The rise of the agentic economy creates a new problem: how do you turn autonomous work into predictable revenue without clinging to per-seat SaaS pricing that no longer matches how value is created?

This guide breaks down AI agent monetization from the ground up: what it is, how the main monetization models work, and which platforms can actually support usage-, event-, and outcome-based billing in production.

What is AI agent monetization?

AI agent monetization is how companies generate revenue from autonomous agents that perform work or deliver outcomes without constant human involvement.

Instead of charging for access (like per-seat or license fees), AI agent monetization ties pricing to the economic value of the work the agent performs.

For example:

- Tasks completed

- Workflows executed

- Outcomes delivered (tickets resolved, leads generated, invoices reconciled)

- Resources consumed (API calls, tokens, credits, compute hours)

In short: You’re not selling software access—you’re charging for work done.

- Wayne Liu, Forbes Council Member

AI agent monetization methods vs. models

- Monetization models = The pricing structures you use (usage-based, event-based, outcome-based, subscription, hybrid).

- Monetization methods/strategies = How you package and deliver your pricing plans (API pricing, agent add-ons in SaaS tiers, “digital worker” licenses, marketplace listings, internal chargeback, etc.).

Think of it this way:

Methods = The go-to-market wrapper (how you take it to market and align it with customer value)

For example, two companies might both use usage-based pricing models, but one sells via API calls, while another bundles the agent into an enterprise plan and meters workflows in the background.

5 core AI agent monetization models

Companies generally rely on five core AI agent monetization models, often blending them to match their product and customers.

1. Usage-based models

Charge per token, API call, task, or minute of “agent work.”

Best when your value is tightly tied to raw processing power and you need margins to scale with compute. Works well for APIs and high-volume workloads, but you’ll want caps, allowances, or budgets to reduce “meter-running” anxiety.

2. Event-triggered models

Charge per workflow run or automation (e.g., “per workflow,” “per task,” “per interaction”).

Ideal when customers think in workflows, not tokens. You hide internal complexity and bill at a more meaningful unit of value, but you must define “events” clearly to avoid disputes.

3. Outcome-based models

Charge only when the agent achieves a measurable result—like a resolved ticket, qualified lead, or reconciled invoice.

This is the strongest value alignment but puts more risk on the vendor and requires robust tracking and agreement on what counts as a successful outcome.

4. Subscription + add-ons

Offer a predictable base subscription (access, included usage, core features), then layer usage or premium agent features as add-ons.

Great for SaaS companies evolving into AI-first, especially for enterprise buyers that want budget predictability but still need usage elasticity.

5. Hybrid agentic models

Combine subscriptions, usage, events, and outcomes in a single framework (e.g., commit + usage, platform fee + workflow credits + outcome bonuses).

This is where most mature AI agent products end up. That's because hybrid pricing models match how customers buy, how agents behave, and how costs accrue.

How to choose the best monetization model and method for your AI agent

The “right” AI agent monetization approach depends on:

- Customer value metric: What’s the clearest unit of value? Time saved, tasks automated, revenue added, tickets resolved?

- Usage patterns and predictability: Do customers have spiky, unpredictable usage, or steady patterns?

- Agent autonomy and outcome clarity: Can you reliably measure success, or is the agent primarily augmenting humans?

- Cost structure and data flow: Do your costs scale with tokens/compute, or are they mostly fixed?

- Buyer type and sales motion: SMB PLG vs. enterprise contracts demand very different structures.

- Compliance and regulatory constraints: Do you need auditable metrics, transparent usage reporting, or specific contractual controls?

- Competitive and market norms: Where can you differentiate vs. where should you fit expectations?

Strong revenue teams start simple, pilot with early adopters, and iterate based on usage, margins, and willingness to pay.

Common monetization mistakes to avoid

Even strong teams trip over the same patterns:

