Adoption is exploding because AI workloads, product-led growth, and CFO demand for ROI all require consumption-aligned pricing.

Modern consumption billing software is required as legacy subscription tools cannot handle usage, credits, or multi-dimensional pricing.

The AI economy broke the subscription model.

When customers can go from 100 API calls to 10 million overnight, a flat monthly price either kills your margins or overcharges your users.

That’s why modern SaaS and AI companies are moving to consumption billing (also known as usage based billing), a billing model where revenue scales with real usage, not seat counts or guesswork.

If you sell AI, developer tools, fintech, or data products, consumption-based pricing and billing isn’t a trend. It’s the only way to align growth, cost, and customer value.

What is consumption billing?

Consumption‑based billing, often called usage‑based billing, is a billing model in which customers pay only for what they consume.

Consumption billing meaning

Instead of paying a fixed monthly fee, the invoice reflects measurable usage, such as API calls, compute hours, documents processed, data stored, messages sent or other metrics aligned to value.

The model is common in cloud services and AI platforms: AWS bills per compute instance and per gigabyte transferred, Snowflake charges per “credit” of compute/storage and OpenAI charges by the token or image generated.

These models give customers the flexibility to start small and scale as their needs grow.

Pricing is what you charge. For example: $0.002 per API call

Billing is how you collect. For example: Invoices, payments and accounting records.

In short: Pricing defines the rules. Billing enforces them.

How consumption billing works

Consumption billing has four layers:

- Metering: Capturing every billable event such as API requests, token usage or storage consumed. Missing events leads to lost revenue, and double‑counting creates trust issues.

- Rating: Applying pricing logic such as per‑unit charges, tiered discounts, minimum commitments or volume‑based rates.

- Invoicing: Aggregating rated usage into clear, timely invoices.

- Revenue recognition: Ensuring compliance with ASC 606/IFRS 15 and properly recognizing deferred or earned revenue.

Why consumption now? Adoption trends and industry drivers

Beyond the headline adoption statistics, several structural shifts explain why consumption pricing is taking hold:

- The AI era. Cloud computing laid the foundation for elastic consumption models. Generative‑AI workloads can fluctuate from a handful of prompts to millions overnight, making static seat‑based pricing impractical. In Greyhound Capital's survey, 85 % of companies using usage‑based pricing said their adoption was driven by a need to align costs with value.

- Customer demand for ROI transparency. Research from Zuora’s Subscribed Institute highlights that 80 % of customers believe usage‑based pricing better aligns what they pay with the value they receive. Buyers, especially finance teams, increasingly want to pay only for what they use and avoid funding heavy users at their expense.

- Product‑led growth and the freemium economy. Usage‑based models lower barriers to entry. Rather than negotiating upfront seat commitments, new users can experiment freely. This is particularly attractive for AI and API companies, Snowflake’s pay‑per‑credit model allowed data teams to test the platform with minimal risk, turning small projects into major accounts.

- Hybrid pricing becomes the norm. A hybrid of subscription and usage pricing is often the sweet spot. For example, a SaaS platform might charge a base fee for basic functionality and layer usage charges on top for compute‑heavy features. Hybrid models provide predictability for the vendor and flexibility for the customer.

Benefits of consumption‑based billing

The appeal of consumption‑based billing goes beyond marketing. When implemented well, it produces tangible advantages for both customers and providers:

Lower barriers to entry and higher conversion

Customers can start without large upfront commitments and “pay as they grow.” Orb notes that this lower barrier helped Snowflake scale quickly because data teams could test the platform with minimal risk.

For vendors, usage pricing fosters product‑led growth making sure users experience value first, then naturally expand their consumption.

Natural account expansion and higher net retention

Under flat subscriptions, revenue grows only when customers upgrade. In usage models, expansion happens organically as customers build more workflows, process more data or launch more AI features.

Improved unit economics and fair cost allocation

Heavy users no longer benefit at the expense of light users. When infrastructure costs scale with usage, revenue scales alongside. Typically, unit economics improve because power users generate more revenue while light users pay less.

