CPQ and billing belong in the same workflow, but in reality they often live in silos.

Configure-Price-Quote (CPQ) software helps sales teams configure products, apply pricing rules, and generate professional quotes while a billing system then picks up after a deal closes, automating invoicing and payment collection.

When these systems aren’t aligned, companies struggle with manual work, errors, and slow revenue. Modern subscription and usage-based pricing models make this alignment increasingly important.

In this post we’ll explain what CPQ and billing each do, how they differ, and why integrating them is critical for fast, accurate quote-to-cash operations.

Reliable data is essential in having a robust go-to-market team and ensuring that every department does its part in revenue generation. A key go-to-market thesis created by Hayden Stafford, president and CRO at sales enablement platform Seismic, is what he calls the “value continuum,” a laser-focused view on client outcomes.

What is CPQ?

CPQ (Configure-Price-Quote) is software that guides sales teams through configuring products/services, applying pricing rules, and outputting quotes.

In plain terms, CPQ helps a rep pick the right product options, automatically calculates the price, and generates a branded proposal document. It embeds business rules so that only valid configurations are offered (e.g. compatible features, bundle requirements, discounts, etc.).

CPQ is often integrated with CRM and product catalogs to ensure real-time accuracy.

What is billing in SaaS?

Billing is the process of charging customers for their use of the software. It includes generating invoices, collecting payments, applying pricing rules (like subscriptions or usage-based fees), handling taxes and credits, and ensuring that revenue is recognized correctly in accounting.

SaaS billing software manages invoicing, payments, and revenue tracking for products or services. In simple terms, billing takes signed contracts and turns them into invoices and accounting entries.

Key components of SaaS billing:

- Subscription management

- Recurring plans (e.g. monthly or annual)

- Trials, upgrades, downgrades, renewals, and cancellations

- Usage-based billing

- Charges based on consumption (e.g. API calls, storage, users)

- Often includes overage calculations or tiered pricing

- Invoicing and payment

- Generating accurate invoices based on contract terms and usage

- Integrating with payment gateways (e.g. Stripe, PayPal) for auto-pay or manual payments

- Revenue recognition and compliance

- Ensuring revenue is booked according to accounting standards (e.g. ASC 606)

- Prorating revenue for mid-cycle changes

- Reporting and analytics

- MRR/ARR tracking

- Churn, upgrades, and lifetime value analysis

In short, billing in SaaS translates pricing models into cash, and is tightly connected to both product usage and customer contracts. Done right, it supports scalable growth and financial accuracy. Done poorly, it leads to revenue leakage, customer frustration, and compliance risk.

CPQ and billing: Key differences

| Aspect | CPQ (Configure-Price-Quote) | Billing |

|---|---|---|

| Primary purpose | Configure product/service orders and generate quotes | Create invoices, process payments, and track revenue |

| Main users | Sales reps, sales engineers, revenue/RevOps | Billing specialists, accountants, finance |

| Key outputs | Quotes or proposals (and approved sales orders) | Invoices, receipts, accounts receivable reports |

| Systems & data | CRM, product catalog, pricing rules, discount approvals | ERP/finance systems, GL, tax engines, payment gateways |

| Timing | Pre-sale (deal negotiation) | Post-sale (order fulfillment and collections) |

| Focus | Accuracy and speed of quoting, deal customization | Accuracy of invoicing, cash collection, compliance |

Why CPQ and billing need to work together

Friction between sales quoting and finance invoicing is a common pain point in SaaS. Unless CPQ and billing share information seamlessly, every custom quote that sales creates, will lead to manual rework for finance.

Now, finance is not going to stop sales from closing deals. So they end up drowning in cleanup later, trying to figure out actual terms, usage, ramps, and discounts.

For instance, many companies treat CPQ and billing as completely separate: CPQ exists to streamline sales, ending at the signed order, and billing “begins in finance” afterward.

This mindset causes delays. Enter: Quote to cash.

