• Explore core AI SaaS monetization strategies, including usage-based, outcome-based, and hybrid models.

• Dig into how to evaluate monetization solutions by scalability, pricing flexibility, automation, and total cost of ownership, and identify which tools best fit startups, scaling SaaS teams, and global enterprises.

76% of private SaaS companies now use AI in their products. This shift is transforming how software is built, packaged, and priced.

That’s why founders and revenue teams are now prioritizing the need to compare AI monetization solutions for SaaS to find the best fit for their revenue workflows.

Unlike traditional SaaS pricing, which often relies on flat subscriptions or per-seat licenses, AI SaaS monetization models typically use usage- or outcome-based pricing that aligns with how customers derive value.

In this comparison guide, we'll cover common monetization strategies for AI SaaS products and do a deep dive to compare AI monetization solutions for SaaS.

Whether you’re a startup experimenting with usage-based pricing or an enterprise scaling complex AI workloads, this guide will help you navigate the best AI monetization solutions for SaaS available today.

What is AI SaaS monetization?

AI monetization is the practice of turning your AI capabilities into measurable, recurring revenue.

For SaaS companies, it means transforming AI features, agents, or automations into products or services that customers are willing to pay for.

It’s not just about adding AI to your product, it’s about capturing its business value through AI pricing models, whether you’re offering seat-based, usage-based, outcome-based pricing, and seamless delivery.

In other words, AI monetization is how SaaS businesses go from “we have AI” to “AI drives our revenue.”

Common monetization strategies for AI SaaS products

AI SaaS monetization strategies typically follow one of several common models:

- Flat-rate pricing: A single plan with one fixed cost. Simple and predictable, but doesn’t scale with usage or reflect variable compute costs.

- Per-user or seat-based pricing: Charges per active user or account. Common in B2B SaaS, but misaligned with AI’s real cost drivers.

- Subscription with AI add-ons: Offers AI features as paid upgrades or in higher tiers (e.g., a $50 plan with a $20 AI copilot upgrade). Keeps revenue steady but may not match actual usage.

- Usage-based pricing: Bills by consumption: per API call, per 1,000 tokens, or per output. Aligns cost with value but adds forecasting variability.

- Outcome- or value-based pricing: Charges for measurable results, e.g., frauds prevented, meetings booked. Ties price to ROI but requires precise tracking.

- Hybrid models: Combines base subscriptions with usage or overages. Balances predictable revenue with flexibility for variable AI workloads.

The rise of hybrid pricing in AI SaaS monetization strategies

Unlike traditional SaaS products that charge purely per seat, AI SaaS companies often blend seat-based pricing with usage or credit-based models.

Instead of e.g. a fixed monthly or annual cost, customers pay based on how much the AI is actually used, whether that’s tokens processed, API calls made, or predictions generated. Each of these actions consumes compute resources, which directly drives cost. That’s why AI SaaS monetization isn’t just about setting a price, it’s about designing a flexible model that reflects how your AI features deliver value.

The smartest AI SaaS companies will likely be able to strike the right balance between predictable seat-based revenue and variable usage-based components that scale with customer engagement.

Best AI monetization solutions for SaaS: Comparison overview

Below is our curated list of the best AI-powered monetization tools for SaaS businesses in 2026, including their pros, cons, and pricing.

| Platform | Best for | Pros | Cons | Pricing |

|---|---|---|---|---|

| Alguna | Scaling AI SaaS companies that want an end-to-end monetization engine | Built for SaaS and AI-native companies that need real-time usage-based billing. Unified quote-to-cash platform with no-code CPQ, billing, and revenue recognition | Newer market entrant, not ideal for eary stage SaaS companies | Free starter; paid from $399/mo (flat, no rev share). White-glove onboarding included |

| Stripe Billing | Early-stage SaaS companies with developer-led teams | Quick setup and excellent APIs; Solid for core subscriptions and basic metering. | Ecosystem lock-in. Limited for complex usage based and hybrid pricing. No native CPQ | 0.7% of billed revenue. Add-ons are extra. No base platform fee |

| Chargebee | Mid-market SaaS with standard subscriptions and teams wanting less DIY than Stripe | Comprehensive subscription lifecycle with built-in analytics and reporting. | Engineering needed for complex usage. Costs scale with revenue. Complex setup and learning curve (as reported by users). | $599/month up to $100k in billings. |

| Orb | Highly technical teams outgrowing basic billing and/or companies wanting deep control | Granular, flexible metering via API. Built for scale and real-time events. Developer-first tooling and auditability. | Not end-to-end (needs Stripe/Alguna for invoicing). Requires engineering ownership. | $749–$3,490/mo + per-event fees. No revenue share. |

