Discover how gen AI monetization platforms meter, price, and bill usage in real time, what to evaluate, and which options fit different pricing models and growth stages.

Know what to look for when evaluating AI monetization platforms and feel confident in your shortlisted options.

Note: Pricing and features are based on public sources and vendor materials as of January 2026.

AI products are reshaping how software gets priced. With usage-based and outcome-driven models on the rise, businesses are actively exploring AI monetization strategies that align pricing with customer value.

Startups and enterprises that are charging per API call, GPU-hour, token, or outcomes are leaving legacy systems behind in favor of purpose-built AI monetization platforms like Alguna and others.

In this guide, we’ll define what an AI monetization platform is, compare the leading options, and help you find the best software to scale usage-based billing with confidence.

What is an AI monetization platform?

AI monetization platforms handle the unique metrics and models used by AI companies, whether they have usage based, credit based, or outcome based pricing. In short, they support any AI pricing model.

End-to-end AI monetization platforms, like Alguna, offer full quote-to-cash infrastructure tailored to AI companies, while more niche options like Paid.ai focus solely on AI agent cost tracking.

Core functions in end-to-end AI monetization platforms typically include real-time usage metering (tracking API calls, tokens, or GPU-seconds), flexible pricing configuration (subscriptions, usage-based, hybrid plans, credit wallets), automated invoicing and payments, along with revenue recognition and detailed reporting.

The difference between AI monetization platforms and AI agent monetization platforms

AI monetization platform is the broader category. They help AI companies monetize their products, APIs, or AI pricing models. They’re purpose-built to help AI-native and AI-powered SaaS companies price, package, and bill for AI usage, whether that’s tokens, API calls, messages, outputs, or outcomes.

AI agent monetization platforms belong to that category, but refer (as the name suggests) specifically to companies that build or deploy AI agents, to help them track, price, and monetize agent activity, supporting any AI agent pricing model.

Best AI monetization platforms for AI startups and enterprises: Comparison overview

| Platform | Best for | Pros | Cons | Pricing |

|---|---|---|---|---|

| Alguna | Scaling AI & SaaS teams that want end-to-end, no-code monetization (pricing → metering → CPQ → billing → rev rec) | All-in-one quote-to-cash; no-code pricing & packaging; real-time usage visibility; strong automation (alerts, dunning, retries); global-ready (multi-currency/entity/tax) | Newer market entrant; most common among startups/scaleups today | From $399/mo, flat fee, no revenue share; includes CPQ & billing |

| Orb | Developer-led teams that want programmable billing and fine-grained control | Powerful APIs; flexible pricing models; scales to high event volumes | Requires engineering effort; limited native CPQ; learning curve for data model | $749–$3,490/mo + usage & integration fees (scales with volume) |

| Metronome | Enterprise-grade AI/API providers handling very large volumes & complex contracts | Proven at massive scale; real-time billing & transparency; deep enterprise integrations; auditability/compliance | High implementation effort; higher cost; historically engineering-centric | Custom est. $10k+/yr base + usage/volume components |

| Paid.ai | AI agent products (chatbots/assistants) needing cost tracking → outcome-based pricing | Agent-centric metrics (tasks/leads); granular cost/margin telemetry; easy SDK; ROI/“value receipt” reporting | Specialized (less general SaaS fit); requires instrumentation; maturing enterprise features/CPQ | Free cost tracking for first year; billing automation custom-priced |

| Chargebee | Companies with simple SaaS or hybrid plans needing fast setup & rich SaaS integrations | User-friendly; strong subscription lifecycle; broad ecosystem; global readiness | Batch-oriented usage (not real-time); limited complex usage logic; no AI-specific metrics | From $599/mo (up to $100k billings) + small % of revenue above threshold |

| Zuora (with Togai) | Global enterprises needing rigorous compliance, approvals, and scalable usage via Togai | Extremely feature-rich; scales to billions of transactions; enterprise workflows/controls; Togai for usage metering | Complex to implement/admin; high cost; not AI-specific out-of-box; can be heavyweight early | From ~$50k/yr + implementation/integration fees; tiered by volume |

Deep dive: 6 leading AI monetization platforms

While all these platforms help automate billing, only a few are truly built for the realities of AI-driven products, where usage surges, pricing changes often, and new pricing models and metrics evolve fast.

Let’s look at how each platform compares in capabilities and focus.

