Modern RevOps platforms leverage artificial intelligence to unify data and automate workflows across the revenue lifecycle.

From quote-to-revenue automation to revenue intelligence and customer success, AI-powered solutions help scaling teams boost efficiency and decision-making.

Key benefits include more accurate forecasting, personalized customer engagement, and the elimination of manual tasks through AI-driven insights and automation.

Below, we compare AI-powered RevOps solutions for scaling teams in key categories, highlighting core features, strengths, ideal use cases, AI capabilities, and pricing models.

How AI is reshaping the entire revenue engine

Across every facet of RevOps – from initial quote to renewal – AI-powered solutions are enabling scaling teams to operate with far greater precision and efficiency.

Quote-to-revenue platforms ensure revenue doesn’t slip through the cracks by automating the quote-to-cash journey from signed deal to cash in the bank, with AI catching errors and optimizing processes along the way.

Revenue intelligence and forecasting tools remove the guesswork from pipeline management, exposing the real state of deals and predicting outcomes more accurately than gut feel ever could. Sales automation platforms help teams do more with less, handling prospecting, follow-ups, personalization, and even real-time call coaching.

On the post-sale side, AI-powered customer success platforms shift teams from reactive to proactive. Churn risks are flagged—or even handled—before they materialize, and expansion opportunities emerge through usage and sentiment signals that humans would otherwise miss.

5 categories that matter in an AI-powered RevOps stack

AI-powered RevOps isn’t one single tool—it’s a growth system.

Each category plays a distinct role in keeping revenue predictable and scalable as your company grows.

- Quote-to-revenue platforms keep pricing and packaging, contracts, billing, and revenue recognition aligned so nothing leaks between sales and finance. They automate the entire revenue workflow and ensure accuracy at scale.

- Revenue intelligence platforms reveal what’s actually happening in deals by analyzing calls, emails, and buyer signals, ultimately, giving teams real visibility into pipeline health.

- Forecasting and pipeline management platforms turn scattered CRM updates into accurate, AI-driven predictions, helping leaders avoid surprises and plan with confidence.

- Sales automation platforms scale outbound and follow-up workflows so reps can focus on selling while AI handles personalization, sequencing, and admin.

- Customer success operations platforms help teams protect and grow revenue by spotting churn risks early, surfacing expansion opportunities, and standardizing playbooks.

These five categories create an AI-enabled revenue engine where insights, actions, and data flow seamlessly across the entire customer lifecycle.

AI-powered quote-to-revenue platforms for scaling teams

AI-powered quote-to-revenue platforms unify the end-to-end process from quoting a deal through billing and revenue recognition.

These solutions often combine CPQ (Configure-Price-Quote), subscription billing, usage metering, invoicing, and revenue recognition in one system.

This integration eliminates data silos and manual handoffs, ensuring quotes, contracts, and invoices stay aligned.

AI capabilities in this category include Contracts AI, smart payment recovery (e.g. automated dunning workflows) to prevent churn, and compliance checks.

⚠️ Always check vendor websites for latest pricing.