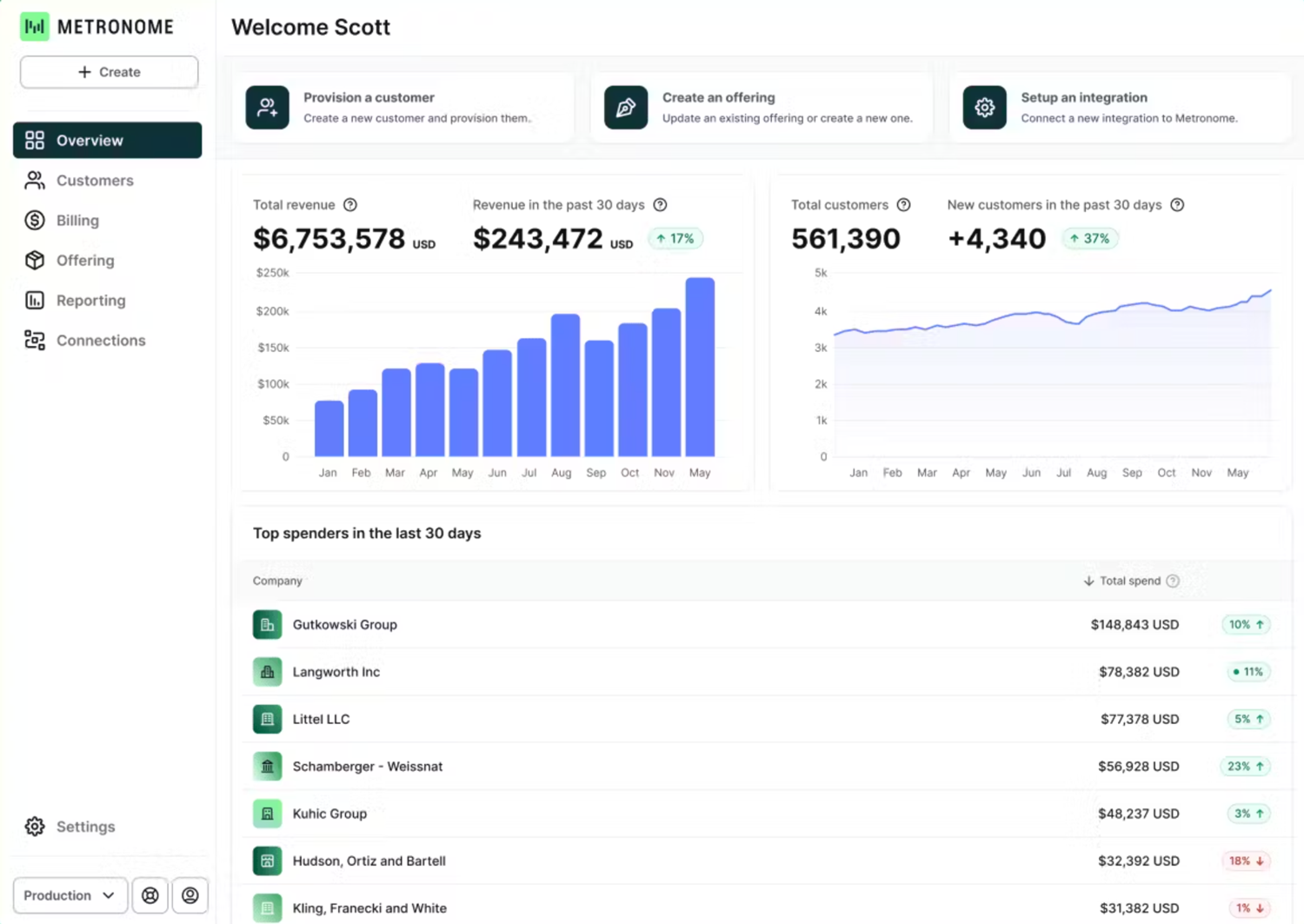

| Metronome | API/AI companies with a mature RevOps org. | Enterprise-scale metering accuracy. Supports complex contracts. Audit-ready invoicing and A/R. | Implementation-heavy and high enterprise cost. Requires ongoing dev/ops ownership. | Custom enterprise, typically $10k+/yr base, scales with event volume. |

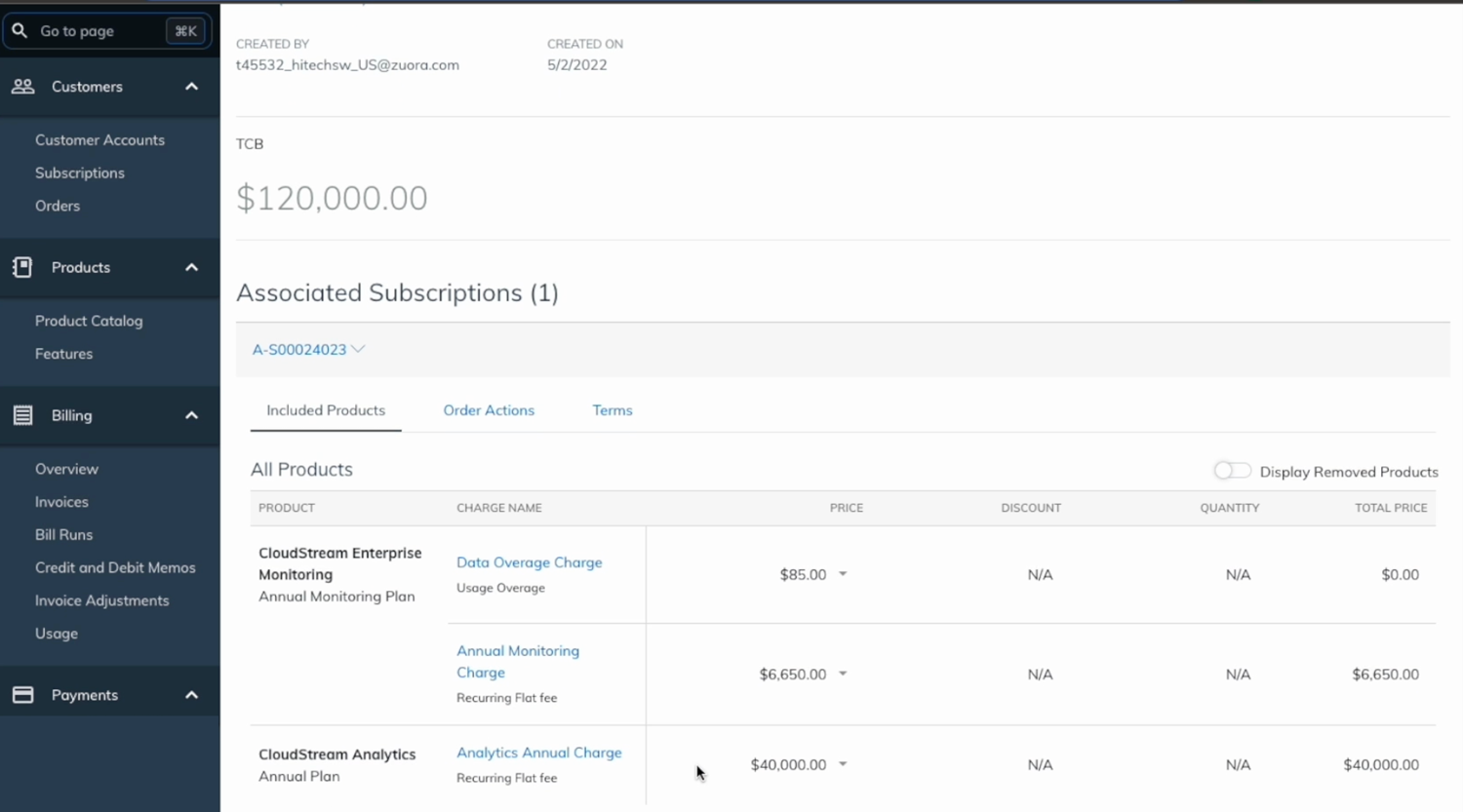

| Zuora (with Togai) | Large multi-entity enterprises that have Strict compliance needs. Existing Zuora users adding usage based pricing. | Complete quote-to-cash engine. Global tax/compliance. | Complex and slow to implement with high TCO and admin overhead. Not AI-native or agile (as reported by users). | Enterprise-only. Budget minimum $50k/yr + implementation. Tiered/custom by volume and modules. |

Deep dive: Compare AI monetization solutions for SaaS

While many platforms claim to support AI monetization, only a few are truly built for the realities of AI-driven SaaS, where usage spikes, pricing evolves quickly, and revenue models keep changing.

Let’s take a closer look at how the leading AI monetization solutions for SaaS compare across features, use cases, and pricing.

