Choosing the wrong tool—or buying them in the wrong order—creates long-term friction. Poor handoffs between sales, legal, and finance lead to manual work, revenue leakage, and expensive re-implementations later.

Modern SaaS, fintech, and AI pricing models raise the stakes. Usage-based, hybrid, and custom pricing dramatically increase the need for pricing-aware CPQ, while CLM becomes essential as contract volume and complexity grow.

If you’re evaluating CLM vs CPQ (or CPQ vs CML) software, you’re probably dealing with one of two problems:

- Sales is moving fast, but quotes, pricing approvals, and custom deals are slowing everything down

- Contracts are scattered across inboxes, shared drives, and PDFs, making renewals, compliance, and revenue forecasting painful

Both CLM (contract lifecycle management) and CPQ (configure, price, quote) are designed to remove friction, but they solve very different parts of the revenue lifecycle.

Choosing the wrong one (or buying them in the wrong order) can lock you into manual work, broken handoffs, and expensive re-implementation later.

This guide breaks down CLM vs CPQ in plain English, shows where each fits in the quote-to-revenue flow, compares leading platforms, and helps you decide what your business actually needs, especially if you’re running SaaS, fintech, or AI pricing models.

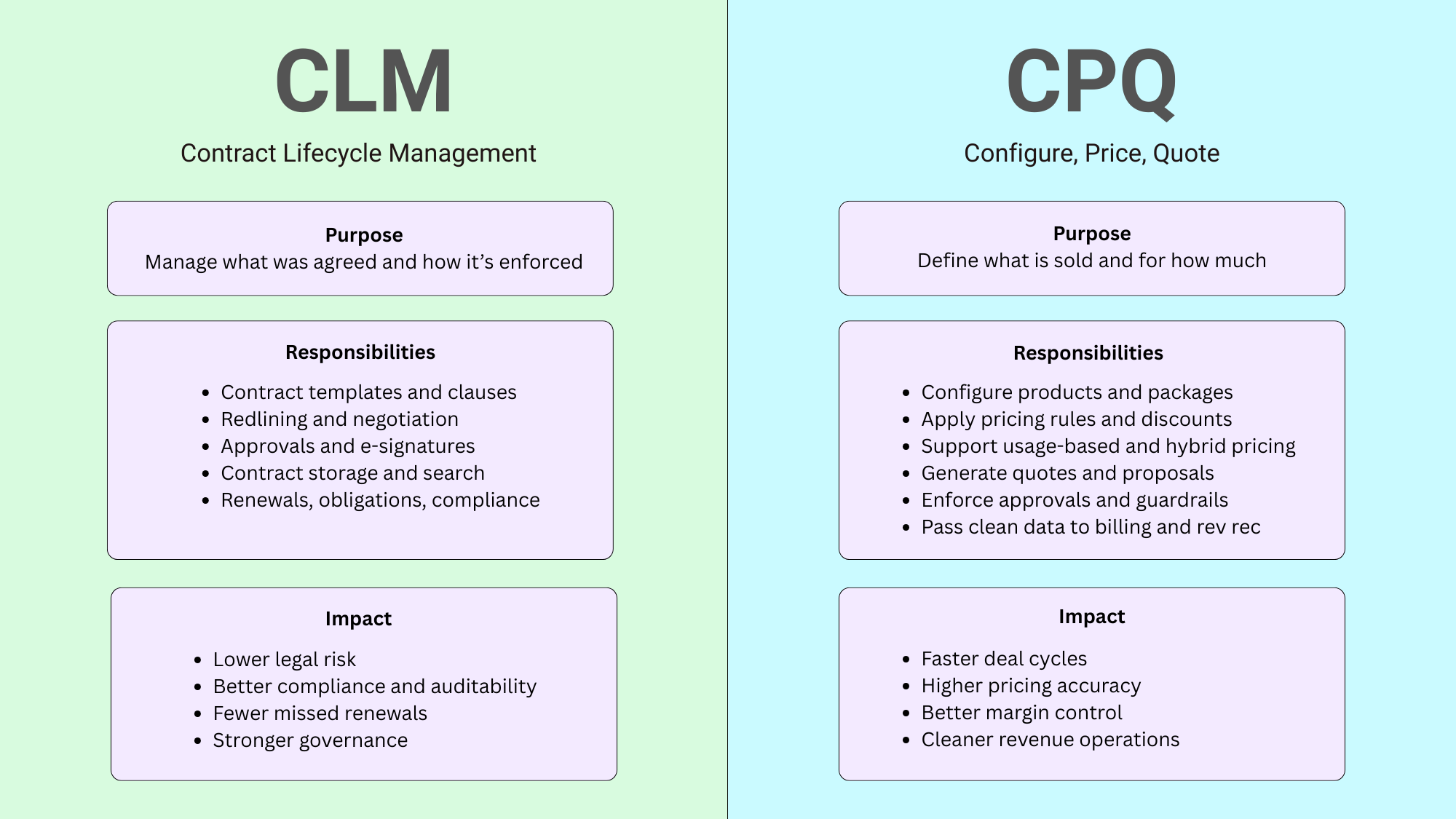

What is CPQ and what is CLM?

What is CPQ (Configure, Price, Quote)?

CPQ software helps sales teams build accurate, compliant quotes quickly. It controls how products are configured, how pricing is calculated, and how quotes are generated—often in real time.

A modern CPQ typically handles:

- Complex pricing (usage-based, tiered, hybrid, credits, ramps)

- Deal approvals and guardrails

- Quote generation synced to CRM

- Downstream handoff to billing and revenue recognition

CPQ sits before the contract is signed and is tightly coupled with how revenue is sold.

What is CLM (Contract Lifecycle Management)?

CLM software manages contracts after pricing is agreed, from draft to signature through renewals and amendments.

