• Learn why AI CPQ matters for usage based and subscription pricing by reducing errors, speeding quotes, and cutting revenue leakage.

• See how Alguna’s AI monetization platform unifies CPQ and billing with a no code setup that fits modern SaaS and AI revenue teams.

• Get an evaluation checklist to choose the right platform for scale, integrations, and fast time to value.

AI and automations are replacing manual, time-consuming work.

But shockingly, most legacy tools still rely on static pricing logic, rigid workflows, and manual approvals. While AI has already revolutionized many aspects of the customer lifecycle, such as sales forecasting and customer support, AI CPQ software is only in its infancy.

But that’s changing fast as a new generation of platforms is bringing intelligence directly into the quoting process. From contract data extraction to workflow automations, platforms like Alguna are showing what the next wave of AI-powered CPQ will look like for modern revenue teams.

In this post, we’ll unpack how AI is entering CPQ along with today’s top CPQ tools with AI features.

What is AI CPQ software (and why it matters)

AI CPQ software is an intelligent configure-price-quote system that uses artificial intelligence to automate pricing decisions, optimize deal configurations, and accelerate the quote-to-cash process.

Traditional CPQ systems rely on fixed rules and manual approvals. AI CPQ, on the other hand, blends automation with insight, using machine learning and natural language models to make quoting faster, more accurate, and less dependent on manual input.

Why AI powered CPQ solutions matter

Even small inefficiencies in quoting can translate into slower deal cycles and potentially millions in revenue leakage . This is exactly the friction AI CPQ aims to eliminate.

By embedding intelligence directly into the quote-to-cash flow, it helps teams price smarter, close deals faster, and reduce revenue leakage without adding operational overhead.

It’s not just a better way to quote, it’s how modern revenue teams stay adaptive in an AI-driven market.

Key benefits of AI powered CPQ software

Here are some of the key benefits, especially for SaaS and AI-centric businesses:

- Speed and sales efficiency: Automation dramatically speeds up quote generation so you can close deals faster. Deals that once took days of back-and-forth can now be configured and quoted in minutes.

- Accuracy and error reduction: AI powered CPQ eliminates manual entry errors and ensures every quote reflects the most up-to-date pricing, discounting, and approval rules. By standardizing configurations and automating validation checks, teams reduce costly mistakes, prevent revenue leakage, and maintain consistent deal integrity across regions and product lines.

- Flexibility for complex pricing models: AI CPQ software are built to handle complexity, whether it’s tiered subscription plans, one-off custom add-ons, or high-volume usage-based pricing.

- Visibility and quote-to-cash integration: An AI CPQ solution connects directly to your CRM, billing, and even ERP systems, providing end-to-end visibility from initial quote to final cash collection. This real-time integration means that once a quote is accepted, the order, billing, and revenue recognition can flow automatically with no manual data re-entry.

- No-code configuration (less engineering dependence): Modern AI CPQ software emphasize no-code or low-code administration. Revenue and sales ops teams can manage product catalogs, pricing rules, and discount policies through user-friendly interfaces instead of relying on engineering tickets. This is huge for agility as your team can launch a new pricing experiment or flash promo in hours, not weeks.

- Scalability and future-proofing: The right AI CPQ solution will scale with your business, supporting more products, more complex deal structures, and even multiple business units or international regions. For example, if you’re a startup today with a single product, an AI CPQ can grow with you to support a multi-product, multi-currency enterprise catalog tomorrow.

AI CPQ software: Comparison overview (2025)

The latest AI powered CPQ software doesn't operate in a silo. Instead, it integrates deeply with your CRM, billing, and product systems to automate the entire quote-to-cash process intelligently.

Below, we compare leading CPQ platforms in 2025 that offer AI or advanced automation features.

Today’s top CPQ tools with AI features

| Platform | Best For | Pros | Cons | Pricing |

|---|---|---|---|---|

| ⭐ Alguna | Scaling AI, SaaS, and fintech companies with usage-based and hybrid models | No-code CPQ with AI features + unified billing, real-time usage metering, quick to implement, solid CRM/finance integrations | Newer entrant with smaller ecosystem, some deep enterprise/industry features still evolving | Starts at $399/month (no revenue share). White-glove onboarding and migration icluded. |

| Salesforce CPQ (Agentforce Revenue Management) | Large enterprises fully invested in Salesforce CRM with complex configurable offerings | Deep Salesforce integration, highly customizable rules/approvals, vast partner ecosystem, enterprise-grade scalability | High total cost of ownership and long implementations, heavier admin. Limited advanced AI today. | Quote-based enterprise pricing (Revenue Cloud/Agentforce) |

| DealHub CPQ | Mid-market B2B teams focused on buyer engagement and fast time-to-value | DealRoom interactive proposals, easy for reps, quick rollout and strong Salesforce/HubSpot/Dynamics integrations, guided selling | Limited depth for complex usage billing, pricing can add up, some features less robust than point solutions | Custom (~$75–$100 per user/month typical, minimums apply) |

| Subskribe | SaaS and subscription businesses needing unified quote-to-revenue (including usage) | All-in-one CPQ + billing + revenue recognition; fast deployment, admin-friendly, no heavy coding | Newer vendor/limited ecosystem, AI maturity still evolving | Quote-based; positioned as lower TCO vs legacy CPQ stacks |

| Nue CPQ | Scaling SaaS/cloud teams on Salesforce, API-driven or hybrid (subscription + usage) pricing | Salesforce-native experience, API-first/developer-friendly, clean UI, easy config, supports hybrid pricing models | Smaller market presence, feature depth still growing, integrations beyond Salesforce may need effort, primarily SaaS-focused | Custom (pricing on request) |

| Zuora CPQ | Large/global subscription enterprises with complex billing, multi-entity, and high volume usage | Handles complex subscription/usage at scale, strong compliance and rev-rec, multi-currency/multi-entity, solid Salesforce integration | High cost, complex implementation and maintenance, steeper learning curve, Salesforce-centric CPQ adds integration overhead if not on SFDC | Quote-based; often ~$50k+/year for core billing, enterprise can reach $250k+/year |

6 leading AI CPQ software solutions

Let’s take a closer look at the top CPQ tools with AI features in 2025, including how they approach AI, and their flexibility for modern AI pricing models, including usage based pricing.

