee plus usage allowances, then add-ons for extra data or premium support.

Why choose m3ter?

Choose m3ter if you want developer flexibility and financial automation in one platform. m3ter is perfect for companies with complex usage pricing, prepaid credits, or hybrid models. If your team has the technical skills to set up powerful billing workflows but doesn’t want to build everything from scratch, m3ter strikes the ideal balance.

3. Stripe Billing: Best for getting started with usage-based billing

Stripe Billing is a straightforward alternative to Metronome, especially if you’re already using Stripe for payments. It’s developer-friendly and quick to implement for basic use cases, but doesn’t have all the advanced features of dedicated billing platforms. Its usage-based billing is built for developer teams that want a quick way to implement recurring charges or usage fees without integrating multiple systems.

Feature highlights

- Subscription management: Create plans with recurring charges, free trials, etc. You can easily handle upgrades/downgrades and Stripe will automatically prorate charges if someone changes plan mid-cycle (though proration can be configured).

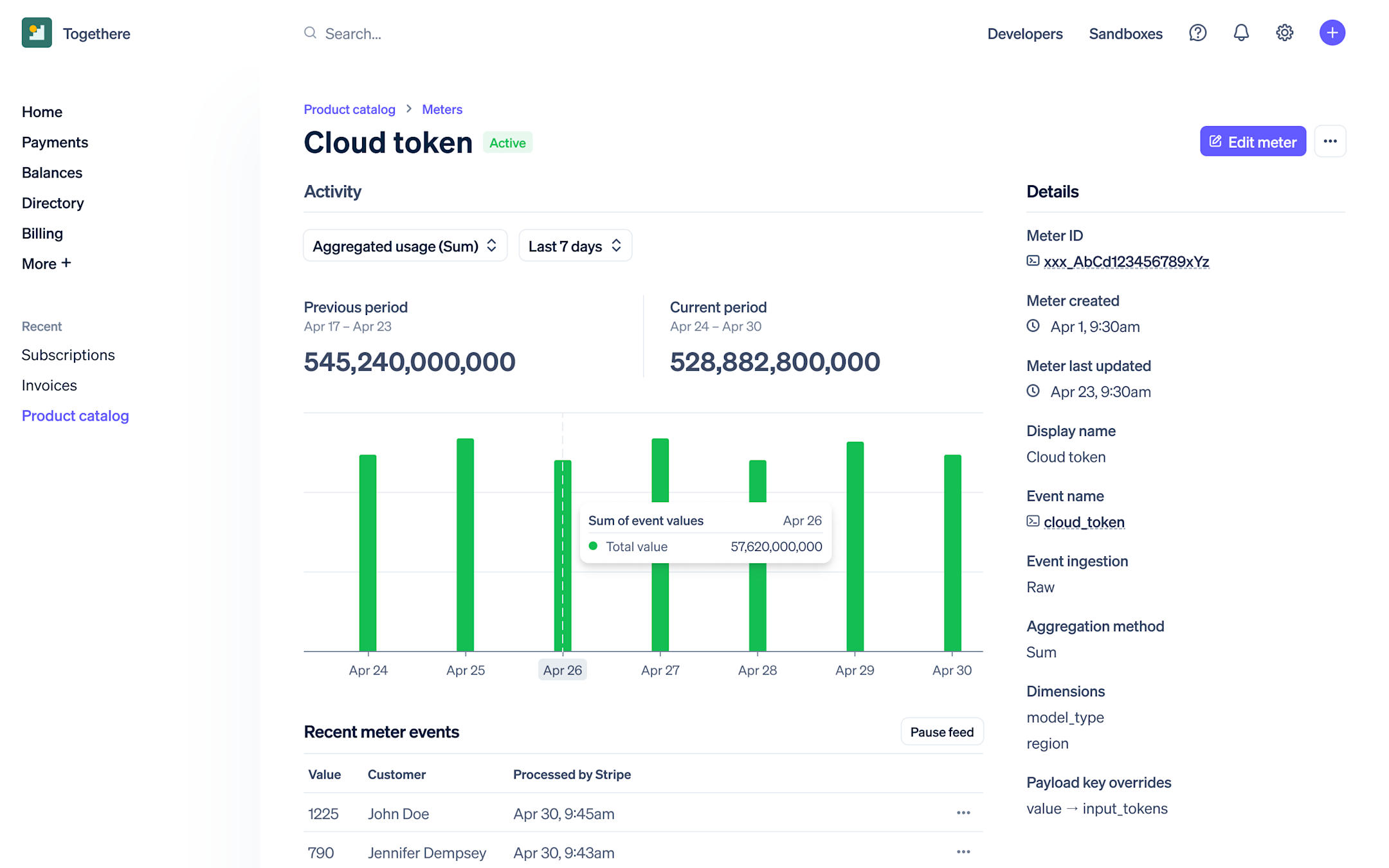

- Meters API: Stripe’s usage-based billing revolves around its Meters API. You define a product price as “metered” in Stripe, then you call the API to report usage for each customer (subscription) each billing cycle. Stripe then multiplies by the rate and includes the usage charge on the invoice.

- Invoicing & payments: Stripe can automatically invoice customers at set intervals, charge their credit cards on file, and if payment fails, attempt retries (dunning) using smart retry logic. It also can send email receipts and invoice PDFs. For customers on manual invoicing (e.g. paying by wire transfer), you can use Stripe to generate the invoice and have them pay offline, recording the payment in Stripe for tracking.