- Shipping agents with “placeholder” pricing and delaying real monetization

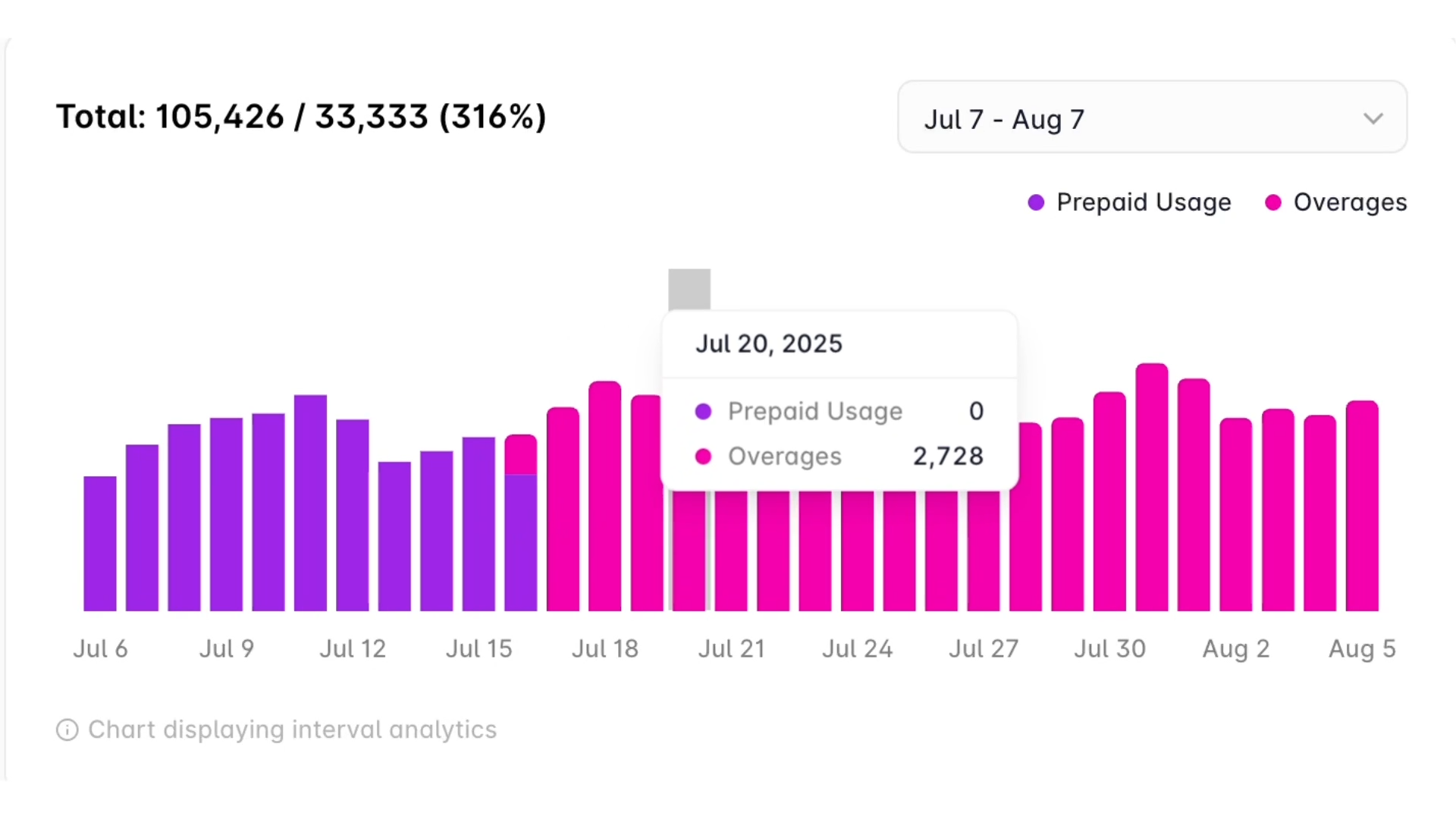

- Weak tracking of usage/events, leading to unbilled overages

- Treating pricing as a one-time decision instead of an experiment

- Picking the wrong value metric and confusing buyers

- Creating bill anxiety with pure usage and no guardrails

- Requiring engineering for every pricing change

When these show up, the problem usually isn’t the agent—it’s the monetization infrastructure underneath it.

Platforms that enable agentic monetization

Monetizing AI agents requires more than counting API calls.

You need:

- Granular metering of tokens, events, workflows, and outcomes

- Flexible pricing logic

- No-code CPQ for complex deals

- Billing, payments, dunning, tax, and revenue recognition that can handle dynamic pricing

That’s why AI monetization platforms have emerged: they become the revenue engine behind AI products.

What to look for in an AI agent monetization platform

- Hybrid billing flexibility: Support usage, events, outcomes, subscriptions, credits, and hybrid models without bespoke engineering.

- Real-time metering and visibility: Capture every event as it happens and give teams + customers clear, real-time spend visibility.

- Pricing experimentation tools: Simulate, A/B test, and iterate pricing models without rewriting code.

- AI-native CPQ and deal management: Configure commit + overage plans, credits, outcome guarantees, and multi-entity deals without involving engineering in every quote.

- End-to-end automation and integrations: Invoicing, payments, dunning, tax, multi-currency, revenue recognition, CRM and data warehouse integrations.

Done well, this becomes your monetization operating system, not "just" billing software.