1. Alguna - AI CPQ software for AI, SaaS, and fintech companies

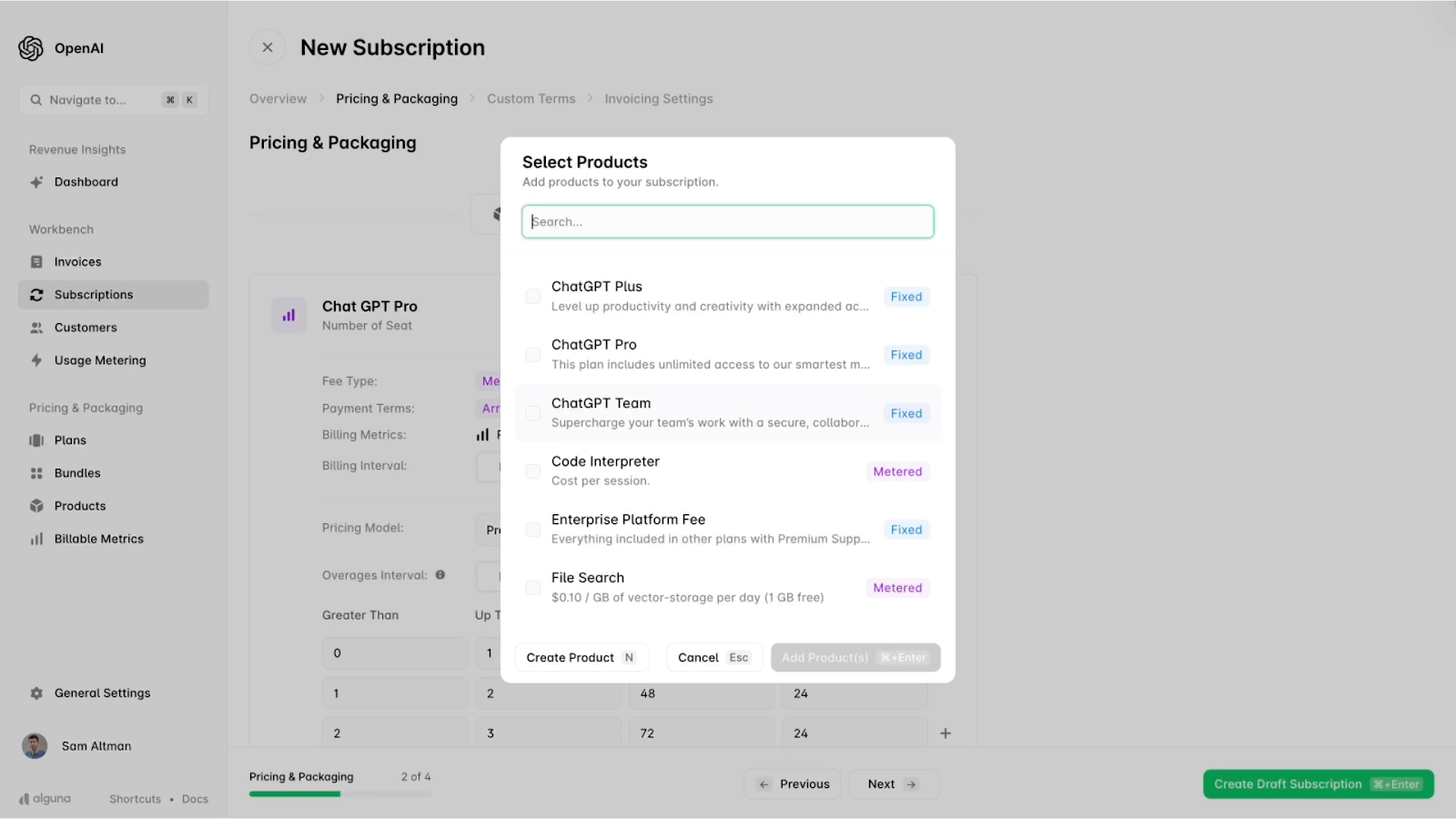

Alguna is an AI monetization platform that offers a modern CPQ solution designed for SaaS, fintech and AI companies moving toward flexible, usage-based pricing and intelligent revenue models. It unifies pricing configuration, quoting, billing, usage metering, and revenue recognition in a single end-to-end platform.

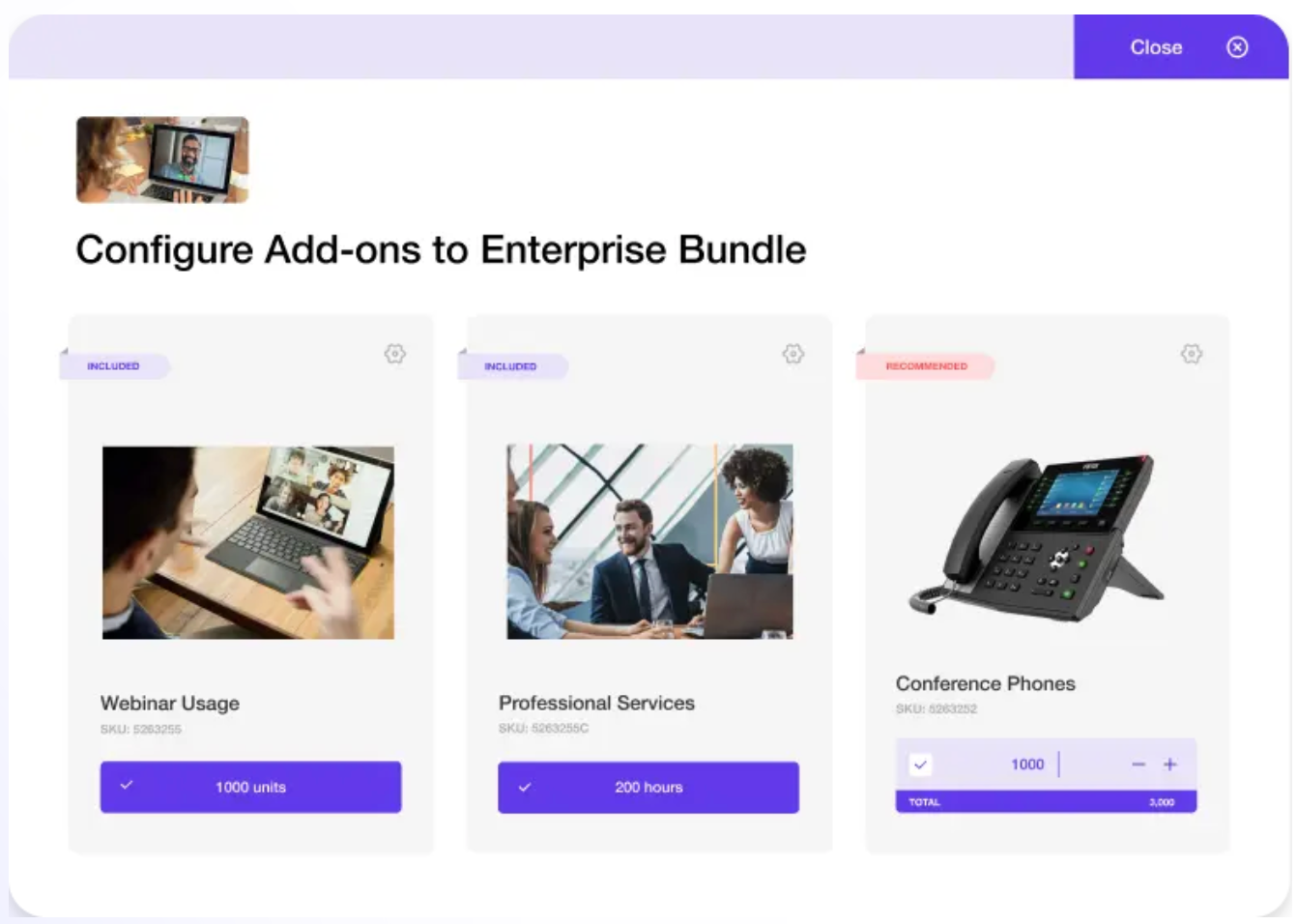

Revenue teams can configure complex models (like prepaid credits, hybrid subscriptions, or metered billing) through a no-code interface, eliminating the need for engineering support.

Quotes, contracts, and invoices all sync automatically across CRM and billing, creating a fast, error-free quote-to-cash cycle.

Key features:

- No-code pricing engine: Create complex pricing logic such as tiers, volume-based discounts, contract-specific rates, or renewal uplifts without writing code. The visual rules engine supports conditional logic for flexible, real-world deal structures.

