Revenue recognition is mission-critical for any business with recurring, usage-based, or multi-element contracts. Under ASC 606 and IFRS 15, finance teams need automation (not spreadsheets) to stay compliant and audit-ready.

Platforms like Maxio and Chargebee RevRec promise to simplify this complexity, but which one is the best fit for your business?

In this guide, we evaluate how Maxio vs Chargebee’s revenue recognition capabilities compare.

Plus, we introduce Alguna as a modern, no-code alternative for scaling revenue teams that don’t want to be held back by long implementation periods and engineering bottlenecks.

Revenue recognition in Maxio

Maxio offers a deeply integrated revenue recognition engine for B2B SaaS finance teams. By combining billing, contract management, and ASC 606-compliant revenue recognition in one system, Maxio eliminates manual handoffs and fragmented workflows.

Its platform is designed to automate complex revenue schedules, support audit-ready compliance, and give finance leaders full visibility from invoice to recognized revenue without relying on external tools or add-ons.

The result is a product suite that can feel fragmented, with separate workflows and UIs stitched together under one brand. For teams looking for a seamless, unified experience, especially across billing and finance, this stitched-together architecture may create friction and slow down implementation.

Maxio’s revenue recognition capabilities include:

- Automated recognition schedules and adjustments: Finance teams can adjust revenue recognition schedules by customer, contract or transaction without overwriting original data. This allows them to reflect real‑world changes—such as contract amendments or usage fluctuations—while preserving historical records.

- Compliance with ASC 606 and IFRS 15: Maxio’s revenue rules allow companies to apply tailored recognition methods across all contracts to meet ASC 606/IFRS 15 and internal policies. Users can create recognition rules that mirror their accounting policies and apply them automatically.

- ERP and GL synchronization: Maxio synchronizes invoices and payments with accounting systems such as NetSuite, QuickBooks and Sage to reduce manual entry and accelerate close processes It also consolidates journal entries so finance teams can view deferred revenue and journal entries across periods and prevent reporting errors.