Pros:

- Integrated payment processing: With Stripe Billing, your billing and payments are unified, no separate payment gateway needed.

- Flexible billing models: Stripe Billing supports standard subscription models and usage-based billing via its metered billing feature.

- World-class APIs and docs: Stripe’s APIs are famously well-designed. Developers can get Stripe Billing running quickly with minimal fuss.

Cons:

- Percentage-based pricing: Stripe Billing’s cost is up to 0.8% of revenue billed, which adds up over time. Especially for high-volume or enterprise, this can get very expensive.

- Limited complex billing features: Stripe is great for straightforward subscription or metered plans, but if you have complex contracts (annual commitments, drawdowns, custom pricing per customer, etc.), Stripe struggles.

- Developer-first, not operations-first: Stripe is built for engineers. If you don’t have an engineering team to manage the integration and any custom logic, it could be hard for a finance team alone to run billing on Stripe.

Pricing: 0.5%–0.8% of billed volume. Stripe Billing’s pricing is tiered: 0.5% of recurring revenue on the Scale plan (higher tier), or 0.8% on the Starter plan.

Why choose Stripe Billing?

Choose Stripe Billing if you need a fast, easy, and fully integrated way to collect payments and manage simple subscriptions. Stripe is the best choice for startups or smaller SaaS businesses that don’t need advanced usage-based billing but want a developer-friendly, globally supported solution that works out of the box with Stripe Payments and dozens of integrations.

