Subscription billing and revenue management are at the core of every growing SaaS business. Maxio and Chargebee are two popular platforms that help companies automate recurring billing, manage complex pricing, and stay audit‑ready.

In this guide, we’ll compare Maxio vs Chargebee in detail, covering features, pricing, integrations, and support to help SaaS finance and RevOps leaders pick the best solution.

We’ll also highlight real use cases for each and introduce Alguna as a modern AI-era alternative to Maxio and Chargebee.

Chargebee vs Maxio: Core differences

TL;DR:

Chargebee is a subscription management platform that serves SaaS companies with simpe pricing strategies. While not purpose-built for AI monetization, if you want fast setup, broad payment coverage, and a tool that handles standard SaaS billing with almost no implementation overhead.

Maxio is built for finance-led teams that need deeper control over contracts and compliance, ASC 606 revenue recognition, multi-entity operations, and investor-grade reporting, all in one unified system.

Both tools can handle recurring billing. The difference is how far you need to stretch your pricing, compliance, and revenue workflows as ARR scales.

Introducing Alguna

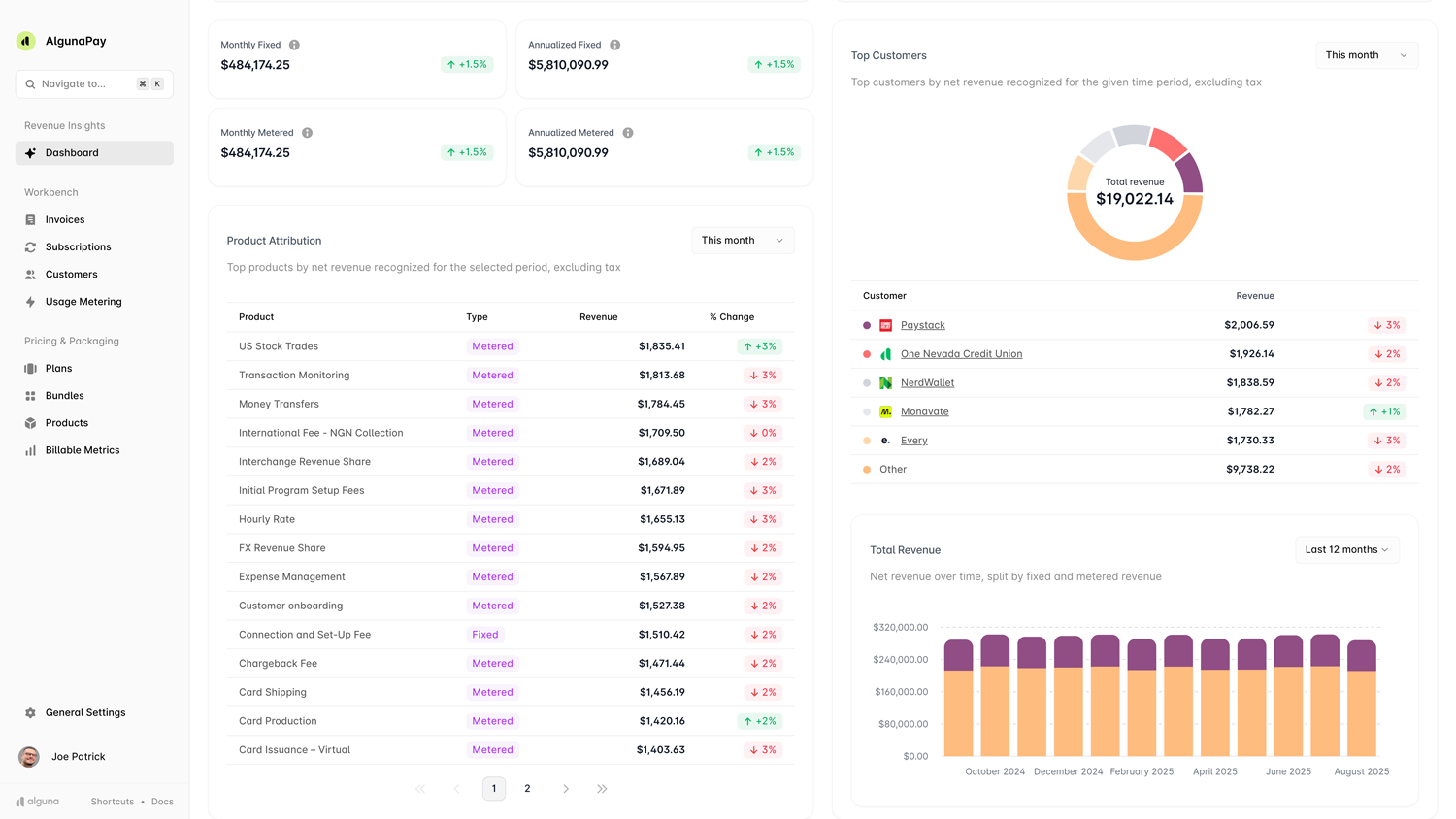

Y Combinator backed Alguna was purpose-built to handle the pricing and billing complexities and speed of the AI era. Modern SaaS, AI, and fintech companies use Alguna’s no-code platform to unify their revenue workflows in one system.

This means pricing, quoting, contracts, metering, billing, payment collections, and revenue recognition all live in a single source of truth. Built by experienced fintech operators, Alguna is setting a new standard in AI and SaaS revenue management.

Maxio vs Chargebee: High-level overview

Here’s a simple side-by-side comparison to summarize the biggest differences:

| Category | Chargebee | Maxio |

|---|---|---|

| Ease of setup | Very fast, minimal engineering | Medium–high, structured implementation |