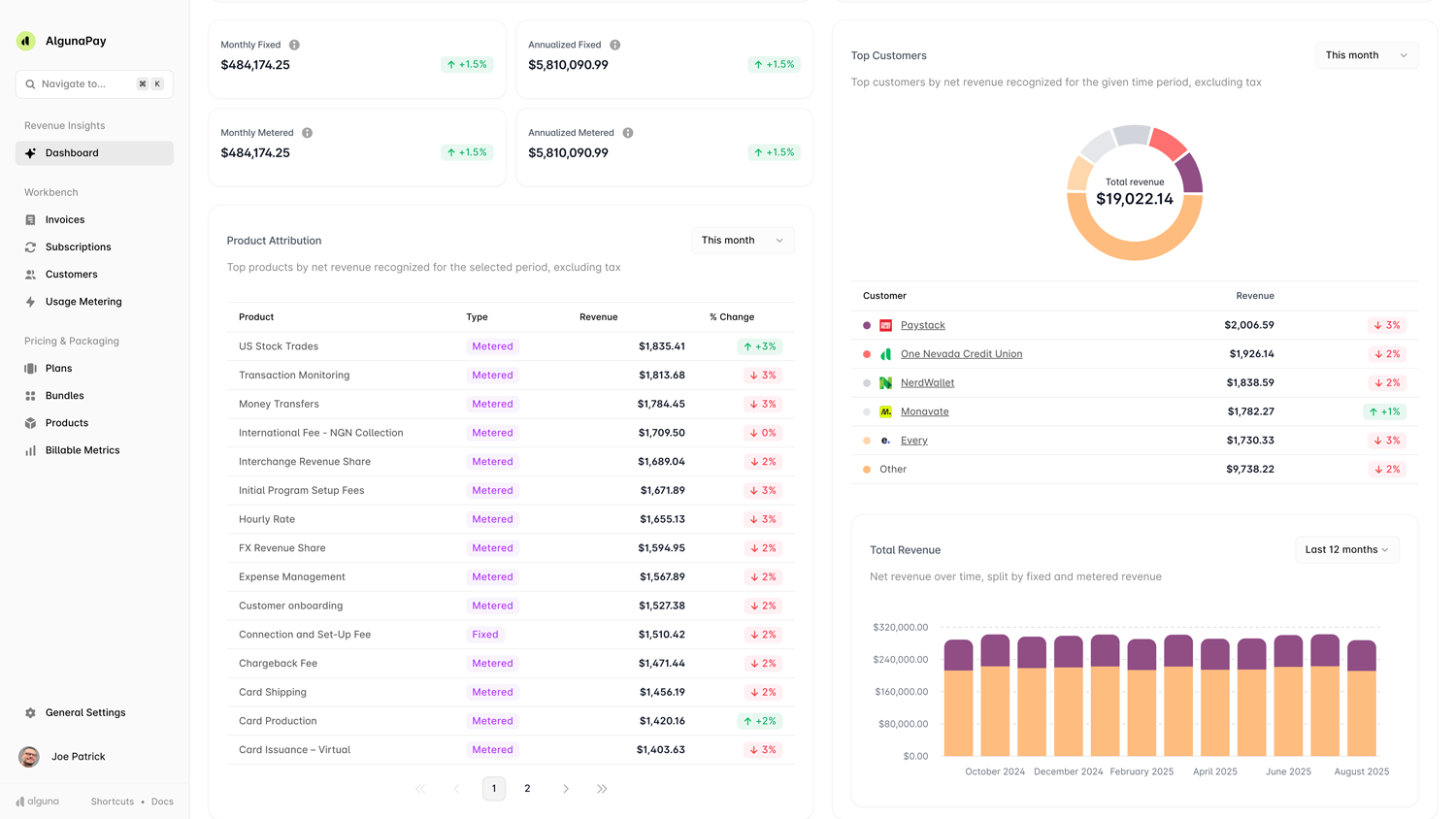

Alguna — End-to-end AI monetization solution for scaling SaaS, AI, and fintech companies

Alguna is the only truly purpose-built AI monetization platform for modern SaaS companies, built from the ground up for AI and usage-based revenue models. The end-end-to-end platform includes a no-code CPQ, billing, and revenue recognition—seamlessly automating your quote to cash process.

Backed by Y combinator and built by fintech veterans that spent years perfecting payment orchestration infrastructures at companies like Primer, Dojo, and Bank of America, Alguna is a force to be reckoned with.

Alguna acts as a complete revenue operations platform, capturing usage events (API calls, tokens, etc.) in real time, auto-invoicing customers, and syncing data with CRM and accounting tools.

Known for fast deployment (customers go live in weeks), Alguna lets teams launch or iterate on pricing without code. Unlike legacy systems, it natively supports AI-era models like pay-per-use, AI agent billing, and hybrid subscription and consumption plans.

Key features:

- Real-time usage metering: Alguna ingests events instantly via APIs or connectors, metering usage against defined pricing metrics and triggering billing actions without delay. Perfect for AI services that charge per action, token, or compute unit.

- No-code CPQ: Build and customize quotes through a visual interface, add discounts, one-off fees, or custom terms. Signed quotes automatically convert into subscriptions and invoices, bridging sales and finance with zero manual effort.

- Revenue recognition and compliance: Alguna automatically handles deferred revenue schedules and accruals, and produces audit-ready revenue reports in compliance with accounting standards.

- Integrations: Connects seamlessly with CRMs such as Salesforce and HubSpot, as well as with accounting tools such as QuickBooks, Xero, and NetSuite. Webhooks and APIs allow further customization, ensuring Alguna becomes your single-source of truth for all things revenue.

- Flexible pricing setup: Supports subscriptions, tiered or volume-based usage, hybrid models, prepaid credits, and outcome-based billing—all configurable without code. This flexibility gives teams full control over pricing without engineering bottlenecks.

As Adam Liska, CEO of Glyphic, shared: “Alguna ticked every box I needed: a centralized system for invoicing, multi-channel payments, and automation. Most importantly, it gave me a clear overview of revenue movements—something Stripe just couldn’t provide.”

Pros:

- Built for AI and usage-based billing: Alguna’s native metering automatically tracks tokens, API calls, and AI outcomes in real time with no custom engineering required. This ensures accurate, audit-ready billing for even the most complex AI workloads.

- Unified, no-code revenue platform: Configure complex pricing plans (tiers, overages, custom contracts) visually, with no developer needed. Quotes, signatures, subscriptions, and invoices all flow through one connected system, eliminating tool sprawl across CPQ, billing, and revenue recognition.

- Fast pricing iterations: Revenue teams can launch or adjust pricing models in minutes, not weeks. Customers report making live, no-code pricing changes without engineering support: a crucial advantage as AI pricing strategies evolve rapidly.

- Full revenue automation: Alguna automates quote-to-cash, revenue recognition (ASC 606 / IFRS 15), and dunning across entities. Multi-entity support is built in, helping scaling SaaS businesses stay compliant and cash-flow positive as they grow.

- Insights and analytics: Alguna surfaces real-time revenue data, helping finance teams spot anomalies and proactively optimize pricing, which turns monetization data into a growth lever.

Cons:

- Newer market entrant (backed by Y Combinator): Alguna raised a $4 million Seed round in 2023 and is still one of the newer players in the billing space.

- May not be suitable for pre-seed SaaS companies: If you’re a pre-seed SaaS with one basic subscription plan and no usage components, Alguna’s comprehensive platform might be more than you need initially.