Quote to Cash: The unified revenue flow

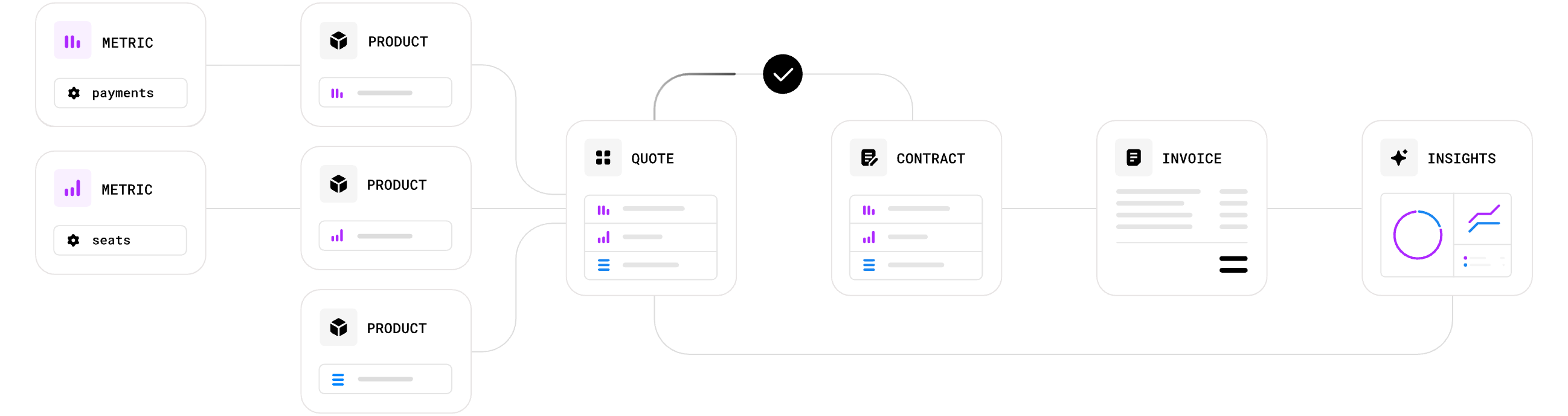

Quote to Cash (QTC) refers to the complete end-to-end process that starts when a customer receives a quote and ends when the revenue from that deal is fully recognized. It includes every stage in between: configuration, pricing, quoting, contracting, billing, payment, and revenue recognition.

When CPQ and billing are aligned, Quote to Cash becomes a single, continuous system—not a set of disconnected handoffs.

A modern quote-to-cash process includes:

- Configuration: CPQ guides reps through building accurate, compliant product bundles.

- Pricing and discounting: Pricing logic is applied consistently, with approval workflows if needed.

- Quoting: Sales generates clean, professional quotes that customers can e-sign.

- Contracting: Signed quotes become structured contracts that billing systems can interpret.

- Billing and invoicing: Usage, subscriptions, and fees are billed automatically—no rekeying.

- Payment collection: Invoices connect directly to payment gateways or collection workflows.

- Revenue recognition: Finance can recognize revenue automatically based on the contract and delivery schedule.

This isn’t just about process, it’s about impact. Companies with unified Quote to Cash workflows:

- Close deals faster with fewer errors

- Send invoices that reflect exactly what was sold

- Accelerate cash flow by reducing delays

- Increase trust between sales and finance

- Improve customer experience with consistent billing

Quote to cash is the connective tissue between CPQ and billing. When done right, it eliminates the translation layer between sales and finance. What gets quoted is what gets billed—and what gets billed is what gets recognized. That’s the foundation for scalable, efficient growth.

How CPQ and billing work together in practice

Let’s walk through a typical quote-to-cash flow with CPQ and billing aligned:

- Opportunity and configuration

A deal is created in CRM and CPQ is used to configure the offering to customer needs. The sales rep selects products and services, applies any custom discounts, and CPQ instantly calculates the price.