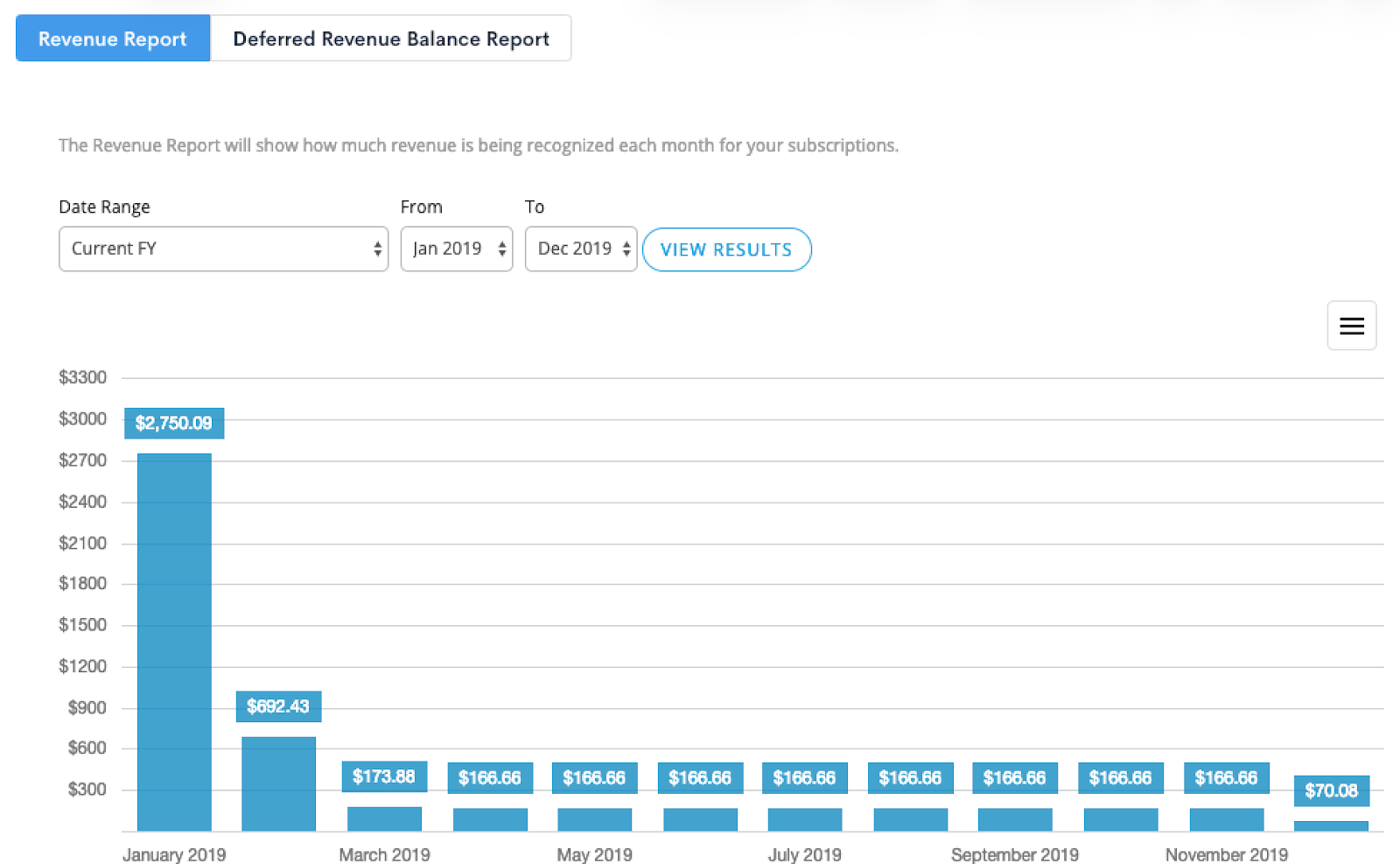

- Automated schedules and waterfall reports: The platform generates automated revenue schedules and waterfall reports aligned to company policies, eliminating manual calculations. Multiple revenue books and performance obligations can be managed concurrently.

- Detailed audit trails and analytics: Maxio provides drill‑down reports by customer, contract or transaction and records every change. Real‑time dashboards allow finance teams to monitor revenue performance and prepare audit‑ready reports.

These features make Maxio suitable for SaaS companies that need deep revenue reporting with built‑in billing and metrics. Its tight integration with subscription billing and GAAP‑compliant reporting helps finance teams close the books faster and maintain accuracy.

Revenue recognition in Chargebee RevRec

Chargebee RevRec is a separate module (or an add‑on) to the Chargebee billing platform. Built for flexibility, it acts as a dedicated revenue sub-ledger that pulls data from billing, CRM, and ERP platforms to deliver ASC 606 and IFRS 15 compliance at scale

Whether you're managing multi-element arrangements, contract modifications, or high transaction volumes, RevRec provides the rules engine, audit trail, and reporting precision finance teams need without overhauling your existing stack.

Chargebee’s revenue recognition capabilities include:

- Full compliance and automation: Chargebee RevRec automates high‑volume and complex revenue transactions, providing compliance with ASC 606 and IFRS 15. It follows the five‑step framework and integrates with the general ledger to automate revenue recognition.

- Reduction of manual errors: By replacing error‑prone spreadsheet processes with automation, RevRec reduces the risk of financial misstatements. It centralizes revenue data by integrating with billing systems, CRMs and payment gateways to ensure accurate reporting.

- Handling contract changes: RevRec supports upgrades, downgrades, prorations, refunds and disputes. It automatically creates revenue schedules for each sales order and adjusts them when contracts change.

