If your CPQ was designed for seat-based SaaS, it will fail in a usage-based world.

Today, nearly 3 out of 5 software companies use or test usage-based pricing models.

This means quotes must reflect units consumed (API calls, seats, gigabytes, tokens, etc.), not just flat subscriptions.

That's why modern no-code CPQ (Configure-Price-Quote) tools are becoming essential to automate complex usage-based quotes.

In this guide, we'll dive into what's (actually) required from a CPQ for usage-based pricing and take a look at the platforms that are up for the task.

CPQ for usage-based pricing: What it is and how it works

Setting up a usage-based quote in Alguna's no-code CPQ.

CPQ for usage-based pricing is a quoting system built to sell and manage contracts where the final bill depends on how much a customer actually uses the product.

Instead of just producing a flat “$X per year” price, it lets companies quote things like:

- Minimum commitments

- Included usage

- Overage pricing (pay-as-you-go beyond the commit)

- Volume or tiered rates

- Ramp schedules and caps

- Credit packs or prepaid balances

In other words, it turns a complex consumption model into a structured, enforceable contract.

Why this is different from traditional CPQ

A traditional CPQ assumes revenue is fixed when the deal is signed. It’s designed for seat-based or flat-fee subscriptions where the only thing that changes is how many licenses are sold.

A usage-based CPQ assumes revenue is variable after the sale. It has to capture not just what the customer buys, but how revenue will scale as usage changes.

So instead of:

“This is a $100,000 contract”

A usage-based CPQ produces:

“This is $50,000 guaranteed, includes 10 million units, charges $0.002 per extra unit, and caps at $300,000.”

That structure is what allows accuracy in billing, revenue recognition, and forecasting.

CPQ built for usage-based pricing: How it works

Unlike traditional CPQ tools that handle flat-rate or seat-based subscriptions, a CPQ built for usage-based pricing is designed to model dynamic, consumption-driven revenue.

Here's how it works:

- Usage metric configuration

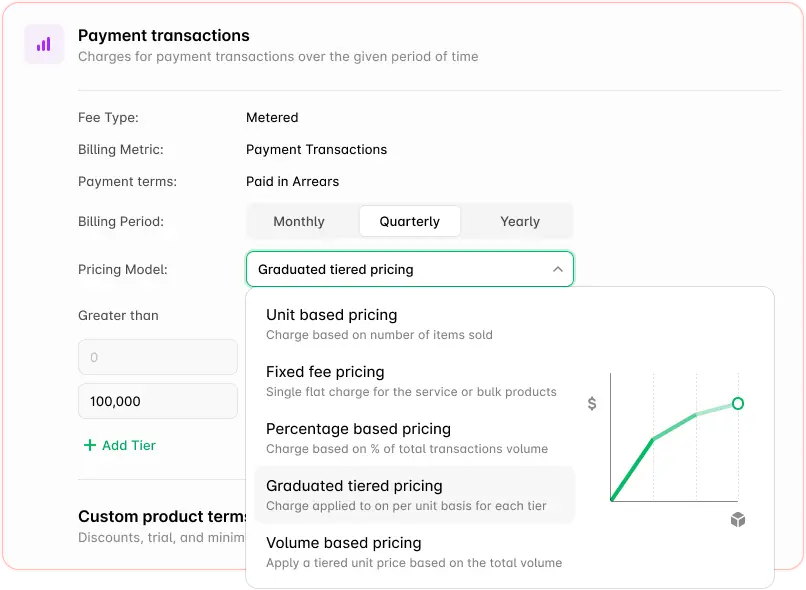

Admins define usage metrics (e.g., API calls, tokens, data processed) as configurable products within the CPQ. These can be priced per unit, by block, tier, or volume. - Flexible pricing logic

The CPQ supports SaaS monetization and AI pricing models like:- Tiered pricing (e.g., $0.10 per call for the first 1M, $0.08 thereafter)

