• SaaS and AI companies use them to reduce churn, improve cash flow, and scale collections without manual effort.

• This guide compares 5 top tools including Alguna, Chargebee, and Recurly to help you pick the right fit.

Every subscription business loses revenue to failed payments.

That's why automated dunning and cash collection tools are the invisible engine behind healthy SaaS and AI revenue.

They recover failed payments, cut involuntary churn, and keep cash flowing without bogging down finance teams.

Here, we'll take a look at five tools that combine smart retries, customer-friendly reminders, and billing automation to effortlessly recover revenue and give finance teams clean operational control.

What are automated dunning and cash collection tools?

Automated dunning and cash collection tools handle everything that happens after a payment fails.

They:

- Detect failed charges instantly

- Send timely reminders

- Retry payments automatically

- Prompt customers to update billing details

The goal is simple: recover revenue that would otherwise be lost to involuntary churn.

Top 5 automated dunning and cash collection tools for billing subscription management

Several platforms stand out for helping SaaS and AI companies automate their dunning processes.

Below is an overview of the five best tools, and what makes each noteworthy.

1. Alguna: Unified platform for pricing, billing, dunning, and collections

Alguna is a Y Combinator backed revenue automation platform that's purpose-built for SaaS and AI companies. Its no-code platform unifies pricing, billing, usage metering, dunning, and collections into one modern system,

Modern SaaS revenue teams typically move to Alguna in order to replace (sometimes multiple) legacy systems with one unified quote-to-revenue solution.

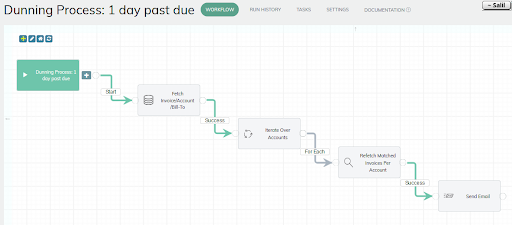

Alguna brings automated dunning into the AI era by eliminating the constant manual follow-ups, payment checks, and overdue invoice chasing that slow finance teams down.