Best for:

- Scaling AI startups and SaaS with usage-heavy models: Companies monetizing usage or hybrid pricing without building internal billing infrastructure, e.g., API services charging per call, or AI platforms billing per result.

- Businesses unifying PLG and enterprise sales: If you have self-serve users and large enterprise contracts, Alguna helps you handle both in a single system. It routes small customers to self-service checkout and supports sales teams with complex quotes, all of which feed into a single billing engine.

- Multi-entity or global SaaS: Companies operating in multiple regions or as multi-entity SaaS benefit from Alguna’s multi-entity support and global compliance.

- Revenue and Finance teams seeking automation: If your Finance or RevOps team is drowning in spreadsheets and manual billing steps, Alguna provides immediate relief. Case in point: Haven AI cut billing prep time by 80% after moving to Alguna.

Pricing: Alguna offers a free starter tier, with paid plans starting at $399/month for the full platform, including white-glove onboarding. Pricing is flat and predictable, no revenue cut.

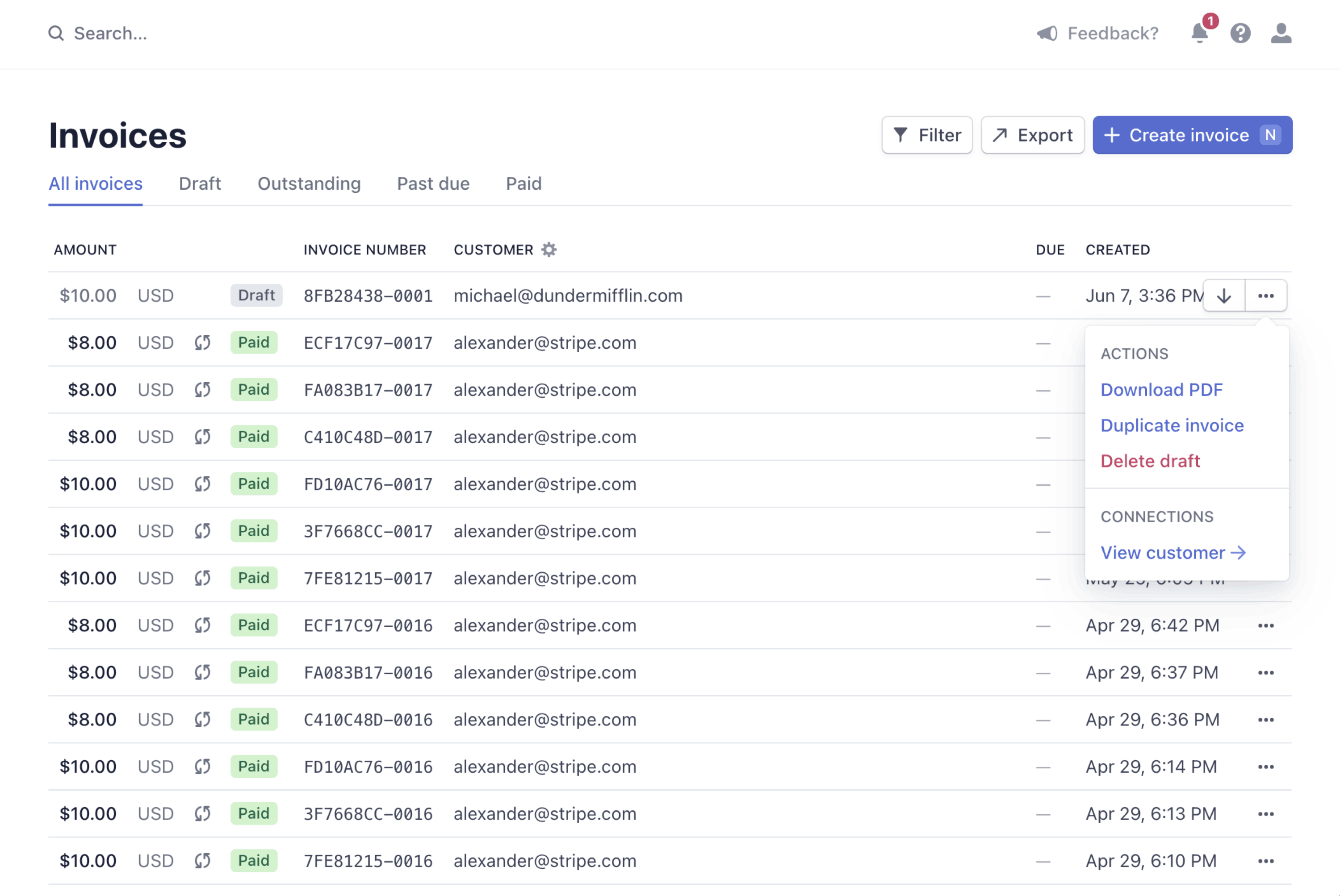

Stripe Billing — Fast start for subscriptions and basic metered billing

Stripe Billing is a part of Stripe's payments ecosystem, helping early stage SaaS startups handle subscriptions and basic usage billing. It’s a favorite among startups because it’s quick to set up, developer-friendly, and integrates seamlessly with existing Stripe payments.

Built for developer-led teams, it shines in straightforward SaaS scenarios but struggles with complex pricing or contracts. In 2026, it remains the go-to for early-stage SaaS and side projects, while scaling companies often graduate to platforms like Alguna or Chargebee.

Key features:

- Subscriptions and basic plans: Recurring billing, one-off invoices, free trials, coupons, etc., all standard in Stripe.

- Metered billing: You can define products as metered, and Stripe will invoice for the usage you report each billing period. Supports tiered pricing, volume pricing in its model, but requires your app to do the counting and send usage totals.

- Customer portal and checkout: Stripe offers a hosted checkout and a self-service portal for users to manage payment methods and cancel subscriptions. This is useful for PLG/self-serve flows where you don’t want to build your own billing UI.

Pros:

- Quick and easy for developers: You can use Stripe’s API or Dashboard to create products, prices, and subscriptions in minutes. The developer experience is excellent: clean APIs, extensive documentation, client libraries, and event webhooks.

- Basic usage and subscription handling: Stripe Billing handles recurring subscriptions with ease, including trials, upgrades, downgrades, and proration. It also supports metered billing, where your app reports usage and Stripe bills in arrears.

- Ecosystem and add-ons: Stripe’s add-ons extend its core billing capabilities, including Sigma for analytics, Revenue Recognition for GAAP compliance, and Stripe Tax for automated VAT/sales tax. Each costs extra, but together they let you manage billing, analytics, and tax without leaving Stripe.

Cons:

- Platform lock-in and integration gaps: Stripe works best inside its own ecosystem. It doesn’t support external payment processors and has limited CRM or advanced quoting integrations, often requiring extra tools to fill the gaps.

- Limited flexibility for complex models: Stripe Billing wasn’t built for highly custom pricing or on-the-fly plan changes. If you need to charge for multiple metrics or implement tiered pricing per customer, it gets cumbersome.