| Pricing complexity | Great for standard SaaS plans | Excellent for hybrid, usage, and custom contracts |

| Recurring billing | Strong out-of-the-box | Advanced billing engine for complex B2B |

| Usage billing | Good via add-ons/modules | Native, flexible, finance-grade |

| Revenue recognition | Optional add-on | Fully built-in, ASC 606 first-class |

| Invoicing and AR | Basic to moderate needs | Robust, audit-ready, multi-entity support |

| Payment methods | 60+ gateways, excellent checkout | Multi-gateway routing + processor control |

| Analytics and reporting | Solid SaaS dashboards | Deep financial analytics + forecasts |

| Integrations | Broad plug-and-play ecosystem | Finance-first CRM / accounting integrations |

| Implementation effort | Light | Heavy upfront, strong long-term |

| Best for | Startups and scaling SaaS with simple pricing | Mid-market B2B SaaS with complex finance needs |

Maxio vs Chargebee comparison: Deep dive

Once your SaaS company moves beyond basic subscription workflows, the differences between Maxio and Chargebee become much clearer.

Both platforms can run recurring billing well, but they’re built for very different levels of biling complexity, financial compliance, and contract management.

This deep dive breaks down how each platform handles subscription management, usage billing, invoicing, revenue recognition, and the finance workflows that matter as ARR scales.

Maxio (formerly Chargify): Built for finance-led B2B SaaS with complex compliance needs

Maxio is a billing and financial operations platform that was formed through the merger of Chargify (billing) and SaaSOptics (revenue recgonition + analytics). In spring 2024, they also acquired RevOps.io to further broaden their product offering.

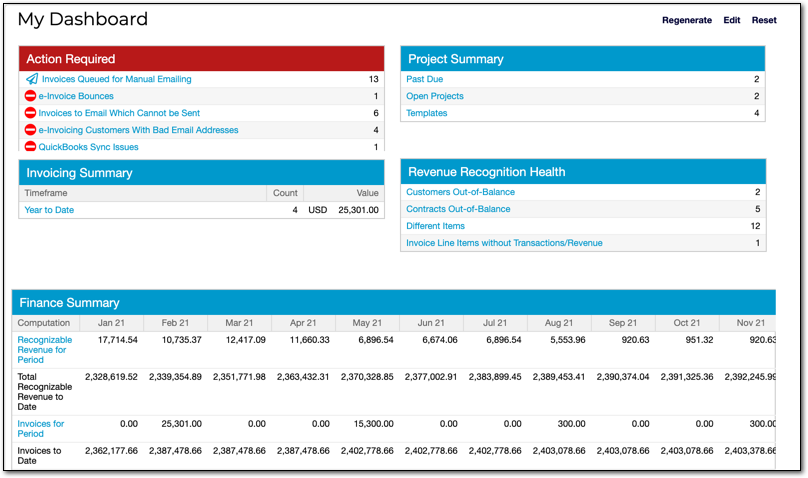

It’s designed for finance, RevOps, and reporting-heavy teams that need accurate ASC 606 revenue recognition, custom contract workflows, and deep SaaS metrics, all in one system.