Leading AI agent monetization platforms

Below are the main categories of platforms used to monetize AI agents today.

1. AI agent monetization platforms

AI agent monetization platforms are end-to-end systems built to power usage-, event-, and outcome-based pricing for AI products and agents.

They combine real-time metering, pricing logic, CPQ, invoicing, payments, and revenue automation into one unified system that serves as a single source of truth for all your revenue movements.

Examples:

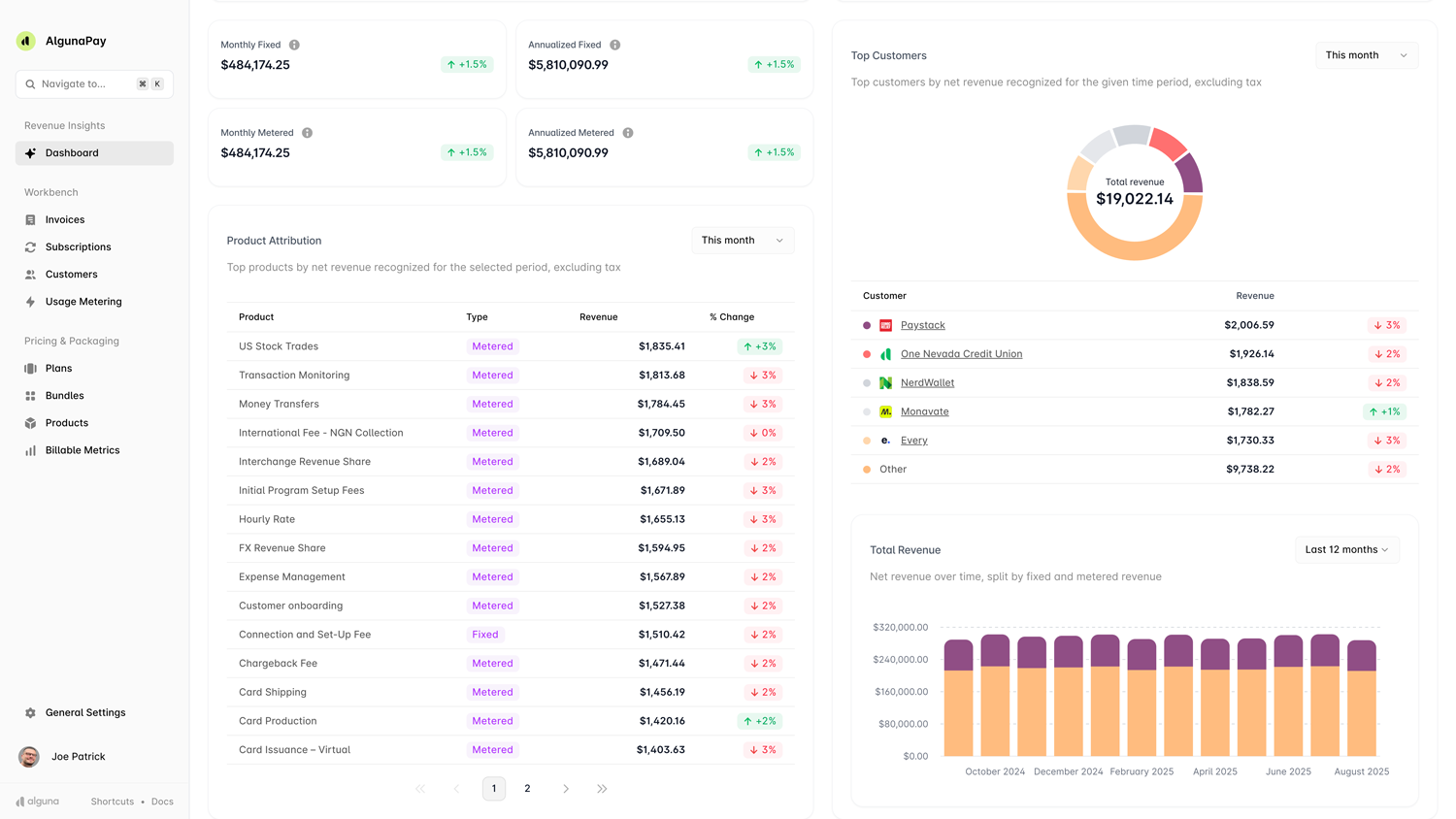

- Alguna: Unified no-code AI agent monetization platform offering no-code CPQ, automated billing, real-time usage metering, and streamlined revenue recognition.

- Orb: Usage-based monetization platform for API and AI companies.

- Metronome: Event-level billing for infrastructure-heavy and AI workloads.

