• Usage-based and hybrid pricing models are the norm, requiring flexible, real-time billing infrastructure.

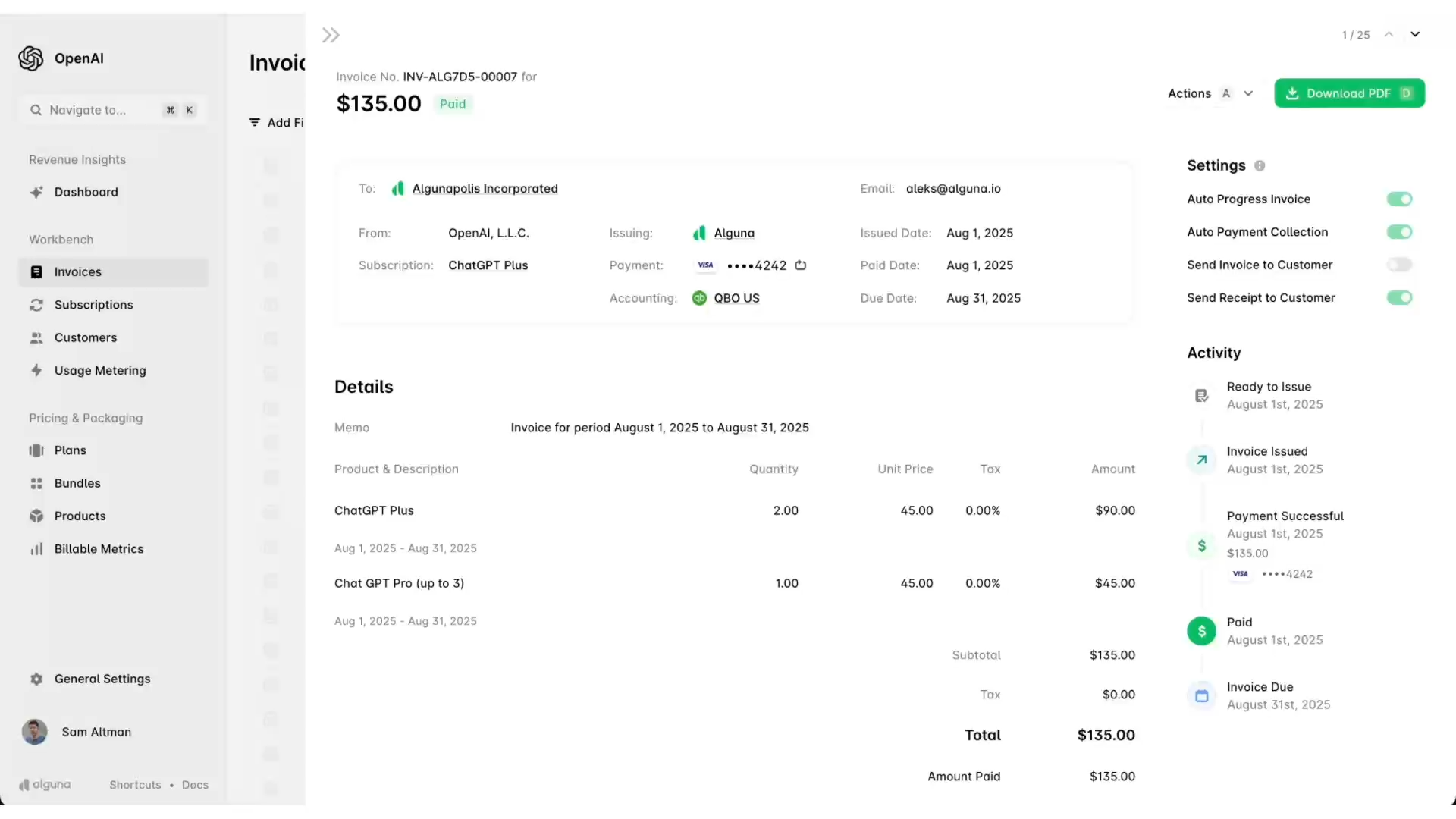

• Alguna stands out as the best invoicing software for automated recurring billing, helping SaaS and AI companies automate quote-to-cash while staying compliant—all in a single no-code system.

AI has raised the bar for billing.

As AI‑powered products continue to transform SaaS in 2026, finance teams need billing systems that can automate invoices, support AI pricing models and scale (without hidden fees).

This guide compares the best invoicing software for automated recurring billing. We’ll look at six leading platforms, including Alguna, Stripe, Chargebee, Orb, Maxio and Zuora, and explain the trends driving the need for automated recurring billing software.

3 reasons to switch to invoicing software for automated recurring billing

Traditional billing systems were designed for simple monthly subscriptions.

Today, finance teams can’t afford to run revenue on spreadsheets and manual invoicing. The subscription economy is scaling fast, usage-based pricing is everywhere, and every missed invoice means lost revenue.

Invoicing software for automated recurring billing isn’t just about saving time, it’s about accuracy, cash flow, and staying competitive in the AI-driven billing era.