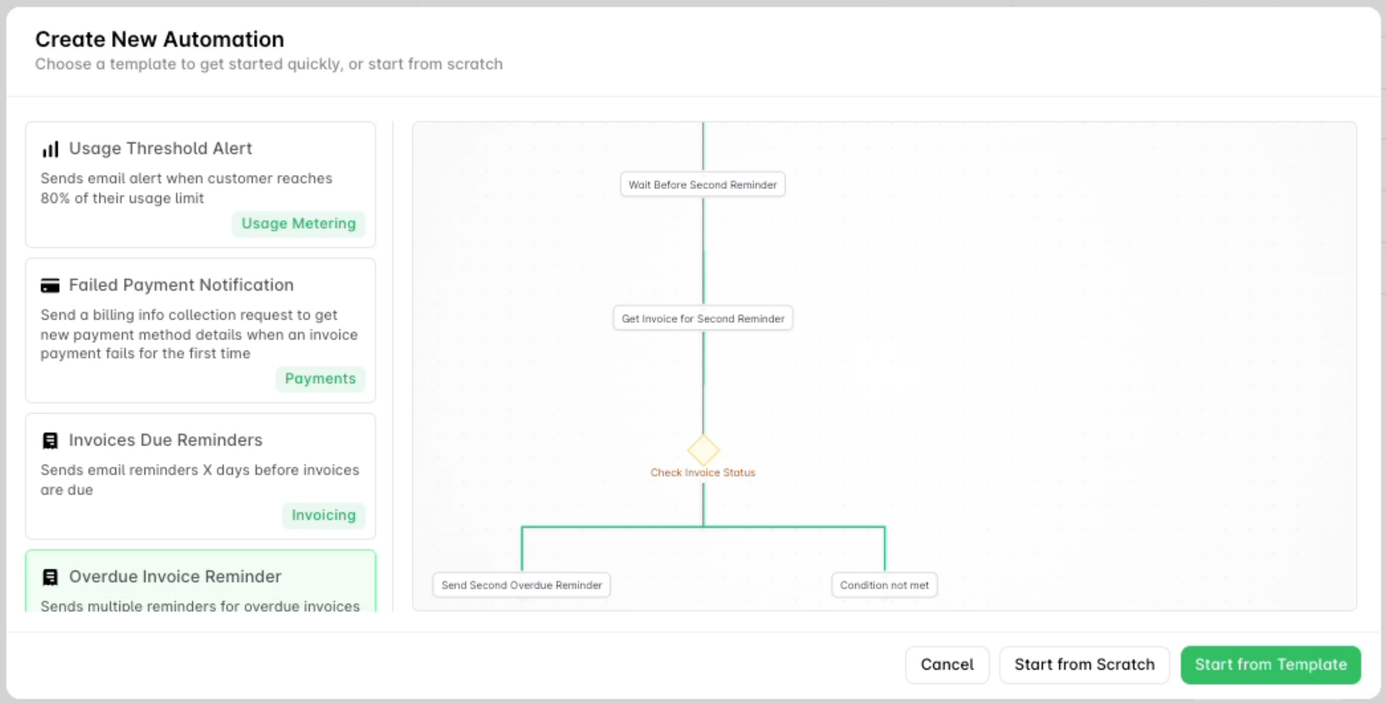

Instead of reactive collections, Alguna turns billing events into automated, intelligent workflows. This means failed payments are recovered faster and nothing slips through the cracks.