2. Usage metering platforms

Usage metering platforms capture and transform raw product activity, such as tokens used, API calls, events, workflows, or agent actions, into clean, billable metrics.

They act as the data layer behind usage-, event-, or outcome-based pricing by ingesting high-volume signals in real time, applying pricing rules, and feeding accurate usage data into billing systems.

Examples:

- Alguna: AI monetization platform that supports complex usage-based billing and metering needs,

- Orb: Usage-based billing and metering platform that ingests granular product usage data, applies flexible pricing logic, and generates invoices.

- Metronome: Usage-based billing platform (recently acquired by Stripe) that helps software companies model multidimensional pricing, rate high-volume events, and automate billing workflows.

- m3ter: M3ter is a metering and rating platform focused on usage-based billing for B2B software. It captures detailed usage data and calculates complex bills.

- Lago: Lago is an open-source metering and usage-based billing platform that gives teams full control over their billing data and workflows.

3. Generative AI monetization engines

Generative AI monetization engines are purpose-built for products powered by large language models.

They focus on the core telemetry behind AI cost and value: token metering, model-level attribution, prompt performance, caching optimization, and ROI tracking across multi-agent workflows.

Examples:

Alguna: Alguna extends beyond metering and billing by offering AI-native attribution for tokens, workflows, and outcomes—giving teams a single system that connects LLM usage, pricing logic, and revenue automation.

Paid.ai: Paid.ai provides cost intelligence for LLM-heavy products, offering granular token tracking, prompt performance analytics, and tools to understand how different models impact cost and ROI.

Langfuse: Langfuse offers observability for prompts, chains, and multi-agent systems, giving teams detailed insight into LLM behavior, token spend, and workflow performance across their entire AI stack.

4. API-first billing tools

API-first billing tools are general-purpose billing and quoting systems built for subscriptions, usage components, and revenue automation.

While not designed specifically for AI, they offer enough flexibility—through APIs, webhooks, and metered billing primitives—to support basic AI usage pricing.

Examples:

Alguna: Alguna supports subscription, usage, hybrid, and AI-native pricing models through a powerful API and unified monetization engine. Unlike traditional billing tools, it also includes AI-native metering, CPQ, and revenue automation, making it suitable for teams evolving from simple usage pricing to full agent monetization.

Stripe Billing: Stripe Billing provides subscription management and lightweight metered billing, ideal for usage components tied to straightforward metrics such as API calls or seats.

Chargebee: Chargebee offers subscription-first billing with configurable add-ons, usage meters, and integrations, making it a fit for SaaS companies layering AI usage into existing pricing tiers.

Zuora: Zuora is a full-featured enterprise subscription platform with support for usage rating, billing, revenue recognition, and complex contract structures.

Maxio: Maxio combines subscription billing, usage components, and revenue analytics, targeted at B2B SaaS teams that want an all-in-one platform for subscription lifecycle management and basic usage billing.

Why Alguna for AI agent monetization

AI agents don’t behave like traditional SaaS, and traditional billing systems weren’t built for thousands of micro-events, dynamic workflows, and outcome-based pricing.

Alguna was built specifically for the AI era.

Alguna unifies:

- AI-native metering: Real-time tracking of tokens, events, workflows, and outcomes across multi-agent systems.

- Flexible pricing logic: Usage, event-based, outcome-based, subscriptions, hybrid commits, credits, and allowances in one place.

- AI-native CPQ and packaging: Let sales + RevOps configure commit + overage deals, credits, and outcome guarantees without engineering.

- End-to-end revenue automation: Invoicing, payments, tax, dunning, contracts, and revenue recognition.

- Self-serve + sales-led in one system: Power PLG pricing, enterprise contracts, and experiments off a single quote-to-revenue engine.

Whether you’re introducing your first agent, transitioning from per-seat SaaS, or cleaning up legacy billing logic, Alguna gives you an AI-native monetization backbone that you can actually iterate on.

Turning AI agents into a scalable revenue engine (and why you shouldn't wait)

AI agents are already doing real work: handling support queues, driving outbound, running financial operations.

If your monetization lags behind, you’re either:

- leaving money on the table,

- confusing customers with opaque bills,

- or blocking adoption because finance teams can’t forecast spend.

The teams that win the next wave of AI won’t just build the best agents. They’ll be the ones who turn those agents into a clean, trusted, scalable revenue stream—with pricing aligned to value, guardrails against bill shock, and infrastructure that doesn’t crumble every time you tweak a metric.

If you’re still trying to make per-seat SaaS pricing work for autonomous agents, that’s your bottleneck now.

Monetize your AI agents with Alguna

Now’s the time to build the foundation of your AI agent monetization.