Startups quickly outgrow spreadsheet-based revenue recognition as they scale subscriptions, usage, and AI pricing strategies. What works for a handful of customers breaks at scale: manual processes create delays, errors, and audit gaps, especially when billing, contracts, and usage data live in different systems.

These inconsistencies inevitably surface in financial reporting, which is why even small mistakes can derail fundraising. Investors now expect GAAP/ASC 606-ready reporting from day one, and startups that recognize revenue upfront instead of over time often end up with costly restatements and damaged credibility.

Automated revenue recognition solves this by giving teams real-time visibility into ARR, deferred revenue, and performance obligations, while speeding up the month-end close, removing engineering dependencies, and keeping you compliant as pricing evolves.

This guide shares the best practices for automating revenue recognition in startups and the tools that support that shift.

What is the definition of revenue recognition?

In SaaS and subscription businesses, it means recognizing revenue only when it’s earned, not just when payment is received. For example, if a customer prepays $1,200 for a 12-month software subscription, the company should recognize $100 per month as revenue over the contract period.

Revenue recognition is governed by standards like ASC 606 (U.S. GAAP) and IFRS 15 (international), which require businesses to follow a 5-step framework that ensures revenue is reported accurately and consistently.

What is revenue recognition automation (and why it matters)

Revenue recognition automation is the process of using software to automatically calculate, schedule, and record revenue in accordance with accounting standards like ASC 606 or IFRS 15 without relying on spreadsheets or manual journal entries.

Instead of manually rebuilding revenue timing each month, the system pulls data from the source (contracts, billing, usage), applies the appropriate accounting logic, and produces accurate, audit-ready revenue entries in real time.

It matters for startups because it:

- Handles rising pricing complexity by pulling contract and usage data directly from source systems and applying revenue rules automatically. You no longer have to rebuild spreadsheets every time a pricing model changes.

- Eliminates costly manual mistakes by enforcing consistent logic and removing spreadsheet formulas that lead to mis-timed revenue or missed updates.

- Ensures compliance from day one by applying ASC 606/IFRS 15 rules consistently across all contracts. Clean, GAAP-aligned financials are now table stakes even at Seed and Series A.

- Improves forecasting and cash flow visibility with accurate earned/deferred revenue data that’s updated continuously.

- Builds credibility with investors by demonstrating disciplined, audit-ready financial operations.

What revenue recognition automation (actually) looks like in practice

In practice, revenue recognition automation replaces manual, spreadsheet-driven workflows with a unified, rule-based system that pulls data directly from contracts, billing, and product usage.

Here’s what that looks like day-to-day:

- Contracts, billing, and usage flow into one system: When a deal closes, or usage occurs, the platform automatically creates or updates the revenue schedule so there are no formulas, no copy/paste, and no separate deferral tabs.

- Revenue schedules generate automatically: The system interprets contract terms (price, term length, performance obligations) and usage to create compliant monthly or daily revenue entries.

- Usage, billing, and revenue stay in sync: If usage spikes, a customer exceeds a limit, or a contract changes mid-term, billing and revenue update together, preventing the “three systems, three ARR numbers” problem.

- Month-end close accelerates: The system automatically generates journal entries, reconciliations, and deferral updates, allowing finance to close days faster and focus on review rather than calculation.

- Real-time visibility replaces backward-looking reporting: Because revenue updates continuously, founders, finance, and investors can see accurate ARR, deferred revenue, and earned revenue at any point in the month and not weeks after close.

7 best practices for automating revenue recognition in startups

Before diving into the best practices, it’s important to understand why they matter.

Most scaling startups struggle with three recurring challenges:

- Fragmented billing/contract/usage systems that don’t sync

- Complex pricing models that break spreadsheets

- Inconsistent or non-auditable revenue processes that create investor and audit risk.

The following best practices for automating revenue recognition in startups eliminate these issues and help you move from manual spreadsheets to a scalable, compliant revenue workflow.

1. Standardize your pricing and billing models early

Automation works best when your pricing and billing aren’t one-off exceptions.

- Simplify SKUs and terms. Decide how each product is billed (monthly, annual upfront, usage-based, hybrid) and map each to a clear revenue rule (e.g., yearly upfront → recognized monthly over 12 months).

- Limit bespoke deals. The more exceptions you allow, the more manual work and “edge cases” you’ll have to maintain outside the system.