| Platform | Platform overview | Best for | AI highlights | Pricing |

|---|---|---|---|---|

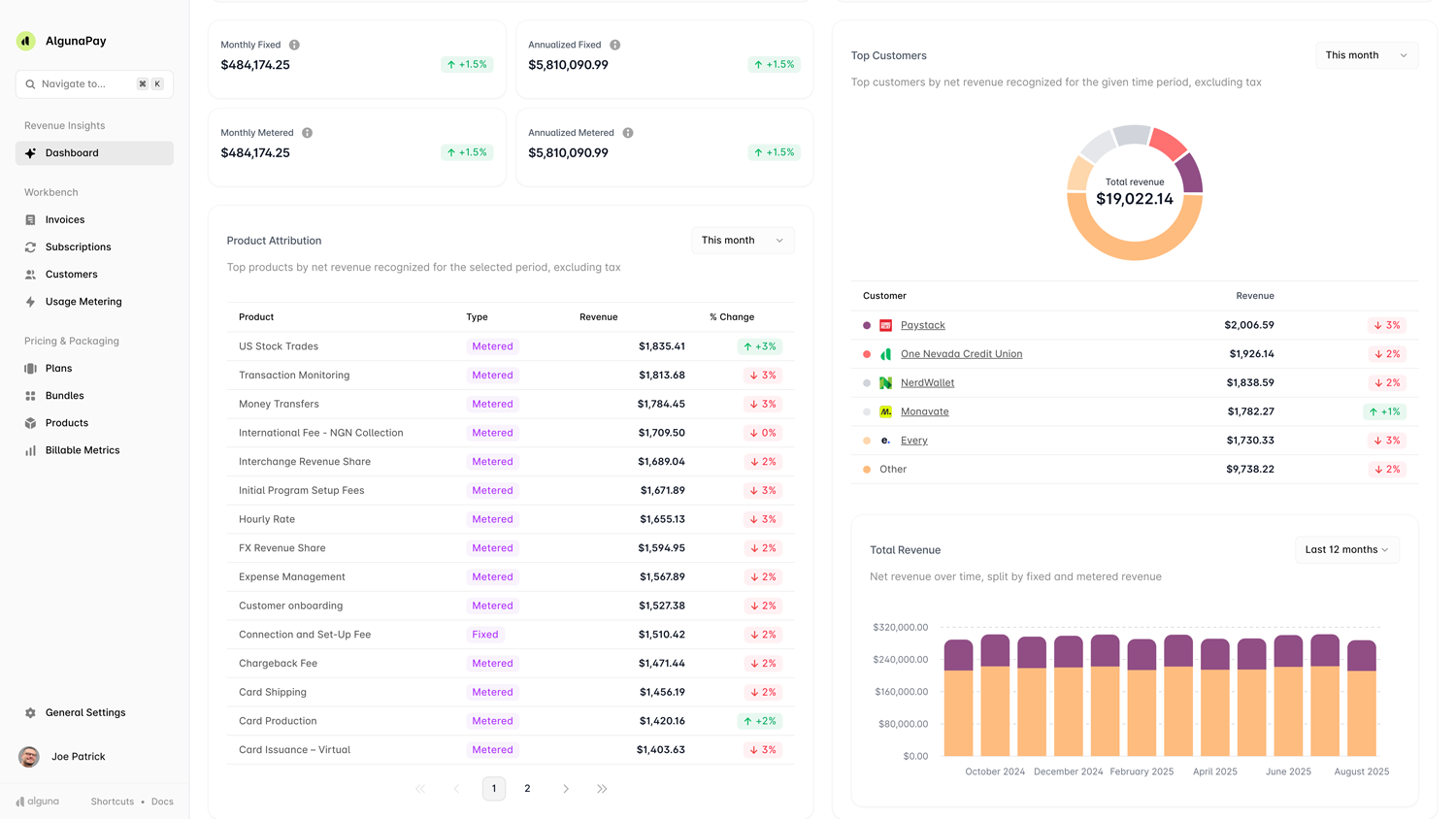

| Alguna | Unified quote-to-revenue: CPQ, contracts, billing, usage metering, invoicing, and revenue recognition in one system. | SaaS & AI companies needing one RevOps engine instead of multiple tools. | AI-assisted quoting (coming soon!), AI contract intelligence, automated revenue workflows. | Free tier available. Paid plans from $699/mo. Enterprise custom. |

| Chargebee | Subscription billing, invoicing, revenue recognition, dunning, and subscriptions management. | Subscription businesses with standard or moderately complex pricing. | Retention AI for churn prediction & targeted retention offers. | Plans from ~$599/mo (Grow) to custom enterprise. |

| Zuora | Enterprise subscription and usage billing with revenue recognition. | Enterprises with complex global monetization. | Predictive billing, collections optimization & revenue analytics. | Enterprise only. Estimate min. $50k/year. |

| Maxio | Billing, usage, revenue recognition + SaaS metrics & analytics. | SaaS finance teams needing billing + analytics in one place. | AI-driven risk identification and automated finance workflows. | Plans from ~$599/mo (Grow) to custom enterprise. |

| Agentforce Revenue Management | Salesforce-native CPQ, billing, catalog & renewals. | Companies standardized on Salesforce CRM. | Agent-style AI auto-generates quotes, renewals & invoice explanations. | Add-on licensing; ~$125–$550/user/mo depending on edition. |

Summary

Alguna offers an AI-native, all-in-one revenue automation platform for scaling RevOps teams. The no-code platform combines CPQ, real-time usage metering, invoicing, automated billing, and ASC 606/IFRS 15 compliance to eliminate revenue leakage and manual work.