- Extract contract data with AI: Upload an executed contract (PDF, Docx, etc.) and automatically extract all key data points to skip hours of manual work. Turn static PDFs into live subscriptions in seconds.

- Usage metering and real-time billing: Alguna tracks any usage metric (API calls, AI inferences, data processed, transactions) via API or integrations. It then instantly converts usage into billable charges with full visibility for both company and customer.

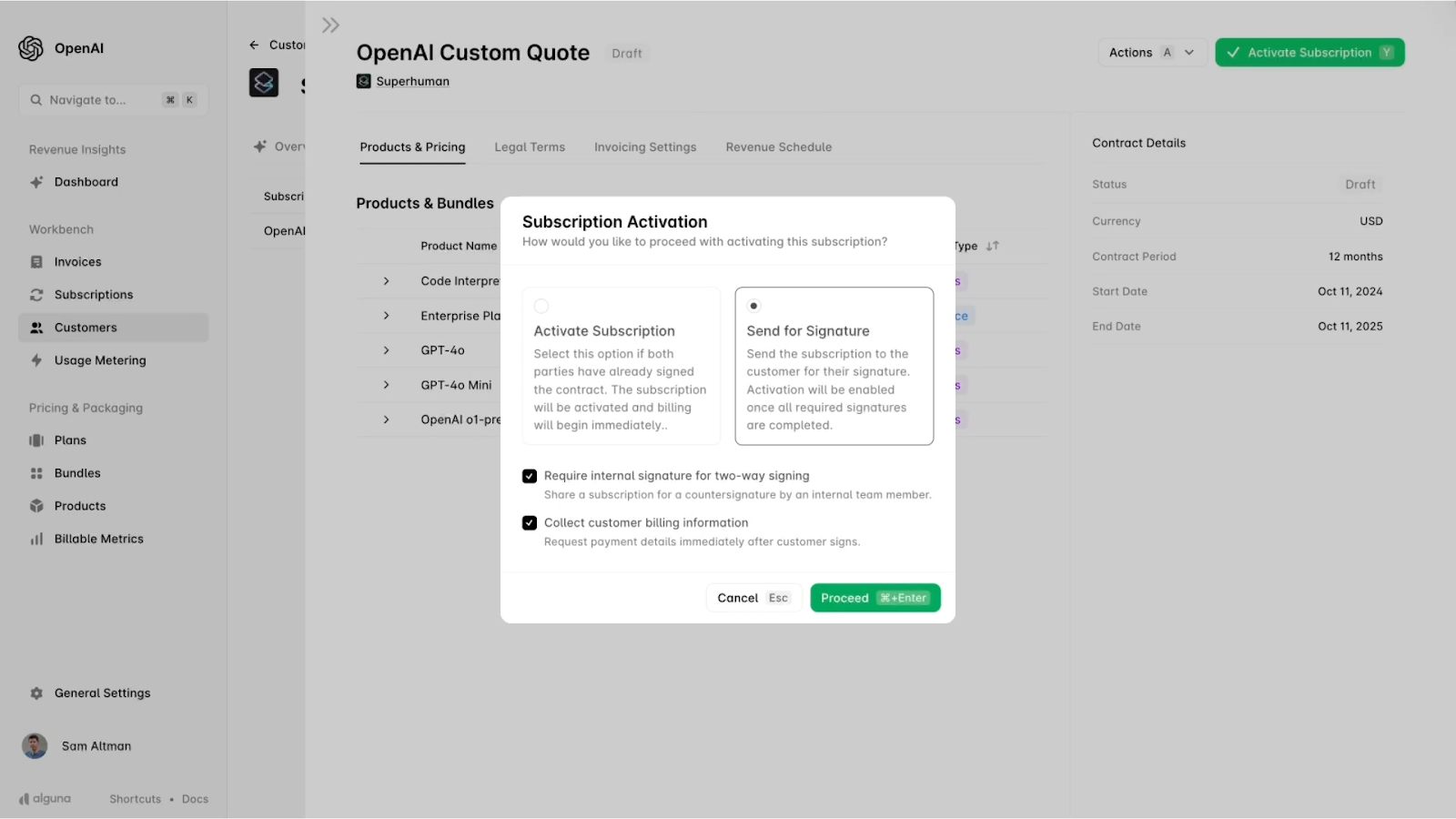

- Quote generation and e-signature: Sales can configure quotes with one-time, recurring, and usage items. Send branded proposals with built-in e-signature. Once signed, the system auto-generates contracts and billing schedules.

- Integrated revenue recognition: Alguna handles ASC 606-compliant revenue scheduling across subscriptions, usage, and hybrid models. If a deal has elements that require revenue spread over time or usage true-ups, the platform handles it, ensuring that what is quoted also appears in finance correctly.

- Multi-entity and currency management: Alguna supports multiple legal entities, each with its own currency, taxation, and accounting rules – all under one umbrella. Inter-company billing and consolidated reporting are also supported, which is often a headache in separate CPQ+billing setups.

Pros:

- Unified CPQ and billing: As an end-to-end platform, quotes flow directly into invoices and revenue recognition. There’s no need to stitch together a CPQ tool with a separate billing system, which reduces reconciliation effort and errors to zero.

- No-code configuration: Pricing changes, discount rules, or new product packages can be configured through a point-and-click interface by non-technical teams. This means pricing experiments or deal adjustments can roll out in hours.

- Built for usage-based and AI models: The platform natively supports metered pricing, hybrid subscriptions, prepaid credits, outcome-based pricing, and more.

- Seamless Integrations: The software offers native integrations with popular CRMs like Salesforce and HubSpot, payment processors, and accounting/ERP systems.

- Fast implementation: Companies can get up and running in weeks (even with the migration of existing contracts).

Cons:

- New market entrant: Launched in 2023 (Y Combinator-backed).

- Typically not a fit for smaller businesses: Alguna is built for scaling companies and enterprise businesses. That means early-stage startups with straightforward deals likely won’t need its extensive CPQ capabilities.

Best for:

- High-growth SaaS and AI startups: Companies that are scaling from product-led growth (self-serve) into enterprise sales, and need a flexible system to handle both. Alguna excels for businesses selling APIs, AI services, developer platforms, fintech services, or any product with a usage-based component.

- Usage-based or hybrid pricing models: Businesses monetizing by consumption (e.g., cloud infrastructure, AI API calls, transaction fees) or running hybrid models (subscription-based fee + usage overages). Alguna handles these scenarios natively, whereas many other CPQs require custom development or separate billing tools.

Pricing: Plans start at $399/month (flat subscription) for the base package, which includes full CPQ and billing functionality. Alguna doesn’t take a percentage of your revenue unlike some billing platforms, making it a sustainable choice as you scale.

All pricing is transparent with no hidden fees (e.g., no extra charge for additional currencies or moderate overages in many cases).

CPQ, e-sign, and billing in one platform

Configure, quote, sign, and bill in one unified monetization platform. Book a demo to see how Alguna streamlines every step from quote to cash, helping your team close deals faster and scale revenue effortlessly.