1. Alguna – All-in-one AI monetization platform for scaling startups and enterprises

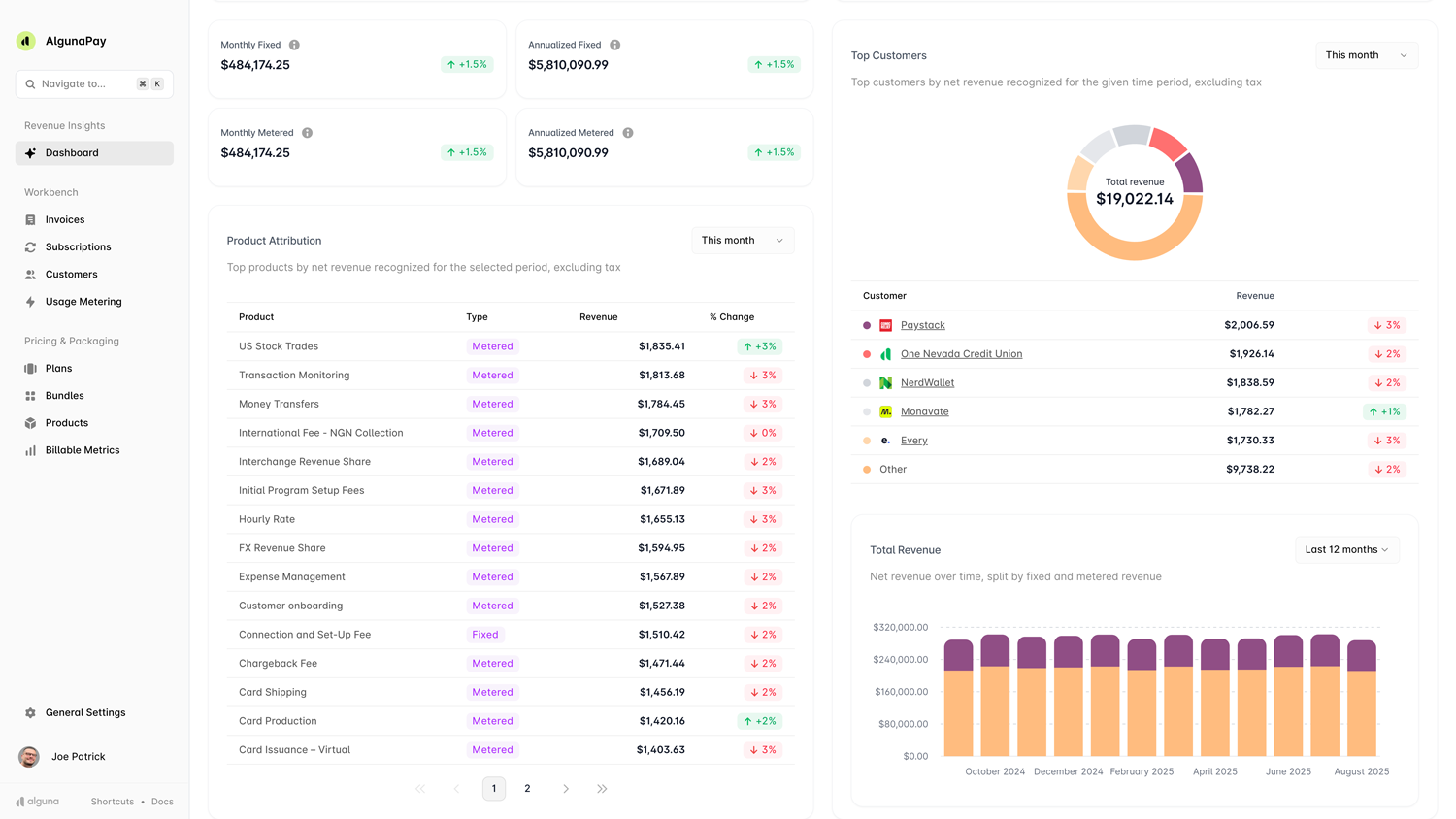

Alguna is purpose-built AI monetization platform for AI, SaaS, and fintech companies. It unifies real-time usage metering, pricing configuration, quoting, billing, and revenue recognition in one tool.

It’s designed to adapt as fast as your AI models do. Alguna replaces the patchwork of tools (that break at scale) with a single source of truth for monetization and revenue.

Alguna emphasizes a no-code approach, meaning product, RevOps, and finance teams can launch or adjust pricing plans without engineering effort.

It handles any pricing model or sales motion flexibly and with ease, making it the go-to option for fast-moving revenue teams.

Key features:

- No-code pricing and packaging for any pricing model: Easily create or update plans (usage-based, tiered, subscription, hybrid) via UI with no engineering required.

- Real-time usage metering: Track usage at granular levels (LLM tokens, API requests, GPU hours, etc.) in real time. Alguna meters and aggregates events as they happen, providing up-to-the-second usage data for billing.

- Unified quote-to-cash: Built-in support for quotes and contracts (CPQ) ties directly into the metering and billing engine. Sales can issue usage-based commitments or custom pricing, and Alguna will automatically operationalize these in billing.

- Advanced revenue automation: The system handles invoicing, payments, dunning, and revenue recognition. Finance teams get GAAP-compliant reports and can trust that every usage event is accounted for.

- Global-ready architecture: Includes multi-currency, multi-entity, and tax support out of the box. Suitable for companies selling AI services worldwide or operating multiple business units.

"But now, where everything has to be integrated, you end up in a situation where you need something that is very agile and flexible, and that's how Alguna started, to help companies avoid dedicating too many resources to back office processes, and not having to use five or six different tools, but instead have everything under one roof."

- Aleks Đekić, Alguna CEO and Co-founder

Pros:

- End-to-end solution: Covers the full monetization lifecycle (pricing, metering, billing and revenue recognition) in one platform, eliminating data silos between sales, products and finance.

- Agile and no-code: It’s built for non-technical teams. Pricing experiments and new usage metrics can be launched without writing code or waiting on release cycles. Unlike developer-heavy tools like Orb or enterprise systems like Zuora, Alguna hits the sweet spot: no-code for speed, but powerful under the hood.

- Real-time visibility: Both companies and their customers get real-time insight into usage and costs. Alguna provides live dashboards and usage alerts so there are no end-of-month “surprises.”

- Scalable and flexible: Built to support both early-stage startups and complex enterprise deals. Handles huge event volumes and complex pricing rules, but with a consumer-grade ease of use.

- Strong automation: Workflows like usage threshold alerts, auto-invoice generation, and payment retries are automated, reducing manual billing ops to near-zero.

- Adam Liska, CEO of Glyphic

Cons:

- Newer market entrant (backed by Y combinator): Alguna is a Y-combinator backed platform that raised a Seed round of $4 million in 2025.

- B2B focus: Alguna's AI monetization platform is purpose-built for B2B companies, so it doesn't t

Best for:

- AI and Gen AI startups that are scaling rapidly but lack a billing engineering team can use Alguna's Gen AI monetization platform to grow with.

- Enterprise AI platforms managing complex, hybrid pricing (subscriptions + usage + one-off credits) across global markets.

- Companies needing usage-based billing without the headache for teams who want to focus on product innovation, not building billing infrastructure.

Pricing: Plans start at $399/month flat-fee (no revenue share) for the base package, which includes full CPQ and billing functionality. Alguna notably does not take a percentage of your revenue, unlike some other platforms.