This fairness fosters trust and reduces churn.

Greater scalability and forecasting flexibility

Consumption pricing allows operations to scale without constant pricing updates. Real‑time usage metrics enable more dynamic forecasting compared with static subscription revenue. Usage data can feed predictive models to anticipate seasonal spikes or AI demand surges.

Enhanced customer satisfaction and transparency

When customers see exactly what they used and what they’re paying for, their trust increases. Aligning price to actual needs fosters trust and transparency as invoices show clear value delivered, making price increases easier to justify.

Built‑in upsell opportunities

Usage growth drives revenue growth. Usage‑based pricing provides upsell opportunities because usage naturally grows as customers see more value.

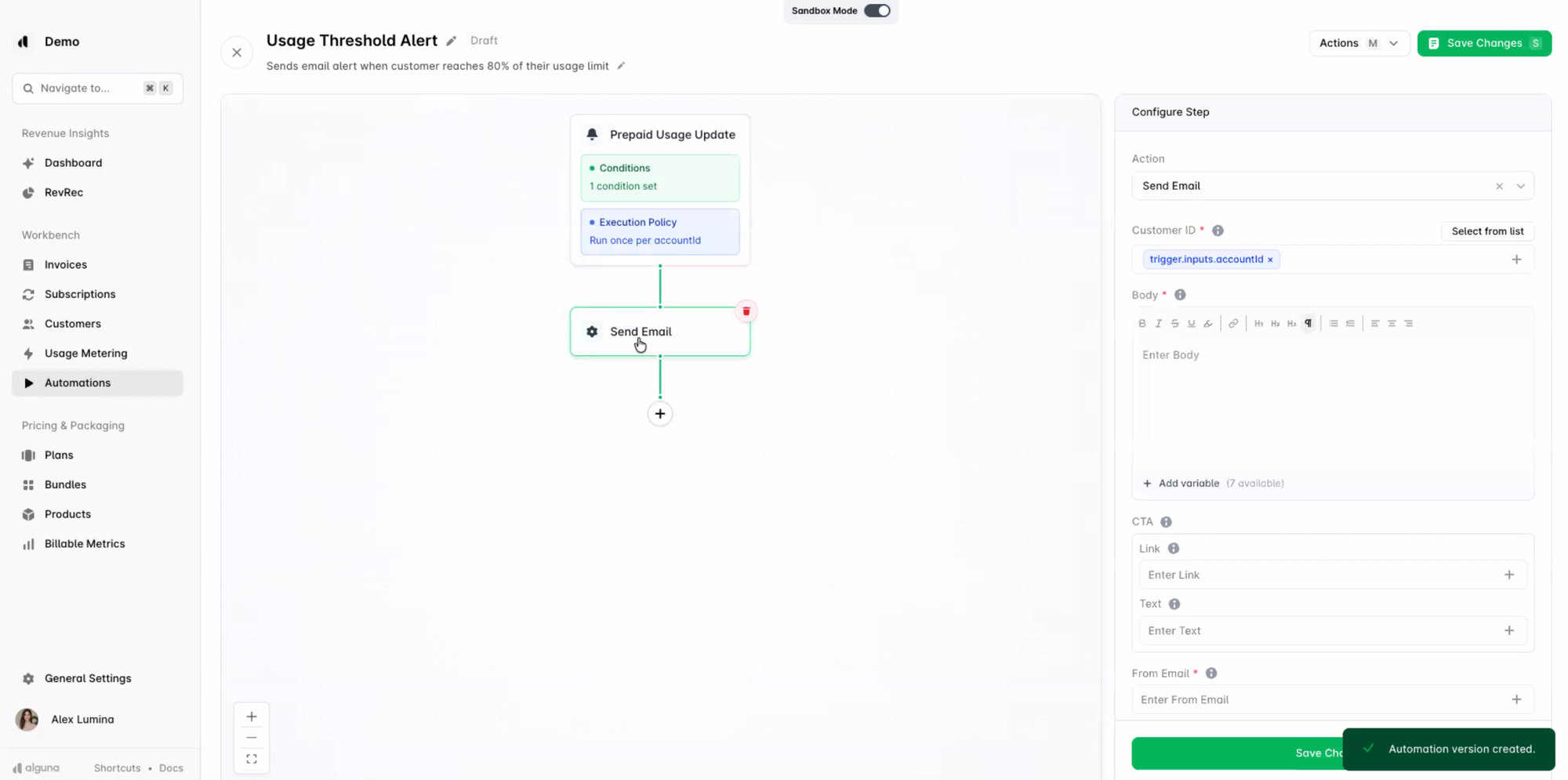

Instead of annual renegotiations, expansion happens continuously, often supported by automated signals from the billing platform.

Attractive to investors and high‑growth startups

64 % of Forbes’ next‑billion‑dollar startups use usage‑based models. These companies value the model’s alignment with customer success and the ability to attract a broad customer base through low entry barriers.

Growth investors increasingly view usage‑based pricing as a hallmark of modern SaaS businesses.

Challenges of consumption‑based billing (and how to overcome them)

Despite its benefits, consumption pricing introduces new complexities. Awareness of these pitfalls—and strategies to mitigate them—is critical for success.

Revenue unpredictability and forecasting complexity

Seasonal usage patterns, viral growth and macroeconomic factors can create revenue volatility. As monthly revenue fluctuates with customer usage it means that companies need better forecasting models and scenario planning.

Implementation and technical challenges

Accurate metering is hard. You must track every billable event without duplication or loss. The complexity of managing real‑time data and generating invoices can be cumbersome without dedicated tools.

Customer bill shock and overage disputes

Consumption spikes can lead to unexpectedly large invoices as customers worry about bill shock. Overage charges is a common challenge. Mitigation strategies include offering spending alerts, usage caps, and anomaly detection.

