If you’re evaluating Tabs revenue automation platform, then end-to-end AI monetization platform, Alguna, should be part of the conversation.

While Alguna and Tabs are both types of revenue automation software, they take different approaches to solving quote-to-revenue challenges for modern SaaS, AI, and fintech companies.

So which one is a better fit for your business?

Below, we dive into what each platform does, how they handle pricing, subscriptions, billing, and collections, and when you should choose which platform.

But first, let’s look at how Y Combinator-backed Alguna compares against Tabs revenue automation platform.

Alguna vs Tabs: Revenue automation software - Overview

| Criteria | Alguna (YC S23 alum) | Tabs |

|---|---|---|

| Year founded | 2023 (YC S23). | 2023 (launched from stealth in 2024). |

| Founder backgrounds | Aleks Đekić, Jamie MacLeod — fintech/billing (Primer, Dojo, Bank of America). | Ali Hussain, Deepak Bapat, Rebecca Schwartz — SaaS finance/software. |

| Platform overview | End-to-end quote-to-cash. Centralizes pricing, CPQ, billing, collections, rev rec to cut spreadsheets/leakage. Deep integrations with CRMs ERPs. | Revenue automation for billing + A/R. Ingests signed contracts, generates invoices, chases payments, recognizes revenue. |

| Best for (target use) | AI/SaaS/fintech scaling with hybrid/usage models; unified subs + usage + multi-entity across quote → billing → rev rec. | Finance teams needing contract-to-cash automation, high invoice volumes, strong CRM/ERP sync. |

| Key features | • No-code CPQ & e-sign • Real-time usage + hybrid billing • Invoicing & dunning • Rev rec (ASC 606), multi-currency/entity • Analytics • CRM/ERP/payment integrations |

• Automated invoicing (recurring/usage/milestones) • Dunning & payments • Rev rec & reporting • AI agents • APIs + integrations |

| Limitations | Not a fit for very basic billing needs. | No CPQ/quote authoring; mid-term changes need workarounds; multi-currency/tax still maturing. |

| Free tier | Yes — Starter (up to 10 invoices/mo) + 30-day trial. | No — paid only; guided demo. |

| Pricing | Starter: $0 • Growth: $699/mo • Enterprise: custom. Flat SaaS; scales by usage/complexity, not % of revenue. | Launch: $1,500/mo • Higher tiers: custom (e.g., NetSuite). Flat SaaS by company needs. |

| Automation & AI | Contracts AI (contract parsing) • MCP (chat interface) • No-code workflow automations. | LLM contract extraction • AI agents for billing/collections • Predictive insights. |

| Integrations & API | CRM: Salesforce/HubSpot • ERP: QuickBooks/Xero (+NetSuite) • Payments: Stripe/others (BYO) • Webhooks/API • Slack/Teams. | CRM: Salesforce/HubSpot • ERP: NetSuite/QuickBooks/Rillet • Payments: Stripe/ACH/Plaid • DocuSign • Avalara • Zapier • REST API. |

| Implementation time | ~2–4 weeks; white-glove migration. | ~1 month; vendor-assisted onboarding. |

| Scalability | Multi-entity/currency, high-volume usage events; IFRS/ASC 606; cloud-native. | Enterprise A/R scale, SOC 2 Type II, audit trails; handles thousands of invoices. |

| Support model | High-touch; Slack/Teams; 24/7 for Enterprise. | Dedicated CSM and support. |

| Security & compliance | SOC 2 Type II; ASC 606/IFRS; full audit trails. | SOC 2 Type II; ASC 606; encrypted, auditable events. |

| Customization & extensibility | No-code configuration; workflows; templates; full REST API + webhooks. | REST API; Zapier; embed billing; custom flows. |

| Revenue model support | Subscriptions, usage, hybrid, one-time, credits/prepaid, outcome/milestones — no code. | Subscriptions, usage, hybrid, milestones — driven by contract terms. |

| Reporting & analytics | MRR/ARR, bookings, churn, A/R aging, usage; exports/warehouse sync; custom dashboards. | ARR waterfall, cash, A/R aging, renewals; finance dashboards; export to BI. |

| ROI & maintenance | Replaces 5–6 tools; cuts leakage; 80% less billing ops time; minimal eng. | Faster cash flow; 50% lower DSO; scales A/R without headcount; fewer errors. |