Alguna's dunning features

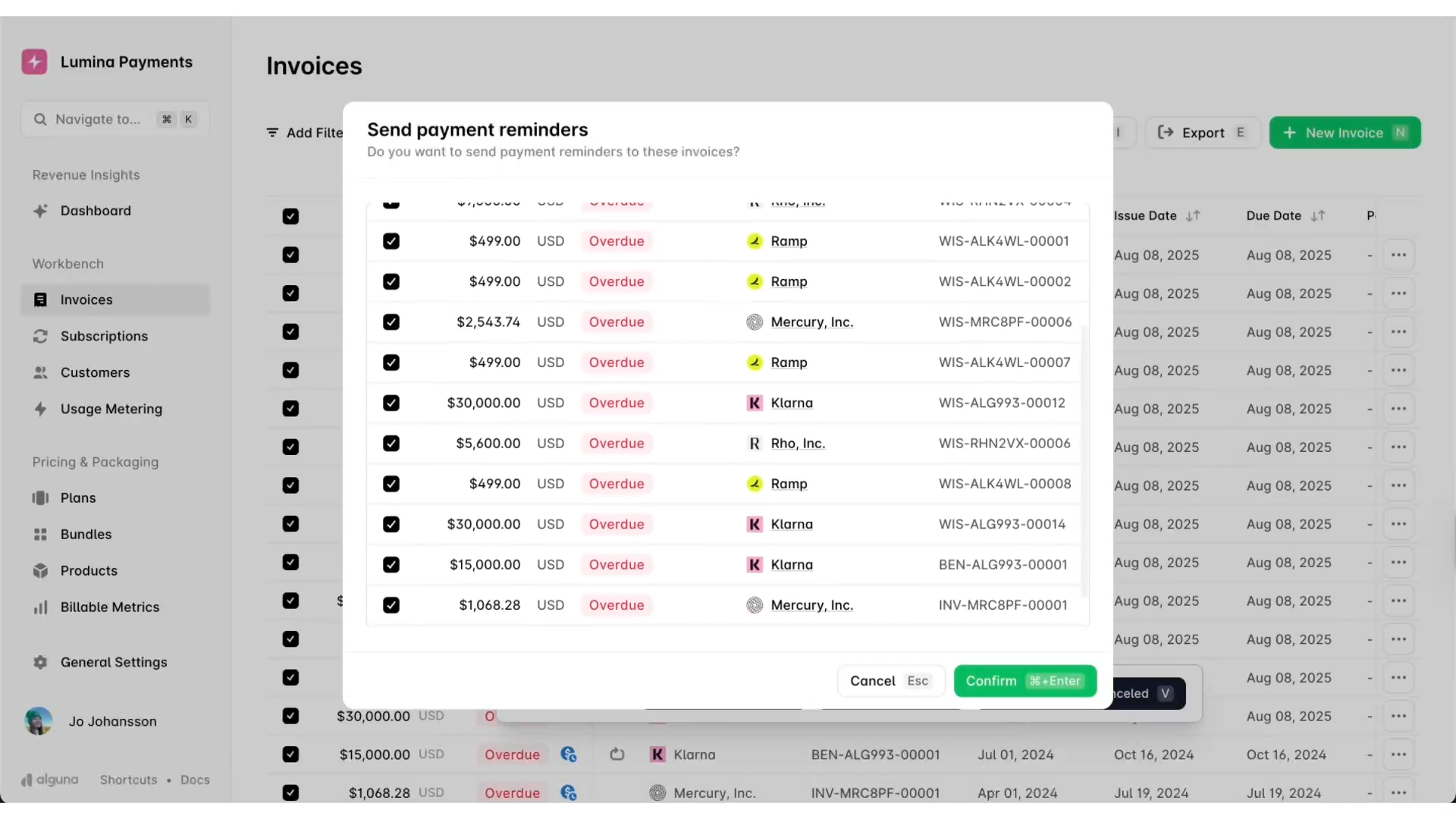

- Automated reminders: Trigger emails, Slack messages, or customer notifications the moment a payment fails or an invoice becomes overdue.

- Smart retry logic: AI-aligned retry attempts based on timing, payment type, and customer history to maximize recovery.

- Escalation workflows: Define how overdue cases progress—from gentle nudges to finance-ready escalation paths.

- Human-in-the-loop approvals: Route exceptions or high-value accounts for review before action is taken.

- Reusable templates: Failed payment workflows, overdue invoice reminders, usage alerts, and more.

- System-wide orchestration: Connect dunning actions across your full stack, including HubSpot, QuickBooks, Slack, internal systems, and external APIs.

Key platform capabilities

- Unified quote-to-revenue platform (typically customers replace 4-5 tools with Alguna)

- No-code CPQ built for the AI era

- Contracts AI turns static PDFs into live subscriptions

- Can handle any pricing model, from subscription management to usage-based, AI tokens, and credits