Because CPQ is integrated with the product catalog, all combinations are valid and pricing rules enforced. - Proposal and contract

CPQ generates an accurate quote document, including product details, pricing, and contract terms. Once the customer signs, that quote converts into a binding contract.

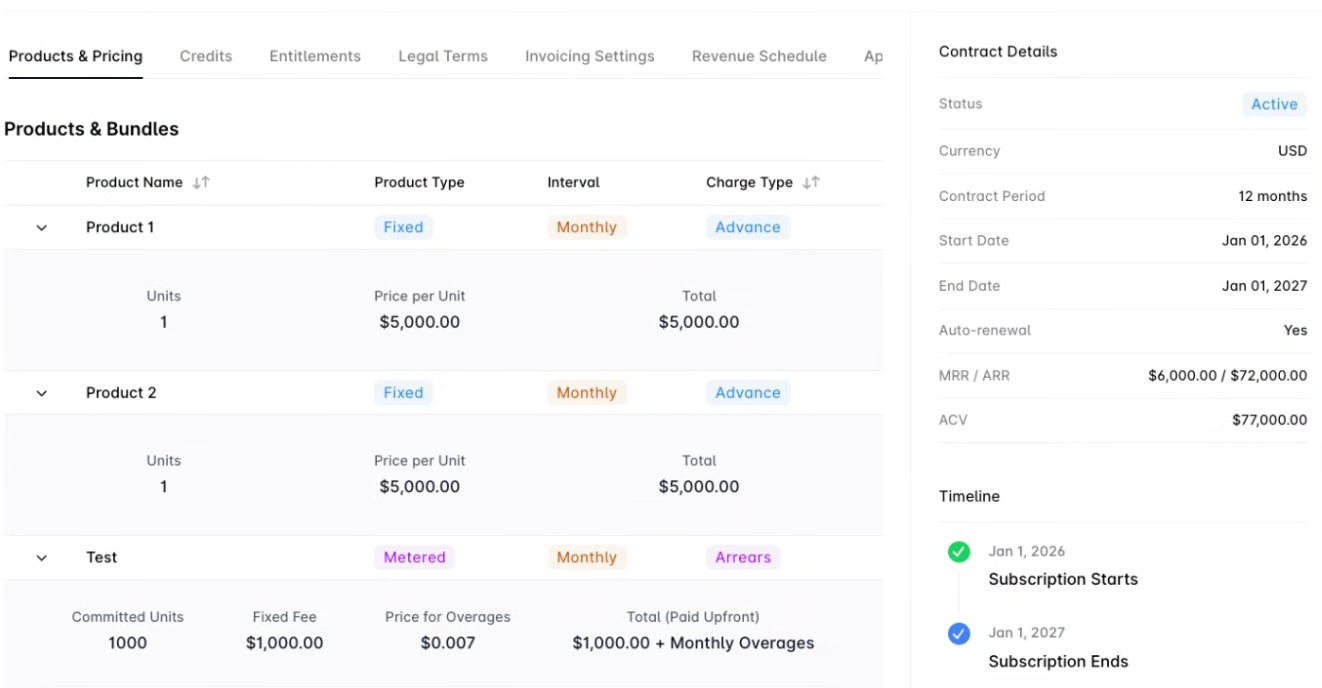

The agreed terms (like subscription plan, start date, billing frequency) are now known. - Order entry into billing

The signed contract is automatically sent to the billing system (or ERP). The billing system creates the customer account or subscription record.

All pricing details from the quote, including any one-time fees or usage rates, populate the billing catalog. - Usage tracking (if applicable)

If the plan includes usage-based components, the system now begins tracking consumption. For example, a software service might record the number of API calls, storage gigabytes used, or hours of service consumed each day.

This usage data flows into the billing engine, ready to be billed. - Invoicing

At the end of the billing period, the system bundles up charges. Thanks to integration, the invoice includes exactly the services from the contract and any measured usage during the period.