- Clarify performance obligations. If you bundle onboarding or services with the subscription, separate their standalone values so revenue can be allocated correctly under ASC 606.

Why it matters: Standardized contracts and billing terms make it possible for your revenue system to generate schedules automatically instead of your finance team decoding each deal in a spreadsheet.

2. Connect usage metering directly to billing and revenue

If you have any usage-based or AI-driven pricing, usage data must feed billing and rev rec directly.

- Integrate metering via API. Usage events (API calls, data volume, model queries) should flow into invoices and revenue entries without manual steps.

- Retire usage spreadsheets. Manually tallying usage each month is slow, error-prone, and doesn’t scale.

- Support more frequent recognition. For highly variable usage, daily or weekly recognition can keep revenue aligned with actual consumption.

Why it matters: This prevents revenue leakage, keeps customers billed correctly, and ensures revenue is recognized in the same period usage occurs and not just when someone updates a sheet.

3. Make your contracts ASC 606-ready from day one

Automation depends on clean, structured contract data.

- Identify performance obligations. Separate software, onboarding, support, and usage packs instead of burying everything in a single line.

- Set stand-alone selling prices (SSP). Define SSPs for your main components so discounts can be allocated consistently across them.

- Standardize contract modifications. Decide how you treat upgrades, renewals, and mid-term changes (new contract vs. modification) and capture the necessary dates and values in your order forms.

Why it matters: Each contract should clearly describe how and when revenue is earned. If the data is there, the system can automate recognition without constant human judgment.

4. Automate revenue schedules from a single source of truth

One of the biggest failure modes is maintaining separate systems, or spreadsheets, for billing and revenue.

- Drive revenue from the same data that drives billing. Contract and billing data should feed your rev rec engine directly.

- Avoid re-keying or duplicating contract terms. No side spreadsheets with different start dates or amounts.

- Let billing events act as triggers. If you invoice monthly for a service delivered monthly, that billing cadence can drive revenue recognition.

Example: Many startups end up with three ARR numbers: one in the CRM, one in Stripe, and one in finance’s Excel file. When revenue is generated from the same source as billing, those discrepancies disappear.

Why it matters: When you automate from the source, accuracy and consistency are baked into the process instead of being manually patched each month.

5. Build audit trails and reporting into your workflow

Automation should make revenue easier to explain, not harder.

- Use systems with full change logs. You should be able to see who changed what, when, and which contract it was based on.

- Generate standard reports automatically. Use the system, not ad hoc Excel builds, to generate revenue waterfalls, deferred revenue roll-forwards, and remaining performance obligations.

- Document your policies. Write down your recognition rules, SSP methodology, and modification treatment, and align them with the system's configuration.

- Review outputs regularly. Make monthly automated revenue report reviews part of your close checklist.

Why it matters: Strong audit trails and clear reporting reduce audit and due diligence pain and demonstrate that revenue is controlled, not just “best effort” in spreadsheets.

6. Shorten the month-end close with rule-based automation

The operational payoff of automation is a faster, calmer close.

- Automate deferral and recognition entries. Journal entries to move cash and A/R into deferred revenue and then into revenue should be generated by the system, not entered manually.

- Use rules for complex patterns. Encode scenarios like “15% upfront, 85% over 12 months” or milestone-based recognition as rules, not one-off calculations.

- Move toward a continuous close. Recognize revenue throughout the month so you’re reviewing numbers at month-end, not starting from zero.

Why it matters: When the system handles the mechanics, finance can spend close week on analysis and commentary instead of data entry and reconciliation.