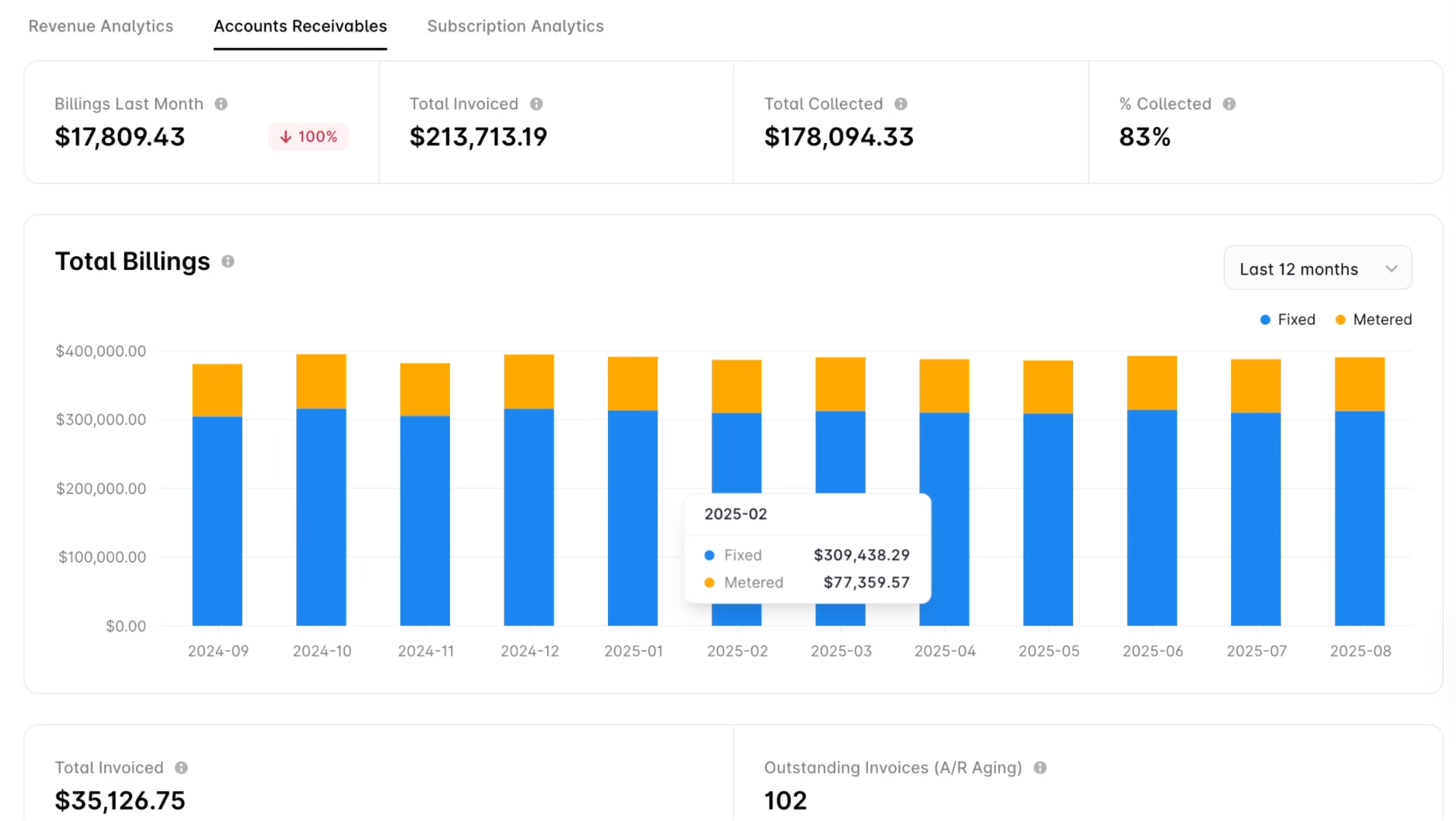

- Real-time AR dashboards and recovery insights

- Streamline ASC 606/IFRS 15 compliance

Limitations

- Newer platform (purpose-built for B2B SaaS and AI native companies)

- Best suited for modern SaaS and AI pricing, not ideal for very traditional ERP-style billing setups

Best for

SaaS and AI companies scaling fast, adopting hybrid or usage-based pricing, or replacing legacy billing stacks with one unified revenue management system.

Pricing

Starts at $399/month with migration and white-glove onboarding included.