1. Manual invoicing is slow and costly

Processing a manual invoice costs about $15 and takes 14 days, with 39 % error rates. Automation cuts those costs by up to 50 %, letting one person handle 23 K+ invoices per year vs. 6 K manually.

By replacing Stripe and PandaDoc with Alguna, the team at Haven went from a fragmented stack to a single end-to-end revenue platform the whole team could trust.

Read case study

2. Usage-based billing is now mainstream

B2B SaaS adoption of usage-based pricing has nearly doubled in five years, 46% of companies now run hybrid subscription + usage models according to OpenView Partners. Automated recurring billing enables real-time metering and flexible pricing to keep up.

Evervault’s billing setup wasn’t just a financial bottleneck—it was an engineering burden. The team had written and maintained thousands of lines of custom code to handle billing calculations and usage aggregations.

As usage data is being ingested automatically, both Evervault and their customers can monitor usage and billing continuously, eliminating billing surprises and improving transparency. With Alguna, the entire quote-to-cash flow is managed end-to-end by the sales team, with no need for finance intervention.

Read case study

3. Failed payments drain billions

Payment failures cause up to 5% annual customer loss and 2–5 % ARR leakage, costing businesses $440 B+ per year. Automated billing with smart retries helps recover that revenue.

After implementing Alguna, Glyphic had its second best month of all time in terms of added revenue. 75% of that revenue came from upsells that previously hadn’t been billed for because it simply was too much of a pain.

Read case study

Key features to look for invoicing software for automated recurring billing

When evaluating invoicing platforms, it’s important to make sure they’re (truly) set up to accommodate automated recurring billing.

- Automated invoice generation and scheduling: Platforms should generate recurring invoices automatically, handle proration and co‑terming, and provide customer portals with real‑time usage dashboards.

- Usage‑based and hybrid pricing support: The system must handle per‑unit, tiered, volume, graduated and prepaid models. Sophisticated platforms let teams launch new usage metrics or credit based pricing without engineering.

- Revenue recognition and compliance: ASC 606/IFRS 15 compliance, automatic revenue recognition for variable consideration, and audit‑grade logs reduce revenue leakage and speed month‑end close.

- Multi‑currency, tax and payment gateway integrations: Global businesses need native tax calculation, multi‑currency invoicing, ACH, and local gateways.

- Smart retries and dunning: Smart retries, automatic payment reminders and anomaly detection help recover failed payments and reduce involuntary churn.

- No‑code automation and workflow flexibility: Modern platforms let finance or GTM teams adjust pricing, discounts and contract terms without writing code.

Comparison overview: 5 best invoicing software for automated recurring billing

The table below summarizes key features, pricing, and preferred platform based on company type.

| Platform | Best For | Key Features | Pricing |

|---|---|---|---|

| Alguna | AI‑native, SaaS, fintech companies with hybrid GTM models. | Unified quote-to-cash, automated invoicing, e‑signature, real‑time usage metering, automated recurring subscription and usage billing, ASC 606‑ready revenue recognition, no‑code pricing designer, customer portal. | Free starter plan with up to 10 monthly recurring/one‑off invoices. Custom plans start at $399/month and include white glove onboarding and migration. No revenue share. |

| Stripe | Startups already using Stripe for payments, API‑driven teams. | Subscriptions and usage‑based billing, hosted customer portal, quotes, metered billing via Meters API. | 0.7% of billing volume (can get costly at scale). |

| Chargebee | Small and mid‑market SaaS companies needing full‑suite subscription management. | Subscription and usage billing, multiple pricing models, calendar billing, payment gateway integrations. | Starts at $599/month for up to $100k monthly billings for core features. |

| Maxio | Growth‑stage B2B SaaS teams focusing on revenue recognition and metrics. | Usage‑based billing, subscription management, recurring invoices, contract management, revenue recognition. | Starts at $599/month for up to $100k monthly billings for core features. |

| Zuora | Large enterprises with complex subscription & usage billing and multi‑entity requirements. | Subscription billing engine with support for recurring, one‑time and usage charges; product catalog, workflow automation. | Estimate minimum $50,000/year (annual contract) with limited usage thresholds. |

Observations:

- Pricing transparency and entry cost:

- Stripe’s pay‑as‑you‑go model is inexpensive to start but can become costly at scale.

- Chargebee and Maxio offer clear monthly pricing but introduce percentage overages.

- Alguna does not take a revenue share and doesn’t have hidden costs, making it an attractive choice for finance teams.

- Orb and Zuora require custom quotes and have high entry points.

- Usage‑based functionality:

- Alguna, Orb, and Zuora all support advanced usage‑based or hybrid billing models.

- Stripe offers metered billing, but complex usage requires custom API integration.

- Chargebee and Maxio provide usage billing, but may not offer real‑time event ingestion or flexible AI‑token pricing.

- Complete revenue platform:

- Alguna combines CPQ, billing, invoicing and revenue recognition in one no‑code platform.

- Maxio includes revenue recognition and metrics.

- Stripe, Chargebee and Orb require additional tools or integrations for CPQ and revenue recognition.

- Zuora offers a full suite of modules but at enterprise‑level cost.