A CLM typically handles:

- Contract templates and clause libraries

- Legal review and redlining

- E-signature workflows

- Renewal tracking and obligations

CLM sits around the legal agreement itself, not the pricing logic behind it.

CPQ vs CLM: 4 key differences

- Focus of the tool

CPQ is a front‑end sales tool that configures products, applies pricing rules and outputs quotes. CLM is a back‑end legal tool that manages contract drafting, negotiation and renewal. - Timing in the process

CPQ operates before signature to ensure offers are accurate; CLM operates after signature to manage obligations and compliance. - Users

CPQ is primarily used by sales, RevOps and finance. CLM is used by legal, procurement and customer success teams. - Data handoff

Integrating CPQ and CLM ensures that structured deal data (SKUs, pricing, discounts, quantities) flows seamlessly into the contract, eliminating manual re‑entry and reducing errors. Integration can improve deal velocity by 15–25 %.

CPQ ensures the right products and prices are offered, while CLM ensures the resulting contract is executed correctly and obligations are tracked.

Comparison overview: CPQ vs CLM comparison table

The comparison table below outlines how CPQ and CLM differ across ownership, use cases, strengths, limitations, and pricing.

This view highlights where each system fits in the revenue lifecycle and which teams typically benefit most.

⚠️ *Pricing is indicative in some cases. Vendors often provide custom quotes based on seats, deal volumes or modules.

| Platform | Best for | Pros | Cons | Pricing* |

|---|---|---|---|---|

| Alguna (CPQ + billing) | SaaS, AI & fintech teams with hybrid pricing | Unified quote-to-revenue; usage-based pricing; no-code configuration | Newer platform; may be overkill for simple SKUs | Starts at ~$699/month |

| Salesforce Revenue Cloud | Enterprises already on Salesforce CRM | Deep Salesforce integration; highly customizable rules | Long implementations; high cost; complex for usage billing | Custom (often $75k+ annually) |

| DealHub | B2B sales teams needing CPQ + CLM + digital sales rooms | Guided selling; deal collaboration; built-in CLM | Usage billing requires add-ons; premium pricing | Custom (from ~$10k/year) |

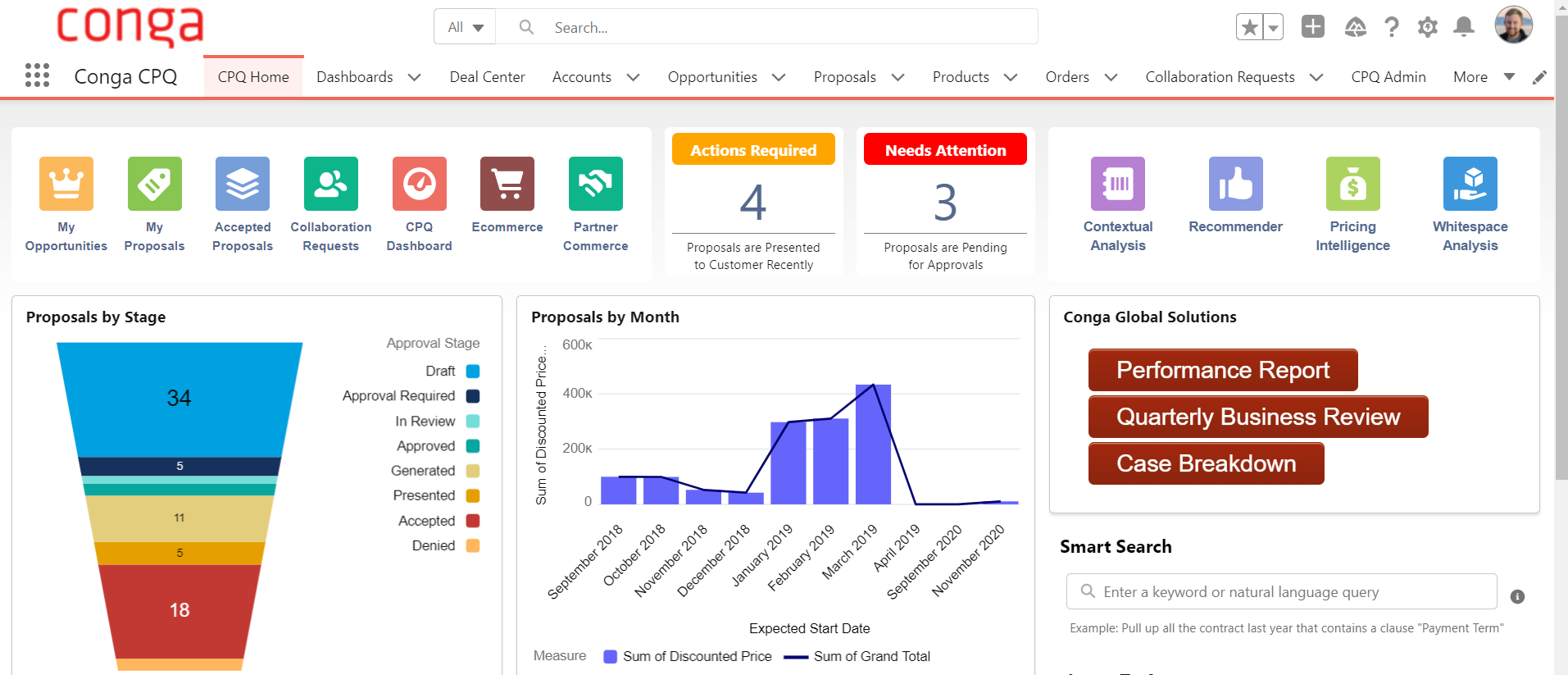

| Conga CPQ / CLM | Mid-market to enterprise looking for a unified stack | Mature CPQ and CLM modules; robust integrations | Heavy implementation; pricing not transparent | Custom / enterprise |

| Ironclad (CLM) | Legal-led teams requiring modern contract workflows | Intuitive interface; strong compliance and collaboration | No native pricing logic; CPQ required for quotes | Custom / per user |

| DocuSign CLM | Organizations already using DocuSign e-signatures | Familiar signing experience; contract workflows | Limited pricing and billing capabilities | Enterprise pricing |

| Sirion (CLM) | Enterprises seeking AI-driven contract governance | AI-powered negotiation; risk dashboards; CPQ integrations | Post-signature focus; requires CPQ for pricing | Custom / enterprise |

| Icertis (CLM) | Global enterprises with complex legal terms | Deep clause libraries; analytics; advanced workflows | Long deployment cycles; integration complexity | Custom / enterprise |

CPQ vs CLM: 6 platforms to consider

Once you understand the conceptual difference between CPQ and CLM, the next challenge is practical: which tools actually deliver on those promises in the real world?