- Adam Liska, CEO at Glyphic

Read the case study

2. Chargebee: Proven platform for standard SaaS subscription models with automated dunning

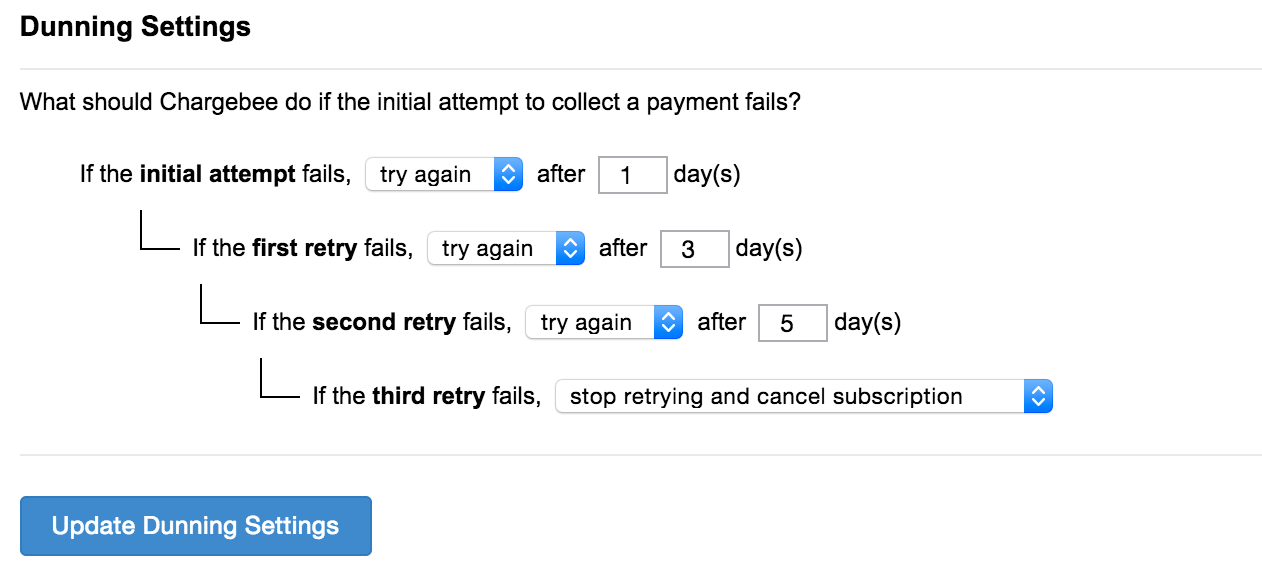

Chargebee is a long-standing subscription billing platform known for its strong recurring billing and revenue operations features. It includes a reliable dunning module to automate payment follow-ups and help improve cash recovery.

Key features

- Configurable dunning rules and reminder sequences

- Automated payment retries

- Subscription lifecycle management

- Integrations with major gateways and CRMs

- Invoicing, coupons, tax handling

Limitations

- Pricing increases as you scale

- Can become complex to manage for usage-heavy or AI billing models

- Implementations can get lengthy for larger orgs

Best for

Growing SaaS companies with straightforward subscription models looking for a mature billing platform.

Pricing

Starts with tiered plans; advanced features and dunning customization included in higher tiers.

3. Zuora: Automated dunning for enterprise

Zuora is an enterprise-grade billing and revenue management suite designed for large subscription businesses. Its automated dunning engine supports complex billing scenarios and global operations.

Key features

- Enterprise-level subscription billing

- Automated dunning workflows with configurable rules

- Revenue recognition (ASC 606/IFRS 15)

- Multi-entity, multi-currency support

- Deep integrations with enterprise systems (ERP, CRM)

Limitations

- Long implementation cycles

- Heavy operational overhead

- Requires technical expertise to manage and optimize

Best for

Enterprises with complex global subscription structures and large finance ops teams.

Pricing

Estimate $50,000 per year along with additional cost for add-ons and integrations.