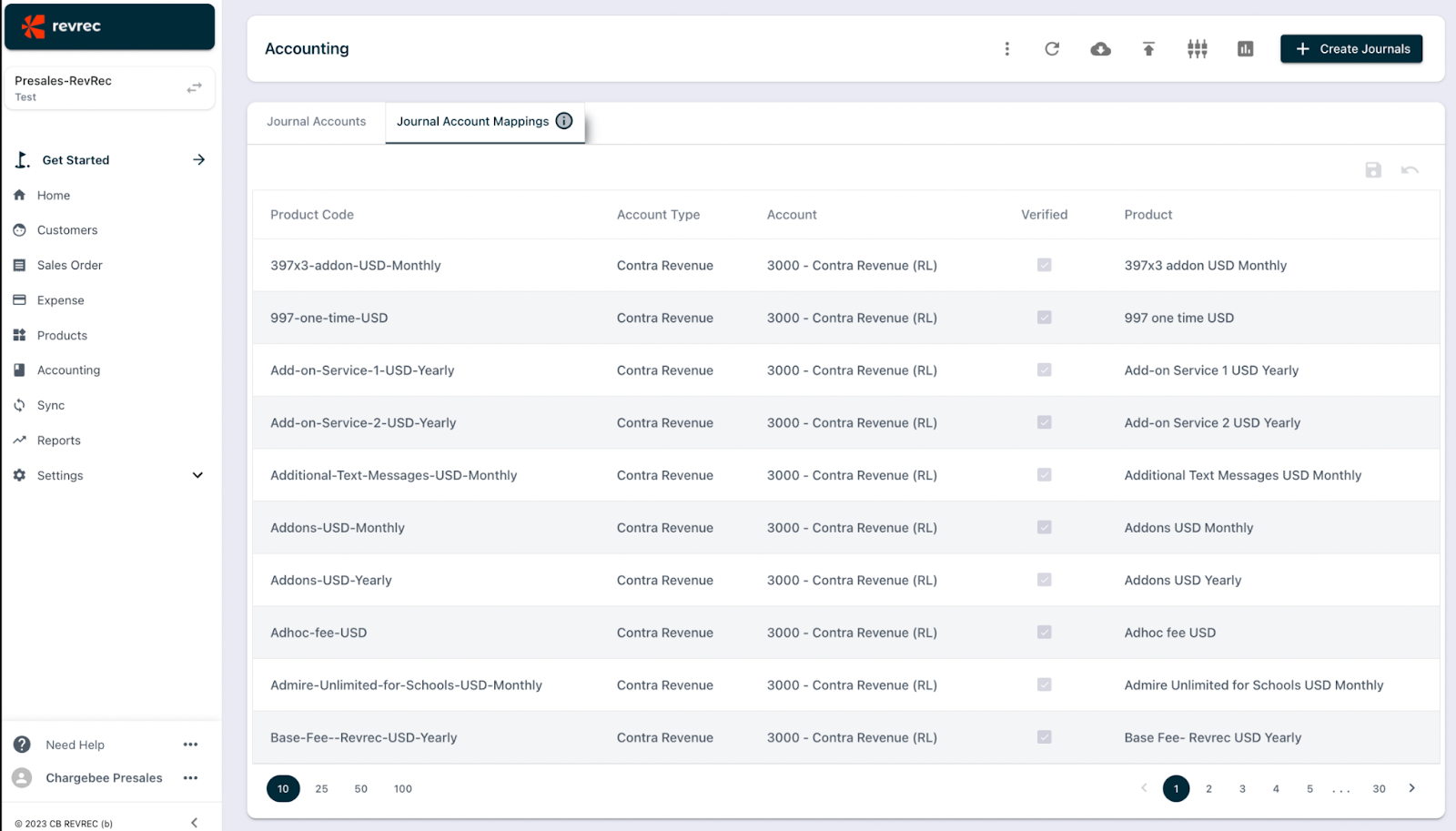

- Revenue sub‑ledger and journal entries: The module operates as a controlled revenue sub‑ledger, computing GAAP revenue and generating monthly journal entries for posting to the general ledger. Finance teams can configure general ledger accounts, map rules and manage the accounting period.

- Built‑in checks and validations: RevRec includes built‑in checks based on industry best practices to ensure auditability and compliance. It can handle variable consideration, collectibility assessment and material rights.

- Integrations and reporting: Out‑of‑the‑box integrations with Salesforce, HubSpot, QuickBooks, Xero, NetSuite and Stripe allow automatic data import. Its reporting package, powered by Microstrategy, offers insights into revenue allocation and helps identify drivers affecting the business. Chargebee RevRec also provides a flexible stand‑alone selling price (SSP) library and an expense recognition module.

Chargebee RevRec therefore caters to businesses that need dedicated revenue recognition beyond basic subscription billing. It is particularly valuable when a company uses multiple billing or CRM systems or has complex partner/reseller arrangements.