Not all CPQ platforms are built to handle modern SaaS monetization and AI pricing models, and not all CLM tools integrate cleanly with sales and revenue workflows.

Some solutions are sales-led, others are legal-led. Some focus narrowly on contracts or quotes, while others try to span the entire quote-to-revenue lifecycle—with very different trade-offs.

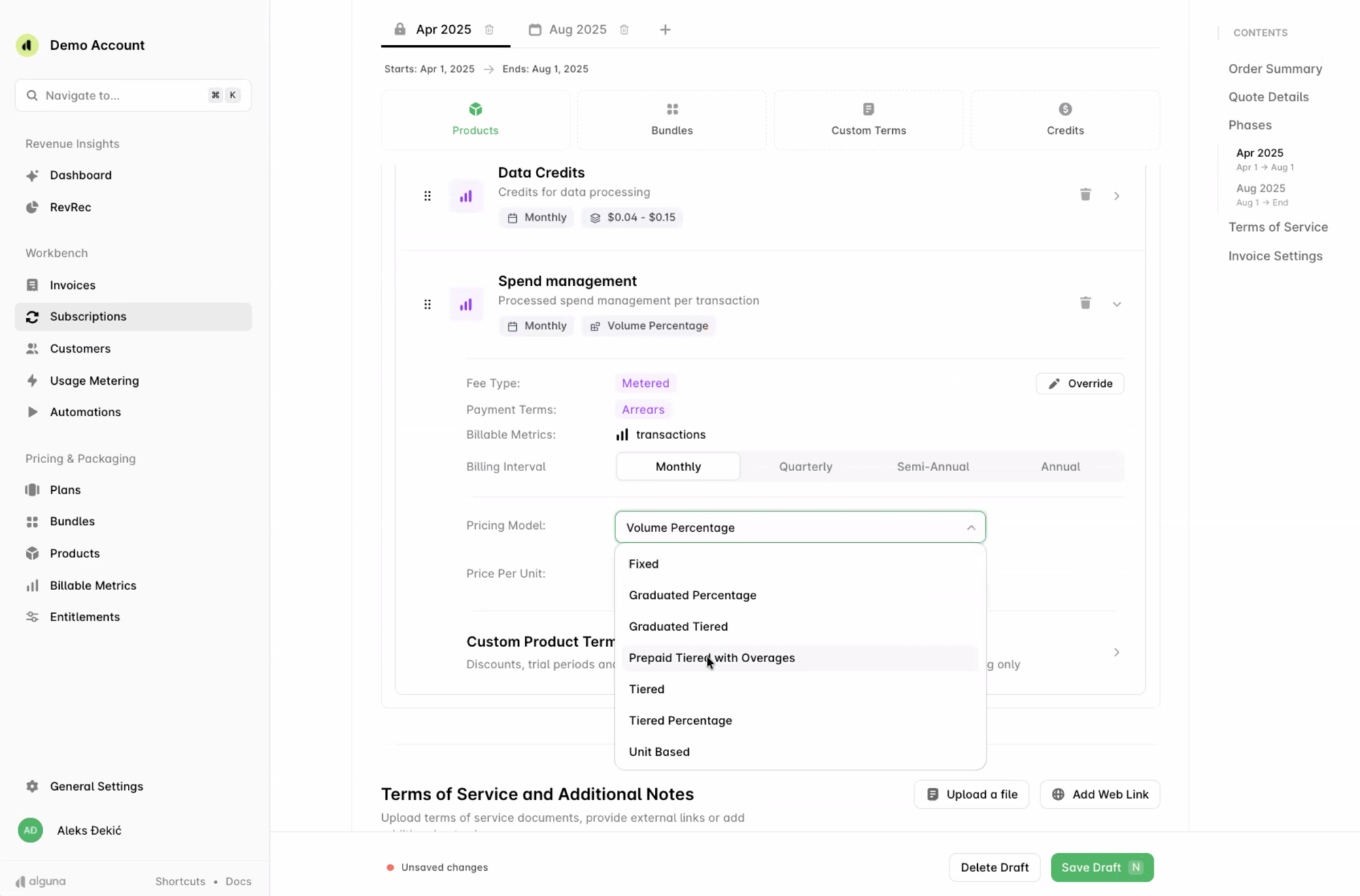

Alguna: Best CPQ for end-to-end quote-to-revenue automation in SaaS

Alguna is a no‑code quote‑to‑revenue platform designed for modern SaaS, AI and fintech companies. It unifies CPQ, billing, usage metering and revenue recognition in one system.

Sales teams can configure products, set usage‑based pricing, automate approvals and generate quotes. Once the customer agrees, the same system creates a contract, invoices usage and recognizes revenue.

