Clerk, originally an authentication platform, recently introduced Clerk Billing to help SaaS companies quickly implement subscriptions and (soon) usage-based billing.

It connects directly to Stripe for payments, meaning Clerk’s billing costs the same as Stripe Billing (0.7% of transactions, plus Stripe fees). The idea is to let developers add pay-as-you-go plans with minimal code, avoiding custom billing logic,

Clerk's limitations

For scaling SaaS and fintech companies, Clerk’s billing is limited in scope. As of early 2026, metered usage billing is still in beta/roadmap (not fully available yet).

Clerk relies on Stripe under the hood, so it lacks advanced usage-rating capabilities beyond Stripe’s basic metered billing. It does not handle complex pricing models (like multi-attribute usage or tiered overages), has no built-in CPQ or contract management, and provides no revenue recognition or finance workflows.

Essentially, Clerk covers subscription signup and payment collection, but not the end-to-end quote-to-cash needs of a growing SaaS and AI companies. Engineering teams may quickly outgrow its simplistic approach once custom pricing, invoicing nuances, or cross-team revenue operations come into play.

If you’re exploring usage-based monetization and Clerk Billing feels too basic or restrictive, there are several alternatives to consider.

Alguna vs Clerk: Usage based billing features

Below is a side-by-side comparison of Clerk and Alguna across key features related to usage-based billing and quote-to-revenue workflows.

✅ indicates the feature is supported out-of-the-box

❌ means the feature is not natively supported or is limited

| Feature | Clerk | Alguna |

|---|---|---|

| Usage metering (real-time, multi-attribute) | ❌ Not supported | ✅ Real-time usage tracking with custom metrics |

| Pricing model flexibility (tiered, per-unit, hybrid) | ❌ Limited to basic subscriptions | ✅ Supports tiered, usage-based, and hybrid pricing |

| CPQ / quote workflows | ❌ No CPQ tooling | ✅ Built-in quoting integrated with billing |

| Contract management (commitments, ramps) | ❌ | ✅ Handles committed contracts and ramp deals |

| Credit/overage handling | ❌ | ✅ Automatic credits and overage charges |

| Invoicing automation | ❌ | ✅ Usage-based invoices generated automatically |

| Revenue recognition | ❌ | ✅ ASC 606-compliant revenue schedules |

| Role-based access (Finance, RevOps, Eng) | ❌ | ✅ Granular roles & permissions for teams |

| Customer-facing UI components | ✅ Pre-built checkout & subscription UI | ✅ Self-serve billing portal for customers |

| Stripe integration | ✅ Uses Stripe for payments | ✅ Connects with Stripe and other gateways |

| Go-to-market agility (pricing iteration without code) | ❌ Engineering needed for new models | ✅ No-code pricing changes for fast iteration |

Alguna provides a comprehensive end-to-end solution for usage-based monetization and SaaS revenue management, covering everything from real-time metering and flexible pricing to automated invoicing and revenue recognition.

Clerk, by contrast, focuses on core subscription billing and requires additional development or future enhancements for advanced usage-based features.

This means scaling SaaS, AI, or fintech companies looking to experiment with consumption-based models and complex contracts may find Alguna better suited to their needs, while Clerk can be a simple starting point for basic subscription billing.

