For growing SaaS, AI and fintech businesses, billing isn’t just an accounting function—it’s a growth lever. The right platform reduces manual work, ensures clean revenue data and supports complex pricing models.

Two platforms at the forefront of this space are Alguna and Ordway. Both offer sophisticated billing and revenue automation, but they take different approaches.

This article compares their capabilities, pricing, integrations, and security so you can choose the best platform to manage revenue across for your business.

Overview: Alguna vs Ordway

| Criteria | Alguna | Ordway |

|---|---|---|

| Year founded & background | Founded in 2023 (Y Combinator S23). Built by seasoned fintech and billing operators that previously built billing and payment infrastructure at companies like Primer and Bank of America. | Launched in 2018. Built by a team that designed many cloud billing and ERP systems. |

| Platform overview |

End-to-end quote-to-revenue automation purpose-built for SaaS. Combines pricing, quoting (no-code CPQ), billing, collections, and revenue recognition (ASC 606/IFRS 15). Syncs directly to CRM and ERP systems to create a single source of truth for revenue movements. |

Order-to-revenue automation. Captures contracts from CRM, generates invoices, automates accounts receivable and revenue recognition, and reports on SaaS metrics. |

| Best for | Scaling SaaS/AI/fintech companies that need complex usage-based or hybrid pricing (subscriptions, usage-based, outcome-based) with unified quote → billing → rev-rec and multi-entity support. | Mid-market to enterprise finance teams who need a mature billing engine and strong revenue recognition; works well for recurring-revenue businesses with complex contracts and high invoice volumes. |

| Key features | No-code CPQ, real-time usage metering, hybrid pricing, automated invoicing, collections, and dunning. Includes AI contract extraction, visual workflow automations, and deep CRM/ERP/payment integrations. | Supports subscription, usage, percentage, dynamic and one-time pricing models; automates invoicing, dunning, accounts receivable and revenue recognition. CRM/ERP integrations. |

| Pricing |

Free Starter plan (up to 10 invoices/month), paid Growth plan starting at

$699/mo, enterprise pricing custom. Flat SaaS pricing that includes migration and white-glove onboarding. No % of revenue. |

Ordway does not publish pricing; you have to contact them for a quote. |

| Strengths | Fast setup (~2–4 weeks). Supports any pricing model. Flexible pricing experiments without engineering support. Unified system reduces tool sprawl (and costs), real-time usage and revenue data, multi-entity support. | Robust revenue recognition compliant with ASC 606/IFRS 15; strong accounts receivable workflows (payment collection, dunning, self-service portal), flexible support for diverse pricing models. |

| Limitations | Less suited to very basic billing needs. | User interfaces can be complex with a steep learning curve; limited customization of billing workflows; integrations sometimes need extra development; performance can lag on very large data sets. |