Chargebee is a popular choice for subscription billing automation with broad integrations and new AI features like Retention AI to reduce churn.

Zuora stands out for enterprise scalability, handling complex global subscriptions with predictive analytics for finance.

Maxio (formed by Chargify & SaaSOptics) differentiates with strong SaaS revenue analytics and an AI framework (MCP) that automates finance tasks (e.g. updating forecasts or schedules based on AI triggers).

Agentforce Revenue Management (Salesforce) brings quote-to-cash into the CRM, leveraging Salesforce’s ecosystem and new AI agents to automate quoting and contract processes.

Revenue intelligence platforms

Revenue intelligence platforms use AI and advanced analytics to turn sales data and customer interactions into actionable insights. They often analyze sales calls, emails, and activities to gauge deal health, predict outcomes, and coach reps in real-time.

These tools break down silos between marketing, sales, and success by providing a unified view of the pipeline and customer sentiment.

⚠️ Always check vendor websites for latest pricing.

| Platform | Platform overview | Best for | AI highlights | Pricing |

|---|---|---|---|---|

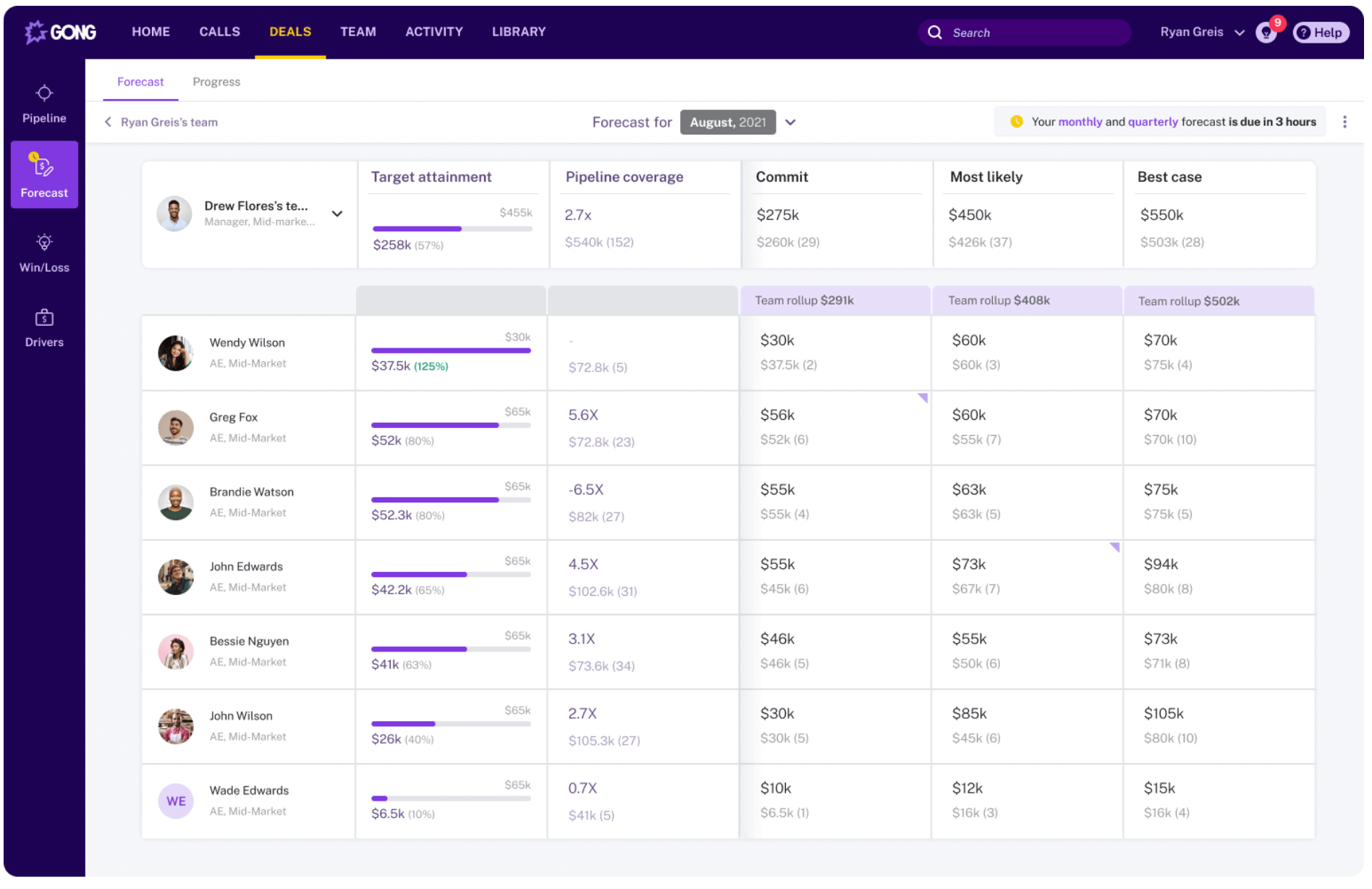

| Gong | Conversation & deal intelligence (calls, emails, meetings) | Sales orgs wanting deeper pipeline & rep insights | NLP-driven risk detection, sentiment, topics, competitor flags | Typically ~$100–$150/user/mo; enterprise add-ons extra |

| People.ai | Automatic CRM activity capture & relationship mapping | Teams with incomplete CRM data & complex accounts | AI identifies engagement gaps, deal risks & win patterns | ~$50–$100/user/mo depending on plan |

| ZoomInfo Chorus | Call recording & analysis integrated with ZoomInfo data | Teams using ZoomInfo for prospecting & discovery | AI call scoring, competitor mentions, automated summaries | Bundled with ZoomInfo; ~$1.5K+/mo for small teams |

| Outreach (RI) | Multichannel sequences + pipeline insights | High-volume outbound teams | AI-driven risk scoring, next-best actions & live coaching | ~$150/user/mo; enterprise plans scale significantly |