If you’re selling multi-year deals, negotiating custom terms, and require advanced revenue recognition, Maxio is built for the job.

Strengths

- All-in-one finance platform combining billing, revenue recognition, AR, and analytics

- Built-in ASC 606/GAAP revenue recognition with no add-ons required to stay compliant

- Handles complex contracts including mid-cycle edits, amendments, milestones, custom terms

- Deep SaaS metrics like MRR, ARR, churn, CAC payback, and cohort analysis

- Built-in cash forecasting and financial insights

- No-code operations workflows for credits, adjustments, and AR tasks

- Strong Salesforce/HubSpot/QuickBooks integrations to sync contracts and revenue

Limitations

- Steep learning curve due to the dual heritage of the platform

- Clunky user experience as Maxio is made up of three different platforms

- Longer implementation as it requires structured onboarding and planning

- Tricky for highly dynamic or experimental usage models without custom configuration

- Higher starting price ($599/month Grow tier) with no true “free” plan for startups

Chargebee: Built for traditional SaaS subscription management

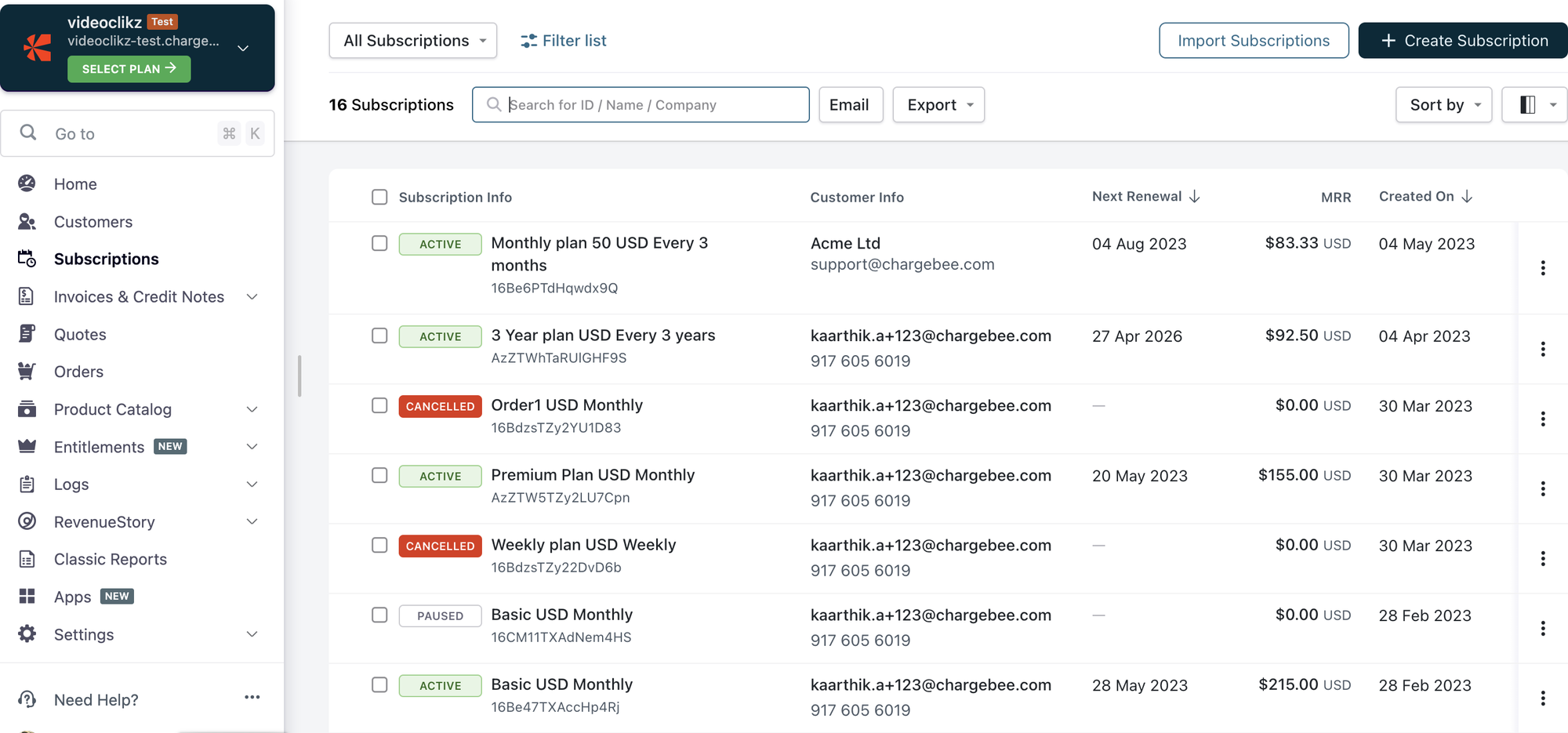

Chargebee is a full-featured subscription management and billing platform built for startups and mid-market SaaS teams who want fast deployment, easy configuration, and broad integration coverage.