Key features

- No‑code CPQ builder for subscriptions, usage‑based, tiered and hybrid pricing models

- Real‑time usage metering and rating

- Automated billing, invoicing and dunning

- Native revenue recognition (ASC 606 / IFRS 15 compliant)

- Pre‑built templates and workflows for SaaS and fintech pricing

- Deep integrations with Salesforce and HubSpot

- Multi‑entity and multi‑currency support

Pros

- Eliminates handoff between CPQ, billing and rev rec, reducing errors and delays

- Supports complex pricing (usage, credits, ramps) without engineering

- Quick implementation (weeks, not months)

Cons

- Newer solution; ecosystem is still maturing

- May be more than needed for simple subscription‑only products

Best for

- Startups and scaleups with hybrid or usage‑based pricing

- RevOps teams seeking a unified quote‑to‑revenue workflow

Pricing

- Flat monthly fee starting around $699/month with no revenue share (free tier available). Custom pricing for larger teams.

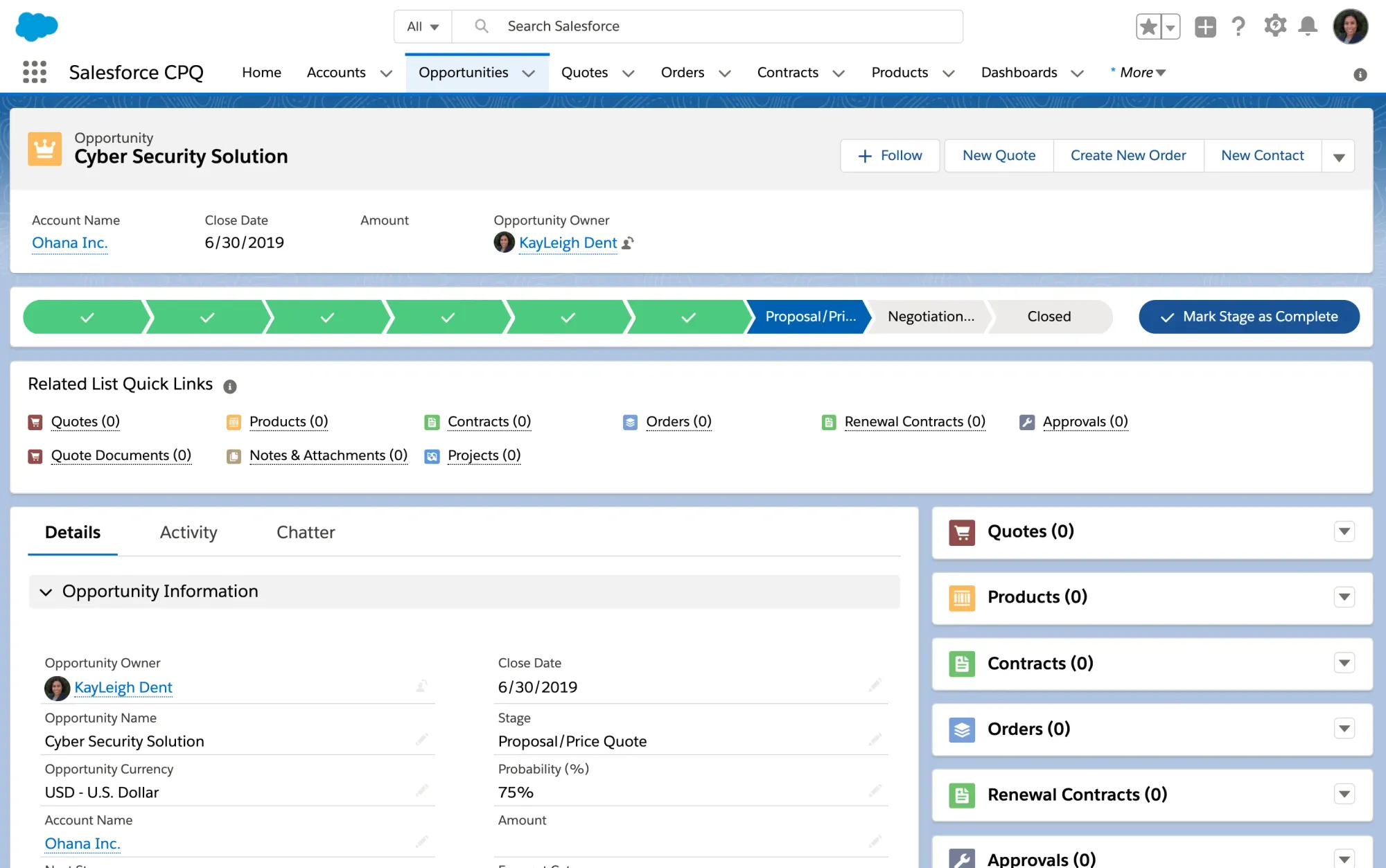

Agentforce Revenue Management (Salesforce Revenue Cloud): Best CPQ for large enterprises already on Salesforce

Agentforce Revenue Management (formerly Salesforce Revenue Cloud) is the CPQ module within the Salesforce ecosystem. It provides configuration, pricing, quoting, billing and revenue management capabilities built on top of Salesforce CRM.

Key features

- Configurable product and pricing rules integrated with Salesforce CRM

- Approval workflows and guided selling

- Integration with Salesforce Billing and Revenue Recognition

- Multi‑currency and multi‑language support

- Extensive ecosystem of partner apps and customizations

Pros

- Deeply integrated with Salesforce CRM and Sales Cloud

- Highly configurable; handles complex discount and approval rules

- Mature ecosystem with many implementation partners

Cons

- Long implementation cycles and heavy custom coding

- Designed around subscription/SKU pricing; limited native usage‑based billing

- Expensive, particularly after adding billing and rev‑rec modules

Best for

- Enterprises already standardized on Salesforce CRM

- Complex sales organizations needing a robust, configurable CPQ

Pricing

- Custom quotes based on users and modules; typically $75k–$250k+ per year when implemented with billing and revenue recognition.