Alguna: Unified revenue management platform with automated revenue recognition

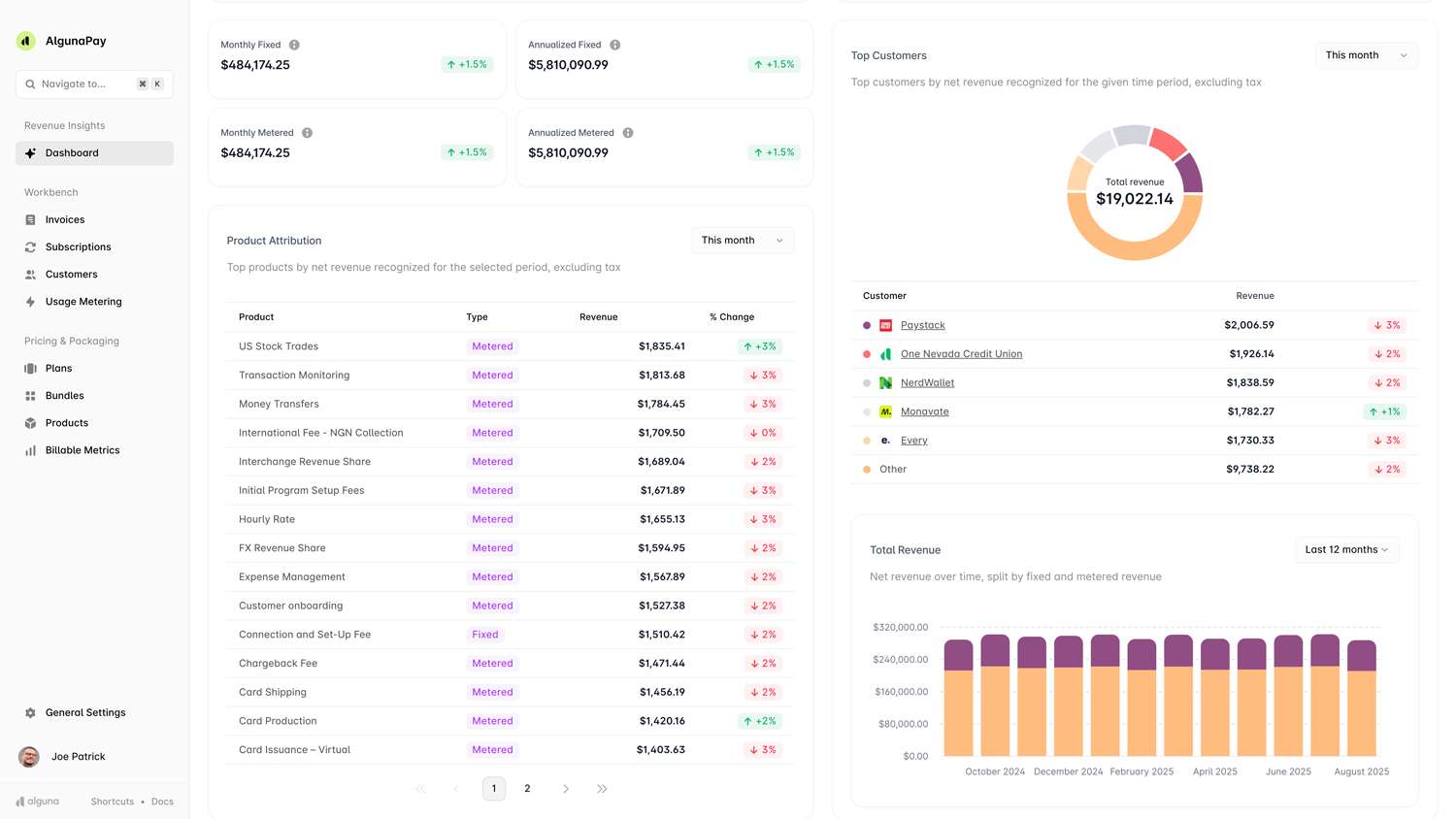

Alguna is a Y Combinator backed quote‑to‑cash platform built for the AI era. Designed for the complexities of modern SaaS, fintech, and AI-native businesses, Alguna unifies CPQ, usage metering, billing, payments, and revenue recognition.

The platform offers real-time, automated revenue recognition that’s natively compliant with ASC 606 and IFRS 15, without the manual work or fragmented data pipelines that often slow down finance teams.

Alguna's revenue recognition capabilities include:

- Streamline ASC 606/IFRS 15 compliance: Reduce audit risk and accelerate month-end closes.