4. Maxio: Best Metronome alternative for financial reporting

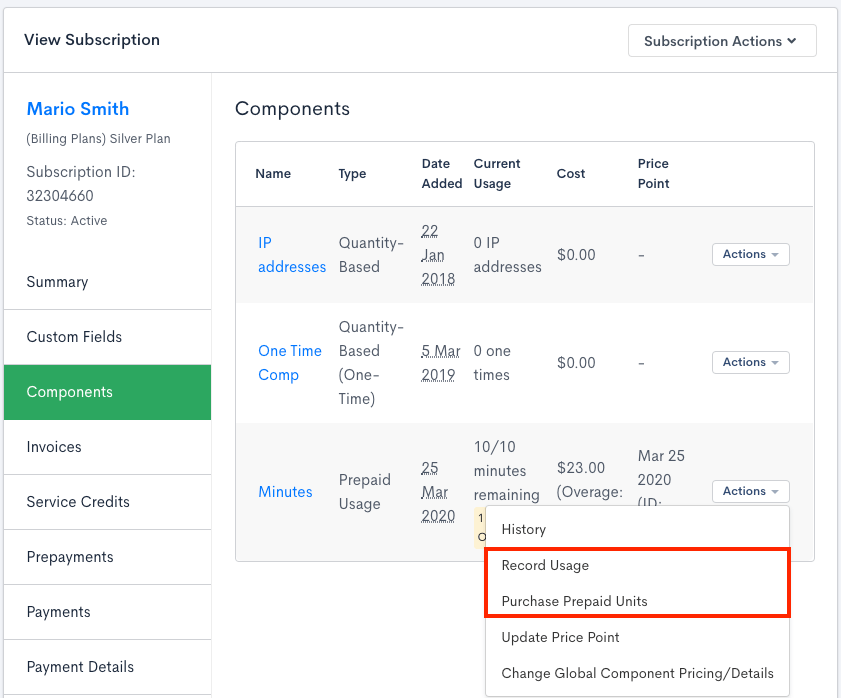

Maxio is the result of a merger between Chargify and SaaSOptics, offering a comprehensive billing and financial operations platform. It’s often cited as a top alternative in billing because it combines subscription management (Chargify’s domain) with robust financial reporting and revenue recognition (SaaSOptics’ specialty).

If you’re looking for an alternative that can handle billing and help your finance team with GAAP compliance and analytics, Maxio stands out. However, as it's not a purpose-built platform like Alguna, customers report disjointed systems and clunky UX.

Feature highlights

- Revenue recognition management: Track deferred revenue, allocate revenue across months, manage prepaid amounts. SaaSOptics originally built these for finance teams to easily generate income statements and balance sheet items directly from the billing data.

- SaaS metrics and dashboards: Built-in dashboards for MRR, ARR, churn, expansion, contraction, customer counts, etc. You can drill down on a customer to see their entire history. It’s like having a lightweight BI tool specifically for subscription business health.

- Audit trails and compliance: Every invoice, payment, and adjustment in Maxio is logged. This is useful for audits. The revenue recognition module is a huge compliance helper, as it ensures your financial reporting aligns with accounting standards without manual calculations externally.

Pros:

- Best-in-class revenue recognition: Maxio includes tools for GAAP revenue recognition, allowing you to automatically defer and recognize revenue from subscriptions over time, and produce reports compliant with ASC 606.

- Mature and reliable: Having been around over a decade (via its predecessors), Maxio is a stable, proven solution.

- Analytics and reporting: Beyond financial metrics, Maxio lets you create custom reports, handle multi-currency consolidation, and even do scenario modeling.

Cons:

- Not specialized in usage-based billing: While Maxio can do usage charges, it requires additional integration with their Advanced Billing module.

- Complexity and setup: Implementing Maxio is not trivial and implementation can take long. There is a learning curve to configure products, pricing, and especially to set up revenue recognition correctly.

- Dated UI and UX: Dated or not as intuitive as newer SaaS tools. You might need more clicks to accomplish tasks, and the navigation between Chargify parts and SaaSOptics parts might not feel completely seamless yet.

Pricing: Custom. Maxio typically offers plans based on your revenue or transaction volume, often starting around $1,000 per month for growth-stage companies.

Why choose Maxio?

Choose Maxio if you prioritize subscription management, SaaS metrics, and revenue recognition in one mature platform. Maxio combines deep financial reporting with robust billing workflows, making it a strong choice for growing B2B SaaS companies that have moved beyond spreadsheets and need GAAP-compliant revenue operations without cobbling together multiple tools.

5. Lago: Best open-source usage-based billing platform

If vendor lock-in or cost is a concern, Lago offers an open-source Metronome alternative. It’s an open-source metering and billing solution that you can self-host or use via their cloud service.

Lago is aimed at startups and companies who want maximum flexibility and transparency in their billing system. With Lago, you have full access to the source code, which can be empowering for engineering teams that want to deeply customize or just avoid proprietary black boxes.