- Volume discounts

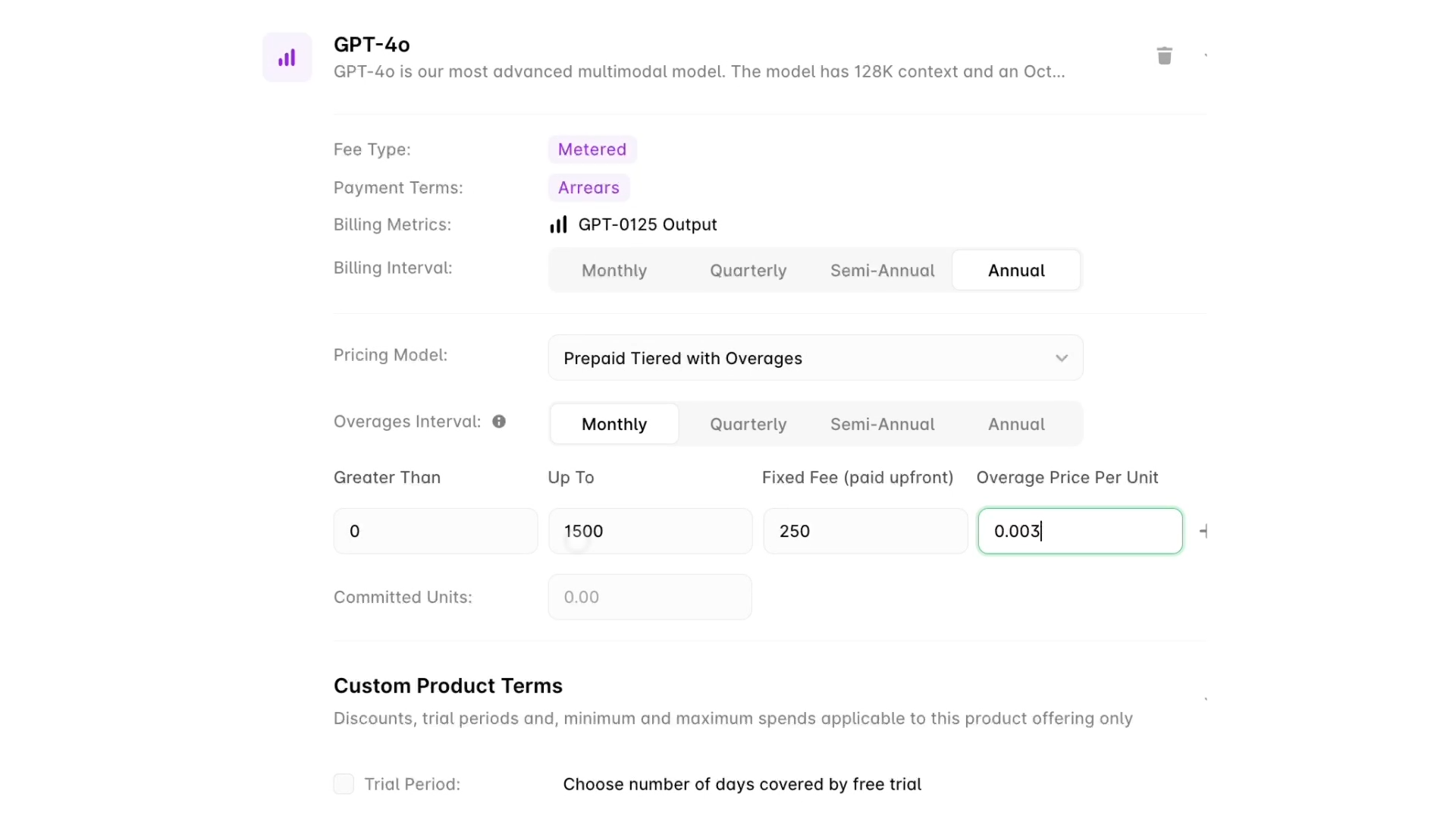

- Prepaid credit buckets with expiration logic

- Minimum commitments + overage charges

- Hybrid deal structures

Sales reps can combine:- Fixed-fee subscriptions

- Usage-based services

- One-time implementation fees

into a single, unified quote—with each component calculated accurately.

- Real-time quote modeling

Reps can enter estimated usage to show projected monthly or annual costs. The CPQ auto-updates quote totals, discounts, and margin metrics in real time. - Integration with billing systems

Once a quote is approved, the usage logic flows into the billing platform, ensuring the invoice reflects the exact structure quoted (tiers, overages, credits, etc.). - Change-ready contracts

Usage-based CPQs support mid-contract changes: upsells, usage ramping, renewals, and proration. This reduces friction when customers grow or shift their usage patterns. - No-code management

Modern CPQs like Alguna allow pricing teams—not developers—to update usage tiers, launch new SKUs, and adjust rate cards on the fly without writing code.