The billing system automates invoice generatio, applying proration for mid-term changes or upsells automatically. (Customers might even receive the invoice along with a payment link in the same step.)

This hands-off invoicing means finance and sales didn’t have to manually re-enter line items or recalculate charges. - Payment and revenue recognition

Once the invoice is issued, the customer pays via the integrated payment gateway. Meanwhile, accounting records the revenue. Because the billing system knows the contract terms and invoiced amounts, it can also support automated revenue recognition.

In general, revenue is recognized as the service is delivered or as usage is consumed, per ASC 606/IFRS rules. Integrated data ensures that the amount booked as revenue matches what was actually invoiced and (eventually) paid.

Meet Alguna: Unified CPQ and billing built for modern revenue teams

If you’re looking to connect CPQ and billing to have one source of truth for your revenue workflows, Y Combinator backed Alguna was built for exactly that.

Alguna combines powerful CPQ and flexible billing in a single platform, so sales, finance, and RevOps teams can work from the same source of truth.

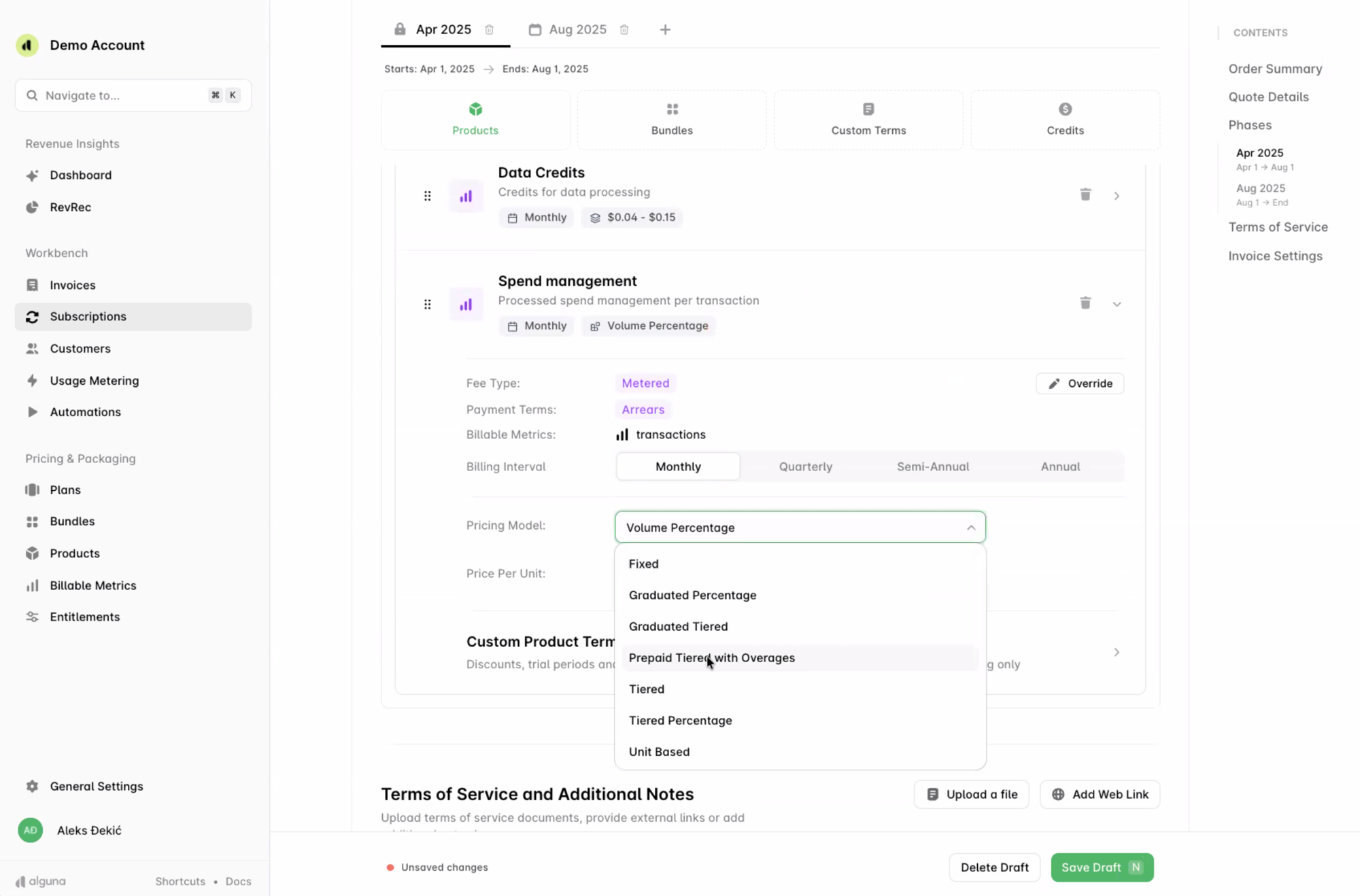

Purpose-built for SaaS, fintech, and AI companies, With Alguna, you can:

- Configure complex SaaS and AI pricing models, including usage-based, tiered, and hybrid plans

- Generate quotes that flow directly into billable contracts with no manual work needed

- Automate invoicing, proration, co-terming, and revenue recognition

- Give GTM teams the speed they want and finance the control they need

Whether you're moving upmarket or launching new pricing, Alguna makes it easy to scale your quote-to-cash process, without stitching together legacy systems and point tools.

Who benefits from alignment

Aligning CPQ and billing creates wins for every team involved in revenue:

- Sales and GTM teams: Integrated CPQ means reps can whip up complex quotes (with subscriptions, bundles, or usage tiers) in minutes, not days. They spend less time waiting on finance to prepare invoices or explain pricing, and can focus on closing deals and supporting customers.