Feature highlights

- Full-featured billing cycles: Lago supports concepts like billing periods, grace periods, and time zone alignment. For example, you can ensure that if you have customers in different time zones, their usage cut-off and invoicing respects their local time – something Metronome lacks.

- Open-Source and community contributions: Users are adding integrations and features. For instance, if you need integration with XYZ payment gateway and it’s not there, there’s a chance someone built it and contributed to Lago’s repo.

Pros:

- Open-source flexibility: You can run Lago on your own infrastructure, modify it to fit your needs, and you’re not tied to a vendor’s roadmap.

- Self-host or cloud: Lago provides both options. Self-hosting is free (aside from your server costs).

- Built-in features beyond metering: Lago is not just a meter. It includes subscription management, invoicing, payment integrations, taxes, coupons, and more.

Cons:

- You need engineering investment: Using an open-source solution means your team will need to deploy, maintain, and possibly troubleshoot it.

- You get what’s in the box (plus what you build): While Lago is quite feature-rich for its age, it may not yet have every niche feature. For instance, advanced revenue recognition or extremely fine-grained analytics might not be present.

- Support and accountability: With a paid vendor, you typically have SLAs and support contracts. With open-source, community support might be your best bet.

Pricing: Open-source (free) or paid cloud.

Why choose Lago?

Choose Lago if you want full control, transparency, and open-source flexibility. Lago is perfect for teams who prefer to self-host their billing system, avoid vendor lock-in, and customize every aspect of metering and pricing. If you have engineering resources and value owning your billing stack, Lago gives you enterprise-grade capabilities without the proprietary black box.

6. Togai (By Zuora): Best as an enterprise add-on to Zuora

Togai, acquired by Zuora in 2024, provides a cloud-based metering and billing solution designed for businesses with usage-based pricing models. It combines metering, pricing, and billing as its three core modules to streamline revenue management so companies can focus on growth instead of building billing systems.

With Togai, you can automatically collect and aggregate usage data in real time, set up flexible pricing plans without writing code, and automate invoicing and payment collection with ease.

Feature highlights

- Event ingestion engine: Togai automatically collects and processes raw usage events from your product (API calls, credits used, GBs processed, etc.) as they occur. You can define how to aggregate usage (daily, monthly, per customer, per SKU) and apply thresholds or minimum commitments.

- Usage dashboards: Get real-time charts showing usage volume by customer, product, or region. Automatically alert internal teams when customers approach thresholds (e.g., 80% of usage allowance).

- Entitlement management: Togai helps you enforce limits and manage feature access by tying billing plans to entitlements, so your product can automatically lock/unlock features when usage caps are reached.

Pros:

- Real-time metering and entitlements: Comprehensive metering module to capture and aggregate any event data in real time, with the ability to manage feature entitlements and usage limits for customers.

- No-code pricing configuration: Togai’s UI lets you configure even complex pricing models (pay-as-you-go, tiered, volume discounts, custom contract terms) without engineering effort.

- Developer-friendly integration: Despite the no-code ethos, Togai is developer-friendly with its APIs.

Cons:

- Part of a larger suite (post-acquisition): With Togai becoming part of Zuora’s product suite, there could be changes in how it’s packaged or integrated. Existing and new users might need to integrate Togai with Zuora’s broader system.

- Limited self-serve documentation: Togai’s public documentation and community are growing but not as extensive as some competitors. Some users rely heavily on Togai’s support team for deeper use cases.

Pricing: Custom.

Why choose Togai?

Choose Togai if you want no-code, scalable usage-based billing that’s fast to implement and easy for non-technical teams to manage. If you want to launch usage billing quickly without sacrificing power or transparency, Togai is a compelling Metronome alternative.

How to evaluate Metronome competitors

With so many competitors each taking a slightly different angle (from lean startups to open-source to enterprise suites), how do you choose the right one?