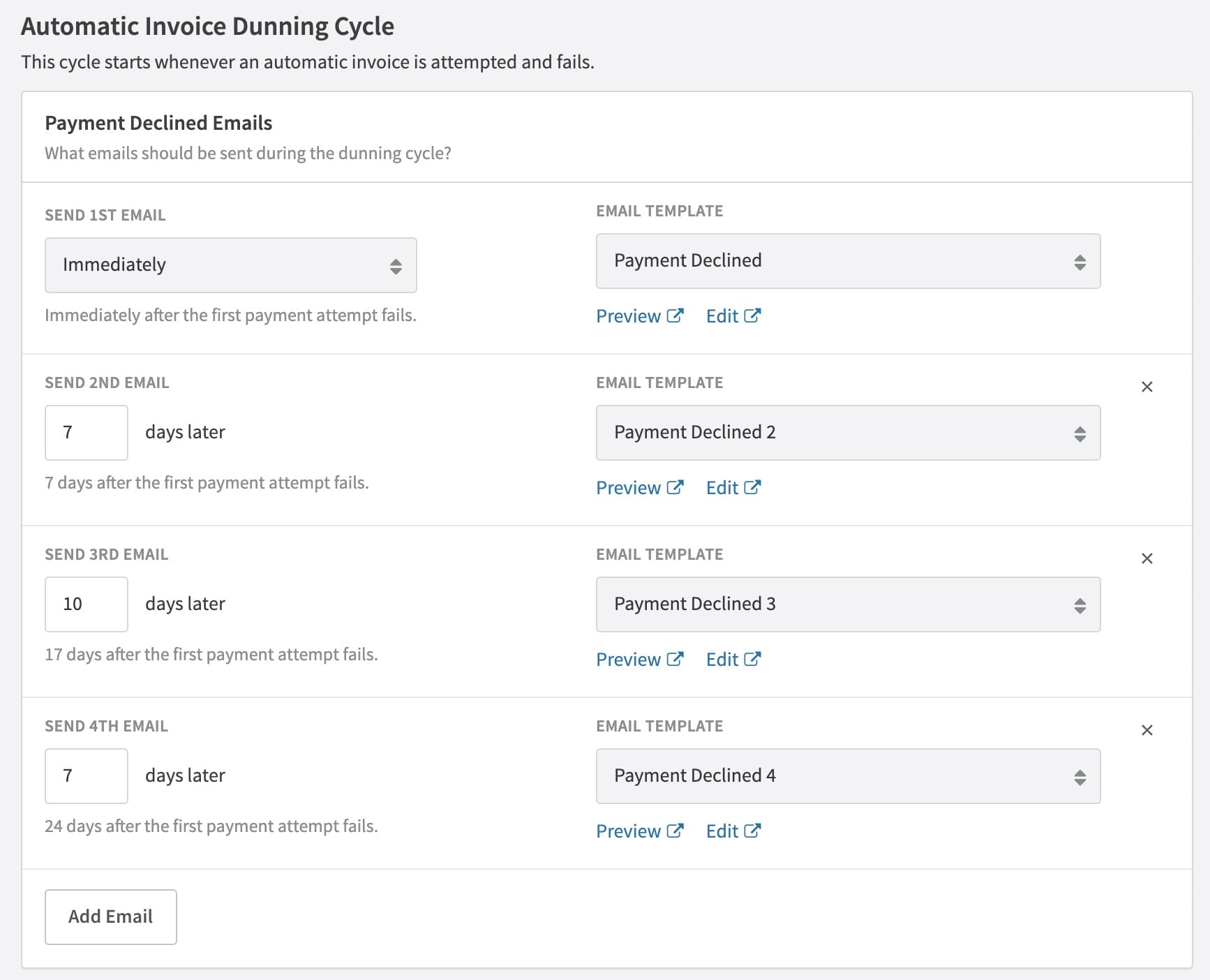

4. Recurly: Subscription billing with strong recovery process

Recurly is a subscription billing platform known for strong recovery performance and ease of use. Its automated dunning features help businesses reduce involuntary churn with structured retry and notification logic.

Key features

- Configurable dunning campaigns

- Smart payment retry schedules

- Subscription analytics and churn tracking

- Global payments support

- Intuitive UI for finance teams

Limitations

- Less flexible for complex usage-based billing

- Limited native revenue recognition

- Some advanced dunning flows require higher tiers

Best for

Mid-market SaaS companies needing a reliable, user-friendly billing platform with strong dunning capabilities.

Pricing

Tiered pricing plus transaction fees with advanced dunning options in higher plans.