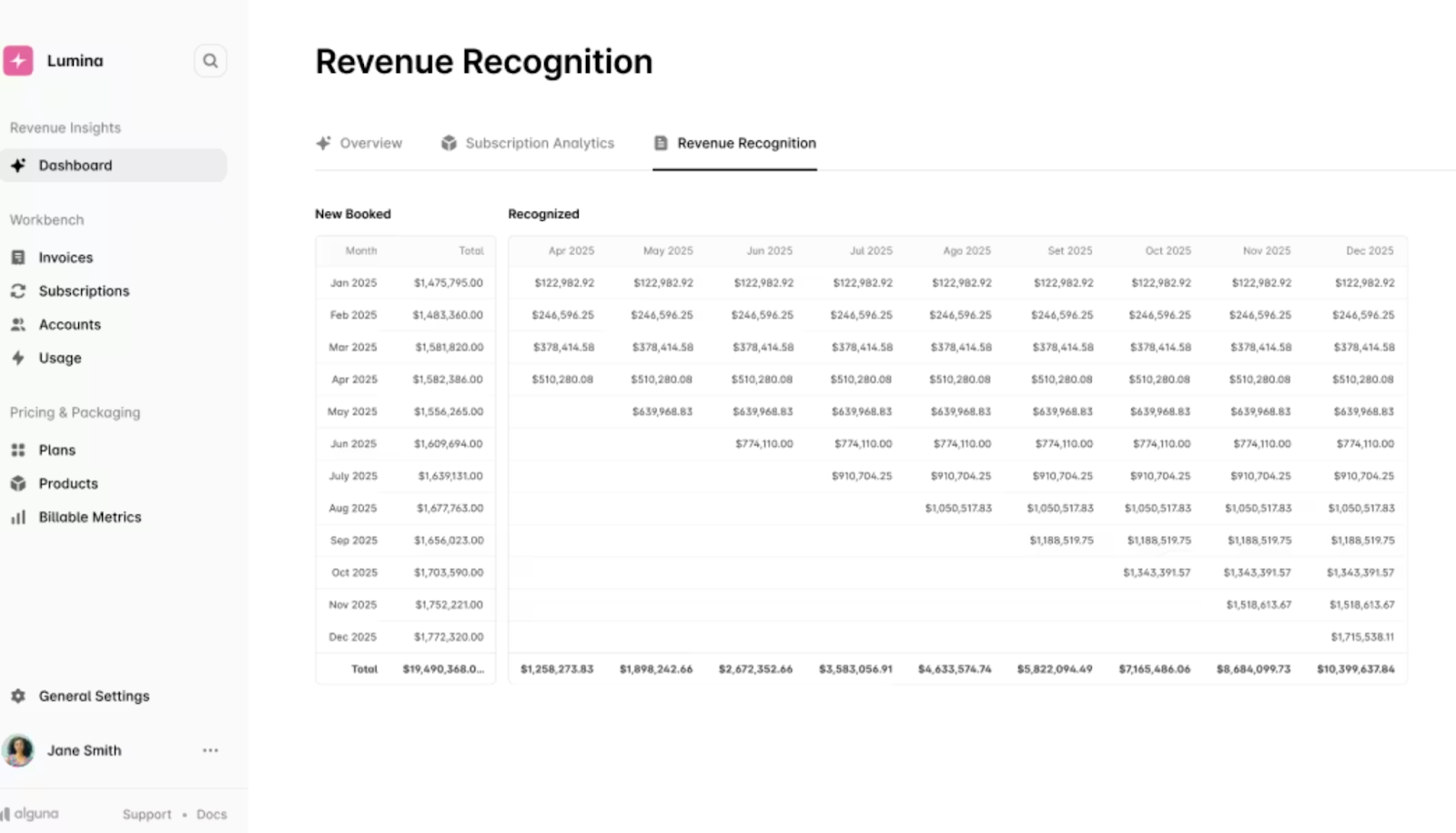

- Flexible contract modeling: Support for subscriptions, usage-based billing, bundles, and complex multi-element arrangements.

- Real‑time fulfillment monitoring: The platform recognizes revenue automatically as obligations are fulfilled.

- Direct integration to ERP/GL: Alguna posts journal entries directly to ERP systems, eliminating manual posting and speeding up month‑end close.