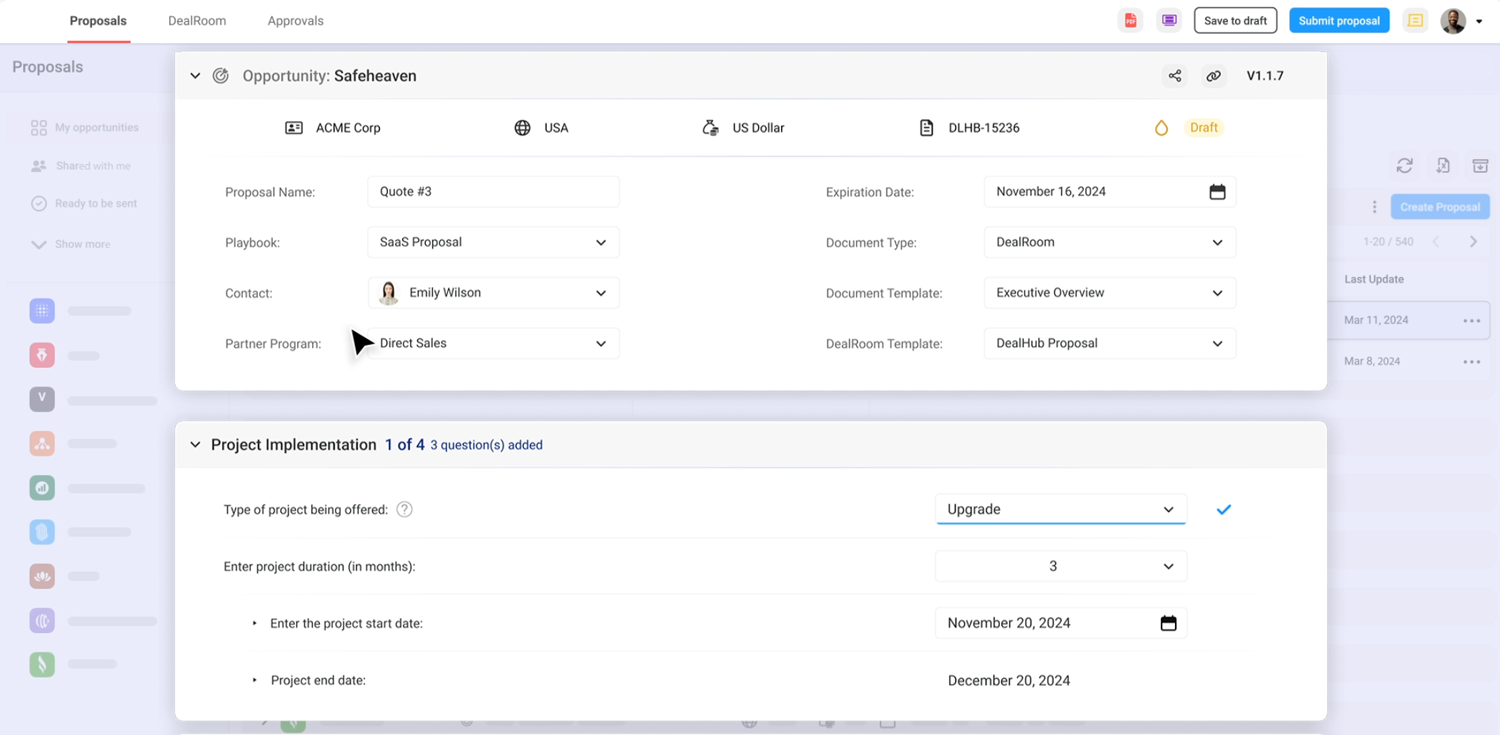

DealHub: Best CPQ for sales-led teams that need collaboration and approvals

DealHub is a no‑code CPQ and deal orchestration platform that combines CPQ, contract lifecycle management and digital sales rooms into a unified workspace. It emphasizes deal collaboration and buyer engagement.

Key features

- Guided selling flows for product configuration and discount approvals

- Digital DealRoom for buyer‑seller collaboration and document sharing

- Built‑in CLM for drafting, redlining and signing contracts

- Multi‑CRM support (Salesforce, HubSpot, Microsoft Dynamics)

- Analytics and performance insights

Pros

- Strong collaboration tools for complex, multi‑stakeholder deals

- Unified platform with CPQ and CLM modules

- Faster implementation than legacy CPQ systems

Cons

- Usage‑based pricing still requires manual setup or external billing

- Feature set can feel heavy for teams needing only simple CPQ

- Premium pricing for advanced functionality

Best for

- B2B sales teams running collaborative, high‑value deals

- Organizations wanting CPQ + CLM + digital sales rooms in one platform

Pricing

- Custom pricing starting around $10k/year, but it varies by seats and modules.

Conga: Best CPQ + CLM for document-heavy enterprise workflows

Conga provides a suite of quote‑to‑cash applications, including CPQ and CLM modules, document generation and revenue management. It evolved from Apttus and serves mid‑market and enterprise customers looking for an integrated stack.

Key features

- CPQ for product configuration and pricing rules

- CLM for contract drafting, negotiation and management

- Document generation and e‑signature

- Conga Max AI assistant for guided selling

- Integration with Salesforce and other CRMs

Pros

- Mature and comprehensive quote‑to‑cash suite

- Strong native integration with Salesforce CRM

- Scalable for complex enterprise pricing and contracting

Cons

- Implementation can be lengthy and requires consultants

- UI and user experience can feel dated compared with newer platforms

- Pricing transparency is limited; many modules require separate licenses

Best for

- Large organizations needing a unified CPQ + CLM stack

- Salesforce‑centric enterprises that want to stay within a single ecosystem

Pricing

- Custom enterprise pricing; often six‑figure annual contracts depending on modules.