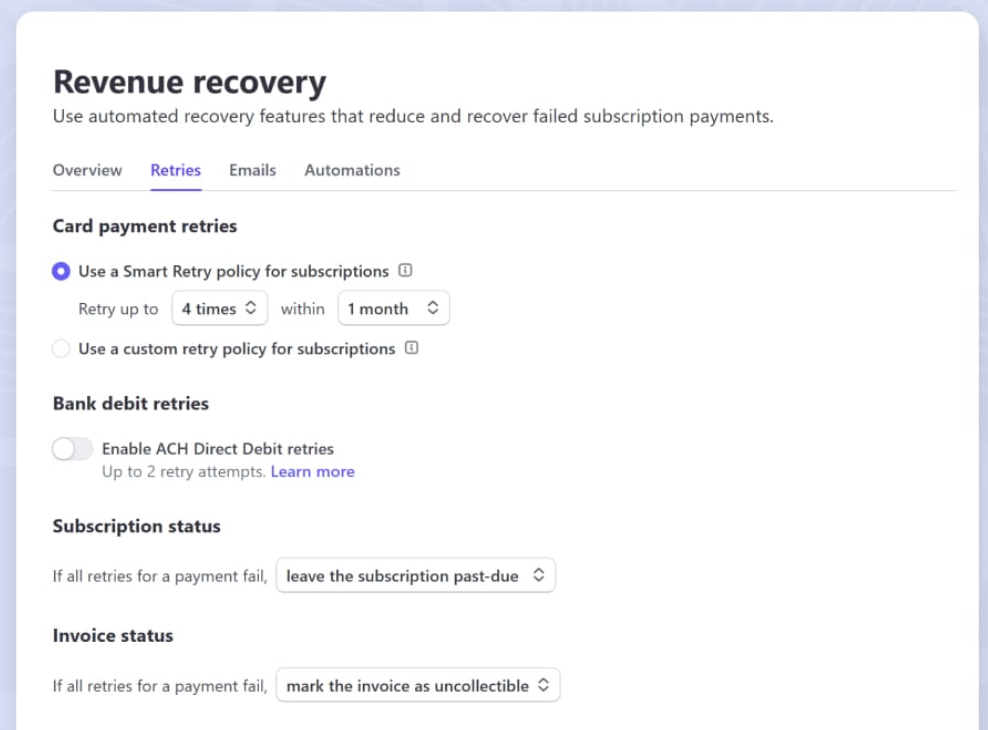

5. Stripe Billing: Basic dunning for startups

Stripe Billing offers subscription management and basic dunning aimed at early stage startups. It’s developer-friendly and ideal for teams already using Stripe for payments.

Key features

- Automatic payment retries

- Customizable email reminders

- Support for subscription and usage billing

- Seamless integration with Stripe Payments

- Card updater (network-driven updates)

Limitations

- Limited dunning customization

- Not built for complex pricing catalogs

- No native revenue recognition

- Can get expensive as you scale due to revenue cut pricing model

Best for

Startups or developer-led teams that want lightweight billing + simple dunning without adding multiple tools.

Pricing

0.5%–0.8% revenue cut based on recurring billing volume +plus payment processing fees.

How to choose the right tool

Use this quick decision guide:

- Early-stage SaaS? Start with a tool that plugs directly into your billing system with minimal setup.

- Scaling quickly? Choose a unified platform (like Alguna) that handles billing, usage, collections, and rev rec in one system.

- Selling globally? Alguna or an MoR model may simplify compliance and payments.

- Complex usage pricing? Pick a system built for AI and usage based pricing—Alguna is purpose-built for this.

Recover more revenue, with less churn and overhead

Automated dunning and cash collection tools are essential for protecting recurring revenue. They reduce involuntary churn, improve cash flow, and give finance teams clean visibility into who owes what (and why).

Whether you choose a unified platform like Alguna or a more specialized tool, investing in modern dunning automation ensures your business recovers more revenue with less operational overhead.