- Audit traceability and automation: It offers fully automated recognition workflows that cut close cycles, provides 100 % audit traceability and eliminates spreadsheets.

- Adaptive to contract changes: Amendments such as renewals or upsells are detected automatically, and the system recalculates recognition schedules in real time, triggering only incremental journal entries.

- Robust integrations and localization: Alguna provides pre‑built connectors to NetSuite, SAP, Microsoft Dynamics, and Salesforce and includes open APIs for custom integrations. It complies with ASC 606/IFRS 15 and offers country‑specific localization options.

Feature overview: Maxio vs Chargebee - Revenue recognition capabilities (+Alguna)

Revenue recognition isn’t just a compliance checkbox. It serves as the backbone of accurate financial reporting and investor confidence in SaaS.

Whether you're navigating ASC 606, managing multi-element contracts, or scaling usage-based pricing, the right platform can drastically simplify operations and close the books faster.

Below, we break down how Maxio, Chargebee RevRec, and Alguna handle revenue recognition, so you can choose the solution that aligns with your business model and finance workflow.

| Feature | Maxio | Chargebee RevRec | Alguna |

|---|---|---|---|

| ASC 606/IFRS 15 compliance | Built‑in rules ensure compliance and allow tailored recognition methods. | Five‑step framework integrates with GL to automate recognition. | AI‑native engine supports ASC 606/IFRS 15 with localization options. |

| Adjustment & contract changes | Adjust recognition schedules by customer/contract without overwriting data. | Handles renewals, modifications, cancellations and partner commissions; auto‑creates schedules. | Detects amendments (renewals, upsells, change orders) and recalculates allocations in real time. |

| Scheduling & journal entries | Automated schedules, waterfall reports and consolidated journal entries. | Serves as a revenue sub‑ledger; generates journal entries and posts to GL. | Generates and posts journal entries directly into ERP/accounting systems. |

| Integration with billing/ERP | Syncs invoices & payments with NetSuite, QuickBooks, Sage and others. | Integrates with billing, CRM and gateways for centralized data. | Pre‑built connectors for ERPs (NetSuite, SAP, Microsoft Dynamics) and CRMs (Salesforce); open APIs. |

| Reporting & analytics | Detailed audit trails and real‑time dashboards for revenue breakdowns. | Microstrategy‑based reporting with insight into revenue allocation and drivers. | Real‑time fulfillment monitoring and 100% audit traceability; export audit logs and schedules. |

| Support for multiple pricing models | Integrated with billing to handle subscriptions, usage and complex pricing; separate revenue books and performance obligations. | Handles multi‑currency transactions, partner sales and complex scenarios including variable consideration. | Flexible contract modeling supports subscriptions, usage‑based billing, bundles and multi‑element arrangements. |

| Audit support & controls | Generates audit‑ready reports and ensures data integrity across transactions. | Built‑in checks and validations; provides control checks and error reports for compliance. | Offers audit logs backed by contract excerpts and digital logs; best‑practice documentation for auditors. |

| Expense recognition | Not explicitly a core feature (external tools may be required). | Includes an expense recognition module for commissions and direct expenses. | Focused on revenue recognition; expense recognition not highlighted. |

Maxio vs Chargebee rev rec capabilities: Final thoughts

Maxio and Chargebee both provide robust revenue recognition solutions, but they cater to different organizational needs.

Maxio is ideal for finance teams that want revenue recognition deeply integrated into their subscription billing system. It offers automated schedules, tailored ASC 606 compliance and powerful analytics within one platform.

Chargebee RevRec excels as an add‑on module that centralizes revenue data from multiple billing or CRM systems and functions as a controlled revenue sub‑ledger. It handles complex contract scenarios and provides a rich reporting framework with built‑in validations.

Alguna introduces a flexible, AI‑native approach that unifies contract management, billing, usage metering and revenue recognition. Its ability to automate contract amendments and provide real‑time audit‑ready logs makes it attractive for businesses leveraging complex pricing or consumption‑based models.

Ultimately, the right platform will depend on the complexity of your contracts, the degree of integration required with existing systems and whether you want a holistic billing and finance stack or a modular solution.

Experience truly automated revenue recognition in a unified platform

Book a demo to see how Alguna compares to Maxio and Chargebee, and how it can simplify your revenue operations from day one.