2. Orb – Best AI monetization platform for developer-led teams

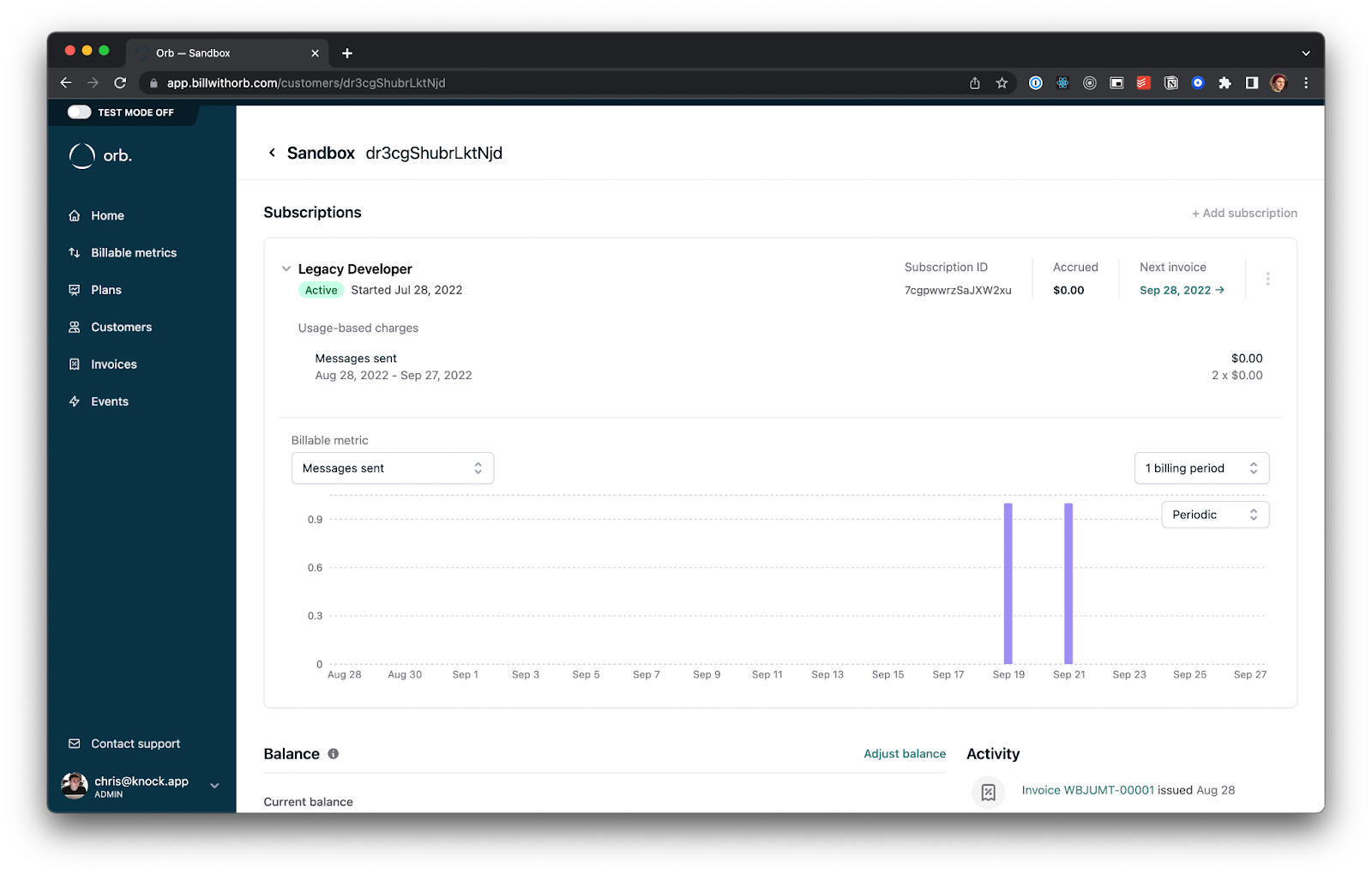

Orb is a usage-based billing platform known for its developer-friendly APIs and event infrastructure. It’s ideal for teams that want fine-grained control and don’t mind doing some coding to tailor their billing.

Orb excels at real-time ingestion of usage events and offers a robust API to define metrics and pricing programmatically. Engineering teams can build custom workflows on top of Orb’s platform, making it a popular choice for companies that have the developer capacity to own their billing logic.

Key features:

- Real-time event ingestion: Orb can ingest raw events (API calls, etc.) in real time and aggregate usage for billing without delays. This ensures timely invoices and up-to-date usage visibility.

- Programmable pricing: Developers can define complex pricing rules via API, supporting tiering, volume discounts, overage pricing, etc., all through code or config.

- Integrations and webhooks: It provides webhooks and integrations so you can connect billing events to your product.

- Reporting dashboard: While dev-focused, Orb does have dashboards for finance to see revenue, track accounts, etc., though not as elaborate as some finance-first tools.

Pros:

- Powerful for engineers: Offers a lot of control as you can treat billing as an extension of your product’s backend, with Orb handling the heavy lifting of metering and invoicing.

- Flexible models: Supports a wide range of billing models (from pure pay-as-you-go to hybrid plans) through its API. Developer teams can implement innovative models beyond standard subscriptions.

- Scalable architecture: Designed to scale with high event volumes (used by infra and API companies with lots of data).

Cons:

- Engineering effort required: To get the most out of it, you need developers to integrate events and possibly maintain custom scripts. One industry practitioner noted that Orb can put engineers “in charge of billing,” which might be fine for dev-heavy teams but not for finance-led teams.

- Limited built-in CPQ/quoting: Out-of-the-box, Orb lacks a native CPQ module or advanced billing workflows for sales. This means handling custom contracts or sales-led billing changes may require additional tools or manual steps.