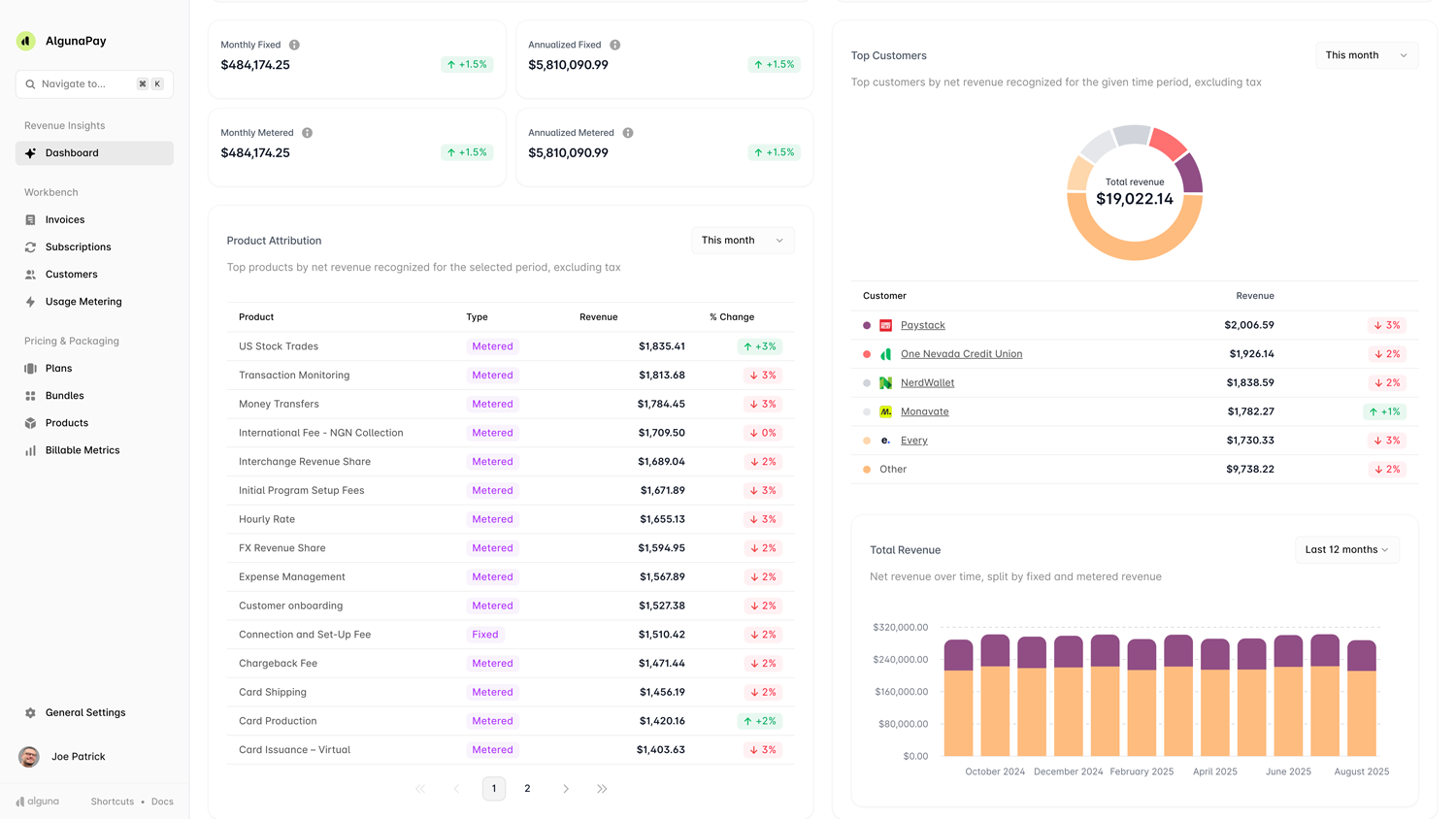

Alguna: AI‑era quote‑to‑revenue platform for scaling SaaS companies

Alguna came out of Y Combinator’s 2023 batch on a mission to unify the quote‑to‑revenue lifecycle for modern SaaS and AI companies.

Built by seasoned fintech operators with decades of experience at companies like Primer, Dojo, and Bank of America, they set out to build an end-to-end revenue automation platform that would eliminate manual processes and tool sprawl once and for all.

Instead of juggling separate CPQ, invoicing, billing, and revenue recognition tools, Alguna brings every part of the revenue workflow under a single roof and into a single source of truth:

- No‑code CPQ and quoting: Teams can build quotes in minutes, mixing per‑seat, tiered and usage‑based pricing within one contract. Built‑in e‑signature flows sync quotes with CRMs and ERPs to eliminate manual paperwork.

- Flexible pricing models: Alguna supports subscriptions, tiered plans, usage‑based fees, hybrid models, credit wallets and outcome‑based pricing. Pricing experiments (new tiers or discounts) can be launched without engineering support.

- Real‑time usage metering and billing: Any custom metric (API calls, feature usage) can be metered in real time. The platform automatically generates invoices based on subscriptions or metered usage, applying proration and credits where needed.

- Collections and payments: Integrated dunning workflows and a customer portal support ACH, SEPA, wire, card and wallet payments. Credits and pre‑paid balances can be reconciled directly in subscriptions.

- Revenue recognition and reporting: The platform automatically creates revenue schedules and posts them to your ERP in compliance with ASC 606/IFRS 15. Real‑time revenue analytics and predictive reporting highlight stalled renewals or margin‑eroding discount.