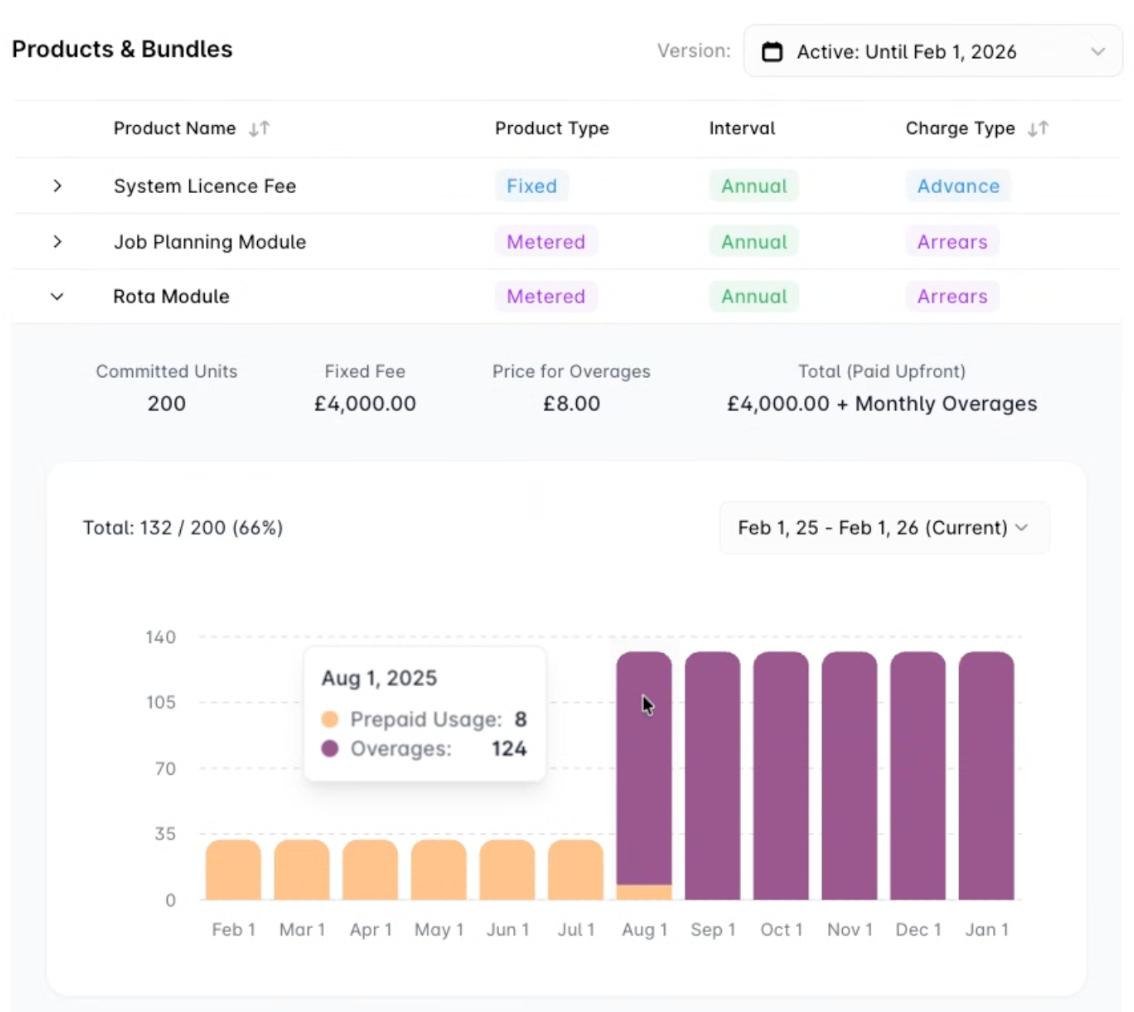

Modern billing platforms like Alguna provide customer portals where they can see usage and overages as well as get notifications when they hit specific usage thresholds.

Volume discounts and tiered pricing further soften overages by rewarding higher usage with lower per‑unit costs.

Complex sales compensation and organizational change

Usage‑based deals often start small and grow over time. Sales compensation becomes complex because commissions can’t be tied solely to initial contract value.

On the finance side, finance teams must adapt to variable revenue recognition, and support teams need access to detailed usage data to answer billing questions.

Ultimately, success requires aligning sales, finance, product and support teams on new metrics (e.g., net dollar retention, activation time) and updating incentives to encourage land‑and‑expand strategies.

Managing fluctuating usage patterns

Fluctuating customer usage patterns is a challenge that complicates forecasting and resource allocation. Companies must build elasticity into infrastructure and budgets.

Real‑time analytics can help anticipate spikes and allocate resources efficiently. Hybrid models, minimum commitments and prepaid credits can provide a baseline of revenue stability while allowing customers flexibility.

Types of consumption‑based pricing models

Different businesses may choose different consumption models or mix them together.

Common structures include:

| Model | How it works | Example |

|---|---|---|

| Pay-as-you-go | Customers pay strictly for each unit consumed. Ideal for unpredictable workloads and early experimentation. | AWS bills per GB-second or per API call; OpenAI charges per token. |

| Volume-based discounts | The per-unit price decreases as usage increases; all units in the billing period use the same discounted price once a threshold is crossed. | Telecom data plans, or Stripe’s transaction fees with lower rates at higher volumes. |

| Usage-based tiers | Usage is divided into ranges with different prices; customers choose a tier that fits their expected usage, often combined with variable charges for overages. | A SaaS app might charge $50 for up to 1,000 users and $100 for up to 5,000 users, with additional usage charges beyond the tier. |

| Minimum commitment / overages | Customers commit to a minimum amount of usage or spend each period; overages are charged per unit above that threshold. | Data platforms may include monthly compute credits, with additional charges for excess usage. |

| Hybrid models | Combines subscription (flat fee) and consumption elements. Provides baseline revenue while allowing variable usage pricing. | Many SaaS providers charge a base subscription for access and layer usage charges on top. |

8 best practices for adopting consumption‑based billing

Consumption-based billing can unlock faster growth and better customer alignment, but only if it’s implemented deliberately.