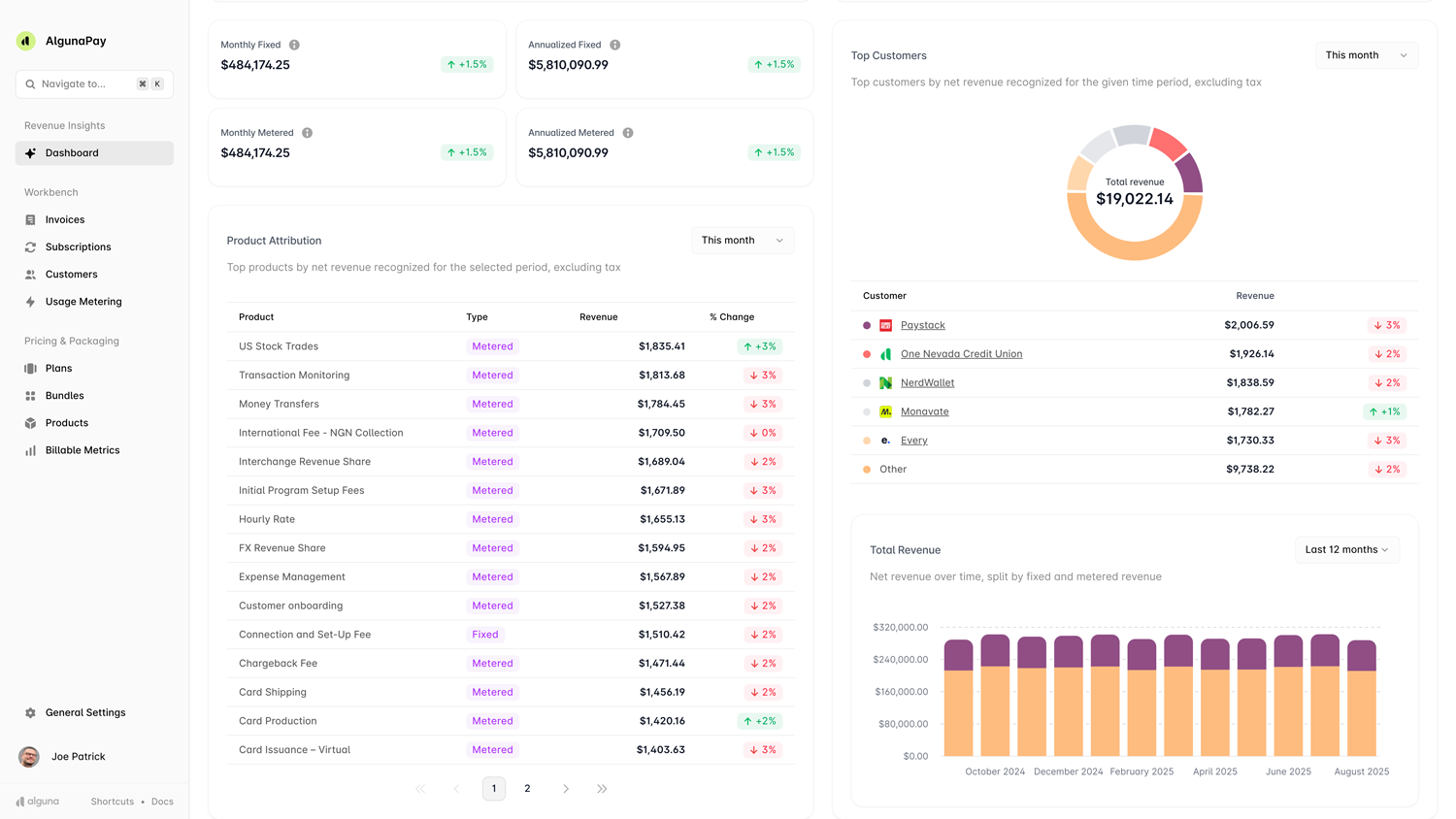

What Alguna’s AI monetization platform offers

Alguna is an AI monetization platform designed for modern SaaS, AI, and fintech companies.