- Developer and manual-heavy beyond basics: Non-technical teams struggle once billing moves beyond standard plans. Custom quotes or discounts often mean manual setup or spreadsheets. There’s no built-in CPQ, so sales teams rely on workarounds.

Best for:

- Early-stage SaaS and simple models: If you’re a new SaaS with a straightforward pricing model (e.g., $X per user/month, or basic subscription tiers) and you prioritize speed, Stripe Billing is often the best initial choice. It’s practically plug-and-play, and you likely already use Stripe for payments.

- Developer-led teams comfortable with APIs: If your team has strong engineering resources to script and maintain custom billing logic, Stripe gives you the building blocks.

Pricing: Stripe Billing charges 0.7% of billed revenue, with no base platform fee. For example, billing a customer $1,000 would incur a $7 fee. You’ll also pay standard Stripe payment processing fees (e.g., 2.9% + 30¢ per card transaction).

Read more: Alguna - Best alternative to Stripe Billing for scaling B2B SaaS teams

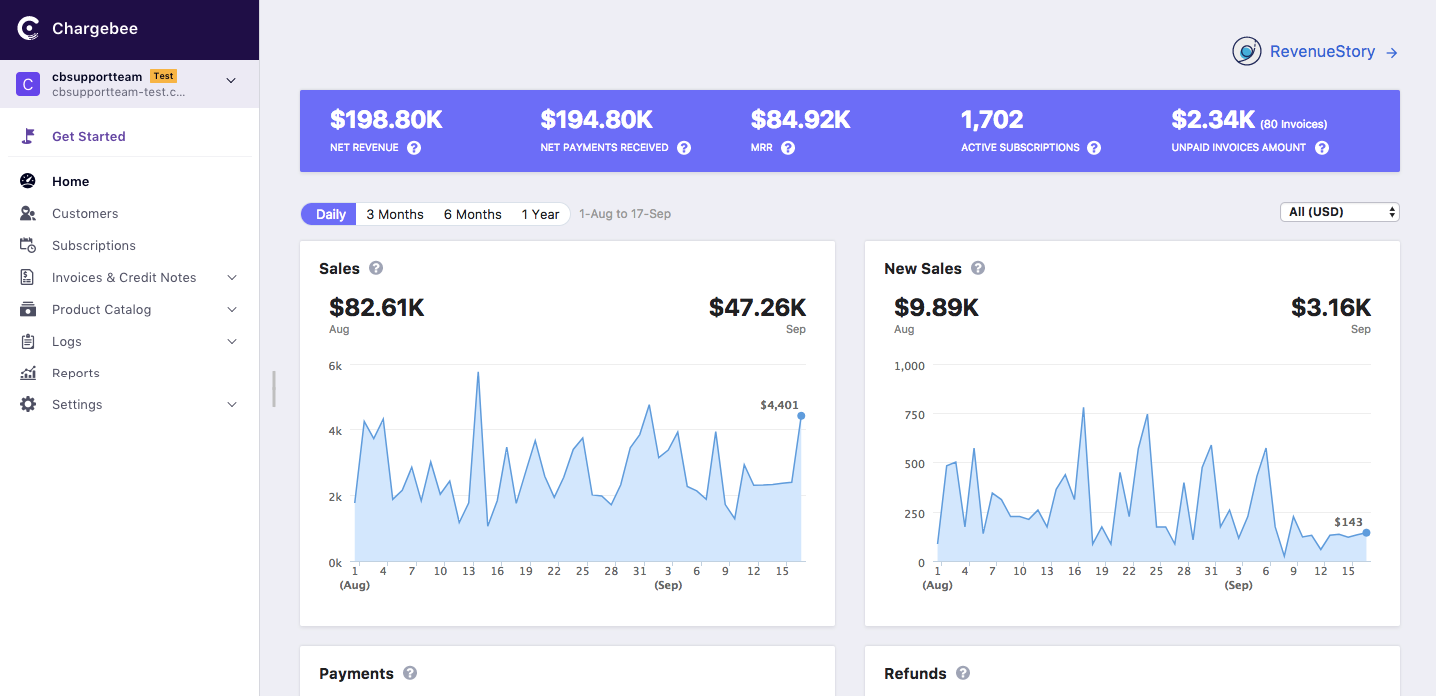

Chargebee — Subscription focus with light metered billing

Chargebee is a long-standing SaaS subscription billing platform designed to automate subscriptions at scale. It handles recurring billing, trials, upgrades, invoicing, and taxes for thousands of businesses.

The platform’s core strength remains subscription lifecycle automation that works well for mid-sized SaaS companies with primarily subscription revenue (and some usage billing).

Key features:

- Recurring billing engine: Handles invoicing and payments for subscriptions at scale, including co-terming subscriptions (aligning different subscriptions to the same renewal date), and managing upgrades/downgrades mid-cycle with automatic proration.

- Revenue recognition module: Chargebee includes a RevRec module to automate revenue recognition in line with accounting standards, useful if you need GAAP/IFRS-compliant financials and want to avoid spreadsheets for deferrals.

- Smart dunning and retention: It provides configurable dunning strategies (retry schedules, email notifications) and an optional “Retention” add-on that can pause subscriptions and capture feedback on cancellations, aiming to reduce churn.

- Catalog and plan management: A UI to create and manage product catalogs, pricing plans, add-ons, coupon codes, etc. This is great for non-developers to update pricing.

Pros:

- Comprehensive subscription management: Chargebee automates the entire subscription lifecycle, including signups, renewals, cancellations, trials, proration, credits, and dunning. It supports advanced billing logic, such as custom intervals, aligned billing dates, and tiered plans, covering most subscription scenarios out of the box.

- Analytics and reporting: Built-in dashboards track MRR, churn, and lifetime value, giving SaaS teams clear visibility into revenue and retention without needing a separate BI tool.

- Integrations and ecosystem: Chargebee connects with major CRMs (Salesforce, HubSpot), accounting systems, tax engines, and more. APIs and webhooks enable custom workflows, such as automatically creating subscriptions when deals close.

Cons:

- Engineering effort for customization: Chargebee offers deep flexibility but requires technical work to tailor. Real-time usage metering or dynamic AI pricing often needs API scripting or external logic. Its no-code UI suits standard subscription setups but not complex, usage-heavy models.

- Complex setup and learning curve: Chargebee’s UI is dense and configuration-heavy. Implementing product catalogs, migrations, and integrations takes time, and its modular growth makes the experience less seamless than a natively unified platform.

- Cost scales with revenue: Chargebee’s pricing ramps up as you grow (see details under Pricing.

Best for:

- Mid-market SaaS with standard subscriptions: If your monetization is largely fixed-price or seat-based, Chargebee is a battle-tested choice.

- Companies needing a solid billing backbone with less DIY: Compared to Stripe, Chargebee is friendlier to non-engineers once set up. Finance teams can pull reports or even create certain coupons or adjustments themselves.