- AI and workflow automation: Recent launches include Contracts AI (extracts pricing and terms from uploaded contracts), Alguna MCP (chat interface for billing and subscription data), and workflow automations that connect billing, payments and communications into reusable flows.

- Integrations: Connects to Salesforce, HubSpot, NetSuite, QuickBooks, Xero and other tools via REST API and webhooks, making it easy to sync data across systems.

💚 When to choose Alguna: If you’re a fast‑growing SaaS, AI, or fintech company experimenting with hybrid pricing, Alguna’s unified quote‑to‑cash platform and no‑code configuration help you move quickly.

You’ll get built‑in CPQ, real‑time usage metering and a revenue recognition engine without requiring engineering resources. Plus, most teams complete migration and onboarding in ~2-4 weeks.

However, if you only need basic subscriptions or simple invoicing, the platform may be more than you need.

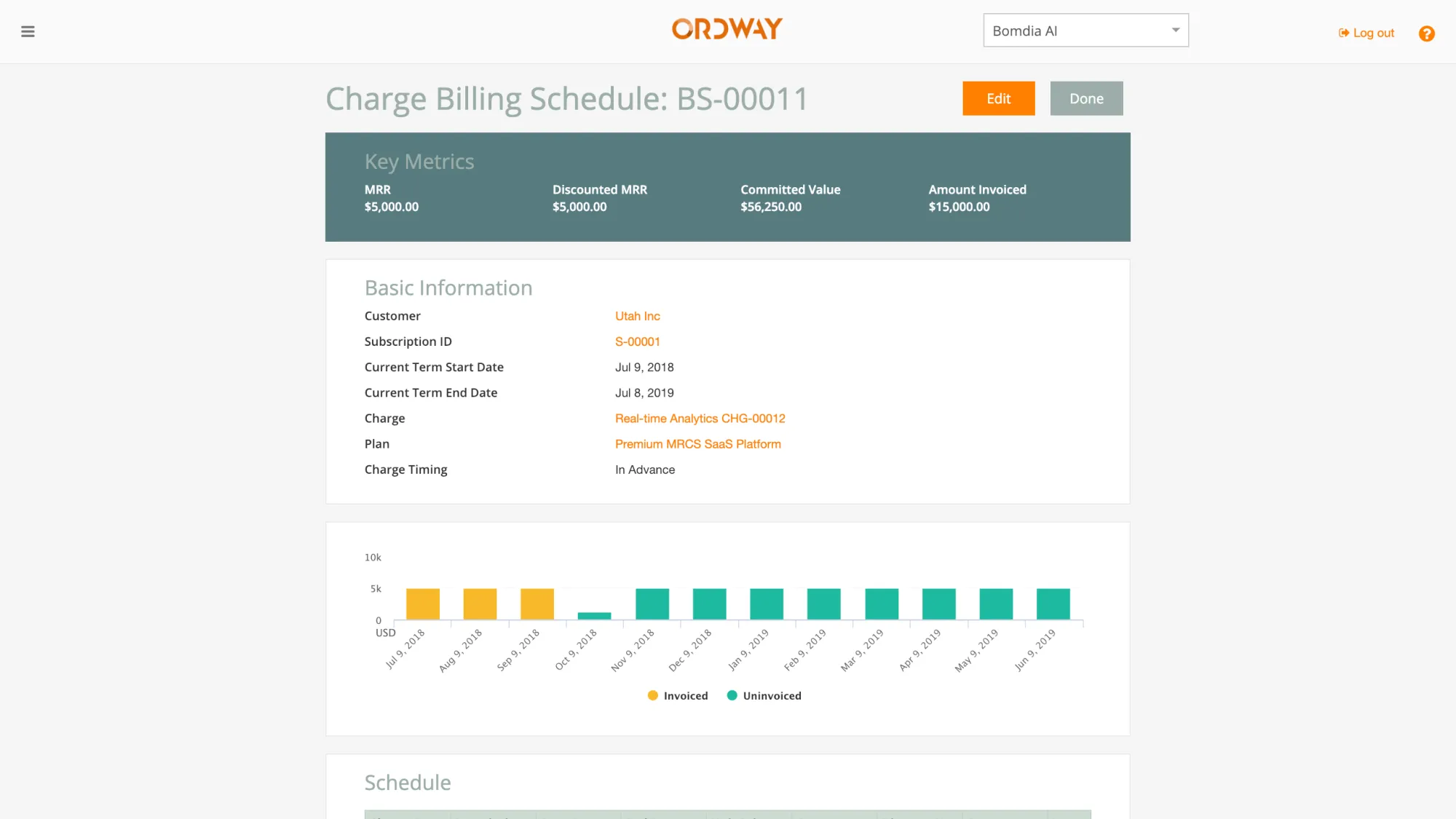

Ordway: Billing and revenue automation platform

Ordway is a billing and revenue automation platform built for finance teams looking for compliance. Designed to support complex contracts, high invoice volumes, and rigorous revenue recognition requirements, Ordway focuses on delivering stability, audit-readiness, and strong accounts receivable workflows.

Rather than focusing on quoting, Ordway shines in turning signed sales orders into cash and recognized revenue.

- Support for diverse pricing models: Ordway’s billing engine handles usage‑based, subscription, percentage, dynamic, and one‑time charges.

- Automated invoicing and accounts receivable: From contract activation to invoice generation, dunning and payment collection, Ordway automates routine processes. Customers can pay via cards, ACH, wire transfers or checks, and a self‑service portal lets them download invoices and check balances.

- Revenue recognition: Ordway tracks deferred revenue for subscription and usage models and recognizes revenue according to ASC 606 or IFRS 15. It supports multi‑element arrangements (SSP, contract modifications) and posts journal entries to your ERP or general ledger.

- Integration ecosystem: Ordway integrates with CRMs, ERPs, accounting systems and payment gateways. This allows bi‑directional data flow with Salesforce, NetSuite, QuickBooks and others.

- Strengths and limitations: Ordway automates billing cycles, renewals and plan changes, ensures ASC 606/IFRS 15 compliance, and integrates smoothly with CRM/ERP platforms. However, the interface can be complex; customizing workflows or integrating new apps may require significant configuration and development work.