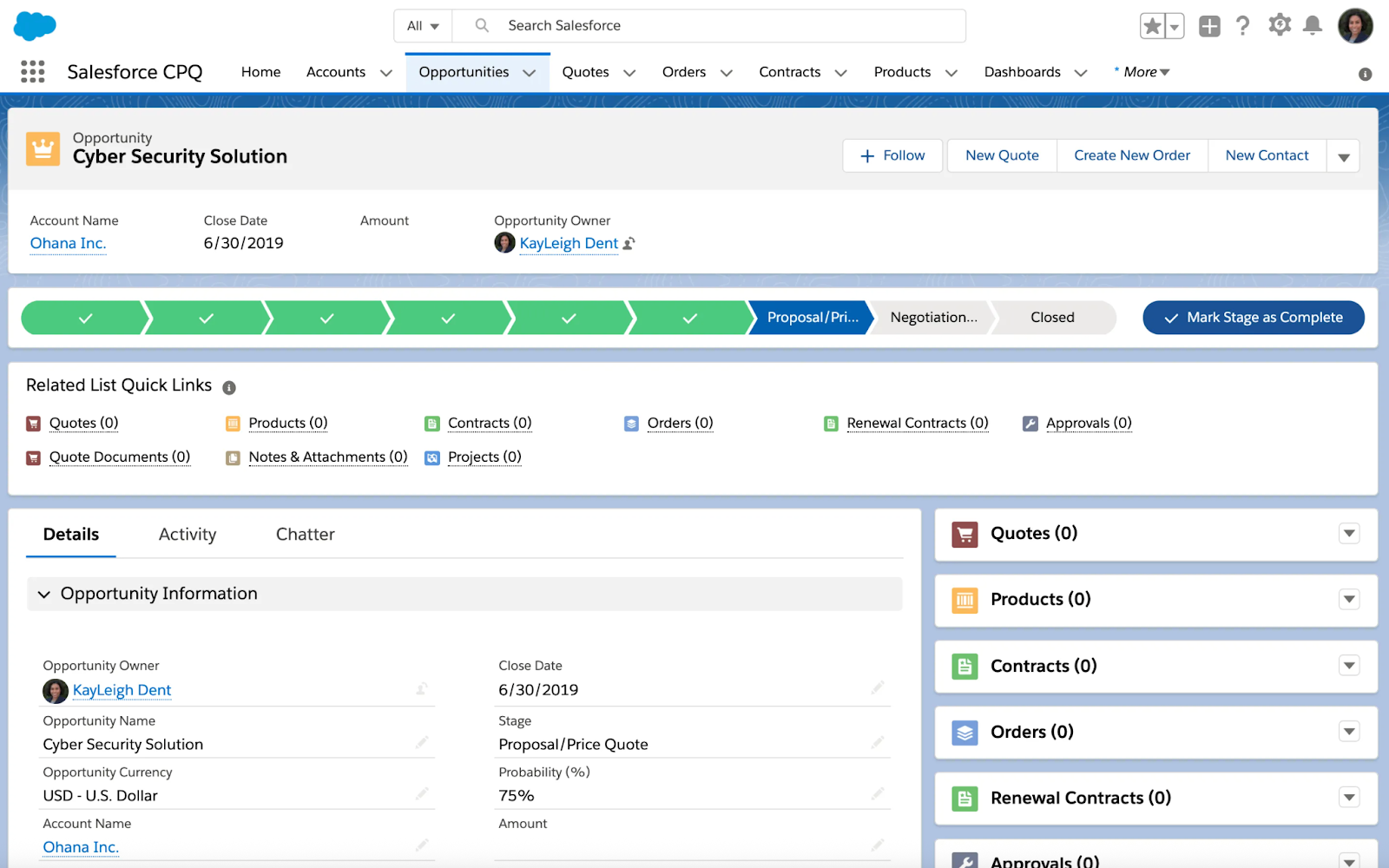

2. Salesforce CPQ (now part of Agentforce Revenue Management)

Natively integrated with Salesforce CRM, Salesforce CPQ allows reps to configure products, apply pricing rules, and generate quotes without leaving their workspace. It’s powerful, highly customizable, and backed by an extensive ecosystem of certified partners who can build complex pricing logic via Apex code.

For large enterprises with deep Salesforce adoption and intricate product catalogs, the platform offers unmatched extensibility and reporting.

However, that power comes with trade-offs: higher costs, longer implementation cycles, and reliance on Salesforce’s ecosystem for full functionality.

Key features:

- Pricing and discount schedules: Salesforce CPQ supports complex pricing logic with real-time margin visibility. This structured foundation positions Salesforce well for the upcoming Agentforce AI features that will apply intelligence to discounting and margin optimization.

- Renewals and amendments: For subscription businesses, Salesforce CPQ handles contract renewals (creating renewal quotes) and amendments (mid-term changes). It can project renewal quotes automatically and handle proration, co-terming of contracts, and more – although configuring these rules can be complex.

- Reporting and analytics: All CPQ data lives within Salesforce objects, enabling advanced analytics and Einstein Discovery dashboards. These deliver insights into deal velocity, pricing trends, and sales behaviors — paving the way for true AI-driven forecasting.

Pros:

- Deep Salesforce integration: Ideal if you already use Salesforce CRM/Sales Cloud. CPQ feels like a natural extension of your CRM, with the same UI and integrated data.

- Highly customizable: You can implement extremely specific pricing and product rules. Salesforce CPQ can be adapted to almost any scenario, given enough expertise.

- Enterprise-grade features: Out of the box, Salesforce CPQ delivers robust features including guided selling, advanced approvals, renewals, contract amendments, and multi-language quote templates.

Cons:

- High cost of ownership: Salesforce CPQ is one of the most expensive options in the market. Between premium licenses, consulting fees, and required admin resources, total annual costs can easily exceed hundreds of thousands of dollars.

- Long implementation timelines: Deploying Salesforce CPQ often takes 6–12 months (and longer for complex setups). Extensive configuration and customization slow down time to value, especially compared to newer AI CPQ solutions, like Alguna, that can launch in weeks.

- Complexity and maintenance: While powerful, Salesforce CPQ is notoriously complex and clunky to manage. Many companies need dedicated admins or developers to maintain it, and over-customization can lead to technical debt that’s costly to reverse.

- Not truly AI-driven: Despite Salesforce’s AI marketing, current AI CPQ features remain basic and are focused on product recommendations and approvals.

Best for:

- Enterprises fully invested in Salesforce: Ideal for organizations that already run Salesforce CRM and want a unified stack for CRM, CPQ, and billing.

- Companies that offer complex sales configurations: Think of industries like enterprise software, manufacturing, telecommunications, where you might have thousands of SKUs or highly configurable offerings.

Pricing: Salesforce does not publicly list standalone prices for CPQ, as it’s usually sold as part of Salesforce Revenue Cloud (now Agentforce Revenue Management) or as an add-on to Sales Cloud. Generally, the cost is quote-based and can vary depending on the number of users and the complexity of your implementation.