| Revenue.io | AI-powered dialing, call coaching & workflows | SDR/BDR-heavy teams | Real-time AI prompts, sentiment, automated follow-up | Custom; per-seat + platform fee |

Summary

Gong pioneered conversation intelligence with AI that analyzes calls/emails to deliver coaching and deal insight, and it’s credited with significant efficiency gains.

People.ai tackles the pervasive CRM data problem by automatically capturing every activity and using AI to reveal what’s really happening in the pipeline. It’s ideal for ensuring forecast accuracy based on actual rep/customer interactions rather than optimistic CRM entries.

ZoomInfo Chorus (formerly Chorus.ai) is a strong choice for teams wanting to improve rep conversations; it ties call analysis with contact intelligence and is known to reduce sales cycle times through better coaching.

Outreach has broadened from an engagement tool to a revenue intelligence platform that not only automates outreach sequences but also predicts deals and guides reps via AI – a good all-in-one for scaling teams needing both automation and insight.

Revenue.io differentiates by deeply embedding AI guidance into reps’ daily tools (CRM, phone, email) to ensure adoption, making every call and follow-up smarter without requiring reps to toggle to a separate dashboard.

Forecasting and pipeline management platforms

Forecasting and pipeline management platforms focus on predicting revenue outcomes and improving pipeline visibility. They centralize your sales forecasts (often incorporating both AI predictions and human judgment) and flag risks in deals or gaps in the funnel.

These tools often serve as a “revenue command center” for RevOps and sales leaders, blending data from CRM, past deals, and rep inputs to produce more accurate forecasts. AI plays a big role here: machine learning models analyze historical patterns and current deal activity to project likely outcomes, and can even provide deal-level risk scores or suggest which deals need attention.