It unifies pricing, quoting, billing, and revenue recognition into a single system so that sales, finance and product teams aren’t juggling multiple tools.

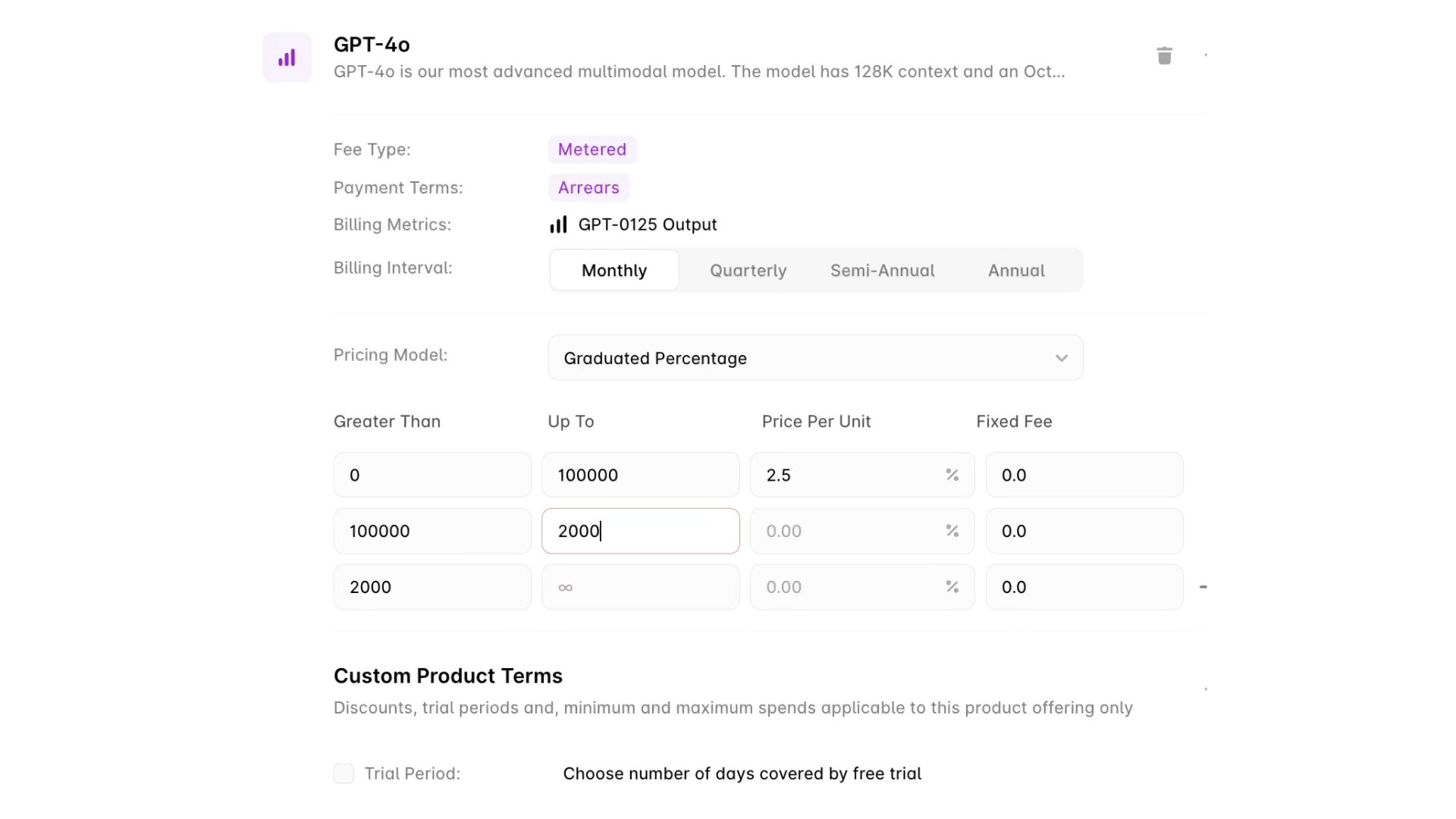

Unlike legacy subscription products, Alguna supports complex hybrid models, including tiered subscriptions, usage‑based fees, credit wallets, and outcome‑based pricing.