Its product catalog, checkout flows, coupons, proration, and dunning tools make it ideal for teams who want to move quickly without dragging in engineering. Chargebee shines when your pricing is relatively standard, and your focus is speed, automation, and seamless integrations rather than deep financial or compliance-heavy workflows.

Strengths

- Easy onboarding with an intuitive UI and minimal engineering requirements

- Rich out-of-the-box billing features, including plans, add-ons, metered usage, proration, and tax handling

- Strong integrations with CRM, ERP, and 60+ payment gateways

- Powerful dunning and retention workflows

- Free starter plan for bootstrapped or early-stage teams

- Great for B2C and B2B subscription workflows

Limitations

- Less flexible for complex hybrid or enterprise pricing, as it often needs API work

- Revenue recognition is a paid add-on and not native

- Costs rise quickly as usage, revenue, or team size grows

- More effort required for full quote-to-cash setup

Chargebee vs Maxio: Feature comparison breakdown

Maxio and Chargebee take fundamentally different approaches to subscription management, pricing flexibility, and financial operations.

This section breaks down their core features side-by-side so you can see where each platform actually shines, and where the limits start to matter as your SaaS business scales.

1. Subscription and pricing flexibility

Chargebee

- Product catalog-based setup: Create and manage plans, add-ons, and pricing tiers through a user-friendly interface with minimal engineering effort.

- Supports common pricing models: Flat-rate, per-seat, tiered, volume-based, and metered usage models are available via configuration or optional modules.

- Discounts and coupons: Easily apply promotional codes, free trials, and custom discounts at the plan or invoice level.

- Multiple billing cycles: Supports daily, monthly, quarterly, and annual billing frequencies with flexible trial durations.

- Add-on usage tracking: Light support for usage-based billing through add-ons or integrations; ideal for simple consumption pricing.

Maxio

- Contract-based pricing engine: Built to support B2B SaaS contracts with highly customizable pricing structures, including mid-contract modifications.

- Supports hybrid models: Seamlessly combines subscription, usage-based, milestone, and event-triggered billing in a single pricing plan.

- Rule-driven plan architecture: Define complex pricing rules for renewals, upgrades, downgrades, minimum commitments, and tier thresholds.

- Flexible billing schedules: Configure billing by fixed date, event, or milestone—ideal for implementation services or multi-phase contracts.

- Multiple revenue elements: Accommodates product bundles, non-recurring charges, setup fees, and recurring components all in one contract.

Maxio shines when pricing gets complex. Whether you’re combining usage-based and fixed fees, supporting milestone-based delivery, or managing highly negotiated contracts, Maxio offers the flexibility and depth finance and RevOps teams need. It’s purpose-built for sophisticated B2B SaaS scenarios that outgrow static pricing structures.

2. Invoicing and billing automation

Chargebee

- Product catalog UI: Easily configure and manage plans, addons, coupons, trials, and proration without needing developer involvement.

- Automated invoice generation: Handles recurring invoices, one-time charges, and usage-based line items with built-in proration and tax calculation.

- Hosted pages and checkout: Includes self-serve invoice portals and hosted checkout to streamline billing workflows and reduce support load.

- Quote-to-invoice flow: Sales reps can create quotes that convert directly into billable subscriptions with minimal manual effort.

- Retry and dunning workflows: Built-in logic to automatically retry failed payments, send reminders, and pause/reactivate subscriptions as needed.

Maxio

- Contract-based billing logic: Supports milestone billing, mid-cycle changes, and multi-element arrangements with full control over contract terms.

- Custom invoice schedules: Finance teams can define when and how invoices are generated—monthly, quarterly, annually, or event-triggered.

- Revenue accounting sync: Automatically generates compliant, audit-ready invoices linked with deferred revenue schedules for ASC 606 compliance.

- Invoice customization and approvals: Allows custom invoice templates and integrates approval workflows for B2B sales operations.