⚠️ Always check vendor websites for latest pricing.

| Platform | Platform overview | Best for | AI highlights | Pricing |

|---|---|---|---|---|

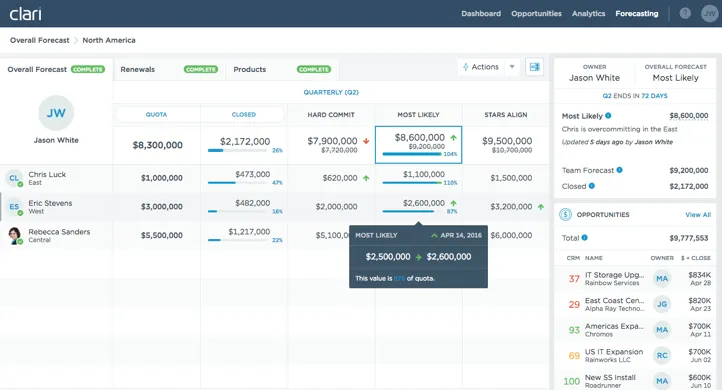

| Clari | Full revenue platform for forecasting & pipeline inspection | Mid-market & enterprise RevOps teams | ML forecast engine, deal risk signals, change intelligence | ~$99/user/mo+; enterprise custom |

| BoostUp | Modern forecasting with multi-dimensional drill-down | Teams wanting flexible forecasting | AI "machine forecasting" alongside human roll-ups | Custom; often lower cost vs Clari |

| Aviso | AI-driven forecasting & guided selling | Enterprise teams leaning into heavy AI | Deep-learning forecasts, win scores, next-step recommendations | Enterprise custom |

| InsightSquared | Forecasting + advanced analytics reporting | Data-rich orgs needing customizable views | ML-based forecast adjustments, performance analysis | Enterprise custom |

| Gong Forecast | Forecasting layer inside Gong | Teams already using Gong platform | Uses call/email cues to validate or adjust forecasts | Add-on to Gong; custom |

Summary

Clari has become synonymous with this space by centralizing forecasting and pipeline reviews, using AI to drive remarkable accuracy, and identifying pipeline gaps (users commonly report major improvements in forecast confidence and shorter sales cycles).

BoostUp is a newer entrant appealing to RevOps teams with its user-friendly interface and flexible forecasting (including scenario forecasts by region or product). Its AI capabilities aim for very high accuracy, and it’s often chosen as a more agile or cost-efficient alternative while still delivering ~95% accuracy with actionable insights.

Aviso stands out with aggressive AI-driven claims (near-98% forecast accuracy) and a broad approach that even includes guided selling – great for enterprises that want to lean fully into AI for both forecasting and execution

InsightSquared (now part of Mediafly) brings a strong analytical approach, merging forecasting with marketing and sales enablement data to give a holistic view of revenue operations. It’s a fit for data-heavy teams that need customizable intelligence beyond what CRM or standalone sales tools provide

Gong’s Forecast module represents the convergence of conversational AI with forecasting by leveraging what’s happening in sales calls and emails to sanity-check and inform the pipeline outlook. This is powerful for identifying “happy ears” forecasts by surfacing when customer sentiment doesn’t align with (rosy) predictions.

Sales automation platforms

Sales automation platforms help sales teams scale their outreach and streamline selling activities through AI and workflow automation.

These are often also referred to as sales engagement platforms, enabling reps to automate emails, calls, meeting scheduling, and follow-ups, while ensuring a consistent process.

Key features include multi-channel sequencing (automated series of emails, calls, and LinkedIn touches), sales playbooks, task automation (logging activities to CRM, setting reminders), and often a power dialer for calls. AI enhances these tools by optimizing send times, personalizing content, scoring leads, and even providing real-time call or email suggestions to improve engagement.

⚠️ Always check vendor websites for latest pricing.

| Platform | Platform overview | Best for | AI highlights | Pricing |

|---|---|---|---|---|

| Outreach | Sequences, tasks, workflows & conversation intelligence | High-velocity SDR/AE teams | AI assistant (Kaia), lead prioritization & risk scoring | ~$150/user/mo; enterprise varies |

| Salesloft | Cadences, dialer, deal workspace & convo intelligence | Teams wanting an all-in-one sales workspace | AI call analysis, cadence optimization, sentiment | ~$75–$125/user/mo depending on tier |

| Groove | Salesforce-native sales engagement & auto-logging | Salesforce-centric teams | AI activity capture & send-time optimization | Custom; typically lower than Outreach/Salesloft |