- Learning curve: Flexibility comes with complexity. Teams might spend significant time understanding Orb’s data model and APIs. It’s best suited for orgs with at least one engineer focusing on billing.

Best for:

- Engineering-driven startups where developers are comfortable owning the billing integration and want maximum control over billing logic.

- Products with highly custom usage metrics that might not fit an off-the-shelf schema. Orb lets you define your own events and units easily via code.

- Teams already invested in building internal billing and want to offload some heavy lifting. In this case, Orb can augment your internal system with robust metering while you keep control over the rest.

Pricing: Orb’s pricing starts at $749–$3,490/month + usage and integration fees. Expect costs to scale with your usage.

3. Metronome – Best for enterprise-grade AI and API monetization

Metronome is an enterprise-scale AI monetization platform, often chosen by API-first and AI infrastructure companies dealing with massive data volumes.

It’s known for its sophisticated metering and rating engine that’s able to process millions of events reliably and for supporting very complex billing schemas. A key selling point is its emphasis on real-time billing and customer-facing transparency.

Key features:

- Hyper-scalable metering: Metronome’s infrastructure is built to capture and aggregate enormous streams of usage events with high accuracy. It’s cloud-native and can handle spikes gracefully.

- Real-time billing and visibility: Invoices and usage data update in real time. Metronome was designed so that customers could see their charges accrue live.

- Enterprise integrations: It offers integrations with CRM, ERP, and finance tools (Salesforce, NetSuite, etc.) and supports workflows for approvals, quotes, and custom contracts, fitting into complex enterprise sales cycles.

- Auditability and compliance: Metronome provides detailed logs and follows compliance standards needed for public companies (e.g., SOC 2). Good for finance teams that need audit-ready billing data.

Pros:

- Proven at scale: Metronome shines for large-scale usage. If you have tens of millions of events or multi-million dollar usage contracts, it’s battle-tested.

- Rich feature set: Beyond metering, it includes features like customer self-service portals, usage alerts, and even design elements to help your end-users manage their spend (e.g., support for usage caps or notifications).

- Enterprise support and security: Metronome engages closely with larger clients, providing support for complex migrations and ensuring security/compliance needs are met.

Cons:

- High implementation effort: Metronome’s depth comes with complexity in setup. Implementing it can be a project – you’ll likely need engineering time and possibly solutions support from Metronome to get everything configured.

- Cost: Metronome is on the higher end of the price spectrum (enterprise custom pricing). It may be overkill (and over-budget) for early-stage startups.

- Focus on engineering teams: Similar to Orb, Metronome historically appealed to engineering-led implementations (the founders’ ethos).

Best For:

- Large AI/ML infrastructure companies – e.g., an AI platform offering APIs or cloud services with high throughput, where precision and performance in billing are mission-critical.

- Enterprises with complex contracts – businesses that need to handle custom pricing per account, multi-year contracts with variable rates, or detailed internal chargeback of AI usage.

- Scale-ups planning for IPO or strict compliance – if you need a billing system that will satisfy CFOs, auditors, and can integrate with an enterprise ERP from the start, Metronome is suitable.

- Usage-first SaaS with a significant mid-market/enterprise customer base – if your go-to-market involves negotiating unique deals, Metronome’s combination of flexibility and control can accommodate that.

Pricing: Custom, enterprise-level only (est. ~$10K+/year). Expect a base platform fee, typically in the thousands per month, plus charges tied to events processed, billings, or overall usage scale.