- Multi-entity support: Built-in logic to handle invoices across subsidiaries, geographies, and currencies with unified financial reporting.

Maxio provides deeper financial control. It’s better suited for B2B SaaS companies that need flexible billing logic, contractual invoicing, and native compliance with accounting standards like ASC 606. Its tight integration with rev rec and accounting processes makes it a strong fit for finance-heavy or audit-sensitive environments.

3. Maxio vs Chargebee revenue recognition capabilities

Chargebee

- RevRec as an add-on product: Revenue recognition is offered through a separate module (Chargebee RevRec), requiring integration with the main billing system.

- ASC 606 / IFRS 15 compliant: Automates recognition rules, allocations, and contract modifications to stay compliant with global standards.

- Multi-source data ingestion: Pulls data from billing, CRM, spreadsheets, and order systems into a centralized revenue sub-ledger.

- Custom rules engine: Supports multiple recognition scenarios (ratable, usage-based, milestone) with customizable logic and validation workflows.

- Audit-ready reporting: Generates journal entries, audit logs, and revenue schedules exportable to ERP systems like NetSuite or QuickBooks.

Maxio

- Native revenue recognition engine: Built-in to the billing platform (no need for a separate product), tightly integrated with invoicing and contracts.

- Automated deferred revenue tracking: Recognizes revenue in compliance with ASC 606 across multiple elements like subscriptions, services, and usage.

- Multi-schedule support: Allows creating multiple revenue schedules per contract (e.g., setup fees vs. recurring charges), with real-time reporting.

- Forecasting and analytics: Offers cashflow projections, waterfall views, and real-time metrics like unbilled vs. deferred revenue.

- Audit-ready compliance: Automatically generates ASC 606-aligned journal entries and documentation for financial audits and board reporting.

Maxio, however, offers a more seamless, integrated experience. For SaaS finance teams using Maxio for billing, revenue recognition is fully automated and embedded in the core platform—no extra setup, no external syncs. If compliance, audit-readiness, and real-time visibility are top priorities, Maxio is likely the better fit.

4. Payment gateways and global support

Chargebee

- 60+ global payment gateway integrations: Natively supports Stripe, Braintree, PayPal, Adyen, GoCardless, Razorpay, and more across different geographies.

- Localized checkout and currency support: Offers multi-currency pricing, localized invoices, and hosted checkout pages that support regional tax formats and languages.

- Multiple payment methods: Accepts credit cards, ACH, SEPA, PayPal, Apple Pay, Google Pay, and direct debit.

- Smart payment routing: Enables dynamic routing of transactions through different gateways for better authorization rates.

- Built-in dunning and recovery: Offers smart retries, card expiry reminders, and automated follow-ups to minimize payment failures globally.

Maxio

- Multi-gateway support: Integrates with major processors like Stripe, Braintree, GoCardless, and others; enables routing across gateways based on geography or use case.

- Custom payment logic: Allows for tailored payment workflows per contract or entity—ideal for enterprise billing across different payment rails.

- Multi-currency invoicing: Invoices and collects payments in different currencies with exchange rates and currency-specific tax handling.

- Tax engine integrations: Connects with Avalara and other tax systems for accurate global tax compliance on invoices.

- AR automation for global accounts: Includes support for aging reports, localized invoice formats, and entity-level cash application to streamline collections across borders.

Verdict:

Maxio, on the other hand, is better suited for finance-driven organizations that require control over how and where payments are routed—especially across multiple business entities or with custom terms. It’s a better fit for companies with more nuanced payment workflows, especially in enterprise B2B SaaS settings.

4. Integrations and ecosystem

Chargebee

- Rich native integrations: Connects with CRMs like Salesforce and HubSpot, ERPs like NetSuite and QuickBooks, and tools like Avalara, Xero, Slack, and Zendesk.

- Marketplace and plugins: Offers a growing marketplace of prebuilt connectors for revenue operations, marketing, and support.

- Developer-friendly API: RESTful API and webhooks allow full customization and automation beyond built-in features.

- Payment ecosystem: Tight integration with Stripe ecosystem (including Chargebee Payments) simplifies setup and reconciliation.

- Partner ecosystem: Large ecosystem of implementation and integration partners available across geographies.

Maxio

- Finance-focused integrations: Strong native support for Salesforce, HubSpot, QuickBooks, NetSuite, and Avalara, with deeper sync for finance workflows.