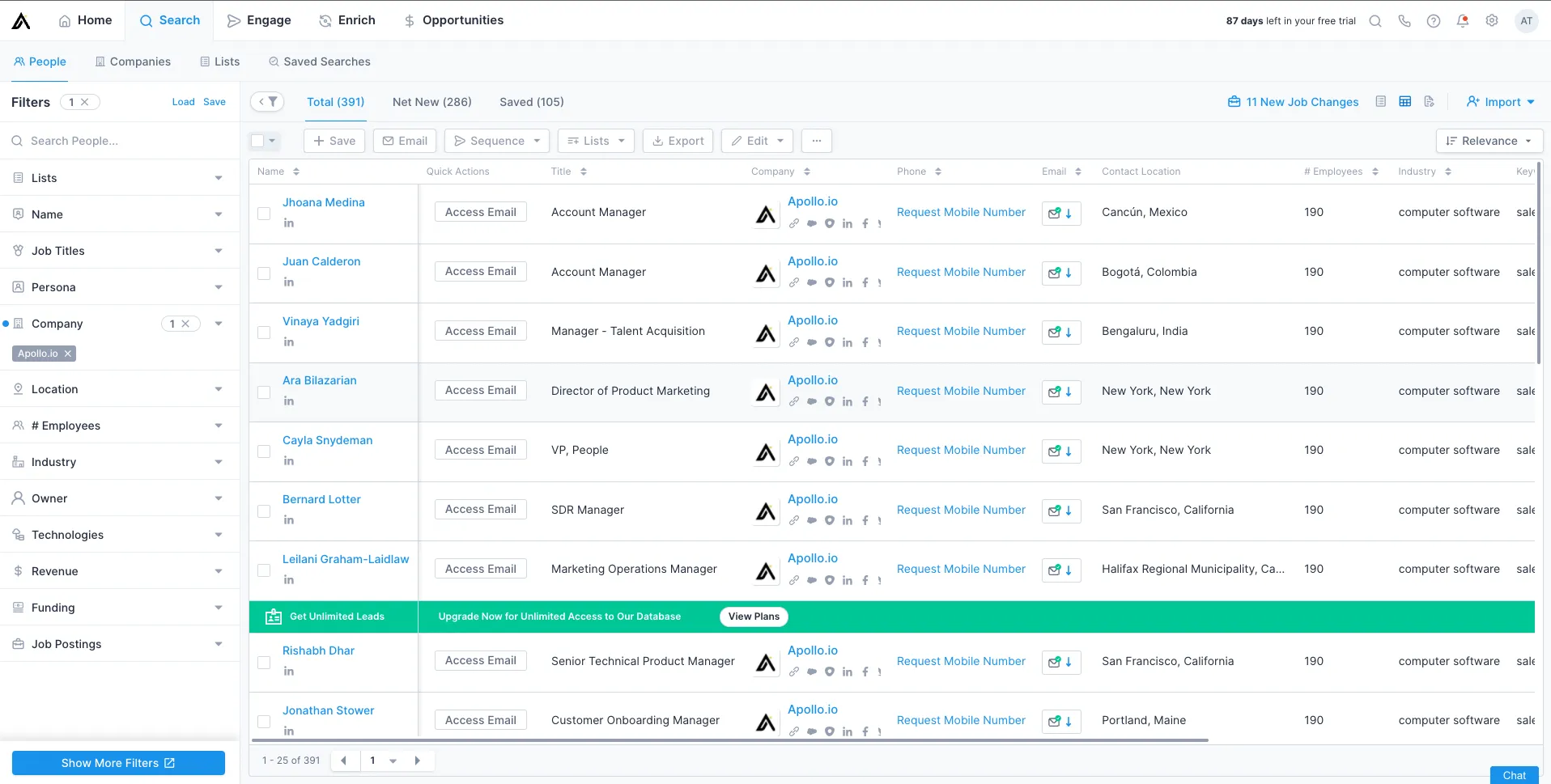

| Apollo.io | Prospect data + outbound sequences in one platform | Startups & fast-moving teams | AI-written outreach, lead scoring & research | Freemium; paid starts ~$49–$99/user/mo |

| HubSpot Sales Hub | CRM + sequences + automation in one tool | SMB/mid-market that want simplicity | AI email suggestions, lead scoring, meeting assistant | Bundled; Pro ~$500/mo for 5 seats; Enterprise more |

Summary

Outreach and Salesloft have long led this category, offering sophisticated sequencing and proven results in boosting rep productivity. Outreach in particular is known for large deployments and showing measurable pipeline lift (e.g., 40% more SQOs) by enforcing consistent outreach processes. Salesloft differentiates with its ease-of-use and integrated coaching, making it a favorite for teams that want quick adoption and an all-in-one workspace.