4. Paid.ai - Best for AI agent monetization

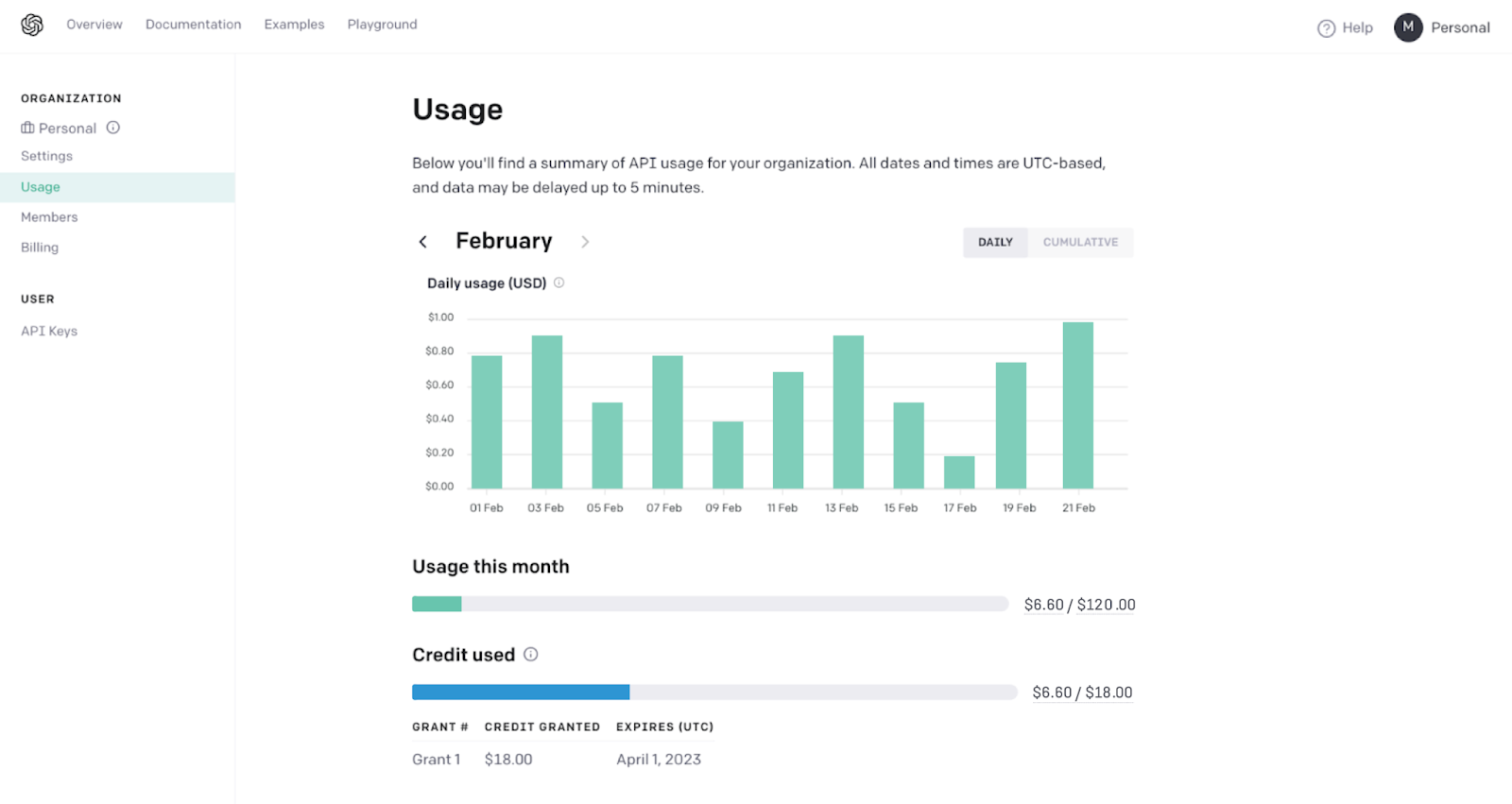

Paid.ai is a niche AI monetization platform built specifically for agentic AI products (think autonomous agents and chatbots). It combines real-time cost-tracking (for LLM and API usage) with flexible revenue-generation tools.

Paid.ai emphasizes self-service: developers embed a small library into their agent code to send usage signals, and product/finance teams use Paid.ai’s UI to define pricing (per action, per 1,000 tokens, etc.) and view analytics.

It’s not an end-to-end AI monetization platform like Alguna, meaning, you’ll likely have to pair it with other tools to make sure your quote-to-cash workflows run smoothly.

Key features:

- Real-time AI cost telemetry: Tracks vendor spend and agent costs.

- Flexible pricing engines: Subscription, per-output pricing, or hybrid plans that auto-generate invoices or usage charges.

- Automated quote/invoice generation and revenue dashboards: ROI and “value receipt” reporting

- Integrations: Sync with CRMs or customer portals.

Pros:

- Purpose-built for AI agent use cases: It handles metrics like “leads generated” or “tasks completed” as billing units.

- Deep cost focus: No other platform ties actual LLM costs to pricing so directly, enabling profitable margins.

- Developer-friendly: Easy SDK and no-code price setup.

Cons:

- Very specialized: Best-suited to AI assistants/chatbots, not general SaaS.

- Requires instrumenting agent code (though Paid.ai provides SDKs).

- Still maturing: Lacks enterprise billing features (e.g. deep CPQ) and billing automation is only via custom sales, not fully self-serve.

Best for:

- Companies building AI-native products or SaaS add-ons where an agent does work, such as customer support bots, AI analysts, autonomous helpers.

Pricing: Paid.ai offers a generous free tier. The AI cost-tracking service is free for the first year, and then teams pay only if they use the billing automation. (Billing/reporting features require contacting Paid.ai for a custom pricing plan).

5. Chargebee – Best for companies with basic AI monetization needs

Chargebee is a well-known subscription billing platform widely used in the SaaS world. It specializes in handling recurring billing, subscription lifecycle (trials, upgrades, cancellations), and invoicing, especially for small to mid-size businesses.

While not built for AI per se, Chargebee has added some support for AI monetization, such as usage-based charges.

Chargebee handles a lot of what a SaaS business needs around billing out-of-the-box, but it wasn’t initially designed for the unpredictable usage patterns of AI services. Still, many companies start with Chargebee for its ease of use and robust integrations, and some manage to bend it to their AI use cases up to a point.

Key features:

- Subscription and plan management: Define products and pricing plans, set up recurring billing intervals, free trials, discounts, coupons, etc. Manage customer subscriptions through their lifecycle.

- Invoices and payment collection: Automated invoicing, payment retries (dunning), and integration with gateways like Stripe, Braintree, and PayPal. The company also offers a self-service portal for customers to manage their payment methods.

- Basic usage-based billing: You can record usage (via API or CSV upload) for metered billing components, such as charging $0.01 per API call. Chargebee will include the usage fees in the next invoice. It also supports one-time charges and add-ons.

- Integrations and ecosystem: Connectors for Salesforce, HubSpot, Xero/QuickBooks, and more. Chargebee also has a robust API and even a hosted checkout page, making it easy to embed in your product.

Pros:

- User-friendly and quick to implement: Chargebee is often praised for its clean UI and relatively quick setup. You don’t need to be a developer to operate a lot of it.

- Global readiness: Multi-currency support, tax calculations via integrations, and compliance features save you headaches if you bill internationally.

- Scalable up to mid-market: Many companies use Chargebee up through tens of millions in revenue. It can scale in customer count and revenue, though extremely large enterprises might outgrow it.

Cons:

- Not built for real-time metering: Chargebee’s usage billing is batch-oriented – you typically report usage at the end of the period to include in invoices. It doesn’t provide real-time usage feedback to customers out of the box.

- Limited usage complexity: You can charge for simple metrics, but implementing complex usage pricing (such as multi-dimensional metrics and dynamic rate cards per customer) would be difficult or impossible to achieve with Chargebee alone.

- AI/ML specifics missing: There’s nothing AI-specific in Chargebee’s offering. There’s no notion of AI tokens or model outputs. You have to map your AI usage to generic “units” and manage that translation largely on your side.

Best for:

- AI startups in early stages that primarily have a simple pricing model (e.g., monthly subscriptions). If your billing is 90% recurring SaaS and 10% usage-based, Chargebee can handle it.