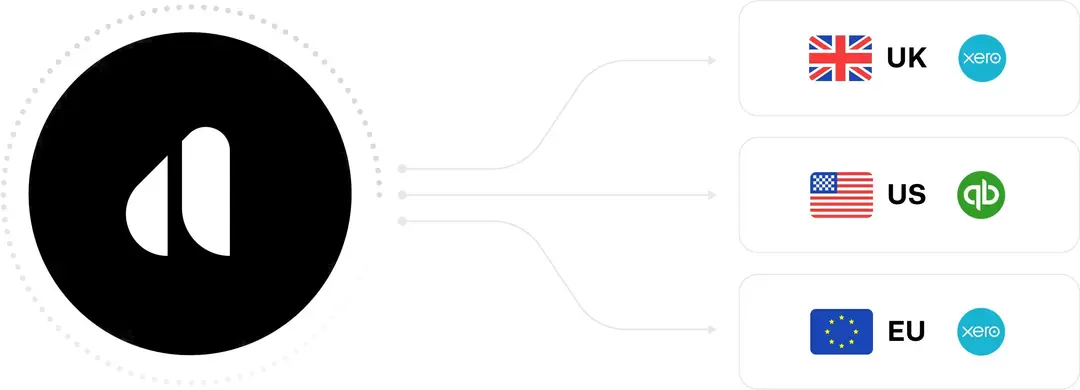

7. Plan for multi-entity and multi-currency early

If you expect to go global or spin up new entities, plan for it now, not during a crunch.

- Pick tools that handle multiple entities and consolidations. You shouldn’t need separate manual consolidation spreadsheets when you add a UK or EU entity.

- Enable multi-currency revenue recognition. Ensure the system can apply appropriate FX rates and handle revaluations where needed.

- Capture data for both ASC 606 and IFRS 15. Even if you report under one standard today, having the right fields makes life easier if requirements change.

Why it matters: Designing for scale up front prevents a painful rebuild of your revenue stack when you expand into new markets or corporate structures.

Ovreview: 3 types of solutions for revenue recognition automation

For early-stage SaaS startups, revenue recognition tools typically fall into three categories.

We cover specific vendors in our post 7 best tools for SaaS revenue recognition 2025, but here’s the high-level landscape to help you understand how these options differ.

| Solution type | Examples | Best for |

|---|---|---|

| Billing platform w/ rev-rec add-on | Stripe Revenue Recognition; Chargebee RevRec | Seed–Series A startups with simple subscription models already billing through Stripe or Chargebee who need quick, lightweight ASC 606/IFRS 15 compliance. |

| Dedicated / finance-first rev-rec | Maxio; Zuora Revenue; Sage Intacct | Later-stage or more complex startups that already have a billing/ERP stack and need robust revenue rules, audit-ready workflows, and detailed reporting. |

| Unified billing + usage + rev-rec stack | Alguna; Tabs | Usage-based or hybrid-pricing startups that want an integrated quote-to-revenue platform instead of multiple tools and manual spreadsheets. |

1. Billing platforms with built-in revenue recognition

Some subscription billing or payment platforms include native rev rec modules. Stripe, for example, offers a Revenue Recognition add-on that auto-creates accrual schedules for Stripe Billing users, while tools like Chargebee provide basic ASC 606 reports for simple SaaS models.

For startups with straightforward subscriptions and all billing already running through Stripe or Chargebee, these tools are often the fastest way to get compliant without adding another system. The trade-off: they struggle with more complex contracts, multiple revenue streams, or lots of usage-based edge cases.

2. Dedicated revenue recognition software

Dedicated rev rec tools are often built with enterprise requirements in mind. Platforms like Maxio, Zuora Revenue, and Sage Intacct are designed to plug into existing CRMs, billing systems, and general ledgers, offering deep functionality for compliance and reporting. They excel at handling multi-element arrangements, SSP allocations, and custom revenue schedules across multiple entities or currencies.

⚠️ But with that depth comes complexity as these systems typically require longer implementations, trained finance teams, and strong IT support, making them a better fit for larger organizations with mature financial operations and heavier compliance burdens.

3. Unified revenue automation platforms

Modern end-to-end revenue automation platforms combine CPQ, usage metering, billing, and revenue recognition into a single platform. Y combinator backed Alguna is an AI-native quote-to-revenue platform for SaaS, while tools like Tabs focus on unifying usage, billing, and rev rec.

This model makes the most sense for fast-growing startups, especially those with usage-based or hybrid pricing, that want real-time revenue schedules, unified data, and minimal manual ops.

How to choose (as a startup)

- Simple, early-stage, subscriptions only? Built-in billing features (Stripe, Chargebee) may be enough.

- Complex contracts, higher volume, or growing finance scrutiny (e.g., fundraising, audits)? A dedicated rev rec tool on top of your existing stack is often the next step.

- Usage-based or hybrid pricing, or you’re growing fast and want to avoid duct-taping systems together? A unified platform like Alguna will be the best long-term fit.

Many startups start with built-in tools, then graduate to a dedicated or unified system as they scale, and their board/auditors care more about revenue accuracy.