Groove has emerged as a strong option especially for Salesforce-centric orgs, focusing on automating data capture and fitting into the rep’s existing workflow (email/CRM) so that nothing falls through the cracks. This is crucial for data-driven teams because Groove ensures CRM is always up to date without burdening reps

Apollo.io represents a new generation combining data and automation – it’s highly attractive for younger companies that need to build lists and reach out at scale quickly, and its AI prospecting capabilities can save countless hours on research.

HubSpot Sales Hub appeals to scaling businesses that prefer a single, integrated solution; it might not have all the advanced dialing features of Outreach or the massive data of Apollo, but it provides a solid balance of automation and AI in a CRM that’s very approachable (and HubSpot continues to infuse AI across its sales tools, from sequencing to guided selling)

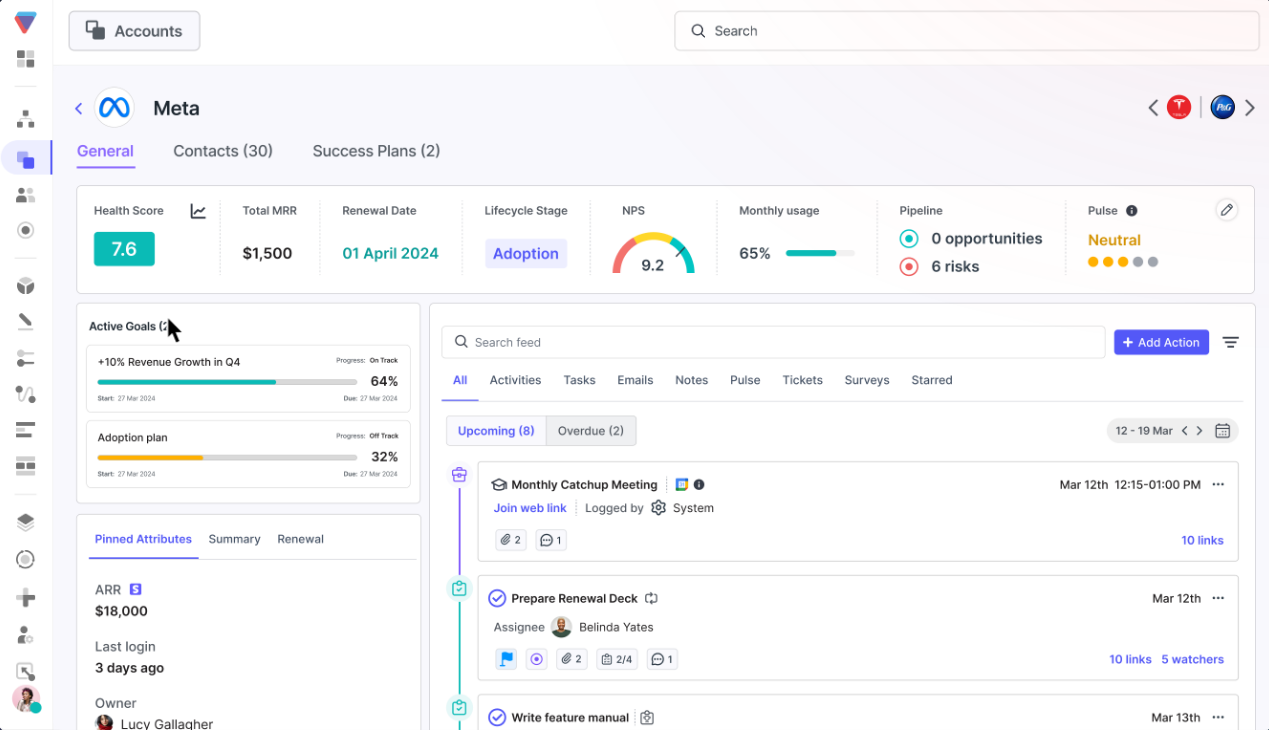

Customer success operations platforms

Customer success operations platforms (Customer Success Platforms, or CSPs) help companies retain and grow their existing customers by providing a 360° view of customer health, usage, and engagement. They enable Customer Success Managers (CSMs) to proactively manage renewals, reduce churn, and drive expansion

Core features include health scoring (often using product usage and support data), automated playbooks for onboarding and renewal, customer communications (in-app messaging, emails), and lifecycle tracking (onboarding progress, QBR management, etc.).