At a glance: Evaluating invoicing software for automated recurring billing

Not all companies need the same features or scale. Use this evaluation matrix to align the platform with your business model and stage.

✅ Indicates strong support or built‑in capability

⚙️ Indicates support via API or add‑ons

⚠️ Indicates limited functionality

❌ Indicates missing functionality

| Criteria | Alguna | Stripe | Chargebee | Maxio | Zuora |

|---|---|---|---|---|---|

| Automation depth | ✅ Fully automated billing engine | ⚙️ API-dependent | ⚙️ Template-based | ✅ Finance automation | ✅ Enterprise rules engine |

| Usage-based support | ✅ Native metering & hybrid | ✅ Custom via API | ⚙️ Limited | ⚠️ Partial | ⚙️ Add-on complexity |

| Ease of setup | ✅ Fast onboarding, go live in weeks | ⚙️ Developer-driven | ⚙️ Moderate | ⚙️ Moderate | ❌ Complex |

| Scalability | ✅ Multi-entity, hybrid GTM | ✅ PLG-friendly | ✅ Mid-market | ✅ Mid-enterprise | ✅ Global enterprise |

| Revenue recognition | ✅ Built-in (streamline ASC 606/IFRS 15 compliance) | ⚙️ Add-on | ⚙️ Add-on | ✅ Native | ✅ Native |

Guidance

- Match pricing to your revenue model. If your revenue is predictable and low‑volume, Stripe’s or Chargebee’s entry plans may suffice. For usage‑heavy or AI‑driven products, prioritize platforms with real‑time metering (Alguna or Orb).

- Consider long‑term scale. Percentage‑of‑revenue models (Stripe, Chargebee) can erode margin as your billing volume grows. Monthly flat fees (Alguna) provide cost certainty. Zuora’s enterprise pricing fits only high‑budget companies.

- Evaluate automation and integrability. Platforms that combine CPQ, billing, invoicing and revenue recognition reduce systems to manage. Alguna and Maxio deliver unified workflows, Orb requires pairing with other tools, Stripe, Chargebee and Zuora integrate with various CRMs and ERPs but may need custom workflows.

- Don’t overlook compliance and analytics. Audit‑ready revenue recognition, multi‑entity accounting and customer‑level insights are essential for enterprise growth. Choose vendors that offer these capabilities or integrate seamlessly with your accounting system.

Why Alguna is the best invoicing software for automated recurring billing

Alguna stands out because it unifies pricing, quote‑to‑cash, usage metering, invoicing and revenue recognition in a single no‑code platform.

Whereas other tools force teams to piece together separate CPQ, billing and analytics systems, Alguna offers:

- Real‑time usage metering: Capture every event (API calls, tokens, or custom metrics) in real time. No more reconciling batch logs or spreadsheets.

- Flexible hybrid pricing: Launch prepaid, pay‑as‑you‑go, tiered or AI‑token plans without engineering involvement. Combine subscriptions, usage, and one‑off add‑ons on the same invoice.

- Automated invoicing and co‑terming: Generate consolidated invoices, handle proration, manage credit balances, and automate dunning; customers see live usage dashboards and projected charges.

- Built‑in revenue recognition: Automate ASC 606/IFRS 15 compliance, variable consideration recognition and audit‑grade logs, enabling faster month‑end close.

- Seamless integrations: Connect to CRMs (Salesforce, HubSpot) and accounting tools (QuickBooks, Xero, NetSuite) with webhooks and APIs.

Alguna makes it easy for AI, SaaS, and fintech companies to get started with automated invoicing and recurring billing as customers get set up in weeks, not months.

For companies monetizing AI agents, generative models or complex SaaS offerings, Alguna’s billing engine provides a future‑proof billing foundation.

Choosing the right invoicing software for automated recurring billing

Invoicing software that supports automated recurring billing is no longer optional.

The rise of AI products and usage‑based pricing means finance teams must track granular events, automate invoices, comply with revenue standards and adapt pricing on the fly.

Each platform in this guide serves different needs:

- Alguna is an end-to-end AI monetization platform that combines no‑code CPQ, real‑time usage metering, automated invoicing for recurring billing, and revenue recognition, making it the most comprehensive and cost‑efficient choice for modern AI‑native and hybrid SaaS businesses.

- Stripe offers an easy on‑ramp for startups already processing payments on Stripe but charges a percentage of revenue and requires engineering for complex usage.

- Chargebee and Maxio provide subscription‑first billing with usage add‑ons, revenue recognition and mid‑market pricing; they work well for traditional SaaS but may struggle with real‑time AI metering.

- Orb excels at real‑time event ingestion and hybrid pricing but lacks CPQ, revenue recognition and may be costly for early‑stage firms.

- Zuora is an enterprise‑grade suite for large companies with multi‑entity operations and significant budgets.

By aligning your choice with your business model, growth stage and the complexity of your pricing, you can ensure that your billing stack is built for scale.

In a time where the stakes are higher than ever, bad billing shouldn’t be the reason revenue teams fall on the finish line.

Put billing on autopilot with Alguna

Finance teams deserve better than spreadsheets and scripts. Discover how Alguna's invoicing software automates recurring billing.