Without the right pricing structure, usage tracking, and finance workflows, teams end up with revenue leakage, billing disputes, and unpredictable cash flow.

1. Choose a value metric that mirrors customer value

Choose a metric (or metrics) customers already understand. The value metric is the unit of measure customers relate to and that correlates with the cost of delivering your service, whether it's requests or events, data volume, compute time, or outcomes delivered.

For example, categorize them into:

- Time‑based (compute minutes)

- Transaction‑based (API calls)

- Volume‑based (GB processed)

- Count‑based (number of endpoints)

Avoid obscure metrics that require customer education.

2. Start simple and iterate

Don’t over‑engineer your pricing. Start with a single metric and simple pricing tiers. Pilot consumption pricing with friendly customers, gathering feedback and refining before broad rollout.

As usage patterns emerge, you can layer additional tiers, volume discounts or base fees.

3. Build trust through transparency and real‑time visibility

Transparency reduces friction and bill shock. Provide dashboards showing real‑time usage and estimated charges in either a customer portal or on your invoices.

Usage threshold alerts at e.g. 50 %, 75 % and 90 % of budget help customers manage spend.

4. Design graduated pricing tiers and safety nets

Offer volume discounts to reward growth and reduce churn risk. Designing graduated tiers that give your biggest users the best rates and combine them with spending caps and hard usage limits to prevent runaway bills.

Prepaid credits and flexible top‑ups give customers control over budgets.

5. Provide usage optimization and cost‑management tools

Help customers reduce their bills by highlighting inefficient queries or resources. For example, Datadog helps customers see which queries consume the most credits. These features build partnership and loyalty rather than an adversarial relationship.

6. Align your organization and update incentives

Consumption billing touches every team. Train sales teams on value‑based selling and adjust commission structures to account for expansion revenue. Teach support teams to explain usage patterns.

Finance should track new metrics like usage cohorts, net dollar retention and time to first value. Making consumption successful requires cross‑functional alignment.

7. Invest in specialized billing infrastructure

Attempting to manage consumption billing with spreadsheets or a subscription‑only billing system is a recipe for errors. You need automated metering, flexible pricing logic, real‑time aggregation and accurate invoicing.

Modern quote‑to‑revenue platforms centralize pricing rules, contracts, usage data and revenue recognition so finance teams can close the books confidently.

8. Monitor churn and retention metrics

Comsumption‑based billing don’t guarantee retention. You still need to track churn and retention metrics closely to understand whether the model fits your users.

Early warning signs (declining usage, increased support tickets) allow for proactive intervention.