- Businesses with multiple billing scenarios: Chargebee can manage a mix of recurring charges and usage-based billing, as well as multiple product lines, which might be tricky in simpler systems.

Pricing: Chargebee’s Rise plan starts at $599/month and covers up to $100K in MRR. The Scale plan is $999/month for up to $200K in MRR, with overage fees of 0.6% to 0.75% on revenue beyond those thresholds. Enterprise plans shift to custom flat fees, removing the percentage-of-revenue model entirely for high-volume SaaS companies.

Read more: Chargebee alternatives: 9 competitors that go beyond basic subscription functionality

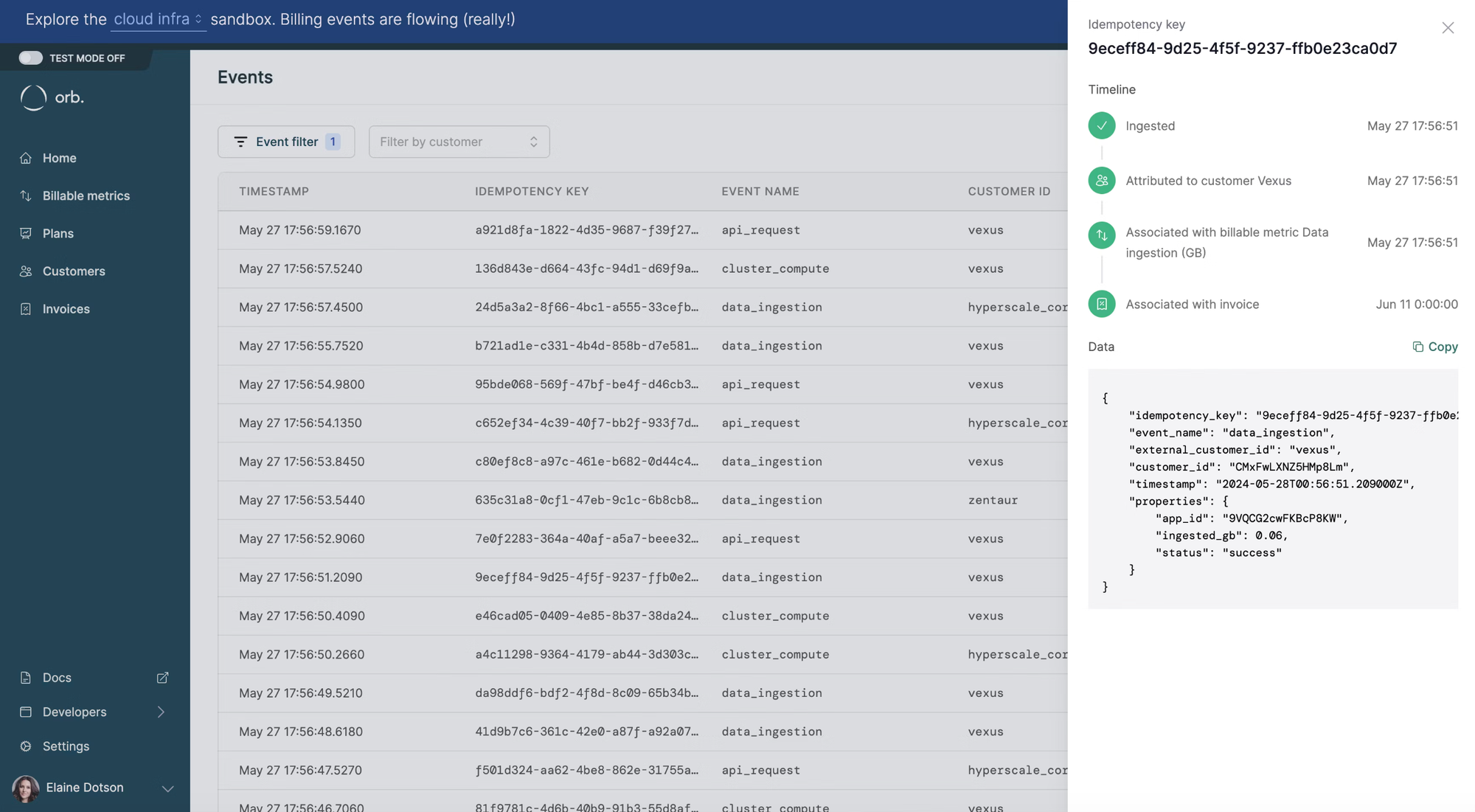

Orb — Developer-first setup built for scale

Orb focuses purely on usage-based billing and metering. It’s a developer-first platform that acts as the underlying infrastructure for tracking events, defining pricing rules, and computing usage charges.

In short, Orb gives engineering teams the plumbing they need to turn product usage into revenue. Built for scale and flexibility, it’s popular among API-driven SaaS, AI, and infrastructure companies processing high event volumes.

However, Orb isn’t a full quote-to-cash platform (like Alguna), but rather a usage-rating engine. Most teams pair it with another tool for quoting, invoicing, and collections.

Key features:

- Event ingestion and aggregation: Orb ingests usage events, like API calls, in real time and aggregates them by customer or time period. It ensures idempotency and accuracy (no duplicates or data drift), so usage data stays clean and auditable.

- Pricing configuration via API: Define custom metrics and formulas, e.g., first 1M API calls free, then $0.0001 per call, capped at $X. Orb automatically calculates charges per customer and supports versioning, so pricing changes don’t disrupt existing plans.

- Usage queries and audit logs: Teams (and even customers via API) can query real-time usage, view breakdowns, and trace charges back to raw events. This transparency and auditability are key reasons developers trust Orb for precise billing.

- Developer tooling: Orb includes sandbox environments, webhooks for threshold alerts or billing events, and SDKs in multiple languages, making it easy to test, automate, and integrate within your product workflow.

Pros:

- Granular, flexible metering: Orb lets you define custom usage events and pricing models programmatically, including per-API-call, per-GB-of-data, and per-1,000-predictions. It supports complex pricing via the API, including tiered rates, volume discounts, and free quotas.

- Built for scale and performance: Orb’s infrastructure can handle millions of events in real time, processing them with strong data accuracy. It’s optimized for high-volume products, such as AI or infrastructure tools, that require precise, up-to-the-minute usage data.

- Developer-first experience: Orb provides clean APIs, detailed documentation, and intuitive query tools for engineers to fetch usage data and compute charges. It treats billing as a software problem, offering prebuilt components like event ingestion, aggregation, and rating engines, so teams can integrate complex usage billing without building everything from scratch.

Cons:

- Not an end-to-end solution: Orb focuses purely on metering and pricing, not full billing operations. You’ll still need another tool (like Stripe or Chargebee) for subscriptions, invoicing, and payments. This means more integration work and potential mismatches if not managed carefully.

- Requires engineering effort: Implementing Orb isn’t plug-and-play. Your dev team must integrate its APIs, instrument your product to send events, and possibly build internal admin tools for managing pricing. It’s designed for technical teams, not no-code RevOps setups.