8 non-negotiable capabilities for CPQ for usage-based pricing

Modern sales teams need a CPQ that treats usage as the core commercial object. Because in modern SaaS, AI, and fintech, how customers use your product is how you get paid.

Below, we've put together 8 non-negotiable capabilities for CPQ software for usage-based pricing.

1. Commitments + overages in the same quote

Your CPQ must be able to quote deals like:

“$50K minimum, includes 10M API calls, $0.002 per extra call.”

That means supporting:

- Minimum commitments (revenue floors)

- Included usage

- Overage pricing

- Multiple meters per deal

Without this, Finance can’t tell what revenue is guaranteed vs variable, which turns forecasting and revenue recognition into guesswork.

2. Tiered, volume, and ramped pricing logic

Real usage deals aren’t flat.

You need native support for:

- Volume tiers (price drops as usage increases)

- Tiered pricing (different blocks priced differently)

- Ramps (usage or commitments that increase over time)

This matters because:

- Sales sells it

- Billing must enforce it

- Finance must forecast and recognize it

If CPQ can’t express it cleanly, someone ends up rebuilding it manually later.

3. Usage-aware contract generation

Your contract should not just say “Customer pays for usage.”

It should specify:

- What counts as usage

- How it’s measured

- What’s included

- What triggers overages

- How pricing changes at different levels

A good CPQ turns these into structured, machine-readable terms, so they can flow directly into billing and revenue systems.

4. Quote → subscription → billing continuity

The fastest way to break forecasting and reconciliation is when:

- Sales quotes one thing

- Finance bills another

- Usage lives in a third system

Your CPQ must create the actual billing object:

- Quote → Active plan/subscription

- Meters → Billing rules

- Pricing → Invoice logic

This prevents the classic “quote-to-invoice drift” that kills trust in revenue data.