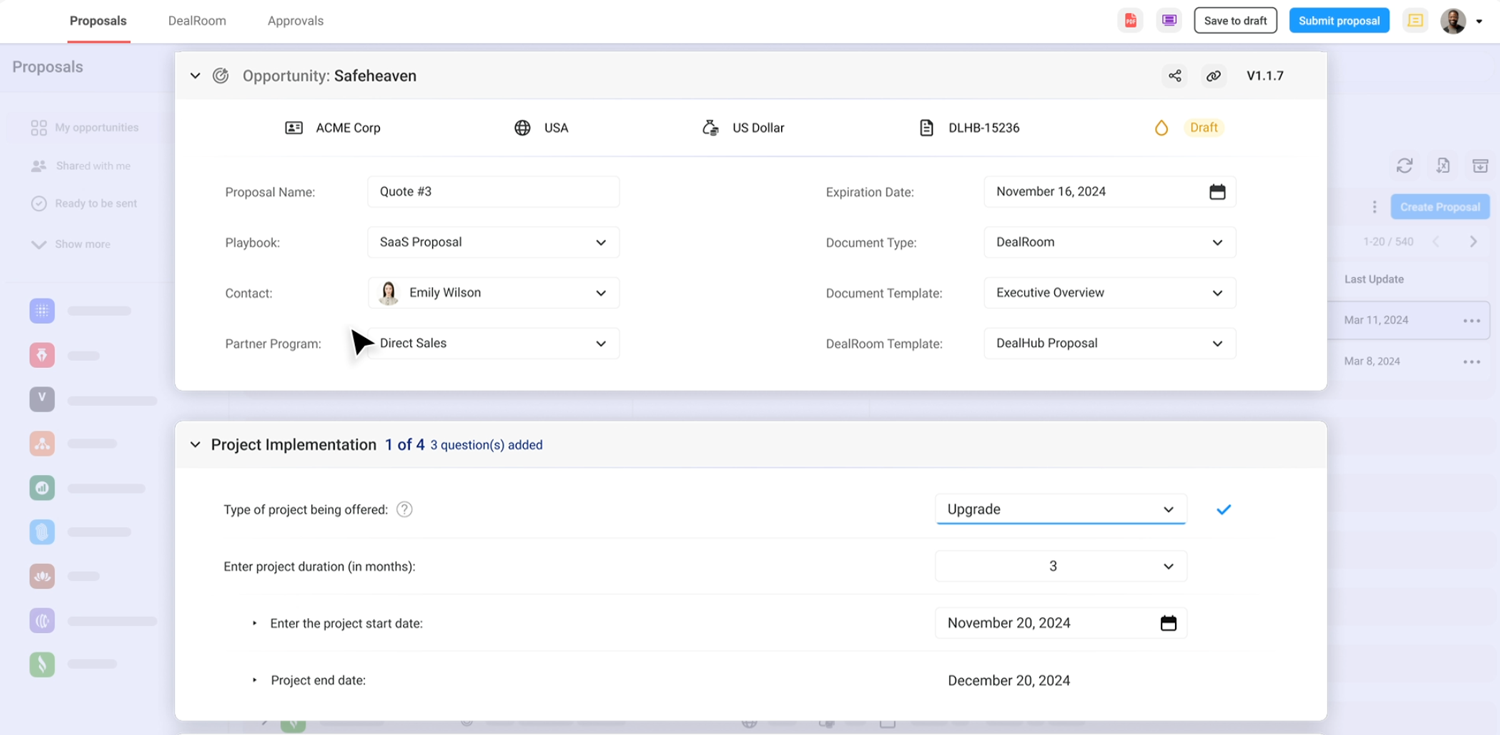

3. DealHub CPQ - Best for mid-market companies looking for light AI CPQ features

DealHub CPQ is a revenue platform popular among mid-market companies that want a more collaborative, guided sales process. Beyond CPQ basics like product configuration, pricing, and approval workflows, DealHub includes CLM and light billing features.

From a usability standpoint, DealHub is easy to adopt, featuring a modern UI, drag-and-drop templates, and fast setup. Sales teams can generate quotes quickly and track buyer engagement in real time.

Overall, DealHub offers strong collaboration tools and solid CPQ functionality, but its usage-based billing and AI capabilities are still evolving.

Key features:

- Configure-price-quote engine: DealHub’s guided CPQ flow lets reps configure products, apply rules, and generate quotes quickly without coding. Automated pricing and approval logic help keep quotes accurate and compliant while reducing manual admin.

- Proposal and contract management (CLM): Combine CPQ, proposal creation, and contract negotiation in one platform. Redlining, version tracking, and e-signature are all built in, streamlining quote-to-close and minimizing tool sprawl.

- Analytics and engagement insights: DealHub provides dashboards on deal progress, proposal engagement, and pipeline efficiency. These insights give leaders visibility into what drives conversions and where reps or deals get stuck — an early form of deal intelligence.

Pros:

- Digital sales room and engagement: This is DealHub’s standout differentiator — the DealRoom experience fundamentally changes how reps and buyers interact. It’s the most distinctive and high-value feature that clearly sets DealHub apart from other mid-market CPQs.

- All-in-one sales docs platform: Eliminates the need for separate proposal, contract, and e-sign tools, speaks directly to efficiency and cost savings — key evaluation factors at this stage.

- Fast implementation: Many companies have reported getting DealHub up and running in a matter of weeks, not months. Since it’s more configuration than coding, and DealHub provides onboarding support, the time to value is relatively quick.

Cons:

- Limited advanced AI/predictive features: DealHub offers basic AI analytics, such as engagement tracking and workflow automation, but lacks predictive pricing or AI-driven optimization. Most recommendations are rule-based, not machine learning–powered, which limits their intelligence compared to AI-native CPQs.

- Usage-based billing depth: While DealHub supports subscriptions and simple usage add-ons, it struggles with complex metered billing or granular consumption pricing. It’s well-suited for standard SaaS models, but companies with advanced usage cycles may face limitations.

- Pricing model (cost): Though more affordable than Salesforce CPQ, DealHub’s per-user pricing (typically around $100/user/month with minimum seat counts) can still add up. Bundled features like CLM or billing often push costs into higher tiers, making it less accessible for smaller teams.

Best for:

- Mid-market B2B teams: DealHub is Perfect for growing SaaS and service companies that have outgrown manual quoting but don’t need full enterprise CPQ complexity.

- Sales teams focused on buyer engagement: If your sales process values heavy interaction with the buyer (demos, proposals, iterative discussions), DealHub’s DealRoom is ideal.

Pricing: DealHub’s pricing is custom and typically subscription-based per user. While exact figures require a quote, reports from buyers suggest it often lands around $75–$100 per user per month for the CPQ and proposal capabilities, usually with a minimum user count (often around 10-15 users).

4. Subskribe CPQ - Best for analytics focused SaaS teams

Subskribe CPQ is a SaaS-focused billing platform designed for finance and RevOps teams that need tight alignment between quoting, billing, and revenue recognition.

Its strength lies in simplicity as Subskribe delivers a clean interface and solid automation for subscription-based or hybrid pricing models.

Subskribe has also added light AI and predictive analytics for forecasting and deal visibility, though its intelligence remains limited. It’s a strong fit for SaaS companies with straightforward or seat-based pricing but less suited for complex usage-based or event-driven billing.