- Companies transitioning from pure subscription to hybrid – e.g., you already sell a SaaS app on subscription and are adding an AI module with usage fees.

- Teams without dedicated engineers for billing – if you want something that non-engineers can manage day-to-day, Chargebee is friendly.

- Use cases needing lots of SaaS integrations – say you want billing tied into your CRM workflow, your accounting software, etc., and you need a tried-and-true solution for that.

Pricing: Pricing starts at $599/month (up to $100K in billings).

6. Zuora (Togai) – Best for global enterprises

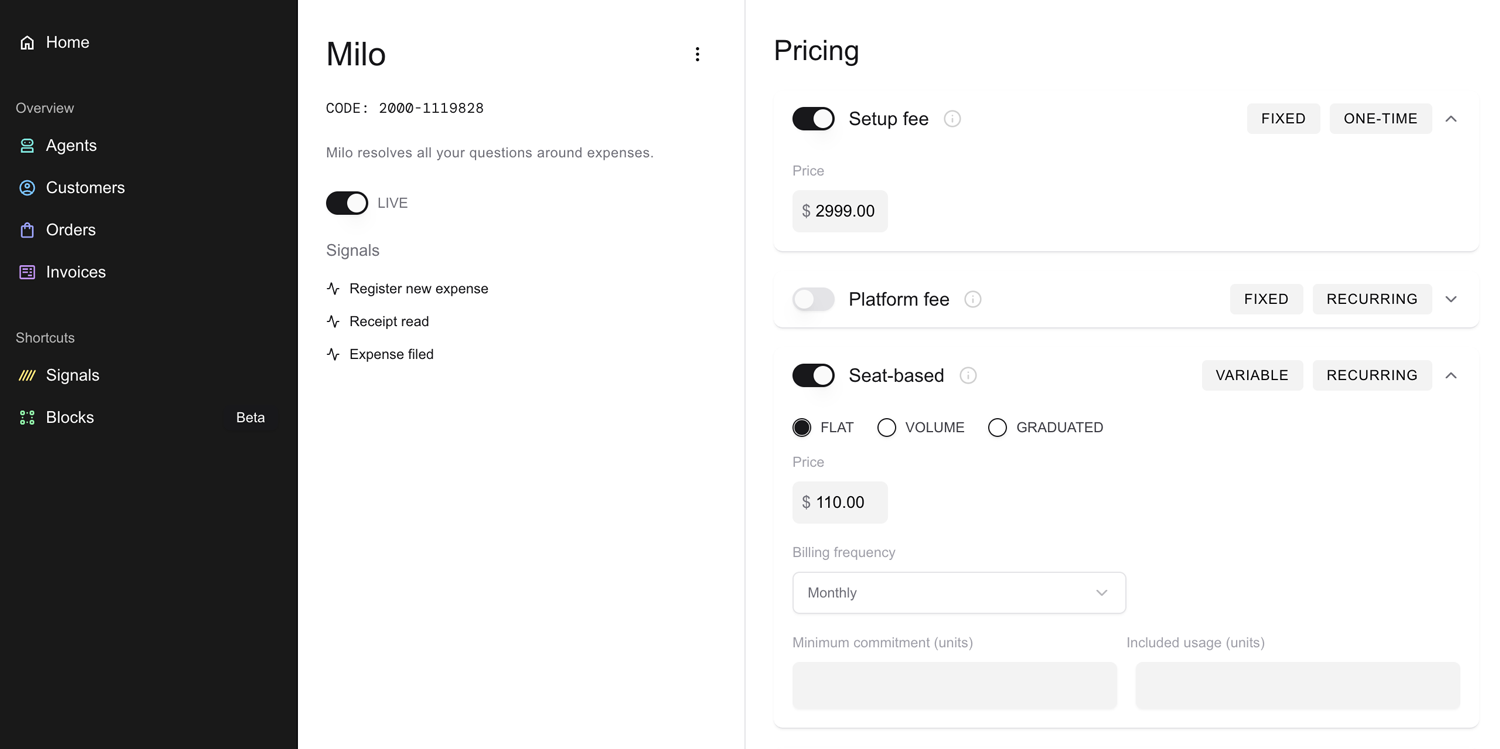

Zuora is well-established in the billing world, known for serving large enterprises with subscription and recurring revenue models. It’s a full quote-to-cash and billing management platform that can be configured to handle subscriptions, usage charges, one-off sales, and more.