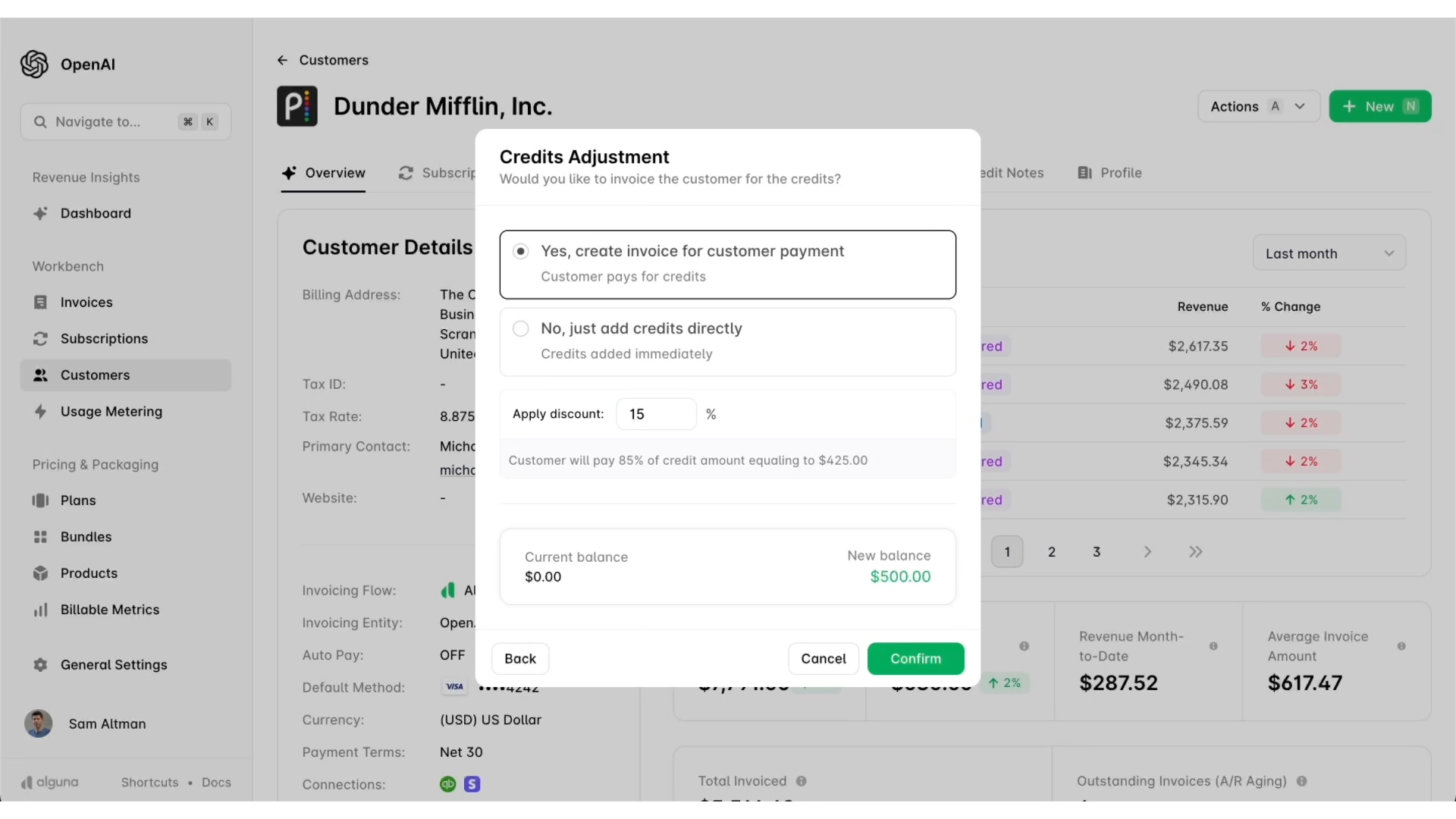

5. Built-in support for credits and prepaid usage

Modern usage pricing almost always includes:

- Prepaid credits

- Draw-downs

- Top-ups

- Expiring balances

If CPQ can’t model credits at the deal stage, Finance won’t be able to:

- Forecast burn

- Recognize revenue

- Track liabilities

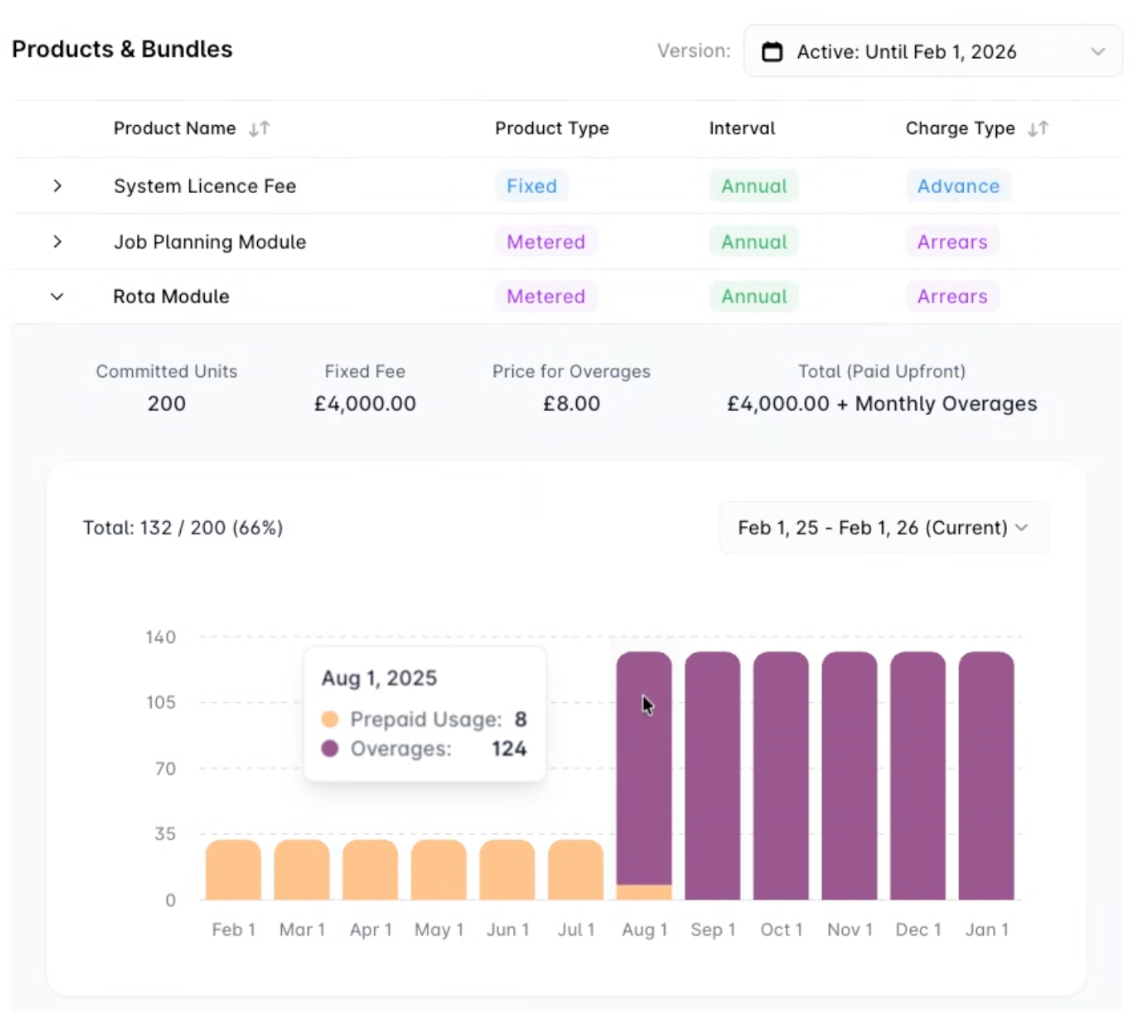

6. Expansion without re-quoting

Usage businesses grow without sales touching the account.

Your CPQ must allow:

- Usage-driven expansions

- Auto-upgrades when tiers are crossed

- Contract-bound overages

So Finance can forecast expansion from usage trends, not just pipeline.

7. Forecast-ready outputs

A usage-based CPQ should be able to tell Finance:

For each customer:

- What’s guaranteed

- What’s included

- What’s priced

- What’s possible

That enables:

- Base / high / low scenarios

- Cohort-based forecasting

- Proper coverage ratios

Without this, you’re (still) stuck in spreadsheets.

In a subscription business, Finance owns the forecast. They take bookings data from Sales, apply recognition schedules, and produce revenue projections. It’s a relatively mechanical process.

In a usage based business, Finance can’t do it alone.

They need: Product data on usage patterns, feature adoption, and customer behavior Engineering support to pipe usage telemetry into forecasting models Customer Success input on which accounts are at risk and which are expanding Sales context on committed deals and expected overages.

This is fundamentally a cross functional problem. And in most organizations, nobody owns it end to end."

- Jeff Ignacio, RevOps Impact newsletter (February, 2026)