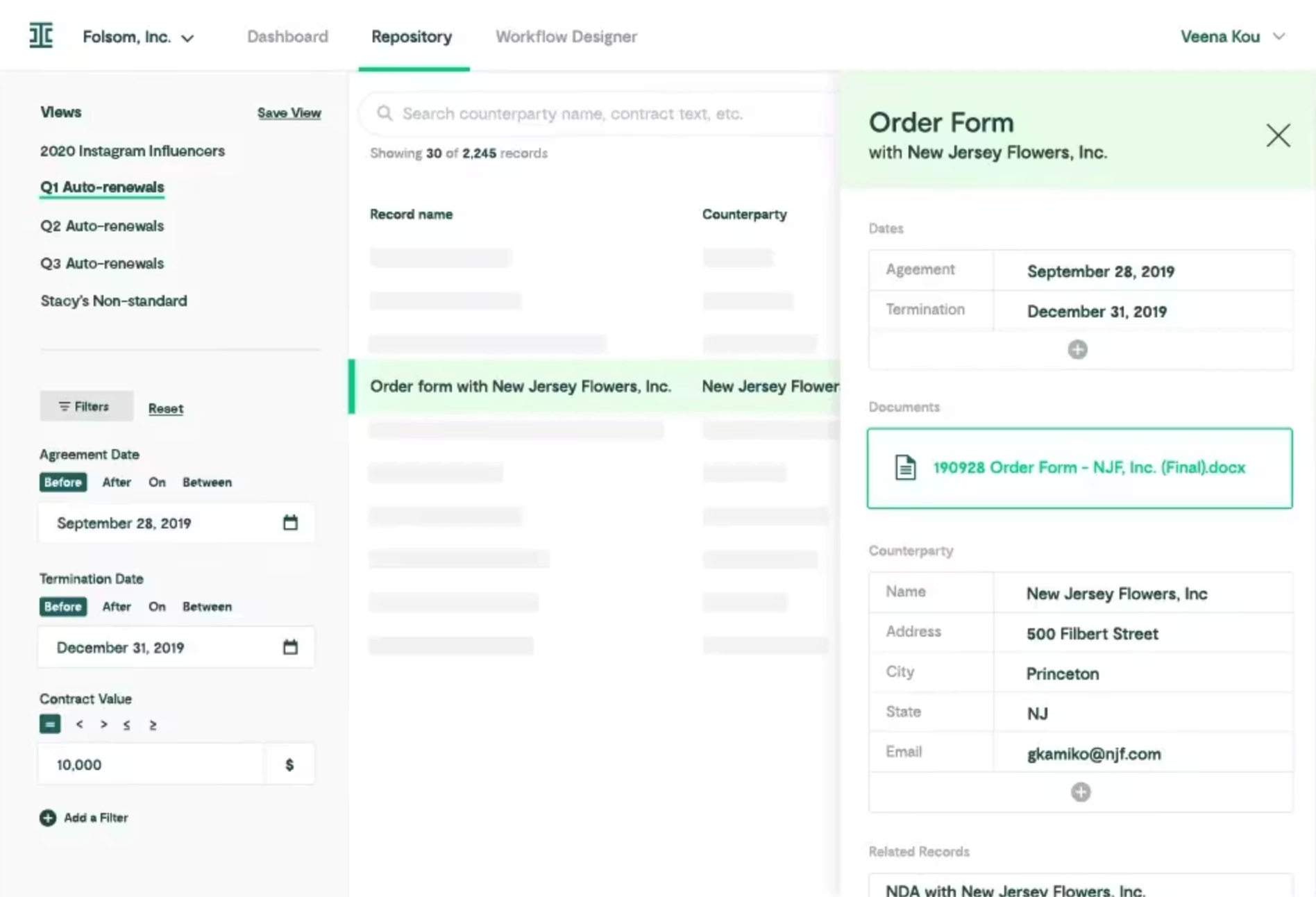

IronClad: Best CLM for legal-first contract management

Ironclad is a modern CLM platform focused on legal workflows and collaboration. It provides an intuitive interface for drafting, negotiating and approving contracts and is popular among legal teams at technology companies.

Key features

- Contract creation from templates and clause libraries

- Redlining and version control with internal/external collaborators

- Automated approval workflows and e‑signature integration

- Contract repository with search and analytics

- Obligations and renewal tracking

Pros

- Excellent user experience and collaboration features

- Strong compliance and audit capabilities

- Integrations with CRM, ERP and e‑signature tools

Cons

- No pricing logic or quote generation; requires CPQ for pricing

- Pricing can be high relative to point‑solution CLMs

Best for

- Legal teams that need a modern, user‑friendly contract platform

- Companies with high contract volume and complex negotiation cycles

Pricing

- Subscription pricing per user; custom quotes based on seats and volume.