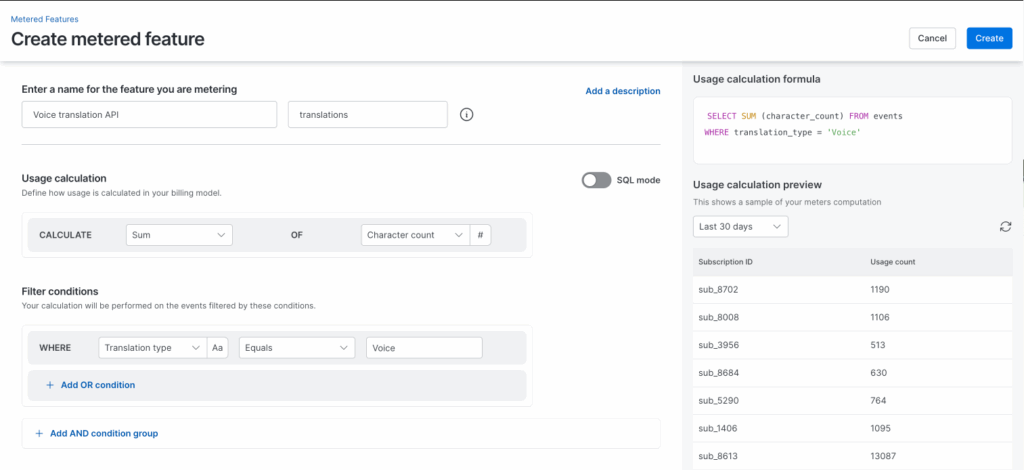

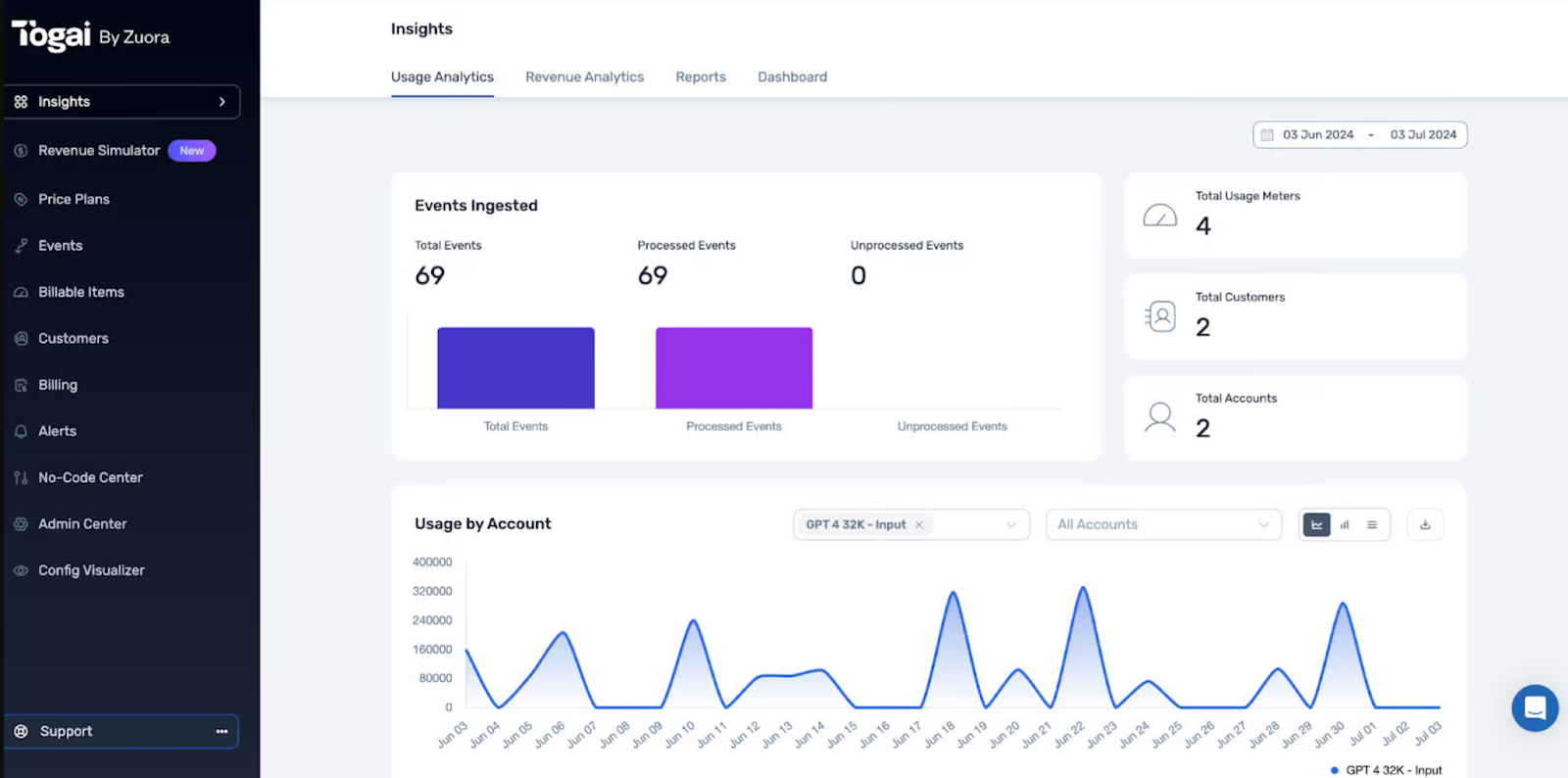

When it comes to AI monetization, Zuora mostly handles that part through its acquisition of Togai.

In practice, Togai plugs into Zuora’s quote-to-cash suite: engineers feed events into Togai’s meter, and revenue flows into Zuora billing/invoicing. Togai also offers drag-and-drop analytics widgets, APIs for embedding usage charts, and pre-built CRM connectors so sales can set up usage-based quotes easily.

Key features:

- Subscription and usage billing at scale: Zuora supports any combination of pricing charges – flat fees, tiered usage, volume pricing, overage, etc. You can model nearly any pricing scheme with its rate plan configuration.

- Invoicing and payment ops: Extremely robust invoicing (scheduled bill runs, consolidated invoices, multi-currency invoicing) and payment processing with lots of gateway integrations. The system also handles revenue recognition rules.

- Multi-entity, multi-region support: Zuora is designed for companies operating across regions and subsidiaries – it can segregate or consolidate financials as needed.

- Customization and APIs: There is a full SOAP/REST API and a suite of developer tools. Many enterprises extend Zuora with custom scripts (Zuora has a concept of “settings API” and allows some code to run on their platform). It also integrates with data warehouses, ETL tools, and has an ecosystem of connectors.

Pros:

- Extremely feature-rich: Zuora is the Swiss army knife of billing. From complex discount schedules to partner revenue sharing arrangements, it can likely be configured to handle those.

- Scalability: Zuora is built to handle billions of transactions. You won’t outgrow it in terms of scale. (Many IPO-stage companies have Zuora as the backbone of their revenue systems.)

- Enterprise approvals and controls: It supports workflows an enterprise would need, like approval processes for rate plan changes, audit trails for every change, and fine-grained role-based access for who can do what in the system.

Cons:

- High complexity: With great power comes great complexity. Zuora is not trivial to implement or change. It often requires certified consultants or a trained internal team to administer.