- Two-way sync with accounting systems: Journal entries, revenue schedules, and invoicing details flow automatically into ERP or GL systems.

- API-first architecture: Enables custom integrations with data warehouses, CPQ tools, BI platforms, and internal systems.

- Custom integration support: Offers guided support and documentation for custom workflows across billing and finance systems.

- Built-in data consistency tools: Avoids double-entry and sync errors through consistent contract → billing → rev rec data models.

Verdict:

Maxio focuses on finance-grade integrations. If your priority is syncing billing and revenue data seamlessly into your GL and CRM for compliant reporting and audit workflows, Maxio’s tight ecosystem wins.

5. Reporting and analytics

Chargebee

- Standard SaaS dashboards: Includes core metrics like MRR, churn, ARPU, and plan-based segmentation.

- RevRec reporting: Chargebee RevRec provides audit logs, revenue waterfalls, and journal entries for recognized vs deferred revenue.

- Export to BI tools: Data exports to external analytics tools like Looker, Tableau, or spreadsheets.

- Basic forecasting: Offers basic future billing visibility through subscription lifecycles and scheduled invoices.

- Cohort analysis: Limited cohort functionality; typically requires external tools for advanced customer behavior analysis.

Maxio

- Advanced SaaS metrics: Native dashboards for ARR, MRR, cash flow, CAC, churn, LTV, bookings, billings, and more.

- Real-time rev rec visibility: Tracks recognized vs deferred revenue, unbilled amounts, and revenue schedules by contract or product.

- Forecasting and projections: Built-in financial forecasting tools based on billing and revenue trends.

- Custom reporting engine: Ability to create finance-grade reports (DSO, burn, net retention) without external BI tools.

- Investor-ready exports: One-click board and audit reports formatted to meet investor and compliance standards.

Maxio provides deeper and more granular financial analytics, especially for SaaS companies scaling toward maturity or managing multiple entities. Its built-in rev rec forecasting and board-level reporting offer stronger support for CFOs and controllers.

6. Implementation and ongoing operations

Chargebee

- Quick setup for standard use cases: User-friendly UI allows RevOps or finance teams to launch without heavy technical resources.

- Guided onboarding: Onboarding team and documentation available for most self-serve and mid-market plans.

- Modular approach: Teams can start small (e.g. subscriptions only) and layer on quotes, taxes, or usage over time.

- Low maintenance: Most updates, pricing changes, or new plans can be configured without developer support.

- Customer success support: Available on mid-tier and enterprise plans to assist with long-term scaling.

Maxio

- Longer implementation window: Initial setup involves configuring billing logic, revenue rules, financial schedules, and integrations.

- Finance-led configuration: Designed to align with your accounting policies, often requiring finance + ops collaboration.

- Custom onboarding plans: Professional services often engaged for data migration, GL mapping, and multi-entity structuring.

- Ongoing finance operations support: Features like AR aging, invoice approvals, and deferred revenue management reduce manual effort.

- Documentation and training: Detailed guidance available for finance teams managing post-implementation workflows.

7. Pricing and total cost

Chargebee

- Free tier available: Starter plan supports up to $250K in revenue with no subscription fee—ideal for early-stage startups.

- Performance plan: ~$599/month (up to $100K MRR) with usage-based fees (~0.75%) applied to overage.

- Add-on costs: Revenue recognition, multi-site support, and advanced reporting often require higher-tier plans or modules.

- Payment processing: Transaction fees apply separately via Stripe, Braintree, etc., unless bundled via Chargebee Payments.

- Predictable for SMBs: Pricing is transparent but scales with volume and additional features.

Maxio

- No free production tier: Sandbox account available for testing, but live billing starts at $599/month (Grow plan).

- Flat pricing per MRR tier: Up to $100K MRR for Grow, with custom pricing beyond that (Scale plan).

- All-in-one pricing model: Revenue recognition, analytics, and reporting are included at no extra cost.

- Enterprise support included: Implementation, compliance support, and onboarding guidance are often bundled.

- Higher entry cost: More upfront investment compared to Chargebee, but better cost control as you scale.