It includes a no‑code CPQ module, allowing teams to build and send quotes in minutes and dynamically combine per‑seat, tiered, and usage‑based pricing within a single contract.

On the billing side, Alguna can meter any custom metric in real time (API calls, feature usage, etc.) and automatically generate invoices based on recurring subscriptions or metered usage.

Pricing experiments, such as new tiers or promotional discounts, can be launched without engineering involvement thanks to its visual UI, and real‑time revenue insights help identify stalled renewals or margin‑eroding discounts early.

The platform is built for multi‑currency and multi‑entity operations with built-in tax and compliance handling, and it integrates with Salesforce, HubSpot, NetSuite, QuickBooks and Xero.

For finance teams, Alguna automatically creates revenue schedules and posts them to your ERP in compliance with ASC 606/IFRS 15. You can also export raw usage data via API or CSV for deeper analysis.

🚀 Recent launches:

Alguna MCP: Enable AI assistants to interact directly with your Alguna account, providing seamless access to billing, subscription, and customer data through natural language interfaces.

Alguna credits: Configure, automate, and reconcile credits directly within subscriptions. No spreadsheets, no workarounds.

Workflow automations: Connect billing, payments, usage, and communication events into structured, reusable flows making sure nothing slips through the cracks.

Revamped RevRec engine: Know exactly what’s earned, deferred, and reportable as product, finance, and RevOps teams all see the same numbers, the same way, at the same time.

What Tabs revenue automation platform offers

Tabs is a modular revenue automation platform aimed at SaaS companies that need to automate billing, collections and revenue recognition.

The platform’s billing module turns signed contracts into invoices, creates billing schedules from any pricing model (API call–based, seat‑based, outcome‑based or traditional subscriptions) and calculates usage in real time. It syncs invoices with your ERP and can recalculate schedules whenever contracts are amended.

Tabs distinguishes itself with powerful collections and cash application tools. Smart dunning sequences send contextual reminders via email or Slack, while AI matches bank deposits to invoices and reconciles them without manual effort.

Customers can pay via credit card, ACH, wire or check using a single portal, and the system auto‑charges stored payment methods. Tabs also includes a revenue‑recognition module that supports subscription, usage‑based and hybrid models and keeps you compliant with ASC 606. It syncs journal entries directly to NetSuite or QuickBooks.

⚠️ However, Tabs doesn’t include CPQ or quoting, pricing experiments require more developer intervention, and it lacks built-in multi‑entity or multi‑currency capabilities.

Alguna vs Tabs: Revenue automation feature comparison

The table below summarises how each product handles major revenue‑operations features.

✅ indicates the feature is supported, along with a brief overview of product offering.

❌ means it isn’t offered.

| Feature | Alguna | Tabs |

|---|---|---|

| Unified quote-to-cash platform (CPQ + Billing + RevRec) | ✅ Unified quote-to-cash system with CPQ, billing and revenue recognition with multi-entity support | ❌ |

| No-code CPQ | ✅ Build and send quotes in minutes, integrated CPQ synced with CRM | ❌ |

| Flexible pricing models (subscriptions, tiered, usage-based, hybrid, outcome, credit) | ✅ Supports any pricing model. Tiered, usage-based, hybrid, outcome-based and credit models | ✅ API-call, seat-based, outcome and annual subscription models supported |

| Mix and match pricing in one quote | ✅ Dynamically combine per-seat, tiered and usage pricing in one quote | ❌ |

| Outcome-based and credit billing | ✅ Designed for modern usage-based, credit & outcome-driven pricing | ❌ |

| Usage metering & real-time billing | ✅ Real-time metering & billing via flexible engine | ✅ Real-time usage ingestion & billing calculation |

| No-code pricing experiments | ✅ Launch new pricing tiers/promos without code | ❌ |

| Automated invoice generation | ✅ Generate invoices automatically from subscriptions or usage | ✅ Generate invoices for any pricing model & send automatically |

| Integrated collections & dunning | ✅ Integrated payments & dunning; handle multi-currency & consolidate billing | ✅ Smart dunning, cash application & collections automation |

