For years, revenue recognition has been the part of finance no one wants to own. It’s complex, tedious, and for most teams, an endless loop of downloading CSVs, updating Excel templates, and hoping the numbers reconcile before the board meeting or audit.

But revenue recognition isn’t optional. If you’re a SaaS, fintech, or any recurring/consumption business, you know the stakes: You can’t just count money when it hits the bank. You have to prove, period by period, that you’ve actually earned it. Enter ASC-606, IFRS-15, and a host of evolving global standards.

Why is this so hard? Most billing platforms are built to invoice, not to recognize. They help you track what’s billed and paid, but not how or when that value is delivered across time. Everything else gets pushed to finance—where the reality is still monthly “spreadsheet gymnastics.”

That’s what we’re fixing today. With Alguna’s new Revenue Recognition engine, the entire flow is automated, transparent, and always audit-ready.

What actually changes?

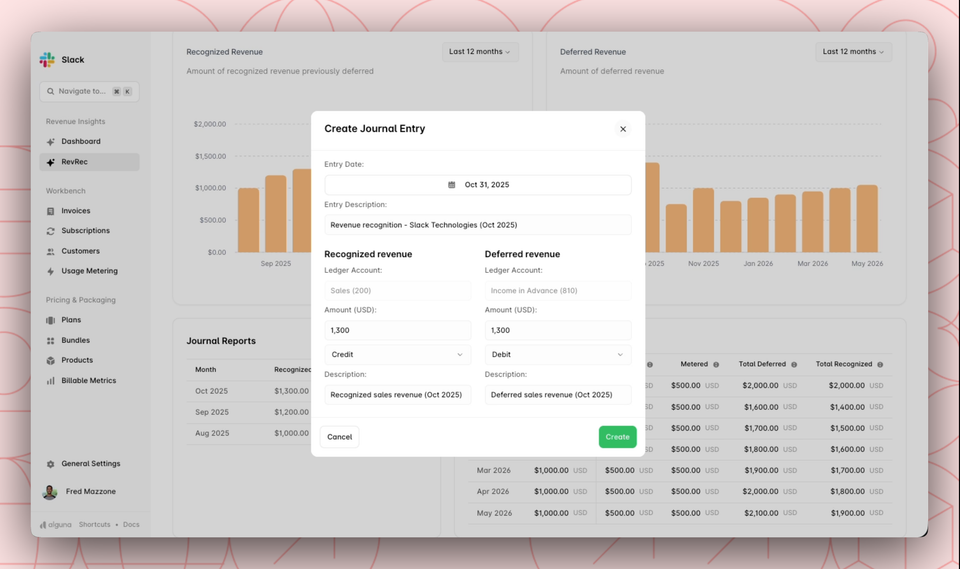

First, your source of truth is unified. Contracts, usage, upgrades, and credits all live inside Alguna, not across disconnected tools. When a contract is signed, the platform instantly generates a revenue schedule—mapping out how and when value is recognized. Whether it’s a simple SaaS subscription, a complex usage-based deal, or a mix of products and credits, Alguna calculates and updates everything in real time.

Real-time visibility:

See recognized and deferred revenue by contract, product, or entity—without waiting for the month to close or an analyst to reconcile numbers. Drill into any line item, contract, or period. Need to explain revenue for a specific SKU or region to the CFO, board, or auditor? It’s all traceable and exportable, on demand.

True automation for finance:

No more late-night Excel hacks. Journal entries for revenue and deferred revenue are posted with a click. ASC-606 and IFRS-15 rules are built in. Multi-entity and multi-currency schedules are handled natively—so you can scale globally without extra reconciliation work.

Audit-ready by design:

Every change, allocation, and event is logged. Every calculation is visible and exportable, with full drill-down for compliance or audits. Credits, refunds, and adjustments tie directly to contracts, so nothing falls through the cracks or lives in someone’s desktop files.

Why does this matter?

Because real revenue automation isn’t just about collecting cash—it’s about knowing, in real time, exactly what’s earned, what’s deferred, and what’s reportable. Product, finance, and RevOps teams all see the same numbers, the same way, at the same time.

And it means never second-guessing your numbers again. No more “Is this the right revenue?” No more “Did we recognize that upgrade?” No more waiting for the quarter to close to find out you’re out of alignment.

How does it work?

Alguna listens to every contract, billing, usage, and credit event. When something changes—a new deal, a renewal, an upsell, a refund—the revenue schedule updates instantly. You can see, post, and audit every revenue event as it happens, not after the fact.

Where does this go next?

We’re closing the loop on contract-to-cash-to-recognition. But this is just the foundation. Next up: deeper integrations with accounting systems, smarter policy enforcement, and even more granular real-time reporting for product, finance, and executive teams.

With Alguna, revenue recognition is no longer an afterthought, an extra spreadsheet, or a risk you manage with crossed fingers. It’s built in, live, and transparent—finally, the same source of truth for everyone.