Key features:

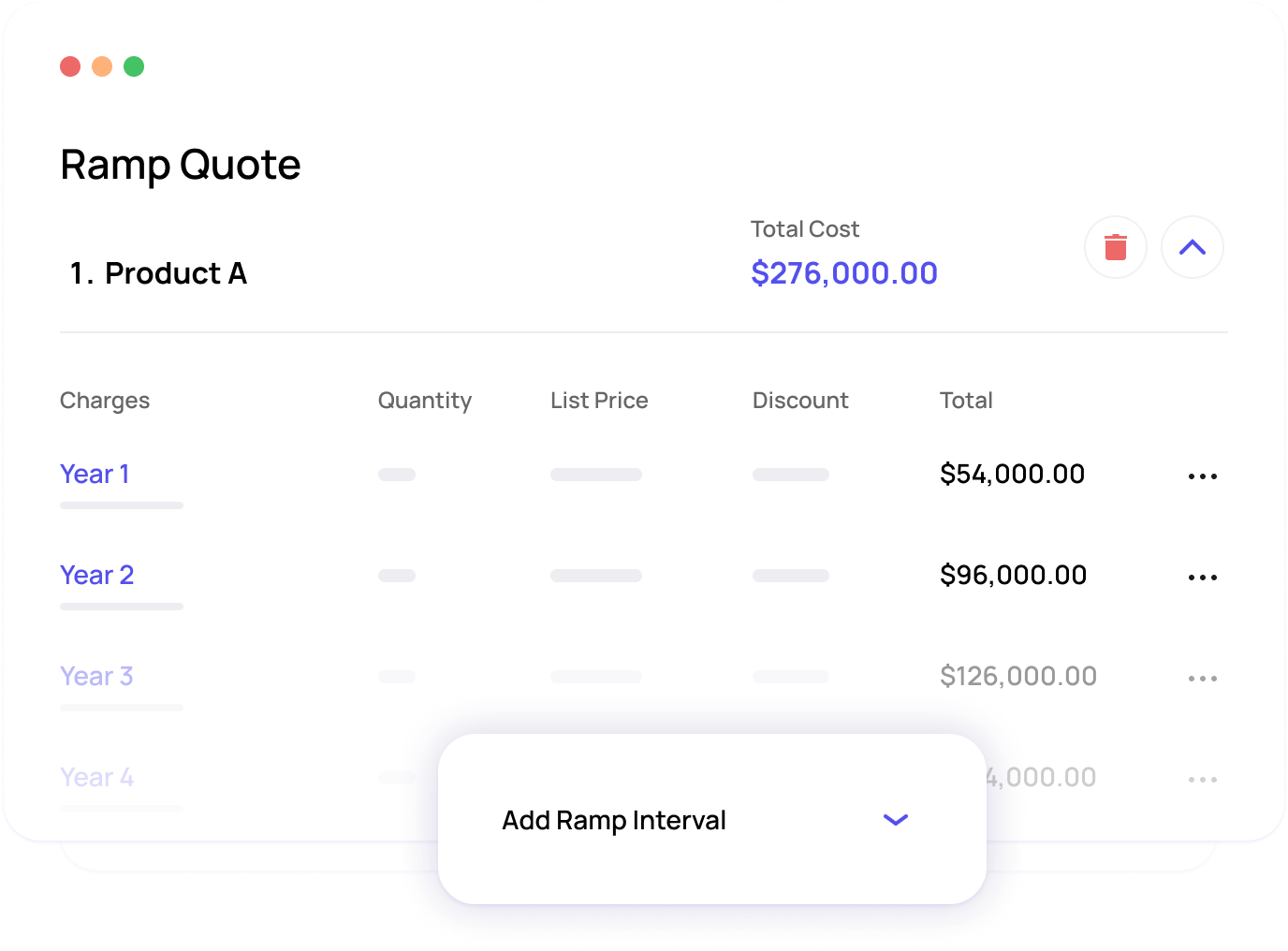

- Adaptive CPQ engine: Build quotes with any mix of recurring, one-time, and usage-based charges. Subskribe handles ramp deals, proration, and co-terming automatically — perfect for SaaS and AI services where pricing evolves with usage.

- Approval workflows and deal desk: Subskribe’s built-in DealDesk and AI assistant let teams model “what-if” scenarios (e.g., change billing terms or discounts) and simulate outcomes in real time. Approvals and guardrails keep deals compliant while improving decision speed.

- Analytics and forecasting: Because all the data from quote to cash is in one system, Subskribe can provide insightful analytics. For example, it can forecast billing amounts for future months based on active subscriptions, or show SaaS metrics like ARR, MRR, churn, and expansion rates.

Pros:

- SaaS-focused features: Built for SaaS and recurring revenue models, Subskribe handles ramp deals, proration, renewals, and hybrid pricing (subscription, one-time, or usage) all within a single quote — ideal for fast-scaling SaaS businesses.

- Quick deployment and iteration: Subskribe’s configuration-based architecture allows teams to go live in weeks and adapt quickly. Admins can modify pricing rules or workflows on the fly, keeping sales processes aligned with changing business needs.

- Deal Desk AI and automation: Its DealDesk AI accelerates deal structuring by suggesting discounts, flagging policy violations, and recommending billing terms — helping revenue teams close faster and maintain compliance.

Cons:

- Focus on SaaS – not one-size-fits-all: Subskribe is purpose-built for SaaS and recurring revenue models.

- Less proven at massive scale: Subskribe is still a young platform, founded in 2020, and while it has several high-growth customers, it doesn’t yet have the same large-enterprise track record as other vendors.

- Ongoing AI maturity: Subskribe’s DealDesk AI features are promising but still maturing. While useful for structuring and optimizing deals, its recommendations can occasionally miss the mark, requiring human review — a sign of an evolving AI system rather than a fully autonomous one.

Best for:

- SaaS and subscription businesses scaling fast: Subskribe is tailored for SaaS, cloud, and subscription businesses that might be outgrowing basic tools but aren’t keen on the heavyweight of legacy CPQ/billing systems.

- Finance and revenue ops needing alignment: If your Finance team complains that what Sales sells doesn’t match what Billing invoices, or if closing the books is painful due to disconnected systems, Subskribe provides a remedy.

Pricing: Subskribe does not publish prices. Based on various sources and the nature of the product, pricing likely depends on factors such as company size (revenue or number of customers/quotes), modules used (CPQ only vs CPQ+Billing+RevRec), and contract length. Estimate $20k per year.

5. Nue CPQ - Best for companies that need a basic CPQ with AI

Nue is a revenue automation platform built to simplify quoting, billing, and pricing for fast-growing SaaS companies. It combines a sleek interface with developer-friendly APIs, making it popular among startups that want flexibility without heavy configuration.

On the AI front, Nue is still in its early stages, offering guided selling and some predictive insights but lacking the depth of true AI-native tools. Its biggest appeal lies in its modern design, API flexibility, and quick setup, making it ideal for scaleups seeking automation without enterprise-level complexity.

However, companies with advanced usage-based or hybrid billing needs may find its capabilities more limited than specialized solutions like Alguna.

Key features:

- Quote and product configurator: Nue provides a configurator to add products/services to a quote, adjust quantities, set term lengths, and apply any pricing modifiers. You can bundle products or define optional add-ons.

- Guided selling and dynamic pricing: Admins can define rules that drive upsells and discounts dynamically. For example, selecting a product can trigger context-aware add-on suggestions or auto-apply volume-based discounts — keeping pricing consistent and policy-compliant.

- Approval workflows and deal governance: Nue includes an approval system that triggers when quotes fall outside defined parameters. It could be a simple manager approval or multi-level approval. Because Nue is CRM-integrated, notifications for approvals can appear right in CRM or via email.

Pros:

- Easy to configure and use: The intuitive interface allows admins and sales teams to configure pricing, approvals, and workflows without specialized CPQ expertise. Drag-and-drop tools make it simple to adapt to new products or deal structures.

- API-First and developer-friendly: Nue is built with an API-first, modern framework that combines a clean UI with developer flexibility. This makes it ideal for SaaS startups that want automation and control without the heavy setup of legacy CPQ systems.