- Limited business-user functionality: Orb lacks a UI for quoting, forecasting, or revenue recognition, and offers minimal out-of-the-box CRM integration. Finance teams will likely need to rely on custom queries or API exports. It’s not an all-in-one monetization platform for business users.

Best for:

- Highly technical, usage-centric startups: Ideal for API-first SaaS or AI companies where usage drives revenue and billing is part of the product experience. Think developer tools, AI APIs, or infrastructure services that want precise control over usage display and pricing logic directly in-app.

- Companies outgrowing basic billing: Teams that start with manual spreadsheets or Stripe’s limited metering often turn to Orb once usage tracking becomes too complex.

- Teams wanting deep control: Orb suits companies that prefer to own their billing experience rather than outsourcing it to a full-stack platform. It lets you build custom workflows, like per-customer pricing and bespoke alerts while keeping billing “under the hood.”

Pricing: Orb’s plans range from roughly $749 to $3,490 per month, with tiers based on features, event volume, and support level. Additional costs apply for higher usage volumes and optional integrations, but there are no revenue-based fees, making it predictable at scale.

Read more: 9 best Orb alternatives for SaaS and AI companies

Metronome — Enterprise-grade usage billing at massive scale

Metronome is a usage-based billing platform built for large-scale SaaS companies handling massive event volumes and complex pricing models. Founded by ex-Stripe engineers, it focuses on accuracy, scalability, and audit-grade reliability, positioning itself as the enterprise counterpart to Orb.

If Orb is the agile, developer-first option for startups, Metronome is the heavyweight designed to process billions of usage events, model intricate contracts, and serve as the system of record for billing and revenue operations. It’s aimed at later-stage or enterprise clients that need precision, compliance, and flexibility, even if that comes with a heavier implementation lift.

Key features:

- Usage metering and rating: Metronome offers robust event ingestion and a powerful rating engine similar to Orb’s. It supports highly configurable metrics and pricing plans, including hierarchical usage structures.

- Invoicing and accounts receivable: It can automatically generate invoices from both usage and recurring fees, integrating with major payment gateways for automated collections. Basic A/R tracking helps finance teams monitor payments and outstanding balances.

- Data pipelines and analytics: Metronome provides detailed usage exports, data warehouse integrations, and analytics dashboards for revenue and usage insights. Every calculation is logged for traceability, supporting its “audit-ready” positioning.

- Security and compliance: Designed for enterprises, Metronome adheres to high compliance standards such as SOC 2 and GDPR, providing the governance and data protection that large organizations require.

Pros:

- Enterprise-scale and reliability: Metronome is engineered for massive revenue operations, processing billions in customer revenue. Its proven scalability makes it a fit for fast-growing SaaS and fintech companies that need a platform they won’t outgrow.

- Supports complex contracts and terms: Metronome handles highly customized pricing agreements. Think bespoke customer tiers, dynamic discounts, usage rollovers, or multi-year commitments.

- Accurate and auditable billing: Metronome delivers audit-ready billing with complete traceability from usage to invoice. It handles edge cases like proration and rounding precisely, ensuring clean reconciliation with finance systems.

Cons:

- Implementation-heavy: Metronome’s power comes at a cost. It demands deep integration and often custom engineering, either by your team or theirs. It’s far from plug-and-play; implementation can take several months, making it a tough fit for companies that need fast deployment.

- High enterprise costs: Metronome operates on custom contracts, typically starting in the tens of thousands per year, and sometimes scales with event volume. It’s priced for large enterprises; smaller companies will find it cost-prohibitive compared to self-serve tools. Even at scale, the premium must be justified against more affordable competitors.

- Developer- and ops-heavy: Running Metronome demands technical resources. Ongoing management, pricing tweaks, or data queries often need engineering support or collaboration with Metronome’s team.

Best for:

- API companies: Metronome is built for massive transaction volumes, making it ideal for payment processors, cloud infrastructure providers, or AI APIs where billing precision is non-negotiable.

Pricing: Enterprise-first, with custom contracts starting around $10K+/year. Expect a base platform fee, typically around several thousand per month, plus variable charges based on usage volume, such as events processed, total billings, or overall revenue scale.

Read more: Metronome competitors: Best alternatives for usage-based billing

Zuora (with Togai) — Global quote-to-cash with real-time usage

Zuora is a leading enterprise billing platform long synonymous with the “Subscription Economy.” Since the late 2000s, it’s powered large organizations with complex, multi-entity billing, payments, and revenue recognition needs.

Historically, though, Zuora was built for traditional subscriptions rather than the demanding usage models driving today’s AI- and API-based businesses.

That’s why, in 2024, Zuora acquired Togai. This allowed them to offer real-time event tracking as Togai handles usage data, while Zuora manages subscriptions, catalogs, and financial workflows.

Key features:

- Unified billing and revenue engine: Zuora’s core platform manages everything from product catalogs and pricing plans to invoicing, renewals, and revenue recognition (RevPro). It supports complex global setups across currencies, regions, and entities.

- Sales-to-finance alignment: With Zuora CPQ integrated into Salesforce, sales teams can configure quotes and push them directly into billing. This reduces handoff friction and ensures contract terms flow cleanly from quote to cash.

- Automated collections and compliance: Zuora Collect automates dunning, retries, and collections, while RevPro ensures GAAP/IFRS-compliant revenue schedules and faster closes.

- Modern usage tracking via Togai: Togai adds real-time metering, letting enterprises track and bill for API calls, tokens, or AI events directly within Zuora. It effectively upgrades Zuora’s legacy subscription backbone into a hybrid, usage-ready billing engine.

Pros:

- Enterprise-grade power: Zuora is purpose-built for large, complex businesses. It handles multi-entity setups, global taxation, and advanced revenue recognition. Used by companies like Zoom and Zendesk, it’s proven at scale and supports nearly any billing model through deep customization.

- Complete revenue suite: Zuora covers the full lifecycle — from quoting to subscriptions, billing, payments, collections, and accounting —in a single ecosystem. This unified approach minimizes integration gaps and keeps revenue data flowing across teams.

- Modern usage metering via Togai: Togai adds real-time usage tracking to Zuora’s stack, enabling enterprises to bill for API calls, tokens, or AI workloads alongside subscriptions. It makes Zuora competitive for AI and usage-based models, merging traditional subscription management with dynamic, usage-aware billing.

Cons:

- Complex, resource-heavy implementation: Zuora is powerful but notoriously complex. Full deployment can take months or even over a year, often requiring dedicated engineers or consultants. Ongoing maintenance is demanding, which isn’t ideal for lean or fast-moving teams.

- High total cost of ownership: Between licensing fees, setup costs, and maintenance, Zuora is one of the most expensive billing systems. It’s best suited for enterprises that can absorb the cost and complexity; smaller SaaS teams will likely find it overkill.

- Not agile or AI-native: Despite Togai’s integration, Zuora remains a legacy system optimized for stability over speed. Rapid pricing iterations, real-time dashboards, or AI-specific use cases can be cumbersome. In short, it’s enterprise-grade, but not built for the agility today’s AI-driven SaaS demands.