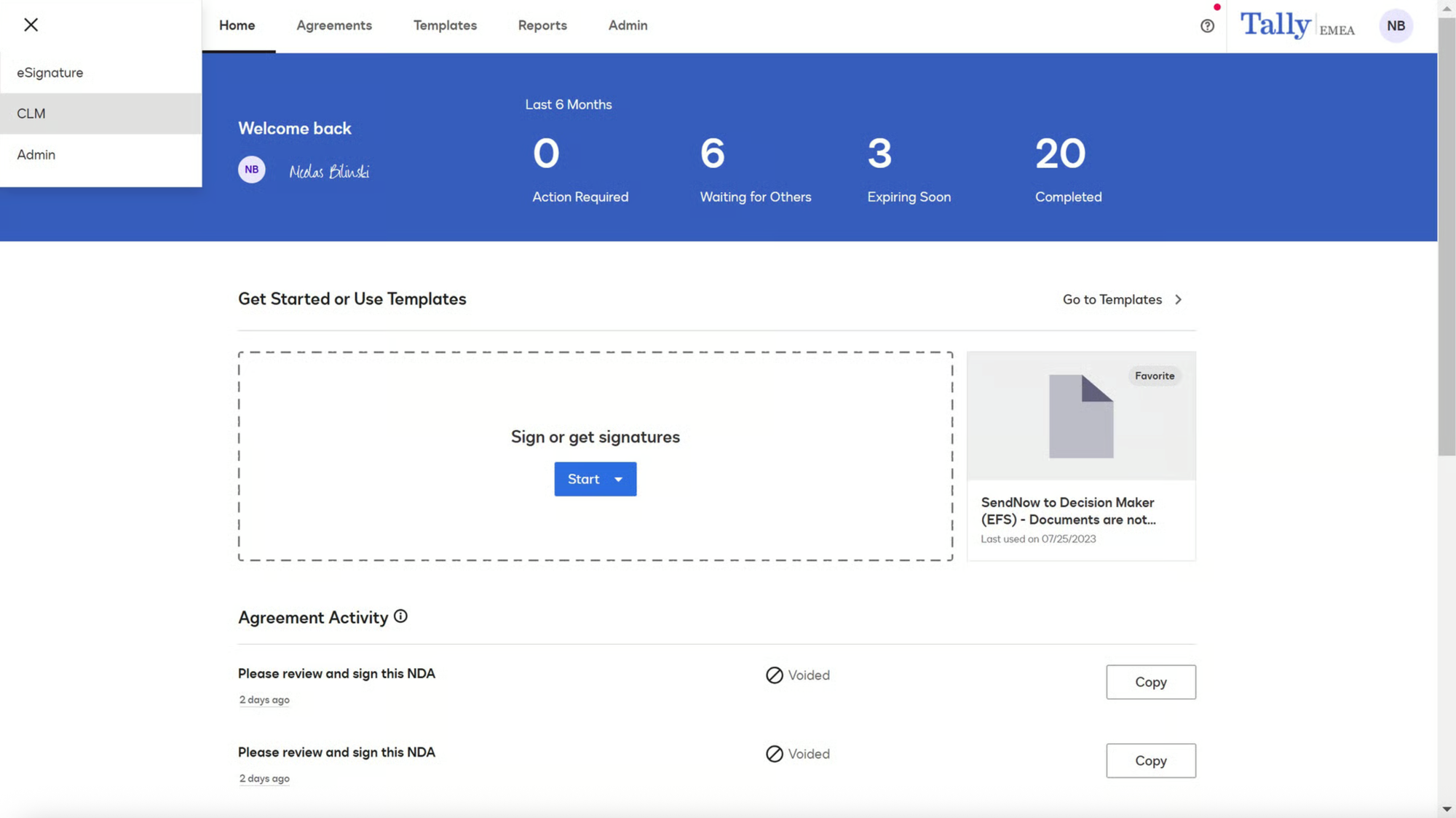

DocuSign: Best CLM for teams standardizing on DocuSign

DocuSign CLM extends the company’s well‑known e‑signature service into full contract management. It helps organizations generate, negotiate and track contracts while connecting seamlessly to DocuSign e‑signatures.

Key features

- Automated workflows for contract creation and approvals

- Clause libraries and templates

- Native integration with DocuSign e‑signature

- Obligation management and audit trails

- API and connectors to CRM/ERP systems

Pros

- Familiar signing experience for end users

- Flexible workflows and automation

- Strong ecosystem of connectors

Cons

- Limited pricing and billing capabilities; requires separate CPQ or billing tool

- Enterprise pricing may be prohibitive for small teams

Best for

- Businesses already using DocuSign for e‑signatures

- Legal and procurement teams needing a unified signing + contract management platform

Pricing

- Enterprise packages with custom pricing based on users and features.

Sirion

Sirion is an AI‑native CLM platform that focuses on post‑signature contract governance, risk management and performance tracking. Its AI assistants help with extraction, clause recommendation and negotiation.

Key features

- AI‑powered clause extraction and redlining assistance

- Risk scoring and obligation management dashboards

- Integration with SAP CPQ, Salesforce CPQ and other pricing tools

- Contract repository with conversational search

- Automated renewals and amendments

Pros

- Advanced AI capabilities for negotiation and risk mitigation

- Strong integration capabilities with CPQ systems

- Helps reduce quote‑to‑contract cycles and pricing errors significantly

Cons

- Primarily post‑signature; still requires a CPQ tool for pricing

- AI features may require change management and training

Best for

- Enterprises looking for AI‑driven contract governance and analytics

- Organizations using SAP or Salesforce CPQ wanting a connected CLM

Pricing

- Custom enterprise pricing; typically part of larger digital transformation initiatives.