8. Real-world fit: which platform for which SaaS?

Choose Chargebee if…

- You’re an early-stage or growth-stage company with relatively straightforward pricing

- You want to launch billing quickly with minimal engineering

- Your focus is on subscription workflows, checkout, and automation vs deep finance

- You value a free starter option and a broad integration ecosystem

Choose Maxio if…

- You sell complex B2B contracts, multi-year deals, or hybrid/usage-based pricing

- A CFO/Controller cares about ASC 606, GAAP compliance, and audit readiness

- You need one system for billing, rev rec, AR, and SaaS metrics

- You’re mid-market or scaling and want to consolidate tools rather than stitch together billing + rev rec + BI

Alguna: A modern alternative to Maxio and Chargebee

Y Combinator–backed Alguna is built as a unified quote-to-revenue engine for modern SaaS and AI companies, especially those combining subscriptions, usage, credits, metering, and fast-changing pricing models.

Instead of stitching together billing, usage metering, CPQ, invoicing, and revenue recognition across four or five tools (the typical Chargebee or Maxio setup), Alguna centralizes the entire revenue lifecycle in one system: pricing → quoting → contracts → metering → billing → collections → ASC 606 revenue recognition.

It’s a no-code platform, so finance, RevOps, and product teams can ship pricing changes and revenue workflows without leaning on engineering.

3 key ways Alguna differs from Maxio and Chargebee

1. Built for AI-era monetization — not just traditional SaaS plans

Maxio and Chargebee both support subscriptions and usage, but they weren’t originally built for the explosion of hybrid pricing models happening in modern SaaS.

Alguna is designed for complexity from day one:

- Usage-based billing, including API calls, tokens, agents, compute, and seats

- Event-based and time-based pricing

- Credit wallets shared across products or workspaces

- Multi-metric models such as seat + usage + minimum commit

- Prepaid usage, drawdowns, and rollover logic

- Pricing experiments shipped instantly with no engineering required

Where Chargebee focuses on subscription catalog management and Maxio focuses on finance rigor, Alguna focuses on monetization flexibility.

2. Unified quote-to-revenue (not “billing + integrations”)

Maxio and Chargebee both rely on external tools to complete the revenue lifecycle:

- Chargebee → CPQ, usage metering, forecasting, rev rec

- Maxio → usage metering, quoting, contracting, billing approvals

Alguna takes a different approach. It is built to be the single source of truth for revenue operations:

- CPQ: Configure plans, quotes, discounts, and custom terms

- Contracts: A single place to capture the truth of what was sold

- Real-time metering: No bolt-on usage tools needed

- Billing and collections: Automated on the same data source

- ASC 606 compliance: GAAP-ready schedules generated automatically

Finance and RevOps get one system to validate:

- What did we sell?

- What did we bill?

- What did we recognize?

No more reconciling three systems and a spreadsheet.

3. Built for scaling teams, not just early-stage or enterprise-heavy orgs

Chargebee is fantastic for early-stage teams. Maxio is strong for mid-market companies with established finance teams. Alguna sits in the sweet spot:

- Teams graduating from spreadsheets, homegrown billing, or patched-together Chargebee setups

- SaaS + AI companies shifting from simple subscriptions to hybrid/usage pricing

- Finance functions that need visibility and control without enterprise software friction

- Businesses expanding into multi-currency, multi-entity, or global usage

Think: fast-growing companies that want the rigor of Maxio without its implementation burden, and the flexibility Chargebee can’t offer natively.

Chargebee vs Maxio vs Alguna: How to decide

Use this simple framework for evaluating Chargebee vs Maxio vs Alguna:

Choose Chargebee if you want:

- Fast setup with minimal engineering

- Strong subscription workflows

- Great checkout and dunning

- A free starter plan

Choose Maxio if you want:

- Deep ASC 606 revenue recognition

- Complex contracts and custom billing terms

- Mid-market finance workflows

- Investor-grade SaaS metrics

Choose Alguna if you want:

- A unified quote-to-revenue system and not 4–5 stitched tools

- Native support for AI-era, multi-metric, usage-heavy monetization

- Real-time metering + billing + revenue recognition from one source of truth

- Agility for finance, product, and RevOps without engineering bottlenecks

Ultimately, the right choice depends on how your pricing and revenue motion will evolve.

If you expect your monetization to get more complex in the next 18–36 months, with more usage, more AI, more hybrid pricing, more custom terms, betting on flexibility now will pay off.

Alguna is the modern, scalable quote-to-cash engine built for that future.

Maxio vs Chargebee - See how Alguna stacks up against the legacy players

Tired of clunky and inflexible legacy systems ? Alguna was built from the ground up to give modern SaaS, fintech, and AI-native companies a smarter way to manage revenue.