Consumption billing software: What modern teams actually need

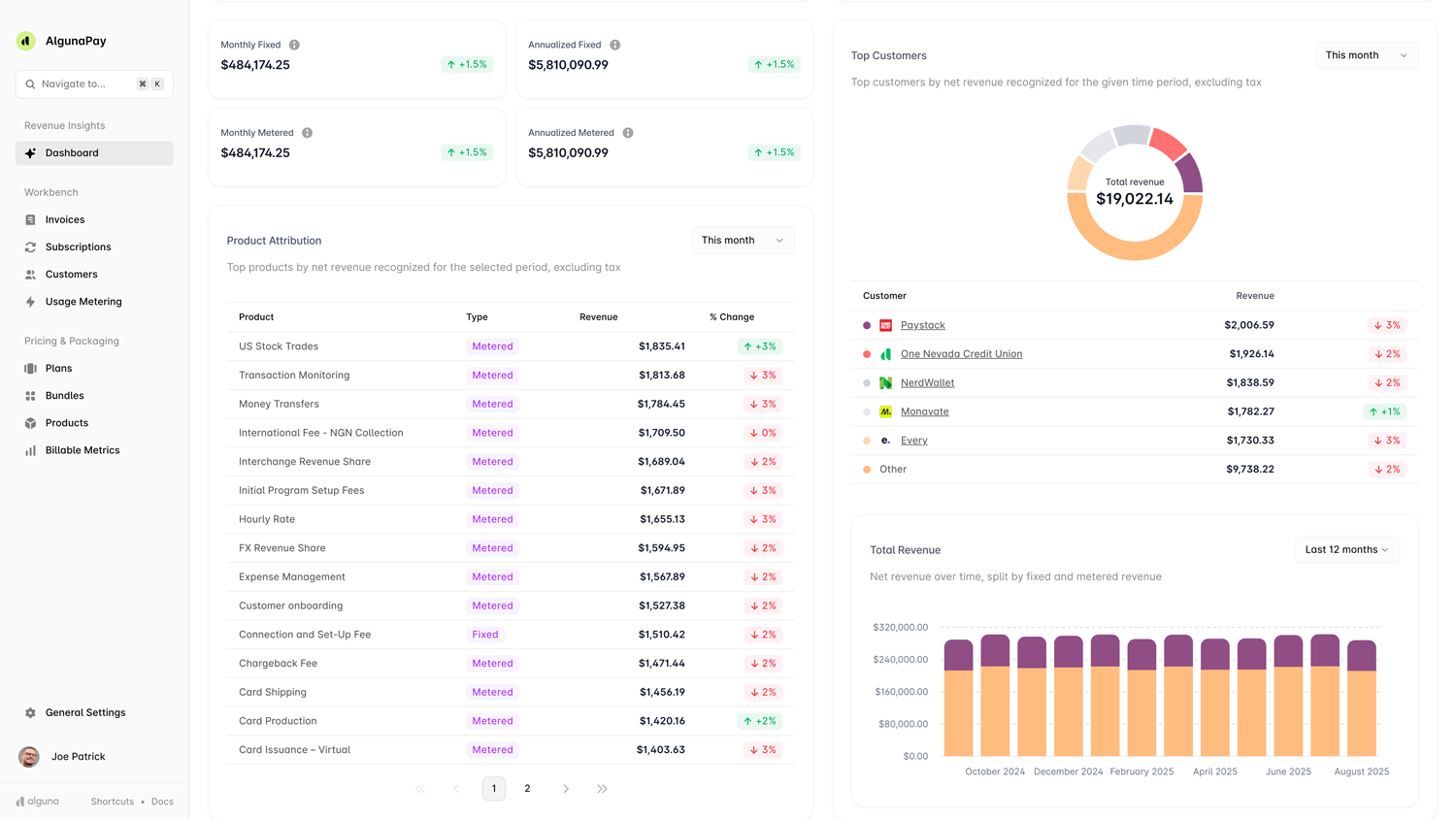

Real-time usage tracking in Alguna.

Running consumption pricing on legacy billing tools is like trying to run cloud infrastructure on a spreadsheet.

It works. Until it really doesn’t.

Modern SaaS and AI companies don’t just need a way to send invoices. They need a system that can translate real product usage into accurate, contract-aware revenue in real time.

That’s what consumption billing software is built to do.

Unlike traditional subscription billing tools, consumption-first platforms are designed for:

- High-volume usage data (API calls, tokens, transactions, compute, events)

- Multi-dimensional pricing (by model, region, tier, SLA, or outcome)

- Credits, commitments, and overages

- Custom enterprise contracts

- Revenue recognition and compliance

This means sales can sell flexible deals, product can ship usage-based features, and finance can still close the books without manual cleanup.

Consumption SaaS billing software: How Alguna enables usage-based revenue at scale

Switching to a consumption‑based model requires more than just a any SaaS billing engine, modern companies experimenting with consumption billing are increasingly opting for a unified quote‑to‑revenue platform.