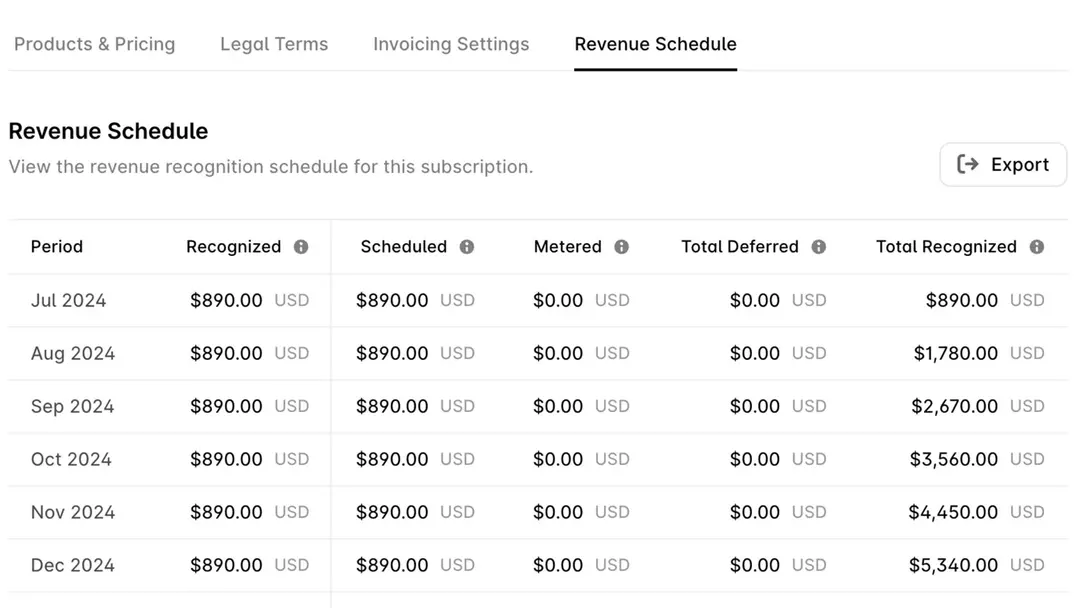

8. Clean handoff to revenue recognition

ASC 606 and IFRS 15 require:

- Knowing what was promised

- Knowing when it was delivered

- Knowing how variable consideration should be constrained

A CPQ that understands usage pricing ensures:

- Performance obligations are defined

- Variable revenue is classified correctly

- Revenue doesn’t get misstated

This is where audits are won or lost.

4 CPQ for usage-based pricing

We’ve broken down four of the leading solutions:Alguna, Agentforce Revenue Managemet (formerly Salesforce Revenue Cloud), Zuora, and Chargebee, and how each supports consumption-based models.

- Alguna: Built for SaaS and AI companies with usage based and hybrid pricing, Alguna offers a no-code CPQ, real-time usage metering, billing, and RevRec in an end-to-end quote-to-revenue platform.

- Agentforce Revenue Management: A powerful but complex option for Salesforce-native teams. Great for enterprise-scale quoting, but setup for usage billing requires time and configuration.

- Zuora CPQ: Best for enterprises with deep subscription and billing complexity. Powerful, but heavy and often consultant-led.

- Chargebee CPQ: A lightweight quoting layer for teams already using Chargebee Billing. Ideal for mid-market SaaS with simpler usage needs.

Frequently asked questions about CPQ for usage based pricing

What is a CPQ platform for usage-based pricing?

It’s a tool that automates configuring and quoting for deals that include metered or consumption charges. These CPQs let reps add usage line items (like per-API-call fees or data tiers) alongside subscriptions, ensuring quotes reflect both fixed and variable pricing.

Can modern CPQ handle usage/consumption billing?

Yes. Leading CPQs support usage-based models out of the box. They let you define usage metrics, tiers, and credit models so the quote dynamically calculates total cost based on projected usage.

Is CPQ different from billing software?

Yes. CPQ focuses on the sales side (configuring deals and generating quotes). Billing software handles invoicing and payments after the sale. However, the best modern suites (like Alguna or Agentforce Revenue Management) integrate CPQ and billing so the quote feeds directly into subscriptions and invoices.

When do we need CPQ?

Companies typically adopt CPQ once pricing complexity slows down sales. If you have multiple products, optional add-ons, usage components, or complex discount approvals, CPQ helps enforce rules and speed quoting. Early-stage startups with simple, fixed-price models may not need full CPQ immediately.

How long does CPQ implementation take?

It varies widely. Modern, out-of-the-box tools can be live in a few weeks (such as Alguna), while enterprise-grade CPQ (like Salesforce CPQ) often takes several months of setup and testing. Usage-based models add complexity, so plan for extra time to define metrics and test billing integrations.

Does CPQ really reduce revenue leakage?

Absolutely. By codifying pricing rules and approvals in software, CPQ ensures no unapproved discounts slip through and usage metrics are billed correctly. In practice, companies report fewer billing errors and higher average contract values after CPQ implementation.

Choose a CPQ that can keep up with your pricing strategy

Usage-based pricing has been coined as the future of monetization for SaaS, AI, and fintech. But to make it work, your sales and finance teams need tools that can quote, bill, and recognize revenue with precision and flexibility. That’s where CPQ purpose-built for usage-based models becomes critical.

Whether you're scaling a token-based AI platform, launching new prepaid usage plans, or experimenting with hybrid billing, your pricing strategy IS your growth strategy. Choose a CPQ that helps you iterate fast, bill accurately, and scale confidently.