As customer portfolios scale, these tools allow segmentation of high-touch vs tech-touch approaches. AI in customer success is relatively new but rapidly growing – it’s used for churn risk prediction, sentiment analysis of customer communications, and even generative AI to draft customer emails or success plans.

⚠️ Always check vendor websites for latest pricing.

| Platform | Platform overview | Best for | AI highlights | Pricing |

|---|---|---|---|---|

| Gainsight | Enterprise CS: health, playbooks, product signals, renewals | Large CS orgs with mature processes | Horizon AI for churn prediction, expansion signals & summaries | Enterprise custom |

| Totango | Modular CS with templates (SuccessBLOCs) | Teams wanting fast implementation | AI-powered health & churn prediction | Freemium; paid tiers custom |

| ChurnZero | Real-time health scoring, playbooks & in-app comms | SaaS companies fighting churn | Always-on AI agents that act on risk signals | Platform + per-user; mid-market pricing |

| Planhat | Flexible CS workspace with revenue & usage data | Teams wanting customization without heavy admin | AI note summaries & sentiment analysis | Custom; mid-market friendly |

| Velaris | AI-first CS platform with full customer 360 | Modern SaaS teams wanting AI-native CS | AI-driven health scores, expansion/churn prediction, convo intelligence | Custom pricing |

Summary (customer success operations): As companies scale, customer retention and expansion become as data-driven as sales, and AI now sits at the center of how modern CS teams operate.

Gainsight remains the enterprise benchmark, offering a deep and highly configurable platform—enhanced by generative AI for risk alerts, customer summaries, and automated communications. It’s powerful but requires meaningful investment and operational rigor, making it a strong fit for companies with complex lifecycles and large CS teams.

Totango takes a more modular and accessible approach. Its SuccessBLOCs and built-in churn prediction models make it easy for teams to stand up a mature CS motion quickly, without heavy implementation work.

ChurnZero leans fully into the “AI co-pilot” direction—its always-on AI agents monitor usage, sentiment, and lifecycle events in real time, triggering playbooks or drafting outreach on behalf of CSMs. For stretched teams, this effectively increases capacity without adding headcount.

Planhat offers flexibility and simplicity, making it suited for mid-market teams that want customization without the overhead of a full enterprise stack. Its AI features support productivity—summarising notes, detecting sentiment, and helping CSMs maintain context across busy portfolios.

Velaris represents the new wave of AI-native CS platforms. Built around a unified customer 360, it uses AI to score health, predict churn or expansion, analyse conversations, and deliver intelligent insights directly into the CS workflow. It’s designed for B2B SaaS teams that want a modern, lightweight, intelligence-first alternative to legacy CS systems.

The AI-powered RevOps stack starts (and scales) with quote-to-revenue

For scaling teams, choosing the right RevOps tools means aligning each platform to your growth stage and operational complexity.

Early-stage companies racing to build pipeline may prioritise sales automation platforms like Apollo.io or Outreach, while more mature teams aiming for predictable revenue lean toward forecasting solutions such as Clari or BoostUp.

But increasingly, the foundation of an effective RevOps engine is the quote-to-revenue platform. As pricing models evolve, usage-based pricing becomes the norm, and deal cycles accelerate, RevOps teams cannot afford disconnected systems for quoting, contracting, billing, usage, and revenue recognition.

AI-powered quote-to-revenue platforms like Alguna serve as the connective tissue that keeps GTM, finance, and customer success aligned. They prevent revenue leakage, automate the commercial workflow end-to-end, and give operators real-time visibility into what’s actually happening across the lifecycle of every customer.

Across the entire stack, one theme is consistent: AI is no longer a feature—it’s the growth multiplier.

Alguna: AI-powered revenue automation solution for scaling teams

Whether you're experimenting with new pricing, scaling usage-based models, expanding globally, or just tired of manual billing workarounds, Alguna gives RevOps teams the flexibility and automation they need to move quickly with confidence.