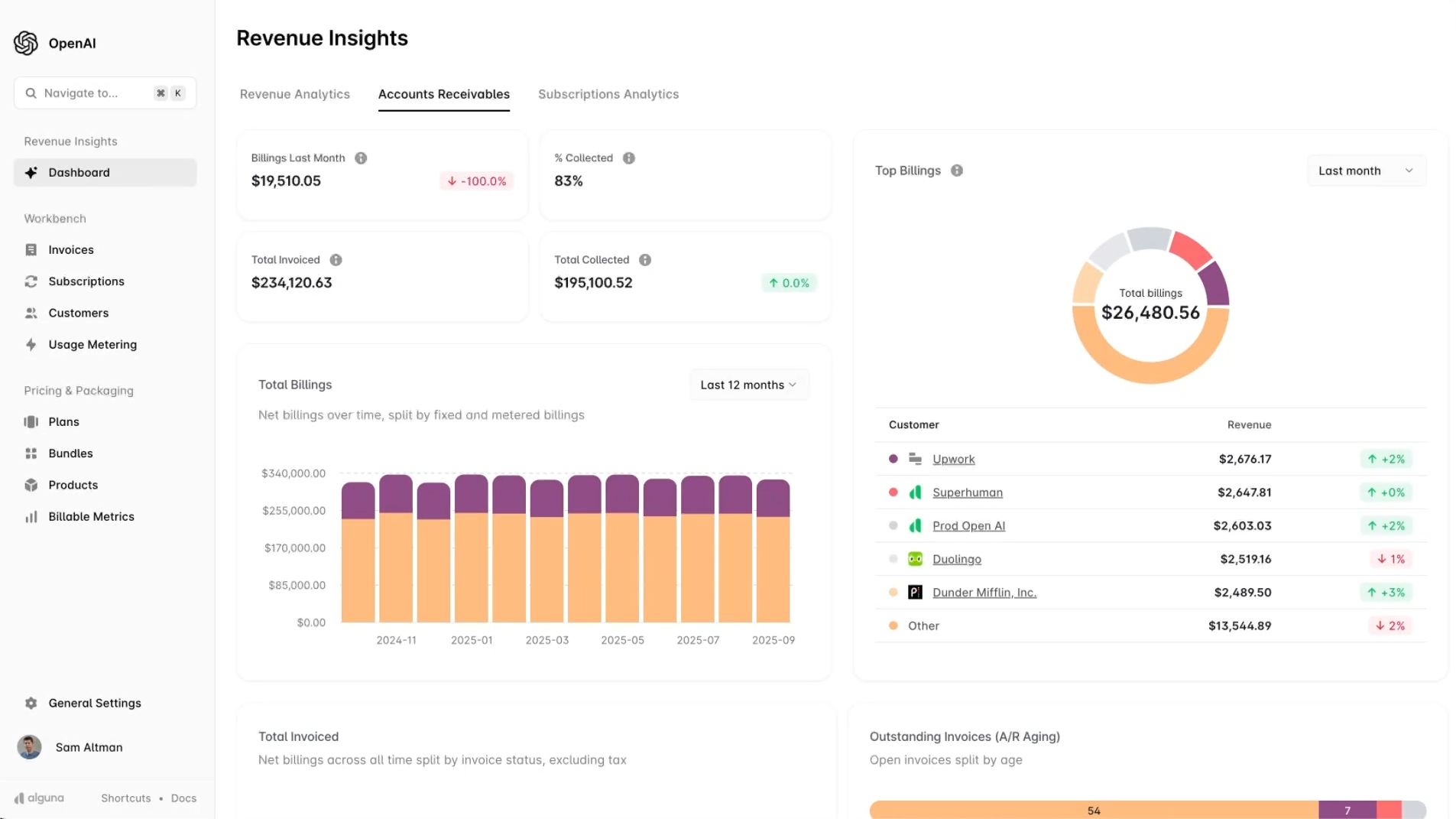

Alguna: All-in-one quote-to-revenue platform built for usage-based billing

Alguna is a modern end-to-end revenue management platform (YC Summer 2023 alum) designed to unify the entire quote-to-cash process for B2B companies.

It combines pricing and packaging, CPQ, usage metering, billing automation, and revenue recognition in one no-code system. Unlike point solutions that only handle billing, Alguna gives you a single source of truth for all your revenue data, from the moment a sales quote is created or a self-serve customer signs up, through to billing and revenue reporting.

Key features:

- Flexible pricing and packaging: Define any SaaS or AI pricing model, subscriptions, tiered usage, pay-as-you-go, prepaid credits, hybrid plans via a no-code UI. You can iterate on pricing without engineering changes (e.g. launch a new usage metric or adjust tiers on the fly). This is crucial in fast-evolving markets where pricing experiments are frequent.

- Built-in CPQ and contracts: Sales teams can use Alguna’s integrated CPQ to configure complex deals with custom terms, discounts, ramp schedules, etc. Once a contract is signed (with e-signature), it auto-syncs to billing and invoicing, no manual data transfer. This bridges the gap between sales and finance, which is something Clerk + Stripe cannot do (you’d otherwise juggle separate quoting tools or spreadsheets).

- Real-time usage metering: Alguna was built with usage-based billing in mind from day one. It can ingest high-volume product usage events in real time, calculate charges against pricing rules, and instantly update customer usage dashboards. Customers can get real-time visibility into their consumption and costs, avoiding “bill shock.” Usage data flows directly into invoices, which Alguna generates automatically on your billing schedule.

- Revenue recognition and analytics: For finance teams, Alguna provides out-of-the-box reports for MRR/ARR, cohort analyses, and can automate revenue recognition even on variable usage fees. It ensures compliance with accounting standards for subscription and usage revenue, a capability usually found only in heavy platforms like Zuora or Maxio.

- Integrations and APIs: Alguna connects with popular CRMs (Salesforce, HubSpot) and accounting systems (QuickBooks, Xero, NetSuite). This means your sales, billing, and financial reporting can be in sync. It also offers webhooks and APIs, so developers can extend or customize as needed.