- Cost is high: Expect substantial annual software fees (six figures is common for larger deployments) plus possibly consulting costs.

- Not AI-specific: Obviously, nothing about Zuora is tailored to AI usage metrics out of the box. You’d still have to define how to meter tokens or API calls and feed that into Zuora.

- Too much platform: Adopting Zuora too early can be like using a sledgehammer to crack a nut. You might end up dedicating more effort to managing the billing system than the value it provides at smaller scales.

Best for:

- Large AI/ML or API companies needing a robust usage engine integrated with Zuora.

- Companies with complex global needs (multi-currency, multi-entity reporting) and deep audit/compliance requirements.

Pricing: Starts at $50k + implementation and integration fees. Generally, it involves an annual subscription fee often tied to your billing volume or number of customers, with tiered pricing.

How to evaluate AI monetization platforms

Choosing the right AI monetization platform isn’t just about features. It’s about actual operational fit.

The ideal solution should match your pricing strategy today and evolve with you as your product, market, and revenue models mature.

Before committing, evaluate each option against these factors:

- Flexibility of pricing models: Choose a platform that supports both your current and future models — usage-based, subscription, hybrid, tiered, free credit tiers, or outcome-based. Your stack should enable pricing experiments out of the box.

- Speed and ease of implementation: Can you configure most of it yourself, or will you need engineers for months?

- Integration with your stack: Look for strong APIs, webhooks, and integrations across your product (for metering), CRM (for quoting), and finance systems. Billing events should flow seamlessly through your lead-to-cash process.

- Scalability and performance: Consider not just your current usage, but your projected growth. If you expect a surge to millions of events per day, pick a platform proven to handle high scale. Also, consider multi-currency and multi-entity support if you’re expanding globally.

- Transparency and customer experience: Does the platform provide real-time usage visibility and clear billing to your end-users? This is a big trust factor in AI and customers should be able to understand what they’re being charged for. Platforms that offer customer-facing dashboards or easy ways to display usage help reduce billing disputes and sticker shock.

- Vendor stability and support: Because billing is so crucial, you’ll want a reliable vendor. Look for a stable vendor with strong reviews, active support, and SLAs. Responsiveness matters, especially for startup-focused tools.

- Pricing (of the platform): Understand how they charge — flat fee, revenue share, per-event, etc. And does that align with your economics? For example, a platform taking 1% of revenue might be fine now, but very costly at scale.

- Compliance and security: Billing data is sensitive. Ensure the platform has necessary compliance (e.g., SOC 2, GDPR, PCI if handling payments). And if you operate in a highly regulated industry, confirm the platform can meet sector-specific requirements.

By weighing these factors, you can narrow down which platform aligns best with your strategy and constraints.

For instance, a seed-stage AI SaaS might prioritize speed of setup and low cost, whereas a later-stage company might prioritize integration with Salesforce and an ERP.

Frequently asked questions about AI monetization platforms

What is the best monetization platform for AI startups?

The best monetization platform for AI startups is one that can handle complex, usage-based pricing and automate the entire quote-to-cash process—from metering to billing to revenue recognition. This includes purpose-built platforms like Alguna but also legacy players like Chargebee.

What do AI platform monetization strategies refer to?

AI platform monetization strategies refer to the different ways companies generate revenue from their AI products, models, or APIs. These strategies go beyond traditional subscriptions as they’re designed to align pricing with the value the AI delivers.

What is an AI monetization platform, and how is it different from regular billing software?

An AI monetization platform lets AI companies meter, price, and bill for usage in real time. This includes things like API calls, tokens, or GPU seconds. Unlike standard billing tools built for flat subscriptions, it supports complex, variable usage models like pay-per-token or outcome-based pricing.

Why can’t I just use Stripe or my existing billing system to charge for AI usage?

You can start there, but scaling becomes messy fast. Stripe and Chargebee weren’t built for real-time metering or complex AI pricing, so you’ll likely end up juggling spreadsheets, scripts, and manual uploads. A dedicated AI monetization platform automates that entire flow, reducing errors and freeing up your engineering team.

What monetization strategies for AI platforms are most common?

AI companies often use usage-based, tiered, or hybrid pricing models. Some sell prepaid credits or charge only for successful outcomes (e.g., resolved tasks or completed API calls). Most start with usage-based pricing because it aligns revenue with variable compute costs.

How do AI agent or AI voice platforms monetize their services?

AI agent monetization platforms usually charge per task, session, or compute time used while voice AI tools bill per minute or character of audio processed. For instance, transcription APIs charge per second. All rely on real-time metering, making specialized AI billing platforms essential.Learn more in our deep dive: 5 ways to (effectively) monetize your agents.

When is the right time to move to a dedicated AI monetization platform?

The tipping point is when manual billing becomes a bottleneck — missed usage, billing errors, or time wasted reconciling data. If pricing changes, customer visibility, or automation become hard to manage, it’s time to upgrade. Platforms like Alguna are lightweight enough to adopt early but scale as you grow.

Future-proof your AI monetization stack

The best AI monetization platform depends on your company’s size, pricing model, and stage of growth. While early-stage startups often prioritize fast setup and flexibility, scaling AI and SaaS businesses need more like real-time metering, revenue analytics, automated recognition, and multi-entity compliance.

By carefully evaluating your requirements and comparing the leading platforms, you can choose a solution that not only keeps your billing accurate but also enables pricing innovation and sustainable growth.

Alguna brings that flexibility together in one platform as it’s built for AI models, API calls, and usage-based products. With real-time sync between sales, finance, and product data, a no-code setup, and global-ready infrastructure, Alguna helps you scale without adding engineering overhead.

Join the next generation of AI revenue leaders

From startups to global enterprises, Alguna helps teams modernize quote-to-cash in a single AI monetization platform by unifying pricing, usage metering, billing, and revenue recognition.