- Supports complex SaaS deals: Nue handles sophisticated SaaS pricing models — from multi-year ramp deals and usage billing to true-ups and renewals — ensuring flexibility for scaleups with evolving contract structures.

Cons:

- Less market presence: Nue is a newer entrant in the CPQ market and lacks the brand recognition, community resources, and reference deployments of larger players like Salesforce or Zuora.

- Feature depth still growing: While Nue covers core SaaS quoting and pricing needs, certain advanced capabilities—like complex discounting, partner quoting, or deep channel management—are still being developed. It’s best suited for companies with straightforward sales structures.

- Integration ecosystem Nue integrates smoothly with Salesforce and via APIs, but if your organization uses other CRMs or custom systems, expect some development work. Its ecosystem of out-of-the-box connectors is smaller than that of more established vendors.

Best for:

- Scaling SaaS and cloud companies: Nue is great for startups and mid-market teams moving beyond manual quoting but not ready for complex enterprise CPQs.

- Developer or API-driven teams: If your strategy involves embedding quoting or billing into your product (like offering upgrade quotes inside your app), Nue’s API-first approach is attractive.

Pricing: Like others, Nue’s pricing is available on request. Given its target market, Nue likely prices based on company size or volume (perhaps number of quotes or revenue managed). It probably has a base platform fee plus tiers for additional usage or modules.

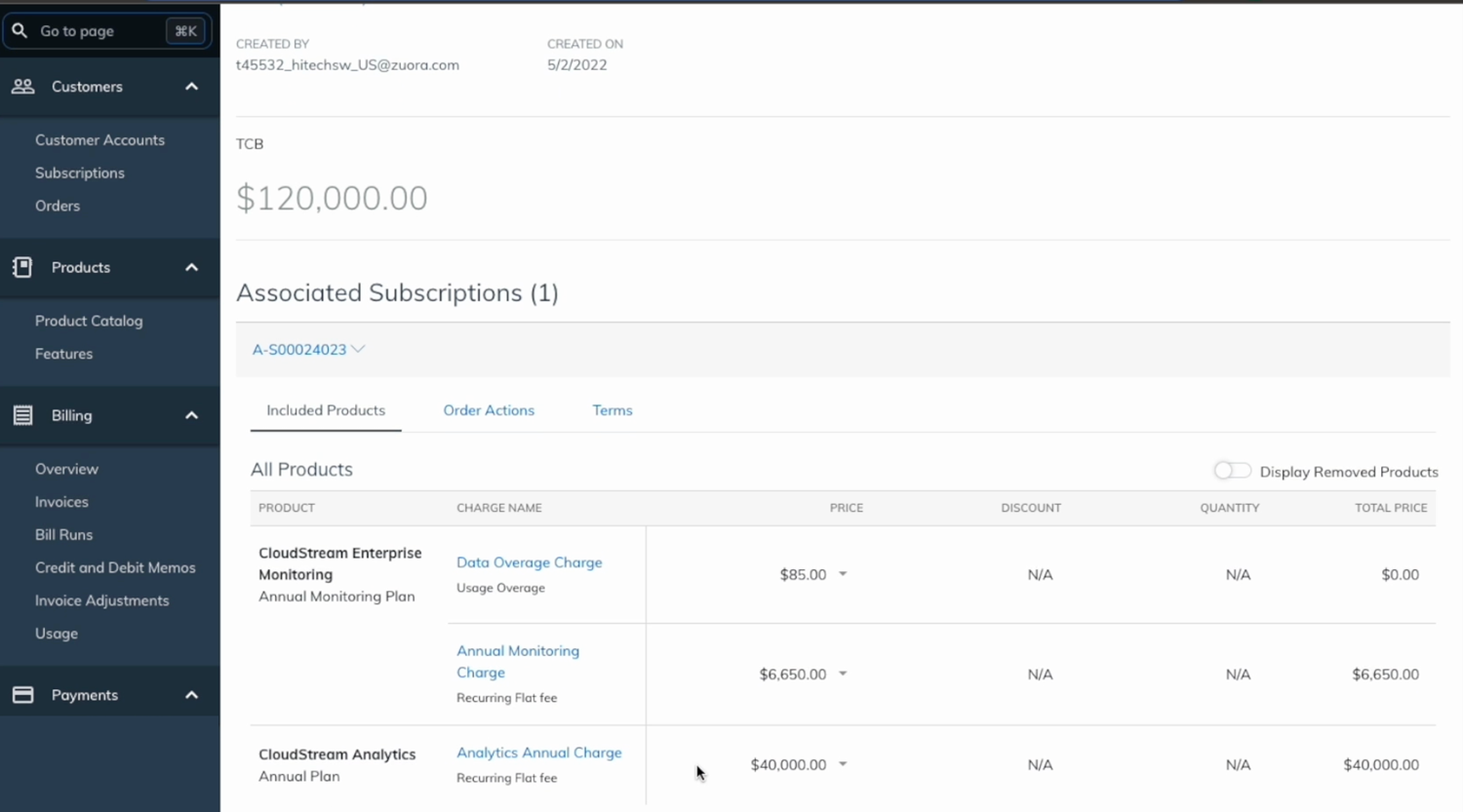

6. Zuora CPQ - Best for enterprises with basic AI and automation needs

Zuora CPQ is part of Zuora’s enterprise billing platform, offering quote-to-cash functionality built around complex subscription and revenue models.

A well-known legacy player that started in the subscription space, Zuora is widely used by large enterprises with intricate billing workflows, multi-entity structures, and heavy financial reporting needs.

In short, Zuora CPQ excels in billing sophistication and compliance, but it’s less agile and intuitive than newer AI-native or usage-focused platforms like Alguna.

Key features:

- Product catalog and rate plans: Zuora’s flexible product catalog supports complex rate plans, including subscriptions, one-time fees, and metered usage. It enables tiered or volume-based pricing and enforces valid product combinations, making it ideal for hybrid or consumption models.

- Quote configuration and proration: Within CRM (typically Salesforce), reps can build quotes that automatically calculate totals, taxes, and prorated charges. Ramp deals, multi-year quotes, and contract terms are fully supported to ensure accurate forecasting and billing synchronization.

- Amendments and renewals: Zuora CPQ handles mid-term changes, renewals, and upsells seamlessly. Reps can modify live subscriptions, generate delta quotes, and send updates to Zuora Billing instantly. This reduces manual handoffs between sales and finance.

- Billing and finance integration: Once accepted, quotes feed directly into Zuora Billing for invoice creation, revenue recognition, and collection. This real-time quote-to-cash connection ensures accuracy between what’s sold and what’s invoiced.

- Analytics and revenue insights: Zuora’s analytics layer surfaces key metrics like churn, ARR growth, and upsell potential. Finance and RevOps teams can use these insights to refine pricing strategies or identify expansion opportunities across the customer base.

Pros:

- End-to-end subscription management: Zuora CPQ turns signed quotes directly into live subscriptions with automated billing, renewals, and mid-term changes. This eliminates manual handoffs between sales and finance, ensuring complete accuracy from quote to invoice.

- Handles high complexity: The platform excels at managing multi-dimensional pricing models and large-volume orders. Whether it’s telecom-style configurations or complex SaaS usage tiers, Zuora can model, price, and automate them reliably.

- Built for scale and compliance: Trusted by large global enterprises, Zuora is fully ASC 606-compliant and engineered for financial precision at scale. It handles multi-currency, tax, and regional billing seamlessly — a major plus for publicly traded or multinational companies.