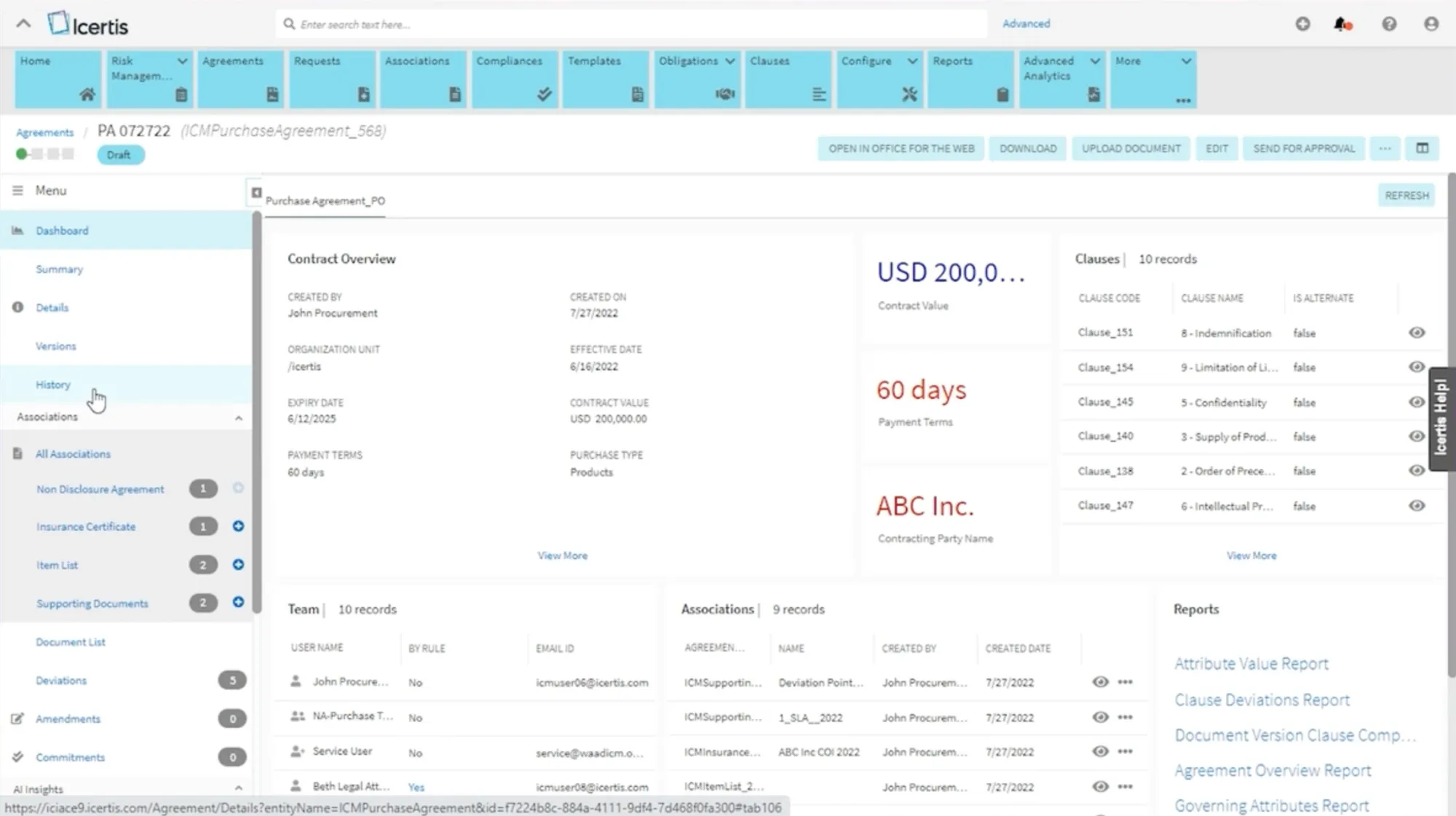

Icertis

Icertis is an enterprise‑grade CLM platform known for its robust clause management, obligation tracking and analytics. It serves some of the world’s largest companies across multiple industries.

Key features

- Centralized clause and template libraries

- Intelligent obligation and compliance tracking

- Advanced contract analytics and reporting

- AI‑driven risk scoring and insights

- Integration with ERP/CRM systems (SAP, Microsoft, Salesforce)

Pros

- Highly configurable for diverse industries and geographies

- Strong analytics and compliance capabilities

- Supports complex contract structures (e.g., frame agreements)

Cons

- Lengthy deployment cycles and high implementation costs

- User interface can be less intuitive than newer CLM tools

Best for

- Large enterprises with complex legal and regulatory requirements

- Companies needing global, cross‑functional contract management

Pricing

- Enterprise pricing; typically custom and dependent on contract volume and integration scope.

How to evaluate CPQ vs CLM for your SaaS business

Ask these questions before buying anything:

- Where does revenue complexity actually live?

If pricing, usage, and billing are painful, CPQ should come first. - Who owns the problem—sales, finance, or legal?

CPQ is finance + RevOps-led. CLM is legal-led. - Do pricing terms need to flow into billing automatically?

If yes, CPQ (or quote-to-revenue) matters more than CLM. - What breaks at scale?

Most companies regret under-investing in CPQ once custom deals pile up.

Frequently asked questions: CLM vs CPQ

Is CPQ the same as CLM?

No. CPQ manages product configuration, pricing and quoting before a contract is signed; CLM manages contract creation, negotiation, execution and renewal after the quote is accepted. They solve different problems and are often used together.

Do small companies need CPQ or CLM?

Small companies with straightforward pricing and a handful of contracts may get by with templates and spreadsheets. However, once deal volume or pricing complexity grows, CPQ and CLM quickly pay for themselves by reducing errors and accelerating sales cycles.

Modern no‑code tools allow small teams to implement CPQ in weeks and see 10× faster quoting.

Can CPQ replace CLM?

CPQ cannot replace CLM. CPQ ensures accurate offers; CLM ensures those offers become enforceable contracts and that obligations are tracked. Using only CPQ leaves gaps in negotiation, compliance and renewal management, while using only CLM doesn’t solve pricing complexity.

What is the ROI of integrating CPQ and CLM?

Integrated CPQ‑CLM stacks can deliver significant ROI: companies report 30–50 % faster quote‑to‑contract cycles and up to 90 % reduction in pricing or contract errors. They also see 15–25 % improvements in deal velocity and fewer post‑signature disputes.

CPQ vs CLM: Why scaling revenue teams should start with CPQ

Choosing between CPQ and CLM (or deciding to adopt both) comes down to understanding where exactly friction exists in your revenue process.

CPQ accelerates quoting, enforces pricing rules and improves accuracy, while CLM governs contract drafting, negotiation and renewal. Modern businesses selling usage‑based or hybrid pricing need both functions to work together seamlessly.

By evaluating your pricing complexity, process bottlenecks, integration needs and total cost of ownership, you can select the right solution for your business. For many SaaS, AI and fintech teams, a unified quote‑to‑revenue platform like Alguna combines CPQ, billing and revenue recognition to eliminate handoffs and accelerate revenue.

Book a demo with Alguna

If you’re evaluating CLM vs CPQ because pricing complexity is creeping in—or already breaking your close, Alguna can help.

👉 Book a demo with Alguna to see how modern CPQ, usage-based billing, and revenue recognition work together in one platform—without the legacy overhead.