- RevOps teams: RevOps owns the quote-to-cash workflow, so end-to-end visibility is gold. With connected systems, revenue operations gain unified reporting on bookings, billing status, and churn. Automated workflows (like co-terming for renewals) reduce manual intervention.

In short, the team can launch new plans or discounts rapidly because the tools are linked and rules-based. - Finance and accounting: Integrated billing cuts down on reconciliation work. Finance gets clean, audit-ready data since invoices flow directly from the original quotes. That means faster month-end closes and fewer adjustments.

In practice, billing teams can generate and send invoices swiftly, reducing days sales outstanding and improving cash flow. - Executives and strategy: When data isn’t trapped in silos, business leaders get a clear picture of revenue performance. Automated systems capture subtle revenue opportunities (like small usage overages) that might slip through gaps. They also provide dashboards for metrics like churn, renewal rates, and product profitability.

Armed with this insight, leadership can make informed decisions on pricing strategy or new offerings. - Customers: At the end of the day, well-oiled quote-to-cash makes for a better customer experience. Clients receive accurate quotes up front and invoices that match exactly what they expected.

Faster turnaround (e.g. instant access after purchase) and clear billing build confidence. Customers aren’t left puzzling over bill discrepancies or chasing support.

Everyone wins when CPQ and billing speak the same language. Sales can focus on selling, finance on optimizing revenue, and customers get a smooth billing experience.

The shift toward connected CPQ and billing

CPQ software drives accurate, fast quoting up front, while billing systems close out the revenue process by invoicing and enforcing compliance.

When these tools operate in silos, companies face errors, delays, and lost revenue. In contrast, an integrated quote-to-cash workflow automates handoffs, accelerates cash flow, and provides full visibility for sales and finance.

If your company still relies on disconnected quoting and invoicing tools, consider auditing your revenue systems.

A good first step is to ask: Can my CPQ quotes flow straight into billing without manual work?

If the answer is "no," it might be time for a quote-to-revenue overhaul in your business.