Cons:

- Not AI-driven: While Zuora has introduced AI-powered pricing and forecasting features, they’re typically offered as paid add-ons rather than native capabilities. Its flexibility and depth make it ideal for enterprises with established finance teams and legacy processes, but it often requires significant engineering support and longer implementations.

- Complex implementation and maintenance: Zuora CPQ is powerful but demanding to deploy. Implementations can take several months and often require certified consultants or experienced internal teams to configure both the Salesforce and Zuora layers. Ongoing maintenance also needs skilled admins to keep up with product and pricing changes.

- High cost: Zuora is a premium enterprise platform with pricing that often starts in the tens of thousands per year and can easily exceed six figures when CPQ and billing are combined. For smaller or mid-market companies, the total investment can be difficult to justify.

- Less flexibility outside subscriptions: Zuora shines in recurring revenue and usage-based models, but is less intuitive for one-off services, hardware, or highly bespoke project pricing. Companies with mixed business models may find it restrictive compared to more flexible CPQs.

Best for:

- Large or scaling subscription businesses: Zuora CPQ is best for companies well into their subscription business model evolution – typically mid-market to enterprises.

- Finance-led organizations with complex billing needs: Perfect for Salesforce CRM users who prioritize billing integration and compliance (ASC 606, IFRS 15) over purely CRM-native functionality.

Pricing: Custom. You’re looking at ~$50k+/year for core billing, while enterprise plans can reach $250k+/year. They have editions like Growth, Enterprise, etc., and typically charge an annual subscription plus an overage for very high usage (such as a number of invoices or subscribers beyond a threshold).

How to choose the right AI CPQ software for your company

Selecting a CPQ solution, especially one with AI capabilities, depends on your company’s specific needs and growth plans.

Here are key criteria and considerations to guide your evaluation:

- Pricing model flexibility: Ensure the CPQ supports all the pricing models you use or plan to use, whether that’s straightforward subscriptions, tiered pricing, one-time fees, usage-based charges, or hybrid combinations. The tool should easily handle flat rates and complex consumption metrics without custom work.

- Integration with your tech stack: Look for a solution that fits into your existing sales and finance stack with minimal friction. Seamless CRM integration is often a must (e.g., if you use Salesforce or HubSpot, the CPQ should plug in so quotes link to your opportunities and customer data ).

- AI capabilities and intelligence: Evaluate what AI-powered features each CPQ offers and whether they align with your goals. If improving quote accuracy and win rates through data-driven insights is a priority, choose a CPQ with strong AI and analytics chops.

- Ease of use and no-code configuration: The whole point of CPQ is to streamline sales, so the software must be user-friendly (ideally no-code). Features like a modern UI, guided selling prompts, and drag-and-drop administration are big pluses. You want a system that your revenue/ops team can configure without needing a developer for every change.

- Implementation time and vendor support: Ask about typical implementation timelines and resources. Some enterprise CPQ projects can take a year or more; if that’s not acceptable, find a solution known for rapid onboarding. Also, the quality of vendor support and training is crucial, especially if you don’t have in-house CPQ expertise. Does the vendor provide a dedicated success manager? Do they offer thorough training for your team? Fast, responsive support can make or break a CPQ rollout.

- Scalability and performance: Consider your company’s growth trajectory. The CPQ you choose should scale in terms of data (more products, more quotes, more users) and complexity (maybe multiple business units, international pricing) without performance lag.. If you plan to expand globally or significantly increase quote volume, ensure the system has proven success at that scale. Multi-entity support and advanced features like multi-currency and localization might be important to check for.

- Total cost of ownership (TCO): Budget is always a factor. When comparing costs, look beyond license fees. Factor in implementation costs, required headcount to maintain the system, and any transaction-based fees. For instance, some billing-integrated platforms might charge a percentage of revenue, those costs can dwarf subscription fees over time.

- Vendor track record and vision: Finally, consider the vendor’s stability and roadmap. A CPQ is a long-term investment, so you want a provider with a solid track record of improvements and an active user community. Evaluate how frequently they release updates and how they are incorporating new tech like AI. A strong roadmap can ensure the solution continues to add value as your business evolves. Also, check if the vendor has experience in your industry or use case.

Frequently asked questions about AI CPQ software

What is the best AI powered CPQ solution?

While “best” depends on your needs, Alguna is a leading AI-native CPQ platform built for modern SaaS and AI companies. It unifies pricing, quoting, and billing with machine-learning intelligence, enabling usage-based and subscription deals to be managed seamlessly.

What are the top-rated AI CPQ solutions for SaaS companies with complex pricing models?

Leading options include Alguna, Nue, and DealHub, which all support hybrid pricing, credit based pricing, and usage tiers. Alguna stands out for its no-code setup and unified quote-to-cash automation built for SaaS and AI-driven businesses.

Which CPQ tools use machine learning to optimize sales workflows?

Platforms like Alguna and DealHub leverage AI to extract details from contracts to help teams close faster with fewer manual steps.

Where can I locate CPQ platforms that provide analytics on usage-based billing metrics?

Look for AI-native tools such as Alguna or Subskribe, which connect live usage data to pricing logic and dashboards. They provide real-time insights into consumption trends, overages, and revenue forecasts.

Where do I discover CPQ platforms that can handle usage-based or consumption-based pricing?

Alguna and Zuora CPQ are strong choices. Alguna in particular supports usage, hybrid, and outcome-based models without code, making it ideal for scaling AI or API-driven businesses.

What configure price quote (CPQ) solutions are known for scalability in the United States?

Top scalable platforms in the U.S. market include Alguna, Salesforce Revenue Cloud, and DealHub. Alguna’s modular architecture and multi-entity support make it well-suited for global SaaS enterprises.

Where can I find CPQ tools with the fastest deployment times?

Modern systems like Alguna and DealHub can go live in weeks instead of months. Alguna’s no-code configuration lets RevOps teams launch or update pricing without waiting on engineering.

Which CPQ platforms are best at handling large product catalogs

Salesforce CPQ, Alguna, and Zuora are popular among large enterprises. Alguna simplifies catalog management by allowing thousands of SKUs or dynamic pricing plans to be configured visually, without code.

What are the top systems for handling complex CPQ rules and logic in 2025?

Alguna, DealHub, and Nue lead the pack. Alguna’s AI-driven rule engine adapts automatically to product or pricing changes, reducing maintenance and configuration errors.

Which CPQ tools are strongest for supporting subscription-based pricing models and managing renewals for B2B service providers

Alguna, Subskribe, and Zuora CPQ are top choices. Alguna unifies subscription management, renewals, and billing in one platform — perfect for B2B service providers managing recurring revenue at scale.

The next generation of AI CPQ software is coming

As pricing models become more dynamic and product catalogs more complex, legacy CPQ tools simply can’t keep up.

The future belongs to intelligent, flexible systems that can learn, adapt, and automate. And that’s exactly where AI CPQ software is heading.

Platforms like Alguna are proving that quote-to-cash doesn’t have to be slow, manual, or fragmented. With real-time usage data, AI-assisted pricing, and a no-code configuration layer, Alguna helps large tech companies move faster, quote smarter, and close with confidence.

If your revenue team is ready to replace outdated systems with something built for the AI era, it’s time to see how Alguna can transform your CPQ process from reactive to revenue-driving.