| Customer payment portal & multiple payment methods | ✅ ACH, SEPA, wire, cards, wallets, and offline logging | ✅ Payment portal accepts card, ACH, wire, check & autocharge |

| Multi-currency & multi-entity operations | ✅ Multi-currency & multi-entity ready; handle tax & entity rules | ❌ |

| Revenue recognition & ASC 606/IFRS compliance | ✅ Auto-generate revenue schedules & recognize deferred revenue with ASC 606/IFRS compliance | ✅ Supports subscription, usage-based & hybrid models; ASC 606 compliant |

| Deep ERP/CRM integrations | ✅ Connects to Salesforce, HubSpot, QuickBooks, Xero & NetSuite | ✅ Bi-directional sync with NetSuite, QuickBooks & ERP; push journal entries |

| Automation for billing/collections | ✅ Alguna's intelligent workflows utomates invoices, collections & reconciliations 24/7 | ✅ AI agent automates invoices, collections & reconciliations; 24/7 execution |

| Revenue analytics & predictive reporting | ✅ Real-time revenue insights & full-funnel metrics; leak alerts & forecasting | ✅ Predictive cash-flow forecasting, renewals AI & AR analytics |

| Align PLG & Sales motions | ✅ Spin up PLG & SLG price plans; compare conversion & time-to-close | ❌ |

| Developer-free configuration (no code) | ✅ Visual UI for billing rules; update pricing without developers | ❌ |

| Raw usage data export & API | ✅ Export raw usage data via CSV or API | ❌ |

⚠️ Always check vendor websites for most up-to-date features.

How Alguna and Tabs revenue automation platforms compare

Below, we compare key differences between Alguna and Tabs across various aspects of the platforms, from supported billing models to integrations, and target users.

1. Billing models and usage-based pricing

Alguna was built for dynamic pricing experimentation and supports any pricing model. It supports any combination of subscriptions, metered usage, one-time fees, or prepaid credits, all configurable without code. Teams can adjust usage tiers, overage rules, or hybrid models directly in the UI, making it ideal for AI, SaaS, or fintech companies that evolve pricing frequently.

Tabs also handles recurring and usage-based billing, but through a contract-driven workflow. It automatically turns signed agreements into invoices, pulling real-time usage data like API calls or seats. While its usage capabilities cover most standard cases, Tabs focuses on simplifying setup rather than supporting complex or bespoke billing logic.

2. CPQ capabilities

Alguna’s no-code CPQ lets non-technical users configure quotes, pricing tiers, discounts, and approval flows, all in a visual interface. Quotes can include hybrid plans or custom enterprise terms, automatically converting into subscriptions and invoices once signed. It’s designed for agility, helping teams adapt pricing or contract terms in minutes.

Tabs includes a lightweight quoting feature that transitions deals from CRM to contract and invoice automatically. It supports proposal generation, automated contract management, and self-service portals for customers to review and pay. While it’s easier for smaller teams to use, it lacks the granular pricing control of a full CPQ engine like Alguna’s.

3. Revenue workflows

Alguna automatically creates invoices, collects payments via any gateway, and syncs everything back to ERP and CRM systems. It supports multi-entity setups, custom billing rules, and automated dunning, making it a single source of truth for all revenue data and reducing manual reconciliation to zero.

Tabs revenue automation begins at contract execution by instantly generating invoices from agreements and automating reminders or payment matching through AI agents. It accelerates cash flow by eliminating manual invoicing tasks and syncing revenue data directly into ERP systems. Tabs excels at precision and speed in collections rather than broader pricing automation.

2. Integrations and ecosystem flexibility

Alguna integrates natively with tools like Salesforce, HubSpot, QuickBooks, Xero, and NetSuite, as well as any payment processor including Stripe, PayPal, Adyen, and ACH.

Alguna's open APIs and webhooks allow it to act as a real-time system of record for quotes, invoices, and payments, ensuring complete data sync across revenue, finance, and CRM systems.

Visit Alguna's Integrations Marketplace to learn more.

Tabs emphasizes accounting connectivity, offering tight integrations with NetSuite, QuickBooks, and Rillet to keep invoices and revenue schedules aligned with the general ledger. It also links to CRMs and e-sign tools like DocuSign, while processing payments via Stripe or ACH. In short, Tabs centralizes billing and collections within the finance stack, while Alguna spans the entire revenue ecosystem.