Why fast-growing startups choose Alguna for automated revenue recognition

Y Combinator backed Alguna is an AI-native quote-to-revenue platform that was purpose-built for the complexities of both AI monetization and modern SaaS monetization.

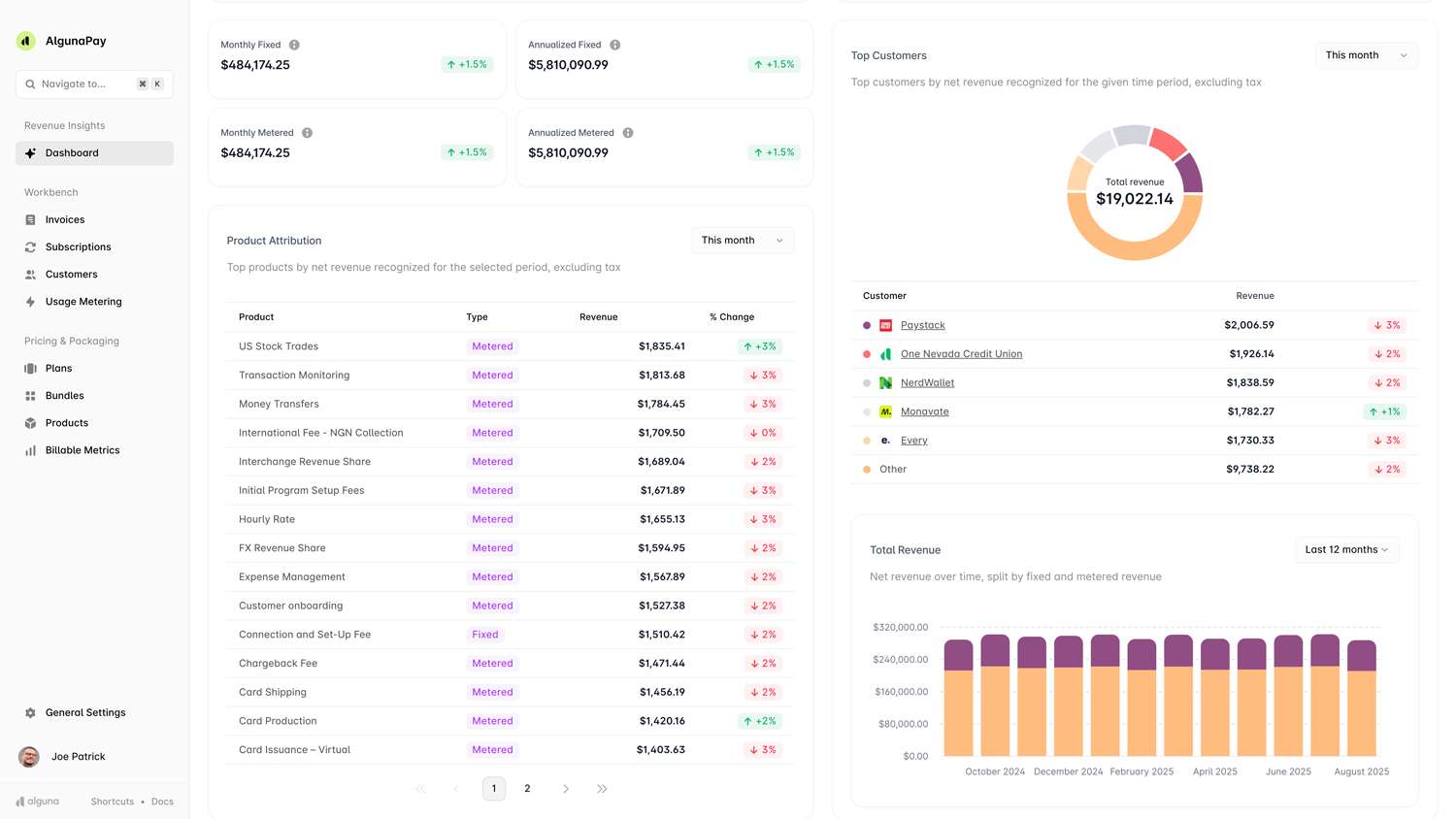

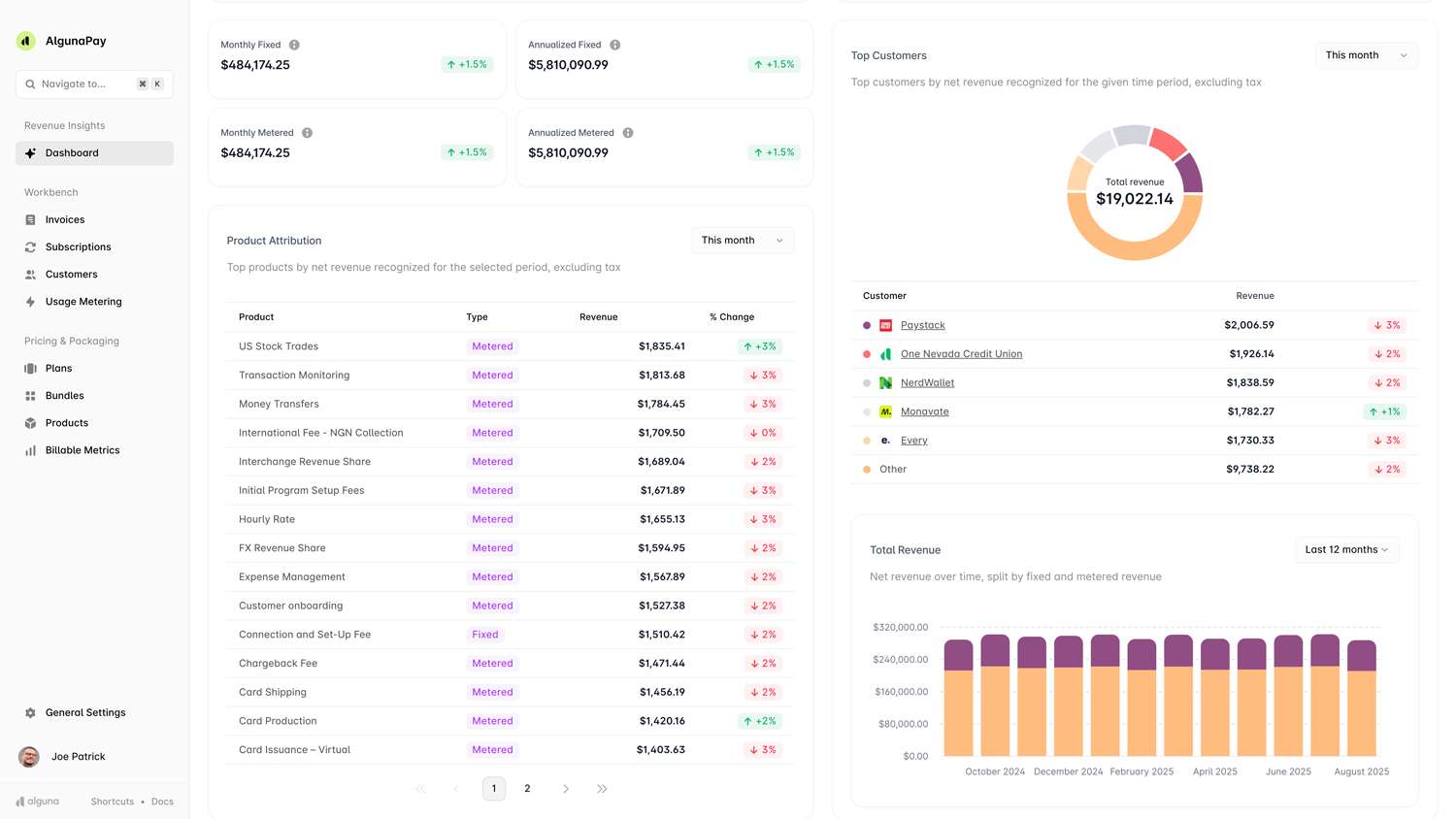

That's why scaling SaaS, AI, and fintech startups choose Alguna. The no-code platform provides finance teams with a unified, real-time revenue engine that handles modern pricing, automates ASC 606, and eliminates the complexity of juggling multiple tools.

What makes Alguna different

- Unified quote-to-revenue stack: Alguna combines CPQ, usage metering, billing, and revenue recognition in a single system. Contracts flow cleanly into billing and rev-rec, giving startups a single source of truth rather than having to reconcile across multiple tools.