Here’s a quick decision guide on key factors to consider when evaluating Metronome alternatives for your business:

✨ Flexibility vs. simplicity: Determine how much flexibility you truly need in pricing and billing models. If Metronome’s coding approach is a bottleneck, look for tools with no-code or low-code pricing configuration.

🏷️ Pricing and cost structure: Analyze the pricing models of each alternative. Metronome reportedly has a high minimum commitment (~$10k/year). Some competitors charge a percentage of revenue (Stripe at 0.5–0.8%), which can become expensive as you scale. Others tools are flat-rate SaaS (Alguna) or even free (Lago’s open source).

⚙️ Integration with your stack: Inventory your current tools (CRM, payment gateway, accounting software) and check compatibility. If you want to avoid heavy lifting, choose a tool with out-of-the-box connectors for your needs.

📈 Scalability and performance: Consider not just your current scale but your projected growth. Can the platform handle a 10x increase in usage data or customers? If you expect hyper-growth or have a data-intensive product, lean toward solutions proven at scale.

👩💼 User experience and team skills: Who will be using the system daily? If it’s developers, they might prefer a platform with a strong API focus. If it’s a RevOps or finance manager, a polished UI with clear workflows (like Alguna’s modern UX or Stripe’s intuitive dashboard) could be crucial.

🔄 Agility and product updates: The SaaS world evolves quickly (think usage-based pricing for AI, new billing models, etc.), so choose a vendor that keeps pace. Smaller startups like Alguna often deploy improvements weekly, often driven by customer feedback.

🛠️ Support and community: Billing is mission-critical. If invoices stop, so does revenue. Gauge the level of support you’ll get.

🔒 Data ownership and compliance: Think about compliance (GDPR, SOC 2) and data needs. If you operate in fintech or handle sensitive data, an open-source/self-hosted route (Lago on your own servers) might appeal for data ownership.

Finally, involve both engineering and finance teams in the evaluation. You want a solution that satisfies the technical requirements and the business requirements. A cross-functional trial (most vendors will offer a sandbox or demo environment) is a helpful approach. Try modeling a sample of your pricing in each tool, issue a fake invoice, see how it feels.

The right Metronome alternative will become obvious when it checks the boxes that matter most to your business’s growth and operations.

FAQs: Metronome competitors

Why would I switch from Metronome to a competitor?If you need faster pricing changes, less reliance on engineering, better integrations, or more global billing support, a competitor may serve you better.

Is migration from Metronome difficult?Most modern platforms offer migration support, but the process depends on your current setup’s complexity and the alternative you choose.

Which Metronome alternative is best for non-technical teams?Alguna is designed for non-technical users, offering no-code automation and a user-friendly interface.

Can these alternatives handle both subscription and usage-based billing?Yes, most leading competitors—including Alguna, Togai, and Lago—support a wide range of billing models, from pure usage to hybrid and subscription.

Are open-source options like Lago a good fit?Open-source platforms offer maximum flexibility and control but require more technical expertise and resources to maintain.

Find your fit: Choosing the right Metronome alternative

Finding the perfect Metronome alternative comes down to understanding your team’s needs and your business’s growth trajectory. Whether you prioritize flexibility (Alguna’s all-in-one no-code platform), cost efficiency (Lago’s open-source model), or enterprise muscle (Togai by Zuora), there’s an option tailored for you.

All the competitors we covered aim to help you experiment with pricing, bill accurately, and get paid on time – the core goals Metronome set out to achieve. By evaluating them against your criteria (flexibility, cost, integrations, scalability, etc.), you’ll be well on your way to choosing a platform that not only matches Metronome, but potentially exceeds it in driving your revenue strategy forward.

In the end, successful billing is about more than just software capabilities. The best billing solution is one that grows with you, automates the complex, and empowers your teams to move faster.

Need more than usage-based billing? Try Alguna.

Book a demo to get a closer look at Alguna's advanced capabilities and automate your revenue workflows, from contract to cash.