When to choose Ordway: If your finance team needs mature order‑to‑revenue automation with deep revenue recognition and robust accounts receivable functionality, Ordway is a strong contender. It’s particularly suited to companies with complex contracts and large invoice volumes.

⚠️ Be prepared for a steeper learning curve and more implementation effort compared with lighter‑weight tools.

Alguna vs Ordway billing and revenue automation: Platform security features

Both Alguna and Ordway maintain SOC 2 Type II compliance, but Ordway’s security story is particularly well‑documented.

Alguna is SOC 2 Type II certified and includes audit trails, multi‑entity and multi‑currency support. This ensures that its no‑code workflows and AI agents operate within a secure environment.

Ordway completed its first SOC 2 audit in 2020 (renewed in 2024), which verifies that an independent accounting firm reviewed and tested the company’s internal controls. The audit confirms Ordway’s controls for security, availability and processing integrity meet the AICPA’s rigorous requirements.

Both platforms comply with ASC 606 and IFRS 15 revenue‑recognition standards and offer audit logs to support financial transparency.

Decision time: Which platform is right for you?

Both Alguna and Ordway help businesses move away from spreadsheets and manual processes by automating billing and revenue operations. Your choice depends on where your company sits in its growth journey:

👉 Choose Alguna if you're a scaling SaaS/AI/fintech company that wants to eliminate manual processes and unify your revenue workflows in a single source of truth. It's a unified quote-to-revenue platform built for non-technical teams to enable them to manage pricing, quoting, billing, and revenue recognition in one seamless system. Transparent pricing and fast implementation make it accessible to growing teams.

👉 Choose Ordway if you have matured beyond basic billing and need deep accounts receivable and revenue recognition functionality. Ordway handles complex contract structures and high invoice volumes, while offering robust compliance and security. Be prepared for a steeper learning curve and consultative onboarding.

In short, Alguna prioritizes no-code pricing complexity and flexibility, while Ordway emphasizes ompliance. By understanding your team’s needs around pricing complexity, integration, security and scale, you can select the platform that will turn billing from a back‑office burden into a strategic asset.

Discover how modern revenue automation works

Alguna gives you real-time usage metering, no-code pricing updates, automated invoicing, and ASC 606-ready revenue recognition—all in one platform.

Book a demo to see how fast you can streamline your entire quote-to-cash process.