Alguna is an AI‑native quote‑to‑revenue platform designed specifically for consumption‑based and hybrid pricing.

- CPQ (configure‑price‑quote): Using Alguna's no-code CPQ, sales teams can craft complex deals with custom rates, commitments and ramp schedules.

- Consumption‑based billing: Capture granular usage metrics, applying tiered discounts, minimum commitments, and overages in real time.

- Credits and commitments: Support prepaid credits, drawdowns and flexible top‑ups.

- Invoicing: Generate clear, accurate invoices that show exactly what was consumed.

- Revenue recognition: Automate and streamline ASC 606‑compliant revenue schedules so finance teams can close the books accurately and quickly.

By unifying quoting, billing and revenue recognition, Alguna eliminates the disconnects that cause revenue leakage, invoice disputes and forecasting headaches.

It lets you model any pricing logic, experiment with new pricing models without code, and give customers transparency via real‑time dashboards. Whether you’re selling AI models, developer APIs, fintech services or any other usage‑intensive product, Alguna provides the infrastructure to adopt consumption‑based billing without chaos.

Alguna gives you a single system to quote, track, bill, and recognize revenue for usage-based and AI-driven pricing models—without spreadsheets, manual reconciliation, or broken handoffs between sales and finance.

👉 Book your personalized demo and see how Alguna turns product usage into predictable, scalable revenue.

Frequently asked questions: Consumption-based billing

What is consumption-based billing for SaaS?

Consumption-based billing for SaaS means customers pay based on how much they actually use the product—such as API calls, transactions, or compute—rather than a fixed monthly fee.

What are the best alternatives to traditional billing for a consumption-based model?

The best alternatives are usage-based, hybrid, and committed-consumption models that combine real-time usage tracking with contracts, minimums, credits, and overage pricing instead of flat subscriptions.

How does consumption billing automation work?

Consumption billing automation tracks usage events, applies pricing rules, generates invoices, and posts revenue automatically, eliminating spreadsheets, manual reconciliation, and billing errors.

Is there a best consumption billing provider for Revenue Ops?

Yes. Revenue Ops teams need platforms that connect CPQ, contracts, usage, invoicing, and revenue recognition. Tools like Alguna are built specifically for this full quote-to-revenue workflow.

What’s the difference between usage-based and consumption-based billing?

They are often used interchangeably, but “consumption-based” usually includes contracts, minimums, and credits, while “usage-based” often refers to pure pay-as-you-go pricing.

Can enterprises use consumption-based billing?

Yes. Most enterprise consumption deals use committed spend, custom rates, and overage pricing to provide both flexibility for customers and predictability for finance teams.

How do you prevent bill shock with consumption pricing?

By using real-time usage dashboards, budget alerts, spending caps, and prepaid credits so customers always know what they’re spending before invoices arrive.

Does consumption-based billing hurt revenue predictability?

Not when combined with minimum commitments and contracts. Modern consumption models are designed to deliver both flexible pricing and predictable revenue.

What products are best suited for consumption billing?

AI platforms, APIs, fintech products, developer tools, data platforms, and cloud infrastructure, anything where customer value scales with usage.

Do I need special software to run consumption-based billing?

Yes. Traditional billing tools were built for subscriptions. Consumption models require real-time metering, contract-aware pricing, automated invoicing, and revenue recognition, which platforms like Alguna provide.

Turning usage into predictable revenue with consumption-based billing

Consumption‑based billing allows companies to align pricing with customer value, lower barriers to adoption, and support natural expansion. But it also introduces forecasting, technical and organizational challenges.

Consumption-based billing is no longer a pricing experiment. It’s the operating system for modern SaaS, AI, and fintech companies.

If your revenue is driven by:

- API calls

- AI tokens

- Transactions

- Compute

- Data

- Or any form of usage

…then your business is only as strong as the system that turns that usage into cash, contracts, and compliant revenue.

The winners in the next generation of SaaS won’t just have better pricing, they’ll have better revenue infrastructure.