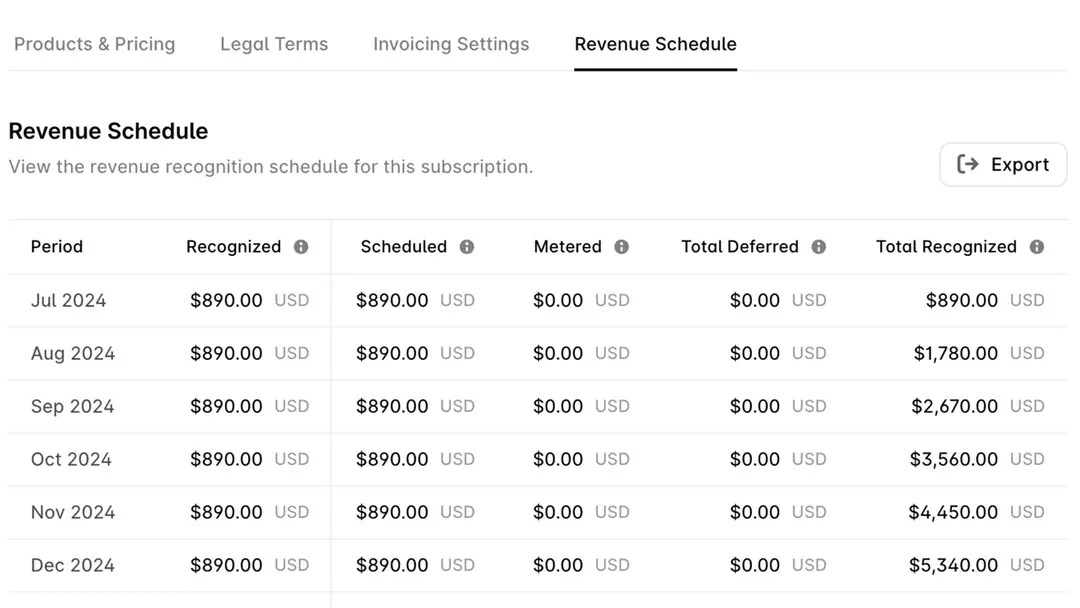

- ASC 606 automation built in: The platform fully automates ASC 606/IFRS 15, handling SSP allocations, performance obligations, and contract modifications. It also generates revenue schedules instantly and keeps them audit-ready by design.

- Real-time revenue schedules: Revenue updates the moment usage hits or a contract changes. Startups get up-to-date ARR, deferred revenue, and earned-to-date insights without waiting for batch jobs or manual spreadsheets.

- Transparent, audit-ready reporting: Every revenue entry links back to the exact contract and quote. Waterfalls, deferral balances, and ARR movements are automatic, making audits and board reporting far easier for lean finance teams.

- No-code pricing + revenue rules: Finance and RevOps (not engineering) can launch and change pricing, billing cadences, and recognition rules. Startups avoid custom code, billing debt, and engineering bottlenecks.

- Built for usage-based and hybrid pricing: Alguna natively supports subscriptions, metered usage, prepaid credits, overages, milestones, and AI/agent-based pricing. It handles complex, evolving monetization without hacks or workarounds.

- Fast implementation and startup-friendly setup: Teams go live in weeks, not months. Migration is white-glove, pricing is flat and predictable, and the platform scales to multi-entity, multi-currency growth.

Turning revenue recognition into a growth advantage

Implementing best practices for automating revenue recognition in startups creates a solid financial foundation for scale. When revenue schedules, billing events, and usage data flow through one consistent system, teams get accurate ARR, dependable deferred revenue balances, and a faster, more predictable close.

As pricing evolves toward usage-based, hybrid, and AI-driven models, following sound revenue processes becomes even more critical. Spreadsheets can’t keep revenue aligned with real-world consumption, and manual work increases audit and fundraising risk. Automated ASC 606 logic ensures revenue is recognized consistently and gives investors confidence in the reliability of your numbers.

Modern platforms like Alguna support this level of automation from day one by unifying billing, usage metering, and ASC 606–compliant revenue recognition in a single workflow. The result is cleaner operations, faster iteration, and a revenue infrastructure built to scale with the business.

Revenue recognition automation without the enterprise overhead

Alguna gives SaaS and AI companies a faster, smarter way to recognize revenue—without stitching together multiple tools.

✅ Streamline ASC 606/IFRS 15 compliance

✅ Unify billing, usage, and revenue schedules

✅ Audit-ready from day one

Book a demo and see how Alguna simplifies revenue recognition for modern SaaS.