Best for:

- Large, multi-entity enterprises: Zuora is built for established companies managing multiple products, regions, or subsidiaries. It integrates tightly with ERPs, making it ideal for organizations that need a single global billing system that scales with complexity.

- Companies requiring strict compliance: For IPO-bound or regulated businesses, Zuora’s audit-ready structure and RevPro integration provide reliable, GAAP-compliant revenue reporting and transparency.

- Businesses blending subscription and usage models: With Togai, Zuora now supports both subscription and metered-usage billing, making it a strong fit for enterprises adding AI- or API-based charges without switching vendors.

- Existing Zuora users adding AI monetization: For teams already using Zuora, integrating Togai is the natural path to enable usage-based pricing, extending current workflows without a full system overhaul.

Pricing: Typically starts around $50,000 annually, plus implementation and integration fees. Pricing is usually tiered based on factors such as billing volume, transaction count, or the number of customers. Enterprise contracts are custom-quoted and often include additional costs for modules such as RevPro or advanced integrations.

Read more: Zuora alternatives: 9 competitors that drive AI revenue

Now that we’ve examined each of the six platforms, you should have a clearer picture of how they differ. Next, we’ll discuss how to approach choosing the right solution for your needs.

How to choose the right AI monetization solution for your SaaS business

With multiple viable options on the table, how do you determine the best SaaS monetization software for your company?

The decision isn’t just about billing, but about setting up a system that can handle scale, align with your AI pricing model, and evolve with your business. Traditional billing tools weren’t built for AI workloads, where millions of usage events and fluctuating compute costs can make or break your margins.

Here’s how to evaluate and select the right platform:

- Match the platform to your growth stage: Early-stage startups often need speed and simplicity. If you’re still validating pricing, tools like Stripe Billing can help you launch quickly.

- Prioritize flexibility in pricing models: AI products evolve fast. Your monetization platform should support modern SaaS monetization techniques (hybrid, usage-based, or outcome-based pricing) without heavy coding. Look for easy experimentation, e.g., free usage up to a limit, then pay-per-use, or switching from per-seat to per-output pricing.

- Balance automation with control: Manual spreadsheets and delayed invoices wreck revenue accuracy at scale. The right system automates the entire quote-to-cash process, from pricing configuration and metering to billing, payments, and revenue recognition. Yet automation shouldn’t mean rigidity; finance and RevOps teams still need the freedom to adjust pricing, issue credits, or generate reports without waiting on engineering.

- Assess scalability and real-time metering: AI SaaS generates huge, unpredictable usage volumes. Your monetization platform must handle real-time event ingestion and analytics without breaking under pressure. Avoid systems that rely on batch processing because they can’t keep pace with AI’s variable workloads or provide accurate, instant visibility for customers and finance teams.

- Factor in resources and ease of implementation: Ask yourself: Do you have engineers to spare? Developer-centric platforms like Orb or Metronome give deep control but need technical ownership. No-code systems like Alguna or Chargebee empower RevOps teams to own billing directly. Time-to-value matters, so look for platforms that can go live in weeks, not months.

- Evaluate the total cost of ownership: Cheap tools can become expensive fast. Stripe’s percentage-of-revenue fees, for example, may outpace a flat-fee solution as you grow. Likewise, a “free” setup that eats up developer time will cost more in the long run. Weigh platform fees against implementation time, maintenance effort, and potential revenue you could unlock through better automation or pricing accuracy.

- Plan for future-proofing: You don’t need an enterprise system on day one, but you do need room to grow. Choose a platform that can scale with your usage models and customer base without re-engineering your billing stack. Flexibility, API depth, and strong integrations are signs you’re picking a system built for tomorrow’s AI economy.

Frequently asked questions about AI monetization solutions for Saas

What’s the difference between SaaS monetization and AI monetization?

SaaS monetization is how software companies generate revenue, historically through subscriptions, seats, or usage fees.

AI SaaS monetization is a subset of that, focused on pricing AI-driven features or products.

Instead of charging per user, AI products often bill by usage, e.g., per API call, per prediction, or per 1,000 tokens. Because AI workloads are compute-intensive and variable, pricing must reflect actual usage and outcomes, not flat access fees.

How can I monetize an AI-powered SaaS product?

There are several proven AI SaaS monetization techniques, including tiered subscriptions (where higher tiers unlock AI features), usage-based pricing (charging per API call, token, or prediction), outcome-based models (charging for results like leads qualified or frauds prevented), and freemium or add-on AI tools.

The best model depends on your cost structure and customer behavior. Many AI SaaS companies adopt hybrid pricing, combining subscriptions and usage for predictable yet scalable revenue.

What AI SaaS monetization strategies work best for SaaS?

Most SaaS companies use one or a mix of the following: flat-rate, tiered, per-user (seat-based), usage-based, outcome-based, or hybrid pricing.

AI-powered SaaS businesses tend to favor usage-based and hybrid models since they align price with both customer value and underlying compute costs.

Which platforms support usage-based billing?

All major platforms now support it to varying degrees:

- Alguna: Purpose-built for AI, supports real-time metering and outcome-based pricing out of the box.

- Stripe Billing: Supports usage, but you must send usage data manually via API.

- Chargebee: Allows usage imports but lacks real-time metering.

- Orb and Metronome: Best for high-volume usage billing, but require integration with separate invoicing systems.

- Zuora + Togai: Adds modern usage metering to Zuora’s enterprise stack.

If usage-based billing is your core need, Alguna offers the most complete, no-code solution; Orb and Metronome excel for developer-led teams.

How do I choose the right monetization model for my AI SaaS?

Start by identifying the metric that best represents value, such as API calls, tokens, or successful outputs. If usage directly correlates with value, go with a usage-based model.

Prefer predictability? Go hybrid.

Benchmark competitors, pilot pricing, and iterate because let’s face it, pricing is never final. As you scale, ensure your billing system can handle real-time metering and flexible pricing changes so you can adapt without breaking your revenue flow.

Future-proof your revenue engine with Alguna

AI monetization is evolving fast. What used to be simple seat-based billing is now dynamic, usage-driven, and often tied directly to compute costs. Every token, API call, or inference carries a price, and without the right system, revenue slips through the cracks.

Most billing tools weren’t built for this; they struggle with AI-scale workloads, leaving teams buried in spreadsheets, manual uploads, and bad data.

To compete, you need more than just a billing tool. You need an AI monetization engine that turns complex usage data into predictable, scalable revenue. Platforms like Alguna are redefining this category—built natively for AI-era monetization, they give companies the control, flexibility, and automation legacy billing stacks can’t match.

Discover why leading AI SaaS companies use end-to-end monetization platforms

From startups to global enterprises, Alguna helps revenue teams modernize quote-to-cash in a single monetization platform purpose-built for AI SaaS companies by unifying pricing, usage metering, billing, and revenue recognition.