5. Pricing structure and cost transparency

Alguna starts at $399/month, offering predictable, flat pricing that scales by feature set rather than transaction volume or revenue percentage. This makes it cost-efficient for scaling companies and growth-stage companies needing advanced capabilities without unpredictable fees. Custom pricing for enterprise companies.

Tabs’ pricing starts around $1,500/month. The higher entry point suits mid-sized teams prioritizing finance efficiency and collections automation. For early-stage or usage-heavy SaaS, Alguna’s transparent pricing delivers stronger ROI and faster onboarding.

6. Developer experience vs no-code empowerment

Alguna offers a best-of-both approach: an API-first foundation combined with visual, no-code configuration for pricing, automation, and workflows. Teams can create quotes, build automations, or update billing logic without engineers, while developers can extend functionality through APIs and webhooks. This flexibility helps RevOps and product teams move faster without sacrificing control or custom integrations.

Tabs is built to minimize setup complexity for finance teams. Most configurations happen inside its interface, with limited need for developer input. It offers a clean API and Zapier support for connecting to existing tools but focuses more on delivering quick time-to-value out of the box. In short, Tabs favors ease of deployment, while Alguna enables deeper customization when needed.

7. Ideal use cases

Alguna is ideal for scaling AI or SaaS companies that want a unified quote-to-cash engine while also experimenting with hybrid or usage-based pricing models. It’s especially suited for multi-entity, high-growth businesses looking to replace fragmented billing stacks with a single revenue platform. Alguna’s no-code flexibility means teams can iterate on monetization quickly without relying on engineering resources.

Tabs is best for B2B companies where finance teams need to automate invoicing, collections, and revenue recognition efficiently. It’s particularly strong in sales-led organizations that rely on contracts as the starting point for billing. By automating everything from contract ingestion to payment reconciliation, Tabs helps reduce manual A/R tasks and improve cash flow predictability.

8. Security, compliance, and scalability

Alguna is SOC 2 Type II certified and fully compliant with ASC 606 and IFRS standards. It’s designed for multi-entity and multi-currency operations, automatically generating compliant revenue schedules and consolidated reports. The platform’s scalability allows companies to handle large volumes of usage events, invoices, and transactions without performance trade-offs.

Tabs also maintains SOC 2 Type II certification and provides built-in audit trails for every invoice and payment event. It supports enterprise finance operations with advanced ERP integrations and access controls for compliance and audit readiness. Tabs is particularly strong for mid-market to enterprise teams scaling invoice volume without expanding headcount.

9. ROI and implementation speed

Alguna typically goes live in 2–4 weeks with white-glove onboarding. Customers often see an 80 % reduction in billing operations time and prevent revenue leakage by consolidating pricing, billing, and rev rec in one place. Because it requires no engineering support for pricing or workflow changes, the platform continues to pay dividends through ongoing agility.

Tabs also offers a quick rollout, with most teams live in about a month. Its automation of invoicing and collections has helped customers close books up to 5× faster and reduce DSO by around 50 %. By using AI agents to manage repetitive finance tasks, Tabs boosts cash conversion and enables finance teams to scale efficiently without adding staff.

Choosing between Alguna and Tabs revenue automation platforms

Choose Alguna if you want a single, intelligent system that unifies pricing, quoting, billing, and revenue recognition. Its no-code automation, rapid setup, and flexible integrations make it ideal for AI-native, SaaS, and fintech businesses scaling across complex pricing models. Alguna helps teams launch new monetization strategies quickly — and stay ahead as pricing cycles shorten in the AI era.

Choose Tabs if your business is centered on signed contracts and you want to automate everything from invoicing to payment collection with minimal setup. It’s an excellent fit for finance-led organizations needing strong ERP integrations and automated A/R workflows. Tabs simplifies collections and reporting, making it a reliable solution for scaling finance operations efficiently.

Modern revenue teams choose Alguna. Book a demo today.

See how Alguna helps SaaS, AI, and fintech teams launch pricing changes, automate revenue, and scale.