Pricing: Alguna uses a transparent flat subscription fee model, not a percentage of your revenue. Paid plans start from $699 per month. Free tier and startup pricing available.

All plans include full platform access (pricing, CPQ, billing, analytics) and white-glove onboarding and migration support to get you off your old system.

This flat-fee approach can be a huge cost saver once your usage revenue grows (unlike Clerk/Stripe’s 0.7% fee that rises with volume).

Pros:

- Truly unified platform: Alguna covers pricing, quoting, billing, and revenue recognition under one roof. You eliminate the patchwork of separate billing engines, quote tools, and revenue spreadsheets. This unification reduces errors and gives every team (sales, product, finance) a shared source of truth.

- No-code for business teams: Designed so that sales, RevOps, or finance can self-serve changes. Updating a pricing tier or launching a promotion is as easy as a few clicks, no need to task engineering. This empowers non-technical stakeholders to own monetization, increasing agility.

- Usage-first architecture: Unlike legacy subscription systems retrofitted for usage, Alguna was built for high-volume usage billing from the start. It natively handles complex metrics (e.g. AI token counts, API call matrices) and real-time calculations. If your product is usage-heavy, Alguna won’t be the bottleneck.

- Custom contracts and billing logic: Alguna shines for B2B companies with custom deals and hybrid pricing. You can set up contracts that mix subscriptions, usage charges, one-off fees, discounts, and credit balances, and Alguna will accurately bill and recognize revenue for each component. Clerk/Stripe can’t easily do complex contract terms like ramped pricing or multi-element arrangements.

Review and control usage and overages in Alguna.

Cons:

- Newer entrant: Being a young platform, Alguna doesn’t have decades of enterprise tenure yet. It was founded in 2023, so some very conservative enterprises might view it as less proven than, say, Zuora. That said, Alguna has built its platform in collaboration with some enterprise heavy hitters in fintech and is enterprise ready.

- Not ideal for very early stage companies: If you’re an early startup with one simple $10/month plan and no usage components, Alguna’s comprehensive feature set might be more than you need initially. In such cases, a lightweight tool or Stripe Billing (or Clerk itself) could suffice until your pricing gets more sophisticated.

Best for:

- Scaling B2B SaaS and AI companies that are quickly layering on usage-based models or per-use pricing. If you expect your monetization to get complex (multiple product editions, usage metrics, custom enterprise deals), Alguna will future-proof your billing and revenue operations.

- Fintech or API platform startups where billing is part of the product. For example, companies charging per API call, transaction, or data volume can use Alguna to meter and bill those events seamlessly. It’s ideal when you need reliability at scale and flexibility to tweak pricing strategy frequently.

- Revenue-led teams that want control. If your Revenue Operations or Finance team wants to own pricing and billing configurations without always relying on engineers, Alguna’s no-code approach is a perfect fit.

Choosing between Clerk and Alguna for usage-based billing

If you’re evaluating Clerk vs Alguna in the context of usage-based billing, the decision really comes down to scope and plans to scale.

Clerk is a solid foundation for authentication and basic subscription flows, especially for early-stage teams that want to move fast and keep everything developer-led. For simple plans and lightweight monetization tied closely to users, it can be “good enough” at the start.

But usage-based pricing changes the game.

Once pricing depends on how customers use your product, and once revenue touches more teams than just engineering, the limitations become clear. Usage metering, pricing logic, contracts, invoicing, and revenue reporting can’t live comfortably in app code forever. Finance and RevOps need visibility, control, and auditability—and sales needs a way to sell custom deals without breaking billing downstream.

Alguna is purpose-built for usage-based and hybrid pricing, and it treats monetization as an end-to-end workflow—not a bolt-on. Real-time usage metering, flexible pricing models, CPQ, contracts, invoicing, and revenue recognition all live in one system, owned by the business rather than buried in custom code.

In short:

- Choose Clerk if you’re early, subscription-first, and optimizing for speed.

- Choose Alguna if usage-based revenue is core to your business, or about to be, and you want a platform that can scale with pricing complexity, team ownership, and revenue scrutiny.

As more SaaS, AI, and fintech companies move toward consumption-based models, the winners won’t be the teams that just track usage, they’ll be the ones that can quote, bill, and recognize revenue from usage without friction.

Ready to monetize usage without duct tape?

If your pricing is moving toward usage-based or hybrid models, your billing stack needs to keep up, without pushing every change back to engineering.

Alguna helps SaaS, AI, and fintech teams move from tracking usage to monetizing it end to end: pricing, CPQ, contracts, billing, invoicing, and revenue—all in one platform.